In the context of digitized data bank is going strong in Vietnam, financial institutions must handle the volume of data records with the compliance requirements is growing. The boom in online trading, demand the the remote client, the speed of processing credit profile, make models, data management, traditional craft no longer afford to meet. This forces the organizations and enterprises in the banking sector have to search for the solution of chemical data, modern, safe, capable of high automation.

The three solutions AI OCR – ECM – Dynamic Workflow from Lac Viet be considered platform digitized data bank core helps optimize the operation from A to Z. AI OCR automatically reading the extracted data from the papers; ECM storage and document management focus on safety standards; and Dynamic Workflow helps automate the entire flow of approval, reduce errors, shorten the processing time.

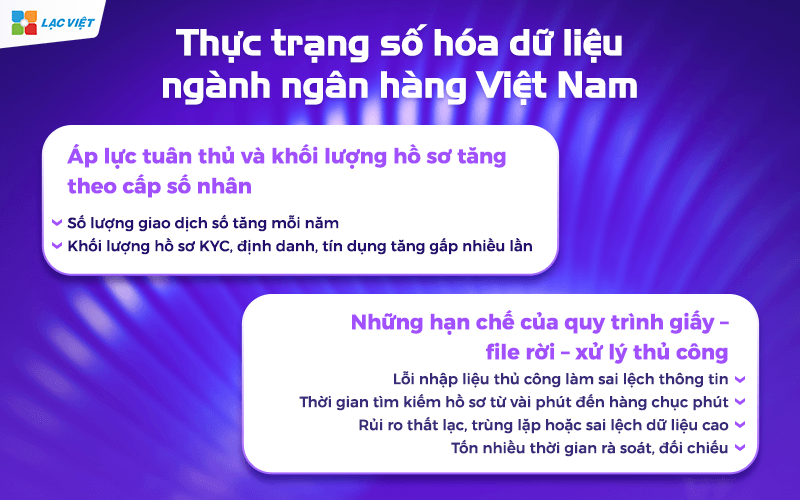

1. The status of chemical industry data bank in Vietnam

1.1 Pressure compliance and volume profile increased exponentially

The banking sector is the field can speed digitizer fastest in Vietnam. According to the report of The state Bank (2024):

- Number of transactions number increased by 52% per year, especially online payment, mobile banking.

- Volume profile KYCto the customer, the credit profile increased many times compared with the previous period.

In addition to the pressure to serve customers quickly, the bank must also ensure compliance with series of strict rules, such as anti-money laundering (AML) to the customer (eKYC), recordkeeping, legal,... this pose requires data governance, accuracy, transparency has the ability to access quickly in any time.

1.2 limitations of the process of paper – file left – processing crafts

The majority of banks in Vietnam still maintains parallel process paper and electronic files leads to many problems in operation:

- Input errors crafts accounted for 20-30% false information during processing credit profile.

- Time record search can take from several minutes to tens of minutes for each request.

- Risk lost, duplicate or misleading data due to high distributed storage in many departments.

- Team operate time-consuming to review, collate → personnel costs increased, performance decreased.

For example: a credit profile can include 10-20 kinds of different paperwork. If data entry, inspection and rotation completely handmade, the approval process can last from 3-7 days. This creates a bad experience for the customer, causing pressure for operating departments.

1.3 why is the conversion of data is a top priority of the bank

Three main reasons why banks must accelerate digitization of data:

- Firstly, improving the processing speed record. According to McKinsey (2023), bank automation application data can shorten 60-70% of the time handle credit.

- Monday, ensure compliance, control risk better. The standard Basel II, Basel III requires banks transparent encryption of the entire data storage profile, the right process, fast access when audit → digitization is mandatory.

- Tuesday, enhance the customer experience. Customers wish to open accounts, loans, credit, mortgage, or look up information without having to wait for hours. Digitized data is the foundation for the bank to deploy services quickly, accurately and without interruption.

