In management, corporate finance, accounting profit is never the only factor determining the survival. A business can quote rates on reported business results, but still fall into depression if not enough cash to pay its short term debts. That is precisely the reason for reporting the cash flow is considered “the measure of vitality” of the business faithfully reflect the ability to operate in the long term. However, not every enterprise is to understand how to set, how to read and harness the maximum value of reporting this important.

The article below Lac Viet Computing will help you complete system of knowledge about reporting cash flow from concept, classification, how to tool support modern fit with each scale business needs.

1. Reported cash flow is what? The business would also need to understand properly

1.1. Definition

Reported cash flow is one of the three financial statements the basic besides the balance sheet accounting and reporting business results. This is the report reflects the entire cash flow in/out of business in a given (month, quarter, or year).

In simple words, if you visualize cash flows are the lifeblood of finance shall report cash flows is a complete record of the financial activities related to cash, including the proceeds from customers, costs, suppliers, investors, loans, debt payments,...

1.2. Differentiate the cash flow with accounting profit

Many businesses myth: there is profit, there is money. Fact, profit is the number of accounting are recorded on accrual basis (accrual basis), that is recorded revenue/expenses when incurred rather than depend on whether the money was in or out.

On the contrary, reports, cash flow only recorded cash flow really have transaction i.e. real money received or spent. Therefore, a business can press interest in the states, but cash flow is still negative if the revenue has not been recovered in cash.

1.3. Reporting cash flows that are mandatory?

According to the accounting regulations prevailing in Vietnam (VAS – circular 200/2014/TT-BTC), and international standards (IFRS), the cash flow statement is a mandatory component in the financial statements of the business can scale just come up or was listing.

However, even with a small business or business professional, the establishment analysis report still bring practical benefits:

- Help business owners control over their ability to pay the short term.

- Restrictions depend on credit, avoid financial risk when the cash flow is weak.

- Actively coordinate sales plan, cost, investment, based on the ability to stream real money.

- 9 Accounting Software online cheap cost reduction for small and medium ENTERPRISES

- 10+ accounting software ERP admin most popular AI for enterprises

- Cash flow from business operations what is? How to properly understand, effective management for business optimization

- Cash flow is what? 5 principles of management business cash flow effectively

2. Why report cash flow is a map of survival of the business?

In corporate governance, there is a paradox common: increased sales, profits cock, but the business is still “safe”, not even enough to pay suppliers, staff or other financial obligations on time. The reason lies not in the ability to generate profit which is located in the cash flow.

Other than reporting the results of operations, business only to see business profit or loss on accounting, reporting, cash flow reflects the actual movement of cash – real business how much money is in place in the states. A business can press interest due to the recognition of sales revenue, but if the customer has not paid yet and inventory has sold, then the money has not actually returned to the fund.

If you've ever wondered: “Business profitable, but not enough money to pay the expenses required – why?” then you are required to properly understand and use the report a post.

2.1 liquidity Management efficiency

A business can record high profits on the books, but if the cash in the account is not sufficient to pay operating costs, business risk remains stalled operation. This is liquidity risk – one of the common causes leading to the failure of many small and medium business.

Reported cash flow help businesses track the amount of money the can, capture the moment cash flow on – going to actively coordinate resources. In particular, reports, cash flow forecast, by week or by month, businesses can identify before the time of the cash lower and planned adjustment of income and expenditure in a timely manner.

For example, if the forecast shows the next 2 weeks there is no flow of money into but to pay salaries and suppliers, big business, may delay the payment has not urgent or find solutions to short-term loans logical.

2.2 decision Support timely financial

Financial decisions right time is a vital element in management. Thanks for reporting, cash flow, businesses can accurately answer questions such as:

- Have enough money to invest in the expansion not?

- There should continue to program the discount to the customer, or should debt collection before?

- Now is the time to loans or to optimize the operation cost?

Instead of relying on feelings or look at your account balances, instant reporting, cash flow allows administrators to make decisions based on financial picture fact: reflecting all planned revenues and expenditures; the time arises. This helps enterprises to reduce financial risk, optimize capital efficiency.

2.3 Increase reliability when called capital or working with the bank

In the process called capital or apply for financial aid, credit, investors – financial institutions do not only look at the profit that special attention to cash flow real. A business have to report cash flow clarity and transparency will:

- Proven ability to pay, payback or the repayment of a debt.

- Build trust with the bank help increase the credit limit or get preferential interest rates more.

- The score increases credibility when raising capital or calling for investment from outside.

3. The structure and the main components of reporting cash flows

3.1. Three main lines in the report

A report cash flow standard will include three large cash flows corresponding to the three basic operations of the business. The division is not indicative form of accounting, but also help businesses see clearly the flow of money is flowing from, you're used to.

a. Cash flow from business operations

This is the reflects the revenues and expenditures directly related to the process of operating our core business. Includes:

- Proceeds from the sale, providing services: funds that actual customers have paid, not revenue recorded on the invoice.

- Pay for suppliers: include raw materials, goods, and services.

