According to statistics, more than 80% of businesses fail not because of lack of profit, which for no good control cash flow. Cash flow management in business is not merely recording income and expenditure, but also the art of maintaining the survival and sustainable development of the enterprise.

So, how to control manage your business cash flow effective? Common mistakes that businesses meet financial risk? And most important, the business can technology application, how to manage cash flow effectively smart?

This article Lac Viet Computing will help you learn in depth about management, cash flow, from the optimal method to app AI in financial monitoring to help businesses maintain liquidity sustainable growth.

1. Overview of the cash flow business

1.1 what is money?

Cash flow (cash flow) is the entire line of movement of cash and cash equivalents into/ out of business in a given time period.

Words easy to understand, cash flow is the rotation of the fact of money – includes cash, bank deposits, money transfer, etc. rather than just the numbers on the accounting reports. Cash flows that the business is how many actually have the money to pay, invest, operate, or no room for risk.

Cash flow is the “blood vessels” of the business. A business may not be profitable in the short term, but it still exists if steady cash flow. On the contrary, business is profitable but cash flow, pussy stretching, it is easy to fall into crisis.

1.2 types Of cash flow of the business

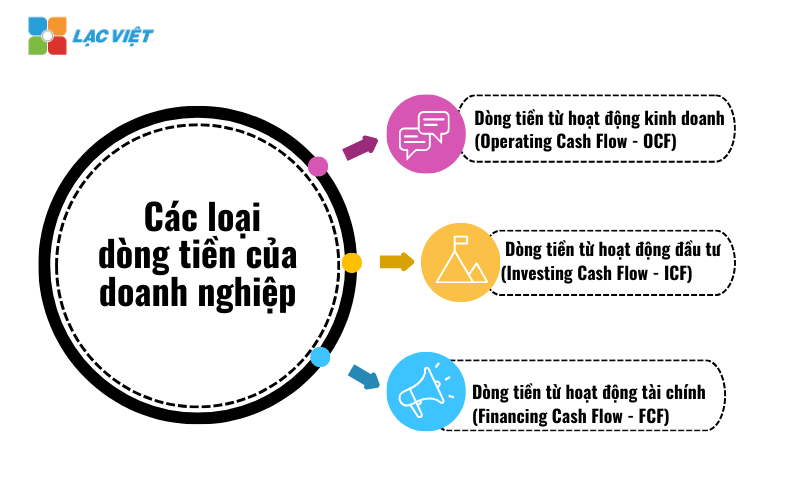

Cash flow of the business not merely as “earnings” or “money spent”. Need clear separation of sources, generate cash flow for the purpose of use to properly evaluate the financial situation to avoid confusion between “revenue” and “amount received”, from which control the flow of money closely, timely decisions.

Standards for financial reporting and governance practices, cash flows are classified into three main groups:

Cash flow from business operations

This is the cash flow core, reflect the ability to generate cash from operations of the business – manufacturing, service business or trade.

Includes:

- Collect money from sales or service provider

- Collect money from the debt (paying customers)

- Spend money buying raw materials, goods and services

- Spend money on salary, insurance, tax

- Operating costs, marketing, equipment maintenance

Enterprise value received when tracking group cash flow this:

- Rated capacity make real cash from operating activities

- Identify the stage of “a sale, but lack of cash” to adjust the public debt, the cost

- Is the basis for balancing sources of money spent on operator daily

Cash flow from investing activities

This is the cash flow related to the long-term assets and other financial investments, the business is expanding scale or divestment.

Includes:

- Spend money purchase machinery, equipment, fixed assets

- Spend money on buying shares, investments in other businesses

- Collect the money from the sale of property, franchise, divestment

- Interest from financial investments (bonds, dividends...)

Meaning:

- Control expansion plans, avoid investment beyond liquidity

- Evaluate the effectiveness cash flow from assets invested: invest – what recouped, how much?

- Create clear base to balance between investment and operating

Cash flow from financing activities

Cash flow finance reflect the transactions between the business owner or organization, financing, strategy is the capital of the enterprise.

