Management compensation is an integral part in the operations of any business. However, the salary management is not only time consuming but also easily lead to errors. Errors in the calculation of payroll, deduction of tax or other benefits that may cause big problems financially and distrust of employees.

With the diversity of the solution payroll software on the market, businesses need to learn to choose the system best suited to the scale and needs. This article Lac Viet will introduce the top software, payroll management highlights in Vietnam, along with the features, pros, cons, prices help businesses make the right decision in investing in technology for the management of personnel.

1. Why businesses should use payroll software?

In the past several years, no less business in Vietnam still maintaining the salary calculator in Excel or other tools. This approach however familiar, but potential risks: easy to errors, time consuming, difficult to control when data personnel is increasing. With the business there from a few hundred to a few thousand employees, just an error formula in Excel file also can lead to the wrong wage, causing a dispute, affecting the reputation and spirit of the workers.

The obvious benefits that businesses receive include:

- Process automation salary calculator: Software salary helps to automatically link data from multiple sources: labor contracts, timesheets, overtime, allowances, bonus, penalty, tax – social insurance. Instead of the hr department to enter the data manually, the system will calculate accurate, fast. For example, a service company has 500 employees each took 5 days to latch payroll, but after deploying software, timekeeping, and payroll, the whole process only 2 days.

- To limit errors, legal risks: The regulations on personal income tax or social insurance, change management software, payroll will be updated timely, ensure the calculations are always correct law to help businesses avoid fines due to violation of administrative and create transparency in the remuneration policy.

- Data security personnel: Payroll data is sensitive information. If stored in Excel or email, the risk of information leakage is very high. Conversely, a system management salary is built on the foundation of modern security will help, access subdivisions, delete, limit the disclosure of information is not desired.

- Increased experience, employee engagement: Not less employees feel a lack of transparency when compensation is wrong or delayed. With payroll software, employee, every individual can look up the salary history of reward and punishment, holidays on the portal. This helps employees feel reassured and more confident in business.

In summary, software, salary management is not just a tool to help hr departments reduce the work load but also the solution strategy, contribute to improving governance, legal compliance, data security and retain talent.

- Criteria for evaluating hr software best & how to implement the right to deliver effective

- 15 software HRM integration of AI in human resource management optimization

- Vietnam launches 3 AI integration in software management personnel LV SureHCS HRM

- 15 Attendance software employee HRM PRECISE management, good pay

2. So sánh nhanh 15 Phần mềm tính lương nhân viên chuyên nghiệp nhất 2026 cho DN Việt

| Software name | Feature highlights | The package cost | Enterprise scale |

| Lac Viet SureHCS C&B |

|

Contact us to get a quote | Medium and large business |

| MISA AMIS |

|

|

Small and medium enterprises |

| Zoho Payroll |

|

Standard package: 19-35 USD/user/month | Small and medium enterprises |

| Cezanne HR |

|

Basic package: 12-15 USD/user/month | Medium and large businesses, multi-national |

| ADP Payroll |

|

Basic package: 10-15 USD/user/month | Big business, multi-national |

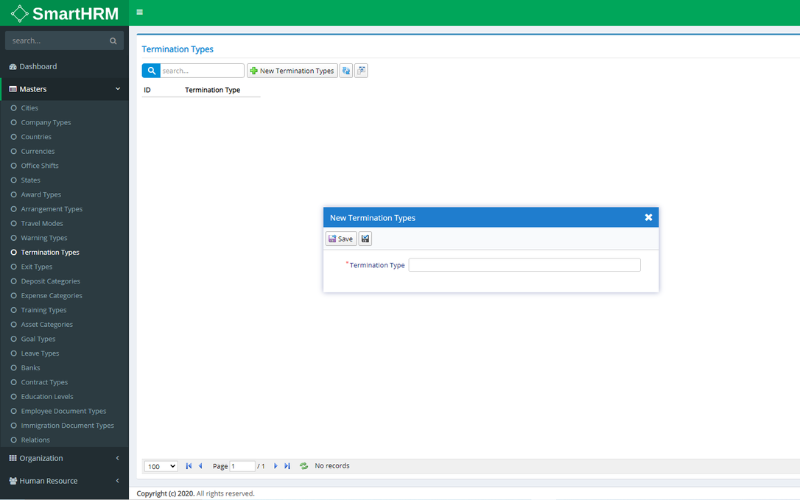

| SmartHRM |

|

|

Small and medium enterprises |

| HRM Pro (Fully) |

|

Contact us to get a quote | Medium and large business |

| Ecount ERP |

|

Basic package: 600.000 VND/month | Small and medium enterprises |

| Tanca |

|

|

Small and medium enterprises |

| Paradise HRM |

|

|

Medium and large business |

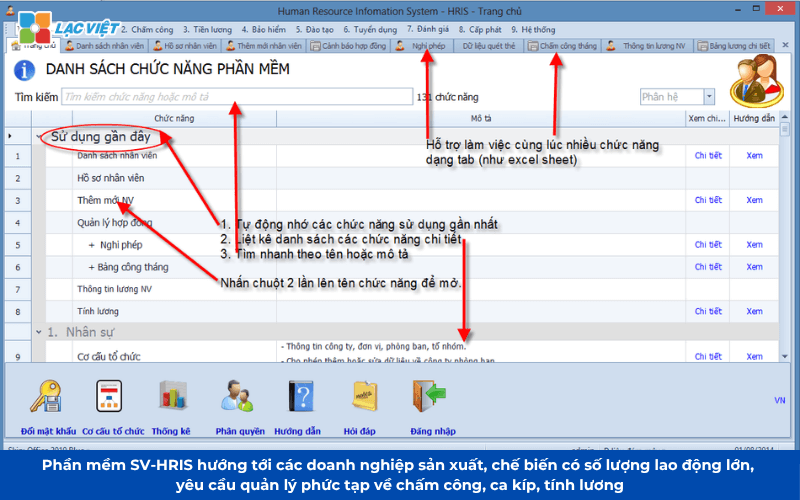

| SV-HRIS |

|

Contact us for a quote

(by number of personnel & distribution system deployment). |

Medium and large business in Vietnam need human resource management & salary in accordance with Vietnamese law. |

| FPT.iHRP (Vietnam) |

|

Quote upon request depending of the size or scope of deployment. | Business medium and large (≥ 300 hr), in particular, corporations, company, multi-branch. |

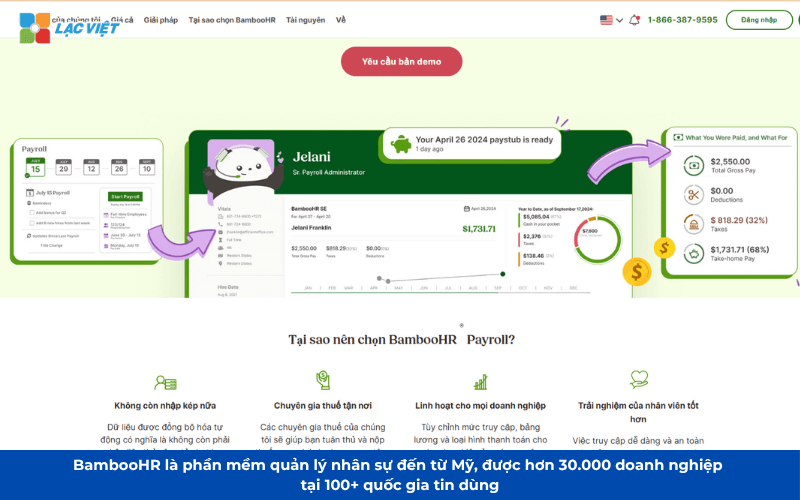

| BambooHR (Usa) |

|

|

Small business – medium (50-500 employees), consistent startup and services company international. |

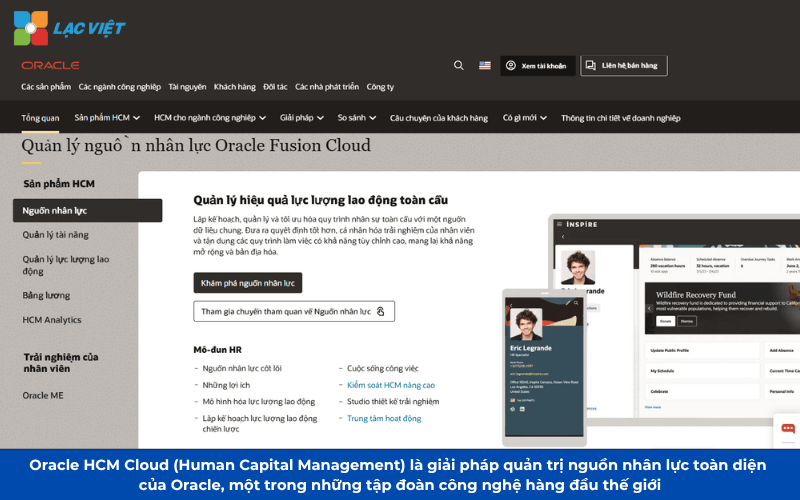

| Oracle HCM Cloud (Usa) |

|

|

Big business, multinational corporations need systems HRM international standards. |

| Workday HCM (Usa) |

|

|

Big business, global; fitting corporations over 1,000 personnel want to manage HR & Payroll integration. |

The table above provides an overview of 15 software payroll credits to help businesses easily compare choose solutions that fit the scale and demand of yourself.

