Dòng tiền chính là “huyết mạch” của doanh nghiệp quyết định khả năng duy trì hoạt động, mở rộng đầu tư và đảm bảo sự phát triển bền vững. Một doanh nghiệp có lợi nhuận cao nhưng dòng tiền liên tục âm vẫn có thể đối mặt với nguy cơ mất thanh khoản, thậm chí phá sản. Điều đó cho thấy lợi nhuận không phải lúc nào cũng đồng nghĩa với sự ổn định tài chính.

So how do businesses can monitor, analyze, control cash flow effectively? Reported cash flow is precisely the tool to help businesses answer this question. This report not only reflects the situation of line actual money, but also help businesses forecast and optimal financial strategy. In this article Lac Viet Computing will go deep into how statement analysis cash flowthe key indicators, the application of technology to cash flow management in a smart way.

1. Introduction to report cash flows

1.1 statements of cash flows, what is?

Statements of cash flows (Cash Flow Statement – CFS) is one of three financial statements the most important of the business, besides the balance sheet (Balance Sheet) and report results of business activities (Income Statement). This report reflects the cash flows out of business during an accounting period certain (month, quarter, or year), to help businesses assess the ability to generate cash flow from business activities, financial investment.

Reported cash flow help businesses answer the important questions such as:

- The business has enough cash to maintain operations not?

- Cash flow from business activities have positive or negative?

- Businesses are funded activities by borrowing too much?

- Ability to pay short-term debts of the business out why?

Data from this report helps managers, investors evaluate the liquidity, cash flow, operational and financial risks of the business.

1.2 the importance of the cash flow statement in financial management business

Reported cash flow plays a pivotal role in the financial management business because:

Evaluate liquidity and debt-paying ability

- Positive cash flow from business operations to help businesses maintain operations without the need to depend on loans.

- Cash flows pussy stretching can alert the risk of insolvency.

Support investment decisions and financing

- If the business has cash flow excess, may invest in fixed assets, stock or expand production.

- If the lack of cash flow, businesses need to raise capital or optimize cash flow activities.

Forecast future cash flows and risk prevention

- Tracking trends cash flow help business plan financial efficiency.

- Cash flow forecast to help businesses proactively respond to emergency situations such as lack of working capital.

Optimized financial costs

- Help business decision the time of the loan debt or pay off debt, reducing interest expense.

- Business can adjust the strategy to allocate cash flow to the optimal cost.

1.3 The difference between the cash flow statement reports the results of business operations and the balance sheet

Below is a table comparing the three financial statements important:

| Criteria | Statements of cash flows | Report results of business activities | Balance sheet |

| The main objective | Tracking cash flow out of business | Reflect revenue, expenses and profit | Provide financial picture at a time |

| Duration | A certain period of time (month, quarter, year) | A certain period of time (month, quarter, year) | At a specific point in time (end of the accounting period) |

| Main content | Cash flow from business operations, finance and investment | Revenue, expenses, net profit | Assets, liabilities, equity |

| Help answer questions | The business has enough cash to operate not? | Profitable businesses don't? | The status of assets and liabilities of the business out why? |

| Only main goal | Cash flow net cash flow from operating activities, investment, financial | Revenue, gross profit, net profit | Total assets, total debt, equity |

Statements of cash flows additional important information, which two statements left no reflection, help managers with a comprehensive view of the financial business.

- 10+ ERP Management Accounting Software with AI Compliant with Circular 99/2025 for Vietnamese Businesses

- 9 Accounting Software online cheap cost reduction for small and medium ENTERPRISES

- [Sample preparation] reported revenue of sales with Excel by day, month

- [Trọn bộ] File Excel report template production costs with the instructions set details

2. The method of reporting cash flows

2.1 the direct Method

The direct method recorded the account of the receipts and expenditures, cash from operating activities, investment, financial transaction fact. How to set as follows:

Determine the cash flow from business operations

- Proceeds from the sale.

