Price and the price of capital are two financial targets core reflects the cost of product formation, the actual cost when the product is consumed. Price to help businesses control costs in the production process, the longer the price of capital direct impact on profit as well as business efficiency.

During operation, many businesses are still not clearly distinguish these two concepts, leading to confusion in the calculation, the time recorded reflected on the financial statements. These discrepancies can distort profit, influence the decision management as well as business plan long term.

The same Lac Viet Computing learn in detail about the concept, how to distinguish the two only goal is in fact, the method of calculation as well as the important note in accounting, thereby helping business admin cost effective to financial decisions correct.

1. Price and price what is capital? Why business needs to understand, right?

1.1. Price is what? The nature, meaning in business

The price is the total cost that the business spent to create that product, from raw material costs, direct labor to production costs such as depreciation of machinery, electricity costs, water factory, free equipment maintenance... Price is calculated for each product – shipment or each unit of product depending on the method of cost accounting is applied in business.

The nature of the price is reflects the level of “attrition” resources to finished products. Only when properly understand the price, the new administrator know products are “fed” into resources in stitch incurred many expenses to from that seeks to optimize costs at the lowest possible level that still ensure the quality.

Price plays a key role in administration, production costs, by:

- Is the basis to compare actual costs with cost estimates, plans, help assess the effectiveness of production activities.

- Detect points of congestion, waste in the production process.

- Prerequisite to the sale price products in a logical manner, avoiding the price too low, eroding profits or too high loss of competitiveness.

A number of methods of calculating the cost of common in business is to follow orders, according to the process, or according to the cost – per methods to suit each production model different.

1.2. Price what is the capital? Businesses are properly understood or not?

The price of capital is the cost of products, goods or services have actually been consumed during an accounting period. This is the only goal of accounting is important to be present on reporting business results to calculate the gross profit of the business.

Other than price, the price of capital is recorded only when the business sold products and have corresponding revenue. If the products have inventory, costs related still not been put into the price of capital in that time.

When reviewing financial statements, these principles mean very practical:

- The price of capital is the cost had “moved” from the asset inventory to cost in the states, directly affecting gross profit and taxable income.

- If the price of capital recorded incorrectly (for example, recognized immediately as expenses incurred instead of when the product is sold), the profit will be distorted, leading to the decision to price, cost plan, distribution channels... is false.

Recorded properly this norm is required to faithfully reflect the operational status of production and business, ensure compliance with the principles of financial reporting.

2. Distinguish price and the price of capital – different Point core

In practice, corporate governance, properly understand the nature of the two indicators, this cost is a prerequisite for accounting data accurately reflect the manufacturing operations – business. If confused, especially in the small and medium enterprises, financial reports, as well as the decision in strategic management are highly susceptible to false.

2.1. Compare price and the price of capital under each criteria

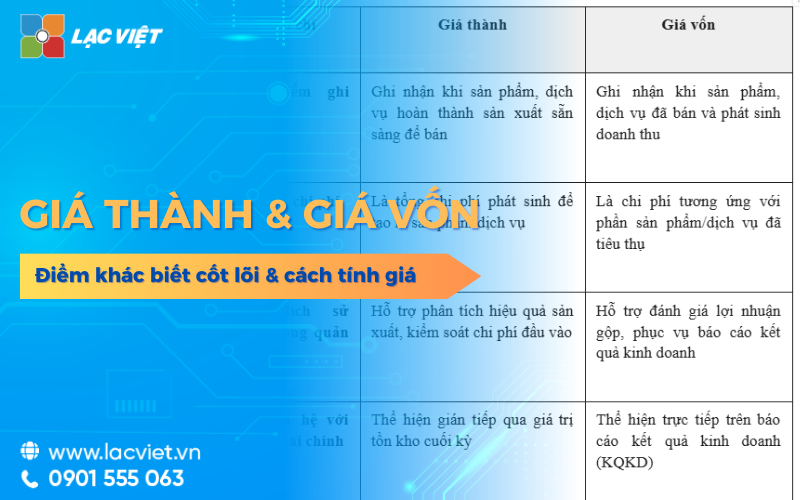

Below is the comparison table details help the reader to distinguish these two concepts in the context of practical application, not only in accounting theory:

