In the context of the market increasingly competitive, the construction of the salary scale is not only required by law but also a strategic tool for business management efficiency. A system of the salary scale is in reasonable design will help balance between the affordability of the business and expected income of workers, while improving transparency, fairness in the organization.

This article Lac Viet will help businesses understand the concept, role and importance of the salary scale, at the same time provides detailed instructions on how to build the salary scale, how the salary scale in accordance with the practice activities.

1. The salary scale is what? Why enterprises should build?

1.1. The salary scale is what?

Pay scale system is arranged wage in each position, job titles in the business, including a lot of different salaries. Each tier shown wages increasing by seniority, ability, or working results.

For example: A sales staff can be arranged 5 pay grade, from 8 million/rank 1 to 12 million/rank 5. Thanks to that, the business easily manage the process of increasing the salary according to seniority or achievement.

Need to distinguish:

- Basic salary: fixed sum charged for labor, is platform to the other mode.

- Minimum wage: the floor Level due to state regulations, the business is not paying lower.

- Pay scale: administration tool, reflecting the remuneration policy, internal, must be higher than or equal to the minimum wage.

1.2. Why enterprises should build?

Pay scale not only is the figure the dry, but also bring many practical benefits:

- Ensure internal: Employees of the same title, the same level wage equal; one who has the power or seniority, higher will be paid at the higher rank. This helps limit the discontent, reduce the risks of quitting.

- Base legal, financial: pay scale is the basis of social insurance contributions, personal income tax and other benefits.

- Tools attract retain talent: A system of wage transparency roadmap advance clear motivation for employee engagement long term.

If the business does not build or operate the pay scale prescribed will be faced with many implications:

- Legal risk: the Decree 12/2022/ND-CP regulating the business in violation can be fined from 5 – 10 million.

- Lost internal: Staff ease of comparison, arose psychological discontent, reducing performance.

- Increased personnel costs, indirect: the Rate of high absenteeism synonymous with the cost of recruiting and training more.

As such, understanding how to build the salary scale not only help businesses comply with the law, but also create a platform for hr management modern sustainable.

2. Legal grounds about the building of the salary scale

The construction of the salary scale can not be made arbitrarily, but must be based on the grounds of the current legislation. This is the basis to ensure businesses comply with regulations and limit legal risks, creating a wage policy transparent and reasonable.

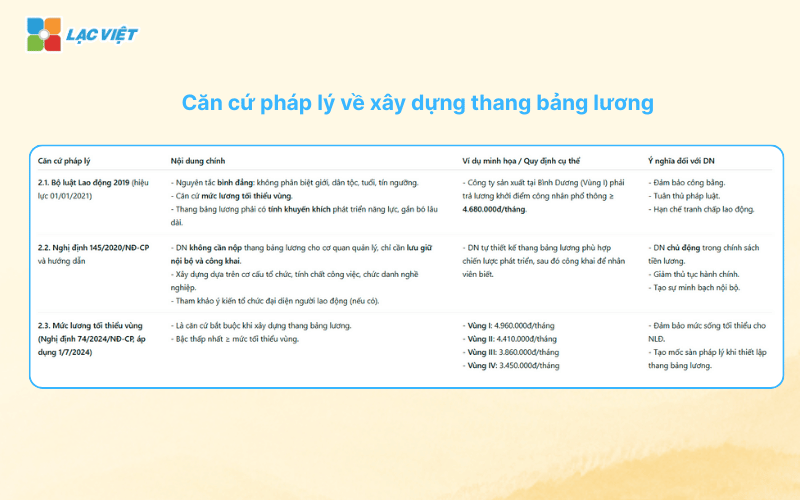

2.1. The Labour code 2019

The Labour code 2019 (effective from the date 01/01/2021) is writing important legal regulations, the general rule when businesses set pay scale. A number of the core include:

- The principle of equality: the Business must build the salary scale ensure fairness, irrespective of gender, ethnicity, age or creed.

- Based on the minimum wage: starting Salary of the lowest rank in the wage scale must be equal to or higher than the minimum wage due to The state announced.

- Ensure recommended: pay scale must have the notches higher wages to encourage employees to improve capacity, long-term commitment to the business.

For example: A manufacturing company in Binh Duong (department I) to ensure the starting salary minimum for ordinary worker from 4.680.000/month or more, according to the regulations on minimum wage.

2.2. Decree 145/2020/ND-CP and the written instructions

Decree 145/2020/ND-CP the guide details some articles of The Labor law 2019, which contains provisions related to the construction of the salary scale:

- Business is the right to self-determination: From date: 01/01/2021, businesses are not required to submit the salary scale for management agencies state as before. Instead, businesses are responsible for keeping internal and public to the workers know.

- Construction principle: the salary scale should be based on the organizational structure, nature of work, title the profession in accordance with the development strategy of the business.

- Transparency in the application: Business should consult with the representative organization of the workers in the base (if applicable) prior to official release.

This facilitates the organizations and enterprises are finding out information on how to build the salary scale more actively in the design of policies, wages, instead of depending on administrative procedures.

2.3. Minimum wages latest

The minimum wage is the government announced every year is grounds for mandatory when setting up the salary scale. From date 1/7/2024, Decree no. 74/2024/ND-CP official application replaces Decree no. 38/2022/ND-CP dated 12/6/2022, the minimum wage is as follows:

- Region I: 4.960.000/month

- Region II: 4.410.000/month

- Region III: 3.860.000/month

- Region IV: 3.450.000/month

(Source: The portal of electronic government)

Thus, when designing how the salary scale, business required to take the minimum wage as a landmark floor for the lowest level, then determine the distance between the notches to ensure the development of income according to seniority or competence.

3. How to build pay scale details for business

Building stairs payroll is the process required the combination of legal regulations, operational practices and hr strategies of the business. The organizations and enterprises are finding out information on how to build the salary scale is often interested in three main factors: compliance, fair competition. Below is the detail process:

3.1. Determine the organizational structure and functional groups the work

First of all, businesses need to clearly define the organizational structure consists of departments and job titles. This helps to classify the location groups according to the nature of work, level of expertise, responsibility.

