In the context of the financial sector – banks are constantly switching of artificial intelligence (AI) is increasingly playing an important role in the optimization of customer service. One of the typical applications and the most popular today is the Chatbot bank.

Chatbot not only helps automate the process of client care but also enhance the user experience, shorten the duration of the transaction, the optimal operating costs.

So Chatbot bank how it works? Business can apply this solution to increase operational efficiency, enhance competitiveness out? Let's Lac Viet Computing find out details in this article.

1. Chatbot bank what is?

1.1. Definition chatbot bank

Chatbot bank is a software system is intelligently integrated artificial intelligence (AI) to support communication between the customer and the bank through sms or voice. Chatbot has the ability to understand, analyze and respond to the requirements of customers in real time, helps to provide account information, instructions, transactions, consulting, financial products, solve the faq.

Other than the operator tradition, chatbot bank can operate 24/7 without interruption, customer support, at any time without waiting. In addition, the chatbot can be integrated on multiple platforms, such as:

- Website bank: customer Support right on the web interface.

- Mobile app (mobile banking): Provides information, support transactions directly in the application bank.

- Social network (Facebook Messenger, Zalo, WhatsApp): Help the bank reach your customers on the channels familiar.

- The total station automatically (Voicebot AI): Support voice without calling directly to employees.

For example: A customer wants to check account balances, instead of calling to the total station, wait wait, they just need to enter questions into the chatbot on the website or banking app, the system will immediately feedback the correct information.

1.3. The difference between chatbot bank and switchboard traditional

Below is the comparison table between chatbot bank and the operator tradition to clearly see the benefits of chatbot in the optimization of customer service.

| Criteria | Chatbot bank | The operator tradition |

| Ability to serve | 24/7 operation, handling multiple requests at the same time | Works only during working hours, the number of employees has limits |

| Response time | Instantly, no need to wait | Long standby time, especially at rush hour |

| Transaction processing | Integrated with the banking system, support checking of balance, transaction history, schedule payments | Employees need access to data, lost more time |

| Operating costs | Save personnel costs, can replace 30-50% of the total station | The high cost, the need to maintain staffing, pay and regular training |

| Personalize customer experience | AI can remember history interactive suggestion financial services suitable | Depends on the skill and memory of the operator |

| Scalability | Easy to scale without increasing personnel | Need recruiting, training more staff when the workload increases |

For example, A large bank uses AI chatbot for customer support registration loans online. Thanks to the chatbot, the bank has reduced by 40% of the time processing the loan request, and help complete records more quickly, without the need to counters.

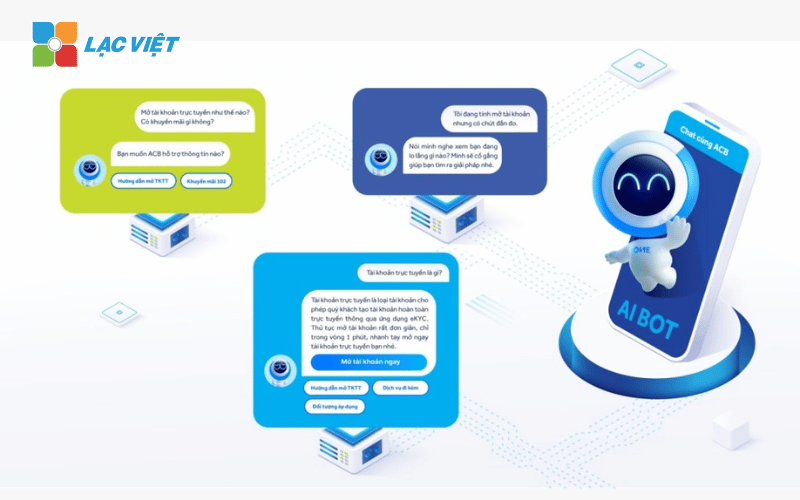

2. Chatbot banking activities, how?

Chatbot banking operation based on artificial intelligence (AI) and processing natural language (NLP – Natural Language Processing), helps the chatbot can understand customer's question, even when expressed in many different ways.

The operation process of chatbot banking include:

- Receive questions from customers: Chatbot receive messages or voice of the customer via the website, application or social network.

