Management system, hr payroll software solution is helping businesses automate the entire process, personnel management, processing payroll, including recordkeeping, timekeeping, payroll, tax deductions, insurance. This tool helps reduce the time, payroll processing, reduce errors, ensure compliance with labor laws. In addition, the system also supported data analysis to provide management reports, help leadership make decisions, hr and finance fast and accurate.

In the era of transformation of system of personnel management salaries have become indispensable tools for businesses that want to optimize operations and improve the efficiency of management.

Instead of handling the business as timekeeping, payroll, tax deductible – insurance or benefits manager, businesses can automate the entire process with just a single platform. This solution not only helps to reduce errors, save time, but also provides data accurate analysis to support management decisions quickly, be more strategic.

The same Lac Viet find out details about this system in the article today.

1. System hr manager salaries

Human resource management system payroll solution is technology that helps business automate the business, hr management, handling payroll. Instead of store personnel records on paper or Excel spreadsheet discrete, enterprises can manage the entire information from the contract, working time, timekeeping, payroll, taxes, insurance to welfare in a centralized platform.

For example, a company with 500 employees ago it took 5 days to do payroll every month, now takes only a few hours thanks to the software personnel salaries at the same time minimize confusion due to input manually.

Distinguished with other software

- Timekeeping software only recorded hours/holidays, export timesheet data; and systems management personnel salaries will use that data to calculate the salary plus allowances, taxes, insurance, and payroll complete.

- Accounting software, financial management, tax reporting overall; system hr manager salaries to focus on workers, hr data, calculate the income details.

Role for business

- Ensure the accuracy and transparency: the System automatically calculates payroll based on attendance data, and internal policies, reduce errors frequently encountered when making crafts.

- Support compliance with law: software personnel management salaries and always updated with new rules about social insurance, personal income Tax, employment Law... help Personnel avoid risks, violations and fines. For example, when the level of SOCIAL change, the system will automatically apply without the need for adjustments.

- Save time for hr – C&B: automation of the stitch from data entry, calculation, production payroll to send payslips to employees. This frees hr C&B from repetitive tasks to focus on strategic hr management salaries long-term.

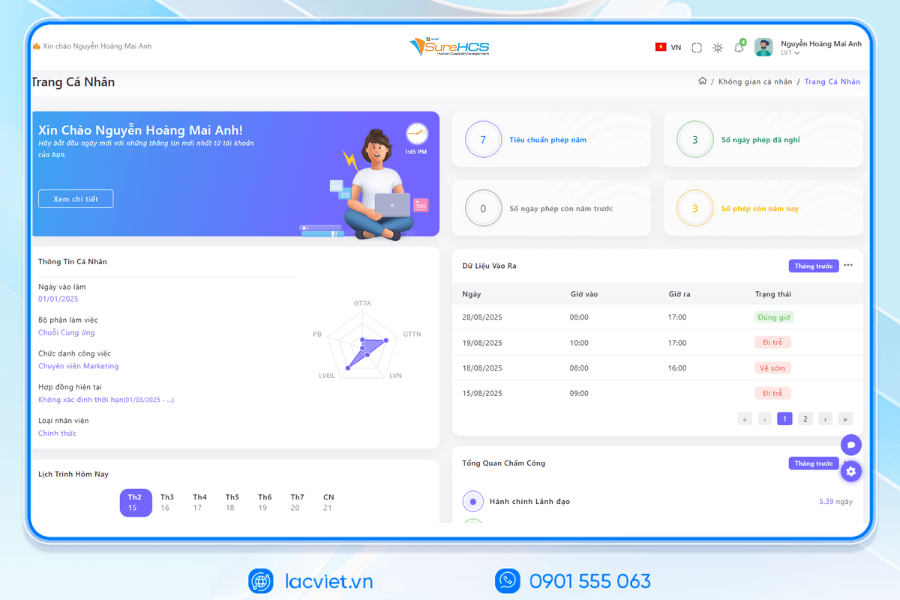

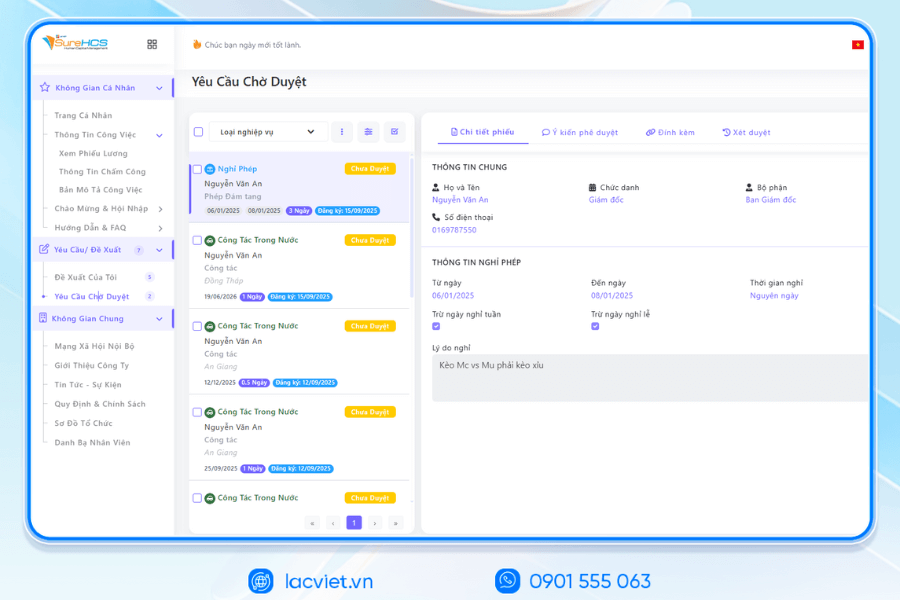

- Advanced experience staff: Thanks for the feature Self-service, employees can actively lookup payroll, leave of absence, update personal information, without passing through many intermediate steps help to improve the satisfaction level of employee engagement, especially in organizations that have large scale.

- Criteria for evaluating hr software best & how to implement the right to deliver effective

- 15 software HRM integration of AI in human resource management optimization

- 15 Payroll Software employee oldest standard business manager salaries

- Vietnam launches 3 AI integration in software management personnel LV SureHCS HRM