For example: A company has 50 personnel can divide into groups of titles is as follows:

- Management team (directors)

- Professional groups (Staff, financial, personnel, engineer technology)

- Support groups (administrative Staff, reception)

- Group of unskilled workers (production workers, warehouse staff)

From this structure, business easily built of wage for each group. Such group management can take 5 – 7 rank, while the workers have 3 – 5 notches to reflect seniority and workmanship.

3.2. Collect market data, reference salary

To ensure competitive, businesses should refer to the average wage in the market for each location.

The source reference common include: Navigos Group, Mercer, Adecco or reports on the labor market from the General statistics office. These comparisons help business just to keep be fair, internal, just make sure there are no “lag” in comparison with common ground from which to increase the ability to attract retain talent.

3.3. Determine the distance wage reasonable

An important principle in the way the salary scale is the distance between the wage. Usual, reasonable distance ranges from 5% – 7%.

For example, If level 1 of the accountant is 8 million, then tier 2 should be from 8,4 – 8,6 million. This gap is enough to create motivation to strive, but not too high lead to loss of balance the budget.

If the distance is too small (under 3%), employees will not feel the difference. On the contrary, the gap is too big (over 10%) can cause unequal and difficult to maintain stability in personnel costs.

3.4. Construction principle of salary associated with the KPI, capacity

To the salary scale really means, enterprises should attach the increase in wage to the criteria specific measurement such as:

- KPI (Key Performance Indicator): Complete the target business or just personal goals.

- Professional competence: evaluation results workmanship skills.

- Seniority: Number of years with the business.

This not only helps businesses control the wage bill, but it also creates fair environment, promote productivity.

3.5. Drafting issued pay scale

After identifying the factors, enterprises need to drafting table the wage scale in the prescribed form, which is clearly shown:

- Name job title

- The number of degrees of wage

- Salary for each rank

Illustrative examples:

| Titles | Tier 1 | Tier 2 | Tier 3 | Tier 4 | Rank 5 |

| Staff accountant | 8.000.000 | 8.400.000 | 8.800.000 | 9.200.000 | 9.600.000 |

Under current regulations, businesses no longer have to pay the salary scale for agencies, labor management, but must be kept internal and public for laborers to know. This helps increase transparency to avoid disputes later.

3.6. Periodically review and adjust

The salary scale is not a document “do once and then leave it”. Businesses need to revise periodically, minimum once a year or when there are important changes such as:

- State regulation of the minimum wage.

- Business scale, appear the new location.

- Labor market volatility.

For example: in the Year 2024, when the government increases The minimum wage more 6%, many businesses are forced to update the pay scale to ensure compliance, and retain personnel.

The timely adjustment to help businesses avoid penalties, at the same time enhance the image recruiter. In particular, with the business development speed quickly, the flexible updates also help to control hr costs more effectively.

Thus, the process by building the salary scale is not just a legal procedure but also the tools human resources management strategy. If done correctly, the business will just ensure compliance with the law, just to optimize costs while improving the mounting employees.

4. Samples payroll excel file standard for business

The form, pay scale standard pre-designed to help businesses have the basic foundation to deploy, saving time in the initialization phase. However, businesses need customize the indicator of the wage coefficient, or basic wage to match the scale and industry business. This is also a useful starting point for the new business establishment or no hr department in charge.

5. Important note when making the salary scale

The construction and application of the salary scale in the enterprise is not merely a legal requirement but also directly affects the fairness, motivation operating cost. When done, the organization should pay attention to some of the following factors:

- To avoid gap wage is too low or too high: If the distance between the wage is too small, the staff is hard to see the difference in income, thereby reducing the motivation to strive. On the contrary, the distance is too large can cause the income gap unreasonable and create financial pressures for the business.

- Should not copy general form, which must be customizable according to business: Every business has particular industry, organizational structure, level of competition is different. Therefore, the application of machinery a sample of the salary scale is available easily lead to the situation “out of phase” with the fact that remuneration policy takes away the competition. For example, in the field of technology, the salary for the position programmers often significantly higher than the market average, while a manufacturing enterprise re-prioritize budget to block direct labor.

- Ensure transparency with workers: According to The Labour code 2019, business to publicly pay scale at work for laborers to know. This is not only to meet legal regulations, but also helps increase transparency, reduce disputes and enhance the trust of employees. When employees clearly see the mechanism payroll, they are easy to stick more permanent, because understand that their rights are guaranteed fair.

- Salary 3P what is? Distance calculator & excel Template STANDARD construction systems salary 3P

- Understand correctly the deductions from salary to calculate correctly and manage effectively