- Analysis intention of customers (AI + NLP): System understands the context of the question, determine whether the client need to support financial transactions, learn banking products or handle other requests.

- Retrieve data from the banking system: If customers need checking your balance, transaction history or account information, the chatbot will connect with the banking system (core banking) to retrieve data.

- Provide feedback on fit: Based on data analysis, chatbot will respond in a natural way, most understandable, which may include text messages, photos, charts or links detailed instructions.

- Learn and improve feedback: AI chatbot that can learn from data, interact with customers, help to improve the accuracy reply from time to time.

For example, If a client ask, “can I open credit card how?”, chatbot will not only provide information but also can:

- Suggestions credit card in accordance with income, the needs of the customer.

- Guide, registration card online now in conversation.

- Connect customers with a counselor if you need more information.

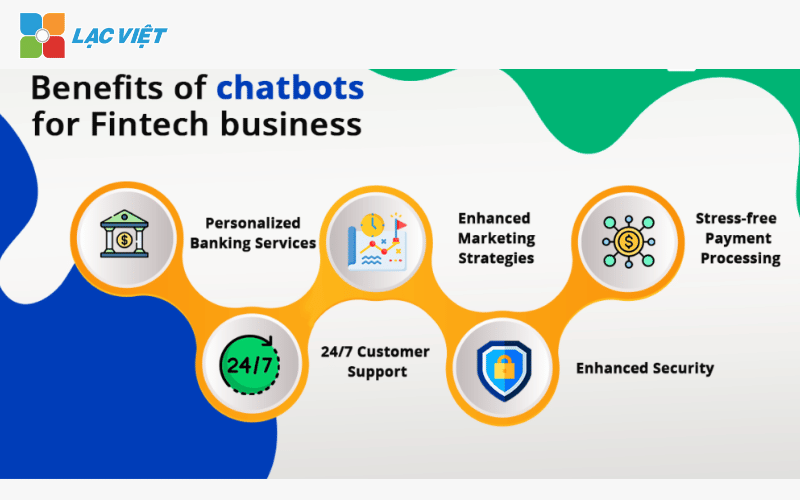

3. Benefits of Chatbot Banking For Business

3.1. To improve customer service, 24/7 support

Customer service is an important element to help the bank build trust and maintain long-term relationships with customers. However, the operator tradition often encounter problems such as:

- Long standby time at peak hours due to excessive download requests.

- The customer must call or to branch to lookup information, causing loss of time.

- Limited time only operate during working hours administration.

With chatbot bank, these problems are solved efficiently:

- Instant feedback, helping customers get the answer instantly without waiting.

- 24/7 customer support regardless of holidays.

- Support multi-channel, customers can interact via the website, application, banking, Facebook Messenger, Telegram or WhatsApp.

- Provide detailed information, such as account balances, transaction history, interest rates, incentive programs without having bank staff.

Practical example: A bank in Vietnam chatbot AI to answer the common questions such as checking your balance, transaction history, exchange rates, interest rates savings. After 6 months of deployment, the number of calls to the switchboard was reduced by 60%, which helps employees focus on the more complex requirements.

3.2. Process optimization, transaction, reduce the load staff

Banks often have difficulty in guiding customers to perform transactions or handle the basic requirements such as registered accounts, open credit card, registration loans. If all these requirements must be performed by the staff, the bank will take a lot of time and manpower.

Chatbot bank can help automate this process, allowing customers to perform transactions in the chat box, such as:

- Guide customers to open new accounts online without the need to counters.

- Registration card, credit counseling loan package is suitable based on income, the needs of the customer.

- Payment reminder invoice, loan, help customers avoid fines due to expired.

- Complaint handling auto, our customers can submit a support request without calling to the total station.

Practical example: A digital bank in southeast Asia to use chatbot to guide customers to sign up online account. The result is 30% of customers open an account without visiting the branch, help the bank save operating costs, optimize customer experience.

3.3. Enhanced security and accuracy

Security is always a top concern when deploying chatbot in banking sector. However, the chatbot modern can integrate AI technology, high security to ensure customer information is protected.

- Client authentication through OTP (one time password) to ensure that only the account holder has the right to information query.