3. Top 15 software payroll hr long life standard business manager salaries

Top 15 Phần mềm tính lương nhân sự lâu đời chuẩn nghiệp vụ tốt nhất 2026:

- Payroll software lacviet SureHCS C&B

- Misa Amis payroll

- Payroll software Zoho Payroll

- Payroll software Tanca

- Payroll software Paradise HRM

- Payroll software HRM PRO of VNResource

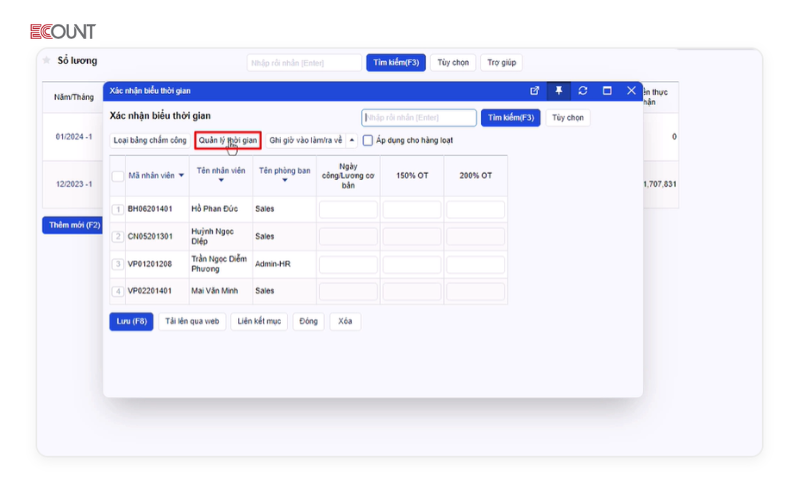

- Payroll software Ecount ERP

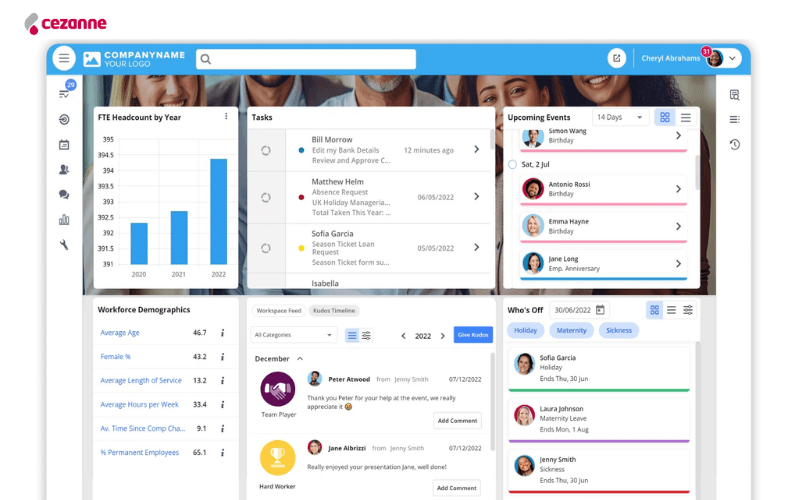

- Payroll software Cezanne HR

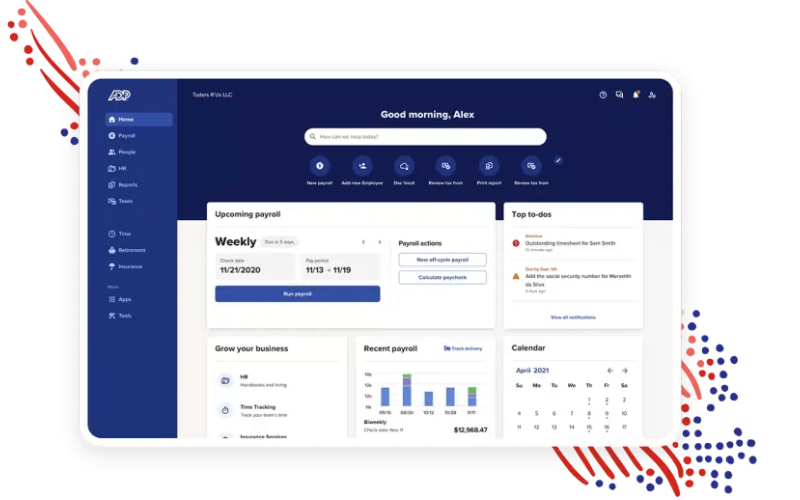

- Payroll software ADP Payroll

- Payroll software SmartHRM

- Payroll software SV-HRIS

- Payroll software FPT.iHRP

- Payroll software BambooHR

- Payroll software Oracle HCM Cloud

- Software payroll Workday HCM

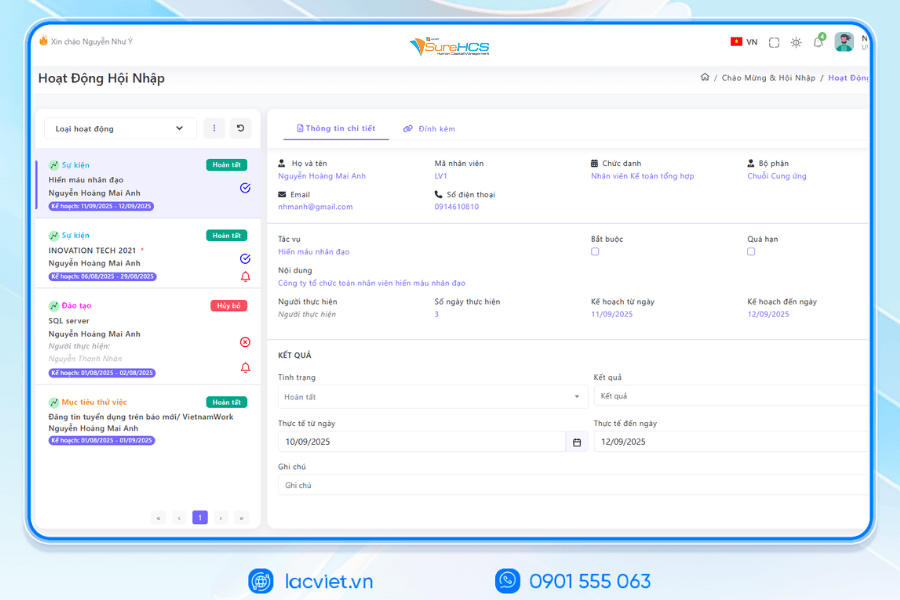

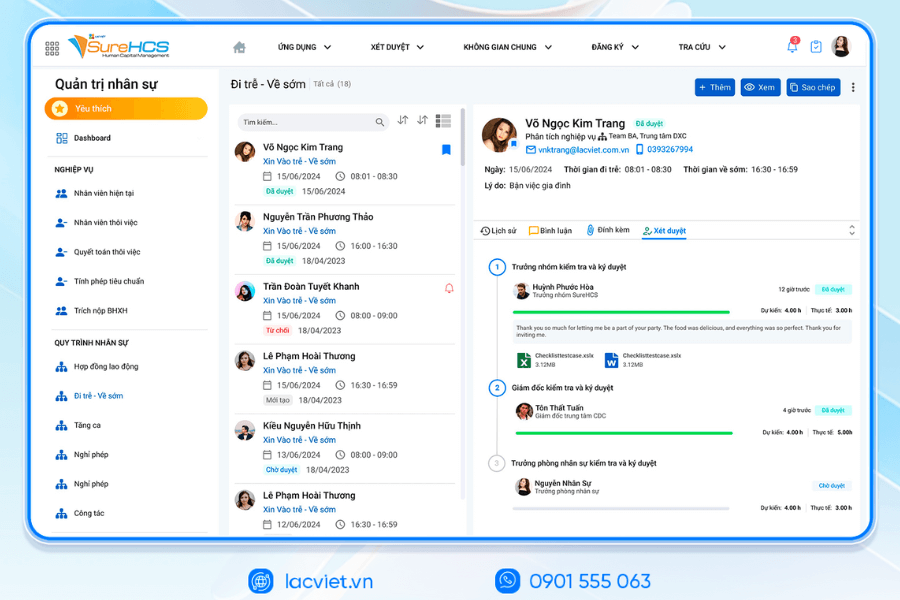

3.1 software payroll Vietnam SureHCS C&B

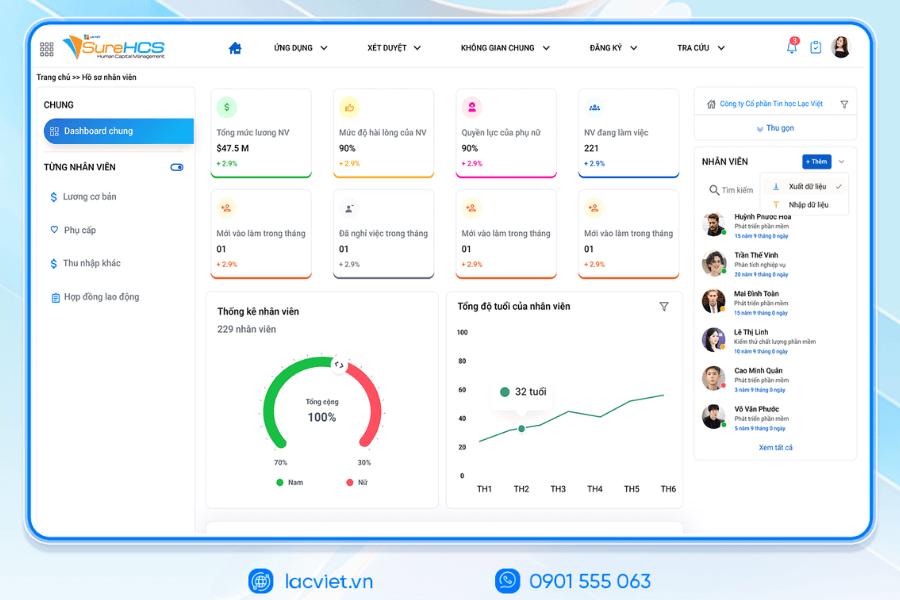

Lac Viet SureHCS C&B là một phần mềm tính lương nhân viên toàn diện được phát triển bởi Lạc Việt, có hơn 30 năm kinh nghiệm tại Việt Nam. Lạc Việt SureHCS được thiết kế đặc biệt để đáp ứng nhu cầu quản lý nhân sự, chấm công tính lương cho các doanh nghiệp ở mọi quy mô, từ doanh nghiệp vừa và nhỏ đến các tập đoàn lớn. Với công nghệ tích hợp AI, khả năng tùy chỉnh linh hoạt, Lạc Việt SureHCS giúp doanh nghiệp tự động hóa toàn bộ quy trình tính lương, giảm thiểu sai sót tăng hiệu quả quản lý.

