Business environment fluctuations, decisions based on data, have become important factors to ensure the sustainable development of the enterprise. However, many businesses still are having difficulties in collecting, analyzing, using financial data in an efficient way. The process of handling traditional data usually takes more time to occur flaws teen timeliness led to the decision not optimal.

SOMEONE Financial Agent from Vietnam created to solve these challenges by providing a system for analyzing smart financial help to business data mining a comprehensive, accurate, fast.

This article Lac Viet Computing will analyze the role of decision making skills based on the data in the enterprise, the barriers of traditional methods and the way ONE Financial Agent to help businesses leverage data to make decisions accurately and quickly more efficient.

1. Importance of decision making based on data in the enterprise

1.1. Why decisions based on data is a vital element?

In the past, many business decisions based on experience, intuition. However, in the digital age, data is a tool to help businesses make accurate decisions than minimize risks and maximize business opportunities.

Here are a few reasons why making decisions based on data become elements of survival:

- Accurately reflect the financial condition of the enterprise: Data helps businesses are clearer perspective on cash flow, profitability, costs, thereby making the investment decision financial management, reasonable.

- Optimizing performance: Data allows businesses to measure the performance of each department from that process optimization, resource allocation more efficient.

- Forecast market trends: The analysis of data to help businesses identify consumer trends, changes in customer needs and market volatility from that actively adjust business strategy.

- Minimize financial risk: By analyzing historical data, financial trends, businesses can identify early risks, optimize cash flow adjusted financial plan to avoid losses.

For example: A manufacturing company wants to expand the market but not sure whether cash flows are sufficient to meet investment needs. If only based on the predicted sentiment, the company may experience financial risks serious. However, if you use financial data to forecast cash flow, evaluate the profitability and cost analysis investment, businesses can make decisions more accurate, reduce risk, optimize resources.

2.2. The barriers in the decision-making traditional financial

Although decisions based on data brings many benefits, but many businesses still encounter barriers make this process becomes less effective. Here are some common challenges:

- Data is fragmented, difficult to access updates: In many businesses, financial data is stored in various sources (accounting software, Excel, ERP, data), causing difficulty in the synthesis of analysis makes the decision-making process takes time and happens flaws.

- Process reports crafts take much time errors: the finance department often take hours, even days, to aggregate reports from many different sources. The data entry manually not only takes time but also easy to cause errors, affect the quality of financial decisions.

- Lack of tool support in-depth analysis: Many businesses just stop in the synthetic data without tool support in-depth analysis that managers difficult to identify the trend, forecast, risk assessment, financial performance correctly.

- Decisions based on feelings instead of data: When there is no data to clear, many business leaders are forced to rely on experience or intuition to make decisions. Can be effective in some cases but also potential risks, especially in the business environment, fluctuations complex.

With the barriers on business, need a solution automates the process of collecting, analyzing and presenting the data, managers can correct decisions quickly more efficient. SOMEONE Financial Agent from Vietnam is precisely the tool to help businesses overcome these challenges and make use financial data to make optimal decisions.

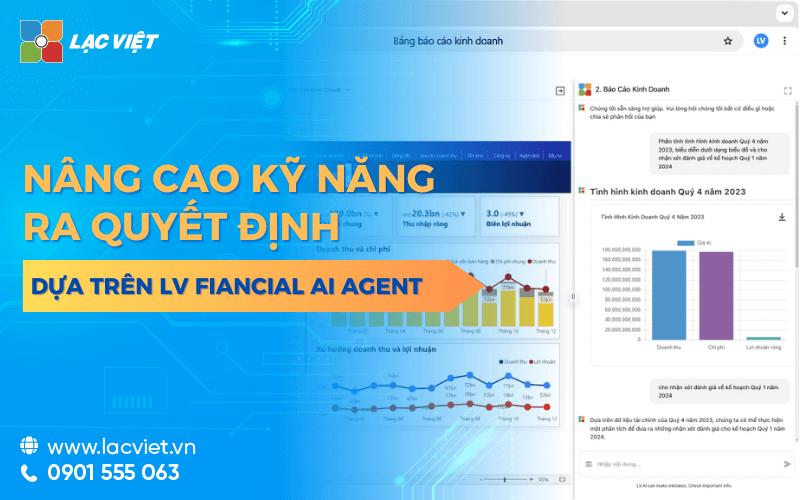

2. SOMEONE Financial Agent of the English – advanced tools skills, decision making based on data

2.1. LV ONE Financial Agent, what is?

SOMEONE Financial Agent of the English as a platform, financial analysis, smart apps, artificial intelligence (AI) to help enterprises automate the process of collecting, processing, analyzing financial data. This system does not merely create the financial statements, but also have the ability to give suggestions forecast, warning of risks based on historical data and market trends.

How ONE Financial Agent activity:

- Collect data automatically from the accounting system, financial reporting, ERP, data sources related in business.