- Integrated with the banking system, helps the chatbot to retrieve accurate information without the risk of errors.

- Automatically detect suspicious behavior, such as unusual transactions or unauthorized login, and alert customers immediately.

- Customer support card lock emergency, report the fraudulent transactions that do not need to call the operator.

Practical example: A bank in Europe to deploy chatbot AI features to detect fraudulent transactions, automatically send alerts to customers if it detects suspicious activity. Thanks to that, the rate of financial fraud decreased by 25% in just 1 year.

3.4. Increase revenue by consulting personalization

Other than the operator tradition can only support each customer a chatbot bank has the ability to analyze customer behavior based on transaction data, financial history, to put out the match.

- Hint financial products according to the needs, such as loan deals, package insurance in accordance with the income.

- Auto-suggest upgrade package services, to help the bank increase in value lifetime customer.

- To personalize content, advice, giving advice based on the financial records of each customer.

Practical example: A bank in Singapore to deploy AI chatbot to open consultant, credit cards, analysis of customer spending and proposed credit card deals fit. The result is the percentage of customers who sign up for the open cards increased by 40%, contributing to increase revenue significantly.

4. How to implement chatbot bank efficiency

Deploying chatbot bank is not simple is to install a software, that need to have a clear strategy, ensuring chatbot smooth operation, bring the actual efficiency for business and the best experience for our customers. To achieve this, businesses need to perform the following steps.

Step 1. Define goals when deploying chatbot

Before integrate chatbot into the banking system, the need to define the main goals that chatbot will undertake. A chatbot bank can be deployed to meet many different needs, including:

- 24/7 customer support: answered to the frequently asked questions about accounts, transactions, service fees, policy loans.

- Consulting financial products: product Suggestions credit cards, insurance, loans based on financial records of customers.

- Automation simple transaction: Support checking of balance, transaction history, prompt payment schedule or guide to account opening.

- Relay for counselor when necessary: A number of complex transactions such as identity validation, handle complaints or transactions that need high security can be chatbot filter ago, moved to appropriate personnel.

Practical example: A bank deploys chatbot with the goal of reducing the load for the operator that allows chatbot automatically handle 60% of the basic requirements, while employees only receive complex problems. After 6 months of deployment, the waiting time of the client 50% discount, help enhance the user experience significantly.

Step 2. Choose the platform chatbot bank in accordance

Not all chatbot is consistent with the financial sector. When choosing chatbot banking, business need to consider a number of important factors to ensure the system to operate effectively:

Support multi-channel and is easily integrated with the banking system: Chatbot should have the ability to integrate with existing system, such as:

- Core Banking Support: access account information, transaction history.

- CRM (Customer Relationship Management): Recorded in interaction history to personalize customer experience.

- Email marketing, SMS: automatically send announcements, promotions, payment reminders.

High data security, meet the standards of the financial industry: security is the leading factor in the banking industry. A chatbot effective must ensure:

- Verify user identity before providing account information.

- Data encryption end to protect customer information.

- Compliance with the standard financial security, such as PCI DSS, ISO 27001.

Multi-language support and voice recognition: If the bank has customers in many countries, the chatbot needs to support multi-language, especially for handling voice (voicebot AI) to help customers to easily interact.

Step 3. Training AI chatbot to increase the accuracy

A chatbot bank only really effective when there is the ability to understand customer needs and accurate feedback. To achieve that, the need for continuous training chatbot using real data.

Coaching chatbot using real data

- Collect the most frequently asked questions from total stations, parts and customer care.

- Building the data conversation diversity, helps the chatbot to understand the many expressions of different customers.

For example, A customer may ask about free shipping money in many different ways:

- “Money transfer no charge?”

- “I need to know free international transaction of this bank.”

- “Free transfer between banks is how much?”

A chatbot good need to understand all variations question on correct answer.

Update script conversation flexibility

The banking sector often change in policy, interest rates, new products. Therefore, the chatbot needs to be updated regularly to ensure to provide accurate information, not misleading for customers.

Practical example: A bank updates chatbot with data about the program of preferential loans new. Thus, within 2 months, the chatbot has automatically consultant success more than 1,000 registered customers loans to help banks save thousands of hours of work of the counselor.

