Mode business accounting is the system of principles, methods of accounting, issued by The state to help businesses recognize and provide financial information transparency unity in accordance with law. The correct application of accounting not only help businesses comply with regulations but also enhance capacity, financial management, support business decisions more accurate.

In fact, many businesses still have difficulty when implementing accounting regime, especially in the transition period number. The problem often lies in the choice of accounting framework suitable organization system account – receipt – books and update the new books from the year 2026. The application is not properly can distort the data, affecting the efficiency of financial management.

The same Lac Viet Computing analysis in a systematic way about accounting regime, from the concept, the mode is applied in Vietnam, significant changes in the coming period until the solution helps businesses implement effective and sustainable in practice.

1. Accounting what is the business?

1.1. Concept of accounting of business

Mode business accounting is the system of principles, methods, specified by The state board practice guide business organization – the accounting work in the process of operation. Through accounting, business know recorded service economy arose as how to use evidence from what accounted for in any account, record, and financial reporting according to certain structure.

Can understand a simple way of accounting like “design standard” for the accounting system. Based on this design, every business can deploy accounting in accordance with the scale and specific activities, but still ensure uniformity, accordance with the law.

Correct application of accounting not only aimed at “complete profile” under the regulations but also the pivotal role in operating activities, control over the enterprise. Specific accounting regime holds the following roles:

- Leaders understand the exact financial situation at each time point: business is profit or loss, cash flows that are safe enough or not, costs are accounted for a large proportion.

- Create the basis to control costs, minimize risks and losses. Especially with the business manufacturing, construction or many business branches.

- Provide reliable data for important decisions such as expanding investment, adjusted selling price, cost reductions or restructuring activities.

- Is an important foundation for apps, accounting software, ERP and transformation of finance and accounting. If there is no mode of accountants make the frame standard, the digitization will lack consistency, very difficult to control.

With respect to the organizations and enterprises are to find out information about accounting of business, noting a clear distinction between the three concepts are often easy to confuse:

| Concept | Accounting | Accounting standards | Accounting policies |

| Nature | Framework to guide practice | Guiding principles | Options apply to your specific business |

| Content | The system of accounts, vouchers, books and financial statements | Specifies how the recorded presentation of accounting information according to the true economic nature | Depreciation method, calculate the price of stock, revenue recognition... in the allowed range |

| Role | Is grounded directly to the accounting organization, getting things done every day | Orientation “noted how is right” in situations, general | Show how businesses use standard accounting regime in actual operation |

In the context of the accounting regulations increasingly flexible, especially with accounting regime applicable from the year 2026, the role of accounting regime was beyond the scope of legal compliance. This becomes the tool of financial management important, to help businesses control operations, increase transparency and ready access to the standards of modern management.

1.2. Why business required to apply accounting?

Apply mode business accounting is not only required by law but also is the foundation of financial management professional. This provision does not merely serve the state administration but also create value directly to the business in operating activities, financial control.

- Requires clear legal & compliance responsibilities: Under the provisions of the accounting Law, every business must organize the work of accounting in accordance with accounting be issued. This is a legal requirement mandatory, non-compliance can lead to the risk of legal sanctions.

- Basis for reporting accurate financial & tax settlement: accounting is the foundation to financial reporting regulations, tax settlement accurate. To help businesses meet the requirements of regulatory authorities in order to limit the risk adjustment, arrears or penalty.

- The foundation for financial transparency & internal control: in Addition to required compliance with legal as well as accounting is the foundation for financial transparency, internal control. Help business track cash flow, control costs, reduce risk, enhance credibility with the bank, partners and investors.

- Create platforms for the conversion of & modern management: correct application of accounting is the foundation for transformation of modern management. To help businesses implement effective accounting software, ERP system, as well as financial reports in real time, thereby optimizing resources and reducing operating costs long-term.

