Accounting raw materials are monitored, recorded, and control the import – export – inventory of raw materials both in number and value. The goal is to manage input costs, calculate the right price to limit losses in production and business. The accounting right under the accounting Law – mode Vietnamese accounting helps businesses ensure data transparency, service tax audit, auditing, and administration.

In fact, many businesses still have difficulty in accounting for raw materials, such as identifying the original price, calculate price, cumshot, warehouse or control difference, easily lead to misleading price as well as the risk when the settlement. These errors, if not timely treatment will directly affect the profitability, the accuracy of financial statements.

The same Lac Viet Computing find out details about accounting materials: from conceptual roles to accounting principle and process of practical implementation at the business.

1. Accounting materials is what?

Accounting raw materials as activity tracking, control the entire life cycle of materials from procurement and warehousing to take inventory on all aspects of quality and value. This helps businesses know quality, value and supplies buy-in, purpose of use, when the warehouse, at the same time determine the correct inventory practice to proactively handle the excess or deficiency in the production.

Especially with business, manufacturing, construction or trade have the proportion of the cost of raw material, accounting accounting materials, not just the accounting profession pure, but also hold the role of cost management and control financial risks. Specific accounting material yielded the following values:

- Control input costs & limited waste as Raw materials usually occupy a large proportion in the product price. Work closely monitoring import – export – survive help business early detection status of the purchase exceeds demand, wastage, abnormal or improper use of norms, thereby reducing losses and optimal cost.

- Base to properly calculate the complete price product: Data, raw materials, accurate accounting determine the true cost of production, to avoid price is team up or recorded deviations, directly affect profit and selling strategies.

- Ensure financial transparency & compliance accounting – tax: The raw material is an important part of financial statements, audit report and tax settlement. The accounting full, standards help businesses limit the legal risks, as well as disputes with regulatory authorities.

- Assist the administrator in planning, procurement & production: information, inventory, consumption of raw materials according to the states is the data input is important to leadership, decision-making on planning, shopping, storage and organization of production in accordance with cash flow as well as market demand.

2. The task of accounting of raw materials

In the context of business increasingly focus on cost management and operational efficiency, the task of accounting materials has expanded a lot more than the “book warehouse” tradition. Accounting supplies now just take on the role business just went into internal administration. The key tasks include:

- Track details the situation import – export – inventory materials: To hold track NVL under each category, every warehouse, every used parts. Businesses need to capture the exact amount of inventory at all times, avoid a shortage of raw materials cause disruptions to production or inventory too large stagnant capital.

- Check the validity and lawfulness of the stock from buy & warehousing: the accountant is responsible to check, invoice, contract, receipt to ensure evidence from adequate, properly regulated, avoid tax risks, as well as errors when the recorded cost.

- Accounting exact value of raw materials: Not only recorded the number, but also to determine the true value of imported materials inventory includes the purchase price and the cost involved.

- Coordinate inventory & collated data with warehouses and production: accounting should coordinate periodic with the same shed parts related to actual inventory and compare with the data of the books. Thereby, timely detection bias, attrition or flaws in the management process.

- Detection & warning risk related to raw materials: adopts accounting data, accounting material may soon recognize the signs of abnormalities such as consumption exceeds the inventory long day, raw materials, slow rotation, from that report leadership to take measures to timely treatment.

- Provides data service reporting & management decision making: Data and materials not only serve the financial statements but also as input for management reports such as cost analysis, analysis, production efficiency, planning budget. This is very important in increasing the value of accounting in modern business.

3. Principles & accounts used in the accounting profession materials

In actual operation, accounting materials are arising frequently, large numbers have a direct impact on costs, prices and profits. If accounting is not correct or missing, consistency, business is very easy to fall into a state of “cost not wrong, but profits still deflection”, which causes difficulties for the administration as well as tax settlement.

3.1. Accounting principle raw materials

Accounting of raw materials are required and subject to the direct adjustment of the Law on accounting, 2015, the accounting Standards in Vietnam no. 02 and accounting business issued under Circular 99/2025/TT-BTC. When done, businesses need to fully comply with the following principles:

Materials must be recorded according to the original price: in Accordance with the Law accounting 2015 and accounting Standards no. 02 – inventory and materials must be recorded at cost, including:

- The purchase price stated on the invoice legal

- Taxes are non-refundable

- Cost of transportation, unloading, storage and other costs directly related to the put the raw material on stock status and ready to use

Not the full set of the cost structure of the original price will do the value of raw material and product price is recorded lower fact, lead to false results, business and financial reporting.