Salient features of Lac Viet SureHCS C&B:

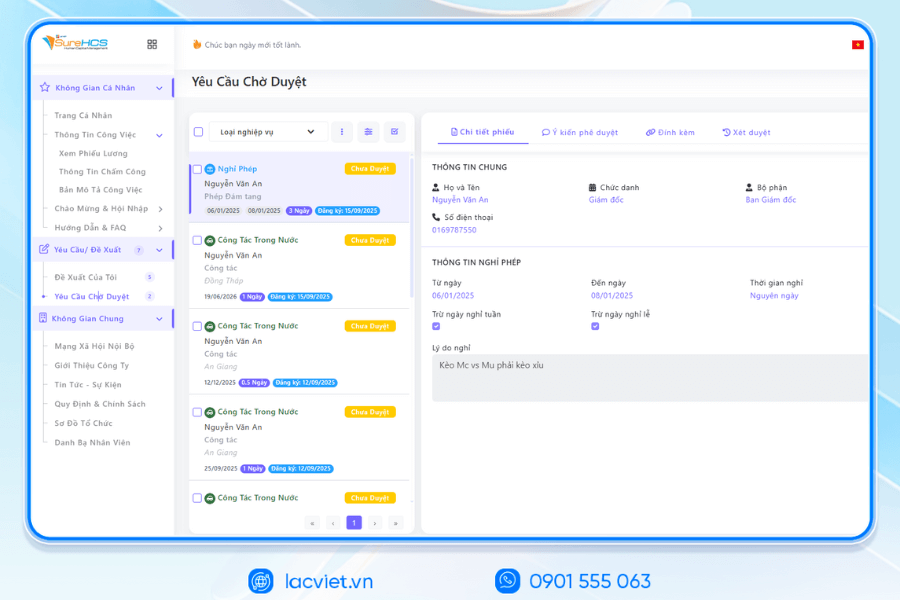

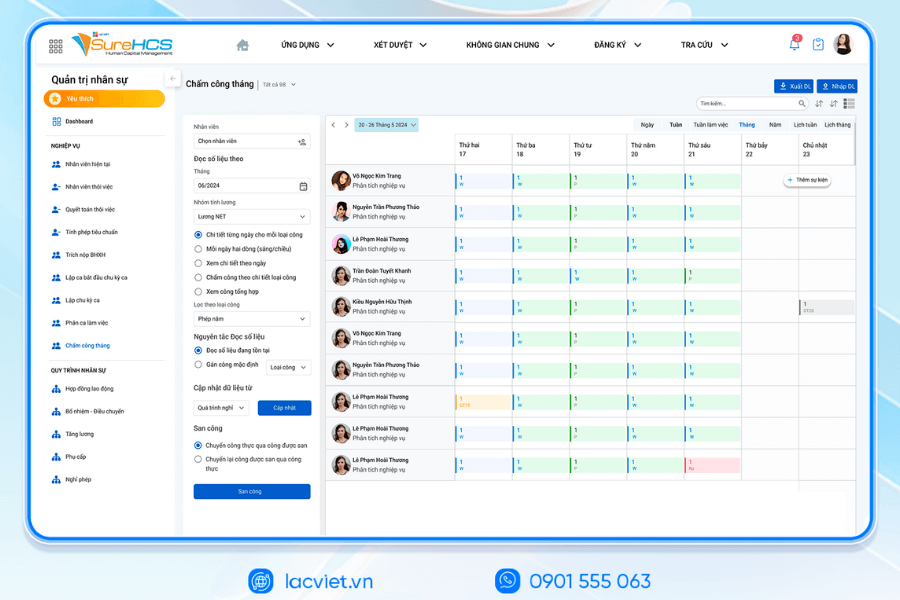

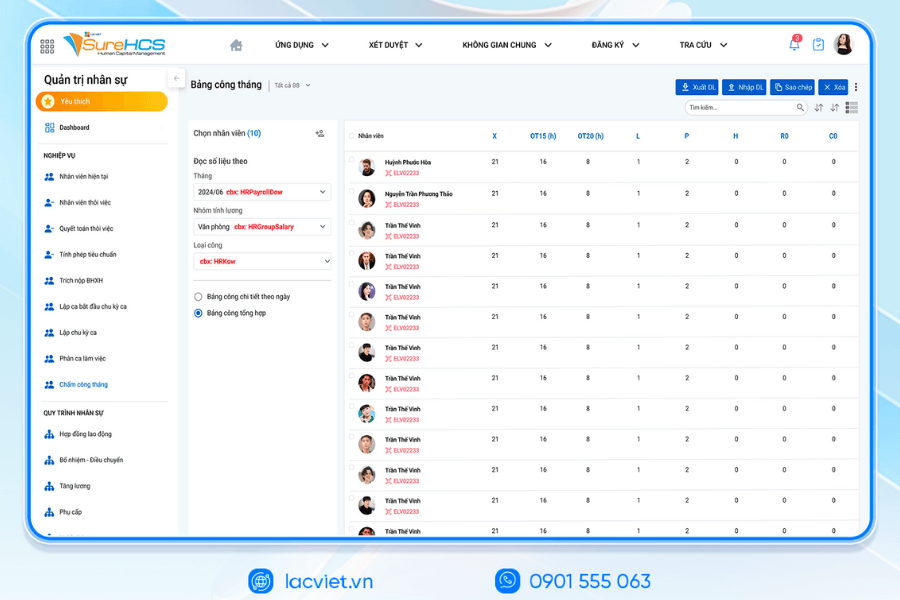

- Attendance management, payroll automation: Integrated systems, timekeeping, and payroll, automatically calculate salary, bonus, allowances, deductions.

- Tax insurance accurate: SureHCS automatically updates the rules on tax, social insurance, ensure accurate calculations comply with the law.

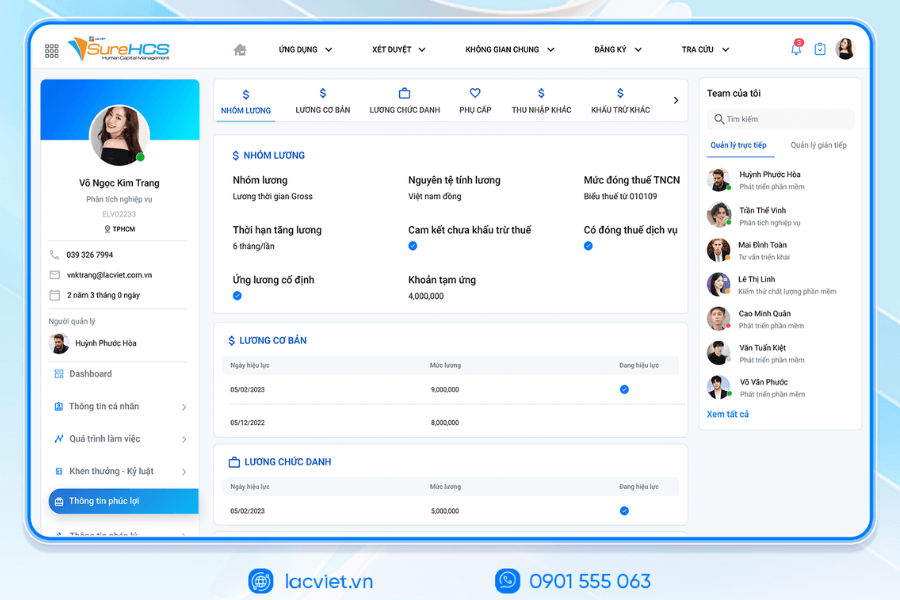

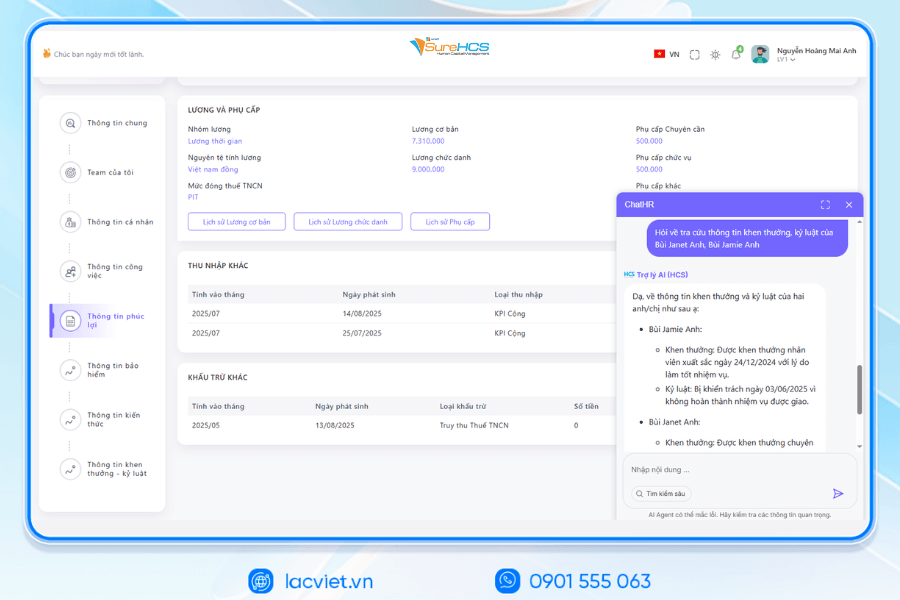

- Information management personnel details: Support records management hr from recruitment, contract labor, to track the process of work and the remuneration policy.

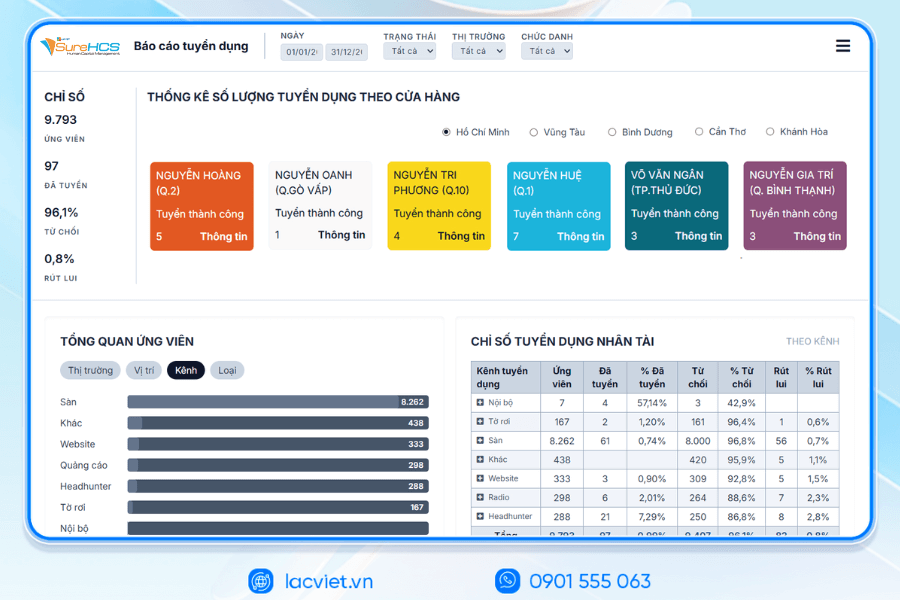

- Financial reporting personnel: Provides the detailed report on payroll, personnel costs, labour performance in real time.

- Integrated multi-platform system: SureHCS can be integrated with the system, financial management, ERP, help business management.

