The form of paid popular today, including: paid time to time, paid according to the product, pay exchange, paid by revenue KPI. Each form has advantages, limitations and suitability to each type of different businesses. The choice of the form of a salary appropriate to help businesses optimize costs to ensure the motivation retain talent.

Depending on the particular industry, the volume of work and business strategy, the business can apply as many forms as paid by the time, by product, by revenue or by exchange. Each method has advantages, limitations, private, directly affecting work motivation, engagement, effective production and business.

Understand the pros and cons of each form not only help construction business policy pay transparency, efficiency but also ensure full compliance with the principle of payment according to current labor law. The same Lac Viet learn the form of paid downloads in the business today.

Tables compare general details 8 form of payroll in business

| Form name | Describe how to pay | Weakness | Business suit |

|---|---|---|---|

| 1. Pay over time | Workers are paid wages based on work time (hours, days, months) and fixed salary agreed. |

|

Administrative agencies, state enterprises or the office positions, administrative and management needs stability. |

| 2. Paid according to the product | Salaries are calculated according to the quantity or quality of the product that the labor completed during the period. |

|

Factory, business, textile, electronic, mechanical, production of consumer goods. |

| 3. Paid exchange | The employee or group is assigned workload specific and received a salary exchange fixed when completed. |

|

Business, construction, agriculture, services, short-term projects (repair, construction, transport). |

| 4. Paid by the revenue or commission | Salary tied directly to revenue or percentage of the contract value/sales is. |

|

Business, commercial, sales, insurance, real estate, consulting services, bank. |

| 5. Trả lương linh hoạt | Salary is flexible structures, including part fixed and part variable (according to the results of work, rewards, benefits, options). |

|

Business, modern technology companies, multinational corporations want to personalize the experience staff. |

| 6. Paid according to performance (KPIS/OKRs) | Salaries or bonuses tied to the level of complete work objectives is measured by KPIS or OKRs. |

|

Business result-oriented, have the system administrator clear goal as company services, technology, retail. |

| 7. Paid by the job title, work location | Salary is determined according to the value of, the responsibility and influence of position in the organizational structure. | Less flexible, does not reflect the difference in capacity between individuals of the same titles. | Business has the organizational structure clear, large company, organization, administration, or group level. |

| 8. Pay according to ability level | Salary associated with the skills, knowledge, experience and level of contribution of the individual instead of just based on the titles. |

|

Enterprise focusing on development, human resources, technology companies, multinational corporations, organizations innovation. |

1. Form paid what is?

The form of payroll is the method of business applicable to determine the pay for employees based on the basis of the agreement, the volume of work, time of work or results achieved. This is important element in human resource management because it directly affects the satisfaction of employees and the ability to control the budget salary.

For example, a manufacturing enterprise can be paid by products to encourage increased productivity, while a service company usually applied form of payroll from time to time to ensure steady income for employees.

Meaning with business and workers

- For business: choose from form-fitting to help optimize personnel costs, encourage work performance, maintaining competitiveness on the labor market. A mechanism reasonable wage also minimize the risk of labor disputes, thereby saving the cost of legal management.

- For labor: Paid clear transparent fair will create trust, motivation and encourage professional development. According to the report of the Organization international Labor office (ILO) in the year 2023, transparency in pay wages to help decrease to 20% of likely employee leaves the company within 12 months of work.

In Vietnam, The Labour code 2019 (Article 94 and Article 95) clearly stated principles pay: corporate pay salary directly in full on time; not distinguish gender in the pay wage; guaranteed salary not lower than the minimum wage due to state regulations. Applying pay wages in the enterprise must be based on agreement with the employee, in accordance with the characteristics of work at the same time ensure the rights of both parties.

2. The form of paid downloads in the business today

Below are details on 8 ways to pay wages in the enterprise helps managers understand the characteristics, advantages and disadvantages, how to apply efficiency ensure both compliance with the principle of payment according to the labor law, both optimal cost just create motivation for employees.

2.1. Form pay over time

Pay over time is the method of salary calculation based on the time actually worked by the employee, may charge by the hour, day, week or month. This is the most common form in the industry requires the stability of working time rather than number of finished product, for example: office, administration, protection of customer care.

Base rules:

- Article 96 of The Labor 2019: workers are paid over time based on the wage scale and payroll taxes due to the construction business.

- Decree 145/2020/ND-CP: Business to publicly distance calculator ensures no lower than the minimum wage.

Business specific rules: salary, months, weeks, days or hours in a labor contract.

For example: A staff administrative salary 12.000.000, if in month working full number of days as specified (for example 26 days), you'll get full pay. If leave without pay 2 day salary will be deducted respectively.

Distance calculator

- By month: month Salary = salary agreement / number of working days standard × number of days actually worked.

- According to day/time: day/hour = month salary / number of days or hours worked standard × number of days/hours actually worked.

For example, Employees whose salary 12.000.000 VNĐ/month, 22 days will be paid 12.000.000 VNĐ. If 20 days, the salary received = 12.000.000 / 22 × 20 ≈ 10.909.000 VND.

Value of benefits for businesses:

- Easy to manage, cost estimates for the hr: Business can calculate the fixed salary every month, advantageous in financial planning.

- Encourage stability and commitment: employees tend to stick for a long time when steady income, don't depend too much on fluctuations in output.

- Meet the requirements of the law: this form is consistent with the principle of payment is stated in The Labor code of Vietnam, guaranteed the rights of the minimum wage, working time.

Restrictions

- Not directly reflect the performance of the individual.

- If not combined KPI or performance bonuses, which can lead to psychological work “full time”, not “sufficient quality”.

2.2. Form paid according to the product

Piecework is the adjective form of salary based on the amount and quality of the product or service that the employee complete. Can apply to industrial production, machining, industry, service is the output measurement is.

Base rules:

- Article 96 of The Labor 2019: Business/employee agreement is paid according to the product.

- Circular 10/2020/TT-BLDTBXH: form of the product must be associated with the level of labor, process quality inspection.

Specify the product must be reasonable, having consulted the workers are not placed too high to force.

For example, A worker may get 5,000 coins for each shirt standard. If that month may 2.000 pcs, income will be 10,000,000, not bonus pass output.

Distance calculator: Salary = Single product price × Number of standard products.

For example, workers may, with a price tag of 25,000 VND/jacket, complete 200 jacket/month-standard wage = 25.000 × 200 = 5.000.000 VNĐ.

| Value benefits for businesses | Restrictions |

|

|

When should I apply: manufacturing, machining, agriculture, food processing where the product is clearly quantified.

2.3. Form of paid exchange

This is a form of pay that business and labour (or labor) agreement before a salary fixed to complete the package a volume of work or specific projects, in the specified time.

Salary does not depend on the number of days of work, duration of labor, or the number of hours the, which is based on the final result. Can apply for individual or group with the contract clear about the scope of work, standard quality, mold delivery time.