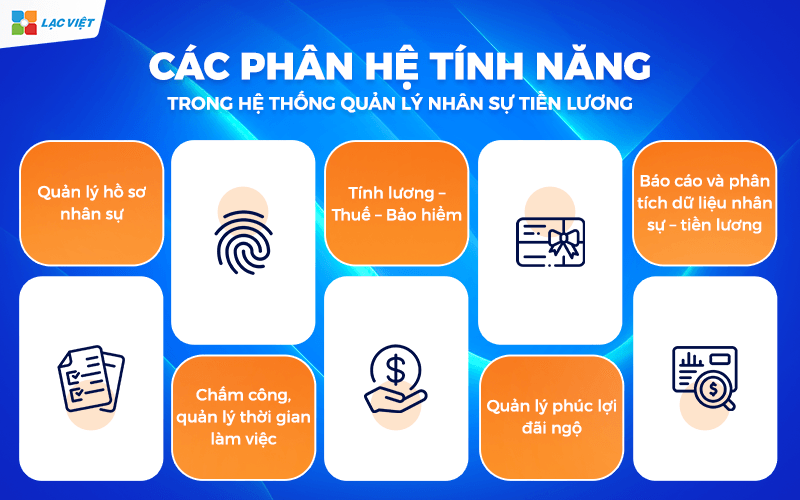

2. The subsystem features in the system of personnel management salaries

2.1. Profile manager hr (Employee Master Data)

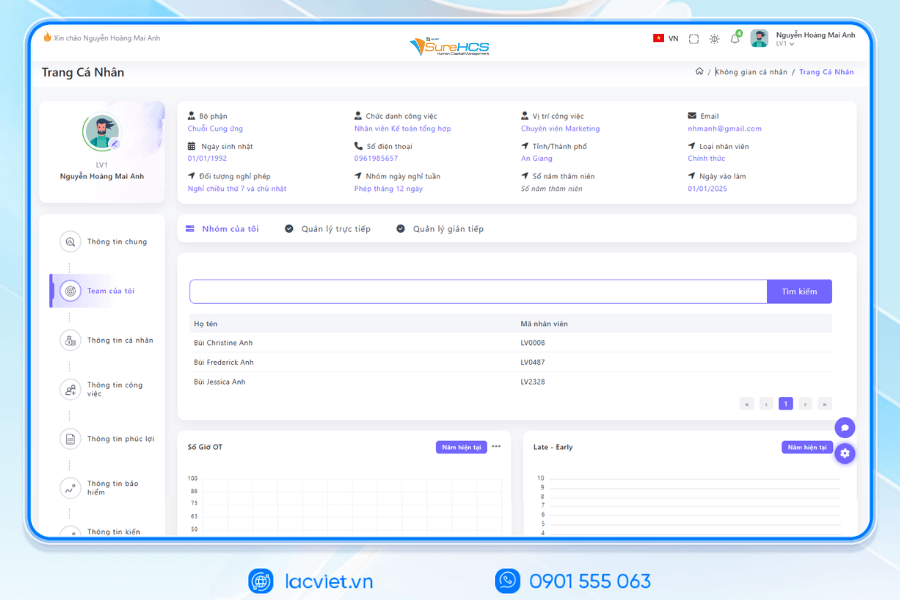

This is the “data center” store the entire information about the employee: employment contracts, annexes, route work, competence/qualifications, reward, discipline, history, change salary, attendance status and SOCIAL insurance/health INSURANCE/UNEMPLOYMENT insurance... From here, data is synchronized to the distribution system, timekeeping, payroll, tax – coverage and reports.

Business get nothing (business value):

- Reduce errors and duplicate data → limited pay false, arrears; standardized service record audio/check out labor – tax.

- Shorten the update time change (adjustment of salary, transfer, promotion), create a “data flow” throughout to timekeeping, payroll, avoid deflection of between the spreadsheet discrete.

- Meet compliance Vietnam: profile, salary, allowance associated with the specified PIT (personal income tax) under the progressive tax 5-35% for resident individuals; 20% for non-residents.

For example, when employees transfer parts extra new level, system update, rank, salaries, allowances effective from the date of X; this information automatically flows to the work/reward of the month corresponding help payroll and PIT accurate't need HR enter manually in multiple files.

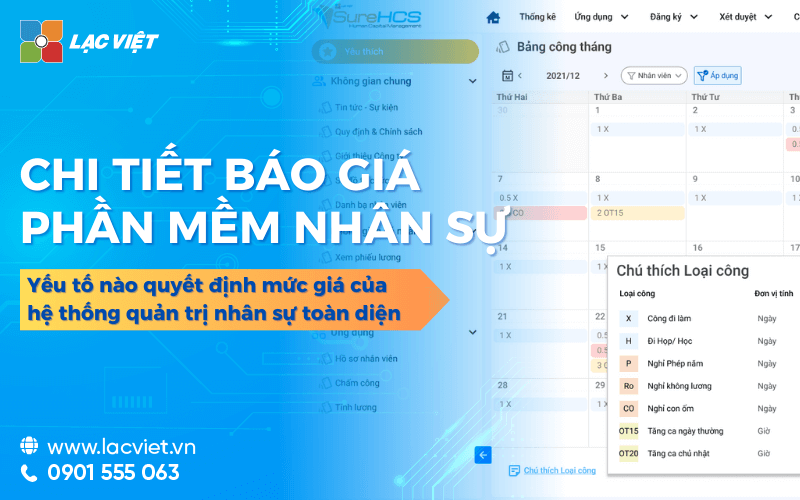

2.2. Timekeeping, time management, work (Time & Attendance)

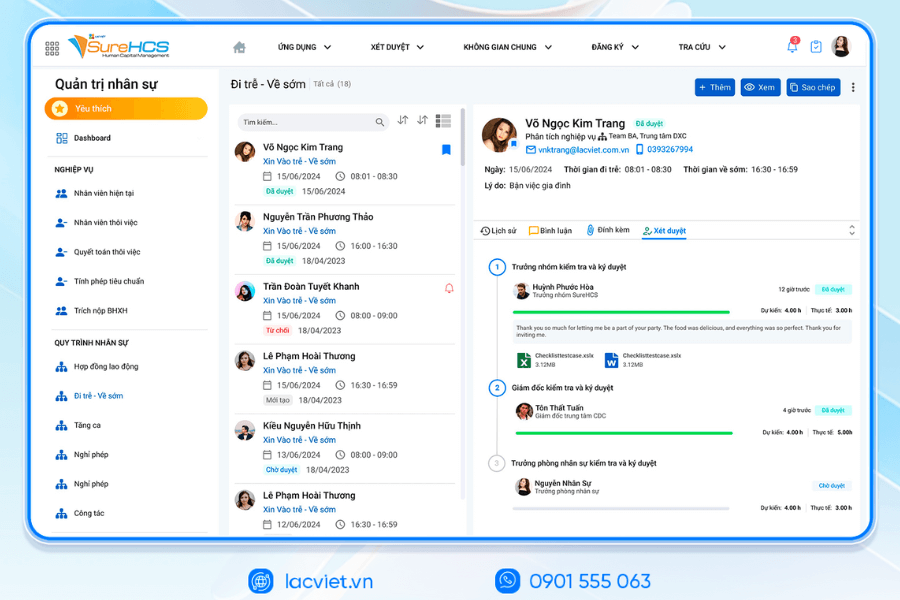

Recorded hours shift/crew, vacation, overtime (OT), late – early; integrated fingerprint machine/magnetic card/face recognition; setting flexible work schedules by department/location.

Business get nothing:

- Control labor costs real time: automatic synthesis – OT – allowances ca help forecast the wages fund before the pay administration OT the right policy. ADP indicate automate attendance – payroll is leverage key to reduce the loss of time, cost allocation and OT reasonable.

- Reduce disputes, increased transparency thanks to data-in/out system, approval allows online history edit recorded.

- Platform for payroll accuracy: attendance standard is the most important input of payroll; many practical lessons found guilty of salary comes from the working time is not accurate or approved slow.

With enterprise multi-ca system, mapped ca, flexible (for example 06:00-14:00; 14:00-22:00; 22:00-06:00), pressure policy OT 150/200/300% according to the type of day. When managing browser change late shift, the system records the reasons and the browser, ensure traceability.