Track performance and continuous improvement

- Ratio analysis feedback accuracy of the chatbot to improve the algorithm.

- Recorded customer feedback to adjust the script conversation more suitable.

- Reviews frequently required to transition for employees, thereby improving the level chatbot to handle these issues automatically.

Practical example: A bank noticed chatbot regular transition customers to a counselor about problems signing up for credit cards. After updating chatbot with more detailed information about the registration process, the number of required support staff reduced by 40%, help the bank optimize resources more efficiently.

5. Introduction solution chatbot bank from Vietnam

Lac Viet AI Chatbot is an advanced solution to help banks automate the process of customer care, optimize operations and enhance user experience. Not only is a feedback tool automatic chatbot AI of Lac Viet is designed specifically for the financial industry, help the bank reduce the load for employees, improve trading performance, increase revenue.

Do you know businesses are spending a lot of money to pay for staff looking for information?

- Of 1.8 hours per day employees spend out to search and collect information, the equivalent of 9.3 hours per week

- Business loss 500 hours per year for employees to perform searches for information for work

- 63% leadership said the sharing of knowledge and information internal trouble, reduce the productivity of the business

Lac Viet Chatbot AI assistant – Freeing up personnel to focus on creative work

- Virtual assistant process – approved LV Chatbot AI for Workflow: Access quick information, content summary, revise errors on file the signed

- Virtual assistant accountant LV Chatbot AI assistant for Finance: remove input crafts, bring the data to the correct input, automatically prompt-term LIABILITIES – PAYMENTS, cash flow forecasting, warning of financial risks

- Virtual assistant customer care LV CareBot AI assistant: Integrated Chat on multi-platform, feedback and customer requests quickly, consulting, flexible, not being constrained by fixed script

- Virtual assistant hr LV Chatbot AI for HXM: save 70% time for HR and leadership, extract the entire database of candidates any file format, faq auto welfare policies, rules, regulations 24/7, statistical, personnel, resources, business in few seconds.

CONTACT INFORMATION:

- Lac Viet Computing Corporation

- Hotline: 0901 555 063 | (+84.28) 3842 3333

- Email: info@lacviet.vn – Website: https://lacviet.vn

- Headquarters: 23 Nguyen Thi Huynh, P. 8, Q. Phu Nhuan, Ho Chi Minh city

5.1 customer Support 24/7 instant feedback

One of the biggest challenges of the bank is to meet the timely needs of the customer, in particular in the frame peak hours or off hours. Chatbot AI of Vietnam to help the bank maintain continuous service, 24/7 customer support without the need to staff the total station.

5.2 guidelines for transactions, check balances, payment reminders

Chatbot AI can support customers to perform many operations as popular as:

- Check account balances, transaction history, exchange rates.

- Guide to account opening, registration loans or issue credit cards.

- Remind customers about payment schedule bills, loans or credit card debt, help them avoid penalties and late fees due.

5.3 analysis of customer behavior, product suggestions suitable financial

Other than the operator tradition, chatbot AI have the ability to learn from transaction data of customers to put these suggestions individualized high.

- If a regular customer savings, chatbot can suggest the package sent to save preferential interest rates.

- With international transactions often, the chatbot can suggest credit cards with incentives perfect money as payment currency.

Thanks to this feature, the bank customer support efficiency, increase the rate of cross-selling products (cross-sell), increase in value, lifetime customer.

5.4 Integrated with the banking system, ensuring information security

Lac Viet AI Chatbot designed to seamlessly integrate with core banking system and CRM, to ensure the bank can manage customer information accurate, confidential.

- Data is encrypted end-to-end, helping to prevent the risk of information leakage finance.

- User authentication using OTP (one time password) or biometrics to help ensure only the account holder can access your personal information.

- To comply with the security standards of international finance, such as PCI DSS, ISO 27001.

Deploying chatbot AI is an important step in the transition of the bank, help simplify financial transactions, increase conversion rates, customer and optimized operating costs.

If your bank is looking for a solution chatbot smart, easy to deploy and highly secure, let's explore right now Lac Viet AI Chatbot – a virtual assistant to help banks improve customer experience and create competitive advantage to excel in the financial sector.