Base rules:

- Article 96 of The Labor 2019: allow business agreement with the employers to pay wages that exchange by volume, the quality of work.

- Business to describe the volume of work, standard quality, time limit for completion in the contract/agreement.

Guaranteed salary exchange last not less than the minimum wage if dividing the average by the time of work.

How to specify salary

- Based on volume, the difficulty of the work.

- Reference costs, the expected time to complete.

- Can plus bonuses if the delivery deadline or quality of exceeding requirements.

| Advantages | Restrictions |

|

|

For example apply

- Exchange construction of the rough, a work item built-in 45 days.

- Exchange machining 1,000 products furniture within 2 months.

- Exchange service maintenance IT system in 3 months, including troubleshooting, periodic maintenance.

Note management

- Need to sign a contract or clear agreement on scope, quality, schedule, criteria for acceptance, and payment method.

- Should have the mold test between states to promptly processed if the progress or the quality is not reached.

2.4. Paid by the revenue or commission

Income is calculated based on a percentage of revenue, contract value, or profit that employees bring to the business. Often combination of sticky wages (guaranteed minimum level of income) and payroll software (commission/revenue). The commission percentage can be fixed or under the ladder (revenue higher, percent larger).

Base rules:

- Article 96 of The Labor 2019: Enterprise have the rights agreement, paid by revenue, rose, for stars transparency.

- Business must be clearly stated in the contract of employment or wage policies, including: Rate % commission or by revenue. Time to pay (month/quarter).

Salary pink flowers must be calculated into wages as a base of SOCIAL insurance contribution if paid regularly.

How to determine the roses

- Based on the profit margin of the product/service.

- Consider the face by the market, competition policy in the industry.

- Can adjust according to each stage of business or each group of products.

| Advantages | Restrictions |

|

|

When to apply: parts trading, brokers, insurance, real estate, financial consulting, advertising services. The industry has the value of the contract or time latch single long.

For example apply

- Employees, real estate brokers, get 2% of the value of apartments for sale success.

- Business software get 10% on the contract value services to sign new.

- Counselor insurance get commission according to each insurance package customer purchases.

Note management

- Building regulations roses transparent, public, way, time of payment.

- Combined training, selling skills, professional ethics to avoid risk commitment false.

2.5. Pay flexible (Flexible Pay)

Pay flexible model is a combination of methods to pay different salaries in the same structure, income, for example: the salary is fixed by the time (to ensure stability) + salary fluctuations in product, performance, or business number (motivational). The goal of this form is to ensure both stable source of revenue for the staff, just create incentive for them to improve productivity.

Base rules:

The Labor code does not have the term “wage flexibility” but allows business owners build mechanism, paid for, why not lower than the minimum wage, public workers.

Businesses often applied in pattern:

- Sticky wages (fixed): ensure the minimum standard of living, grounded in SOCIAL.

- Wage soft (flexible): association with job performance, bonus, benefits.

Specific provisions in the regulation on the payment of wages, bonuses issued internal.

| Advantages | Restrictions |

|

|

Object suitable business:

- Scale business medium/large, active multi-sector or have many kinds of different positions (administrative, production, sales...).

- Organizations want to move from pay hard to model elements recommended but still keep stability.

2.6. Paid according to performance (KPIS/OKRs)

This form is mounted directly to the income of employees with the work results, based on indicators that measure efficiency (KPI) or target – result key (OKRs). Wages are usually composed of a fixed part + bonus/commission based on the results achieved against the objectives set out.

Base rules:

The Labor code 2019 allow enterprises to build the rating system and paid according to performance, for transparency, can consult with the representative organization of EMPLOYEES (if any).

Business often prescribed:

- Basic salary (fixed) guaranteed not less than the minimum area.

- Salary performance based on the results of complete KPI/OKR be unified from the beginning.

KPI/OKR, reward mechanism must be issued in regulation of remuneration notice to the entire staff.

| Advantages: | Restrictions: |

|

|

Object suitable business:

- The business can measure work efficiency clear, especially industry, sales, marketing, project management, production by production.

- Organizations have a culture of transparency, result driven, ready-investment rating system work efficiency.

2.7. Paid by the job title, work location

This is a form of pay to popular tradition, based on ranks, titles or job position that workers undertake. Wages are usually associated with system pay scale due to the construction business in accordance with the law, the organizational structure.

Base salary:

- Job description (Job Description).

- Frame the salary scale according to titles.

- Ask about qualifications, skills, responsibilities of each position.

Applicable objects:

- Office staff, managers, and professional staff.

- Businesses have clear management, medium and large scale.

Formula:

Salary = basic salary under the titles + (allowances if available)

For example:

- Hr: basic Salary 20.000.000 VNĐ + allowances responsibility 2.000.000 VNĐ.

- Staff C&B: base Salary 12.000.000 VNĐ + allowances lunch 1.000.000 VND.

Food receipt of hr = 22,000,000 VNĐ/month.

| Benefits to business | Point term chếạn the |

|

|

2.8. Pay according to ability level

This form is based on the competencies, skills, qualifications, level of proficiency, expertise of staff. Salary depends not only on position but also on personal value created for the business.

Base salary:

- Frame capacity (Competency Framework) is the construction business.

- Degree or professional certificate.

- Capacity assessment periodically (according to the matrix power).

Applicable objects:

- Technical personnel, experts, programmers, creative staff.

- Business in the field of technology, professional services, consulting.

Recipe: Salary = basic Salary position + (coefficient of capacity × correction Level)

For example:

- Basic salary location programmers: 15.000.000 VNĐ.

- The coefficient of capacity (as assessed skills, certifications, experience): 1.2.

- Level adjustment: 5,000,000 VND.

Food get = 15.000.000 + (1.2 × 5.000.000) = 21.000.000 VND/month.

| Benefits to business | Weakness |

|

|

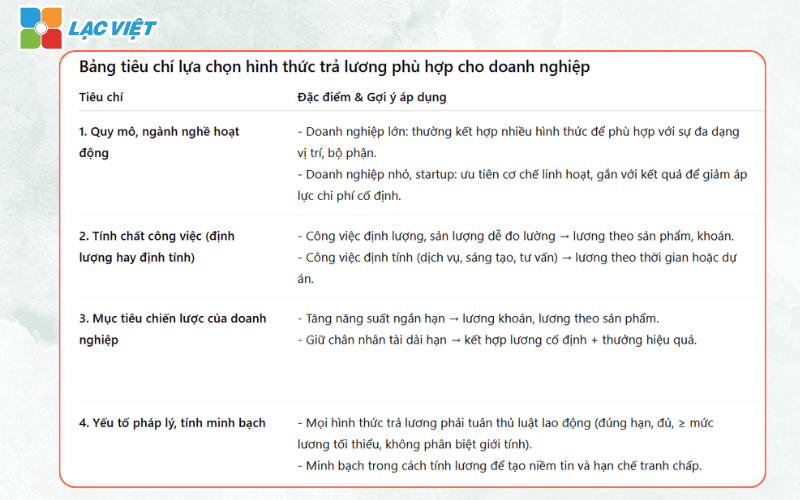

3. Should choose the form of paid how? The selection criteria suitable for business

Choosing the right method to pay wages not only decided to effective hr management, but also directly affect the ability to retain talent and competitiveness of the business. A form of paid accordingly to ensure both meet the principle of pay under the labor laws, medium optimization, budget, medium, motivational work.