- Cash paid to suppliers, employees, taxes, and interest on the loan.

Determine cash flow from investing activities

- Money purchase/sale of fixed assets, stock, stock.

Determine cash flow from financing activities

- Proceeds from issuance of shares, loan capital.

- Pay dividends, repay loans.

Advantages and disadvantages of direct method

- Advantages: Provides accurate information about the actual money; Help businesses easily track cash flow in/out.

- Cons: time-Consuming due to the requirements detailed notes. 't reflect the fluctuations in accounts receivable and payable.

2.2 indirect Method

The indirect method starts from the net profit on the reported results of operations, business, then adjusted according to the changes in assets and liabilities to calculate the cash flow from business operations.

How to set as follows:

Start from profit after tax

Adjusted for the account not related to cash

- Adding back depreciation expense (as it is not a cash outflow).

- Adjustments changes in working capital (receivables, payables, inventory).

Determine cash flow from financial investment, such as the direct method.

Advantages and disadvantages of indirect methods

- Pros: Easy to set up for using available data from reports the results of business activities. Reflects the link between accounting profit and cash flow reality.

- Cons: Not detailed cash flow in/out reality. Not clearly shown step by revenues and expenditures specific.

Compare the direct method and indirect: Businesses should choose which method?

| Criteria | Direct method | Indirect method |

| Mode details | Very detailed | Synthesis based on other reports |

| Popularity | Little use of complex | Used more popular |

| Suitable with any business? | Small business, less cash transactions | Big business, many transactions non-cash |

| The ability to forecast cash flow | More accurate | More limited |

Large enterprises often use indirect methods because of its ease of establishment, in accordance with accounting systems, modern, while small businesses can choose the direct method to track cash flow in more detail.

3. Structure reports, cash flows, and the detailed meaning

Statements of cash flows consists of three lines of key money: cash flow from business operations cash flow from investing activities, and cash flow from financing activities. Each cash flow reflects a different aspect of financial management business and need to be analyzed in a comprehensive way to assess the financial health of the business.

3.1 cash Flow from business operations

Cash flow from operating activities (Operating Cash Flow – OCF) reflect the amount of cash the business generates from business activities core. The items include:

- Net profit from business operations (starting from after-tax profit if set up under the indirect method).

- Depreciation of fixed assets (to be combined do not affect cash flow, in fact).

- Changes in working capital:

- Receivables customers: If tank, means business is recorded revenue but not on it.

- Accounts payable: If tank, means businesses are delaying payments to suppliers, helping keep cash in the short term.

- Inventory: If rising, can the business is difficulty in consuming the product.

Meaning of cash flow from business operations

- Positive cash flow from business operations that the business will have the ability to self-financing activities that do not need a loan.

- Cash flow from business operations can signal business are struggling in creating realistic cash-flow from the main business activities.

Businesses need to note something when the cash flow from business operations, pussy or cock?

- Positive cash flow is high: If cash flows from business activities, but revenues did not increase, respectively, can businesses are delaying payments to suppliers or reduce investment in inventory, this can affect business operations in the future.

- Negative cash flow: If cash flow from operations, business continuity, sound business may have to depend on debt or sell assets to maintain operations.

For example: A business has after-tax profit of 50 billion VND, but accounts receivable customers increased by 20 billion VND and inventory increased by 15 billion VND, the cash flows actually received from business activities only 15 billion VND instead of 50 billion VND. This suggests that businesses are experiencing problems in managing cash flow earned.

3.2 cash Flow from investing activities

Cash flow from investing activities (Investing Cash Flow – ICF) reflects expenses, income related to investment in long-term assets of the business. The items include:

- Spend money to procure fixed assets, machinery, equipment.

- Collect money from the liquidation of fixed assets.

- Spend money on investments in subsidiaries, joint ventures, securities long-term investments.

- Collect the money from the sale of shares or other financial investments in the long term.