- Pay staff salaries, rent, insurance, taxes, the cost of regular activity.

Positive cash flow from business operations is good signal: business is operating efficiently, generate cash flow from the main activity.

b. Cash flow from investing activities

This group reflect the transactions related to shopping, sell long-term assets or investments financial. Includes:

- Procurement of machinery, equipment, software, office...

- Proceeds from the liquidation of fixed assets or transfer of capital.

- Loan transaction, investment into other units.

Note: cash Flow investment, usually in the growth stage because the business is expanding manufacturing business. It is important that businesses need to control the tempo of investment in accordance with the financial possibilities out there.

c. Cash flow from financing activities

Reflect the transactions do change the scale, capital structure, debt of the business. Includes:

- Borrowing and repayment of borrowing (banks, bonds...).

- Receipt of capital contribution of the shareholders, issue shares.

- Pay dividends, buy back shares...

This group shows businesses are mobilized or repay capital like. In a number of stages, the business can live thanks to the cash flow from financing (e.g., loans to compensate the shortage of cash flow in business), but if prolonged will potential risk of solvency in the future.

3.2. Flow net cash and net cash flow

After synthesis of the three cash flow, the enterprise will have:

- Cash flow net from each activity (business – investment – financial)

- Cash flow net in the states: the Sum of all three, after re-adjusted rate difference (if any)

Cash flow net in the period = cash Flow business + cash Flow investment + cash Flow finance

Illustrative example: A business in the reporting period are:

- Profit after tax: pussy 200 million

- But the net cash from operating activities: ocean 500 million

- Cash flow and investment: pussy 300 million (purchase of new machinery)

- Cash flow finance: pussy 100 million (repayment of bank loans)

→ Cash flow net in the states: +500 -300 -100 = +100 million

Although business openings in accounting but still have positive cash flow shows the ability to pay its short-term is still assured. The opposite case, the interest rate, but the money is warning about liquidity risk.

Understand the three cash flow and main flow net cash in your reports help managers not only keep track of financial activities in a transparent manner but also make decisions based operating cash flow real instead of feeling from accounting profit.

4. Distinguished reporting cash flows direct/indirect

When reporting, businesses can choose two methods are accepted by the accounting standards Vietnam (VAS) and international (IFRS): the direct method and the indirect method. Both lead to the same result on cash flow net in the states but differ in the way presented in detail. The properly understand these two methods will help firms to choose how to set consistent with the goal of financial management or internal reporting requirements outside.

4.1. The direct method transparent easy-to-follow

With the direct method reports cash flows presents the specific funds collected and spent, classified according to each activity as:

- Cash receipts from customers

- Cash paid to suppliers

- Money to pay staff salaries

- Proceeds from sale of assets

- Money spent on investment in machinery and equipment

This method is the same as table summarizing the actual transaction of business, very intuitive, easy to understand even with people who do not specialize in finance. Businesses can use this report to:

- Accurately track the flow of money out – on a daily basis.

- Early detection of irregularities in spending.

- Planning budget actual week/month.

However, the direct method usually requires system software manager full accounting can extract transaction data in a detailed way exactly. If using Excel, the data collection can be time-consuming to errors.

4.2. Indirect methods of flexible common in financial statements

The indirect method starts from accounting profit (after tax) on reported business results, then adjusting the factors not related to cash, such as:

- Depreciation of fixed assets

- Exchange rate differences have not yet made

- Increase/decrease inventory, public debt

The goal of this method is to convert accounting profit of realistic cash-flow from business operations. Therefore, indirect methods are fit for purpose financial reporting synthesis is commonly applied by:

- The big business audited.

- The business listing, have shareholders or investors need to keep track of financial statements periodically.

- The units need to compare between states, accounting and cash flow real.

However, easy to deploy over, but indirect methods have the drawback is not clearly shown step by revenues – expenses specific guide to the cash flow management daily becomes more difficult.

Businesses should choose which method?

Choose the method of reporting cash flows should be derived from:

- Target users: If to control realistic cash-flow method should be used directly. If serving the audit, or information disclosure, the indirect method is optimal.

- The ability to accounting system: If the system software has not enough ability to access the cash flow details, the indirect method will be easy to deploy more.

- Resources financial accounting current: small Business can start using the indirect method then gradually integrated more directly when the system operate better.

Currently, many software solutions modern accounting allows the integration of both methods, supports medium businesses are under financial reporting standard just have the table, cash flow management, internal clear.

5. Guide to reporting cash flows with template

5.1. Report template cash flow according to the standard VAS

Under circular no. 200/2014/TT-BTC – mode accounting Vietnam business standard report consists of three parts:

- Cash flow from business operations

- Cash flow from investing activities

- Cash flow from financing activities

Depending on the method of establishment (directly or indirectly), the presentation details will be different. However, the form required of VAS always request made clear line net cash from each activity and cash flow net in the period. This is the standard structure required for the business, medium-sized and above, or the unit must establish audit report.

