LV Financial AI Agent – application solutions data mining in business using artificial intelligence to help businesses automate financial reporting, forecasting trends, trading and risk control in real time. No longer have to wait for the report from the department, no longer the flaws in the aggregate figures – with just a few simple operations, leadership can grasp financial picture overall, optimize cash flow, and strategic decisions more accurate.

The same Lac Viet Computing find out details in this article.

1. The importance of data mining in modern business

In the digital era, data is not only a resource but also is the key to help enterprises the correct decision to raise competitiveness. However, practice shows that many businesses are sinking in the sea of data that don't know how to exploit the results. Data were collected from business activities, financial transactions, customer behavior,... but if there is no analysis tool is suitable, the business will have difficulty in extracting value from that data.

This is where apps, data mining, (Data Mining) in combination with artificial intelligence (AI) becomes an inevitable trend. This technology not only helps enterprises automatically analyze data, but also to forecast financial trends, optimal trading strategy and risk control effectiveness.

To support business data mining finance in a smart way, Vietnam Financial AI Agent advent as a financial expert virtual to turn data into valuable information to serve the decision more accurate. This solution not only helps to automatically generate financial reports but also provides in-depth analysis, risk warning and advisory financial strategy based on historical data.

So data mining in business brings benefits? Business can apply AI how to optimize performance? Let's find out in the next section below.

2. Application data mining in business finance

2.1. Optimized financial statements in real time

In the process of operation, businesses are faced with the problem of synthetic analytical and tracking financial data to make decisions strategy. However, most businesses still depend on the method or the system cumbersome, time-consuming prone to errors.

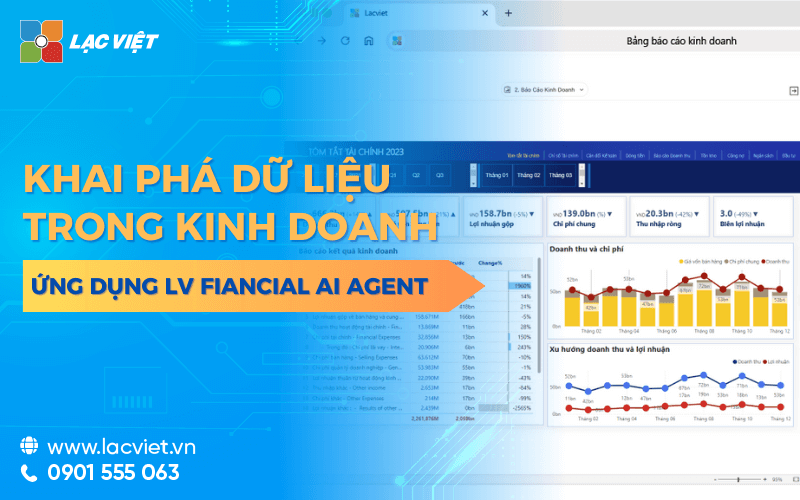

Solution Lac Financial AI Agent to help fully automate this process, allowing businesses to create financial statements in just a few seconds, at the same time provide visually about the financial situation in real time.

Specifically, the system supports business:

- Update the data immediately instead of waiting aggregated from multiple parts.

- The data presented in chart form action helps leaders easily follow.

- Create critical reports without the need for expert financial support.

A number of financial statements important is automation, including:

- Balance sheet – to Help businesses control over assets, liabilities, equity in real time.

- Reported cash flow – tracking cash flow in/out to maintain stable liquidity.

- Report the debt – status Monitoring receivables and payables to optimize cash flow.

- Analyze revenue – profit – rating performance business find opportunities to optimize costs.

2.2. Trend forecasting, finance, decision support

In the business environment fluctuations, the ability to accurately forecast financial trends is the determining factor to the success of the business. However, the analysis of financial data in the traditional way, not only time-consuming but also many potential errors.