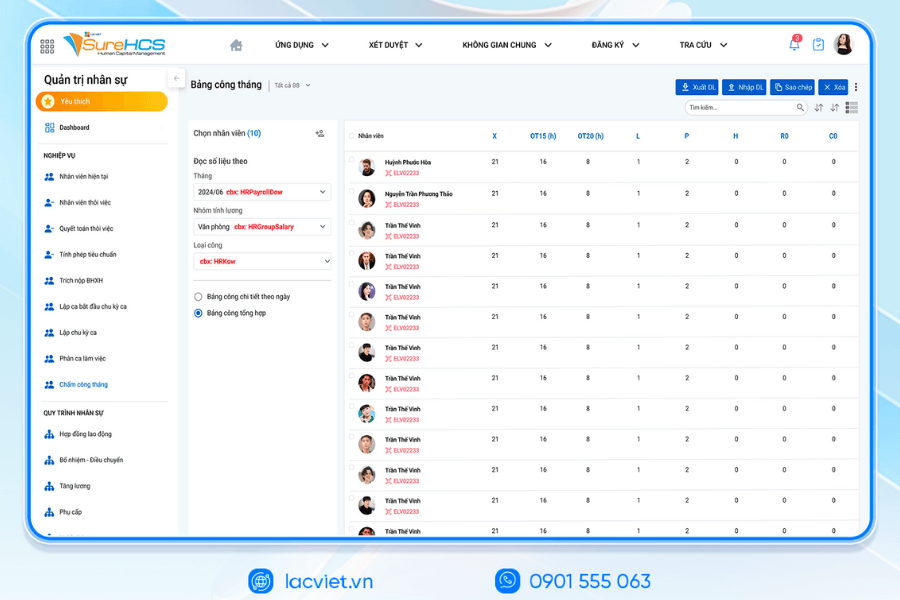

2.3. Payroll – Taxes – insurance (Payroll – PIT – SHUI)

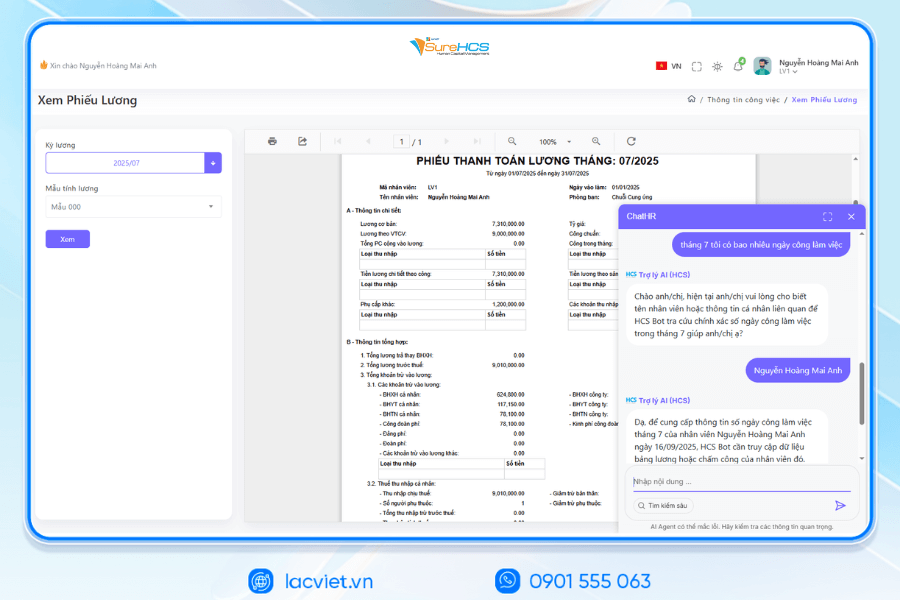

Automation recipe salary (basic salary, KPI/commissions, allowances, deductions) and the deduction on personal income Tax (PIT), SOCIAL insurance/health INSURANCE/UNEMPLOYMENT insurance, in paycheck; the record settlement, payroll service audit.

Enterprise value:

- Sharply reduced processing time pay period: a study Total Economic Impact (TEI) of Forrester made under the authorization of Paycom recorded organizer template up to 80% of the time processing payroll weekly as the best HR payroll on a platform and process automation. This is reference useful about the potential savings when switching from type to automatic.

- Legal compliance Vietnam: personal income Tax: residency bear icon progressive 5%-35%, non-residents 20% for income from salary/wages; tariff 2025 has not changed compared to 2024, but the Finance Ministry is taking comments adjust the number of degrees of tax (draft), businesses should be prepared script updates.

- SOCIAL insurance/health INSURANCE/UNEMPLOYMENT insurance: total closed frequently is 32% of the wages fund (business 21,5%: SOCIAL insurance OF 17.5% + health INSURANCE OF 3% + UNEMPLOYMENT insurance 1%; workers 10,5%: SI 8% + health INSURANCE 1,5% + UNEMPLOYMENT insurance 1%). Agency function, the newsletter specialized reiterated these rates during the year 2024-2025.

- Change of law: the Law on SOCIAL insurance 2024 effect from 01/7/2025 with some adjustments to the scope, method; businesses need to monitor to timely update the system.

- Transparent with employees: paycheck details, diy lookup helps reduce the wonder lifting experience (ESS). SHRM recorded experience staff positively associated with the intention of sticking significantly higher.

Illustrative example: employee A 26 public, 12 hours OT last week, allowance night shift, have dependents 1. System: (1) calculate the gross → net according to the rules OT; (2) deduct the SOCIAL insurance/health INSURANCE/UNEMPLOYMENT insurance right ceiling; (3) applicable icons PIT after deduction of the family; (4) carrying costs by departments; (5) to issue payslips and file bank; (6) prepare, file, serve, settlement last year.

2.4. Benefits manager compensation

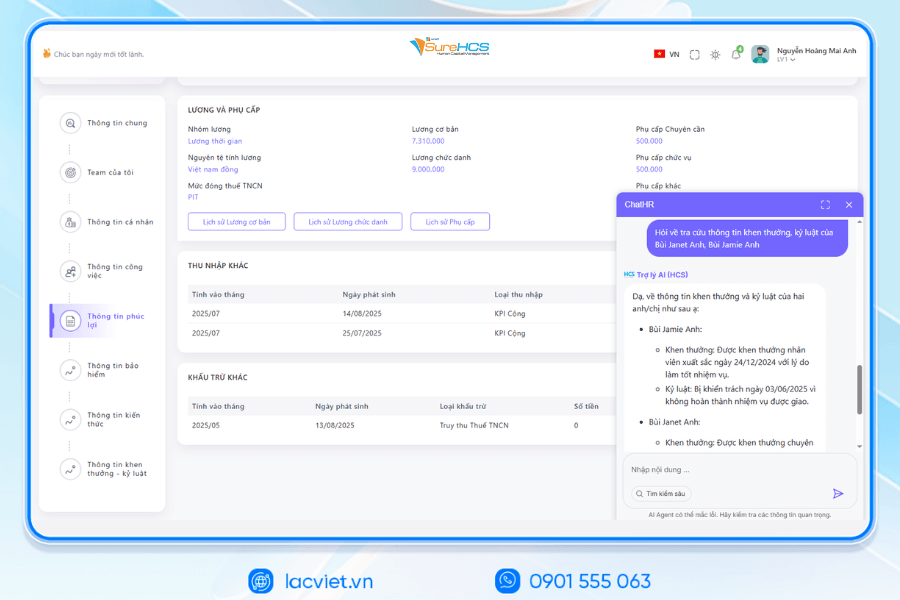

Manage benefit programs, mandatory and elective: welfare fund internal insurance health supplements, gifts, grants learning/travel rewards program mount/KPI... personalized according to group of employees, location, seniority.