Includes:

- Collect money from bank loans, issuance of bonds

- Collect money capital contributions from shareholders, investors

- Pay loan principal and interest loan

- Dividend profit for shareholders

Actual value the business receives:

- Track capacity rotation external capital in a clear way

- Limited status of “loans to pay old debts” without incurring cash flow, operating respectively

- Assess the level of dependence on borrowed funds, from which adjust the capital structure, reasonable

- 10+ accounting software ERP admin have ONE standard TT 99/2025 most popular for Vietnamese enterprises.

- 9 Accounting Software online cheap cost reduction for small and medium ENTERPRISES

- Cash flow from business operations what is? How to properly understand, effective management for business optimization

- Reported cash flow is what? How to set, read excel file standard with professional template

2. Cash flow management is what? Why the need for effective management?

2.1 cash flow Management is what?

Manage your business cash flow is the process of planning, tracking, control the flow of money out (expenses) and cash inflows (revenues) in the whole operation of the business. In other words, this is how businesses ensure there are always enough cash to:

- Ensure the likelihood of timely payment: cash Flow stability to help businesses proactively pay salaries, purchase of raw materials, payment of bills, without being dependent on loans or revolving capital fold.

- Maintain manufacturing operations – business continuity: Business will not be interrupted orders, stop production line or lose customers just because of “lack of cash in the short term”.

- Optimal use of capital: When you know the time of surplus – deficit cash flow, the business can decide to invest, pay debt or save reasonable instead to capital “is dead” or unexpected deficits.

- Prevention of financial risks, take advantage of market opportunities: cash Flow is the layer of “safety cushion” to help businesses respond to market volatility or leverage investment opportunities quickly when appear.

Other with the only interest in profitability, cash flow management put emphasis on liquidity fact – ie the amount of money actually left to use, does not depend on the numbers recorded on the accounting reports.

2.2 why businesses need to manage cash flow effectively?

Avoid liquidity risks and the risk of bankruptcy, despite high profits

A business can be profitable on the financial statements, but is still facing the risk of bankruptcy if not enough cash to pay the financial obligation. Cash flow management to help businesses maintain solvency, reducing the risk of losing your financial balance.

Statistics from the financial research shows more than 80% of businesses fail is due to cash flow problems, not due to lack of profit. Ensuring positive cash flow is vital to maintain operations, expand business.

Optimized use of capital to grow the business

Cash flow management business is not just to control spending, but also is to optimize the use of capital. Business has positive cash flow stability can:

- Investment to expand production and product development

- Enhance competitiveness by improving customer service

- Capitalize on market opportunities that do not depend on external debt

Help business financial forecast more precisely

Cash flow forecast helps business financial planning long term, determine when to raise capital or when to re-invest profits. The business has forecast system good cash flow can usually withstand more in the period of economic fluctuations.

According to a survey by PwC, business strategy manage cash flow effectively have the ability to maintain high profits by more than 20% compared to the business does not tightly control cash flow.

3. The index and how to calculate the cash flow of the business

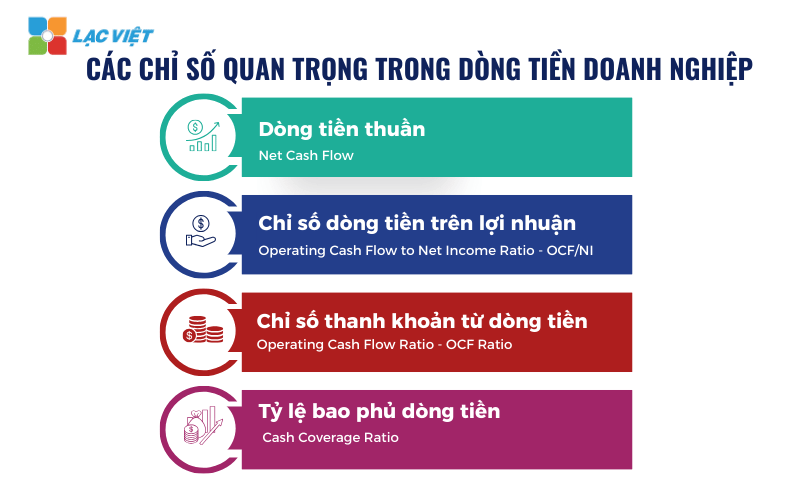

Comparison of indicators important practical application

| Index | Recipe | Meaning | The rating is good |

| Flow net cash (Net Cash Flow) | Total cash flow – to- Total cash outflow | Evaluate the ability to create cash out of the business | Cash flow positive |