- Accounting salaries and deductions from wages, standard circular 200

- 4 How to manage payroll for business from crafts to digitize automatic

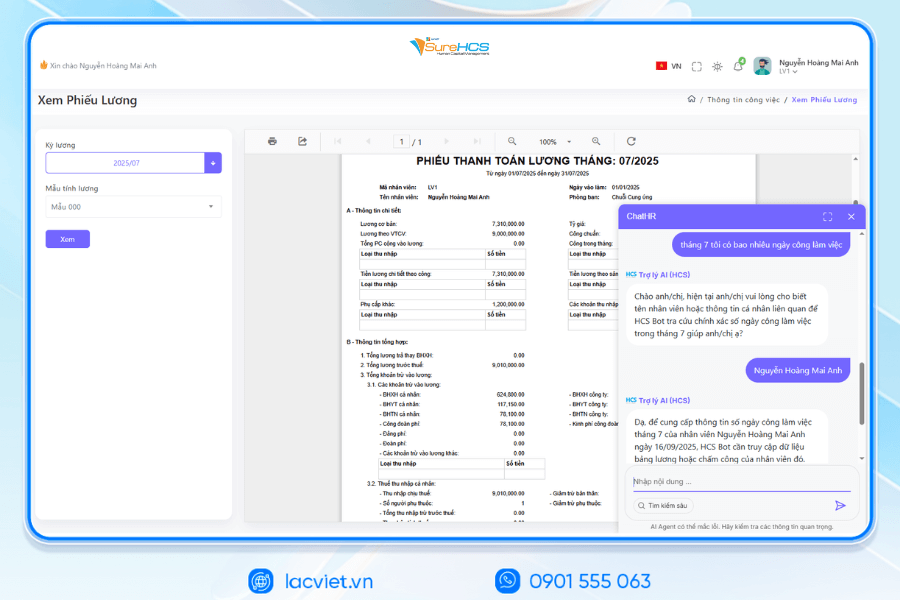

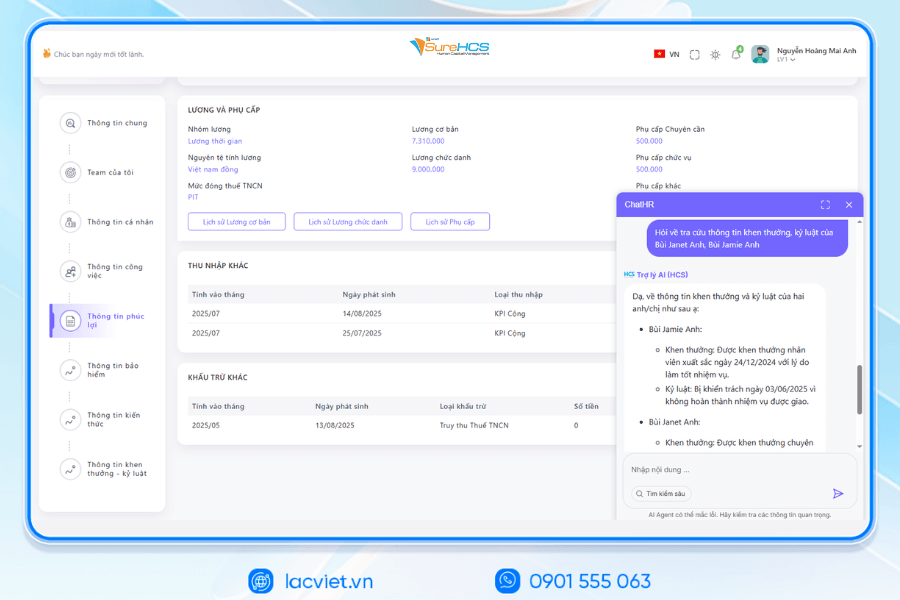

6. LV SureHCS HRM – support tool construction management staff salaries, the standard efficiency

In the context of labor market fluctuations quick, businesses need to take advantage of modern tools to build, manage, pay scale more effectively, rather than just rely on how to make crafts on Excel.

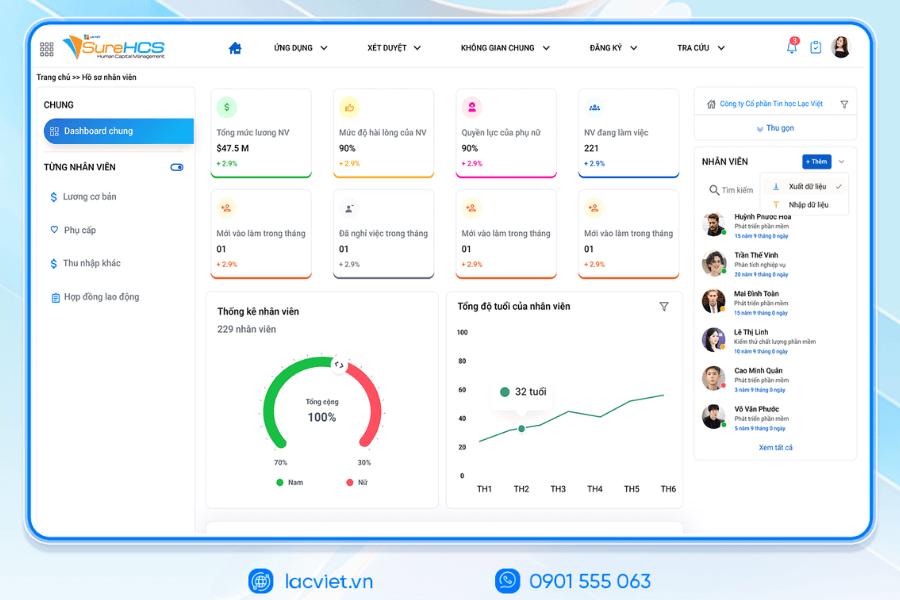

With respect to the business can scale from medium to large human resource management software are essential tools to standardize automation payroll process. A number of outstanding value that the business received when app:

- Automate calculations, updated according to the latest regulations: minimize the risk of errors, especially when there is a change in the minimum wage, personal income tax or social insurance.

- Time saver resources: Instead of losing hours and hours to scrutinize formula in Excel, the system will calculate instant ensure accuracy.

- Ensure transparency, easy access to data: When employees have questions, HR or payroll accounting can immediately extract reports, minimizing conflicts.