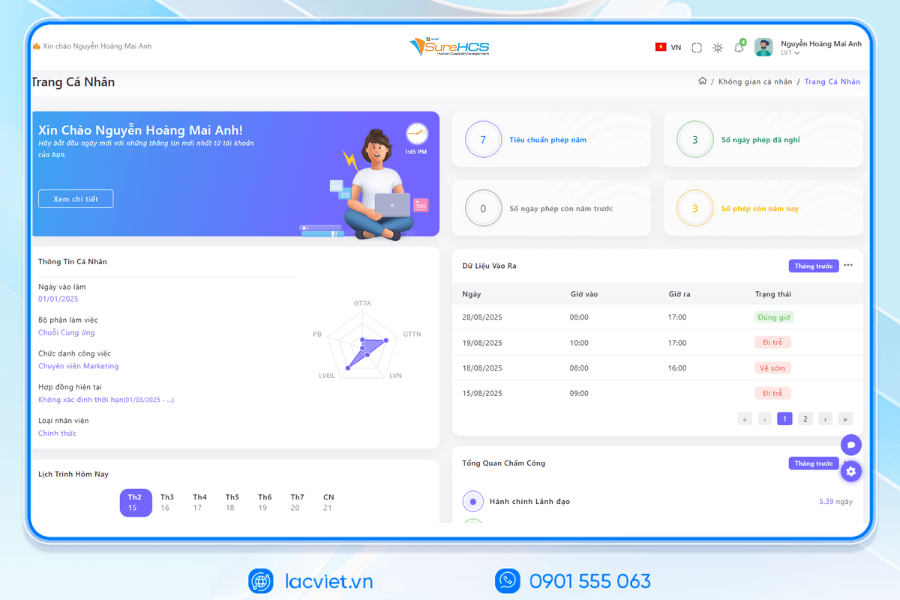

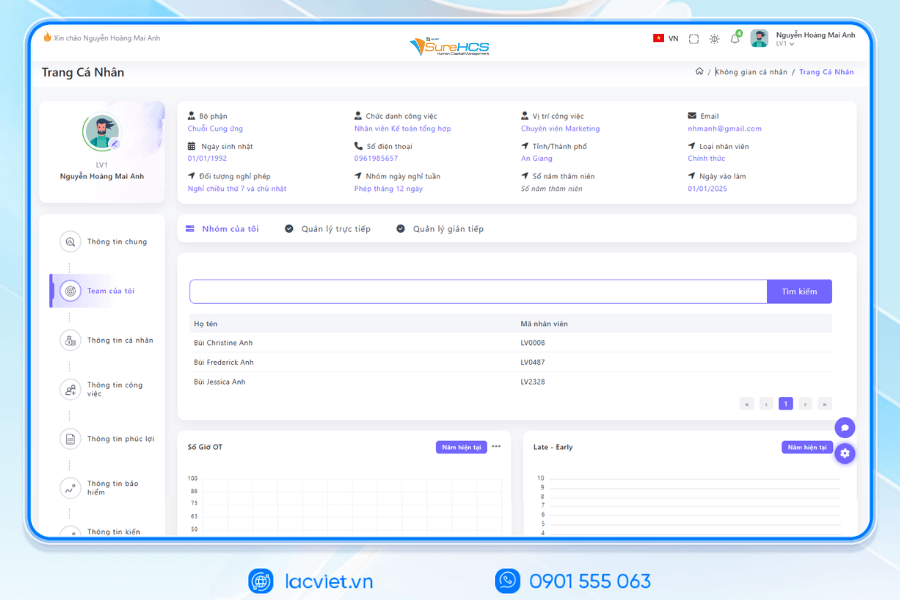

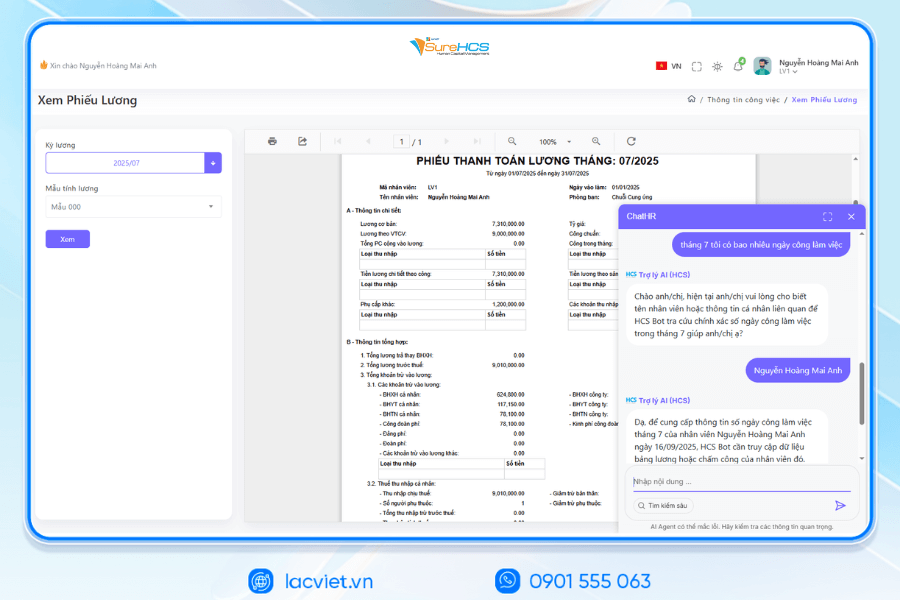

- Employee portal (Self-service): Employees can check the information of salary, vacation, benefits individuals through the online portal.

See details, feature & get FREE Demo

Table advantages and disadvantages of Lac Viet SureHCS

| Advantages | Cons |

| The ability to customize flexible to meet various regulatory requirements | The deployment process can take time for big business |

| Calculate salary accuracy, compliance rules law | Higher cost compared to other software in the same segment |

| Tích hợp dễ dàng với ERP software | Technically demanding in the custom system |

| Our team of technical support professional | Requires personnel training for effective use |

Price of the package Lac Viet SureHCS

Lac Viet SureHCS packages offer flexible services according to the needs of the business:

- Basic Package: In accordance with the small business, from 15 million/year, including management, hr, payroll basic.

- Standard Package: From 30 million/year, including advanced features such as attendance management, tax, insurance.

- Premium Package: For large enterprises with many branches, from 60 million/year, including full-featured management, detailed reporting, integrated ERP.

LAC VIET SUREHCS – HR MANAGEMENT SALARY C&B CUSTOM DEPTH FOR BIG BUSINESS

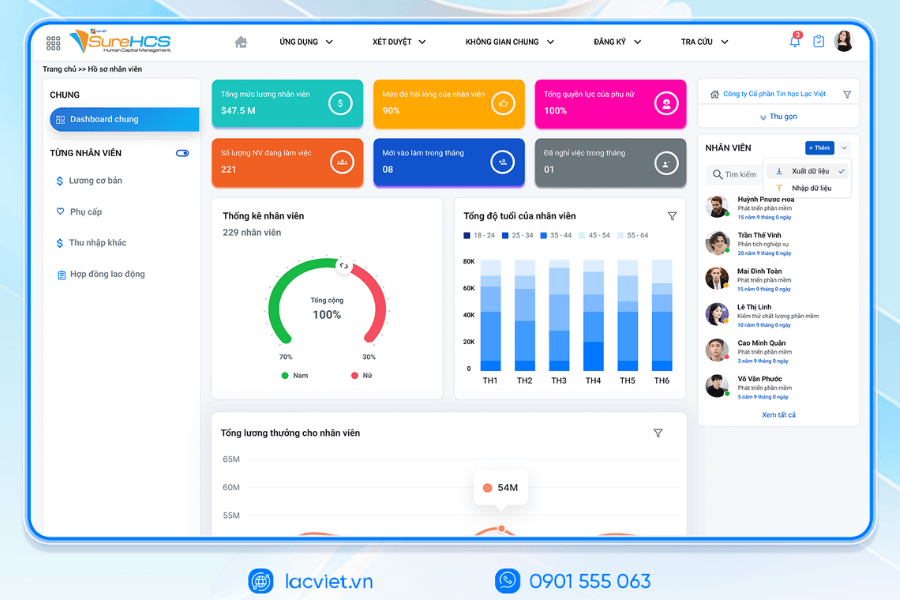

Lac Viet SureHCS is software HRM personnel management comprehensive, developed by Lac Viet – unit more than 30 years of experience in the field of management software business in Vietnam with international standards such as CMMI Level 3, ISO 9001:2015 and ISO 27001:2013.

SureHCS not only meet the professional personnel standards, which are designed to handle the hr – C&B – wages complex, large-scale, multi-company, multi-sector, in particular in accordance with FDI enterprises, corporations, factory, logistics, aviation, hotel, trade – in service.

The system is flexible deployment On-premise or as a custom model in depth, to help businesses automate the entire process hr – attendance – payroll – benefits – insurance, complete replacement job management using Excel discrete.

The module's core hr software lacviet SureHCS:

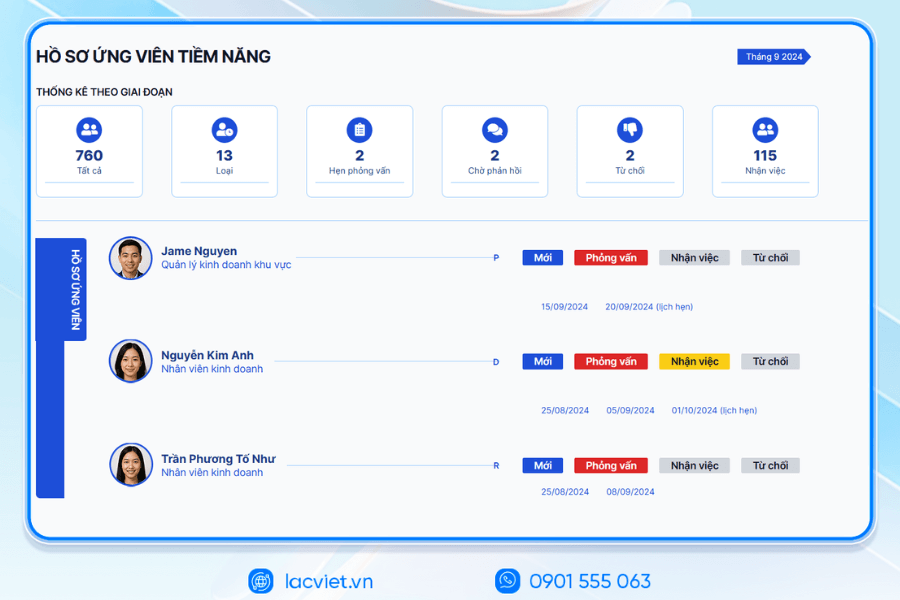

- The Recruit – Training: Management throughout the recruitment, integration, training, hr support and build the Talent Pipeline for large-scale enterprise.

- Port information & records Management personnel: Store personnel records, electronic focus, portal self-service for employees and contract labor power on the system.

- The timekeeper: Dots, multi-form (fingerprint, face recognition, Face ID, GPS, Wifi, online), connect many types of timekeeper, support attendance by the hour, shift flexibility for the plant, and hotels.