| OCF/NI (cash Flow on profitability) | Cash flow from operating activities / net profit | Determine the level of the quality of accounting profit | >1 |

| OCF Ratio (indicator of liquidity from cash flow) | Cash flow from operations / current Liabilities | Reviews solvency short-term debt with cash flow activity | >1 |

| Cash Coverage Ratio (coverage Ratio, cash flow) | (Cash flow from operating activities + Interest) / Interest | Assess ability to pay interest on the loan | >1.5 |

3.1. Flow net cash (Net Cash Flow)

Flow net cash (Net Cash Flow) is the actual amount remaining after the business minus all the expenses from the total cash flow in a given time period. This is an important indicator to help assess whether the business is generating positive cash flow or not.

Formula for calculating cash flow net

Flow net cash = Total cash flow – to- Total cash outflow

In which:

- The total flow of money into: includes revenues from sales revenues from investments, loans or issuing stock.

- Total cash outflow: include payments to suppliers, employee wages, loan repayment, operating expenses, investment in fixed assets.

Analyzing fluctuations in cash flow, net

- Cash flow positive net: Businesses are generating more money than the amount of money spent to help maintain operations, expand investment.

- Cash flow net voice: If prolonged in many states, businesses can face the risk of insolvency. However, negative cash flow in the short term can occur when business invest heavily in fixed assets or business expansion.

3.2. Money flow index on profitability (Operating Cash Flow to Net Income Ratio – OCF/NI)

Money flow index on profit (OCF/NI) reflects the rate of cash flow from operations compared with net profit of the business.

Formula:

OCF/NI = cash Flow from operating activities / net profit

In which:

- Cash flows from operating activities: Taken from the cash flow statement.

- Net profit (Net Income): the remaining balance after deducting all expenses from revenue.

Meaning and how to evaluate

- OCF/NI > 1: Business generating more cash than accounting profit and shows profits are high quality, less affected by the account not to cash (for example, depreciation).

- OCF/NI

3.3. Index liquidity from cash flow (Operating Cash Flow Ratio – OCF Ratio)

Index liquidity from cash flow (OCF Ratio) measurement capabilities, the business can pay its short term debts by the cash flows from business activities.

Formula:

OCF Ratio = cash Flow from operations / current Liabilities

In which:

- Cash flows from operating activities: Reflect the actual amount that the business generates from its core activity.

- Short-term debt: include accounts payable, short-term loans, the other financial obligations coming due within a year.

Meaning and how to evaluate

- OCF Ratio > 1: Business has enough cash flow to pay short-term debt, demonstrate the ability to liquidity.

- OCF Ratio

3.4. Coverage ratio cash flow (Cash Coverage Ratio)

Coverage ratio cash flow, measuring the ability of businesses in the payment of interest on loans by the cash flows from business activities.

Formula:

Cash Coverage Ratio = (cash Flow from operating activities + Interest) / Interest

In which:

- Cash flow from business operations: the actual amount Of business generated from business activities.

- Interest: Total interest that a business must pay in the accounting period.

Meaning and how to evaluate

- Cash Coverage Ratio > 1.5: the Business ability to pay interest on the loan better, less financial risk.

- Cash Coverage Ratio

4. 5 principles of management business cash flow optimum efficiency

Cash flow management efficiency not only helps business “is not lack of money” but also the factors that determine the ability to survive long-term development. Here are 5 core principles are more successful business applied as a “lodestar” in the financial control daily.

4.1. Plan the flow of money in the short and medium term

Cash flow is not stable by the day or month. There are times when businesses collect money very much, but “money” after only a few account details, big surprise. If no to the previous forecast, business easy to fall into a liquidity crisis that could not manage.