3.1. Scale, industry activity

Large-scale enterprises often applied in combination many ways to pay wages to match the diversity of location, parts.

For example: office block paid from time to time to ensure the stable block production by applying the paid according to the product to boost productivity. In contrast, small business or startup is usually preferred mechanism to pay wages, flexible, associated with the result of the work to reduce the pressure fixed costs.

3.2. The nature of work (quantitative or qualitative)

- With work that yields easily measured (e.g., apparel, manufacturing components), paid according to the product help pinned income with actual results, motivational markedly.

- With the qualitative (consulting services, content creation), way paid by time or according to the project to help ensure a stable income, at the same time easy to control the quality.

Choosing the wrong form can cause an imbalance: productivity does not increase, although the cost of personnel or staff lack motivation because income does not reflect the effort.

3.3. Strategic goals of the business

If the goal is to increase productivity in the short term, businesses can apply form paid securities or according to the product. Conversely, if the priority retain talent, wage policies need to combine between the fixed part (base salary from time to time) and the volatility (bonus according to performance).

3.4. Regulatory factors, transparency

Mọi hình thức trả lương trong doanh nghiệp đều phải tuân thủ nguyên tắc trả lương theo luật lao động: trả đủ, đúng hạn, không phân biệt giới tính, không thấp hơn mức lương tối thiểu vùng. Bên cạnh đó, minh bạch trong cách tính lương là yếu tố then chốt giúp xây dựng niềm tin hạn chế tranh chấp.

For example, if applicable, pay method according to the product, businesses should announce clearly the level, standard quality, how to determine the unit price of the product. Transparency helps employees understand and believe in the wage mechanism, while protecting the business before the legal risks.

- Salary 3P what is? Distance calculator & excel Template STANDARD construction systems salary 3P

- Understand correctly the deductions from salary to calculate correctly and manage effectively

- Accounting salaries and deductions from wages, standard circular 200

- How to build stairs payroll standard with excel template for business

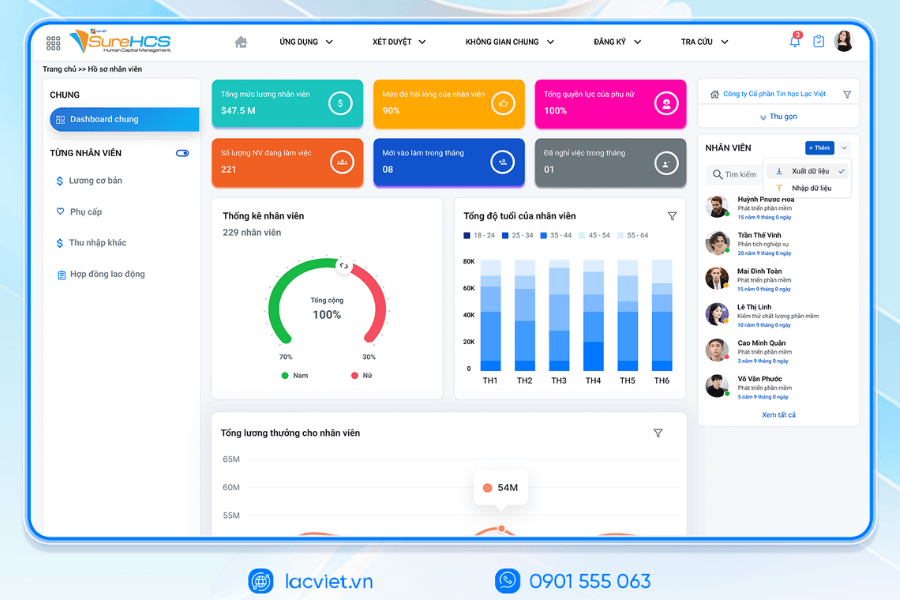

4. The optimal solution process payroll with hr software

In the context of business must manage many ways to pay different salaries as paid by duration, by product or by revenue, the calculation is not only time-consuming but also the potential risk of errors. Software hr management modern bring the benefits highlights:

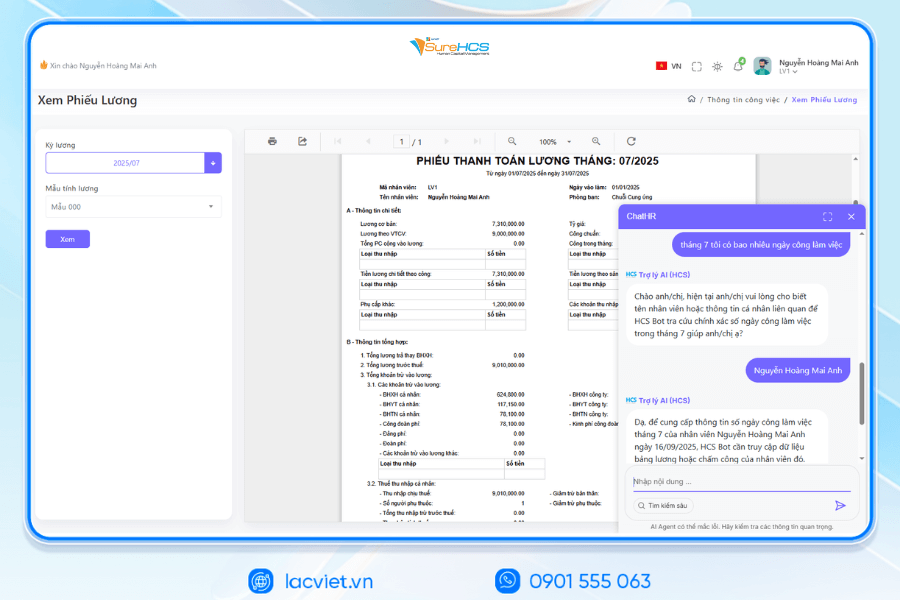

- Process automation salary calculator: The system has the ability to synthesize data from attendance systemoutput, KPI... to payroll calculations accurately. This helps to reduce up to 90% errors due to input manually, at the same time shorten the time, payroll processing from several days down to just a few hours.

- Ensure compliance with legal regulations: the management software, payroll be configured according to the current labour code, to correctly apply the principles of pay, the minimum wage regulations on overtime, holiday, new year, deductions filing insurance to help businesses limit the legal risks, labor dispute.

