Compare circular 99/2025 TT-BTC and circular 200/2014 TT-BTC shows a shift of orientation in the accounting business. If circular 200 biased standardized and compliant, then the circular 99 emphasize transparency, flexibility, service management, internal. The asymptotic IFRS, as well as adjust the system account, financial statements, create a platform for enterprises to improve management capability and integration ready.

For many years, circular 200 is the foundation for the accounting system business, contributing to the standardization of accounting and financial reporting. However, higher requirements on governance, risk control, as well as international integration, accounting framework, this gradually reveal limitations. The issuance of circular 99/2025 is step adjustment of strategy, direct impact on the way business organizations accounting system and financial management.

The same Lac Viet Computing learn in detail each aspect comparison between two circular, from the scope of application, the system account to requirements management and internal control, in order to support business approach as well as implementing circular 99 an effective way.

1. Overview of circular 99/2025 & circular 200/2014

1.1. Circular 99/2025 TT-BTC, what is?

Circular 99/2025/TT-BTC issued by the Ministry of Finance issued on 27/10/2025 officially take effect from 01/01/2026, replace circular no. 200/2014/TT-BTC. Here is text the latest legal regulations and accounting business in Vietnam in the stage of deep integration with the international economy.

Different approaches ago, circular 99 not only focus on “accounted for right”, which aims to improve the quality of financial information, the use value of accounting for managers. Specific:

- Increase transparency & accountability that: accounting information not only serves the state management agency, which also serves leaders, investors, banks with stakeholders.

- More flexibility in the organization accounting system: the Business is active right system design, accounts, vouchers, books and pattern matching activity fact, instead of being hard bound into molds.

- Neckline standards IFRS: IFRS (reporting Standards international financial) is the system standards are used in more than 140 countries. The asymptotic IFRS help Vietnamese enterprises to easily compare, transparency and integration, especially with FDI enterprise or business plans to expand into international markets.

- Expand the range to management & internal control: accounting not only noted the results of the past, but also the role of risk control, support, administration, cost-effective operation.

Can understand in a simple, circular 99 is the upgrade steps of the accounting system business, helping accountants become a tool of financial management-real, instead of just parts of records and reports.

1.2. Circular no. 200/2014 TT-BTC, what is?

Circular no. 200/2014/TT-BTC is the mode business accounting is applied from 2015, the regulations are quite detailed and specific about:

- Account system accounting

- Sample financial statements

- Vouchers, accounting books

- Method recorded, accounted for the economic

In fact, circular 200 has brought many positive value, particularly during periods of Vietnamese enterprises need to standardize accounting work. This circular in accordance with:

- Medium business, large operation according to the traditional pattern

- Models accounting or craft sale

- Business puts emphasis on tax compliance, financial reporting periodically

However, after more than 10 years of application, circular 200 revealed a number of limitations:

- System accounts, stock from mould, less flexible

- Not keeping up with demand of goods administration, according to real-time data

- Not yet meet the requirements of multinational enterprise or business direction to IFRS

The main point of this creates points of difference between circular 99 and circular 200, is also the reason core, causing the Ministry of Finance have issued circular 99/2025 to replace as well as upgrade the legal framework current accounting.

2. Compare circular 99/2025 TT-BTC and circular 200/2014 TT-BTC details

2.1. Scope & application object

2.1.1. Adjustment range

One of the differences between circular 99 and circular 200, located in approach, scope of accounting.

Under circular no. 200/2014, accounting is mainly seen as active:

- Noted professional economic

- Financial reporting according to the form prescribed

- Service tax audit, compliance testing

This approach is suitable in stage businesses need to standardize the books, but limited when businesses need data to management, cost analysis, or evaluate the effectiveness of each department.

According to circular 99/2025, the scope of accounting is expanded markedly, including:

- Accounting procedures, internal

- Internal control, trace service

- Risk management financial

- Information transparency serves the executive, investor

This helps accounting not only “past statements,” which became a tool for decision support. For example, instead of just summing up the cost of the end states, businesses can track expenses by responsibility centers, early detection points unreasonable to adjust timely.

With the perspective of management, circular 99 help businesses reduce the risks skewed data, increase the autonomy in management, especially important when the scale businesses increasingly expand.

2.1.2. Applicable objects

Circular no. 200/2014 apply in general to business according to the accounting regime in Vietnam, but has not been designed to meet the model:

- Multinational enterprise

- Business that needs reporting according to international standards

- Business operating on platform number, string, multi-branch

Circular 99/2025 extended application objects:

- Apply for most business

- Allows FDI choose to apply IFRS in a number of content

- Be specified, separated for microentrepreneurs, special industry

This flexibility helps enterprises reduce the cost of converting the accounting system when working with partners, banks or foreign investors.