The impact of cash flow on investment to its ability to grow business

- Negative cash flow from investing activities is often a good signal if business investment to expand production, purchase of assets, this suggests the business is growing. However, if excessive expenditure that does not generate revenue, respectively, the business may experience liquidity problems.

- Positive cash flow from investing activities can be a sign the business is sale of assets or divesting investment, this may reflect strategic restructuring or financial difficulties.

3.3 cash Flow from financing activities

Cash flow from financing activities (Financing Cash Flow – FCF) represents the financial transactions of the business with shareholders and creditors. The items include:

- Collect money from the issue of shares, increase its charter capital.

- Collect money from a bank loan or bond issue.

- Spend money to pay dividends to shareholders.

- Spend money on the loan repayment, payment of principal, interest on the loan.

How to evaluate financial strategy of the business through cash flow this

- Cash flow finance: it Usually reflects the business is raising capital from outside, be it debt or issuance of stock. If cash flows from business activities, not enough to cover operational costs, businesses will have to borrow more to maintain operations.

- Cash flow financial pussy: show business is to pay the debt or to pay dividends to shareholders. This can be a positive sign if the business has enough cash flow from business operations to maintain without the need for additional borrowing.

Summary and important note

- Cash flow from operating activities is the most important factor because it is the ability to generate cash from core operations. Business can be profitable but still difficult, if not control, good cash flow this.

- Cash flow from investing activities help evaluate a strategy to expand and grow your business. A business growth often have cash flow investment pussy.

- Cash flow from financing activities help businesses raise capital or repayment, but need tightly controlled to avoid the risk of losing your financial balance.

The analysis report cash flow help businesses be more clear view about the possibility of cash management, optimal financial and strategic decisions effectively.

4. Statement analysis, cash flows, with the only important numbers

Phân tích báo cáo lưu chuyển tiền tệ không chỉ dừng lại ở việc quan sát số liệu mà còn phải đánh giá các chỉ số tài chính quan trọng. Các chỉ số này giúp doanh nghiệp nhận diện xu hướng dòng tiền, đánh giá sức khỏe tài chính và đưa ra quyết định manage your business cash flow hiệu quả hơn.

4.1 ratio analysis, cash flow from operating activities compared to the total cash flow

Ratio of cash flow from operations compared to the total cash flow reflects the level of dependence of the business on cash flow from business activities compared with other sources such as investment or financial. This indicator helps to assess the sustainability of cash flow that the business generates.

Formula

The rate of cash flow the business activities = cash Flow from operating activities/Total cash flow at×100%

Meaning

- High index (> 60%): Business has steady cash flow from business activities, less dependent on external funding.

- Low index (

For example: If the business has cash flow from operations is 50 billion and total cash flow into the states is 80 billion VND, then this ratio is: 50/80×100=62.5%

=> This is a positive sign because the cash flow from business operations accounted for the majority of the total cash flow.

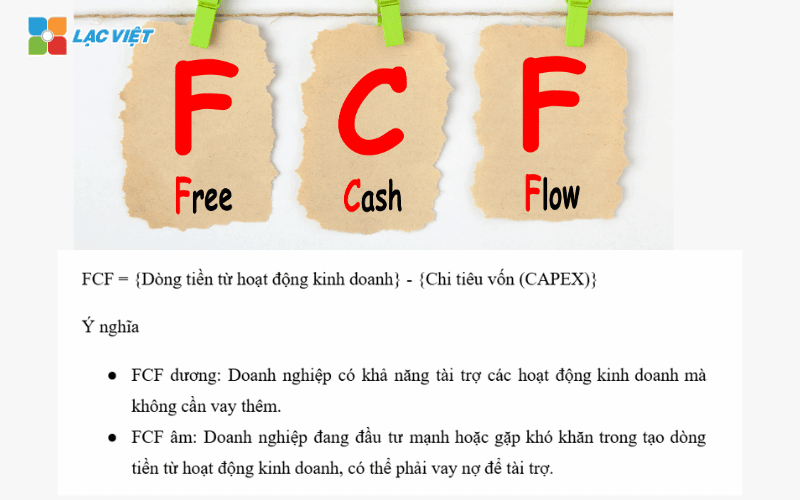

4.2 analysis of the ratio of free cash flow (Free Cash Flow – FCF)

FCF is the cash flow remaining after the business pay for the necessary investments to maintain and expand business operations. This is important indicators help to assess the ability to generate excess cash to pay down debt, dividend distribution or invest in new opportunities.