Materials must be tracked in detail according to each type and each warehouse: According to Article 6 of the Law on accounting 2015, and requirements for transparency, internal control in circular 99, a business must:

- Open the window details on each type of raw material

- Track individually according to each warehouse or storage locations

- Recorded a full and timely manner, the import – export – survival

If only track the total inventory without details on each type and each warehouse, business will be difficult to control wastage and loss, and risk when inventory or inspection tax.

The method of calculating the price of stock must be selected and applied consistently: As specified in circular 99/2025/TT-BTC (which was amended and supplemented), the business is choosing the method of calculating the price of stock as:

- Method weighted average

- The method first in – first out (FIFO)

The method selected should be applied consistently throughout the accounting year. Case changes methods, a business must have a valid reason and thuyết minh full in the financial statements in accordance with the regulations.

Materials used must be properly purposes and are properly accounted for cost object: Raw materials when the repository must have sufficient grounds valid as warehouse, production orders, or suggest to use supplies. The accountant is responsible for accounting for expenses properly according to the parts used:

- Direct production

- Management workshop

- Sales

- Business management

The accounting right cost object to help businesses calculate the right price, performance evaluation each department and service analysis, governance decisions.

Business must perform inventory, and handle discrepancies inventory: in Accordance with Article 40 of the Law on accounting 2015, business required to inventory of raw materials, periodically or upon request. After inventory, accounting must:

- Collation of material fact with bookkeeping

- Determine the cause of excess, teen

- Perform accounting treatment difference according to current regulations

The no inventory or no treatment difference inventory will reduce the reliability of financial reporting and increase legal risks for business.

3.2. The account of raw materials accounting is often used (materials, tools...).

According to Mode of business accounting, issued in circular 99/2025/TT-BTC, the accounting of raw materials, mainly using the following accounts:

- Account 152 – Raw materials: Used to reflect the existing value and volatility increase and decrease of raw materials in stock. This is central account in accounting materials, help businesses track inventory on the face value.

- Account 153 – tools: Apply to the types of tools and not enough standard recorded as fixed assets. The clear distinction between raw materials – tools to help businesses cost allocation-time and accurate use.

- Account 111, 112 – Cash & bank deposits: a Reflection form of payment when purchasing raw material. Keeping track of the correct payment account help control the flow of money, debts more effectively.

- Account 331 – pay the seller: Recorded liabilities that arise when a business purchases raw materials but hasn immediate payment. This is the basis to manage payment obligations, negotiating terms with suppliers.

- The account costs, 621, 627, 641, 642: Used to set the cost of raw materials according to each intended use: direct production, the cost of joint production, cost of sales or cost management business. The allocation of the right help administrators evaluate the exact effect each department.

In summary, the proper use of accounting accounts to help businesses accurately reflect the inventory – cost – debt incurred. This is an important basis to control costs, ensure data transparency to serve for effective governance and decision-making.

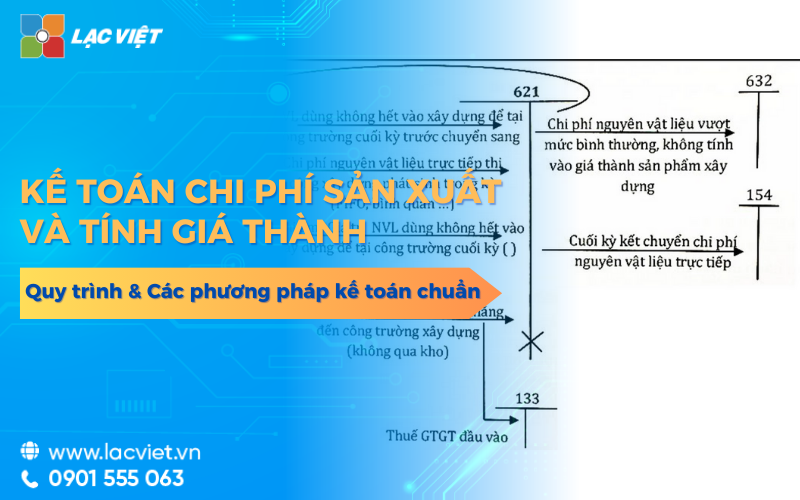

4. By accounting for material details (import, export, adjust NVL, ...)

To help the organizations and enterprises are to find out information about accounting of raw materials, easy to visualize, here are some actual examples common:

4.1 warehousing raw materials purchasing in addition

When businesses purchase of raw materials, production service, got enough and there are bills, vouchers, valid accounting made recorded as follows:

- Debt TK 152 – Raw materials

- Debt TK 133 – VAT is withheld (if available)

- Have TK 111, 112 or 331 – depending on the payment type

This helps enterprises recorded the full value of raw materials at cost, including costs directly related to bringing supplies to the warehouse. Accounting exact right from imported stock is the foundation important to properly calculate the product price and tax declaration prescribed.

Under the guidance of the Ministry of Finance circular of 99, the expenses of purchase if not fully integrated into the original price may distort the value of inventory and direct influence to the results of trading on the financial statements.

4.2. the raw material for production

When raw materials production activities, products, accounting record:

- Debt TK 621 – the Cost of raw materials directly

- Have TK 152 – Raw materials

Pen math this reflects the transfer of valuable raw materials from warehouse to production costs in the states. Through TK 621, businesses can track the consumption of raw materials in each period, each workshop or each order, from which compare with norms have built.

With respect to governance, the accounting of the true cost of raw materials directly help businesses:

- Calculate the price of the product more accurately

- Timely detection condition beyond the level or waste materials

- As a basis adjustment planning, purchasing and production

According to the guide cost management of the Ministry of Finance, better control the cost of raw materials is one of the key factors that help enterprises improve production efficiency and competitiveness.

4.3 adjust The excess material shortages following inventory

After performing inventory periodically or irregularly, the business can arise the difference between the actual data and bookkeeping. Meanwhile, the accountant should handle in accordance with regulations:

Case excess raw material has not yet determined the cause:

- Debt TK 152 – Raw materials

- Have TK 338 – pay, payable other

Case of lack of raw material awaiting processing:

- Debt TK 138 – other receivables

- Have TK 152 – Raw materials

The pen this math help business promptly difference, inventory, at the same time form the basis to determine the cause and responsibility related. Handle transparent disparity inventory not only ensure the integrity of financial reporting, but also helps to strengthen internal controls, limit your risk when the tax or audit check.

According to the accounting Law and guidelines for current business't done a full inventory and accounting arbitrage inventory can be evaluated as not in compliance with accounting regime, reducing the reliability of financial data.

5. The standard process accounting materials in business

In actual operation, many businesses risk not due to accounting for the wrong account, that due to the accounting process, raw materials, not tight, lack of control between the parts purchase – inventory – accounting. A standard procedure to help businesses ensure both compliance with the law on accounting, just good cost control and limit losses.

Step 1: Import the raw materials

Enter the warehouse is the first step can directly affect the accuracy of the whole number of raw material after this. About business process and warehousing of raw materials, need to do the following:

- Receiving & inspection full stock from: the accountant should receive the relevant documents such as purchase contracts, invoices, delivery notes. Checking stock from help ensure raw materials are purchased legally, qualify recorded expenses as well as tax deductible (if any).

- Reality check quantity & quality of raw materials: Raw materials enter a warehouse must be contrasted between vouchers and practical. Case of shortage, wrong size, or poor quality need to make a record now, avoid recorded wrong right from the start.

- Establishment receipt & recorded promptly on accounting system: After the test, accounting or warehouse establishment receipt basis of accounting. The recorded timely help data inventory always reflect the true fact, avoid “row was about the warehouse, but the books do not have”.

- Collated data between accounting & stock: the End of each day or periodically, the accountant should collate data warehouse with inventory. This is the critical control help early detection of errors, limiting the risk of loss.

The import process inventory closely to help businesses better control input costs, avoiding noted the lack or the excess raw materials, thereby reducing the deviation cost and risk when tax settlement.

Step 2: Export warehouse & use of materials

Export warehouse is sewn to develop flaws, most wasted if there is no clear process.

- Base stock to clear, valid: Raw materials will only be shed when production orders, stock recommendation warehouse or use plan approved. This helps to ensure raw materials are used for proper purposes, avoid stock arbitrarily.