2.2. Voucher system accounting & bookkeeping

2.2.1. Accounting vouchers

Circular 200, the business must use the certification form from the Ministry of Finance issued. This ensures consistency, but cause difficulties when:

- Internal processes complex

- Businesses use ERP software or system integration management.

According to circular 99, the business are designed vouchers for is to ensure full legal content. The actual value of this change is:

- Reduce manipulate data entry duplicate

- In accordance with operating procedures reality

- Easy integration with accounting software, electronic invoicing, ERP

For example, a retail business can design sales vouchers attached directly to the POS system, help accounting data updates almost in real time.

2.2.2. Accounting

Circular 200 still rely heavily on the system accounting tradition, in accordance with the accounting model craft.

Circular 99 towards:

- Simplified books

- Reduced power window paper

- Centralized data on system software

This helps businesses save storage costs, increase speed access information and support, data analysis, financial flexibility over.

2.3. Account system accounting

2.3.1. More flexibility with business accounting

One point to important improvements of circular 99 compared with circular 200, located in level of flexibility in the organization accounting system business.

- Circular no. 200/2014 applicable requirements table standard account, at least allowing for complete customization. When businesses expand operations, accounting often have to “manage” in the framework of available leads to reported lack of depth of management.

- Circular 99/2025 allows enterprises to build and expand the system account in accordance particular industry, business model, as well as requires internal administration.

The greatest benefit is the financial statements reflect the real operation, helping leaders to properly assess the effectiveness each business segment.

2.3.2. Add new accounts to meet international standards

Circular 99 supplement a new account number in the direction neckline IFRS, such as:

- TK 215 – biological Assets

- TK 8212 – corporate income Tax and supplemented by the minimum tax global

These accounts help businesses be more active when integration, particularly in the context of many multinational corporations are applied to the tax the global minimum.

2.4. Financial reporting & disclosure of information

2.4.1. Name & structure report

The difference of circular 99 & circular 200, located in the name, structure, system, financial statements, reflecting the orientation integration with international standards.

- Circular 99 using the term structure report neckline IFRS, for example, “balance Sheet” to the Statement of Financial Position.

- Circular 200 still keep the traditional structure, familiar with accounting in water, but hard to compare with international reporting.

This change helps businesses easily work with investors, banks, foreign partners, reduce the time to explain and transform data.

2.4.2. Transparency under IFRS than

One of the differences in our nature between circular 99 & circular 200 is evident in the level of transparency of financial reporting, particularly when placed in the context of asymptotic standard IFRS and requires modern management.

- According to circular 99, financial statements requires disclosures in more detail, focusing on the nature of transaction as well as the accounting estimate important.

- Circular 200 overs brought mould, primarily serves compliant.

Many international studies show that increasing the level of transparency of financial statements help to raise the confidence of investors as well as reduce the cost of capital, thereby improving the ability to mobilize finance for business.

2.5. Ask about internal control & risk management

This is the difference between life and “nature” when comparing circular 99 and circular 200.

Circular 200 no clear requirements about the system of internal control, causing many businesses only focus on recorded data.

Circular 99 requires business:

- Building regulations accounting

- The set up process, internal control

- Distribution rights, responsibilities, clear

standardized accounting framework to help reduce the risks of errors and fraud, while improving quality as well as reliability of financial data. Thereby, the construction business is management platform sustainable, ready to open wide scale, long-term development.

3. System tables accounts accounting TT 99 latest

Account system accounting circular 99/2025/TT-BTC be lean in the direction neckline IFRS, with 71 account level 1, less than 5 accounts compared to circular no. 200/2014/TT-BTC. This adjustment is evident shift thinking in accounting from the adherence to service management as well as financial transparency.

Some notable changes at the account level 1 can be identified clearly before collating detailed in the table below, including:

- Adjust the name account in essence the money line, in which TK 112 is renamed to “term deposits” instead of calling “bank deposits” before.

- Additional TK 215 – biological Assets in order to reflect fully the particular asset in agriculture, fisheries, asymptotic classification according to IFRS.

- Remove the account related to funding career as TK 461, TK 466 shows the TT-99 focus purely on the frame, business accounting, separation mechanism, financial management, administrative – career.