Enterprise value:

- Tank mounted, hold the foot: to experience good staff closely related to satisfaction and intention to stay;

- Employee empowerment: self-service portal helps the employees to register/change package benefits, see rights rest; many real analysis showed ESS lifting feel of self satisfaction.

- Budget control benefits: track usage by department/group of employees to reallocate to rights is appreciated more.

For example: In high season, the enterprise allows to choose between “travel allowances” or “package child health clinic expansion”. Display system benefits, level of support, fund balances in real time; employees choose matching packet data connection to the payroll that month.

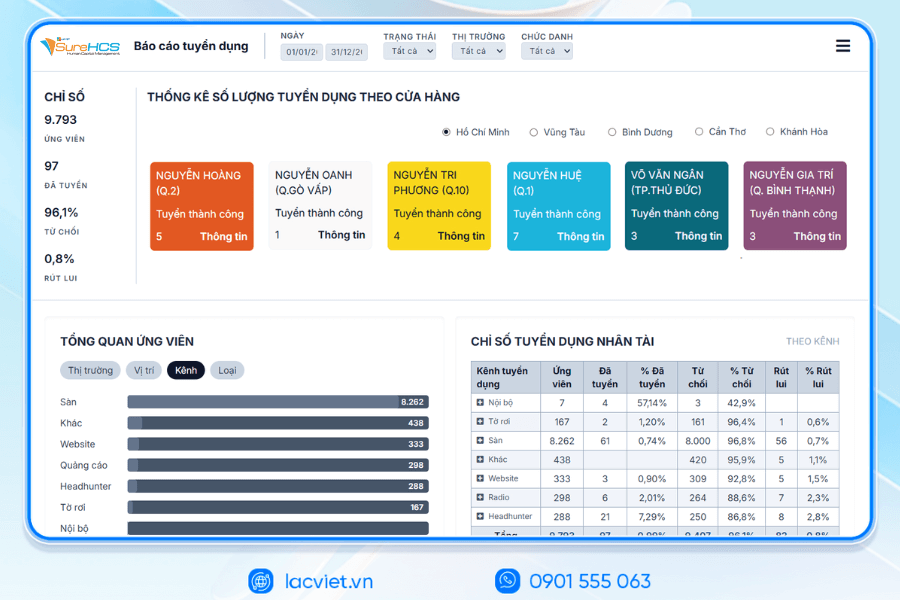

2.5. Reporting and data analysis, personnel – salaries

Dashboard visual labor costs, fluctuations in hr, the rate of OT, productivity shift/team salary structure, allowances, scenario analyses budget of wages (what-if). The ability to localize risks (anomaly detection) on data the wage.

Enterprise value:

- A decision quickly based on the data: see wage costs by business unit, forecast pension fund of 3-6 months, simulation impact when adjusting the allowance/OT.

- Automation task repetition in HR: McKinsey estimates, about 2/3 of the work, HR can now automate a large extent, freeing up time for activities more strategic (planning, force, capacity development).

- Control compliance in real-time: warning beyond the ceiling, close up, BH, ca crew violation, OT exceeding the threshold or fluctuations in wage unusual shift/unit.

3. Benefits when businesses use hr system payroll

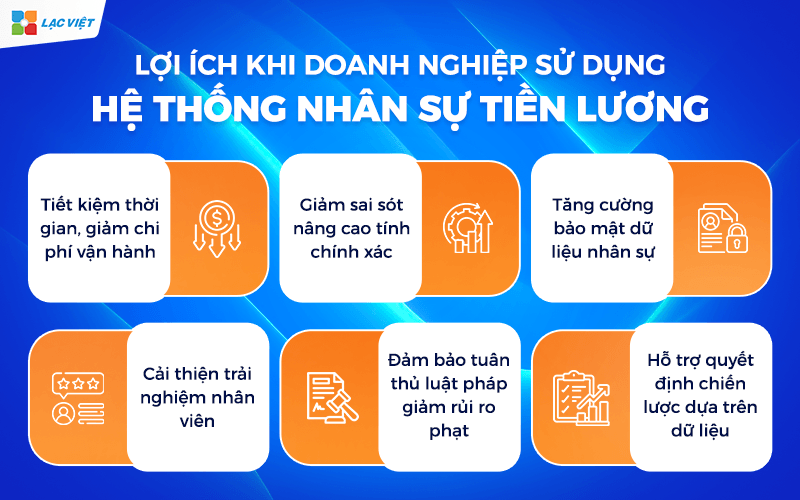

3.1 save time, reduce operating costs

Many studies showed that when the business moved from processing payroll manually (Excel documents) to the system automatically, the processing time up to 50-80%.

The small and medium companies can save 2-3 hours per pay period; average business can cut down more than 50% of the time, payroll processing, respectively 8-10 hours per semester, while large organizations may be reduced to 15-20 hours each pay.

Hr – C&B no longer have to time-consuming data entry check number; words that can focus on the strategy experience staff planning, force efficiency.

3.2 Reduce errors and improve accuracy

The system software personnel management, payroll automation, recipe calculator, remove errors due to input manually. This is especially useful when calculating the allowance, OT, personal income tax and insurance complex. Bio research from WebHR affirmations help system “provides greater accuracy, reducing errors”.

3.3 strengthen data security personnel

A centralized system for storing employee data (profile, wages, taxes, insurance...) with access authorization, and encryption helps to reduce the risk of loss or disclosure of sensitive data. Create a safe environment for your personal information, increase the confidence of employees in management process.

For example, in the Philippines, 68% of businesses recorded accuracy salary increase after implementing the HRIS system, at the same time, improve data security.

3.4 Improving the experience staff

The ports self-service allows employees to actively lookup payroll, updated information, see rights, registration of leave without going through HR. According to the survey of G2, there are up to 24% of employees ready to find a new job after only one getting food wrong.

Increased sense of safety, trust, satisfaction; reduce the pressure on HR departments, improving the efficiency of service.

3.5 Ensure compliance with the law reduced the risk penalty

Labour law, tax and SOCIAL insurance/health INSURANCE/UNEMPLOYMENT insurance is always updating, automation system will correctly apply the current regulations, reduce the risk of violations. The modern platform also supports multi-zone (multi local), sequence voltage code code and error warning before pay.

Businesses avoid fines significantly, loss of reputation or time-consuming explanations with agency management.

3.6 Support strategic decisions based on data

The modern software integrated dashboard visual reports: personnel costs, allocated salary, actual OT, trends, volatility of labor, the rate of the holiday... help leaders hold fast the situation timely decisions.

McKinsey estimates, about 2/3 of the current work of HR can be automated, allowing HR made the project more strategic.

Hr administrator salaries become tools to support planning, budgets, staff development, optimal cost of flexibility.