- Save cost management: According to a survey by CIPD 2024, the business application solutions payroll automatically save an average of 20-25% of the cost of personnel management, by reducing the volume of administrative work and limited to outsource services salary calculator.

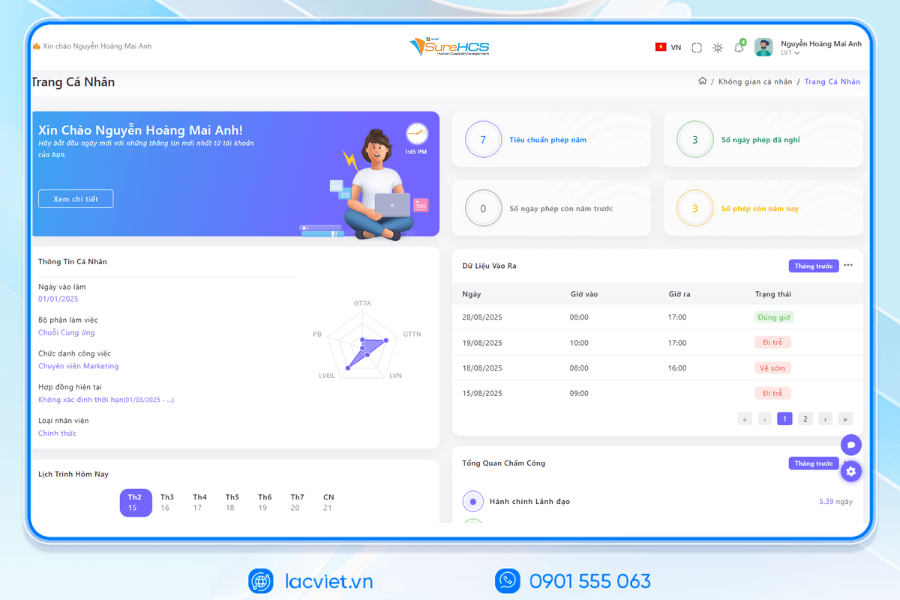

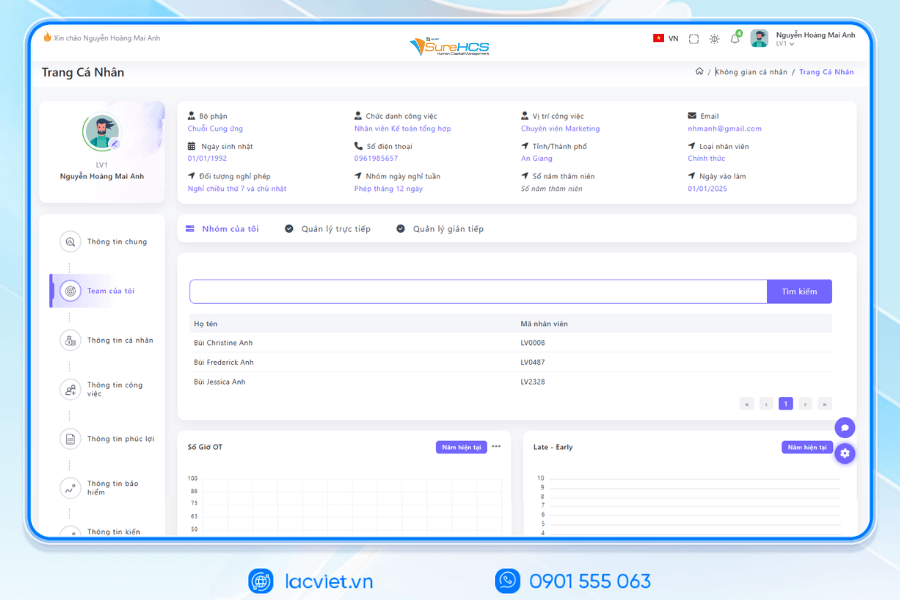

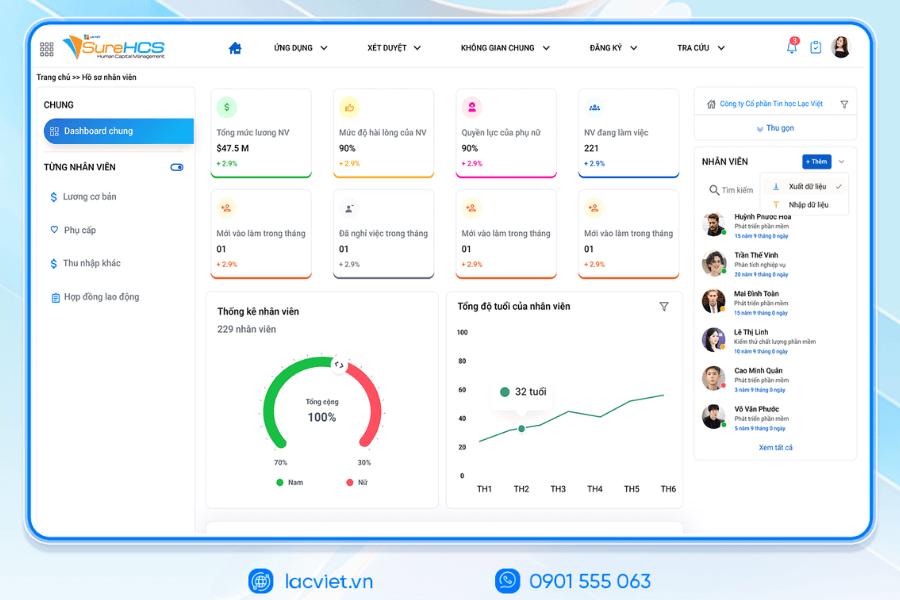

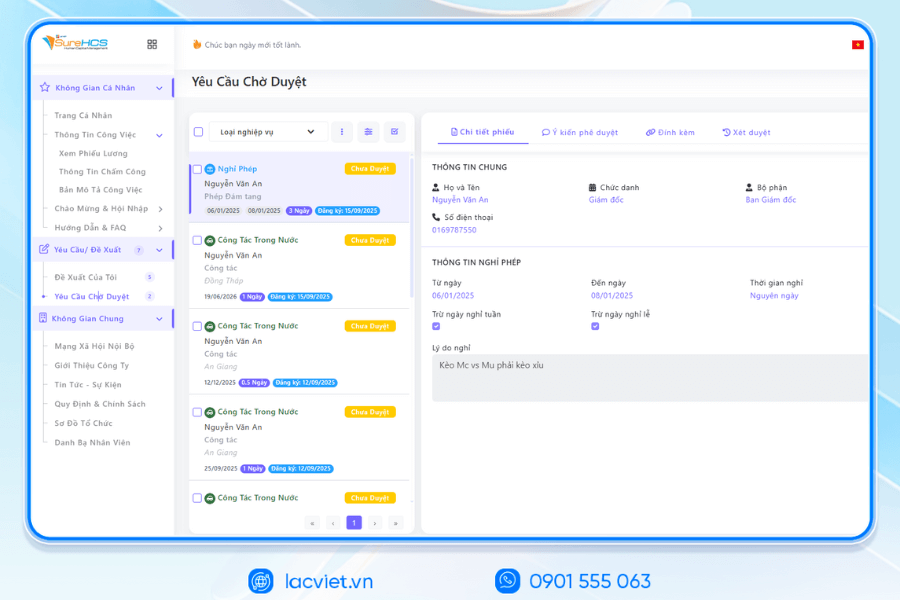

