CBAM – mechanism adjust border carbon of the European union – official go into phase applies from the end of 2023, marked a major turning point in thinking global business. CBAM is not a barrier purely technical. This is a powerful tool to fulfill the commitment to reduce emissions net of the EU, at the same time promote the trade partners – including Vietnam – participate in roadmap carbon neutral earnest

This article Lac Viet Computing will help the business understand the nature of CBAM, the sectors affected, the potential risks if not prepared and most importantly, lays out a roadmap practical action to adapt effectively take advantage of the opportunities from this new system.

1. CBAM and the global war on switch green

In less than a decade, the world has witness a turning point in the way countries approach the issue of greenhouse gas emissions. From a theme environmental pure, reducing emissions has now become an integral part in the strategy of economic development – trade of the economy.

The European union (EU), with a pioneering role in the transformation, green has deployed CBAM – mechanism adjust border carbon as a measure of hand strength to promote environmental justice, and protect the manufacturing industry, domestic ago unfair competition from other countries there is no regulation to control emissions closely.

CBAM is not merely a tax. This is a comprehensive mechanism combination of emission monitoring, data transparency and pricing carbon, forcing exporters outside the EU must comply with the same requirements as European business. This marks a radical change: from now on, carbon emissions become a “trade costs” will directly affect price, market share and competitiveness of products.

For Vietnamese businesses, especially in sectors such as steel, cement, aluminum, fertilizers, power, inherent exports to the EU or join the global supply chain, CBAM is a policy that can not be ignored. The slow adaptation not only makes business shouldering the cost, but also face the risk of being removed from the market or international supply chain.

So, properly understood – understood CBAM from now on is an important first step for business:

- Assess the level of risk

- Prepare data system emission

- Building the roadmap to improve technology fit

- Scope 3 Emission is? Comprehensive guide to measuring and managing emissions indirect

- What is CO2 offset Point? Explained in easy to understand and practical applications for business

- Carbon Neutral is what? Roadmap to help businesses achieve carbon neutral

- Carbon Footprint is? Calculate, reduce the Carbon footprint for your business

2. CBAM is what? Detailed analysis of the mechanisms that regulate border carbon of the EU

2.1. CBAM is what?

CBAM is shorthand of Carbon Border Adjustment Mechanism – it is the adjustment mechanism of the carbon tax at the border. This is a new policy is the EU designed to solve a phenomenon known as “leakage of carbon” – news businesses relocate their production to other countries have regulated emissions more loosely to avoid the cost of the environment, then export back into the EU.

Specific CBAM requires the importer to the EU market must:

- Calculate the amount of greenhouse gases arising in the process of manufacturing products

- Declare under standard due to EU regulations

- Buy the number of “certificate CBAM” corresponds to emissions

Other than a tax traditional guest on product value, CBAM is a mechanism that combines measurement – monitoring – offset emissions through credits carbon. The main goal is to ensure all products, whether produced now, must bear the cost of carbon-the same as on the EU market.

2.2. CBAM other nothing compared to the environmental taxes other?

One of the points easy to confuse is the CBAM is often misunderstood as “tax on imported carbon”. However, CBAM there are many points radically different compared to the environmental taxes typically:

- CBAM do not apply a fixed tax rate. Instead, the importer must calculate the amount of gas CO₂ arise and purchase the amount of credit, respectively, with the price of credits is adjusted according to the market ETS (system trading emissions of the EU).

- CBAM required to declare details, transparency about the production process: from raw material inputs, energy use, manufacturing technology,... to determine the emissions of fact.

- Other markets credit only voluntary carbon CBAM is a mechanism required for goods imported into the EU, systematic monitoring, verification, sanction clear if the violation.

In summary, CBAM is not a “technical barriers” merely which is a measure standards new environment in international trade. Any business like timely application will not only protect the directory that also take advantage of the opportunity to upgrade the production, branding blue today.

3. CBAM influence how to business Vietnam?

The European union deployed CBAM not just a matter of foreign policy, which impact directly to active directory, manufacturing and competitiveness of various industries in Vietnam. Properly understand the level of influence will help businesses proactively plan like this, instead of passive, dealing with expenses incurred, loss of customers or lag in the global trends.

3.1. The export industry which is directly affected?

CBAM the first phase focused on the products that the level of carbon emissions in the production process, including:

- Steel and steel products from steel Industries are emissions due to use of coal in metallurgy, process of fusing materials.

- Cement: production process of clinker (the main component of cement) is the emission of CO₂ significantly.

- Aluminum: Consuming the electrical energy in the electrolytic process, especially if you use power from the source fossil.

- Fertilizer: chemical processes to create CO₂, CH₄ and N₂O.

- Electric/hydrogen (hydro): Most is the electricity produced from coal or oil.

According to the General department of Vietnam Customs, the only private exports of commodity group iron and steel to the EU in the year 2023 has reached almost $ 1 billion. Meanwhile, a number of businesses, cement, aluminum, fertilizers, also are expanding market to Europe.