- Analyze information in real time to help managers easily track cash flow, debt, profitability, financial indicators important.

- Predict hint financial strategy to support business decision making fast, accurate based on available data.

- Presentation of data in the form of visual chart that helps leaders easily grasp information, analyze trends.

The role of WHO in supporting financial analysis business:

- Improve accuracy: minimize errors compared to the process of data entry, data processing craft.

- Increase the speed of processing information: Access to financial data in just a few seconds, instead of losing hours and synthesis report.

- Provider perspective: WHO has the ability to analyze and assess the impact of each financial decisions, help businesses choose the most optimal scheme.

- Decision support flexible: Instead of relying on periodic reports, businesses can track the financial status in real-time, make decisions in a timely manner.

For example, A business wants to expand the scale of production, but has not clearly cash flows that are sufficient to pay or not. Instead of having to wait for the report from the finance department, ONE Financial Agent can immediate cash flow analysis, debt, operating costs, forecast the impact of investments, which in turn helps leaders make decisions more accurate.

2.2. The salient features of the AI Financial Agent in decision support

Analyze financial data in real time

SOMEONE Financial Agent to help managers keep track of the entire state financial business in a continuous manner. The system updates the data as soon as there is new transactions, helps leaders always know the cash flow, liabilities, revenues, expenses, without waiting for the report from the accounting department.

Business benefits received:

- No longer dependent on the financial statements can access information immediately.

- Make decisions faster, based on data updated in real time.

- Reduce the risks shortage of cash flow, thanks to the system of constant monitoring of financial volatility.

Automatically generate financial reports in depth

SOMEONE Financial Agent has the ability to synthesize analyze financial data to create the reports as important as:

- Balance sheet

- Income statement – profit

- Cash flow income – expenses

- Receivables – payables

- Inventory status

These reports not only help leaders understand the financial performance, but also support the evaluation of the performance of each department, budget planning for the future.

Business benefits received:

- Save time synthetic data, instead of reporting crafts take hours or even days.

- Standardized reports more accurate, avoid errors due to input manually.

- Customize report according to the needs: Leadership can adjust criteria analysis, the report according to each department, product or market.

Predicted trend financial risk warning

Don't just stop at the report, ONE Financial Agent also has the ability to analyze historical data and market trends to forecast the financial volatility in the future.

The anticipated features include:

- Cash flow forecast in 3-6 months to help businesses prepare schemes to raise capital if necessary.

- Recognize the risk of losing balance, financial early warning about the account, the debt is overdue or irregular expenses.

- Risk assessment, investment, helping businesses avoid the wrong decision when expanding business.

Business benefits received:

- Avoid financial risks thanks to early warning systems.

- Financial planning initiative, is not affected by the fluctuations in cash flow.

- Support strategy smart investment to help the business take advantage of opportunities, business potential.

Financial advisor smart

SOMEONE Financial Agent acts as a financial expert, virtual business support in the:

- Hint optimal operating costs, help reduce waste without affecting business operations.

- Analysis of financial performance of each division, helps leaders assess the exact contribution of each business unit.

- Assist with the planning budget, based on actual data and market trends.

Business benefits received:

- No need to spend the cost to hire expert financial advisors, WHO can give suggestions right away.

- Optimal operating costs, improve profit business.

- Minimize the wrong decision, thanks to analysis based on actual data instead of feeling.

Visualize data using a chart automatically

SOMEONE Financial Agent using technology visualization data, which helps businesses easily track financial indicators over the chart instead of a table of data dry.

Business benefits received:

- Quickly grasp financial trends, no need to read complex reports.

- Compare financial performance over time, help to adjust the strategy in a timely manner.

- Easily share data with other departments, decision support sync.

3. How ONE Financial Agent to help improve decision making skills in business

3.1. Improve accuracy in decision-making

One of the biggest challenges that businesses encounter when making financial decisions is the lack of precision in the data. This can come from errors and data entry, data aggregation, heterogeneous, or delays in reporting. SOMEONE Financial Agent to help remove these problems by:

- Collect financial data automatically from the accounting system, ERP, CRM and other software management other business, ensuring data is always updated in real time.

- Remove errors due to data entry craft to help minimize risks from the number deviations can lead to financial decisions't accurate.

- Generate reports automatically with high precision, to ensure that all financial indicators from profit to cash flow, are analyzed based on the actual data.

For example: A business is considering expanding the market but not sure about the ability to finance. SOMEONE Financial Agent can automatically synthesize the related data such as revenues, expenses, cash flow, debts and to make an assessment on the level of financial security before business investment decisions.

3.2. Increase the speed of processing information timely response

In the business environment and volatile, making decisions quickly is vital. A decision delay can cause the business to lose the opportunity, growth, or risk serious financial.

SOMEONE Financial Agent to help businesses speed up information processing and timely decisions by:

- Access the financial statements in just a few seconds, instead of taking hours to synthetic data.