How effective:

- Table setting plan cash flow weekly, monthly, quarterly

- Predict cash flow on (sales revenue, debt collection, interest) – outflow of cash (pay salaries, pay suppliers, investment in machinery)

- Marking time capable of deficiency to proactively prepare

Illustrative example: A commercial enterprise know before the 4th quarter is the peak season sales, but also a time to pay much import menu. If there is no plan cash flow 2-3 months in advance, businesses can miss the chance to enter the correct time or are forced to borrow fold with high interest rates.

Values bring:

- Limited risk on cash surprise

- Actively seek embodiment response (rotate round capital, delaying spending, concessional loan)

- Create the stability of capital flows, ensure businesses operate without interruption

4.2. Optimal receivables – payables

Business is not “dead” because of the hole, but because don't collect the right term. The collection of your debt, while still have to pay bills inputs that businesses fall into the status of “many sales, but always lack of money”.

Effective strategy:

- Shorten the duration of recovery of the debt from the customer through the payment policy flexible but tightly

- Make the most of the time liabilities that still maintain credibility with suppliers

- Use reminders automatic renewal, or KPI public debt clear for the accounting department/sales

Illustrative example: A construction business to receive payments from customer after 90 days, while having to payment for raw materials within 30 days. Not renegotiate the term of the debt, or no solution “bridge” financing that cash flow is always stressful.

Values bring:

- Balance the time of collection – details

- Pressure relief loans short term

- Increase proactive in coordinating the budget

4.3. Inventory management smart

Inventory is “cash is freezing”. Whether it is goods or raw materials, work to inventory too much synonymous with the cash flow in custody, not words. In the context of highly competitive inventory less flexible also entail risks outdated decrease in value, even the hole.

The solution should be applied:

- Periodic review inventory optimization by industry, seasons

- Connect inventory management with sales plan and cash flow to enter only the appropriate

- Model application “just-in-time” or inventory management according to ABC to priority groups, items have rotation speed fast

Illustrative example: A company imports electronic components enter inventory 3 months but fast moving market, causing 40% inventory reduction price after only 6 weeks. If planning a purchase based on cash flow analysis the pace of sales, the business was able rotated capital more efficiently.

Values bring:

- Freeing up capital is “buried” in stock

- Speed up revolving cash flow

- Optimal area warehouse and storage costs

4.4. Construction reserve fund cash flow

Not a business that can completely avoid risks: customers debt slowly, costs incurred sudden market fluctuations. A reserve fund cash flow acts as a “cushion” financial help businesses succumb ago instability.

Strategy building fund:

- Extract a part from profits or revenue stability constants months to create the fund

- Send funds to the account profitability low, but easy to withdraw, avoid lock capital

- Construction principle use of funds: use only for cash flow risks, do not use for regular expenses

Illustrative example: A business F&B retain 5% of revenues each year into the reserve fund. When disease outbreaks, sales activity decreased by 60%, but thanks to this fund, they still maintain is paid wages and rents in 2 months – enough time to turn things around.

Values bring:

- Maintain liquidity, including to meet fluctuations

- Increase the ability to react to pre-crisis

- Create trust with shareholders, investors, personnel

4.5. Enhance transparency, monitoring cash flow, internal

Cash flow if they are not watched closely will happen errors, losses, or allocated inefficiently. Especially with multiple business branches, multiple projects or departments of independence, decentralization, and monitor cash flow is paramount.

Solution deployment:

- Applied management software cash flow connect with the accounting system, sales, warehouse

- Delivery KPI cash flow by department/project: positive cash flow, speed, debt collection, expense ratio actively

- Recurring collated data real – planned for early warning of deviations

Illustrative example: A delivery business using software financial dashboard cash flow by day help the director of financial holding now available balance at each branch. Thanks to that, just a branch signs, pussy, money prolonged operating parts will be on the right.

Values bring:

- Increase transparency, internal control

- Timely decisions when cash flows that are unusual signs

- Improving the efficiency use of resources throughout the system

6. Common mistakes in managing business cash flow

Do not follow the regular cash flow

One of the biggest mistakes of business is not tracking cash flow regularly and systematically. This leads to the business only discovered the problem when it was too late, such as when the bank account is nearly depleted, or when the business can't pay the expenses important.

The consequences of not tracking cash flow

- Not timely identification of financial risks: If there is no tracking system, businesses can not promptly detect these warning signs, such as declining revenues, costs spike or customers delayed payments.