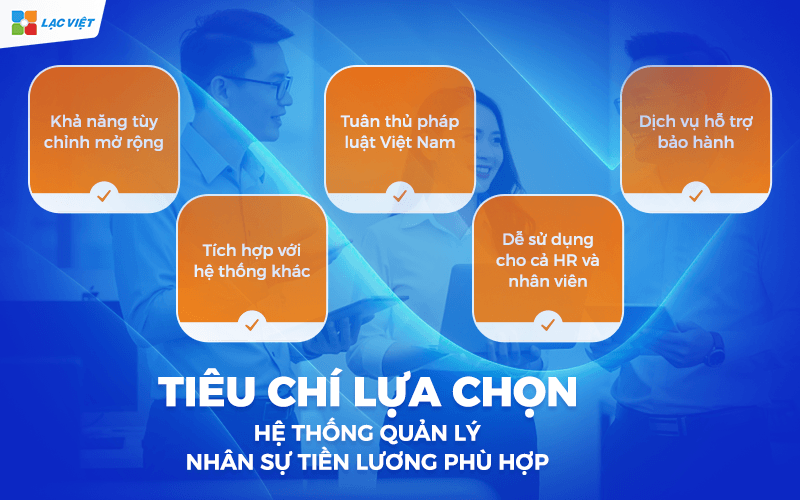

4. Selection criteria management system, hr payroll compliance

Choosing the wrong solution will cause the business costly, take time to deploy and directly affect the satisfaction of employees.

Here are 5 core criteria help the organizations and enterprises choose hr software optimal wage.

4.1. The ability to customize the extension

Every business has the organizational structure, policies, wages, bonus, allowances welfare regime separately. The system should allow:

- Custom formula for calculating the salary for each department, group of employees or individual project.

- Add or adjust the data field (example: bonus KPI, allowance regions, voluntary insurance) without the need to program again from the beginning.

- Scale up when business increased the number of staff or open more branches, which does not affect processor performance.

According to a survey by Deloitte (2023), 43% of businesses said elements “scalability” is a top priority when choosing hr software salary, because this is the factor that helps the system is not “outdated” when business development.

4.2. Integration with other systems

A system of personnel management salaries effective to integrate smoothly with other platforms such as:

- Attendance system (fingerprint scanner, face recognition mobile app)

- Accounting software to automate accounting of the cost of wages, pay insurance, personal income tax.

- Employee portal (ESS) to staff lookup, salary slips, leave calendar, offload the workload for HR.

A study by PwC Payroll Operations Survey 2022 suggests, the business integrates payroll with ERP or HRM can be reduced to 25-30% of the time, payroll processing, monthly, at the same time significantly reducing the errors due to input manually.

4.3. Compliance with the laws of Vietnam

The system must ensure the automatic update of the new legal provisions about:

- Regional minimum wages

- The rate of pay, social insurance, medical, unemployment

- Personal income tax, deductions.

Especially important by the labor law, tax policy in Vietnam change frequently. If the system does not timely updates, businesses will have to handle the account arrears or penalty due to errors, directly affect the reputation and financial.

4.4. Easy to use for both HR and employees

A software hr management salaries, though many features, but if the interface difficult to use will make HR take time, training operation staff, difficult to access information.

The system should have:

- Intuitive interface, grouping features clearly.

- Manual integrated right in the software.

- Mode of access granted to HR, accounting, staff see the information fit his role.

4.5. Service support warranty

A factor often overlooked, but greatly affect the operational efficiency is service after sales support. Businesses should prioritize suppliers:

- Has a team of technical support, quick response (via hotline, email, chat).

- Warranty policy upgrades clear, does not arise hidden fees.

- Training and transfer process for HR departments the way.

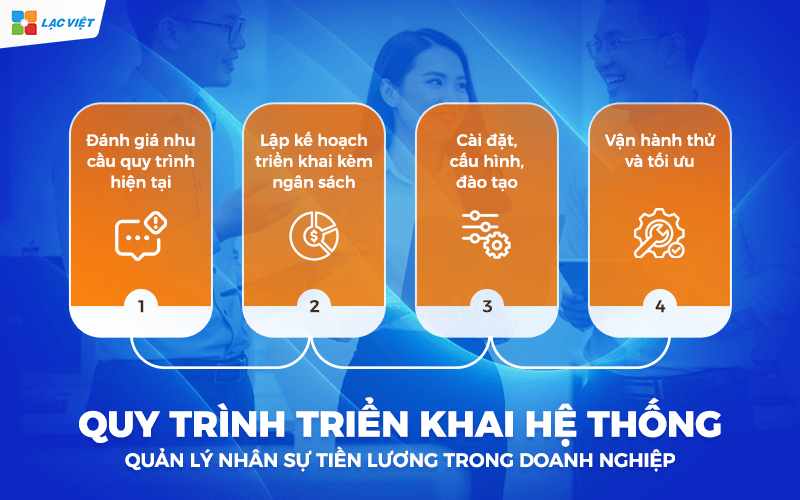

5. Deployment process management system, personnel wages in the enterprise

Implemented a system for personnel management salaries't just buy the software and install, which is a process to change the method of operation of the business. If done properly, businesses can significantly reduce the processing time, liang, minimize errors.

Step 1: needs Assessment process current

Before choosing hr software, payroll, business need to review the entire process are applied:

- Method of timekeeping, payroll now is manual or semi-automatic?

- Errors frequently encountered (for example: the difference attendance data – payroll, deferred pay).

- Scale personnel, nature of employment (full-time, seasonal, shift), and requires management reports.

Step 2: planning deployment with the budget

An implementation plan should include: scope of application (company-wide or individual departments ago), route, time, and resources involved (IT, HR, accounting).

Budgets need to calculate the cost of software license, deployment, training, annual maintenance.

For example, a business of 500 employees when implementing management systems, personnel wages usually cost from 300 – 500 million VND for the first year, including service maintenance support.

Step 3: Installation – configuration – training

- Installation: The software is set up according to the infrastructure of the enterprise (on-premise or cloud).

- Configuration: Customized according to the regulation of wages, allowances, bonuses, shift, recipe calculator, tax – SOCIAL insurance of the business.

- Training: Divided into 2 groups – commissioning groups (HR, accounting) and management team (board of directors) to use dashboard reports.

Step 4: commissioning and optimization

This stage usually lasts 1-3 pay period to check the accuracy of the data, compare the results calculated automatically and manually. After confirming the accuracy and the system will go into operation officially.

At the same time, HR should collect feedback from staff management to adjust the features, report, or process integration.