2. The mode of business accounting is applied in Vietnam today

2.1. Mode business accounting circular 99/2025/TT-BTC replaces circular no. 200/2014/TT-BTC

Circular 99/2025/TT-BTC due to the Ministry of Finance is the new accounting system, officially replacing the circular 200/2014/TT-BTC applicable for the financial year starting from the date 01/01/2026. This is step important adjustments to modernize frame business accounting, in accordance with administrative requirements as well as the trend of international integration.

Compared with circular 200, accounting circular 99 are built to reduce rigidity in the organization of accounting, increased autonomy for business as well as enhance the role of accounting in financial management internal. This circular does not only focus on compliance requirements legal but also create the foundation for the standardization of data, application, technology, transformation of finance and accounting.

About the overall direction, circular 99 emphasize the main content such as:

- Increased flexibility in the organization accounting system business.

- Update the system account, the financial statements in accordance with practices of business today.

- Enhanced transparency requirements, financial information, neckline practices and accounting standards the international.

Enterprises are adopting circular 200, the transition to circular 99 from the year 2026 is both a legal requirement and it was the opportunity of reviewing accounting system, improving the quality of data to support decision-making better governance.

2.2. Mode business accounting, small & medium circular 133/2016/TT-BTC

Besides accounting circular 99/2025/TT-BTC, the current circular 133/2016/TT-BTC is still in effect and continue to be applied to the small business & medium in Vietnam. This is the mode of accounting is built with the goal of reducing pressure compliance, simplify the accounting profession, in accordance with the business on a small scale, activity patterns, not too complicated.

Characteristics of accounting according to the circular 133:

- The system of accounts & financial statements are designed more simple: circular 133 system design, accounts software limited open more account details. This approach helps the accountant to record, control and reduce the risk of errors in accounting.

- Matching small scale business, accounting and personnel limitations: accounting circular 133 helps to reduce the volume of records, ease of training when transfer the work, at the same time limiting the operating costs of the accounting department.

- Flexibility in the organization vouchers & bookkeeping: circular 133 allows businesses to proactively design stock from as well as the books aligned with internal processes to meet the requirements check and compare. Help small business easy-to-integrate software, accounting, sales management and reduce operation manually.

- Can be applied in parallel with the new accounting system, according to circular 99: In the period of transformation, business small/medium can continue to apply circular 133 if not ready to personnel or system. Help business consolidation accounting platform, standardized data step by step switch to circular 99 when conditions are suitable.

In summary, the circular 133/2016/TT-BTC is not just a mode of accounting “simplified”, which is the real solution to help small business & medium balance between legal compliance and governance. Choosing the right accounting regime right from the start will help businesses reduce risk, optimize resources ready for the next development step.

2.3 changes in accounting from important 2026

From 01/01/2026, circular 99/2025/TT-BTC official replacement circular 200, bringing many changes in the accounting profession, financial management, and reporting of data. This requires not only compliance with the law but also the opportunity for enterprises to improve the quality of financial management internal.

The business is designed vouchers & bookkeeping

Mode new accounting allows business owners the construction documents in accordance with the peculiarities of operation, for meet legal regulations and inspection requirements, for reference. Thus, accounting information closely reflects more practical as well as favorable when integrated with accounting software – ERP.

Additional accounts accounting new

Mode new accounting system updates account to reflect more closely the nature of economic activity, requires modern management, the typical includes:

- TK 215 – biological Assets: keep track of your own value crops, livestock, helping to reflect the peculiarities of agricultural production rather than pooled in fixed assets.

- TK 2295 – Reserve losses biological assets: recorded downside risk due to natural disasters, disease outbreaks, reflecting the full cost and risk level.

- TK 82112 – CIT supplementation according to tax the global minimum 15%: reflect tax obligations arising enterprises with international operations.

The addition of this account helps financial statements reflect the true state, support effective analysis each field, as well as improve the quality of the forecast, financial decisions.

Tighter regulation of financial statements & notes

Mode new accounting requirements business more transparent in notes to clarify accounting policies the same assumptions critical. Thereby, improve data quality, increase reliability of financial reporting as well as support leadership decision-making management more accurate.