Formula

FCF = cash Flow from operations – capital Expenditure (CAPEX)

Meaning

- FCF duong: the Business have the ability to finance the business operations without borrowing more.

- FCF negative: Business is to invest heavily or encounter difficulties in generating cash flow from business operations can be taking out a loan to finance.

For example: If the business has cash flow from business operations is 200 billion and capital expenditure (purchase of machinery factory) is 50 billion VND, then: FCF = 200 − 50 = 150 billions VND

=> Business there FCF positive, meaning that there is enough cash flow to expand without debt.

4.3 analysis the coefficient of ability to pay by money

The coefficient of the ability to pay with money (Cash Ratio) measures the ability to pay short-term debts in cash available of the business.

Formula

Coefficient of solvency cash = Cash and cash equivalents/short-term Debt

Meaning

- Index > 1: Businesses have the ability to pay the whole debt, short-term cash, less liquidity risk.

- Index

4.4 analyzing the money flow index on equity (Cash ROE)

Cash ROE (Return on Equity) measures the efficient use of capital owners in the generate cash flow from business operations.

Formula

Cash ROE =cash Flow from operations business/Equity×100%

Meaning

- The index is high (> 15%): Business performance, use of capital good, generate strong cash flow from business operations.

- Only the low (

Summary and important note

| Index | Formula | Meaning |

| Ratio of cash flow from business operations | Cash flow business / Total cash flow into | Assess the level of sustainability of the cash flow business |

| Free cash flow (FCF) | Cash flow business – capital Expenditure (CAPEX) | Measurement of cash flow excess after funding for long-term investment |

| The coefficient of ability to pay by money | Cash / short term Debt | Evaluate the possibility of debt payments in cash available |

| Cash ROE | Cash flow business / Equity | Performance evaluation using equity |

Tracking and analyzing these indicators help businesses better understand the financial performance, cash flow projections, plans to finance management more reasonable. Businesses can apply the BI tools, AI to track this index in real time, from which a decision fast and accurate.

5. Technology application in analysis statements of cash flows

In the context of business faced with financial volatility non-stop, the application of technology to analyze and report cash flow help businesses track the exact amount, optimal management, financial forecast, financial trends in the future. Here are two important technology to help businesses manage cash flow analysis efficiency.

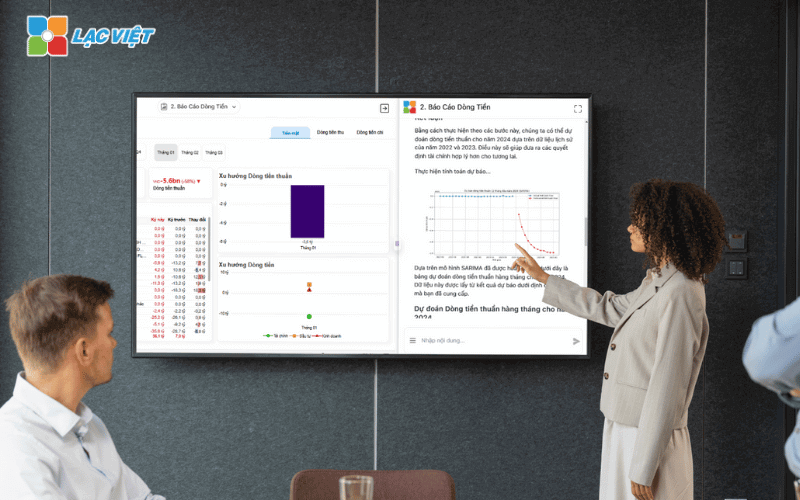

5.1 Use of BI Financial Dashboard to track cash flow real time

BI (Business Intelligence) Financial Dashboard is a tool to help businesses synthesis, visualization, data analysis, cash flow in real time, support the management decision quickly. The common platform can mention:

- Power BI: Supports connect data from multiple sources, panel construction cash flow activity.