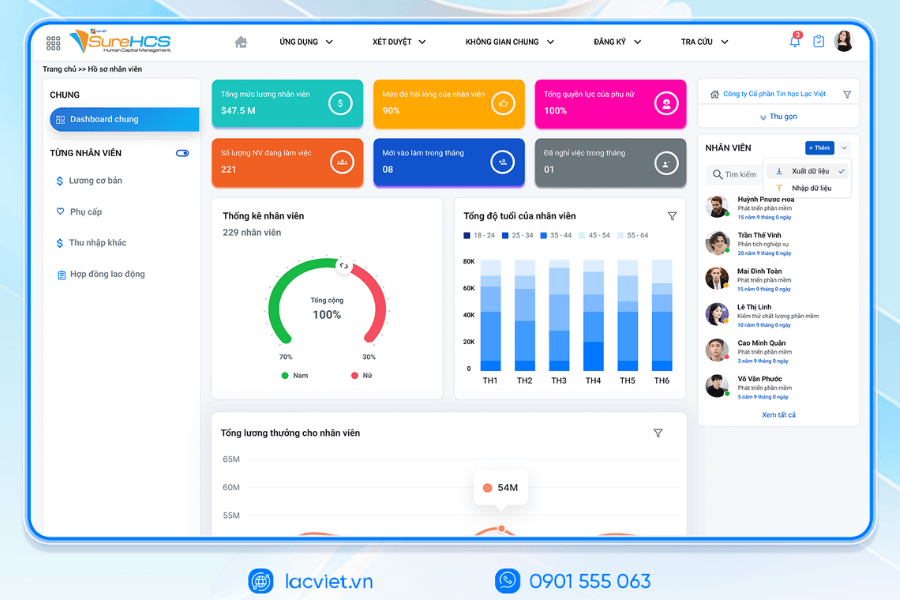

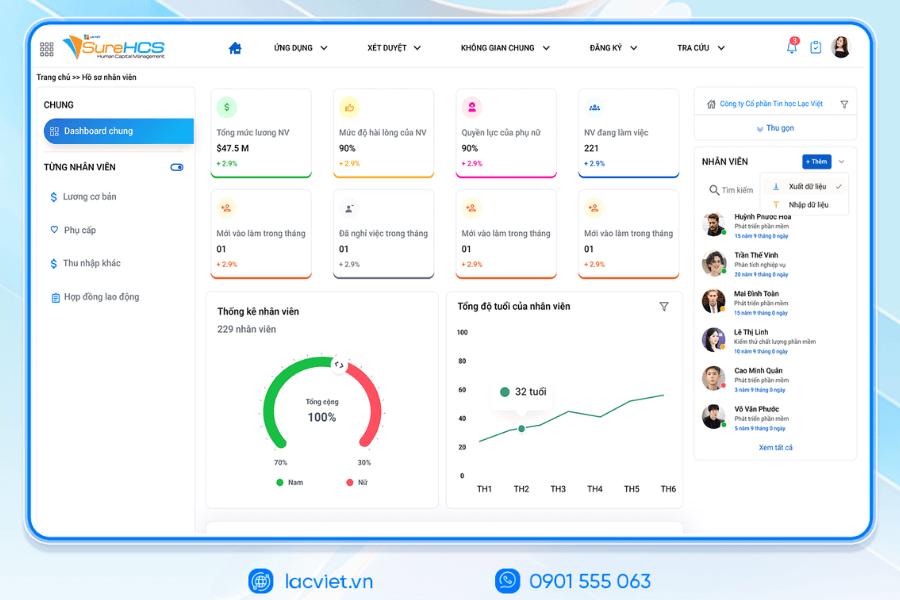

6. Hr manager salary with hr solutions, Lac Viet SureHCS

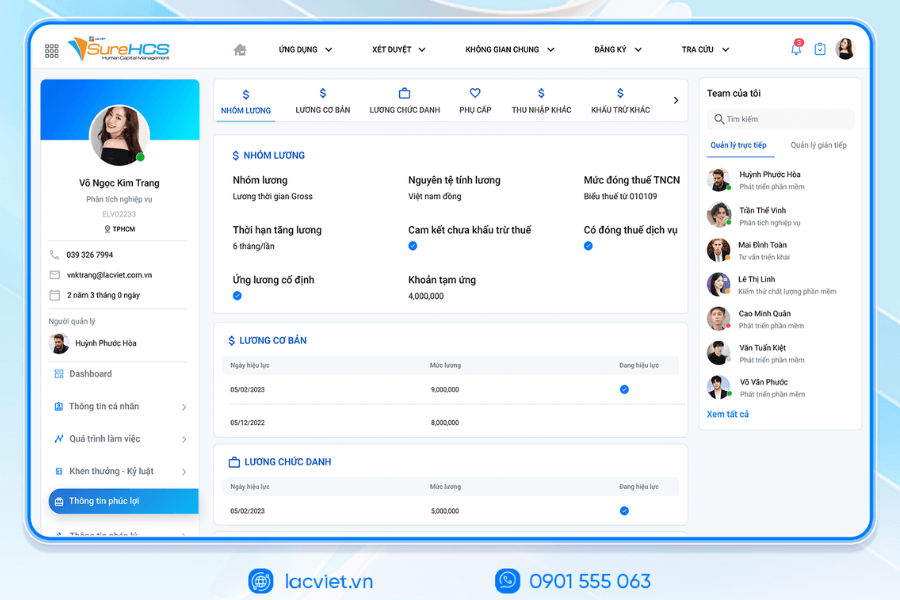

If the business is looking for a software solution, hr payroll comprehensive medium optimum payroll process, ensuring compliance with laws, Lac Viet SureHCS is the option worth considering. Developed by News corporation Lac Vietnam has more than 30 years of experience in the field of information technology, LV SureHCS fully integrated features to manage personnel, timekeeping, payroll, tax and insurance to help businesses save time, reduce errors and enhance the experience of employees.

Highlights of SureHCS is the ability to flexibly customized according to the characteristics each industry, enterprise scale. The system can automate the entire process, personnel management, salary from entering timesheet data, calculate salary and allowances to the tax deduction social insurance.

Thanks to that, the hr department not only shorten the processing time but also minimize the risks of errors to ensure data transparency correctly.

LAC VIET SUREHCS – HR MANAGEMENT SALARY C&B CUSTOM DEPTH FOR BIG BUSINESS

Lac Viet SureHCS is software HRM personnel management comprehensive, developed by Lac Viet – unit more than 30 years of experience in the field of management software business in Vietnam with international standards such as CMMI Level 3, ISO 9001:2015 and ISO 27001:2013.

SureHCS not only meet the professional personnel standards, which are designed to handle the hr – C&B – wages complex, large-scale, multi-company, multi-sector, in particular in accordance with FDI enterprises, corporations, factory, logistics, aviation, hotel, trade – in service.

The system is flexible deployment On-premise or as a custom model in depth, to help businesses automate the entire process hr – attendance – payroll – benefits – insurance, complete replacement job management using Excel discrete.

The module's core hr software lacviet SureHCS:

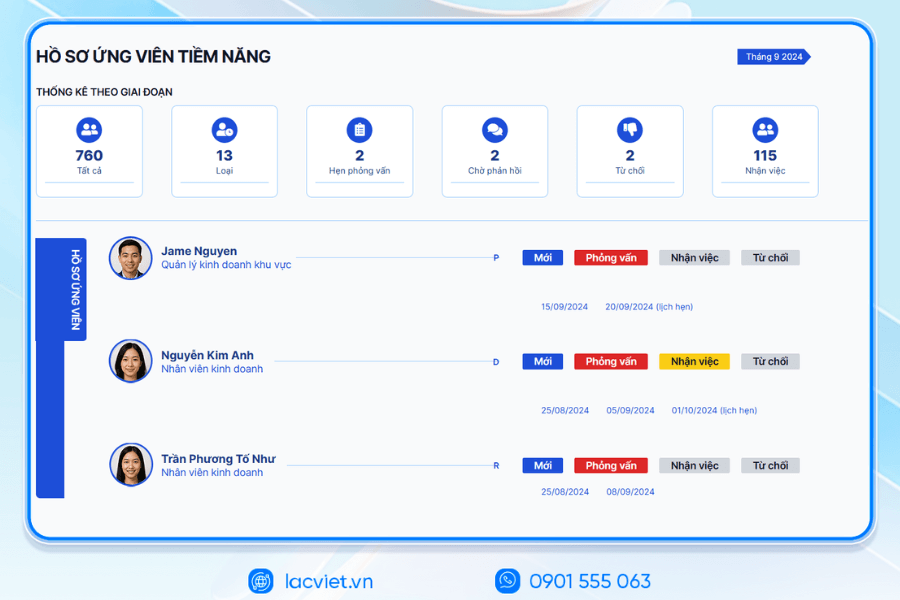

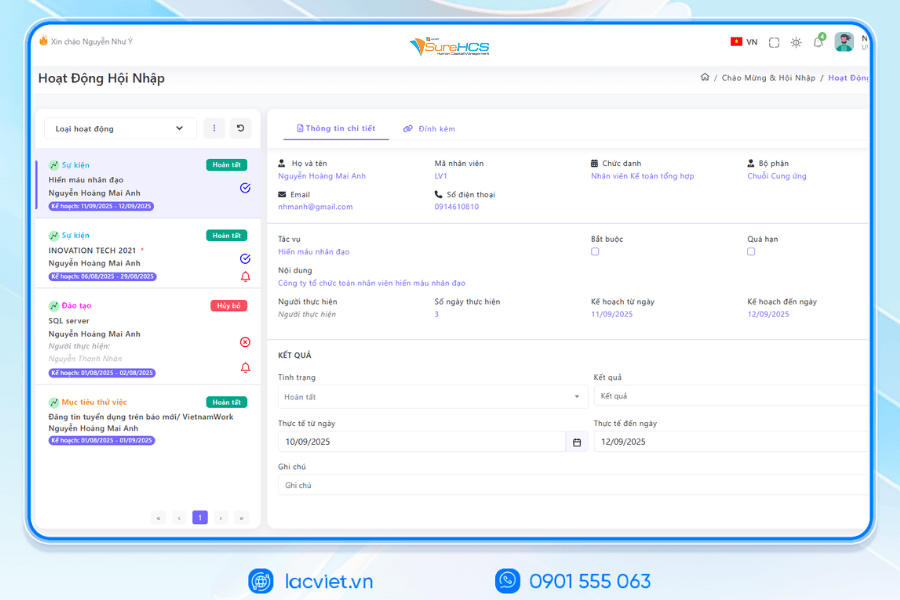

- The Recruit – Training: Management throughout the recruitment, integration, training, hr support and build the Talent Pipeline for large-scale enterprise.

- Port information & records Management personnel: Store personnel records, electronic focus, portal self-service for employees and contract labor power on the system.

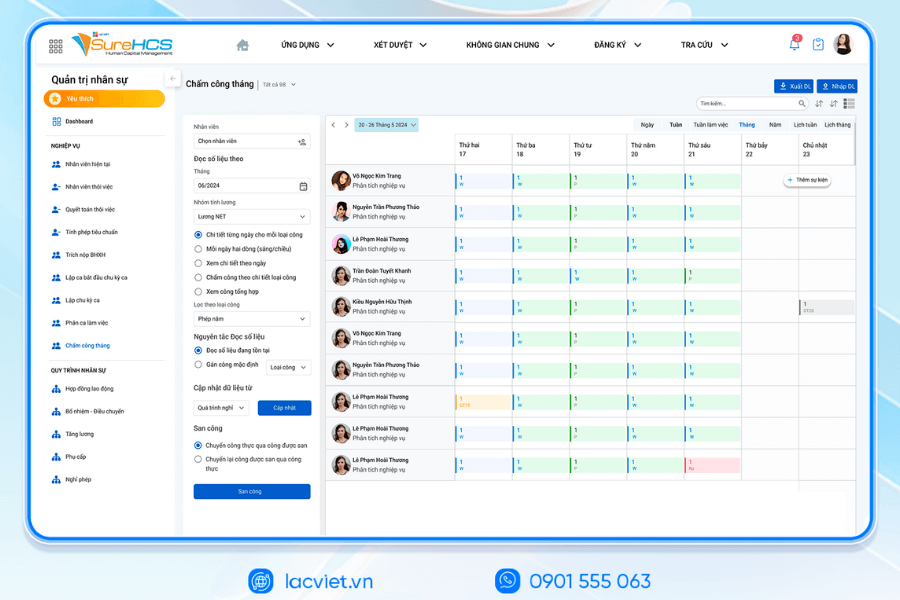

- The timekeeper: Dots, multi-form (fingerprint, face recognition, Face ID, GPS, Wifi, online), connect many types of timekeeper, support attendance by the hour, shift flexibility for the plant, and hotels.

- The payroll & C&B: Automatic salary calculation according to many models (hour, shift, product, 3P, KPI performance...), link directly attendance data – performance – welfare, completely replace the salary calculator using Excel.

- Welfare – SOCIAL insurance – salary: Management benefits flexible, integrated iVAN connect SOCIAL and electronic Bank Hub salary automatically, support pay multi-currency for FDI.