The point of this change is an important basis for enterprises collate, to identify differences as well as properly understand the logic design of the system account under the 99 in the synthesis below:

| TT | NUMBER TK TT | ACCOUNT NAME | |

| Level 1 | Level 2 | ||

| 1 | 2 | 3 | 4 |

| ACCOUNT TYPE ASSET | |||

| 01 | 111 | Cash | |

| 02 | 112 | Term deposits | |

| 03 | 113 | Money transfer | |

| 04 | 121 | Trading securities | |

| 05 | 128 | Investments held-to-maturity date | |

| 1281 | Term deposits | ||

| 1282 | Bonds | ||

| 1283 | Loans | ||

| 1288 | Other investments held to maturity | ||

| 06 | 131 | Receivable of clients | |

| 07 | 133 | VAT deductible | |

| 1331 | VAT is deducted of goods and services | ||

| 1332 | VAT is deducted of fixed assets | ||

| 08 | 136 | Receivable internal | |

| 1361 | Capital business in subdivisions | ||

| 1362 | To collect about the exchange rate differences | ||

| 1363 | To collect about the borrowing costs eligible for capitalization | ||

| 1368 | Receivable other internal | ||

| 09 | 138 | Other receivables | |

| 1381 | Lack of assets awaiting disposal | ||

| 1383 | SCT's imports | ||

| 1388 | Other receivables | ||

| 10 | 141 | Advance | |

| 11 | 151 | Goods in transit | |

| 12 | 152 | Material, materials | |

| 13 | 153 | Tools | |

| 14 | 154 | The cost of production, unfinished business | |

| 15 | 155 | Products | |

| 16 | 156 | Goods | |

| 17 | 157 | Goods on consignment | |

| 18 | 158 | Raw materials in warehouse | |

| 19 | 171 | Transactions for the purchase and resale of government bonds | |

| 20 | 211 | Fixed assets tangible | |

| 21 | 212 | Fixed assets finance lease | |

| 22 | 213 | Fixed assets intangible | |

| 23 | 214 | Wear and tear of fixed assets | |

| 2141 | Wear and tear of fixed assets tangible | ||

| 2142 | Wear and tear of fixed assets finance lease | ||

| 2143 | Wear and tear of fixed assets invisible | ||

| 2147 | Wear and tear BĐSĐT | ||

| 24 | 215 | Biological assets | |

| 2151 | Rinse your pet for regular products | ||

| 21511 | Rinse your pet for regular products not yet reached the mature stage | ||

| 21512 | Rinse your pet for regular products reach the mature stage | ||

| 215121 | Original price | ||

| 215122 | Value accumulated depreciation | ||

| 2152 | Animals get the product once | ||

| 2153 | Crop by crop, or remove the product once | ||

| 25 | 217 | Real estate investment | |

| 26 | 221 | Investment in subsidiaries | |

| 27 | 222 | Investment in joint venture, link | |

| 28 | 228 | Other investment | |

| 2281 | Investment capital contribution to other units | ||

| 2288 | Other investment | ||

| 29 | 229 | The loss reserve assets | |

| 2291 | Provision for diminution in value of trading securities | ||

| 2292 | Reserve losses investing in other units | ||

| 2293 | The room must be uncollectible | ||

| 2294 | Provision for diminution in value of inventory | ||

| 2295 | Reserve losses biological assets | ||

| 30 | 241 | Construction in progress | |

| 2411 | Shopping tangible fixed assets | ||

| 2412 | Basic construction | ||

| 2413 | Repair, periodic maintenance, fixed assets | ||

| 2414 | Upgrading fixed assets | ||

| 31 | 242 | Cost of waiting for allocation | |

| 32 | 243 | Assets deferred income tax | |

| 33 | 244 | Escrow, sign on | |

| TYPE OF ACCOUNTS PAYABLE | |||

| 34 | 331 | To be paid to seller | |

| 35 | 332 | To pay dividends, profit | |

| 36 | 333 | Tax, accounts payable state | |

| 3331 | Value added tax payable | ||

| 33311 | Output VAT | ||

| 33312 | VAT on imported goods | ||

| 3332 | Excise tax | ||

| 3333 | Import | ||

| 3334 | Corporate income tax | ||

| 3335 | Personal income tax | ||

| 3336 | Tax resources | ||

| 3337 | Land tax, land rent | ||

| 3338 | Environmental protection tax, other taxes | ||

| 33381 | Environmental protection tax | ||

| 33382 | Other taxes | ||

| 3339 | Free – fee – accounts payable other | ||

| 37 | 334 | Payables to employees | |

| 38 | 335 | The cost to pay | |

| 39 | 336 | Pay internal | |

| 3361 | Pay internal business capital | ||

| 3362 | Internal payable on exchange rate differences | ||

| 3363 | Internal payable on the borrowing costs eligible for capitalization | ||