- Automatic warning about the financial volatility important, as cash flow negative, debt, overdue, or the cost spike.

- Given financial forecasting quickly, help businesses plan to adjust timely.

3.3. Support the management in strategic long-term financial

Not only to help businesses handle information quickly, AI Financial Agent also supports building strategic long-term financing through the ability to forecast trends in the optimal financial resources.

AI system can:

- Forecast financial trends based on historical data, which helps businesses identify ahead of the business cycle, from which financial planning accordingly.

- The proposed optimal solutions budget helps the business to allocate resources more efficiently, reduce costs not necessary.

- Analysis of financial performance according to each department, product or market, to support business in the restructuring of the portfolio to optimize returns.

For example: A manufacturing enterprise need to predict the demand for raw materials for the following year. SOMEONE Financial Agent can analyze the data consumption of raw materials in the past, combined with the forecast of market demand, proposed plans to enter the business help avoid shortages or excess inventory.

3.4. Reduce the risks to strengthen financial performance

One of the strengths of the AI Financial Agent is the ability to analyze financial risk and provide solutions to minimize risk.

AI system can:

- Detect unusual transactions, warning businesses about the risk of fraud or errors finance.

- Assess the level of risk in the investment decision, to help businesses avoid these investments are not effective.

- Forecast risk of losing balance financial, warning about cash flow, or loans to term, help with business plans, handled promptly.

For example: A business is considering investing in a project to expand the factory. SOMEONE Financial Agent can analyze the financial impact of this project, assess the level of risk based on historical data and propose the scheme more secure financial help businesses make smart decisions.

4. Why businesses should choose LV Financial AI Agent?

In the context of business increasingly depends on data to make financial decisions, AI Financial Agent from Vietnam to provide a platform powerful analysis with advanced technology and the ability to customize flexible.

4.1 technology, data analysis, advanced

SOMEONE Financial Agent used algorithms, big data analytics (Big Data Analytics) and artificial intelligence (AI) to collect, aggregate and analyze financial information in real time. This system not only helps business automate the process of creating a report that also predict financial trends based on historical data.

For example, A retail business can use AI Financial Agent to analyze trends, revenue, seasonal, from which adjust the strategic import of advertising budgets in an optimum way.

4.2 the Ability to flexibly customized according to business needs

Unlike other systems, financial statements, fixed, AI Financial Agent enables enterprises to customize reports, metrics analysis according to own needs.

- Business can optionally financial indicators important that they want to track, such as profit margin, cash flow, accounts receivable, accounts payable.

- System support adjust the report according to each department, to help leaders be more detailed view about the financial situation of each unit in the enterprise.

- The report is displayed in the form of visual charts to easily compare, track financial volatility over time.

Business benefits received:

- Process automation, financial analysis, minimize errors due to manual processing.

- Custom flexible according to the particular business, is not bound by the report form rigid.

- Save time and synthesize data to help leaders have more time to focus on business strategy.

4.3. Integrated, seamless connection with the system of financial management

One of the biggest barriers when implementing new technology in business is the ability to integrate with existing systems. SOMEONE Financial Agent is designed to connect with the accounting software, ERP, CRM, helps businesses make maximum use of data that do not need to change the technology infrastructure.

SOMEONE Financial Agent has the ability to synchronize data from the accounting software as popular as AccNet, SAP, Oracle, Misa or ERP systems, CRM's internal business.

- Financial data from the software this will be WHO collect automatically, eliminating the delay due to input manually.

- The financial statements can be accessed directly from the current system, no need to file or enter manually.

- Limiting error errors due to import data from various sources to help financial information is always accurate sync.

For example: A real estate business using AI Financial Agent can be integrated with software contract management, accounting, cash flow, to help accurately track revenues, costs, and liabilities of each project.

4.4 No need to change the infrastructure, cost savings initial investment

The deployment of AI Financial Agent does not require businesses to change IT system availability, significantly saves the cost of the initial investment.

- The system works on the cloud platform (Cloud), which allows businesses to use immediately without the need to install hardware complexity.

- Can deploy step by step, in accordance with the business at every scale.

- Easy to expand, upgrade, no need to change the entire process of financial management.

For example, A logistics company can start implementing AI Financial Agent with functional analysis, cash flow, then expanded to manage public debt, financial forecast as demand increases.

Business benefits received:

- Don't lose the cost of upgrading infrastructure, make maximum use of the existing system.

- Easy to expand, in accordance with business in multiple stages of development.

- Financial information is synchronized updates real-time, helping business make a decision fast more accurate.

![[ĐẦY ĐỦ] Mẫu báo cáo tài chính, tình hình tài chính file excel theo Thông tư 200 và 133](https://lacviet.vn/wp-content/uploads/2025/04/mau-bao-cao-tai-chinh.png)