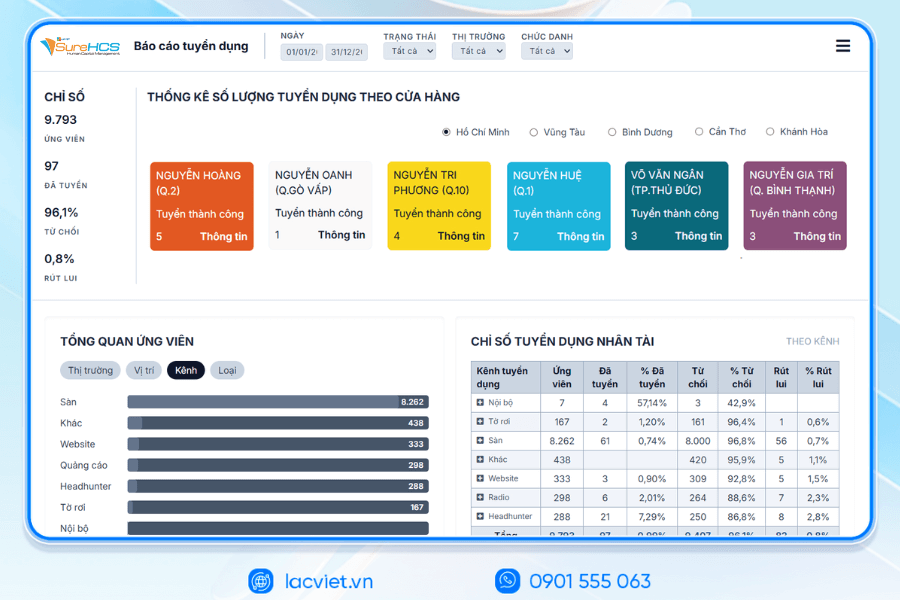

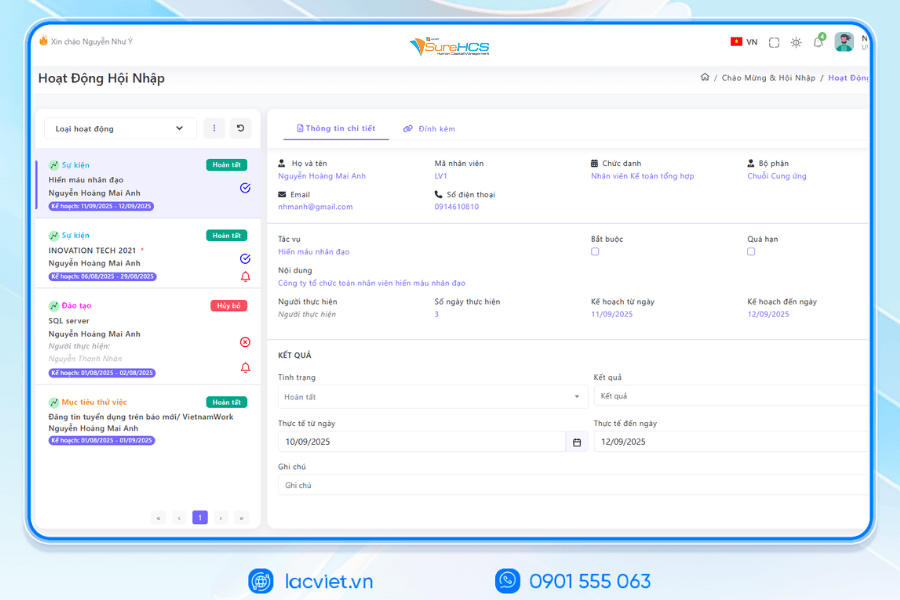

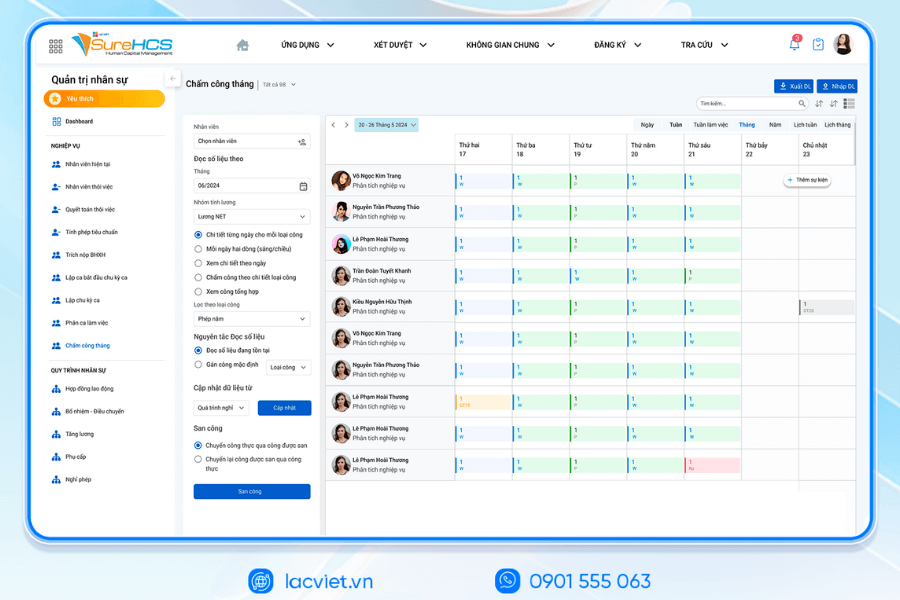

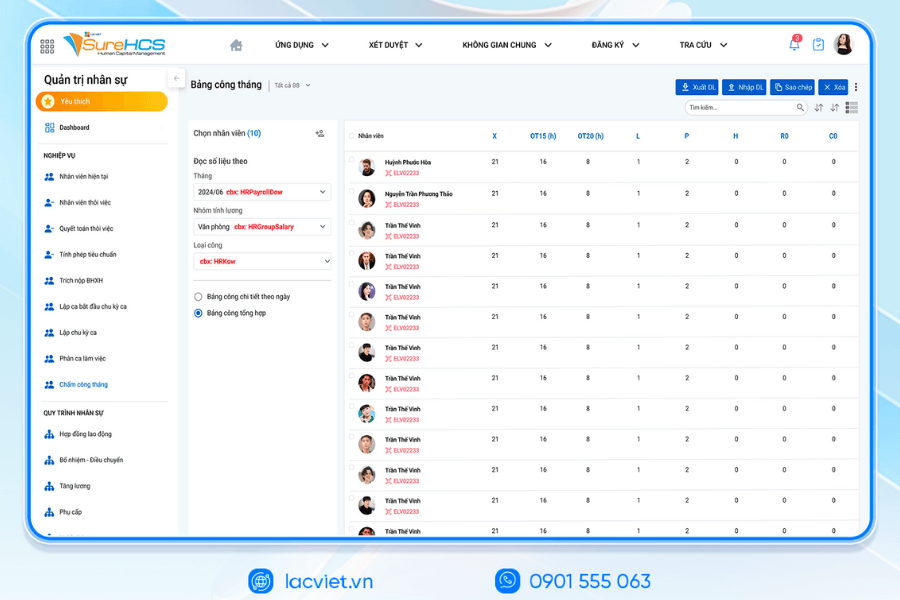

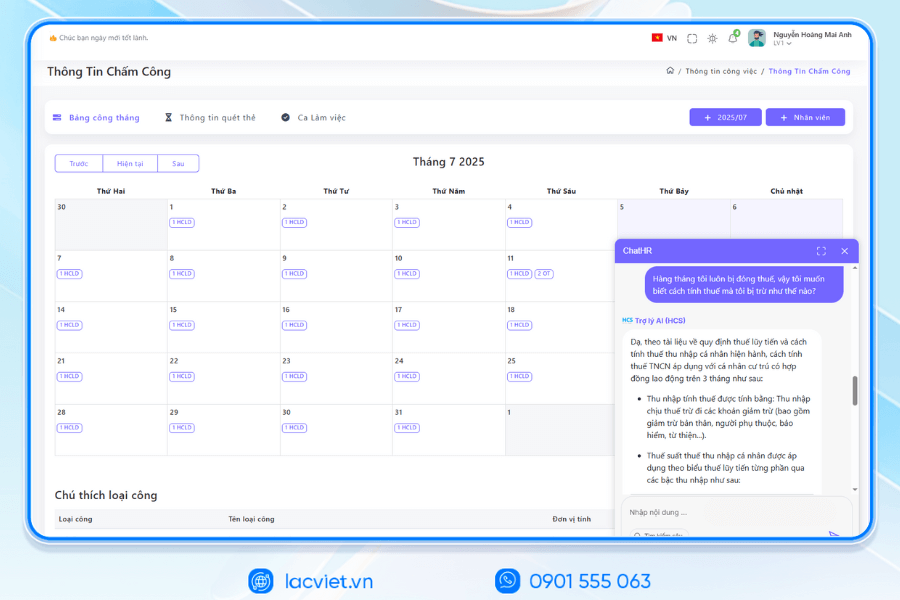

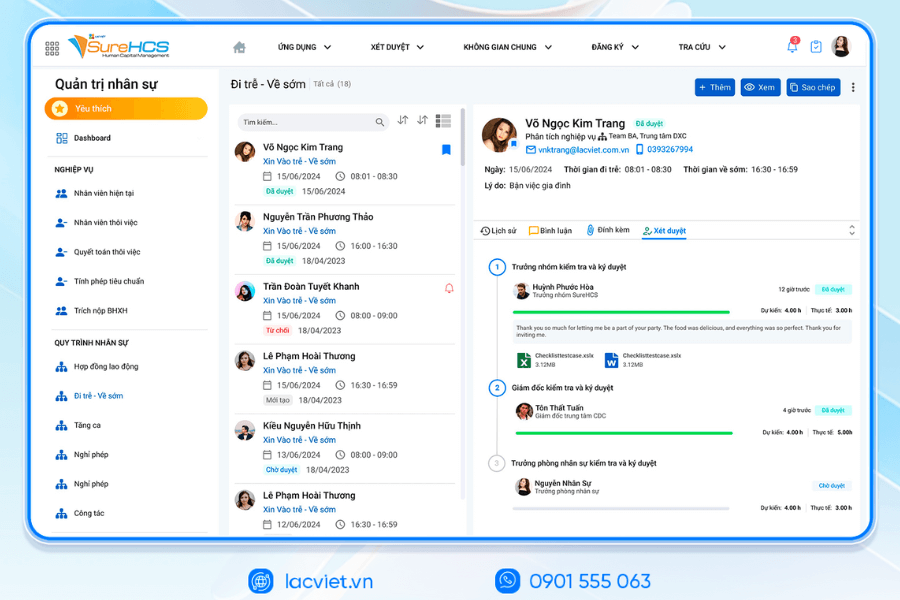

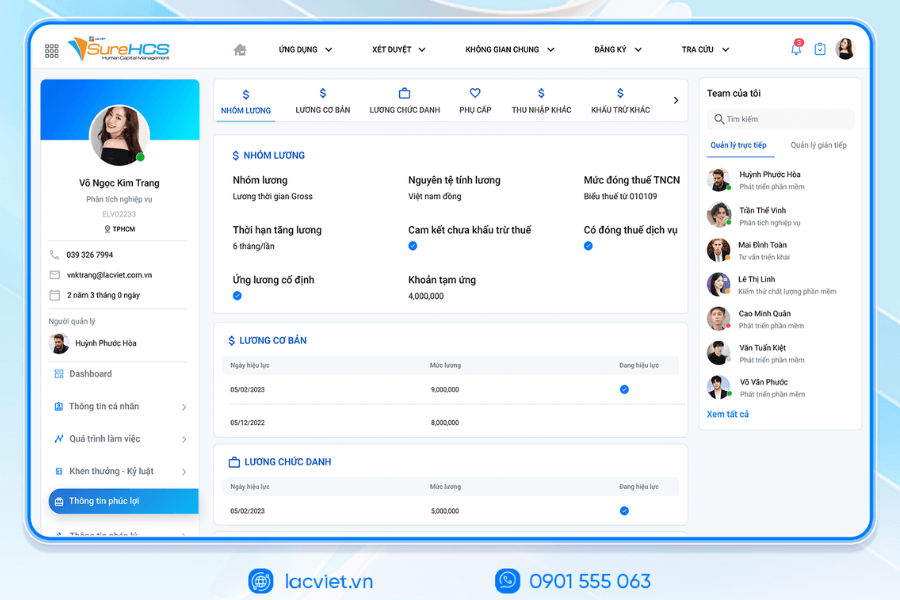

Software hr LV SureHCS is the solution in hrm comprehensive is designed to be flexible to meet all forms of pay in the enterprise, including: over time, by product, by sales or a combination of methods.

- Tightly integrated modules: Data from attendance management, production, KPI and contract labor is related more help payroll consistently accurate.

- Automatically apply diverse forms of wage payment: Whether firms pay wages according to the product for workers, according to the time for office staff or sales for the business division system are processed at the same time ensuring the rule of pay transparency.

