Convert numbers for the finance & banking sector

Flexibility in response to changing markets and enhanced speed capabilities in transaction processing bring a great experience to the customer.

- Bank

- Financial services

- Money exchange company

- Securities company

- Loan - installment services

Specific challenges of the industry and standards after digital transformation

Difficulty/mission

- Managing and securely processing big data is an effective challenge.

- Credit risk management and asset management require accuracy.

- Investment portfolio management and profit optimization.

The requirement is for results after digital transformation

- Optimizing credit risk management through data analysis and artificial intelligence to make accurate credit decisions.

- Efficient analysis of operations, providing 24/7 decision support.

Difficulty/mission

- The diverse needs of the service require personalization, from financial management to financial solutions tailored to the needs of each customer.

- Interactive multi-channel interactions require data and system integration, ensuring safety and security.

The requirement is for results after digital transformation

- Automated chatbot for advising, caring, and resolving complaints.

- There is a sales analysis system, customer segmentation, customer behavior analysis, and trend prediction.

Difficulty/mission

- Working environment dynamic admin mankind, multi-point should experience good employee.

- Need continuous training to employees clearly understand the products, financial services, business process.

The requirement is for results after digital transformation

- Automating recruitment processes and evaluating candidate competencies.

- Online training, monitoring and evaluating work performance.

- System personnel management based on artificial intelligence, working environment, and instill corporate culture.

Difficulty/mission

- Products, financial services, high diversification should constantly changing.

- To ensure compliance with legal provisions in credit operations, ensuring safety standards, security in the industry.

The requirement is for results after digital transformation

- Have the system provider of financial services, online transaction process, simplify, minimize errors, and enhance reliability of products/services, comply with regulations and industry standards.

Solution for financial sector transformation from Lac Viet with partners

Solution for financial sector transformation from Lac Viet with partners

Together we explore the potential of the solution converter of comprehensive: process optimization – personalization services – information security.

Comprehensive enterprise management software

Digitization of documents (electronic documents, incoming and outgoing correspondence)

Collaboration tools, electronic signatures, and task management.

Real-time employee experience system

Management of candidate, customer, and supplier experience

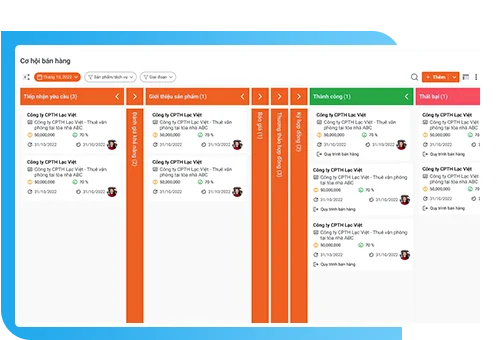

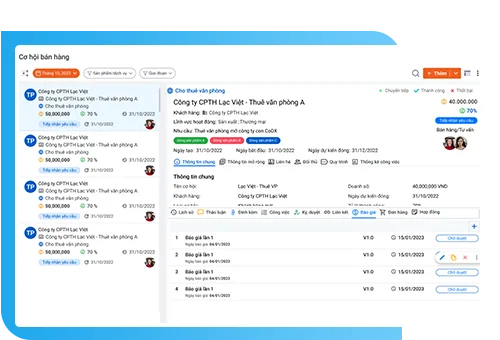

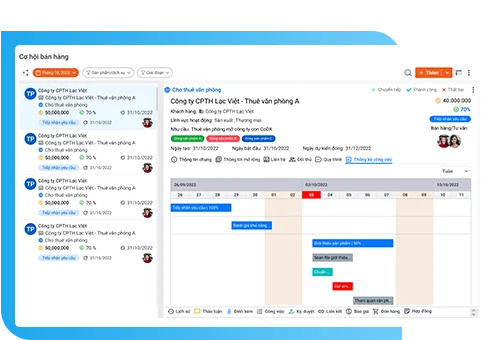

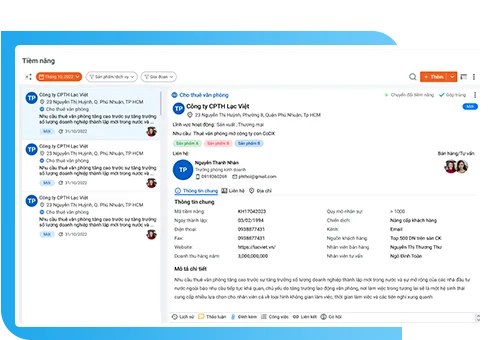

Customer

(LV-DX CRM)