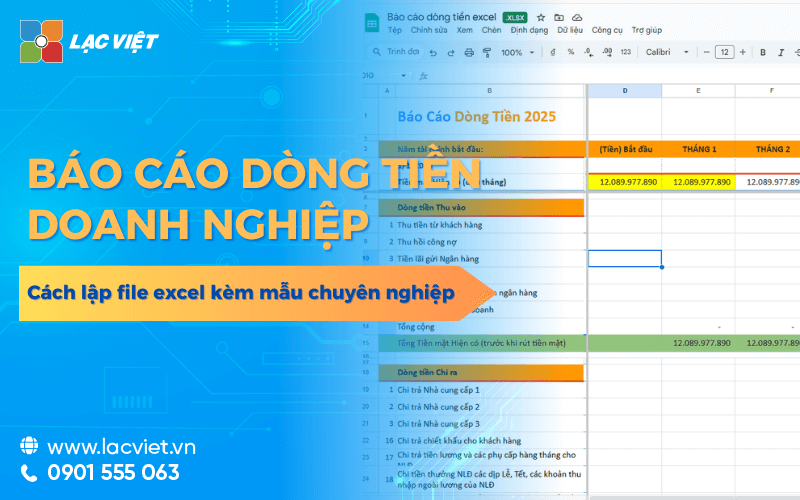

5.2. Excel template report free cash flows

For small business or want to track internal report template cash flow Excel is a reasonable option and save. Excel template efficiency are often required:

- Classification of clear, three groups of activities with the line item details such as: cash receipts from customers, payroll, buy equipment, get loan, repayment...

- Recipe of flow net cash helps users to track fluctuations.

- Column comparison this – before to identify financial trends.

Manual Excel template:

- Specify the reporting period (week/month).

- Enter the actual data from cashbook, bank statement or accounting software.

- Ensure the correct classification group activity to avoid deviations.

- Periodic updates and storage for continuous monitoring.

This form in accordance with the new unit started or need to set up quickly in order to present internal. However, to increase the accuracy, associated with accounting data overall, enterprises should gradually move on to use dedicated software.

DOWNLOAD SAMPLE EXCEL FILE REPORT CASH FLOW AT THIS

5.3. Restrictions when reporting cash flows using Excel crafts

Excel is still the familiar tools common for many small and medium business when starting cash flow management. However, when the scale of operation increases or business that needs planning, financial details, Excel, revealed many weaknesses:

- Easy-to-happen errors in the formula, manipulate data entry craft leads to data not reliable.

- Not in sync with the actual data from the accounting software, bank, or sales system. Therefore, the data often be late, lack of updates.

- Inability to forecast or warning makes business difficult to detect early shortage of cash.

- Can't open wide flexibility when the volume of transactions grows, the number of branches or accounts increase.

This leads to a paradox: the business still reported cash flow per period, but cannot be used that report to governance decisions in a timely manner.

6. Financial AI Agent – solutions cash flow analysis, smart auto

To overcome the above limitation, many businesses today are turning to use software support cash flow management integrated artificial intelligence (AI). One of the highlights solutions on the market today is Vietnam Financial AI Agent tool – cash flow analysis-automatic is designed in accordance with environmental accounting and finance in Vietnam.

Lac Viet Financial AI Agent to solve the “anxieties” of the business

For the accounting department:

- Reduce workload and handle end report states such as summarizing, tax settlement, budgeting.

- Automatically generate reports, cash flow, debt collection, financial statements, details in short time.

For leaders:

- Provide financial picture comprehensive, real-time, to help a decision quickly.

- Support troubleshooting instant on the financial indicators, providing forecast financial strategy without waiting from the related department.

- Warning of financial risks, suggesting solutions to optimize resources.

Financial AI Agent of Lac Viet is not only a tool of financial analysis that is also a smart assistant, help businesses understand management “health” finance in a comprehensive manner. With the possibility of automation, in-depth analysis, update real-time, this is the ideal solution to the Vietnam business process optimization, financial management, strengthen competitive advantage in the market.

SIGN UP CONSULTATION AND DEMO

The benefits that businesses get:

- Automatic synthesis of cash flow analysis from multiple data sources are available such as: accounting software (AccNet) system sales, data bank, the contract of purchase – sale.

- Early detection of negative cash flows given instant alerts, suggestions disposal such as varicose debt suppliers, priority debt collection or control spending.

- Display visual reports, in real-time helps leaders to grasp the financial picture, current, and forecast of future scenarios.

- Automatic reporting cash flows according to the standard Vietnam or internal requirements, reducing the burden to department of accounting and finance.

- Closely connected with ecology software AccNet ensure data consistency, reduce the time input for projection craft.

Reporting cash flows not merely material internal accounting, but also as tools in strategic management helps enterprises proactively control the liquidity forecast, financial risks and make decisions, investment spending reasonable. In the context of economic upheaval, the proper analysis cash flow will help businesses not only survive but also sustainable development.

If the business you're looking for a solution to manage cash flow effectively automate, report, forecast and risk warning please experience now Club Vietnam Financial AI Agent at: https://lacviet.vn/lac-viet-financial-ai-agent