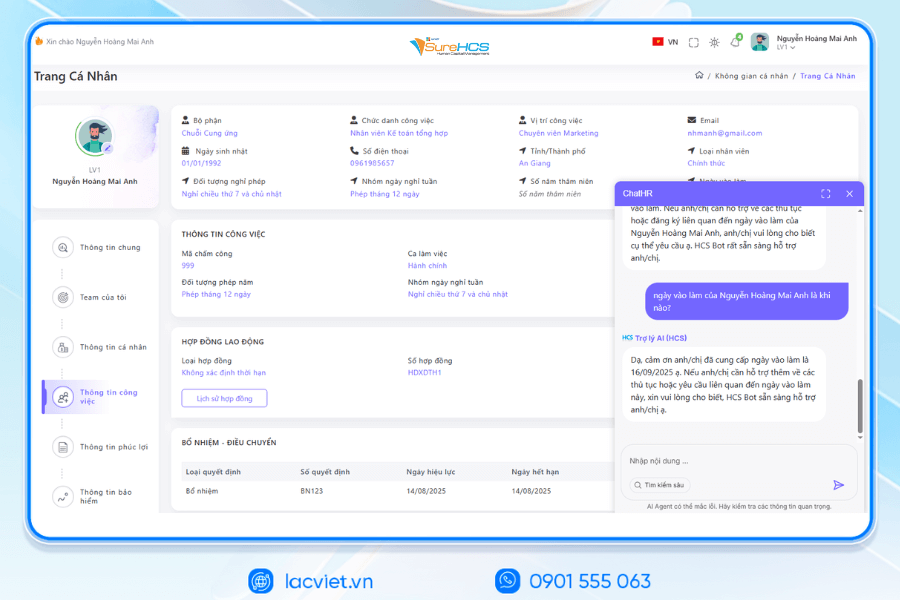

INTEGRATED AI ACCELERATED CONVERSION OF HUMAN RESOURCES MANAGEMENT

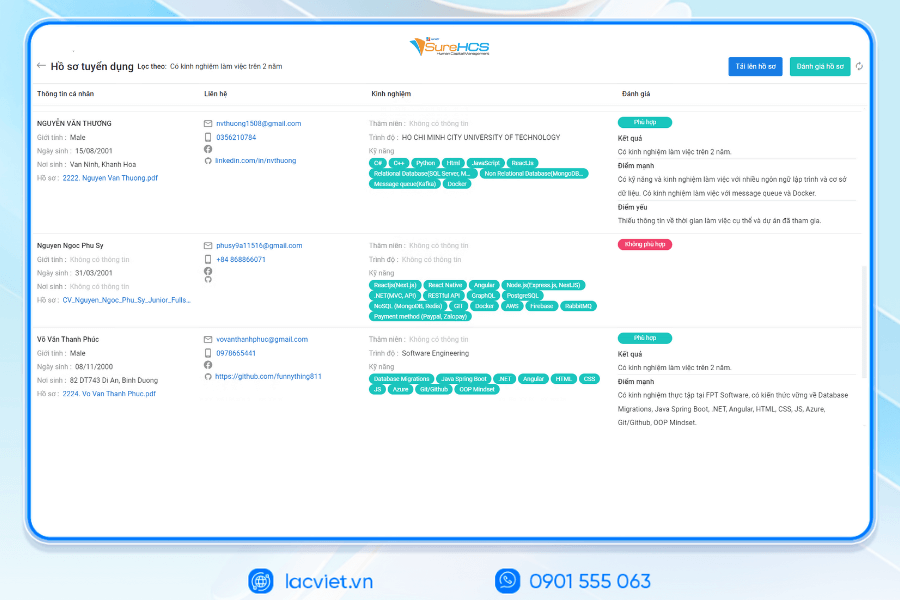

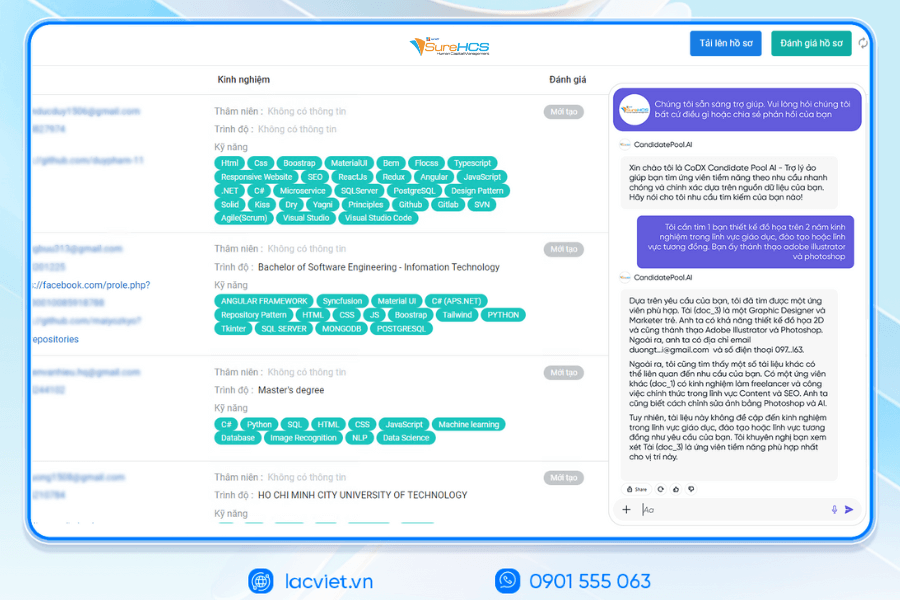

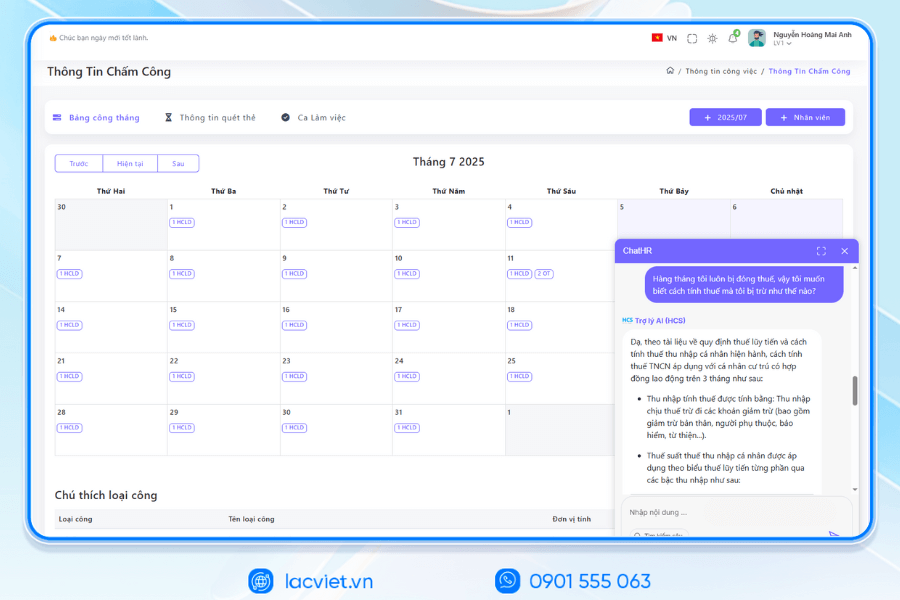

Lac Viet has officially launched The 3 AI assistant hr deeply integrated into the LV SureHCS including LV-AI.Docs, LV‑AI.Resume and LV‑AI.Help to automate the task administration, standardized data enhanced experience personnel

- LV‑AI.Docs: automatic dissection transfer data from documents such as CCCD, windows, SOCIAL insurance, by level of digital records, standardized

- LV‑AI.Resume: automatic dissection CV any format, analyst CV auto, construction, candidate profile, find people with the right criteria by prompt intelligent data mining candidate pool efficiency

- LV‑AI.Help: chatbot internal support, answer questions HR 24/7 access form process quick contextual user

TYPICAL CUSTOMERS DEPLOYING LV SUREHCS HRM

SureHCS are trusted and used by many large enterprises and leading corporations such as: Coca-Cola, Takashimaya, Textile SuccessfulPlastic Long Thanh Phu Hung Life, Airports of Vietnam (ACV)the business belonging to the SGCthe FDI enterprises in the fields of production, logistics, trade – in service.

- Coca-Cola Vietnam: System deployment LV SureHCS to digitize comprehensive human resource management group has standardized the data, the optimal operating HR according to international model.

- Textile company Success (TCM): Application LV SureHCS to manage hr, payroll, benefits, timekeeping and capacity profile for nearly 5,000 employees across 5 areas of activity – from textiles and fashion to real estate.

- Total company air Port, Vietnam (ACV): Choose to trust LV SureHCS to operate the system large-scale personnel with over 10,000 employees, 24 subdivisions, solved the problem of complex business of modeling state-owned companies.

SureHCS particularly suitable for:

- Large-scale enterprise, from 300 to 10,000 hr

- Corporations and enterprises multi-company, multi-branch

- FDI, manufacturing, factory, logistics, aviation should attendance – analysis ca – salary calculator complex

- Businesses are C&B peculiarities, need custom depth according to the actual operating

- Businesses are personnel management using Excel, many types of timekeeper, need automate the entire process

SIGN UP TO RECEIVE DEMO NOW

WHY BUSINESSES SHOULD CHOOSE TOUCH THE SUREHCS?

- Customized according to the actual business, no pressure mold as packaged software.

- Handle the personnel – salaries complex that many software HRM other does not respond.

- Deep understanding operated business English & FDI, ensure compliance with legal Vietnam (labour, SOCIAL insurance and personal income tax).

- Ecosystem integration strength: attendance – payroll – bank – SI – electronic contract.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: surehcs@lacviet.com.vn

- Website: https://lacviet.vn | www.surehcs.com

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

With friendly interface, easy to use, support English – English – Chinese human resource management software LV SureHCS suitable for both large organizations, multi-national and small and medium enterprises are understanding, solutions, management software, hr payroll modern.