- Tableau: data visualizations cash flow with the chart easy to read, easy to analyze.

- Vietnam Financial AI Agent: Integration of AI to analyze, forecast and detailed explanation business cash flow in real time.

Through BI Financial Dashboard, businesses can:

- Tracking cash flow in real time with charts, graphs, figures, help capture the right financial situation.

- Cash flow analysis from three main activities: business, investment, financial transparency, detail.

- Automatic alerts negative cash flow: When the flow of money fall into the danger zone, the system will alert to businesses to take measures to adjust.

- Performance comparison cash flow over time: comparison of current cash flow with the previous period to detect trend change in the financial structure.

For example: A business use Lac Viet Financial AI Agent can track the money flow out into according specific categories, view trends cash flow in 3 months – 6 months – 12 months, get proposed to cut cost or optimal revenue when the system detects cash flow signs of decline.

5.2 Application AI in the cash flow forecast for business

Cash flow forecast is an important step to help business planning, financial control, liquidity, ensure business activity is stable. A system to forecast cash flow effectively help business:

- Actively managed funds, avoid shortages cash flow surprises.

- Take financial decisions exactly as to expand production, investment, or adjust the funding strategy.

- To avoid risk, liquidity risk, reduce the risk of default, or to loans with high interest rates.

- Optimize cash flow activities, help businesses balance income and expenditure in an effective way.

AI technology helps business analysis, historical data, detect trends, given the forecast cash flow accurately. The AI engine can now:

- Automatically collected, processed data from financial statements, banking, public debt receivable and payable.

- Cash flow forecast the future by analyzing trends in revenues, expenses. economic fluctuations.

- Recommendations financial help optimized business strategy, cash flow.

A typical example is the Vietnam Financial AI Agent system, advanced AI to help businesses:

- Analysis and forecast of future cash flows based on real data.

- Warning risk, liquidity risk, propose solutions to balance cash flow.

- Automatic reporting, cash flow, save time for the business.

- Integration with accounting systems, banking, business help track cash flow continuously without the need for manual data entry.

Lac Viet Financial AI Agent to solve the “anxieties” of the business

For the accounting department:

- Reduce workload and handle end report states such as summarizing, tax settlement, budgeting.

- Automatically generate reports, cash flow, debt collection, financial statements, details in short time.

For leaders:

- Provide financial picture comprehensive, real-time, to help a decision quickly.

- Support troubleshooting instant on the financial indicators, providing forecast financial strategy without waiting from the related department.

- Warning of financial risks, suggesting solutions to optimize resources.

Financial AI Agent of Lac Viet is not only a tool of financial analysis that is also a smart assistant, help businesses understand management “health” finance in a comprehensive manner. With the possibility of automation, in-depth analysis, update real-time, this is the ideal solution to the Vietnam business process optimization, financial management, strengthen competitive advantage in the market.