In addition to the company's direct export, business outsourcing or supply of raw materials for European partners are also affected indirectly. Supply chain “green” is becoming the evaluation criteria partner. A business is no transparency about emissions can take the opportunity to cooperate long-term, though not export directly.

3.2. The new requirements that businesses must meet

To comply with CBAM, business will not be able to continue business under the old model, which need to apply the process to declare measure emissions strict, including:

- Emissions reporting details in accordance with EU standards: Enterprises need to calculate emissions CO₂ throughout the production process – from raw material input, power consumption, heat, until the technology used. These metrics must be calculated according to the method is EU approval, not to be estimated in the usual way.

- Transparency of data, energy, technology: factors such as the rate of use of electricity from renewable sources, type of fuel used (coal, oil, gas, biomass...), device performance, the level of recycling... all affect emission levels.

- May need evaluation by the Tuesday of independence (verifier): EU encourages or requires business units are used, verify accredited to ensure transparency, reliability of reporting.

The standardization of this process not only serves CBAM, which is also a platform for businesses to prepare for the standard ESG report, sustainable development and market credits carbon future.

3.3. The cost, potential risks if not prepared early

CBAM not allowed “to stand outside observer”. Businesses do not prepare the system data or deliberately delay will be faced with many risks, in particular:

- Cost high emission: If the business does not provide data emission particular, the EU will use the emission default – usually the highest level in the industry to calculate the number of certificates CBAM need to buy. This significantly increases the cost of imports, causing loss product competitive advantage.

- Take orders, was excluded from the supply chain: The partner EU or global manufacturers increasingly ask suppliers to be transparent about emissions. If the business does not meet the requirements CBAM, the risk of losing the contract or not be re-signing is very high.

- Lag in the trend of sustainable development: while the region are investing measurement system – saving carbon reduction, business English, if continued, slowly step will encounter difficulty in accessing capital, green, international certification and the support policy of the state in the future.

CBAM is a powerful reminder that in the modern business world, carbon emissions, is a “kind of invisible costs” but is becoming increasingly tangible, measurable, and impact on business results. Any business slow prepared not only be free but also have to pay the price by market opportunities, reputation, and ability of sustainable growth.

4. Business need to do to cope with CBAM?

CBAM is not just a new policy that is clear signal that businesses need to be proactive “measure – count – prove” responsible for the environment if you want to maintain, expand the international market especially European market. Here are three action group urgent that Vietnamese enterprises should be made from now to adapt effectively with CBAM.

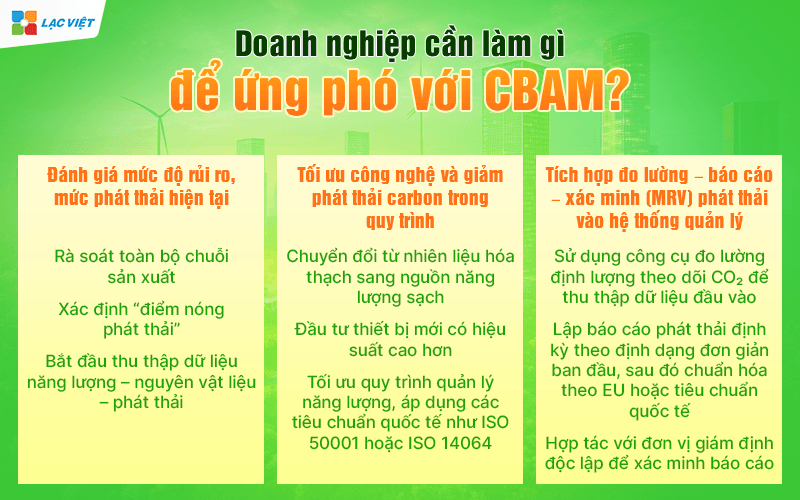

4.1. Assess the level of risk, the emission current

Before making any improvement plan or any investment, businesses need to understand the real state emission of yourself: are incurred from anywhere, at any level, are affected in the supply chain.

The need to do immediately:

- Reviewing the entire production chain, especially the stages that use fossil fuels such as coal, oil, FO, or tech furnaces/metallurgy older generation.

- Identify “hot spots emissions,” for example, area, power consumption, large area heat treatment, manufacturing processes, raw materials.

- Start collecting energy data – raw materials – emissions. Businesses do not need to invest large system, but can build up the internal trace table to get acquainted with the recorded periodically.