| 3368 | Pay other internal | ||

| 40 | 337 | Payment-in-progress construction contracts | |

| 41 | 338 | Pay, payable other | |

| 3381 | Surplus assets pending | ||

| 3382 | Union funds | ||

| 3383 | Social insurance | ||

| 3384 | Health insurance | ||

| 3386 | Unemployment insurance | ||

| 3387 | Revenue awaiting allocation | ||

| 3388 | Pay, payable other | ||

| 42 | 341 | Loans, debt finance lease | |

| 3411 | The account borrowers | ||

| 3412 | Debt finance lease | ||

| 43 | 343 | Bonds issued | |

| 3431 | Bonds often | ||

| 3432 | Convertible bonds | ||

| 44 | 344 | Get escrow, sign on | |

| 45 | 347 | Deferred income tax pay | |

| 46 | 352 | Redundancy pay | |

| 3521 | Provision of warranty products and goods | ||

| 3522 | Backup warranty construction | ||

| 3523 | Preventive restructuring business | ||

| 3525 | Payable other | ||

| 47 | 353 | Bonus, benefits | |

| 3531 | Bonus | ||

| 3532 | Welfare fund | ||

| 3533 | Welfare fund was formed in fixed assets | ||

| 3534 | Prize fund management company executive | ||

| 48 | 356 | Fund development of science and technology | |

| 3561 | Fund development of science and technology | ||

| 3562 | Development fund of science and technology has formed the property | ||

| 49 | 357 | The price stabilization fund | |

| THE TYPE OF ACCOUNT EQUITY | |||

| 50 | 411 | Capital investment of the owner | |

| 4111 | Capital contributed by the owner | ||

| 41111 | Common stock have voting rights | ||

| 41112 | Preferred stock | ||

| 4112 | Capital surplus | ||

| 4113 | Conversion option bonds | ||

| 4118 | Other capital | ||

| 51 | 412 | Difference revaluation of assets | |

| 52 | 413 | Variances exchange rate | |

| 53 | 414 | Investment and development fund | |

| 54 | 418 | The fund other equity | |

| 55 | 419 | Stock acquisition of yourself | |

| 56 | 421 | Profit after tax has not distributed | |

| 4211 | Profit after tax undistributed accumulated to the end year ago | ||

| 4212 | Profit after tax has not distributed this year | ||

| ACCOUNT TYPE REVENUE | |||

| 57 | 511 | Sales revenue, service provider | |

| 58 | 515 | Revenue financing activities | |

| 59 | 521 | The sales deductions | |

| THE TYPE OF ACCOUNT THE COST OF PRODUCTION, BUSINESS | |||

| 60 | 621 | The material cost, direct material | |

| 61 | 622 | Costs directly | |

| 62 | 623 | Cost of used construction machine | |

| 6231 | Cost | ||

| 6232 | Cost of materials | ||

| 6233 | The tooling cost production | ||

| 6234 | Depreciation construction machines | ||

| 6237 | Cost of services purchased in addition | ||

| 6238 | Cash expenses other | ||

| 63 | 627 | The cost of production in common | |

| 6271 | Cost of workshop staff | ||

| 6272 | Cost of materials | ||

| 6273 | The tooling cost production | ||

| 6274 | Depreciation of fixed assets | ||

| 6275 | Taxes, fees and charges | ||

| 6277 | Cost of services purchased in addition | ||

| 6278 | Cash expenses other | ||

| 64 | 632 | Cost of goods sold | |

| 65 | 635 | Financial expenses | |

| 66 | 641 | Cost of sales | |

| 6411 | Staff costs | ||

| 6412 | The cost of materials, packaging | ||

| 6413 | Cost utensils | ||

| 6414 | Depreciation of fixed assets | ||

| 6415 | Taxes, fees and charges | ||

| 6417 | Cost of services purchased in addition | ||

| 6418 | Cash expenses other | ||

| 67 | 642 | Cost management business | |

| 6421 | Employee expense management | ||

| 6422 | The cost of materials management | ||

| 6423 | The cost of office supplies | ||

| 6424 | Depreciation of fixed assets | ||

| 6425 | Tax – free – fee | ||

| 6426 | Cost contingency | ||

| 6427 | Cost of services purchased in addition | ||

| 6428 | Cash expenses other | ||

| THE TYPE OF ACCOUNT OTHER INCOME | |||

| 68 | 711 | Other income | |

| THE TYPE OF ACCOUNT OTHER COSTS | |||

| 69 | 811 | Other expenses | |

| 70 | 821 | Cost of corporate income tax | |

| 8211 | The cost of corporate INCOME tax current | ||

| 82111 | Income tax expense current corporate under the provisions of the Law on enterprise income tax | ||

| 82112 | Cost of corporate income tax and supplemented by tax regulations, the global minimum | ||