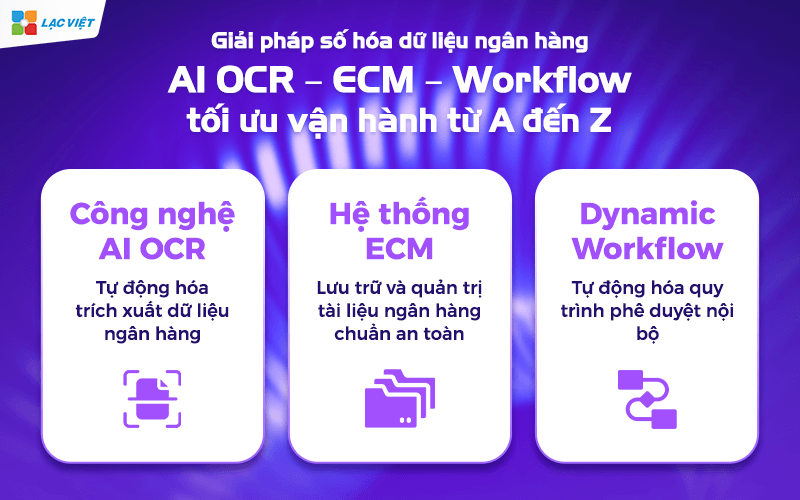

2. Solution digitized data bank: AI OCR – ECM – Workflow optimal operation from A to Z

This section focuses in-depth analysis of three core technology in the solution of chemical bank: this technology solve the problem? Effective practices out? Can help speed up processes and reduce risks?

2.1 AI technology, OCR – automation to extract data bank

OCR (Optical Character Recognition) tradition only recognizes characters, i.e. see what word, then pass the correct word into the text. However, in the banking environment, documents are often complex: matte photo papers heterogeneity, variety of form, stamp, signature... so OCR typically easy wrong or not recognized correctly.

Technology AI OCR is the upgrade version, using technology deep learning (deep learning) to identify contextual. Means the system understand the content rather than just read. For example, when processing an identification citizens, AI OCR understand where is number identifier, where is the date and place of issue – even when location information is not fixed.

So, AI OCR particularly suited to digitize the bank – where materials come from many sources and different formats.

AI OCR problem solving what of the bank?

Processes such as KYC, account opening, credit approval require input collate a lot of papers. This causes time-consuming, easy to errors. AI OCR help:

- Automatically extract information from the CCCD, register, statement, credit contract

- Automatic classification of records according to the group material

- Standardize data before putting into the ECM, or Core Banking

- Reduction depends on the input of employees

2.2 System ECM – storage and document management, bank safety standards

ECM (Enterprise Content Management) is system admin entire documents, records, data format, number of turns of the business. For banks, ECM-like “electronic archive center”, where all records are stored, decentralized, easy search.

For example, When auditing lookup request a loan records old 3 years ago, thanks to ECM, employees only need to enter profile code and get the immediate results in few seconds.

ECM problem solving nothing?

- The bank must record storage legal in many years prescribed SBV

- Records exist in many branches → risk of lost deviations

- Access profile may affect internal control

- Records management scattering increases the cost of physical storage

ECM helps to solve radical by centralizing the entire document on a single system.

- Search profile in seconds instead of minutes or hours

- Access control and authorization details → increase safety

- Save the entire operation → support audits and inspections

- Tightly integrated with AI OCR to identify – automatic storage

- Is an important foundation for the bank operated out of 100%

2.3 Dynamic Workflow – automate the approval process internal

Workflow is system automation workflow. Each profile go from step A to B to C, how, who is responsible, need to approve the stars – all are to be digitized.

In the bank, the workflow is especially important because each task are related to risk control, internal. If you do it by hand, all processes are prone to:

- Omission of step approval

- Data discrepancies

- Delay due to paperwork

- Do not track is responsible for each individual

Workflow help standardize the whole operating process.

Most of the business processes can all put on the workflow:

- An approval process personal credit/business

- Account opening process

- Process for control transactions

- The process of bank or debt recovery

- Process risk control customer reviews

Thanks to that, the bank reduced depends on the exchange via email or handling paper craft sheet.

- Digitizing records is what? Procedures, regulations businesses need to know when deploying

- Business should select the solution digitized document how effectively save the cost?