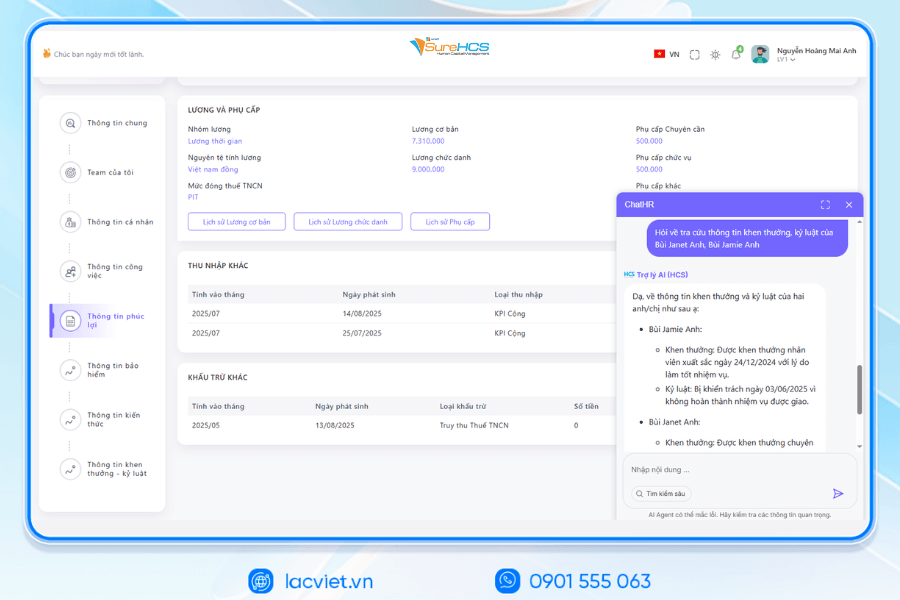

- Report analysis personnel costs in real time: The leader can see the total cost of salaries, bonus, comparing fluctuations between the states to make decisions timely adjustment.

LAC VIET SUREHCS – HR MANAGEMENT SALARY C&B CUSTOM DEPTH FOR BIG BUSINESS

Lac Viet SureHCS is software HRM personnel management comprehensive, developed by Lac Viet – unit more than 30 years of experience in the field of management software business in Vietnam with international standards such as CMMI Level 3, ISO 9001:2015 and ISO 27001:2013.

SureHCS not only meet the professional personnel standards, which are designed to handle the hr – C&B – wages complex, large-scale, multi-company, multi-sector, in particular in accordance with FDI enterprises, corporations, factory, logistics, aviation, hotel, trade – in service.

The system is flexible deployment On-premise or as a custom model in depth, to help businesses automate the entire process hr – attendance – payroll – benefits – insurance, complete replacement job management using Excel discrete.

The module's core hr software lacviet SureHCS:

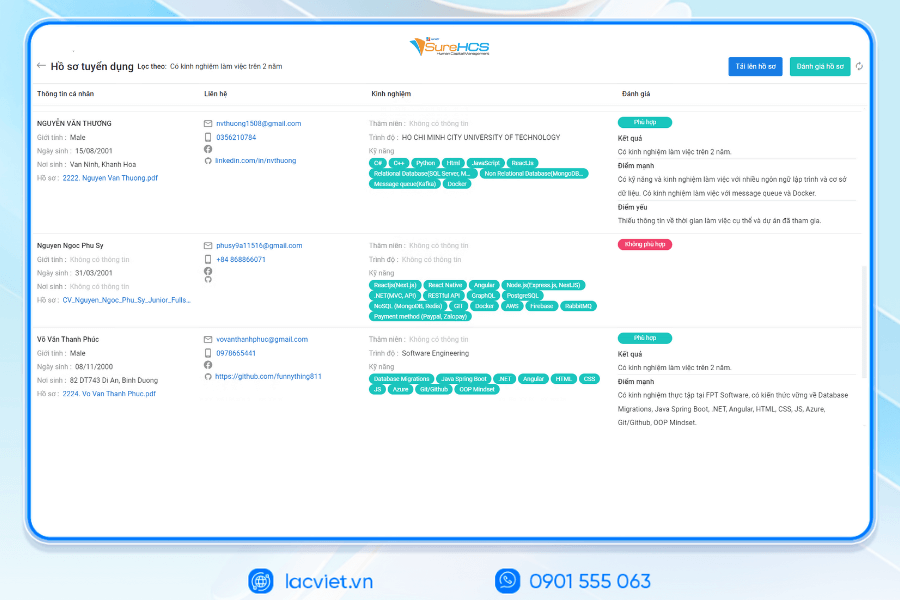

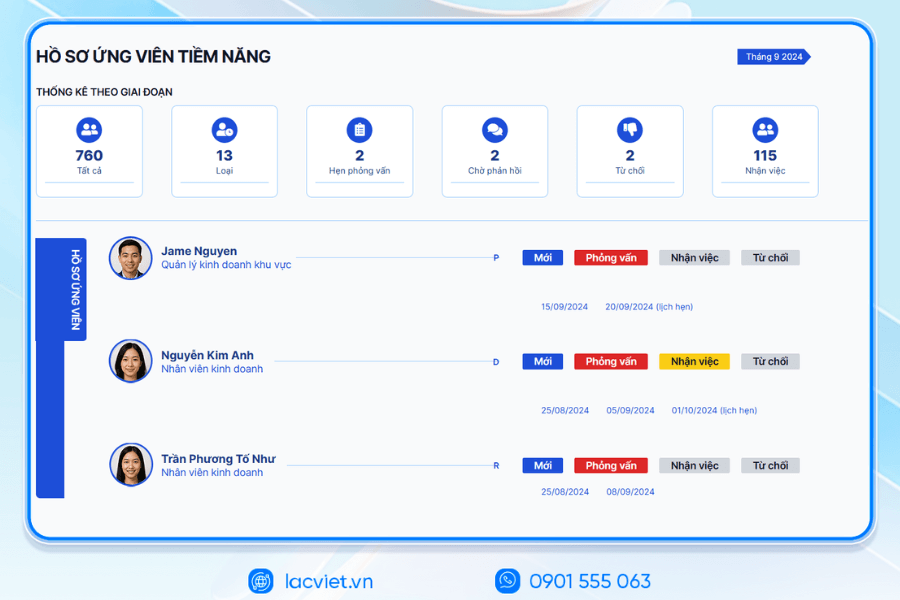

- The Recruit – Training: Management throughout the recruitment, integration, training, hr support and build the Talent Pipeline for large-scale enterprise.

- Port information & records Management personnel: Store personnel records, electronic focus, portal self-service for employees and contract labor power on the system.

- The timekeeper: Dots, multi-form (fingerprint, face recognition, Face ID, GPS, Wifi, online), connect many types of timekeeper, support attendance by the hour, shift flexibility for the plant, and hotels.