| 8212 | Costs deferred INCOME tax | ||

| ACCOUNT DETERMINATION BUSINESS RESULTS | |||

| 71 | 911 | Define business results | |

4. Detailed differences in the system account circular 99 & circular 200, the Ministry of Finance

4.1. Asset account

| STT | Number TK | Name TK-Level 1

(TT 200/2014) |

Name TK-Level 1

(TT99/2025) |

Difference |

| ACCOUNT TYPE ASSET | ||||

| 1 | 111 | Cash | Cash |

|

| 2 | 112 | Bank deposits | Term deposits |

|

| 3 | 113 | Money transfer | Money transfer |

|

| 4 | 121 | Trading securities | Trading securities |

|

| 5 | 128 | Investments held-to-maturity date | Investments held-to-maturity date | Keep the name TK-level 1 and 4 TK level 2 (1281, 1282, 1283, 1288). |

| 6 | 131 | Receivable of clients | Receivable of clients | Keep the name TK-level 1 |

| 7 | 133 | VAT deductible | VAT deductible | Keep the name TK-level 1, TK 2 level. |

| 8 | 136 | Receivable internal | Receivable internal |

|

| 9 | 138 | Other receivables | Other receivables |

|

| 10 | 141 | Advance | Advance | Keep the name TK-level 1 |

| 11 | 151 | Goods in transit | Goods in transit | Keep the name TK-level 1 |

| 12 | 152 | Material, materials | Material, materials | Keep the name TK-level 1 |

| 13 | 153 | Tools | Tools |

|

| 14 | 154 | The cost of production, unfinished business | The cost of production, unfinished business | Keep the name TK-level 1 |

| 15 | 155 | Finished products | Products | Change the name TK-level 1 from “Finished products” to “products”. |

| 16 | 156 | Goods | Goods |

|

| 17 | 157 | Goods on consignment | Goods on consignment | Keep the name TK level 1. |

| 18 | 158 | Goods in bonded warehouses | Raw materials in warehouse | Change the name TK-level 1 word “goods in bonded warehouses” of “Raw materials at the warehouse” |

| 19 | 161 | Genus career | No | Remove TK 161 in circular 99. |

| 20 | 171 | Transactions of buying and selling bonds | Transactions for the purchase and resale of government bonds | Keep the name TK-level 1 |

| 21 | 211 | Fixed assets tangible | Fixed assets tangible |

|

| 22 | 212 | Fixed assets finance lease | Fixed assets finance lease |

|

| 23 | 213 | Fixed assets intangible | Fixed assets intangible |

|

| 24 | 214 | Wear and tear of fixed assets | Wear and tear of fixed assets | Keep the name TK-level 1, TK 2 level |

| 25 | 215 | No | Biological assets | Additional TK level 1 new account, 215.

TK 215 includes 3 TK 2 level:

|

| 26 | 217 | Real estate investment | Real estate investment | Keep the name TK level 1. |

| 27 | 221 | Investment in subsidiaries | Investment in subsidiaries | Keep the name TK level 1. |

| 28 | 222 | Investment in joint venture, link | Investment in joint venture, link | Keep the name TK level 1. |

| 29 | 228 | Other investment | Other investment | Keep the name TK-level 1, TK 2 level |

| 30 | 229 | The loss reserve assets | The loss reserve assets |

|

| 31 | 241 | Construction in progress | Construction in progress |

|

| 32 | 242 | Prepaid expenses | Cost of waiting for allocation |

|

| 33 | 243 | Assets deferred income tax | Assets deferred income tax |

|

| 34 | 244 | Pledge, mortgage, deposit, sign a bet | Escrow, sign on |

|

4.2. Accounts payable

| STT | Number TK | Name TK-Level 1

(TT 200/2014) |

Name TK-Level 1

( TT 99/2025) |

Difference |

| 35 | 331 | To be paid to seller | To be paid to seller | Keep the name TK level 1. |

| 36 | 332 | No | To pay dividends, profit | Additional TK new 332. |

| 37 | 333 | Tax – accounts payable state | Tax – accounts payable state | Keep the name TK-level 1 the TK level 2 and TK level 3 main (3331 to 3339). |

| 38 | 334 | Payables to employees | Payables to employees | Keep the name TK-level 1 Circular 99 not listed in detail TK 2 level. |

| 39 | 335 | The cost to pay | The cost to pay | Keep the name TK level 1. |

| 40 | 336 | Pay internal | Pay internal | Keep the name TK-level 1, TK 2 level |

| 41 | 337 | Payment-in-progress plan construction contracts | Payment-in-progress construction contracts | Change the name TK-level 1 (Remove the word “plan”). |

| 42 | 338 | Pay, payable other | Pay, payable other |

|

| 43 | 341 | Loans – debt finance lease | Loans – debt finance lease | Keep the name TK-level 1, TK 2 level |

| 44 | 343 | Bonds issued | Bonds issued |

|

| 45 | 344 | Get escrow, sign on | Get escrow, sign on | Keep the name TK level 1. |

| 46 | 347 | Deferred income tax pay | Deferred income tax pay | Keep the name TK level 1. |

| 47 | 352 | Redundancy pay | Redundancy pay |

|

| 48 | 353 | Bonus and welfare fund | Bonus, benefits | Keep the name TK level 1, the TK level 2 |

| 49 | 356 | Fund development of science and technology | Fund development of science and technology |

|

| 50 | 357 | The price stabilization fund | The price stabilization fund | Keep the name TK level 1. |