- Bank application number

- Customer relationship management

- Customer support chatbot

- Marketing automation management

- Social media management

Financial

(LV-DX Accounting)

- Financial accounting - financial analysis

- Inventory management

- Electronic invoice

- Partner management

Human resources

(LV-DX People)

- HR software - Timekeeping

- Benefits management software

- Online training management

- Yield management - capacity

Service

(LV-DX Banking)

- Product management/banking services

- Software anti-money laundering

- Software risk management, compliance, Basel

- Software blockchain

One integrated system - catering to all business transactions

Data mining service or application

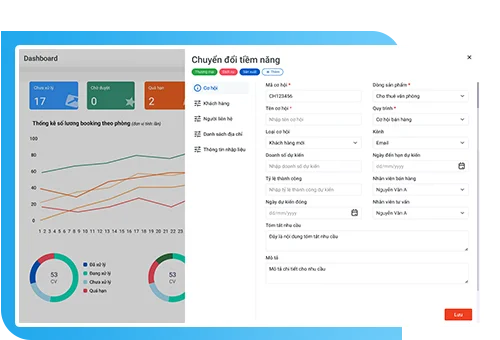

Data analytics system - Making data the central hub for management anytime, anywhere

Reports, statistics, data analysis, customer hàngnhân the finance, cash flow, financial product/service Pack, revenue/profits, branches, transaction offices, regions, provinces ...track operational efficiency

Utilizing artificial intelligence applications such as Big Data, Deep Learning to mine digital data

Analysis of big data from transactions, orders, customer information, to develop appropriate products, and optimization of trading strategies. Fraud detection, risk assessment, credit, risk management market.

Transforming data into valuable assets that can be inherited.

Specialized technology devices and solutions system

Security Camera systems, DVR/NVR, motion sensor.

Card reader, facial recognition device, turnstile.

WiFi router, WiFi access point

Touchscreen display, invoice printer, card reader machine

Barcode scanner, the computer, the system LED lights guide.

Temperature sensor, humidity sensor, light sensor, measuring device

IT services & equipment - Infrastructure & platform software

Challenges, opportunities & trends in development finance and banking

According to PwC Vietnam 2023 72% of banks in Vietnam are concerned about the risk of network attack. While technology Infrastructure, many banks have IT systems the old.

Total assets: Expected to reach 22 million billion by 2025. Credit: Expected increase of 14-15% per year. Raising capital: The expected increase of 13-14% per year. Non-profit Expected to grow by 18-20% per year.

Bank number will become the mainstream trend in the banking industry. The development of new technologies such as AI, Big Data, Blockchain, creating more opportunities for conversion of numbers.

Report from McKinsey in the year 2023: 70% bank in Vietnam is implementing transition strategies number50% of the bank is expected to complete in the next 3 years & profit could rise to 20%. The electronic payments market in Vietnam is expected to increase 20%/year in 2021-2025.

According to Visa, the market “Non-cash payment” in Vietnam is expected to reach 80% in the year 2025. According to MoMo, the number of payment transactions through e-wallet MoMo increased by 150% in the year 2023. Parallel that “The mobile payment market,” Vietnam is expected to reach $ 40 billion by 2025 (according to Statista). While Apple Pay has been deployed in more than 60 countries and territories (according to Apple)

The whole world is undergoing a digital transformation. It's time for businesses to proactively adapt to the trend, seize opportunities, and overcome challenges.

Depending on the actual situation, we will advise businesses on selecting applications based on the digital transformation model that aligns with the strategy they need to implement, their readiness level, and the maturity of enterprise management in the proposed model.

Artificial intelligence applications necessary in the conversion of finance and banking

Lac Viet and its partners have been, are, and will continue to apply artificial intelligence to accelerate rapid digital, green, and sustainable transformation.

Big Data Analytics

Analysis of big data from transactions, orders, customer information, to develop appropriate products, and optimization of trading strategies.

Machine Learning & Computer Vision

Machine Learning: fraud detection, risk assessment, credit, risk management market. Computer Vision: Recognition, signature, check the contract, support appraisal loan.

Artificial intelligence applications necessary in the conversion of finance and banking

Lac Viet and its partners have been, are, and will continue to apply artificial intelligence to accelerate rapid digital, green, and sustainable transformation.

Natural Language Processing (NLP)

Chatbot & Virtual Assistants support order, complaint resolution, auto-reply. Artificial Intelligence for Banking (AIB): Personal goods and services, financial advisory,smart, manage your account, pay bills.

Blockchain

System blockchain tracking software, security, transaction management, asset management, security monitoring.

Collaborate to bring innovation to every industry

Years of Growth

Softwares

IT services

Customers

Users

Reviews of our customers