- The payroll & C&B: Automatic salary calculation according to many models (hour, shift, product, 3P, KPI performance...), link directly attendance data – performance – welfare, completely replace the salary calculator using Excel.

- Welfare – SOCIAL insurance – salary: Management benefits flexible, integrated iVAN connect SOCIAL and electronic Bank Hub salary automatically, support pay multi-currency for FDI.

INTEGRATED AI ACCELERATED CONVERSION OF HUMAN RESOURCES MANAGEMENT

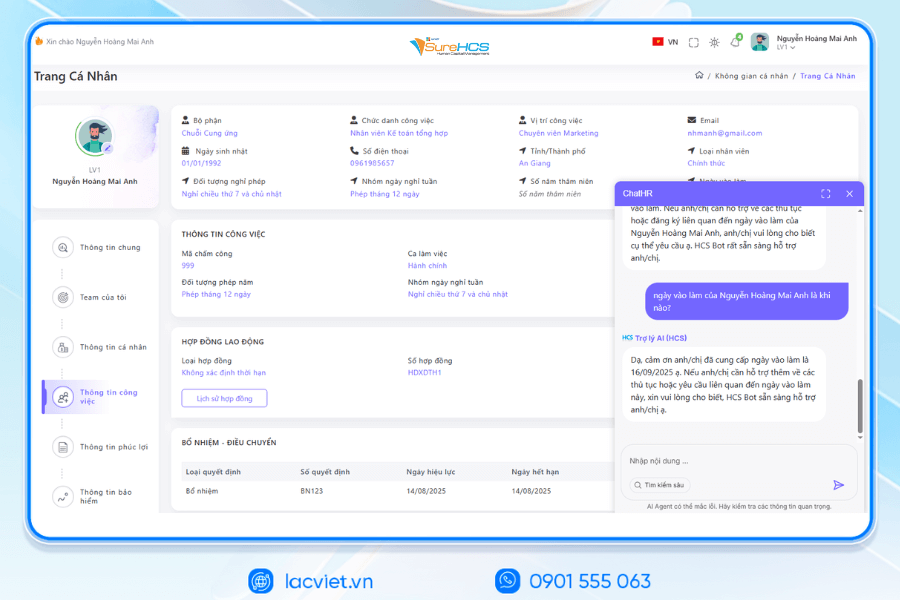

Lac Viet has officially launched The 3 AI assistant hr deeply integrated into the LV SureHCS including LV-AI.Docs, LV‑AI.Resume and LV‑AI.Help to automate the task administration, standardized data enhanced experience personnel

- LV‑AI.Docs: automatic dissection transfer data from documents such as CCCD, windows, SOCIAL insurance, by level of digital records, standardized

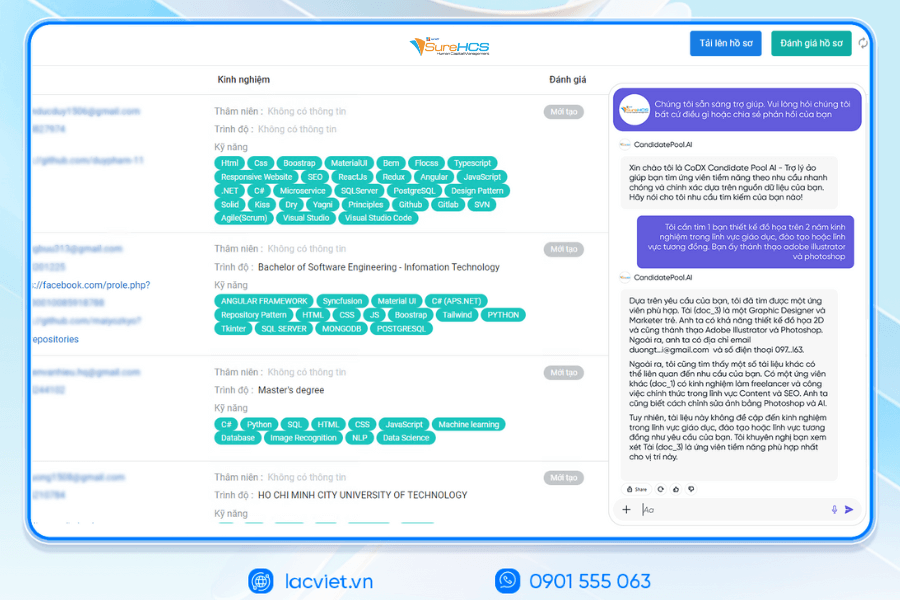

- LV‑AI.Resume: automatic dissection CV any format, analyst CV auto, construction, candidate profile, find people with the right criteria by prompt intelligent data mining candidate pool efficiency

- LV‑AI.Help: chatbot internal support, answer questions HR 24/7 access form process quick contextual user

TYPICAL CUSTOMERS DEPLOYING LV SUREHCS HRM

SureHCS are trusted and used by many large enterprises and leading corporations such as: Coca-Cola, Takashimaya, Textile SuccessfulPlastic Long Thanh Phu Hung Life, Airports of Vietnam (ACV)the business belonging to the SGCthe FDI enterprises in the fields of production, logistics, trade – in service.

- Coca-Cola Vietnam: System deployment LV SureHCS to digitize comprehensive human resource management group has standardized the data, the optimal operating HR according to international model.

- Textile company Success (TCM): Application LV SureHCS to manage hr, payroll, benefits, timekeeping and capacity profile for nearly 5,000 employees across 5 areas of activity – from textiles and fashion to real estate.

- Total company air Port, Vietnam (ACV): Choose to trust LV SureHCS to operate the system large-scale personnel with over 10,000 employees, 24 subdivisions, solved the problem of complex business of modeling state-owned companies.

SureHCS particularly suitable for:

- Large-scale enterprise, from 300 to 10,000 hr

- Corporations and enterprises multi-company, multi-branch

- FDI, manufacturing, factory, logistics, aviation should attendance – analysis ca – salary calculator complex

- Businesses are C&B peculiarities, need custom depth according to the actual operating

- Businesses are personnel management using Excel, many types of timekeeper, need automate the entire process

SIGN UP TO RECEIVE DEMO NOW

WHY BUSINESSES SHOULD CHOOSE TOUCH THE SUREHCS?

- Customized according to the actual business, no pressure mold as packaged software.

- Handle the personnel – salaries complex that many software HRM other does not respond.

- Deep understanding operated business English & FDI, ensure compliance with legal Vietnam (labour, SOCIAL insurance and personal income tax).

- Ecosystem integration strength: attendance – payroll – bank – SI – electronic contract.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: surehcs@lacviet.com.vn

- Website: https://lacviet.vn | www.surehcs.com

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

The choice of the form of paid not just a matter of compliance with legal regulations but also the strategic hr management important direct impact on work performance, operating costs and the ability to retain talent. Businesses need to carefully consider between characteristics industry, production model – business, objects of labor, as well as development goals, to apply the method paid accordingly.