| Criteria | Price | Price of capital |

| Time recorded | Recorded when products, services, complete production ready to sell | Recorded when products and services sold and the revenue is earned |

| Essence cost | Is the total cost incurred to create product/service | Is the cost corresponding to the product/services have consumed |

| Purpose of use in management | Support analysis, production efficiency, cost control input | Support reviews gross profit, service report business results |

| Relation to financial reporting | Express indirectly through inventory value end of period | Shown directly on the report business results (&SUMMARY) |

The presentation compared according to criteria helps managers not in-depth accounting easy to grasp the essence to practical application. Meanwhile, if the accountant recorded the price of capital as soon as costs incurred instead of when the product is sold, profits will be distorted – condition quite common in new business development admin costs or use accounting software is not appropriate.

2.2. The confusion common between the price and the price of capital

In fact, many businesses are still out, as well as recorded not properly between the price and the price of capital, which leads to the errors common following:

- Wrong price = price of capital: A lapse in popularity is understood that all production costs incurred in the period are the price of capital. This perspective ignores the fact that the cost of just shipping the price of capital when the product is sold. This makes the profit reported is lower than the actual or do not accurately reflect the business performance.

- Recorded at the wrong time: Recorded price of capital too soon, when the product hasn't been sold, that cost is not in accordance with the revenues of the states. According to accounting Standards, revenue – related expenses must be recorded in the same period to reflect accurate profit.

The result of confusion when recorded wrong:

- False financial statements: gross profit – net profit after tax is charged or over-doing the wrong number in financial analysis.

- Business decisions, lack of precision: the leader Board based on the data, deviations may make wrong decisions about selling prices, plans, costs or expand production.

- Affect relations with banks, investors: financial Data does not reflect the true state activity can reduce the reliability of the report in the eyes of financial partners.

3. How to calculate the price and the price of capital in business

Most businesses, especially the unit is in learn about the prices and the price of capital, are having difficulty not only in data collection but also in the conversion of data into information service decision management. This section focuses clarify how to calculate, how to apply in actual operation, as well as the mistakes to avoid.

3.1. How to calculate price popular today

Formula for calculating price basic:

Product cost is the total cost to produce a unit of product. Most basic recipe:

(Price = Cost of direct material + Cost of direct labour + manufacturing Costs general)

In which:

- The cost of raw materials direct: is the cost you spend for the materials constitutes direct products.

- Cost, direct labour: is the cost paid to workers directly involved in production.

- Production costs general: is the cost of servicing the general production such as water and electricity, depreciation of machinery, cost of factory.

The method of calculating the price of commonly used:

Purchase pattern production as well as demand management, businesses can select the right method:

- Calculated according to the orders: in accordance with the business produced according to each order separately, for example in the menu.

- Calculated according to the process: Apply when producing constant repetition, similar products together, for example the manufacture of concrete, corrugated steel.

- Calculated according to the norm: compare actual costs with cost-standard due to control deflection, improving the efficiency of management.

Illustrative examples:

A business production tables and chairs complete the 1,000 products in states with the total cost of production is 500 million. Then:

Price unit = 500,000/products

This information serves not only accounting, but also is the basis for the business department, the reasonable price, guaranteed profit margin plans.

3.2. How to calculate the price of capital according to each type of business

The price of capital reflects the cost associated with the product, goods or services already consumed way determine the price which will vary according to the model of activities of the business. Here's how to determine the price of capital in each business type downloads:

- Commercial enterprise: (goods not through production that is purchased for resale)

Cost price = purchase Price + Cost of purchases allocation

Purchase cost allocation can include shipping fee, import tax, the cost of warehousing...