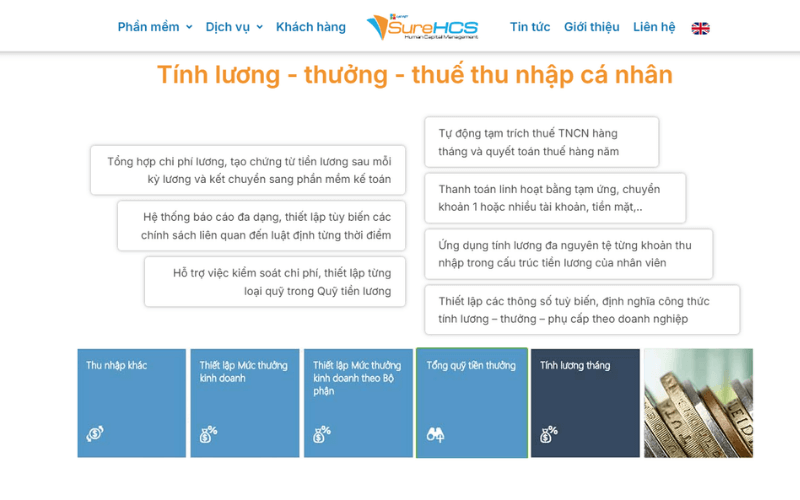

- The payroll & C&B: Automatic salary calculation according to many models (hour, shift, product, 3P, KPI performance...), link directly attendance data – performance – welfare, completely replace the salary calculator using Excel.

- Welfare – SOCIAL insurance – salary: Management benefits flexible, integrated iVAN connect SOCIAL and electronic Bank Hub salary automatically, support pay multi-currency for FDI.

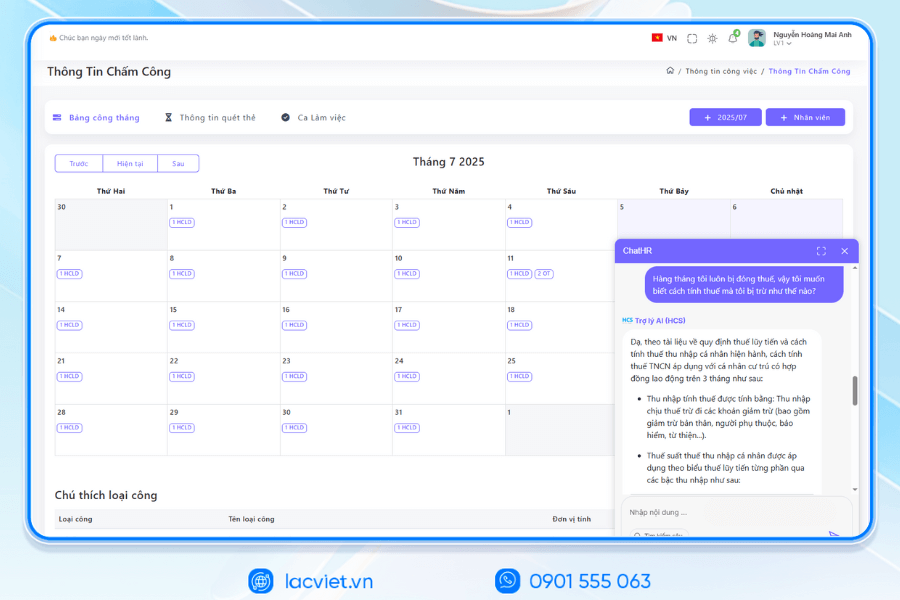

INTEGRATED AI ACCELERATED CONVERSION OF HUMAN RESOURCES MANAGEMENT

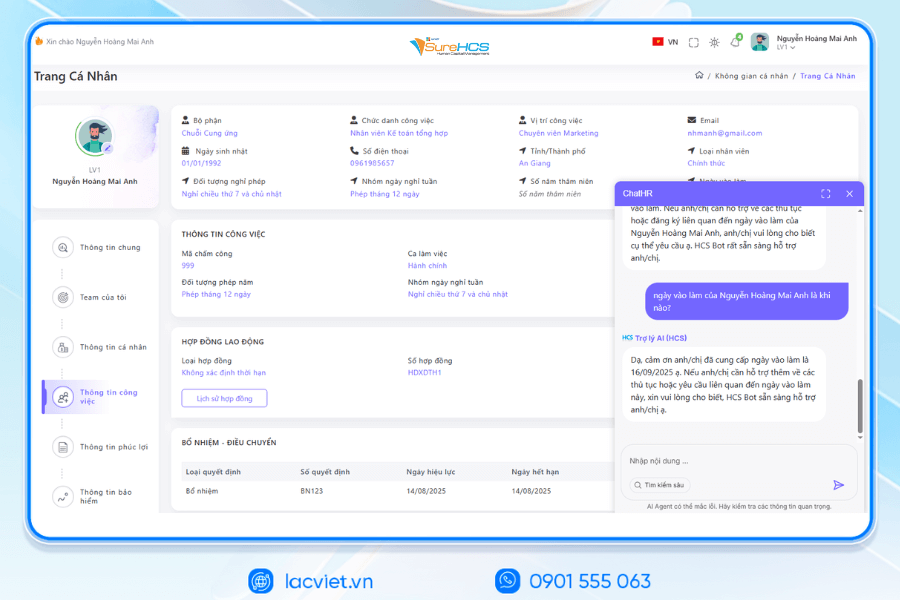

Lac Viet has officially launched The 3 AI assistant hr deeply integrated into the LV SureHCS including LV-AI.Docs, LV‑AI.Resume and LV‑AI.Help to automate the task administration, standardized data enhanced experience personnel

- LV‑AI.Docs: automatic dissection transfer data from documents such as CCCD, windows, SOCIAL insurance, by level of digital records, standardized

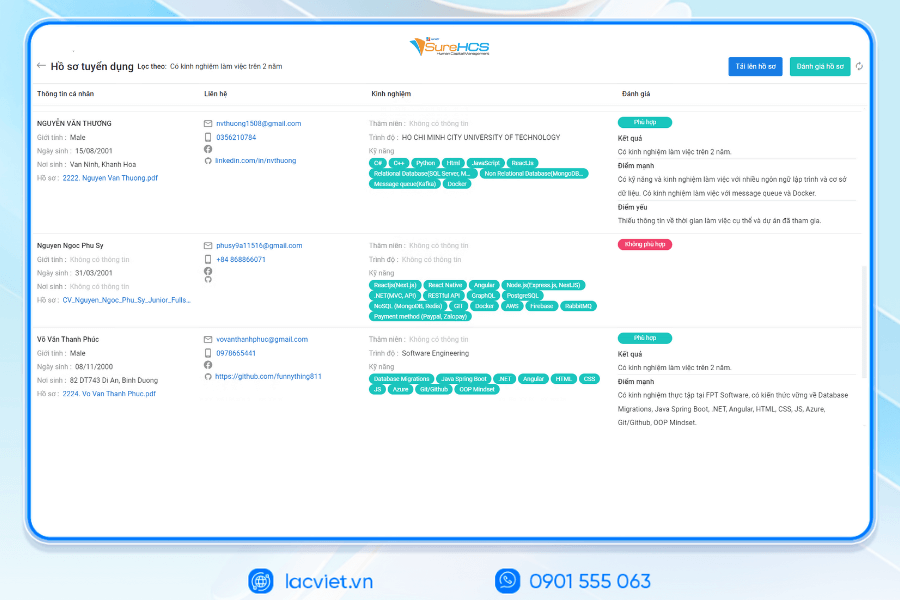

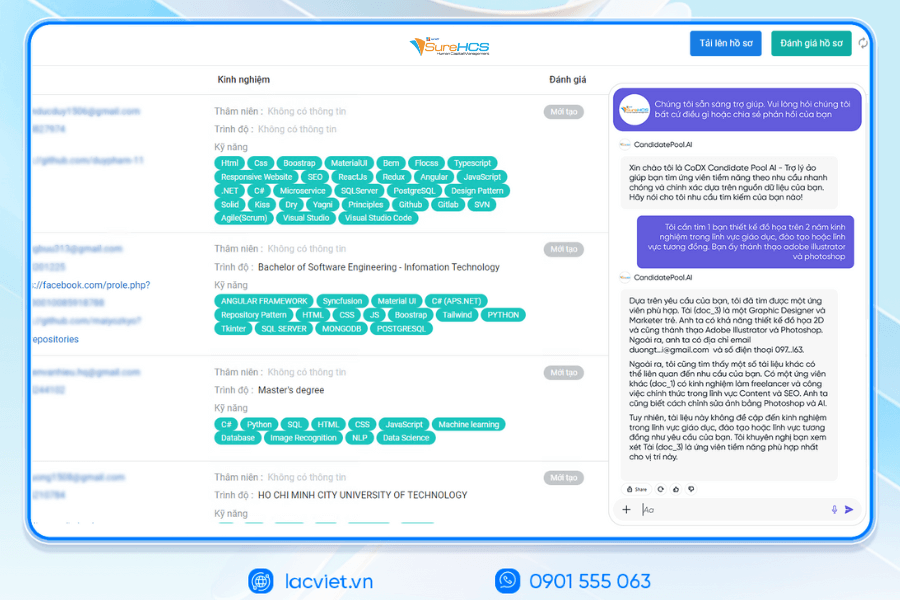

- LV‑AI.Resume: automatic dissection CV any format, analyst CV auto, construction, candidate profile, find people with the right criteria by prompt intelligent data mining candidate pool efficiency

- LV‑AI.Help: chatbot internal support, answer questions HR 24/7 access form process quick contextual user

TYPICAL CUSTOMERS DEPLOYING LV SUREHCS HRM

SureHCS are trusted and used by many large enterprises and leading corporations such as: Coca-Cola, Takashimaya, Textile SuccessfulPlastic Long Thanh Phu Hung Life, Airports of Vietnam (ACV)the business belonging to the SGCthe FDI enterprises in the fields of production, logistics, trade – in service.

- Coca-Cola Vietnam: System deployment LV SureHCS to digitize comprehensive human resource management group has standardized the data, the optimal operating HR according to international model.

- Textile company Success (TCM): Application LV SureHCS to manage hr, payroll, benefits, timekeeping and capacity profile for nearly 5,000 employees across 5 areas of activity – from textiles and fashion to real estate.

- Total company air Port, Vietnam (ACV): Choose to trust LV SureHCS to operate the system large-scale personnel with over 10,000 employees, 24 subdivisions, solved the problem of complex business of modeling state-owned companies.

SureHCS particularly suitable for:

- Large-scale enterprise, from 300 to 10,000 hr

- Corporations and enterprises multi-company, multi-branch

- FDI, manufacturing, factory, logistics, aviation should attendance – analysis ca – salary calculator complex

- Businesses are C&B peculiarities, need custom depth according to the actual operating

- Businesses are personnel management using Excel, many types of timekeeper, need automate the entire process

SIGN UP TO RECEIVE DEMO NOW

WHY BUSINESSES SHOULD CHOOSE TOUCH THE SUREHCS?

- Customized according to the actual business, no pressure mold as packaged software.

- Handle the personnel – salaries complex that many software HRM other does not respond.

- Deep understanding operated business English & FDI, ensure compliance with legal Vietnam (labour, SOCIAL insurance and personal income tax).