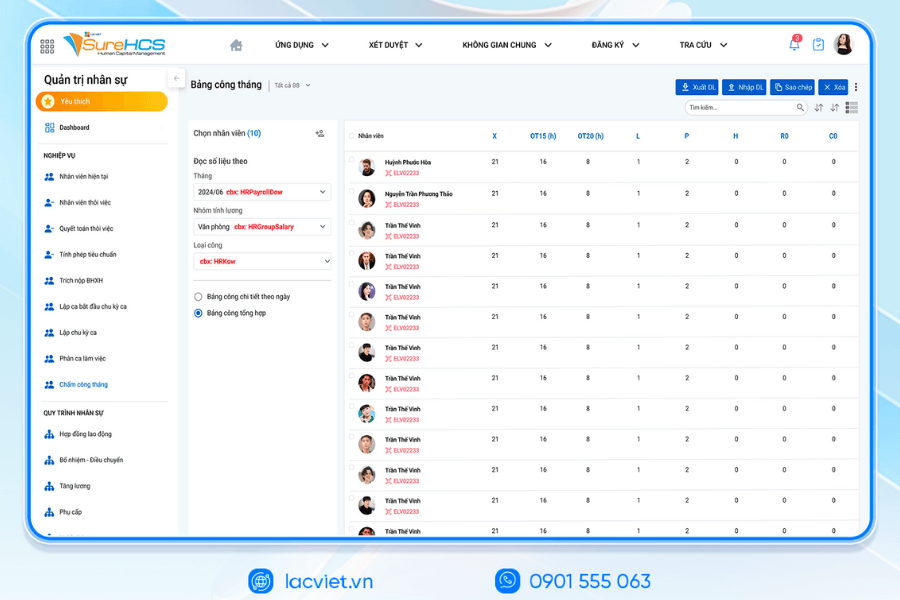

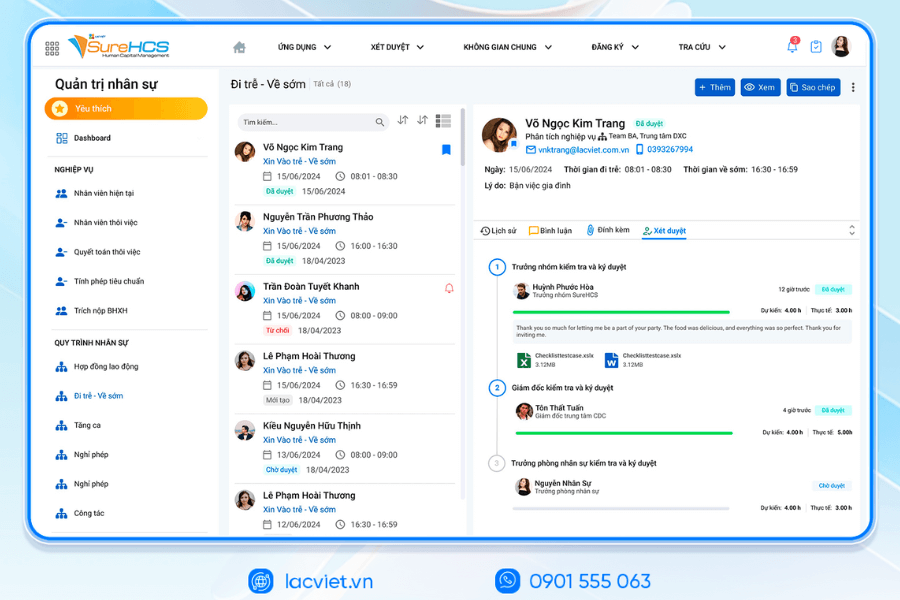

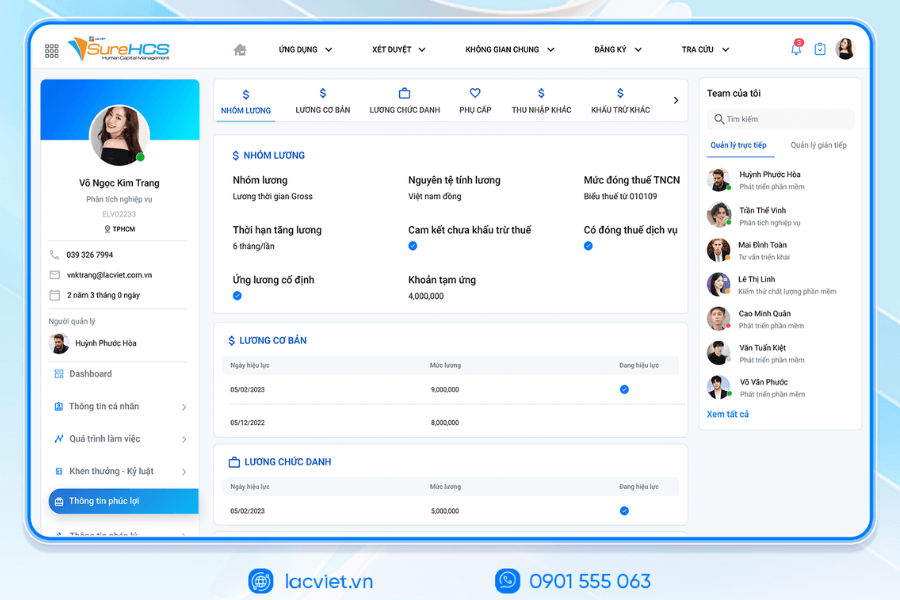

- Integration with other modules: As attendance management, contract management, welfare, help shape an ecosystem management personnel sync.