- Accounting cost in the correct used parts: When the warehouse, the accountant should record the cost of raw materials in the correct object to use as the production, management or sales. The accounting properly to help businesses calculate the price accurately assess the effectiveness of each department and control the consumption of raw materials more efficiently.

- Track details on each object set cost: For business, manufacture or construction, the track materials in each order, work or project is very necessary. This helps administrators know works or products are consumption of raw materials exceeds the permitted level.

- Application accounting software to limit errors manually: When using accounting software, data warehouse export is the automatic update contact information with the relevant department.

The export process inventory clear helps businesses better control the cost of raw materials, limiting waste and improving the efficiency use of resources.

Step 3: inventory & assessment inventory

Inventory is the last step but have a decisive role to the reliability of accounting data and materials.

- The frequency of inventory: Businesses need to make inventory of raw materials periodically by month, quarter, or year, at the same time conduct an inventory of extraordinarily when there are signs of false data, change of personnel, warehouse or request the administrator to ensure data inventory accuracy and transparency.

- Identify & handle variances inventory: After inventory and accounting to compare the actual number with the register to determine the excess or lack. Any discrepancy must be recorded in writing, determine the cause and handled in accordance with the regulations on accounting.

- Classification wastage reasonable: wastage of raw material should be classified clearly between attrition in the level permitted and loss beyond the norm to determine responsibility. This classification helps businesses strengthen internal control and limit the risk of removal costs when tax settlement.

- Determine the value of inventory end of period: inventory value is determined according to the formula:

(Inventory value = the Number of unsold real × Unit price of stock by the method applied)

Inventory & assessment inventory accuracy to help businesses properly reflect the financial situation, improve the reliability of reporting in order to support timely decision-making.

5. The risks businesses are often in materials management

In practical advice as well as implementing accounting raw materials for many businesses, one can see that the majority of risk related to raw material does not stem from lack of regulations, which from the organization to manage and track not fit with the scale of operation.

Loss and wastage of raw materials due to loose control

Raw materials are the property easy to losses in business since directly related to many parts: purchase, inventory, production. If the process input – output – use is not tightly controlled, the business is very difficult to detect wastage unusual.

With many businesses, account loss, this is not a clear identification of which only manifested indirectly through the price increase, but profits did not improve.

Wrong data due to data entry craft for control

Many businesses still manage materials in Excel, discrete or recorded manually, which leads to:

- Data of import – export does not update timely

- Deviations between accounting, inventory reality

- Take as much time as reference for final

Errors of data affects not only financial statements but also reduce the reliability of the information service leadership decisions.

Large inventory cause stagnant capital & development costs

Materials management not effective often leads to two state downloads:

- Inventory too much of the purchase exceeds the demand

- Inventory is slow-moving but are not timely warning

With the business of production, inventory not only increases the costs of storage, but also potential risks, damaged, outdated materials.

Lack of data, timely service & decisions

When the data and materials are synthesized only last month, or last quarter, the administrators do not have sufficient information to:

- Adjusted purchase plan

- Control production costs in real time

- Early detection of points of congestion in operation

This is especially detrimental to the organizations and enterprises are to find out information about material accounting to scale or standardized financial management.