Practical benefits: map the are emission levels will help your business:

- Know exactly where he is on a “risk map CBAM”

- Choose the right place to invest in improvements, avoid spreading the cost

- Have a database to later integrated into the report emissions, serve CBAM or ESG

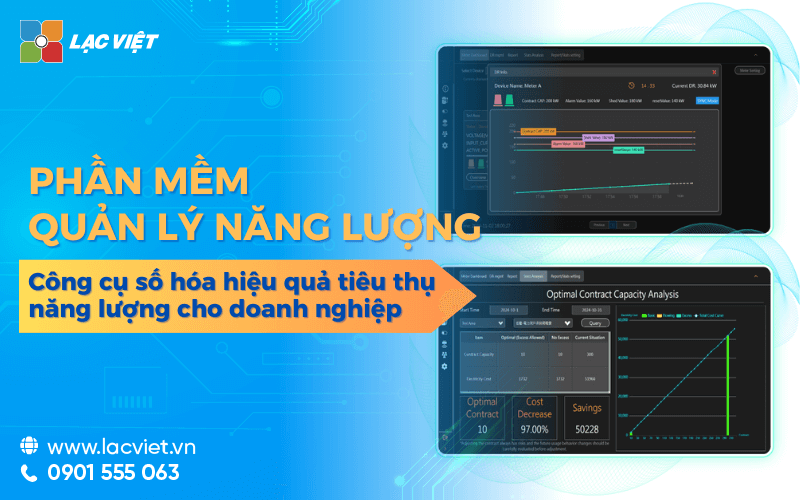

4.2. Optimum technology and reduce carbon emissions in the process

After knowing the current state emissions, businesses need to start planning the optimal technology and reduce the amount of greenhouse gases arise. Goal is not just to reduce costs CBAM in the future, but also improve operational efficiency, save energy preparing for the requirements of the export market blue.

Some possible solutions:

- Switching from fossil fuels to clean energy sources, for example from coal to natural gas, or biomass.

- The investment in new equipment has higher performance, especially in the stitching large electrical power consumption, such as motor, air compressor, heating system.

- Optimal process energy management applied to international standards such as ISO 50001 (energy management) or ISO 14064 (calculate greenhouse gas emissions).

Note: Not necessarily investment or immediately change the entire line. Should start with the solution “low cost – high efficiency”, for example, improved operating procedures, equipment replacement drain before reclamation control system, smart...

4.3. Integrated measure – report – verify (MRV) emissions into the management system

CBAM not only requires businesses to “reduce emissions”, which also require proof transparent, accurate emissions have been cut. Therefore, businesses need step by step system setup MRV (Measurement – Reporting – Verification), means: measurement, reporting and verification.

Manual deployment:

- Use the tools of quantitative measurement like electric meter, equipment, energy monitoring software, track CO₂ to collect input data.

- Reporting emissions under the simple format first, then proceed to standardized according to the guidelines of the EU or the international standard.

- Cooperate with unit independent appraiser (verifier) to verify the report when needed, creating reliability, good service for process CBAM from 2026 onwards.

In addition CBAM system MRV longer supported:

- As a basis for reporting ESG or report sustainable development

- Preparation conditions, market participants credits carbon when the Vietnamese market for the official commissioning

- Point increase in the bid documents, records, please provide the capital of financial institutions, international

MRV help businesses not only “meets requirements”, but also “risk management” and “creating new value” from the data emissions. This is an important foundation for Vietnamese businesses compete fairly with global rivals in the era of commercial carbon neutral.

- How to calculate credits carbon and the method applied to calculate credits carbon

- Business how to get credits carbon accordance with international standards?

- Coefficient of Co2 emissions according to the IPCC and any conversion of the form of energy

- Net Zero is what? Roadmap 2050 and solution goal commitment

5. Stages of development according to the roadmap CBAM for business

CBAM is deployed according to the route consists of two stages, with the scope of application initially focused on the sectors with high emissions. With the Vietnam business understanding phase applied and industry influence is the foundation to build the roadmap, action match, saving efficiency.

5.1 Phase transition (2023-2025): familiar and standardized data

From January 10/2023, CBAM officially entered the transition period. During this time, businesses do not have to pay any fees emissions, but required to declare the amount of carbon emissions in each product exports to the EU periodically quarter.

Specific business needs:

- Provide data emissions in the production process, including energy use, fuel type, equipment performance...

- Calculate the amount of gas CO₂ respectively based on the technical guidelines of the EU

- Report according to the form, may need any verification by side Tuesday in some cases

This is the stage of “preparation technique” for businesses to get acquainted with the CBAM, at the same time check availability of the system internal data. The initiative from this period to help businesses avoid when step on stage official.

5.2 the official Phase (from 2026): charge emission and buy stock just CBAM

Starting from the year 2026, CBAM move on to stage full operation. At this time, the business is not only the declaration but also have to pay a fee for the carbon emission arises in the product.

This fee is not fixed, but depends on the number of emissions and the market price of the certificates CBAM (to be tied to the price of credits in the ETS system – market emissions of Europe). Meaning:

- Emissions as high cost as large

- Business how to use old technology, many of the fossil energy will disadvantage

- On the contrary, business, applied technology, energy-saving will save significant costs CBAM

This sets out clear requirements: want to keep the EU market, businesses must invest on control of emissions from now on.

CBAM is not a “tax environment temporary”, which is a part in the development strategy for green economy long of Europe, and soon will spread to many countries other development. Business slow to adapt will not only incur high costs when under pressure emission levels by default, but also have the risk of losing market, customers and position in the global supply chain.

On the contrary, business preparation from today – from the assessment of emissions, collect data transparency, improved technology to establish management systems, emissions – will keep export markets, improve brand reputation to welcome the inflow of sustainable investment in the future.