The impact to the organization, accounting, software & financial management

Mode new accounting allows business owners the construction documents in accordance with the peculiarities of operation, for meet legal regulations and inspection requirements, for reference. This approach allows accounting information reflects the fact more favorable than in integrated accounting software – ERP.

3. The core content of the accounting business

Accounting is not abstract concepts or serve only for tax reporting. The essence of the accounting business is shown through the four components core: evidence from the accounting system, account, ledger, and financial reporting. This is the “backbone” of the entire accounting system is also data platform for business management.

3.1. Voucher system accounting

Accounting vouchers are legal grounds to take every economic arising in business. Can understand simple, if no voucher valid, the profession that there is no basis for accounting, there is no legal value as well as potential risks of tax.

In operations management, finance, stock from not just to “save profile”, which plays an important role in internal control. The actual role of accounting vouchers:

- Demonstrate professional incurred are real, legitimate, and reasonable.

- Is the basis to control costs, revenues, debts and assets.

- To help businesses protect themselves when inspections, tax or audit independence.

For example, the Same account the cost of buying service, if the business is full contract, invoice and test records revenues and expenses that have the ability to be accepted as tax settlement. Conversely, the lack of evidence from the will that cost is directly affect the profit after tax.

This shows the organization of the stock from this, according to mode of business accounting serve not only compliance but also reduce financial risks, losses internal.

A number of symptoms from common accounting in business:

- Bill of sale, purchase receipt to

- Receipts, voucher

- Payroll, timesheets

- Commissioning of the contract

3.2. Account system accounting

Account system accounting is a tool to classify, track, summing up the business economy, according to each group of objects such as assets, capital, revenue, expenses.

In mode, business accounting, account system is built according to the principles reflect full – clarity – consistency, help businesses see the “financial picture” in a structured way, instead of numbers, discrete.

Value management when properly used the system account accounting:

- Help accounting accurate revenue, cost, and determine the correct gain or loss in each period.

- Support financial reporting fast, lose depends on the handling end of the period.

- Facilitate data analysis in depth: according to the department, project, product, or branch.

For example: if the business account opening details to track costs on a project by project leaders can quickly know which projects are effective, which projects beyond the budget to make timely adjustments.

In the context of the new accounting system allows businesses greater flexibility in the design of the system account, the leverage right, this will help improve the quality of data management instead of just serving external reporting.

3.3. Bookkeeping & accounting forms

Accounting is the collection, systematization, storage the entire accounting data according to the order time, economic content. If the voucher is “input”, then the ledger is where you turn that data into valuable information to use.

Now, according to mode of business accounting, there are several forms of accounting book popular, such as:

- General

- Journal voucher

- Diary – ledger

Each form has advantages, but the most important point is that businesses need to choose the form appropriate to the scale, the level of automation and accounting software are used.

In fact, the business has apps, accounting software or ERP is often preferred form general because:

- Easy to integrate data automatically

- Reduce duplicate records

- Convenient for access, check data

A system of accounting book is well organized will help enterprises shorten the duration closeout final pressure drop for the accounting department increases the reliability of financial data.

3.4. Financial statements in accordance with accounting business

Financial reporting is the output the most important of the accounting system, reflecting comprehensive financial situation, business results, as well as cash flow of the business during an accounting period.

In accounting, the financial statements required include:

- Balance sheet

- Report results of business activities

- Statements of cash flows

- Notes to financial statements

Angle management, financial reporting not only to file management agency, which also brings many practical value:

- The balance sheet helps leaders assess the health, financial solvency, as well as the level of capital adequacy.

- Report results of business activities that the business is profiting from, where costs are abnormally increased.

- Statements of cash flows reflects the ability to create real money factor, survival of the business.

- Notes to financial statements help explain the nature of data, accounting policies and the potential risks.

In summary, the four core content is the foundation of accounting. When held and operate properly, the accounting system not only meet the requirements of compliance with the law but also become a tool of financial management effective leader board support the correct decision.