- Lac Viet integrated AI into the process of chemical conversion support number

- 3 Ways to scan documents in large numbers, quickly for your business

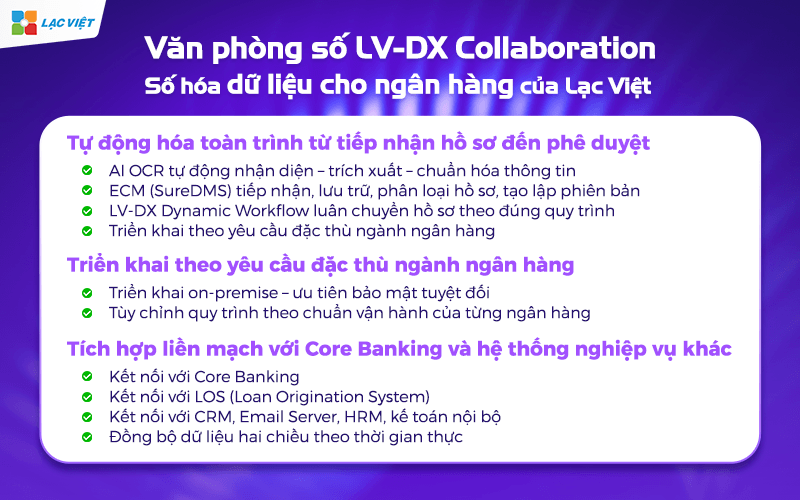

3. Bộ giải pháp Văn phòng số LV-DX Collaboration – số hóa dữ liệu cho ngân hàng của Lạc Việt (AI OCR – ECM – Dynamic Workflow)

In the context of the bank to handle high-profile giant, requires strict compliance and pressure optimized operating costs, the solution digitized data of Vietnam built in the direction of “automate the entire process”. This is not just the integration of three technologies, AI OCR – ECM – Workflow, which is an eco-system consistency helps the bank to switch from manual processes to operate digitized.

3.1 Automates the entire process from receiving records to approval

Instead of having employees enter data manually, classification, transfer, processing, exchange, via email or submit the signed papers, the solution of Lac Viet create a closed cycle: AI OCR → ECM → Dynamic Workflow

The way the actual operating

- AI OCR recognized automatically – extract – standardized information from CCCD, statement, testimony from the transaction, contract...

- ECM (SureDMS) receiving, storage, sorting records, create document version standard – service audit and fast access.

- LV-DX Dynamic Workflow rotation profile in accordance with the process: from appraisal → approved → storage → report.

The entire journey processing capital take a few hours → receding few minutes, does not depend on the location, staff or affiliates.

3.2 Deployment according to the particular requirements the banking sector

One of the distinct elements of Lac compared with the solution common is the ability to customize the internal regulations and professional characteristics of each bank.

On-premise deployment – priority absolute security

The system is deployed on-premise in a data center of the bank. This helps:

- Complete control over customer data

- Meet the confidentiality provisions of the state bank

- Easy integration with internal systems that do not affect safety

For business finance where data security is the most important criteria – deployment model is particularly suitable.

Customize the process according to the standard operation of each bank

- Each bank has business processes separately. So:

- Workflow is designed according to the standard approved internal

- Rules appraisal, scoring, risk warning can configure flexible

- ECM custom authorization by role, department, branch

- AI OCR training according to the form records the fact of the bank (CCCD, contracts, statements, declarations, finance, etc.)

This help system “fit” with model operating current can not change the process or organizational structure.

3.3 Seamless Integration with Core Banking systems and other professional

In operation, banking, data and processes can't separate operations. The solution of Lac Viet is designed to automatically connect, sync data, ensure processing flow uniformly from input to output.

Vietnam provides the system API standards help:

- Connect with Core Banking

- Connect with LOS (Loan Origination System)

- Connect with CRM, Email Server, HRM, accounting, internal

- Sync data two-way, real-time

When AI OCR extract the data – information will be pushed directly into the Core Banking completely remove operation enter the data manually.

If you need to build a system of chemical bank standard AI OCR – ECM – Workflow, ask:

Get advice and demo banking data digitization solutions from Lac Viet Computing

Digitized data in the bank is no longer improved step is optional, which became the foundation imperative to financial institutions remain competitive, legal compliance, expand the ability to serve customers. When the data is standardized, automated and connected throughout the whole system, the bank not only significantly reduce operating costs, but also improve the speed of processing profile, limit your risk, create a consistent experience between the trading channel.

- Should have used service scan rates? 6 criteria business need to know

- Software of goods (materials, processes) COMPREHENSIVE up platform numbers for business

- Digital technology, what is the? 4 technology digitization popular

- Main difference between digitization and transformation of what is? Practical example