4.3. The type of account equity

| STT | Number TK | Name TK-Level 1

(TT 200/2014) |

Name TK-Level 1

( TT 99/2025) |

Difference |

| 51 | 411 | Capital investment of the owner | Capital investment of the owner |

|

| 52 | 412 | Difference revaluation of assets | Difference revaluation of assets | Keep the name TK level 1. |

| 53 | 413 | Variances exchange rate | Variances exchange rate |

|

| 54 | 414 | Investment and development fund | Investment and development fund | Keep the name TK level 1. |

| 55 | 417 | Funds assist in arranging business | No | Remove TK 417 in circular 99. |

| 56 | 418 | The fund other equity | The fund other equity | Keep the name TK level 1. |

| 57 | 419 | Stock fund | Stock acquisition of yourself | Change the name TK Level 1. |

| 58 | 421 | Profit after tax has not distributed | Profit after tax has not distributed |

|

| 59 | 441 | Capital investment in basic construction | No | Remove TK 441 in circular 99. |

| 60 | 461 | Source of funding career | No | Remove TK 461 in circular 99. |

| 61 | 466 | Source of funding has formed fixed assets | No | Remove TK 466 in circular 99. |

4.4. Sales account

| STT | Number TK | Name TK-Level 1

(TT 200/2014) |

Name TK-Level 1

( TT 99/2025) |

Difference |

| 62 | 511 | Sales revenue, service provider | Sales revenue, service provider |

|

| 63 | 515 | Revenue financing activities | Revenue financing activities | Keep the name TK level 1. |

| 64 | 521 | The sales deductions | The sales deductions |

|

4.5. Account the production Cost business

| STT | Number TK | Name TK-Level 1

(TT 200/2014) |

Name TK-Level 1

( TT 99/2025) |

Difference |

| 65 | 611 | Purchase | No | Remove TK 611 in circular 99. |

| 66 | 621 | The material cost, direct material | The material cost, direct material | Keep the name TK level 1. |

| 67 | 622 | Costs directly | Costs directly | Keep the name TK level 1. |

| 68 | 623 | Cost of used construction machine | Cost of used construction machine | Keep the name TK-level 1, 6 TK 2 level. |

| 69 | 627 | The cost of production in common | The cost of production in common |

|

| 70 | 631 | Production cost | No | Remove TK 631 in circular 99. |

| 71 | 632 | Cost of goods sold | Cost of goods sold | Keep the name TK level 1. |

| 72 | 635 | Financial expenses | Financial expenses | Keep the name TK level 1. |

| 73 | 641 | Cost of sales | Cost of sales |

|

| 74 | 642 | Cost management business | Cost management business | Keep the name TK-level 1, TK 2 level |

4.6. The type of account other

| STT | Number | NAME TK-Level 1 (TT 200/2014) | Name TK-Level 1

( TT 99/2025) |

Difference |

| THE TYPE OF ACCOUNT OTHER INCOME | ||||

| 75 | 711 | Other income | Other income | Keep the name TK level 1. |

| THE TYPE OF ACCOUNT OTHER COSTS | ||||

| 76 | 811 | Other expenses | Other expenses | Keep the name TK level 1. |

| 77 | 821 | Cost of corporate income tax | Cost of corporate income tax | Keep the name TK-level 1, TK 2 level

Additional details TK level 3:

|

| ACCOUNT TYPE SPECIFY THE BUSINESS OUTCOME | ||||

| 78 | 911 | Define business results | Define business results | Keep the name TK level 1. |