4. Mistakes businesses often encounter when applying accounting regime

In the process of implementing the accounting system, many financial risks stemming from the fundamental flaws when applied accounting regime, not from complex business. These deviations are often difficult to notice right away, but will clearly revealed when expanding business scale, tax settlement, or work with banks, investors.

4.1. Wrong application of accounting compared to scale business

A common mistake is the choice of accounting is not in accordance with the scale, the level of development of the business.

- Many small business applicable accounting regime too complex, opening too many accounts in detail, reporting excess of actual needs. Make accounting department, overload management costs increase, but price value information brings not commensurate.

- On the contrary, not less business has expanded its operations (many branches, project, product) but still maintain the accounting system as simple as the initial stage. As a consequence, businesses do not track is effective each business segment, difficult to control costs when making decisions based on data.

This shows the selection as well as correct operation mode business accounting is a prerequisite to effective governance, not just compliance with the law.

4.2. Establishment certification, books are not defined properly

Flaws in the voucher – book is the direct cause leading to tax risks, as well as misleading financial statements. The common errors include the following:

- Stock from lack of required information or not enough legal grounds.

- Noted inconsistencies between documents – accounting – financial reporting.

- Store stock from the craft, scattered, difficult to access when needed for screening.

In many cases, businesses only discovered the problem when is tax inspection or audit, at this cost remedy is usually very large, including access to tax revenue – fines – cost adjustment data.

Organization vouchers – book right according to the accounting not only to “full record” but also the tools protection, business risk, legal, finance.

4.3. Do not update timely accounting regulations new

From the year 2026, the new accounting system, most official application with many important changes. However, many businesses have psychological delayed, wait until the “mandatory” new deployment, which leads to the result:

- Could not adjust the system account-books, reports.

- To edit the data retroactively, causing pressure for the accounting department.

- Incurred training costs, system upgrades in a short time.

Slow updates of accounting not only makes business is about compliance, but also disrupt the operation of financial management in the transition period.

5. Solution Accnet ERP helps business applicable accounting regime more effective

From mistakes on it can be found that the core problem of many businesses lies not in the lack of regulation, which is located in the way organizations operate accounting systems in practice. This is the reason why more and more entrepreneurs choose accounting software – ERP to standardized as well as enhance effective application of accounting business.

5.1. Standardized accounting procedures according to current mode

AccNet ERP supports business design as well as operating the accounting process in a synchronized way, consistency as well as keep abreast of the current accounting year. At the same time, ready to adapt to changes in the future:

- Standardized whole processing flow accounting, from voucher, accounting, control of data to prepare financial reports and management reports.

- Ensure compliance with the provisions of accounting – financial, but still allows for flexibility according to specific industry and business models as well as the required internal management of each business.

- Supports extended scale easily as business more branches, project, product, or activity patterns new without upsetting the accounting system out there.

Thanks processes are standardized across the system, businesses can actively control the financial situation, to reduce dependence on personal experience limit the risk when there are operational checks, inspections or settlement.

5.2. Application software accounting – finance in business

Compared with the method of recording or use multiple software discrete, the application AccNet ERP bring value markedly for accounting and financial management:

- Automation of accounting as well as data processing, significantly reducing action, limit errors and depends on the individual.

- Data accounting – finance is concentrated, contact information, help control access to collated data quickly and transparently.

- System financial statements as well as management reports are timely updates. Support leader board to monitor the situation financial decisions based on accurate data.