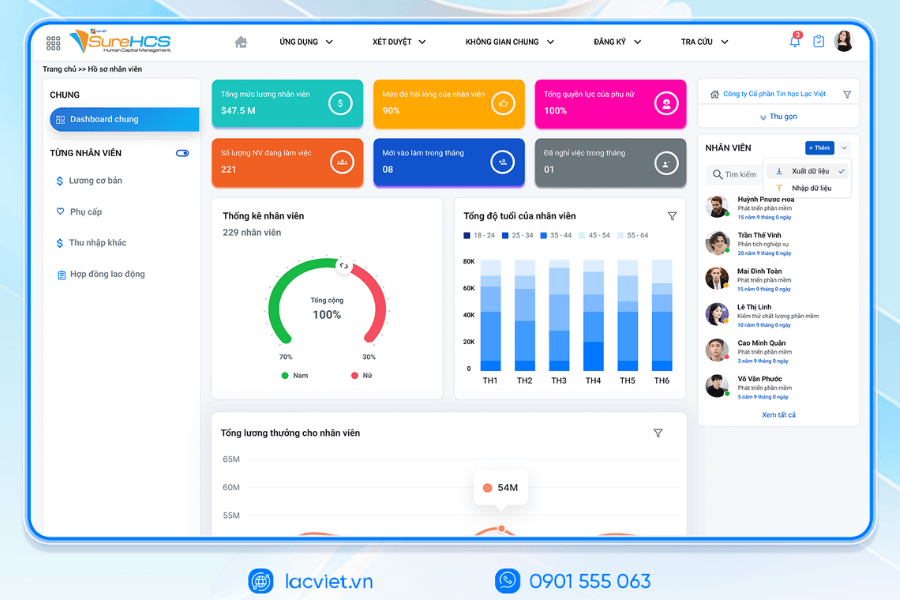

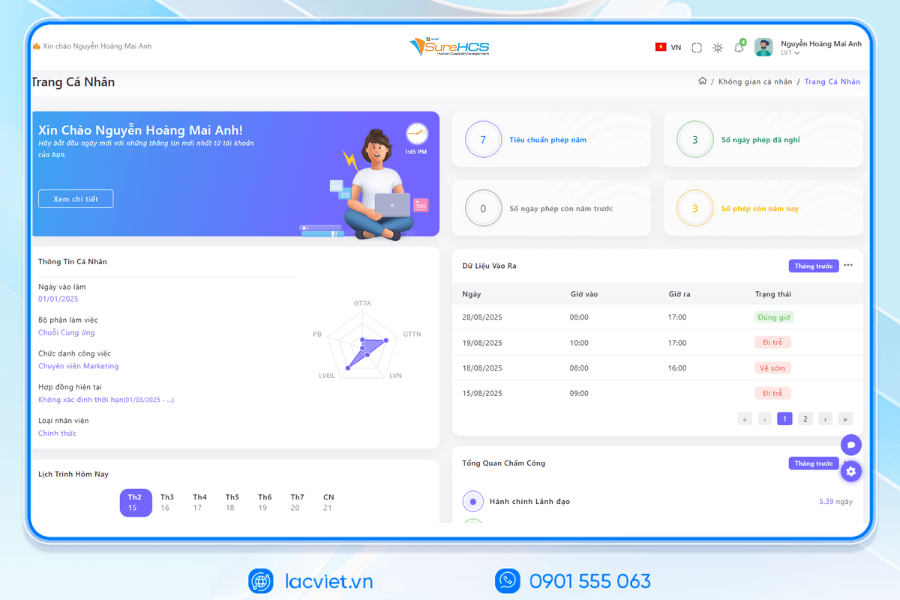

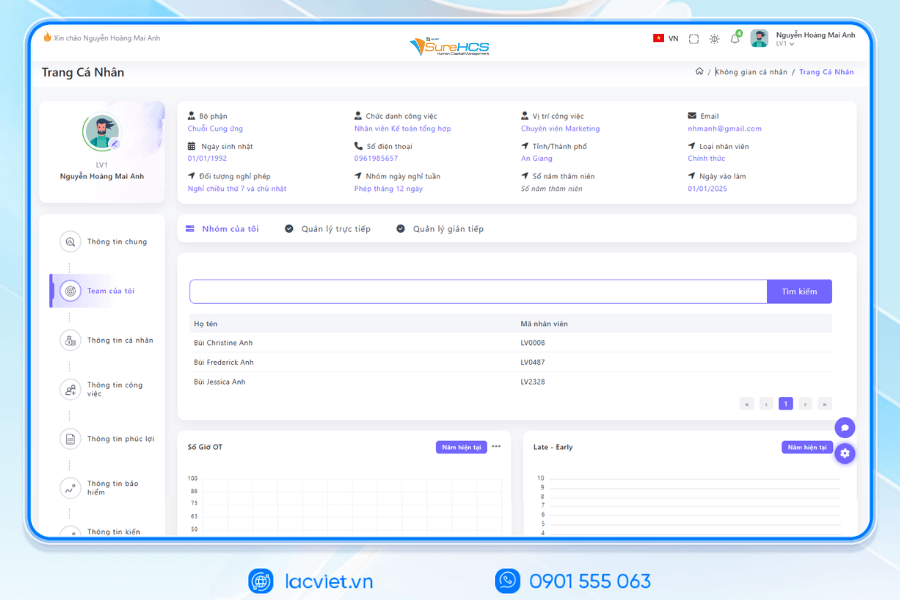

LAC VIET SUREHCS – HR MANAGEMENT SALARY C&B CUSTOM DEPTH FOR BIG BUSINESS

Lac Viet SureHCS is software HRM personnel management comprehensive, developed by Lac Viet – unit more than 30 years of experience in the field of management software business in Vietnam with international standards such as CMMI Level 3, ISO 9001:2015 and ISO 27001:2013.

SureHCS not only meet the professional personnel standards, which are designed to handle the hr – C&B – wages complex, large-scale, multi-company, multi-sector, in particular in accordance with FDI enterprises, corporations, factory, logistics, aviation, hotel, trade – in service.

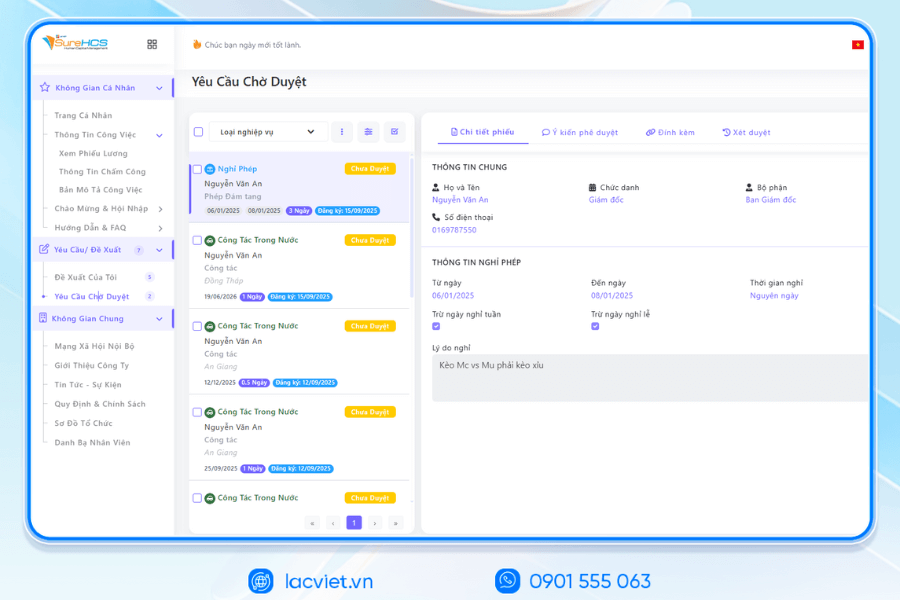

The system is flexible deployment On-premise or as a custom model in depth, to help businesses automate the entire process hr – attendance – payroll – benefits – insurance, complete replacement job management using Excel discrete.