SIGN UP CONSULTATION AND DEMO

6. Guide how to read and analyze reports, cash flow real

| STATEMENTS OF CASH FLOWS | |||||||||||||

| (By direct method) | |||||||||||||

| Year 2012 | |||||||||||||

| Unit: VND | |||||||||||||

| Indicators | Code | Notes | Year | Year ago | |||||||||

| 1 | 2 | 3 | 4 | 5 | |||||||||

| I. cash flow from business operations | |||||||||||||

| 1. Proceeds from the sale of goods, provide services and other sales | 1 | 3,643,539,722 | |||||||||||

| 2. Cash paid for the supply of goods and services | 2 | (350,758,772) | |||||||||||

| 3. Cash paid to employees | 3 | (875,450,337) | (281,700,000) | ||||||||||

| 4. Cash paid interest on the loan | 4 | (354,750,000) | |||||||||||

| 5. Money spent on filing corporate income tax | 5 | (326,815,660) | |||||||||||

| 6. Cash from other business activities | 6 | 1,569,750,000 | |||||||||||

| 7. Cash paid for other business activities | 7 | (1,887,105,695) | (7,624,935) | ||||||||||

| Net cash flow from business operations | 20 | 1,418,409,258 | (289,324,935) | ||||||||||

| II. Cash flow from investing activities | |||||||||||||

| 1. Money spent to shopping, construction of fixed assets and other long-term assets | 21 | (148,718,364) | |||||||||||

| 2. The proceeds from the liquidation sale of fixed assets and other long-term assets | 22 | ||||||||||||

| 3. Money spent on loan, purchase of debt instruments of other entities | 23 | (74,000,000,000) | (127,161,137,550) | ||||||||||

| 4. Cash withdrawal, loan, re-sell the debt instruments of other entities | 24 | 50,015,000,000 | 37,926,057,000 | ||||||||||

| 5. Money spent on invested capital contribution to other units | 25 | (22,000,000,000) | |||||||||||

| 6. Cash withdrawal of investment capital contribution to other units | 26 | 31,600,000,000 | |||||||||||

| 7. Revenues loan interest, dividends and profits are divided | 27 | 5,178,546,182 | 1,254,297,913 | ||||||||||

| Net cash flow from investing activities | 30 | (9,355,172,182) | (87,980,782,637) | ||||||||||

| III. Cash flow from financing activities | |||||||||||||

| 1. Proceeds from stock issuance, receipt of capital contribution of owner | 31 | 88,492,870,000 | |||||||||||

| 2. Pay capital for the owner, buy back shares of the business was released | 32 | (78,400,000) | |||||||||||

| 3. Loan short term and long term get | 33 | 9,000,000,000 | |||||||||||

| 4. Repayments of loans | 34 | ||||||||||||

| 5. Payoff debt-finance lease | 35 | ||||||||||||

| 6. Dividends, profits were paid to the owner | 36 | (4,602,080) | |||||||||||

| Net cash flow from financing activities | 40 | 8,916,997,920 | 88,492,870,000 | ||||||||||

| Net cash flow in period (50 = 20 + 30 + 40) | 50 | 980,234,996 | 222,762,428 | ||||||||||

| Cash and cash equivalents at beginning of the period | 60 | 222,762,428 | |||||||||||

| The influence of changes in foreign exchange rates currency converter | 61 | ||||||||||||

| Cash and cash equivalents at end of period (70 = 50 + 60 + 61) | 70 | VII.34 | 1,202,997,424 | 222,762,428 | |||||||||

Sample report on established under the direct method, i.e. the flow of money in and out is clearly presented according to each type of actual transactions.

Statements of cash flows consists of three main parts:

- Cash flow from business operations (part I)

- Cash flow from investing activities (part II)

- Cash flow from financing activities (part III)

In addition, the report also displays the aggregate net cash flow in the period, cash balances at the beginning and end.

6.1. Analysis of cash flow from business operations

Purpose: to assess the ability to generate cash from business operations of the business.

Proceeds from the sale, service providers and other sales (Code 1): This is the cash flow key from business activities, increase if compared with the previous period that the business had revenue growth well.

- Year: 3.643.539.722 VND

- Years ago: there is No comparative figures

- Review: Business revenue, cash significantly.

Cash paid for the supply of goods and services (Code 2): Account, cash, business, pay to the supplier. If this amount is too large compared to the amount collected, the business may experience issues about cash flow.

- Year: (350.758.782) VND

- Review: expenses not too large compared with proceeds from business activities.