- Easy to fall into the shortage of liquidity: Even if profitable business, but if there is not enough cash to pay operating costs, the business can still experiencing financial difficulties, serious.

- Possibility of penalties for late payment: failure to manage cash flow closely can lead to delays in payment of debts, affecting the reputation of the business and can lead to penalties from banks or partners.

Relying too much on profit that missed cash flow

Many businesses only focus on profit on financial statements without attention to the line actual money. However, the accounting profit does not accurately reflect the financial situation of the business. A company highly profitable, but if customers delayed payments or inventory rising, the business can still troubled about cash flow.

Solution to balance profit and cash flow

- Closely manage public debt customers: Applicable payment policies closely, require a deposit or reduce the time of payment.

- Optimize cash flow activities: Decrease in inventory is not necessary, negotiating payment terms better with suppliers.

- Planning cash flow instead of just relying on reported profit: Using models, cash flow management to ensure that the business always has spare cash.

Don't have a backup plan cash flow

Business cash flow can be affected by many factors such as declining sales, customer payments, costs or economic fluctuations. If there is no backup plan, cash flow, business will have great difficulty when unexpected situations occur.

The consequences of not having a backup plan cash flow

- When the market is experiencing volatility (for example, recession, disease), businesses do not have the cash reserves to maintain operations.

- Must go emergency loan with high interest rates, increasing the cost of finance.

- Lose the possibility of payment with suppliers, leading to disruption of the supply chain.

Cash flow management is poor due to lack of software support

Many small and medium businesses still manage cash flow manually on Excel or according to the sense, which led to the uncontrolled flow of money accurately and timely.

The consequences of not using the software to manage cash flow

- Take time in the synthesis of data, control over income and expenditure account.

- There is no early warning about cash flow problems, resulting in financial decision mistakes.

- Difficult to forecast future cash flows, reducing the ability of financial planning.

7. The software tool supports managing cash flow business efficiency

In the context of business increasingly expand the scale of operations and cash flows become more complex, managing cash flow business by feeling or track on the books discrete no longer fit. Business number need to the tool which has ability to record, analyze, forecast cash flow accurately, continuously.

Here is the useful tool, from simple to in-depth can support businesses at any scale in managing cash flow effectively.

7.1. Excel template cash flow management 12 months

This is a tool platform for SME businesses or businesses have not implemented the system accounting software specialist. This Excel template is help business plan cash flow by month analysis, the difference between planned and actual, from which to make decisions timely adjustment.

Feature highlights:

- Recorded cash inflows (revenues from sales, debt collection, investment...)

- Recorded cash flow out (wages, rent, cost of purchase, repayment...)

- Tracking cash balances at the end of each month

- Warning, pussy, cash or difference threshold allows

Values bring:

- Help business initiative budgeting in each cycle

- Increased ability to control expenses, coordinating payment

- Business suit no specialized software

7.2. Accounting software has integrated a report cash flow

Accounting software modern day not only helps in recognition of accounting data, but also can automatically generate a report cash flow in each period, each project, or each of the departments. A number of software downloads in Vietnam was integrated financial indicators helps business analysis quick status current cash flow.

Features should be:

- Statements of cash flows under the direct method/indirect

- Track the actual amount from the sales receipts, purchase orders, payroll costs, taxes

- Connect with the bank to update account balances instant

- Lets compare planned and actual time to time

Values bring:

- Help managers have clear view of the line of actual money

- Limit the risk of errors due to input crafts

- Speed up financial decisions when you need fast processing cash flow

7.3. ERP system or software BI integrated cash flow

Enterprises with large-scale or growing according to the model, multi-departmental, multi-branch system, ERP (overall management) software, or in BI (Business Intelligence) is a strategic choice. These systems not only monitor cash flow, but also directly connected with sales data, inventory, liabilities and financial plan to build report multidimensional analysis.