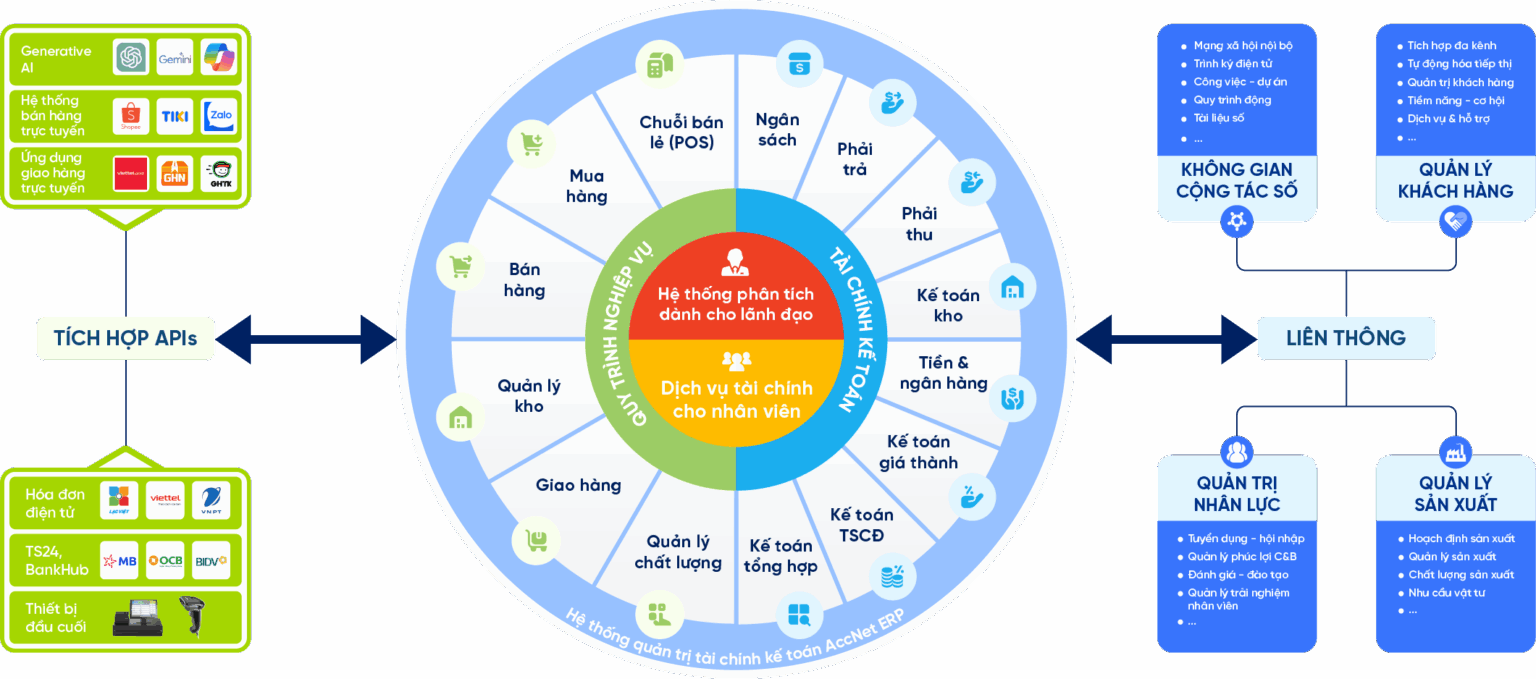

6. Accnet ERP helps to manage business accounting and materials optimal standard TT99/2025

To solve the above risks, the general trend of many businesses today is the application software, accounting software integration, which AccNet ERP is a solution suitable to particular management accounting, in Vietnam.

- Standardize & automate the process of accounting materials: AccNet ERP helps business set up process input – output – inventory of raw materials uniformly, from purchasing, warehouse to accounting. Data is recorded once and used throughout, to reduce dependence on manual action as well as to limit errors.

- Track inventory in real time, timely warning: The software enables inventory tracking raw materials according to each stock, each type and instant updates when arising import – export, at the same time allows to set the threshold inventory min – max to warn shortage of raw materials affect the production or discovery, inventory excess, causing stagnant capital.

- Accounting of raw materials in sync with purchase – production – price: AccNet ERP tight integration between the Purchase, Inventory, accounting and production cost, help data, raw materials, is automatically allocated to the cost of production. Thanks to that, the business can calculate the price of more accurate cost analysis according to each product, orders, or works, at the same time support leadership decisions based on real data.

- Enhance transparency & reliability of accounting data: The use of AccNet ERP helps businesses build data systems, accounting concentration, has the ability to trace vouchers and collated quickly when needed inventory, audit, or tax settlement, this element is particularly important for businesses that are in the stage of standardized administration, finance or expand the scale of operation.