- Ecosystem integration strength: attendance – payroll – bank – SI – electronic contract.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: surehcs@lacviet.com.vn

- Website: https://lacviet.vn | www.surehcs.com

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

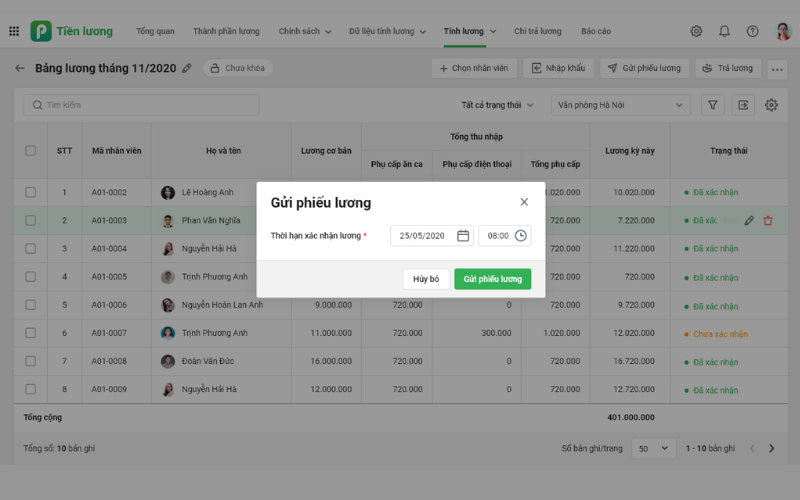

3.2 Misa Amis payroll

Misa Amis payroll is one of the products of ecosystem management business of MISA Amis, one of the leading technology companies in Vietnam. Developed to help businesses automate the process of payroll, minimize errors in the calculation of payroll, personal income tax, social insurance.

Particularly suited to small and medium enterprises, with friendly interface, easy to use, easily integrated with the accounting software, human resource management, other.

Salient features of Misa Amis payroll

- Automation salary calculator: automatic calculation of payroll based on attendance data, employment contracts, remuneration policy of the business. Software supports to customize the payroll in multiple positions, wage level, wage structure different.

- Tax management and insurance: calculate the deduction of personal income tax (PIT) according to the rule of law, at the same time updates the latest regulations on social insurance (SOCIAL insurance), health insurance (health INSURANCE), unemployment insurance (UI).

- Integrated system of personnel management – accounting: tích hợp chặt chẽ với các software HRM personnel management, kế toán khác của MISA như MISA HRM, MISA AMIS giúp đồng bộ dữ liệu về lương thưởng, thuế và các khoản bảo hiểm, đồng thời hỗ trợ xuất báo cáo chi tiết.

- Report details: MISA provide detailed reports about payroll, personal income tax, SOCIAL insurance, personnel costs in real time, support the management in the control of decisions related to labor costs.

Table advantages and disadvantages

| Advantages | Cons |

| Automate the process of payroll tax deduction, insurance | More suited to the small and medium business |

| Easy integration with ecosystem software MISA other | Unlimited customize with the business has particular requirements |

| Detailed reports, and track payroll, personnel costs | The cost can be high for very small business |

| Friendly interface, easy to use for both non-expert users | The ability to expand features not much compared to the solutions international |

| Good support from MISA with a network of vast customers | Requires stable internet to ensure access to timely data |

Price of the package Misa Amis payroll

- The basic package (Basic): From 5 million/year. Fit small business with basic features, such as managing payroll, tax deductions, insurance.

- Standard package (Standard): From 10 million/year. Include the more advanced features, such as report, salary details, manage multiple branches, integrated with the accounting software, hr.

- Premium package (Premium): From 20 million/year. Fit medium business and large with the features, comprehensive management, payroll, tax, insurance, financial reporting, multi-branch.

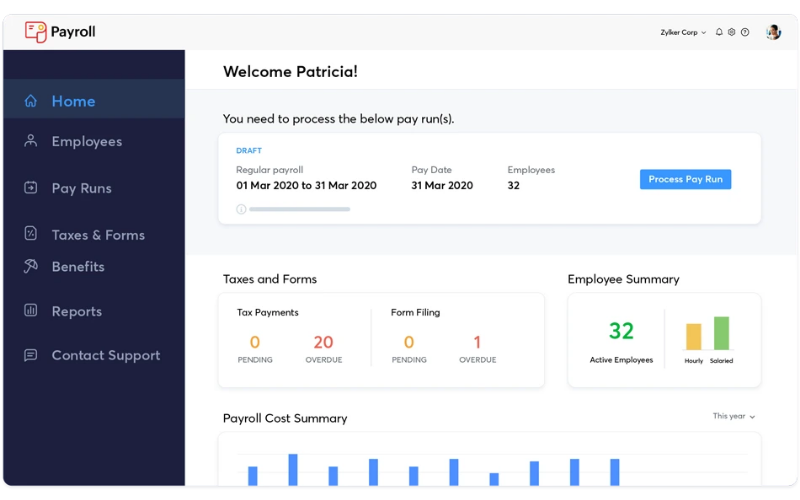

3.3 payroll software Zoho Payroll

Zoho Payroll is a payroll software comes from Zoho Corporation, a technology company worldwide with many management solution business. Zoho Payroll focusing on automation, process payroll, tax administration, ensure the accuracy in the payment of wages to employees. Designed for the small and medium business, Zoho Payroll featured with the ability to deploy quickly, easy to use, integrated with the system Zoho another as Zoho Books, Zoho HR.

Salient features of Zoho Payroll

- Automation salary calculator: The software automatically calculate salary, bonus, allowances, deductions, such as insurance tax.

- Tax administration in accordance: Zoho Payroll automatically updates the application of the legal provisions related to tax, to help businesses comply with the law.

- Attendance and leave management: Integrated timekeeping, track-day leave of employees, automatically adjustable to the pay table.

- Employee portal: Allows employees to access pay information, leave requests, update personal information.

- Report salary details: The software provides the report, salary details, support tracking analysis of personnel costs.

- Integration with Zoho Suite: Zoho Payroll easily integrates with other products of Zoho, help enterprise comprehensive management of financial operations, accounting, hr.

Table advantages and disadvantages of Zoho Payroll

| Advantages | Cons |

| Friendly interface, easy to use | Less extensive features than the premium software |

| Integrates well with the system Zoho Suite | Not yet support multiple languages, regulations, local laws |

| Reasonable price, suitable with small and medium enterprises | Does not fit with the business have very large scale |

| Support many features of the tax, insurance | The ability to customize more limited for enterprises with specific needs |

Price of the package Zoho Payroll

- Standard Package: From $19/month (about 450,000 copper) – included features, tax, payroll, insurance management.

- Premium Package: From $29/month (about 690,000 copper) – includes full-featured hr management, detailed reporting, integration with Zoho Books and Zoho HR.

3.4 management software, payroll Tanca

Tanca is a software management salary calculator was developed with the objective of the optimization process payroll timekeeping for business. This software aims to integrate easily with other systems and provides many useful features for businesses from small to medium.

Salient features of Tanca

- Payroll automatically: Tanca business support, automatically calculate salary according to various criteria such as working time, workload, level, rewards, punishments.

- Integrated timekeeping: Support integration with the timekeeping devices, help recorded hours of work, overtime, vacation of employees.

- Insurance management society – tax: The software automatically calculates deductions related to social insurance, health insurance, personal income tax according to the regulations.

- Management benefits, bonus mode: Support business tracking management bonuses, allowances, welfare of employees.

- Report details: Provides visual reporting of payroll costs allocation the cost of salary for each department, the index of the other.

Table advantages and disadvantages of Tanca

| Advantages | Cons |

| Fits small and medium enterprises | Extended features need to purchase additional service package |

| Friendly interface, easy to use | Not uncommon for businesses large-scale complex |

| Integrates well with the timekeeping devices, other systems | The ability to customize the limit of some function |

Price of the package Tanca

- Package Basic: About 1.5 million/month, fit small business.

- Pro Package: About 3 million/month and offers more features extending, such as benefits manager, report analyzed in detail.

3.5 software payroll Paradise HRM

Paradise HRM is a management software, hr payroll for the medium and large business. This software focused on automation of hr processes, including timekeeping, time management, work, wage calculation.

Salient features of Paradise HRM

- Payroll automatically: Paradise HRM help payroll automatically based on information about working hours, overtime, allowances deducted.

- Smart attendance: Phần mềm tích hợp với các hệ thống chấm công khác nhau, giúp ghi nhận theo dõi chính xác thời gian làm việc của nhân viên.

- Management, insurance and taxes: Calculate automatically updates the account insurance, tax according to the regulations of the state.

- Management bonus and allowance: Keep track of the policy, bonus, allowances, benefits of the business.

- Reporting system multi-dimensional: Provides detailed reports about pay, benefits, indicators of staffing to help businesses manage costs and optimize resources.

Table advantages and disadvantages of Paradise HRM

| Advantages | Cons |

| Provide comprehensive solution for medium and large business | Cost to deploy high |

| Support management, timekeeping, and payroll with many flexible options | The user interface can be complicated for new users |

| Report detail, suitable for large enterprises wishing to manage pests | Deployment time time for businesses that have large system |

Price packages Paradise HRM

- Package Standard: From 5 million/year for medium and large business.

- Enterprise Package: Ge flexible based on the custom requirements of the business, suitable for big businesses who needs to manage complexity.

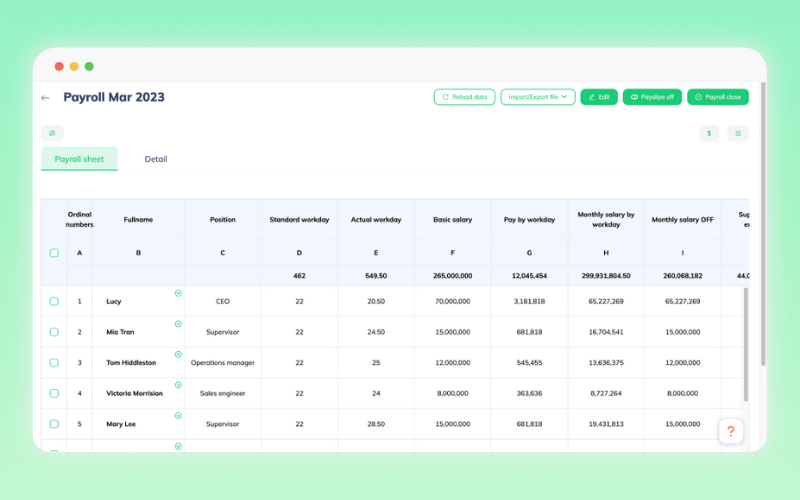

3.6 software payroll HRM PRO of VNResource

HRM PRO là một phần mềm quản lý chấm công tính lương toàn diện do VNResource phát triển, đặc biệt phù hợp cho các doanh nghiệp vừa, lớn tại Việt Nam. Phần mềm được thiết kế với các chức năng chuyên biệt để hỗ trợ quản lý lương thưởng, bảo hiểm, quản lý hồ sơ nhân sự, chấm công một cách chính xác, tự động hóa quy trình.