Thanks to AI and data mining, Vietnam Financial AI Agent can automatically analyze data, history, discovery rule to forecast financial trends in the future.

This technology helps enterprises:

- Identify trends, revenue, cost in the next period.

- Predict future cash flows, which helps business proactive financial planning.

- Warning of financial risks, such as signs of reduced revenues or loans to term need to handle.

- Proposed financial strategy optimal support leaders make decisions based on real data.

For example, If the system sees revenues are reduced by 10% each month in the quarter closest, WHO will give a warning proposed adjustment strategies such as enhanced marketing campaign or optimize operating costs.

Thanks to the ability to detect trends early, the business not only to avoid risks, but also capitalize on business opportunities ahead of the opponent.

2.3. Control risks, optimize cash flow

Management of financial risks is one of the most important tasks of the business, especially when having to batch processing transactions, accounting, financial reporting complexity. Without a monitoring system, smart businesses can miss the early warning signs of financial risk.

Vietnam Financial AI Agent to help businesses control financial risk by using data mining, accounting, analysis, transaction history, detect anomalies.

Important features include:

- Detect errors in financial reports, alerts when the number of material anomalies.

- Analyzing receivables – payables, help businesses proactively handle the debt prior to maturity.

- Tracking cash flow real-time help to control liquidity, avoid the shortage of capital suddenly.

- Get comprehensive financial fraud, the detection of unusual transactions have risk signs.

For example, If the system detects a trading account worth unusually high in comparison with the previous transactions, WHO will automatically send an alert to the finance department to check business help prevent the risk of financial fraud in a timely manner.

Besides, WHO also help with business cash flow management smart, by the proposed spending plan and re-investment matching, to help optimize human capital.

3. LV Financial AI Agent – solutions, data mining, financial optimization

In the context of business must process large amounts of financial data is growing, the automation of data analysis not only helps save time but also improve the accuracy effective decisions. LV Financial AI Agent is advanced solution combines artificial intelligence (AI) and data mining to help businesses harness the financial information in a smart way system.

3.1 automatically generate financial reports in real time

One of the biggest challenges that businesses encounter is the synthesis and analysis of financial statements crafts, causing lose a lot of time, prone to flaws. LV Financial AI Agent to help businesses create financial statements in just a few seconds, instead of losing every hour or daily.

The types of reports automatically, including:

- Balance sheet, asset tracking, debt and equity.

- Reported cash flow, to help control the flow of money in/out, liquidity forecast.

- Report the debt to income – pay, help business proactive financial management.

- Income statement – profit, help assess business performance in real time.

For example: A manufacturing enterprise often have to wait 3-5 days to general financial report last month. With LV Financial AI Agent, this process only takes a few minutes, provided the right information to lead timely decisions.

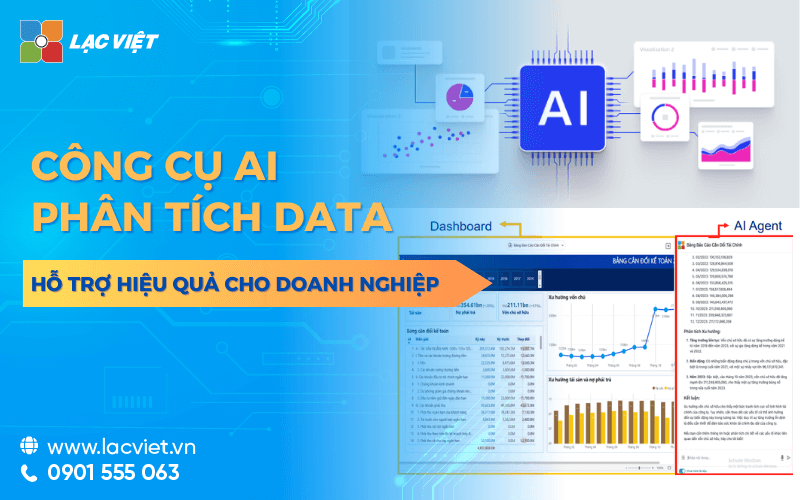

3.2 Integrated AI consulting financial intelligence

Don't just stop at providing reports, LV Financial ONE Agent acts as a financial professional virtual business-depth analysis of “health” financial giving hints strategy.