The module's core hr software lacviet SureHCS:

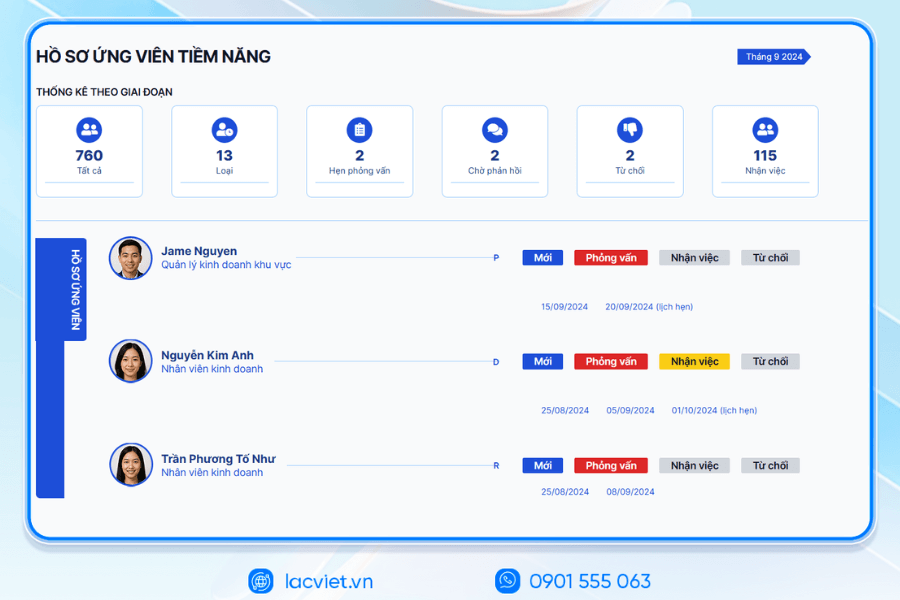

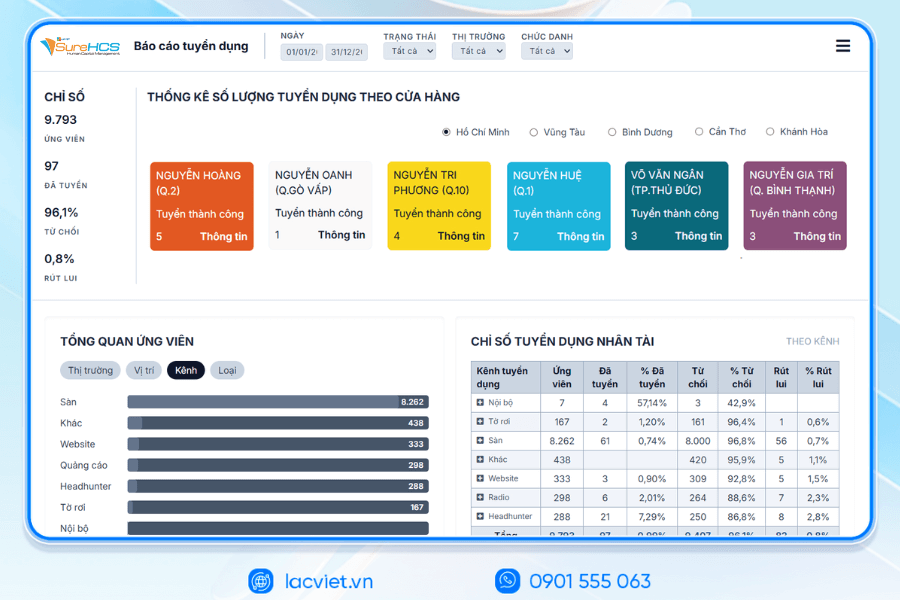

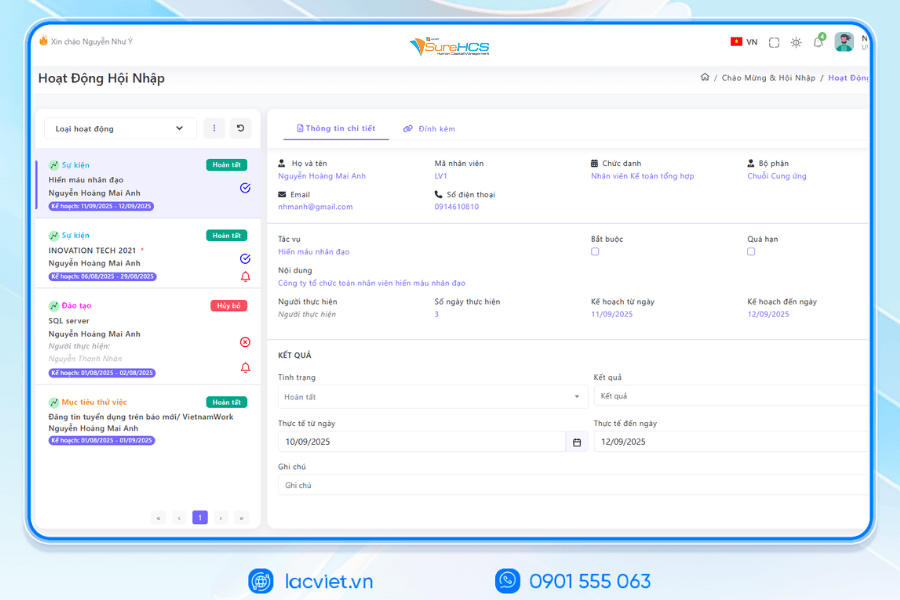

- The Recruit – Training: Management throughout the recruitment, integration, training, hr support and build the Talent Pipeline for large-scale enterprise.