5. Accounting software Accnet ERP responsive circular 99 latest

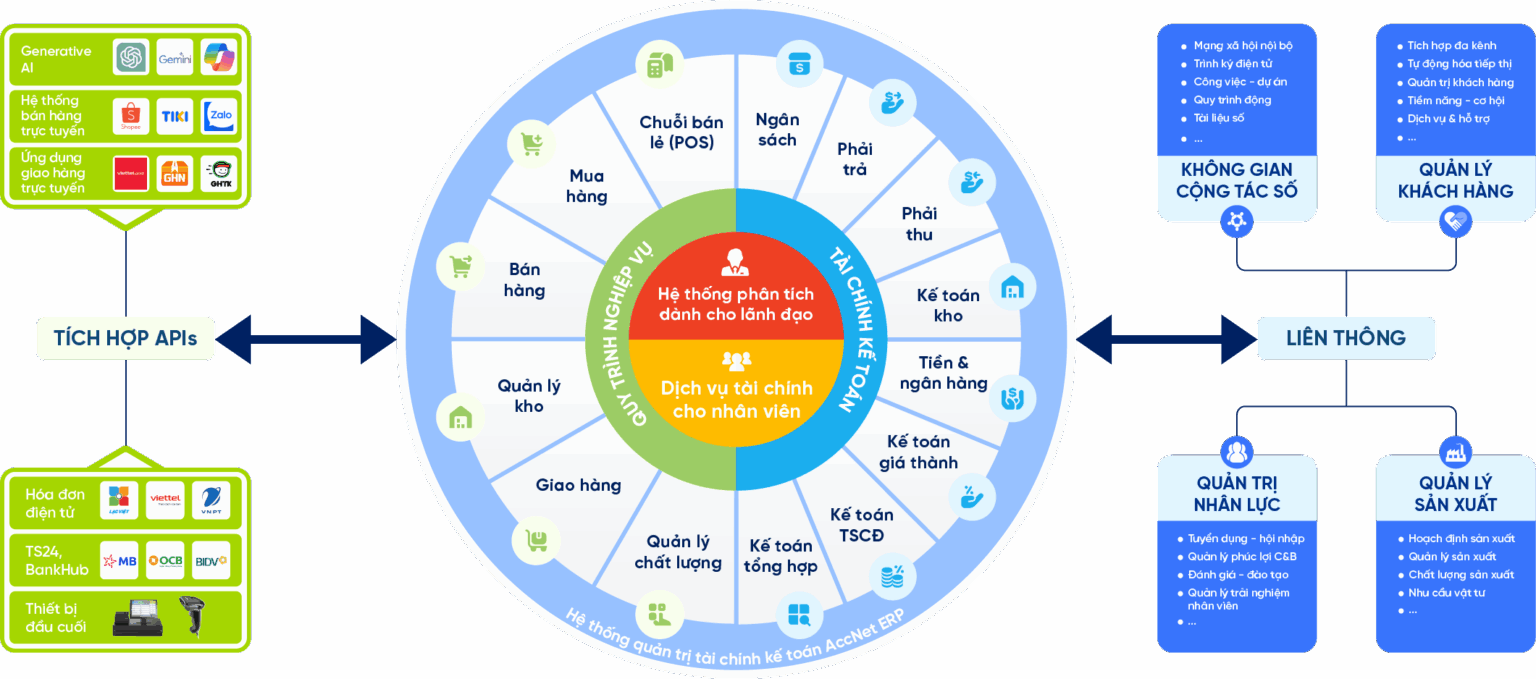

AccNet ERP software not only serving accounting records and financial reporting, which is designed as a foundation of financial management – accounting, overall, consistent with the orientation of the circular 99/2025/TT-BTC in the context of a comparison and transition from circular 200. From the perspective of the professional, financial management in the enterprise, AccNet ERP brings practical value clear when deploying TT-99.

AccNet ERP support for business:

- Standardized accounting system according to circular 99, neckline IFRS: the System allows to organize, expand account flexible according to specific industry needs and governance, matching the spirit of “open” on its circular 99. This is the point distinctly different than circular 200, which apply frame accounts hard.

- Raise the level of transparency and quality of financial reporting: accounting Data is centralized management, contact information between the modules. Help report reflects the true nature activities, meet the requirements of disclosures more transparent circular 99.

- Automation business, reduce risk of errors crafts: AccNet ERP automates the stitch accounting, reconciliations, debt, cost allocation and depreciation of assets, helping to reduce dependence on manual handling limit errors as well as fraud when accounting data is growing.

- Support financial management in depth: the System allows analysis of data by business unit, project, product, customer, or contract, to help the leader board to properly assess the effectiveness each array operation, instead of just looking statements synthetic compliant.

- Convenient when working with investors, banks & foreign partners: data structures, as well as reports neckline IFRS to help businesses reduce the time to process, collate and transform data. Especially useful when raising capital or scaling in the context of comparing circular 99 and circular 200.

- Ready for transformation of financial & long-term growth: process accounting – finance is digitized as well as standardized business easily to expand the scale, increase the number of branches or re-structure models, activities that do not increase the risk manager or depends on the individual.