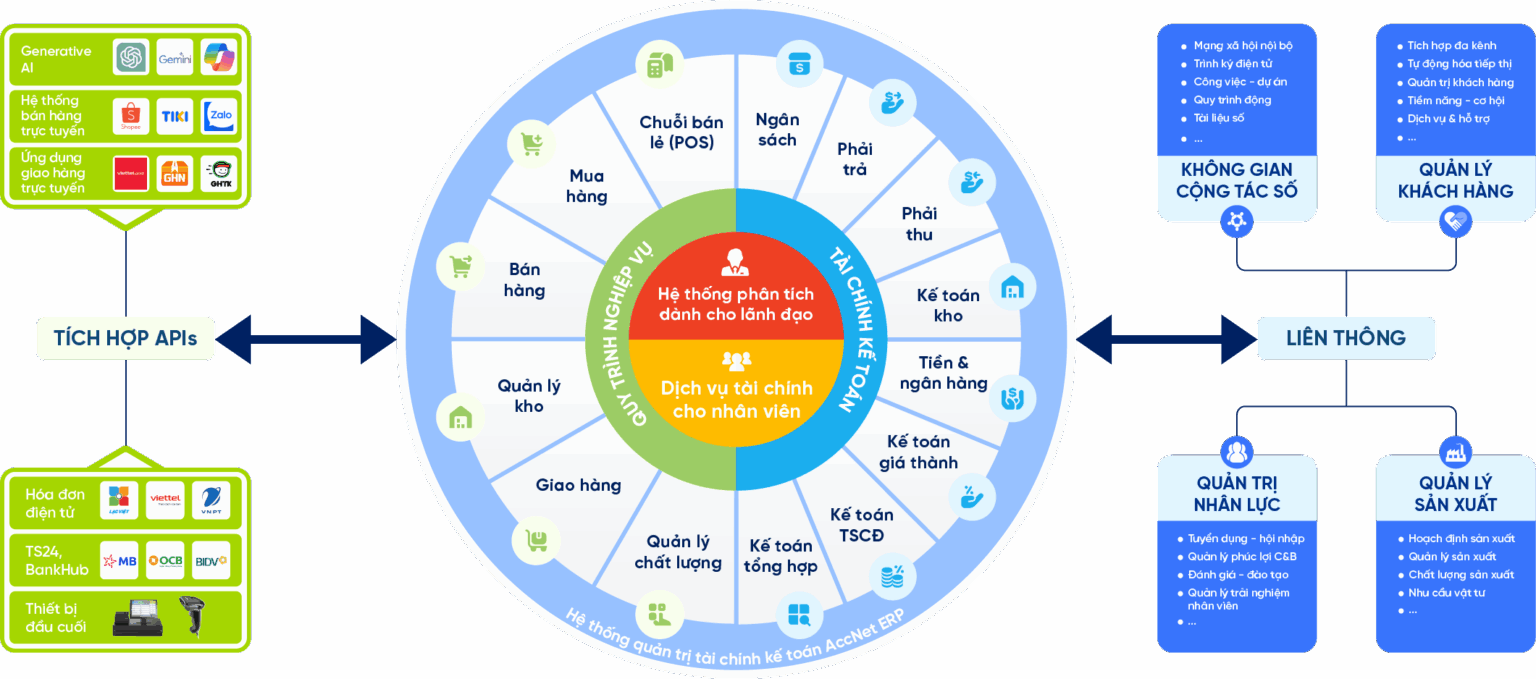

ACCOUNTING SOLUTIONS ACCNET ERP INTEGRATED AI AUTOMATE ALL BUSINESS

AccNet ERP is a software solution financial accounting integrated in the management system, comprehensive enterprise, which is developed by Lac Viet corporation. Difference highlights of AccNet ERP is the app artificial intelligence (AI) in many accounting process to help businesses:

- Automation of accounting and classified documents.

- Improving the accuracy in data control.

- Shorten processing time business accounting – financial.

Thanks to that, AccNet ERP not only is support tool but also a “smart assistant” with the business in financial management transparent effect.

Feature highlights:

✔️ Automatic accounting vouchers, collate public debt thanks to AI.

✔️ Manage your finance – accounting multi-branch, multi-subsidiary.

✔️ Financial statements consolidated standards of Vietnam & international (VAS, IFRS).

✔️ Cash flow management, budgeting, forecasting the exact cost.

✔️ Connect with the manure management system, hr, production, sales to sync data.

✔️ Integration of AI in data analysis, risk warning and proposed optimal scheme.