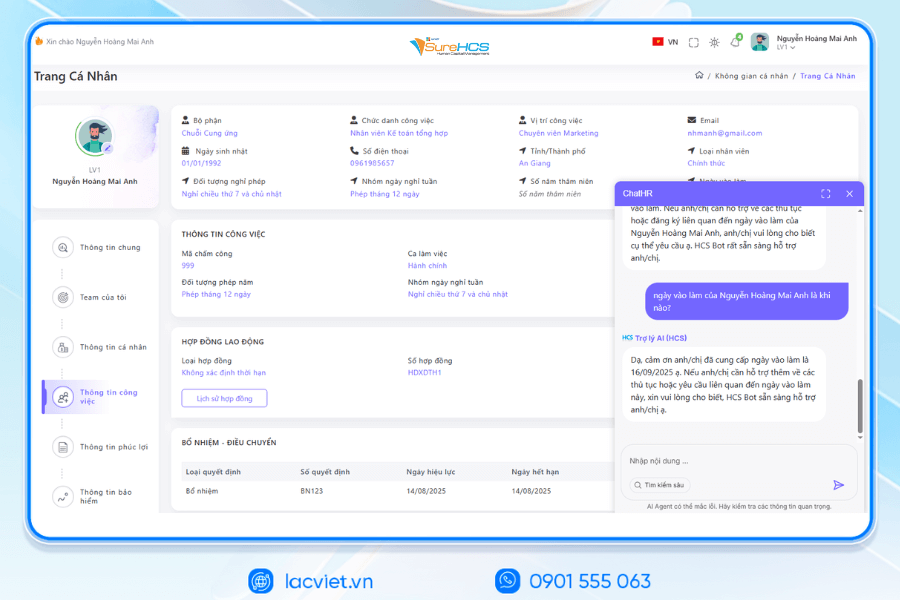

- Port information & records Management personnel: Store personnel records, electronic focus, portal self-service for employees and contract labor power on the system.

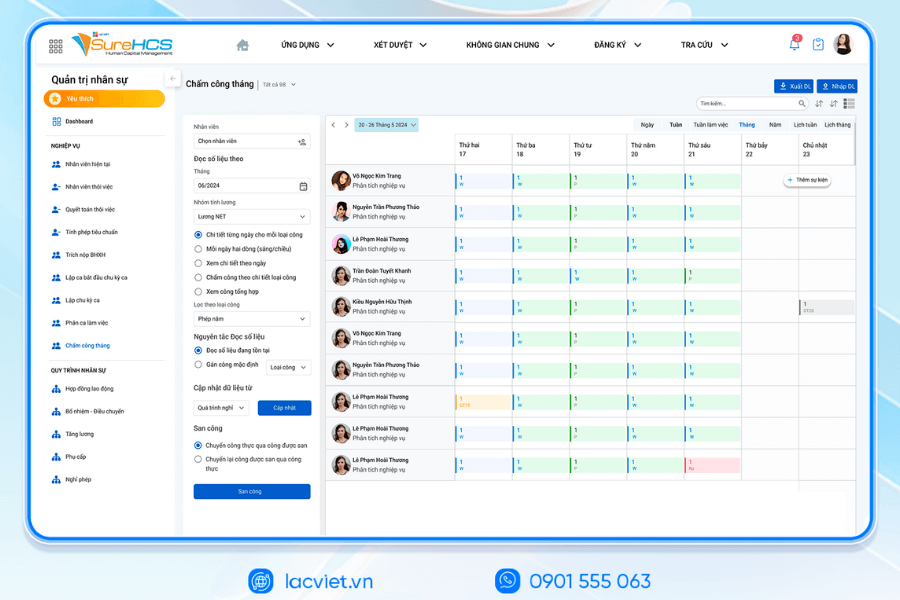

- The timekeeper: Dots, multi-form (fingerprint, face recognition, Face ID, GPS, Wifi, online), connect many types of timekeeper, support attendance by the hour, shift flexibility for the plant, and hotels.

- The payroll & C&B: Automatic salary calculation according to many models (hour, shift, product, 3P, KPI performance...), link directly attendance data – performance – welfare, completely replace the salary calculator using Excel.

- Welfare – SOCIAL insurance – salary: Management benefits flexible, integrated iVAN connect SOCIAL and electronic Bank Hub salary automatically, support pay multi-currency for FDI.

INTEGRATED AI ACCELERATED CONVERSION OF HUMAN RESOURCES MANAGEMENT

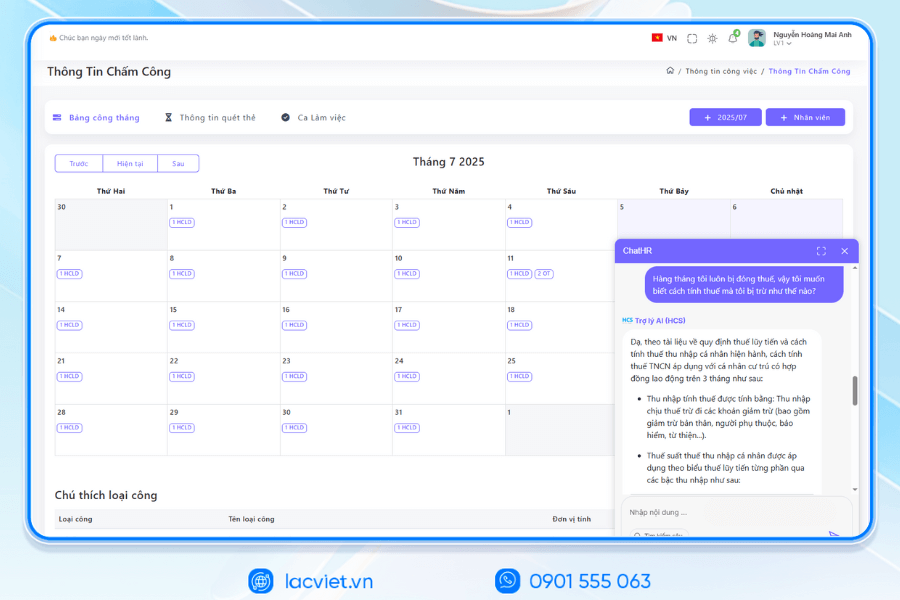

Lac Viet has officially launched The 3 AI assistant hr deeply integrated into the LV SureHCS including LV-AI.Docs, LV‑AI.Resume and LV‑AI.Help to automate the task administration, standardized data enhanced experience personnel

- LV‑AI.Docs: automatic dissection transfer data from documents such as CCCD, windows, SOCIAL insurance, by level of digital records, standardized