The ability to support cash flow excel:

- Sync data in real-time from all parts

- Cash flow analysis by product, project, venue or customers

- Cash flow forecast according to the financial model is designed specifically

- Automate alerts, pussy, cash, excess payments, or spike costs

Values bring:

- Capacity forecasts to plan cash flow strategy

- Optimal use of working capital based on master data

- Increased ability to control risks, decision-making in real time

7.4 application Finance AI Agent of Communication in management, cash flow analysis business

In the context of AI technology is changing the way business financial management, Finance AI Agent of the Encyclopedia brings a groundbreaking solution to help businesses automate cash flow analysis, to optimize the financial decisions, more accurate forecast.

This is a system assistant financial intelligence have the ability to cash flow analysis, real-time trend detection anomalies, propose optimal solutions to business always guaranteed source of funds operational stability.

Finance AI Agent to help businesses manage cash flow and how?

Monitoring cash flow in real time: One of the major difficulties of the business is not have a panoramic view of the cash flow on – going real-time. Finance AI Agent to help:

- Monitor the flow proceeds – cost auto: the System collects data from accounting software like AccNet or the ERP system, from which aggregate cash flow without the need to enter data manually.

- Display visual reports: Provide chart cash flow easy to understand, help businesses quickly identify the cash balance account for income and expenditure, the largest in each of the states.

- Warning negative cash flows: If the business has cash flow net continuous, the system will send early warning to managers make timely adjustments in financial strategy.

Cash flow analysis, trend forecasting: Not only help to track current cash flow, Finance AI Agent also has the ability to analyze, forecast future cash flows by:

- The AI system will compare data cash flow of the business in many states before, identify the factors that influence given trends cash flow in the period to come.

- Cash flow forecast in many scenarios: AI can take out many forecasting models based on different assumptions, such as: If sales increase by 10%, then the cash flow will change how? If customer's payment delay 30 days, the enterprise risk shortage of cash?

- Support financial decisions based on data: Based on cash flow projections business can plan spending, borrowing or investing more reasonable.

Support optimize receivables and payables: One of the reasons why cash flow businesses affected is the management of public debt has not yet effective. Finance AI Agent support:

- Track the real-time debt: the AI System automatically updates the list of customers in arrears, time to maturity, to help businesses control over the receivables.

- Forecast risk of late payment: AI can detect which customers tend to delayed payments based on transaction history, from that proposed measures to remind or adjust the terms of payment.

- Optimize accounts payable: the proposed System the time of payment optimal for businesses to avail the discount policy from suppliers, while ensuring cash flow is always positive.

Decision support flexible financing smart: Finance AI Agent to not only track cash flow which also acts as a financial advisor intelligence, help businesses optimize financial decisions important:

- The proposed plan to cut costs: If the cash flow business is in trouble, the AI system will analyze the costs, hints, cut the unnecessary costs that do not affect the business operation.

- Strategic consulting, capital mobilization: If your business needs additional cash flow, AI will propose alternatives such as bank loans, issuing bonds, seeking external investment, and calculate the impact of each alternative.

- Building plans long term cash flow: Finance AI Agent that helps the enterprise plan cash flow within 6-12 months to ensure the initiative in financial management.

Lac Viet Financial AI Agent to solve the “anxieties” of the business

For the accounting department:

- Reduce workload and handle end report states such as summarizing, tax settlement, budgeting.

- Automatically generate reports, cash flow, debt collection, financial statements, details in short time.

For leaders:

- Provide financial picture comprehensive, real-time, to help a decision quickly.

- Support troubleshooting instant on the financial indicators, providing forecast financial strategy without waiting from the related department.

- Warning of financial risks, suggesting solutions to optimize resources.

Financial AI Agent of Lac Viet is not only a tool of financial analysis that is also a smart assistant, help businesses understand management “health” finance in a comprehensive manner. With the possibility of automation, in-depth analysis, update real-time, this is the ideal solution to the Vietnam business process optimization, financial management, strengthen competitive advantage in the market.

SIGN UP CONSULTATION AND DEMO

Any business has the cash flow steady, accurate forecasting and control liquidity to good businesses that will have competitive advantages, strong, ready to capture growth opportunities overcome the difficult period.

By applying the method manage your business cash flowoptimize the cash cycle, using the software supports special is app AI to analyze cash flow, businesses can automate the monitoring financial decisions based on accurate data and predict risk before it happens.