TYPICAL CUSTOMERS ARE DEPLOYING ACCNET ERP

- Nitto Denko – control production costs thanks to the application of accounting costing: Nitto Denko has chosen solution AccNet ERP to deploy the system accounting calculating cost ofhelp business control costs more effectively in the production process. After a period of use, company, highly effective, practical system that brings, as well as the degree of stability superior to other software in the market.

- ANTESCO – restructuring process works with management accounting operation: At ANTESCO, our team of consultants and deployment of AccNetERP has collaborated closely with the business in the first phase, reset the standard process and construction work-flow related departments throughout. The solution has helped ANTESCO significantly improve management capabilities, operating in a synchronized way and versatile

- Khatoco – expansion pack solution AccNetC after the successful implementation of original: Lac Viet has successfully deployed package solution AccNetC for trade co., LTD Khatoco in Nha Trang, according to the agreement signed on 29/07/2014. After the system is first put into operation efficiency, Khatoco intends to continue cooperation and expand the distribution finance – accounting and retail management with AccNetC, expressing the deep trust in implementation capacity and quality of service from Lac Viet.

SIGN UP TO RECEIVE DEMO NOW

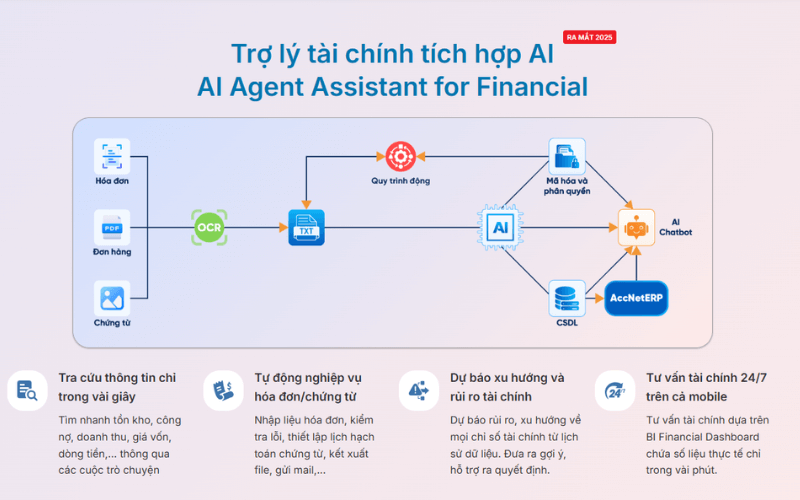

INTEGRATED AI ACCELERATION CONVERTER OF ACCOUNTING

AI in AccNet ERP't just stop at automate data entry, but also:

- Identification & classification certificate from smart: AI scan, read & sort invoice, voucher, receipt, limit errors due to input manually.

- Financial forecasting & budget: the system uses algorithms machine learning to forecast cost, revenue, business support decision fast.

- Warning risk accounting: AI to detect abnormalities in the book, from which timely warning of false or fraud risks.

- Reports assistant smart: AI suggested report template, automatic data aggregation support, leadership, financial analysis instant.

BUSINESS IS WHAT WHEN IMPLEMENTING ACCOUNTING SOFTWARE LAC VIET?

- Experience more than 30 years develop software solutions business management in Vietnam.

- Ecosystem of comprehensive: AccNet ERP easily connect with other solutions of Lac Viet (HRM, Workflow, Portal...).

- Advanced technology: Integrated AI support, cloud & on-premise flexible.

- Services dedicated support: A team of knowledgeable professionals with accounting – finance in Vietnam, companion throughout the deployment.

- Trust from thousands of customers in many areas: finance, banking, manufacturing, trade, services.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: accnet@lacviet.com.vn | Website: https://accnet.vn/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

Mode business accounting hold a central role in financial management, just to meet compliance requirements while improving data quality to serve the decision. Understanding the nature, mode selection, in accordance with the scale and actively update the changes from year 2026 help businesses reduce risk, optimize resources. When the accounting system is organized and whether modernization in the right direction. Business will be the foundation solid financial foundation for sustainable development, long-term growth.