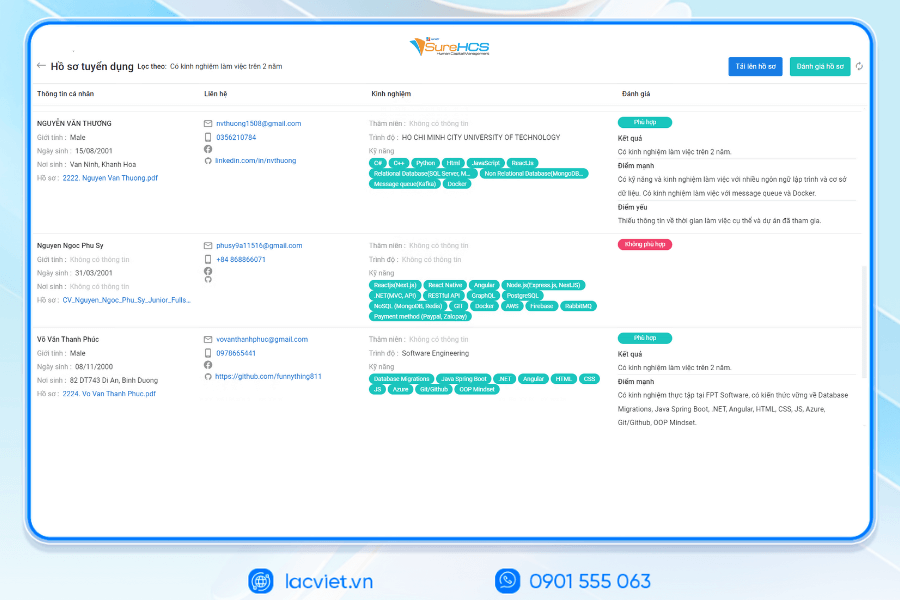

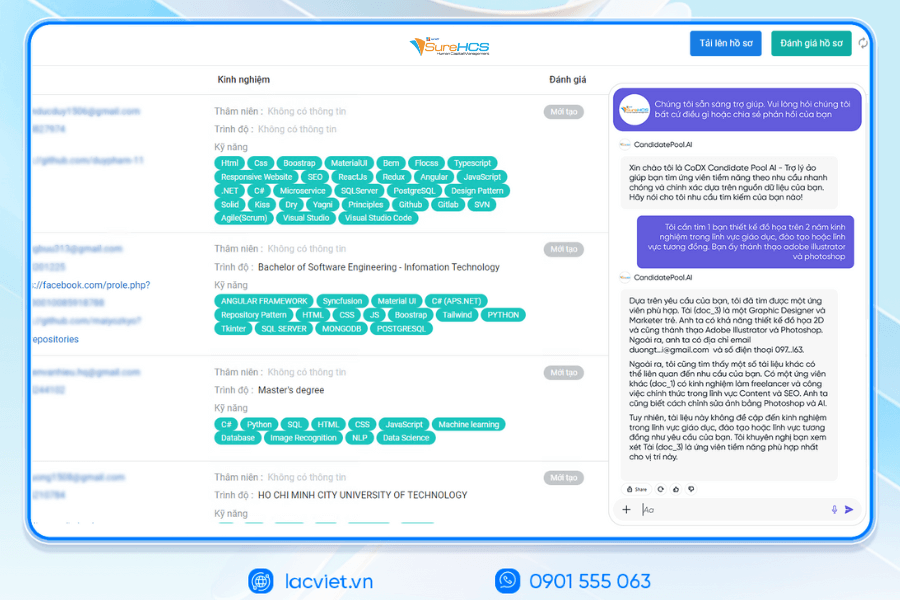

- LV‑AI.Resume: automatic dissection CV any format, analyst CV auto, construction, candidate profile, find people with the right criteria by prompt intelligent data mining candidate pool efficiency

- LV‑AI.Help: chatbot internal support, answer questions HR 24/7 access form process quick contextual user

TYPICAL CUSTOMERS DEPLOYING LV SUREHCS HRM

SureHCS are trusted and used by many large enterprises and leading corporations such as: Coca-Cola, Takashimaya, Textile SuccessfulPlastic Long Thanh Phu Hung Life, Airports of Vietnam (ACV)the business belonging to the SGCthe FDI enterprises in the fields of production, logistics, trade – in service.

- Coca-Cola Vietnam: System deployment LV SureHCS to digitize comprehensive human resource management group has standardized the data, the optimal operating HR according to international model.

- Textile company Success (TCM): Application LV SureHCS to manage hr, payroll, benefits, timekeeping and capacity profile for nearly 5,000 employees across 5 areas of activity – from textiles and fashion to real estate.

- Total company air Port, Vietnam (ACV): Choose to trust LV SureHCS to operate the system large-scale personnel with over 10,000 employees, 24 subdivisions, solved the problem of complex business of modeling state-owned companies.

SureHCS particularly suitable for:

- Large-scale enterprise, from 300 to 10,000 hr

- Corporations and enterprises multi-company, multi-branch

- FDI, manufacturing, factory, logistics, aviation should attendance – analysis ca – salary calculator complex

- Businesses are C&B peculiarities, need custom depth according to the actual operating

- Businesses are personnel management using Excel, many types of timekeeper, need automate the entire process

SIGN UP TO RECEIVE DEMO NOW

WHY BUSINESSES SHOULD CHOOSE TOUCH THE SUREHCS?

- Customized according to the actual business, no pressure mold as packaged software.

- Handle the personnel – salaries complex that many software HRM other does not respond.

- Deep understanding operated business English & FDI, ensure compliance with legal Vietnam (labour, SOCIAL insurance and personal income tax).

- Ecosystem integration strength: attendance – payroll – bank – SI – electronic contract.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: surehcs@lacviet.com.vn

- Website: https://lacviet.vn | www.surehcs.com

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

Construction of the salary scale is not only a mandatory procedure prescribed by legislation but also the administration tool important to help businesses create fairness, retain talent, and optimal personnel costs. Investing in a system hr manager salaries professional transparent suit particular business will become advantage long-term.