Technology help:

- Automatically detect financial risks based on historical data.

- Given financial forecast accuracy, support business plan effective.

- Trend analysis fluctuations in cost, revenue, proposed to adjust the fit.

3.3 Display data in chart form, intuitive, easy to understand

Read and understand the table of financial data is not always simple, especially for the leader, not in-depth about accounting. LV Financial AI Agent to provide the report as a chart visualization, which helps businesses have the overall look and easy tracking financial trends.

For example, Instead of viewing a table of data dry on fluctuations in cash flow, businesses can track chart cash flow is updated real-time, to help identify quick financial condition.

3.4 report is flexible, easy to share

Besides directly displayed on the system, LV Financial AI Agent support file report quickly, help businesses easily share financial data with the related department. The report can be customized according to your needs, with just a drag – drop simple.

4. Why businesses should choose LV Financial AI Agent?

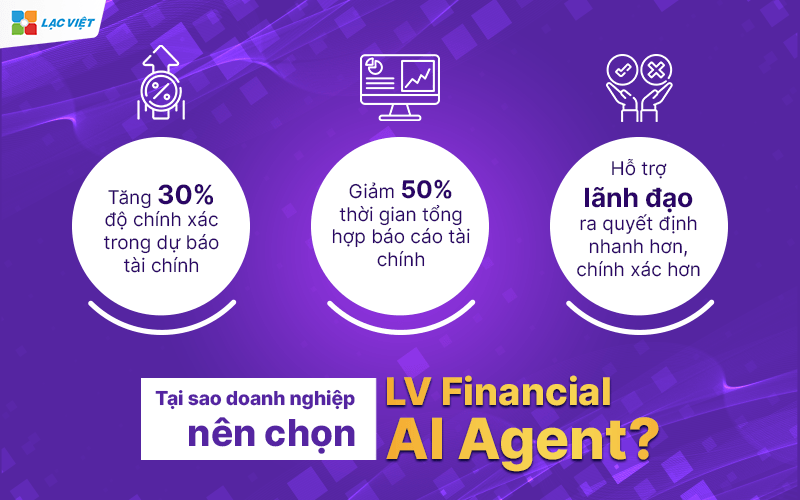

The deployment of AI in financial analysis not only helps in optimized business processes, but also bring many practical benefits:

4.1 Reduction of 50% of the time integrated financial statements

With the ability to automate, LV Financial AI Agent to help cut down more than a half-time processing statements help accountants focus on the strategic mission over.

For example: A company e-commerce there are thousands of transactions per day need to aggregate sales data and profit. Previously, this process took more than 10 hours per week, but with AI, the whole is handled in just a few minutes.

4.2 Increased by 30% accuracy in financial forecasting

Thanks to the ability to analyze historical data to detect trends, AI systems to help businesses more accurate forecast of revenues, expenses, cash flow and financial risk.

For example, If ANYONE noticed the speed of recovery of debts more slowly than normal, the system will give a warning the proposed treatment to avoid the risk of shortage of working capital.

4.3 Support leadership decisions faster, more accurately

Business leaders often need decisions related to budgets, investments, cut costs or expand the business. Instead of waiting for the report from the department, that they can access financial data at any time, at the same time get analytics advice from WHO.

For example: When need to decide whether to expand the factory or not, leaders can use AI to analyze cash flow, profit and operating costs, help make decisions more accurate.

To optimize the data mining in businessLV Financial AI Agent is advanced solution to help businesses leverage the maximum potential of data. Contact consultant free demo LV Financial AI Agent today to experience the ability to automate finance!!!