Feature highlights:

- Payroll automatically: Based on factors such as attendance, overtime, allowances, deductions tax, social insurance.

- Management, insurance, tax: Calculate deductions and social insurance, health insurance, personal income tax under the provisions of the law.

- Integrated timekeeping: Software, integrated with the attendance system, support automatic calculation of working hours, vacation time.

- Records management staff: Track personnel records full work history, payroll to performance evaluation.

- The report, detailed analysis: Provides the report, salary details according to the duration, departments, help businesses track personnel costs efficiently.

| Advantages | Restrictions |

|

|

Price service packages:

- Basic package: Start from 12 million VND/year.

- Advanced package: Customize according to your business needs, can reach up to 100 million VND/year, depending on the number of employees, the integration feature.

3.7 payroll software Ecount ERP

Ecount ERP là một phần mềm quản lý doanh nghiệp đến từ Hàn Quốc, tích hợp nhiều chức năng quản lý bao gồm kế toán, kho bãi, mua hàng, bán hàng, đặc biệt là chấm công tính lương nhân viên. Phần mềm này phù hợp cho các doanh nghiệp vừa và nhỏ, giúp tối ưu hóa quy trình tính lương một cách nhanh chóng dễ dàng.

Feature highlights:

- Payroll automatically: Calculate pay based on hours of work, allowances, insurance, taxes correctly.

- Integrated with the accounting system: Salary data is integrated automatically into the accounting system, help businesses easily manage cash flow and cost of personnel.

- Management, insurance, tax deductions: Automatic deductions of insurance, personal income tax.

- Records management staff: Storage, data management, employees from salary to the work process.

- Financial reporting personnelSupport : synthesis report, details of salary and other expenses related to personnel.

| Advantages | Restrictions |

|

|

Price service packages:

- Basic package: About 600,000 VND/month, suitable for small and medium business.

- Advanced package: 1 million VND/month with many extended features such as management, purchasing, sales, warehousing.

3.8 management software, timekeeping, and payroll Cezanne HR

Cezanne HR is software personnel management on cloud platform is designed for businesses from medium scale to large. With more than 80 countries use, Cezanne HR striking thanks to its ability to support hr management international, which has auto pay, personnel management, insurance. This software is particularly versatile easy to use with ability to customize in accordance with the legal regulations vary in each country.

Feature highlights:

- Payroll international: Calculate salary according to hours of work, allowances and deductions, compliance with national regulations.

- Tax management, insurance: Integrated tax social insurance automatically ensures correct regulation.

- Attendance management, leave: Integrated with time and attendance system, automatic update of the day leave in payroll system.

- Personnel management comprehensive: Records management staff, contract labour, training and development of employees.

- Report analysis personnel costs: Provides detailed reports on wage costs, insurance, allowances over time.

| Advantages | Restrictions |

|

|

Price service packages:

- Basic package: About 12 – $ 15/user/month.

- Premium package: Customized according to the requirements of the enterprise, integrated with many advanced features.

3.9 management software, payroll ADP Payroll

ADP Payroll is one of the payroll software the world's top is designed to meet the needs of the business can scale from medium to large, especially the multinational enterprise. ADP Payroll help optimize the management of payroll, tax deductions, insurance, financial statements.

Feature highlights:

- Salary calculator global: Calculate auto pay according to hours of work, allowances, deductions, according to international standards.

- Tax management, insurance: Support calculate withholding tax, social insurance, according to the regulations of many countries.

- Personnel management integration: Manage the entire hr data, from recruitment, contract labor to staff development.

- Support payroll diverse: Support multiple methods of payroll from working full-time, part-time to pay under the contract.

- Analysis report: Support detailed reports about the cost of wages and deductions, export data for analysis, forecast financial.

| Advantages | Cons |

|

|

Price service packages:

- Basic package: Start from 10 – 15 USD/user/month.

- Advanced package: Customize according to the business model, the features requires.

3.10 payroll software SmartHRM

SmartHRM is software management, timekeeping, and payroll of company development in Vietnam, meets the management needs, payroll, timekeeping, social insurance, and manage personnel records. This software is suitable for the small and medium enterprises in Vietnam thanks to features simple, reasonable cost, the ability to integrate easily with other systems.

Feature highlights:

- Payroll automatically: Automatically calculate pay based on hours worked, overtime, allowances, deductions.

- Management, insurance, tax: Calculate social insurance, income tax, self-motivated individuals.

- Manage attendance, holidays: Integrated with time and attendance system, electronic time tracking, work and vacation.

- Records management personnel: Store information personnel, contract management, history salaries and bonuses.

- Analysis report: Provides the detailed report about the cost of payroll and hr.

| Advantages | Restrictions |

|

|

Price service packages:

- Basic package: About 5 – 7 million VND/year, consistent with the small business.

- Advanced package: Customized according to the needs of the business, can up to 15 – 20 million VND/year.

3.11. Payroll software employee SV-HRIS

SV-HRIS is the solution management personnel – salaries of company Information technology SV development. This software is geared to the business, production and processing are the number of labour, requires complex management of attendance, shifts, payroll. The strong point of the SV-HRIS is capable of handling bulk data, and the system detailed report on the salary – insurance.

Feature highlights

- Attendance management diversity: Support for multiple clocking (card machine, fingerprint, QR code), especially suitable for manufacturing enterprises.

- Calculate salary according to the ca, kip, product: Support multiple methods, different pay, satisfy particular manufacturing industry.

- Manager insurance/taxes: automatically calculates the account, SOCIAL insurance, health INSURANCE, personal income tax, according to the regulations.

- Pay statements, hr: System in-depth reports on salary, expense, allowance, help leadership make adjustments policy.

- Integrated HRM master: in Addition to salary, SV-HRIS, there are other modules such as recruitment, training, employee evaluation.

| Advantages | Restrictions |

|

|

The package price software

- The original On-Premise: the Cost to deploy around 50 – 100 million USD depending on the number of modules and employees.

- Japanese Cloud (SaaS): subscriber per month, on average, from 500,000 – 1,500,000 VND/month. (Source reference: SV-HRIS.com – information updated price 2025)

3.12. Payroll software FPT.iHRP

FPT.iHRP is the solution in hrm comprehensive due FPT development, designed specifically for the Vietnamese market. Software focused on data management, hr, payroll, benefits, development of human resources. With more than 20 years deployed in many large corporations, FPT.iHRP is appreciated thanks to the ability to flexibly customized according to the peculiarities of each business.

Feature highlights

- Payroll – management benefits: automation Systems, process payroll, support the form of payroll complex (in hours, products, KPI...). Fully integrated regulations on personal income tax, SOCIAL insurance, health INSURANCE according to Vietnam's criterion.

- Timesheet – shift: direct links to the timekeeper, handle shift, ca fracture, overtime, vacation... reduced by 90% handcrafted.

- Performance evaluation & training: Support setting KPI, OKR, and build roadmap development staff.

- Records management personnel: Provide database focused, easy lookup, access reports by departments, branches.

- Dynamic reporting (Dynamic Reports): fast reports, personnel, pay, costs according to the requirements of leadership.

| Advantages | Restrictions |

|

|

The package price software: FPT does not publish a specific price, usually the quotation according to the requirements of each business:

- Deploy on-premise or cloud.

- The cost ranges from 100 million – a few billion purchase scale the number of employees, the level of custom. (Reference: FPT Software)

3.13. Payroll software employee BambooHR

BambooHR is software management personnel from the U.s., is more than 30,000 businesses in 100+ countries trust. Other than FPT.iHRP strong focus on math, timekeeping, and payroll in Vietnam, BambooHR direction to experience staff to help businesses build process HR modern, professional,.

Feature highlights

- Personnel management: storage profile, focus, ease of access for staff and management.

- Recruitment, Onboarding: Provides ATS (Applicant Tracking System), which allows to create job posting, tracking candidates, support the integration of new employees.

- Performance management: goal setting, evaluation, 360-degree feedback.

- Track time & vacation: Manage work hours, sick leave, vacation paid.

- Integrated payroll (payroll): BambooHR no payroll direct that integrate with software Payroll of 3rd parties in each country (in the U.s. is TRAXPayroll). With enterprise payroll needs extra links with the hinterland.

- Reports & analysis, hr: Dashboard intuitive, export data in many formats.

| Advantages | Restrictions |

|

|

The package price software: Price BambooHR not public, only quotes when you contact us. BambooHR offers 2 main packages:

- Essentials: includes records management, hr, vacation, basic reports.

- Advantage: extended management, recruiting, onboarding, performance reviews, advanced reports.

3.14. Software, timekeeping, and payroll Oracle HCM Cloud

Oracle HCM Cloud (Human Capital Management) is the solution human resource management comprehensive of Oracle, one of the leading technology in the world. This platform is designed according to the model cloud (cloud-based), supporting businesses from medium-sized to very large in managing the full life cycle hr: from recruitment, training, performance management to salary and bonus. Oracle HCM Cloud is widely used by many multi-national corporations, particularly in the financial sector, manufacturing and retail.

Feature highlights

- Personnel management, comprehensive: Integrated from employee information, attendance, payroll, to benefits manager.

- Recruitment and integration (Recruiting & Onboarding): automate the recruitment process, combining AI to sift profile, fast accurate.

- Management salary (Payroll Management): Support payroll, multi-national, in accordance with many legal regulations, service tax is different.

- System smart analytics (HR Analytics): Provides in-depth reporting, predict trends, holiday work, performance, personnel costs.

- Experience employee (Employee Experience): modern interface, easy to use on both web and mobile.

| Advantages | Restrictions |

|

|

The package price software

Oracle does not publish formal charges on the website, which is often customized according to business needs. However, according to many sources refer to:

- Prices range from us $ 13 – 20/user/month for the basic modules (Core HR).

- The module enhanced (recruitment, payroll, data analysis) can increase the total cost up to us $ 25 – 40/user/month.

- Cost of initial deployment can be from a few tens of thousands to hundreds of thousands of DOLLARS, depending on scale.