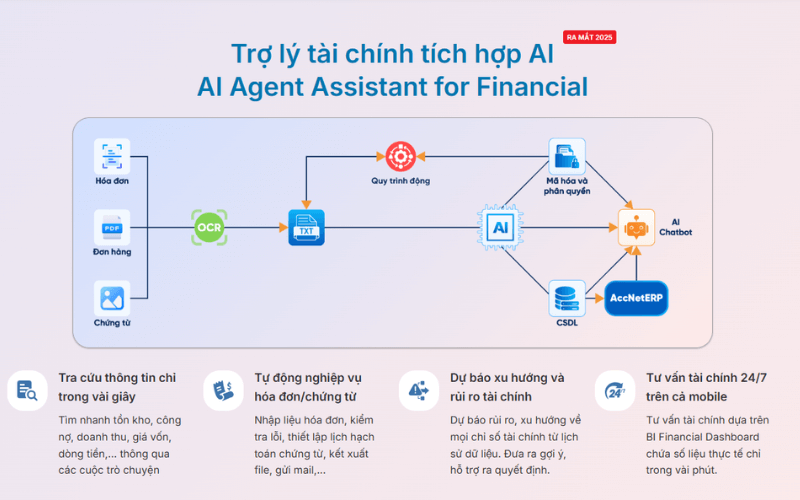

ACCOUNTING SOLUTIONS ACCNET ERP INTEGRATED AI AUTOMATE ALL BUSINESS

AccNet ERP is a software solution financial accounting integrated in the management system, comprehensive enterprise, which is developed by Lac Viet corporation. Difference highlights of AccNet ERP is the app artificial intelligence (AI) in many accounting process to help businesses:

- Automation of accounting and classified documents.

- Improving the accuracy in data control.

- Shorten processing time business accounting – financial.

Thanks to that, AccNet ERP not only is support tool but also a “smart assistant” with the business in financial management transparent effect.

Feature highlights:

✔️ Automatic accounting vouchers, collate public debt thanks to AI.

✔️ Manage your finance – accounting multi-branch, multi-subsidiary.

✔️ Financial statements consolidated standards of Vietnam & international (VAS, IFRS).

✔️ Cash flow management, budgeting, forecasting the exact cost.

✔️ Connect with the manure management system, hr, production, sales to sync data.

✔️ Integration of AI in data analysis, risk warning and proposed optimal scheme.

TYPICAL CUSTOMERS ARE DEPLOYING ACCNET ERP

- Nitto Denko – control production costs thanks to the application of accounting costing: Nitto Denko has chosen solution AccNet ERP to deploy the system accounting calculating cost ofhelp business control costs more effectively in the production process. After a period of use, company, highly effective, practical system that brings, as well as the degree of stability superior to other software in the market.

- ANTESCO – restructuring process works with management accounting operation: At ANTESCO, our team of consultants and deployment of AccNetERP has collaborated closely with the business in the first phase, reset the standard process and construction work-flow related departments throughout. The solution has helped ANTESCO significantly improve management capabilities, operating in a synchronized way and versatile

- Khatoco – expansion pack solution AccNetC after the successful implementation of original: Lac Viet has successfully deployed package solution AccNetC for trade co., LTD Khatoco in Nha Trang, according to the agreement signed on 29/07/2014. After the system is first put into operation efficiency, Khatoco intends to continue cooperation and expand the distribution finance – accounting and retail management with AccNetC, expressing the deep trust in implementation capacity and quality of service from Lac Viet.

SIGN UP TO RECEIVE DEMO NOW

INTEGRATED AI ACCELERATION CONVERTER OF ACCOUNTING

AI in AccNet ERP't just stop at automate data entry, but also:

- Identification & classification certificate from smart: AI scan, read & sort invoice, voucher, receipt, limit errors due to input manually.

- Financial forecasting & budget: the system uses algorithms machine learning to forecast cost, revenue, business support decision fast.

- Warning risk accounting: AI to detect abnormalities in the book, from which timely warning of false or fraud risks.

- Reports assistant smart: AI suggested report template, automatic data aggregation support, leadership, financial analysis instant.

BUSINESS IS WHAT WHEN IMPLEMENTING ACCOUNTING SOFTWARE LAC VIET?

- Experience more than 30 years develop software solutions business management in Vietnam.

- Ecosystem of comprehensive: AccNet ERP easily connect with other solutions of Lac Viet (HRM, Workflow, Portal...).

- Advanced technology: Integrated AI support, cloud & on-premise flexible.

- Services dedicated support: A team of knowledgeable professionals with accounting – finance in Vietnam, companion throughout the deployment.

- Trust from thousands of customers in many areas: finance, banking, manufacturing, trade, services.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: accnet@lacviet.com.vn | Website: https://accnet.vn/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

Compare circular 99/2025 TT-BTC and circular 200/2014 TT-BTC shows the difference lies not only in technical accounting, but also reflects the radical changes in thinking and management accounting of the business. If circular 200, focused on standardized, documented and comply with, the circular 99 heading to information transparency, flexible system, as well as mounting accounting with management, the internal control with integration with international standards.