Cash paid to employees (Code 3): If personnel costs spike, can businesses are scaling or have high labor costs.

- Year: (875.000.000) VND

- Review: Business has expenses to pay wages, but not to a level that is too high.

Money income from activities other (Code no. 6): The sources of revenue other than sales, there can be income from ancillary services or liquidation of assets.

- Year: 1.569.750.000 VND

- Review: this cash Flow is quite high, can businesses get more revenue in addition to revenue privacy.

Cash paid for other business activities (Code 7): expenses not directly related to the purchase or salary. If too large, can businesses are inefficient spending.

- Year: (1.887.105.695) VND

- Comment: Accounts, quite large, to consider in detail the items.

Net cash flow from business operations (Code no. 20): the most important indicator that reflects the business can self-funded works.

- Year: 1.418.469.258 VND

- Years ago: (289.324.935) VND

- Review: cash Flow from business operations has moved from negative to positive, indicating significant improvement.

6.2. Analyzing cash flow from investing activities

Purpose: to evaluate how businesses use cash flow to invest in long-term assets or financial.

Money spent to procure fixed assets (fixed assets) and other long-term assets (Code no. 21): If too high, businesses can now expand production.

- Year: (148.718.364) VND

- Review: investment, low business not to spend much for expanding fixed assets.

Money spent on loan, purchase of shares and financial investment other (Code 23): If too large can affect cash flow.

- Year: (127.161.137.550) VND

- Review: Business has financial investments significantly, it can be risky if not recovered.

Cash withdrawal of investment capital contribution to other units (Code 26): If you have positive cash flow, the business can now divestment or withdrawal of investment.

- Year: 31.600.000.000 VND

- Review: Business has the capital recovery, can help improve cash flow.

Net cash flow from investing activities (Code no. 30): If too large, the business can meet liquidity risks.

- Year: (19.255.132.182) VND

- Review: cash Flow investment pussy, big businesses are focused on investment strong.

6.3. Analyze cash flow from financing activities

Purpose: to evaluate strategic financing of the business, through debt or raising equity.

Proceeds from issue of shares capital contribution of owner (Code 31): If there are cash flow into the large, can now raise capital to expand.

- Year: 88.492.870.000 VND

- Review: Business, raise capital, can serve to expand business.

Loan short term and long term get (Code 33): If many borrowers may increase the risk of debt.

- This year: No data

- Review: Business't borrow more debt.

Debt payoff the loan (Code no. 34): If the business pays the debt loan without cash flow from business operations support, which can cause financial stress.

- This year: No data

- Review: No terms of repayment of the loan in states.

Net cash flow from financing activities (Code 50): If positive, can do business, raise capital, if you can do pay more debt.

- Year: 980.324.398 VND

- Review: cash Flow financial ocean, mainly from raising capital.

Conclusions and lessons drawn from the analysis report

- Cash flow from business activities ocean (1.418 billion VND), showed that business activity had significant improvement compared with the previous year.

- Cash flow from investing activities, pussy, big (-19.255 billion VND), reflecting businesses are investing heavily in long-term assets and financial.

- Cash flow from financing activities big thanks to mobilize capital (88.492 billion VND), to help finance other activities.

- Total cash flow net in any ocean (980 billion VND), help, cash, end of period increased 1.202 billion VND, ensure good liquidity.

Businesses should continue to monitor investment performance to ensure the investments profitable, and to manage public debt and optimizing it costs to maintain cash flow positive business.

Cash flow is a measure of the financial health of the business. A profitable business is good, but not control the flow of money can quickly fell into financial crisis. Conversely, a business can strategically manage cash flow closely, optimize cash flow from business operations, investment, financing will have more advantages in the large-scale expansion, competition in the market.

If your business has no strategy to manage cash flow effectively, this is the appropriate time to start the application method statement analysis cash flow and modern technology into financial management, ensure cash flow is always tightly controlled direction to sustainable development.