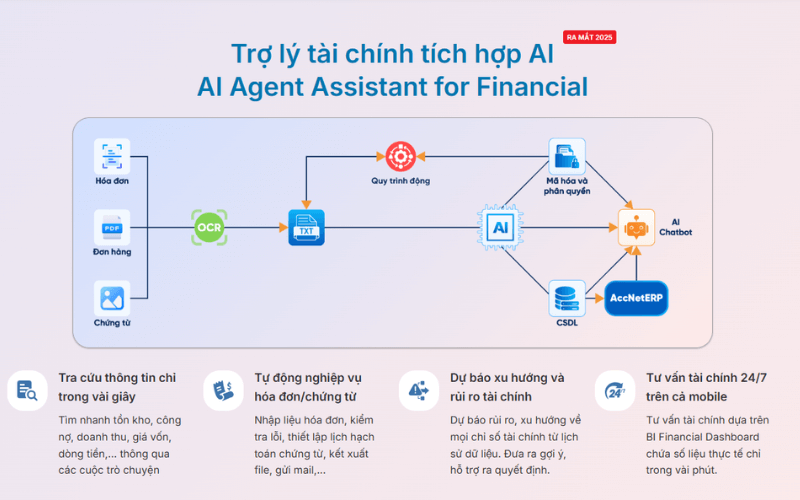

ACCOUNTING SOLUTIONS ACCNET ERP INTEGRATED AI AUTOMATE ALL BUSINESS

AccNet ERP is a software solution financial accounting integrated in the management system, comprehensive enterprise, which is developed by Lac Viet corporation. Difference highlights of AccNet ERP is the app artificial intelligence (AI) in many accounting process to help businesses:

- Automation of accounting and classified documents.

- Improving the accuracy in data control.

- Shorten processing time business accounting – financial.

Thanks to that, AccNet ERP not only is support tool but also a “smart assistant” with the business in financial management transparent effect.

Feature highlights:

✔️ Automatic accounting vouchers, collate public debt thanks to AI.

✔️ Manage your finance – accounting multi-branch, multi-subsidiary.

✔️ Financial statements consolidated standards of Vietnam & international (VAS, IFRS).

✔️ Cash flow management, budgeting, forecasting the exact cost.

✔️ Connect with the manure management system, hr, production, sales to sync data.

✔️ Integration of AI in data analysis, risk warning and proposed optimal scheme.

TYPICAL CUSTOMERS ARE DEPLOYING ACCNET ERP

- Nitto Denko – control production costs thanks to the application of accounting costing: Nitto Denko has chosen solution AccNet ERP to deploy the system accounting calculating cost ofhelp business control costs more effectively in the production process. After a period of use, company, highly effective, practical system that brings, as well as the degree of stability superior to other software in the market.

- ANTESCO – restructuring process works with management accounting operation: At ANTESCO, our team of consultants and deployment of AccNetERP has collaborated closely with the business in the first phase, reset the standard process and construction work-flow related departments throughout. The solution has helped ANTESCO significantly improve management capabilities, operating in a synchronized way and versatile

- Khatoco – expansion pack solution AccNetC after the successful implementation of original: Lac Viet has successfully deployed package solution AccNetC for trade co., LTD Khatoco in Nha Trang, according to the agreement signed on 29/07/2014. After the system is first put into operation efficiency, Khatoco intends to continue cooperation and expand the distribution finance – accounting and retail management with AccNetC, expressing the deep trust in implementation capacity and quality of service from Lac Viet.

SIGN UP TO RECEIVE DEMO NOW

INTEGRATED AI ACCELERATION CONVERTER OF ACCOUNTING

AI in AccNet ERP't just stop at automate data entry, but also:

- Identification & classification certificate from smart: AI scan, read & sort invoice, voucher, receipt, limit errors due to input manually.

- Financial forecasting & budget: the system uses algorithms machine learning to forecast cost, revenue, business support decision fast.

- Warning risk accounting: AI to detect abnormalities in the book, from which timely warning of false or fraud risks.

- Reports assistant smart: AI suggested report template, automatic data aggregation support, leadership, financial analysis instant.

BUSINESS IS WHAT WHEN IMPLEMENTING ACCOUNTING SOFTWARE LAC VIET?

- Experience more than 30 years develop software solutions business management in Vietnam.

- Ecosystem of comprehensive: AccNet ERP easily connect with other solutions of Lac Viet (HRM, Workflow, Portal...).

- Advanced technology: Integrated AI support, cloud & on-premise flexible.

- Services dedicated support: A team of knowledgeable professionals with accounting – finance in Vietnam, companion throughout the deployment.

- Trust from thousands of customers in many areas: finance, banking, manufacturing, trade, services.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: accnet@lacviet.com.vn | Website: https://accnet.vn/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

Accounting of raw materials plays a critical role in controlling cost, calculate the right price to ensure financial transparency for business. The accounting right principles and organization process closely to help limit losses, reduce risk when solving audit. At the same time, data, materials accurate also support administrator effective decisions about procurement, production and cash flow. Therefore, standardized accounting materials is an important basis for financial management of sustainability.