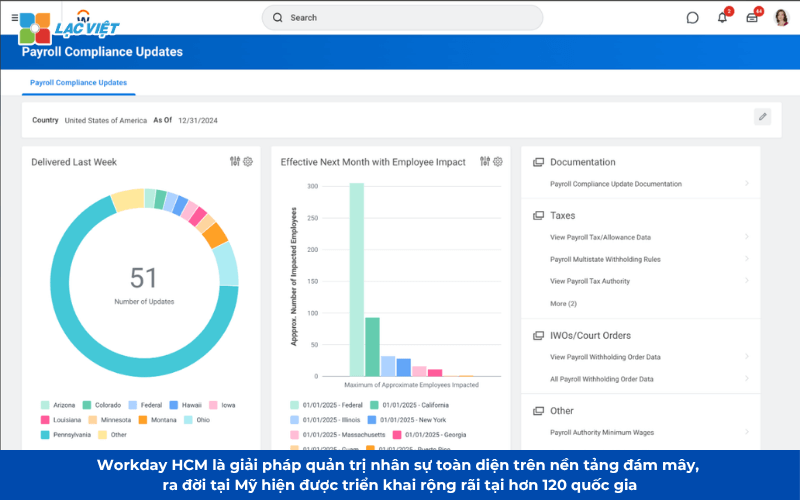

3.15. Software payroll Workday HCM

Workday HCM is a human resources management solution the comprehensive, cloud-based, born in America is to be widely deployed in more than 120 countries. Workday stand out thanks to the design philosophy “people-centric” focus on the user experience, the ability to adapt flexibly to change. This is the top choice of many corporations in the Fortune 500.

Feature highlights

- Personnel management and organizations: Management profile, organizational structure, contract labor.

- Salary management: automate payroll, timesheets, shift; compliance with labor laws in many countries.

- Smart recruitment: application of AI/ML in screening profiles to predict the appropriate level.

- Learning & development: Integrated online learning platform, the training.

- Forecast analysis: reporting in real time, predict trends in hr by AI.

- Features Self-service: Employees can self-manage information, sign, vacation, track payroll through the mobile app.

| Advantages | Restrictions |

|

|

The package price software: Similar to Oracle, Workday no listing price public but based on the market survey:

- Base price hovers around USD 20 – 30/user/month.

- If the business full use of module (HR Core, Payroll, Recruiting, Learning, Analytics), the cost can be up to USD 40 – 60/user/month.

- Free deployment starting usually from USD 100.000 – 300.000 depending on the number of personnel and the scope of integration.

4. Selection criteria management software, payroll suitable for business

When choosing software to manage payroll, review the important criteria is essential to ensure software is not only in accordance with the scale current needs but also has the ability to expand to meet the future requirements.

Below is the criteria that businesses should consider when choosing payroll software, ensuring the investment they bring the highest efficiency.

4.1 automation Capabilities, comprehensive

Businesses need to choose software that has the ability to automate the entire payroll process, from the calculation of basic salary to the tax, insurance and other deductions. This not only helps reduce the load workload for the hr department but also minimize the errors due to the calculation manually.

4.2. The ability to customize according to the remuneration policy private

Every business has, salary structure, management processes, welfare policies different. Therefore, the software should have the ability to customize flexible to suit the peculiarities of each organization. In addition, the software must support the business in the large-scale expansion without interrupting the process management salary.

Many businesses are in a stage of growth, from 100 employees to 500 employees within 2 years, software, payroll, initially did not meet the needs expansion led to overcrowding in data management. Therefore, businesses have to be replaced by a software has the ability to expand better.

4.3 Integrated with the system of HRM and other tools

Software manager salary should be tightly integrated with the system of personnel management (HRM), attendance management software, other business such as accounting, tax, to ensure consistency in data.

4.4 confidentiality and comply with the law

Issue of data security is one of the important factors that businesses should pay attention to when choosing payroll software. Software must ensure data security, especially the sensitive information such as payroll, personal information, deductions. Besides, the software also need full compliance with the laws and regulations labor, tax and insurance.

Follow IBMabout 30% of the business encountered security problems when using the software do not meet the standard. Therefore, when choosing software, enterprises need to check the standard security features comply with the law that the software provides.

4.5 Ability to create reports and detailed analysis

Payroll software must provide the report feature diverse with the ability to analyze detailed data about the cost of payroll, tax, and insurance allowances. These reports help business leaders have the overall look of personnel costs, thereby making the strategic decisions accordingly.

4.6 Costs of deployment, the ability to support technical

Cost is always a deciding factor when choosing software. Businesses need to thoroughly evaluate the initial cost, maintenance cost, and technical support to ensure that the software brings benefits outweigh the cost. In addition, our team of technical support, customer service, supply unit, software is also an important criterion to help businesses solve the problems arising in the process of use.

5. Software manager salary is suitable for any business?

The selection of applied management software, payroll is not just for large corporations that fact, most of the business in many scales, can take advantage of to optimal management. Depending on the particular institution, needs and resources, the software will bring the different values:

5.1. Small businesses (under 100 employees)

- Needs: mainly need a tool payroll simple, automate the manipulation repeat replace for Excel.

- Problems encountered: Management by spreadsheet crafts to errors especially when there are allowances, bonuses, overtime.

- Solution: Use the payroll software employee basic, low-cost, but still ensure accurate transparency.

- Value received: save 30-40% of the time, payroll processing, monthly limitation disputes with employees.

5.2. Medium business (100 to 500 employees)

- Needs: Not only salary, but also need to manage attendance, benefits, insurance, personal income tax.

- Problems encountered: the volume of work that parts C&B overload, difficult to ensure accurate and complete for the entire staff.

- Solution: Apply software, timekeeping, and payroll have the ability to connect data between timekeeping, labor contracts, allowances.

- Worth getting: a significant Reduction in processing time administrative procedures. Create transparency when employees can lookup payroll, history of timekeeping through the portal. Help business in full compliance with regulations on SOCIAL insurance and tax.

5.3. Big business, corporations (over 500 employees)

- Demand Management salary complex according to various ranks, branches or different countries.

- Problems encountered: Difficult to control payroll data concentration, the risk of errors is high, affecting corporate image, satisfaction of employees.

- Solution: Need a system for payroll management integrated ERP or HRM, support decentralized detailed, multi-language, multi-currency.

- Value received: enhance ability, data analysis, personnel costs to support strategic decisions. Ensure compliance with security in high level. Advanced experience staff thanks to transparency and access to information initiative.

Can see, regardless of small or big business can benefit from the application software salary. It is important to choose the right solution matching the scale of demand, instead of “as many features as possible,” but not optimal cost.

6. Overview of payroll software employee

6.1 software review what is?

Payroll software is a technology solution designed to automate the process of calculating the remuneration, the remuneration for employees. Instead of calculating manually using Excel spreadsheets or tools other basic payroll software to help manage personnel can carry out this process correctly, quickly and transparently.

These tools are often integrated with the management system, timesheet management, employee data, social insurance, tax,... create a payroll process full-automatic interface.

Payroll software plays an important role in helping the business maintain the accuracy and transparency in the remuneration policy. Especially for businesses that have large scale, managing wages for hundreds or thousands of employees requires a powerful system to reduce the load pressure for the hr department, and ensure the timeliness and transparency.

6.2. Software salaries are the basic features how?

Management software, payroll offers a variety of features to help businesses automate process optimization manager salary. Below are the main features that a software salaries need to have:

- Automate payroll calculations: This is the basic features, but most important. Payroll software automates the whole process calculated from the input clocking, additional allowances, calculate personal income tax, social insurance, medical insurance, other deductions. The automation helps to minimize errors due to input manually to ensure consistency in the salary of business.

- Time management, timesheet integration: Payroll software is often integrated with time and attendance system to accurately calculate the number of working hours of each employee including overtime, vacation hours, leave or holidays. This feature ensures that the factors related to working time are accurately reflected in the wage, which does not need to calculate manually.

- Calculate the tax and deductions automatically: The software automatically calculate the personal income tax, social insurance, medical insurance, other deductions in accordance with the law. This helps businesses comply with regulations of the state to ensure that the deductions are done accurately and minimize the risk of penalties due to violations of labor laws.

- Report data analysis: Payroll software online provides features detailed report on payroll analysis, payroll costs, keep track of your employee benefits. These reports not only help hr departments manage the details but also provide key information to leaders take strategic decisions about policy salary, bonus and benefits.

- Integrated with the system of HRM else: Some payroll software is easily integrated with the system of personnel management (HRM), allows automatic update of information about employees, contracts, promotion, salary adjustment, the personal information within help businesses maintain consistency in the data management payroll personnel.

7. Long-term benefits when deploying software manager salary in the enterprise

When businesses decide to invest in payroll software, worth getting't just stop at the shortened processing time payroll monthly. In fact, many studies have demonstrated that the application of the system management salaries brings the strategic benefits, help businesses grow sustainably in the long term.

7.1. Save time and operating costs

According to a survey by Deloitte in the year 2023, the business application software, payroll management can reduce an average of 40-50% of the time handle salary compared to manual method. Instead of hr C&B takes 7-10 days for general attendance, calculating allowances, tax deductions and SOCIAL insurance, software, salaries can be completed within 2-3 days with high accuracy. Not only does this reduce the load workload for the hr department but also save operating costs every year.

7.2. Transparency, enhance the satisfaction of employees

One of the common causes that disgruntled employees are errors in salaries and bonuses. When using the software, timekeeping, and payroll, the entire data from hours of work, overtime, allowances are recorded and calculated automatically. Employees can check the payroll through the gate personal information, restrict disputes create beliefs about fairness. As reported by SHRM (2022), the business can pay system transparency often have rate sticking employees higher than 23% compared to business management craft.

7.3. Enhance optimal control personnel costs

Management fees pay not only the administrative tasks, but also is an important part of financial strategy. A software to manage payroll, modern often comes with intuitive reporting to help leaders capture trends in wage costs, compare salary by department, by project or by period. This allows business decisions quickly, from the optimal staffing personnel to balance the budget long-term.

7.4. Compliance with laws reduce risk

Labor law, the rules on personal income tax, social insurance changes frequently cause difficulties faced by many businesses in stitching updates. With payroll software employee, the calculation formula is automatically updated according to the latest regulations, limiting the risk of errors that lead to administrative penalties or damage credibility. This factor is especially important with businesses large-scale or multi-national operations.

7.5. Platform for the conversion of hr comprehensive

Finally, the application of the system management salary is an important step in the transition of personnel. When salary data is digitized, integrated with other modules such as recruitment, performance reviews, training, business can build an overall picture about human resources. This is the base to take out the remuneration policy flexibility, personalization welfare and improve the experience of employees.

Can see, investing in payroll software is not just short-term solutions to help reduce the volume of administrative work, but also bring long-term value on the financial performance, the mounts staff, the competitiveness of the business.

In the context of convert numbers are going strong in Vietnam, the application of payroll software not only are a temporary solution but also is a step in the strategy for the sustainable development of the enterprise. By choosing the right software, businesses will not only optimize the payroll but also improve the effective hr management, thereby creating an environment of professional work experience of employees. Hope that the information in the article will help the business to have an overview and selected solutions manager salary calculator best.

CONTACT INFORMATION:

- Lac Viet Computing Corporation

- Hotline: 0901 555 063 | (+84.28) 3842 3333

- Email: info@lacviet.vn – Website: https://lacviet.vn

- Headquarters: 23 Nguyen Thi Huynh, P. Phu Nhuan, Ho Chi Minh City