- Manufacturing enterprise: (cost Price of the product sold is the cost of production of that product, i.e., the cost has shifted from production to consumption)

Cost price = production cost of products sold

This means that if the product had not been sold, then the cost is still in inventory are not recorded in the price of capital.

- Business services: (Cost formation service is charged immediately upon service completion and acceptance)

The price of capital = Cost to directly create the service has completed, test

This cost can be the cost of consumables...

3.3. The important note when calculating the price and the price of capital

Some of the key businesses need to pay attention to ensure the data reflect the true fact, support good decision as follows:

- Classification of cost true nature: Sai and direct costs, indirect costs lead to wrong price or the price of capital. For example, in the cement production power consumption for grinding machine should be the cost of production in common, can't be merged into raw materials, if not clearly distinguish.

- No omission or recorded to coincide costs: the case of shipping cost imports is calculated twice in the cost of purchase, cost of production in general will make the price of capital and the price is inflated. Affect policy decisions in the selling price, profit analysis.

- Compliance with accounting standards & legislation: the Calculated price, record price, which needs to comply with the accounting standards is to ensure the financial statements reflect honest. Such regulation, the time of recognition of revenue – the cost to the states to determine the profit right states.

To figures reflect the real business need, cost classification true nature, avoiding noted missing or duplicate, at the same time comply with the accounting standards of the time recorded revenue – cost. The connect accounting data with commissioning data will help improve accuracy, decision support effective governance.

4. Why business need good governance prices and the price of capital?

In fact, management is worth the price of the capital not only is the only goal of accounting, but also as input data for important decisions such as pricing, cost control as well as production planning. Good governance two indicators helps business data variable accounting tool effective governance, service operating in the investment rating.

4.1. Optimal cost – increase sustainable profitability

Good governance prices to help businesses control the cost from the root, i.e. control now in the process of production or provision of services, instead of just cutting cost deal at the end of the period.

When the price is right detailed analysis under each element of cost, businesses can:

- Identify clearly stitch how are consuming the most cost (raw materials, labor, or general expenses).

- Detection of expenses incurred unreasonable or wasting lasts.

- Reviews effective use of machinery and personnel, as well as resources available.

With respect to the organizations and enterprises are to find out information about price and the price of capital, this is the most obvious benefit. Profit increased not due to increased selling prices, which thanks to control the cost better.

4.2. Support business decisions accurately

Data rates and the price of capital is exactly the platform to board leadership decisions based on data, instead of feeling like:

- The product prices reasonable: When know prices of fact, business know the minimum price should reach to non-hole from which to build policies, the price is suitable for each market, each group of customers.

- The decision to expand or shrink production: analysis of the price of capital in each product, order or project to help businesses identify products which generate real profit, the products would only generate revenue but profit margins low.

- Evaluate the effectiveness of each product, project: When the price of capital is properly attached with corresponding revenue, leadership can compare the results between the product lines make the decision to focus resources in the right place.

In summary, good governance data rates to help businesses business decisions based on clear data, reduce risk, as well as deviations in operating. This is the foundation to leadership, resource allocation efficiency, enhance competitiveness in a sustainable way.

4.3. Enhance the competitiveness of business

In the context of the cost of materials, labor, and logistics volatility. Business a good control on the price will take competitive advantage markedly. Specific:

- Business can be more flexible in price policy, adjusting selling prices according to the market without compromising profit margins.

- The profit margin is maintained more stable, limit, margin status “virtual” due to the recorded cost wrong.

- The ability to react to market fluctuations, faster, more active than the opponent.

Thanks admin tight price – price of capital, the business is not only good cost control, but also active in competitive strategy long-term. This is the basis for enterprises to adapt quickly to market fluctuations, maintaining stable profitability, strengthening the position than the opponent.

5. Application software Accnet ERP in management accounting for business production, trade

In the context of transformation of management, value and price of capital using a spreadsheet or software discrete increasingly revealed many limitations: data dispersion, updates slow, difficult to control errors, no support of management analysis.

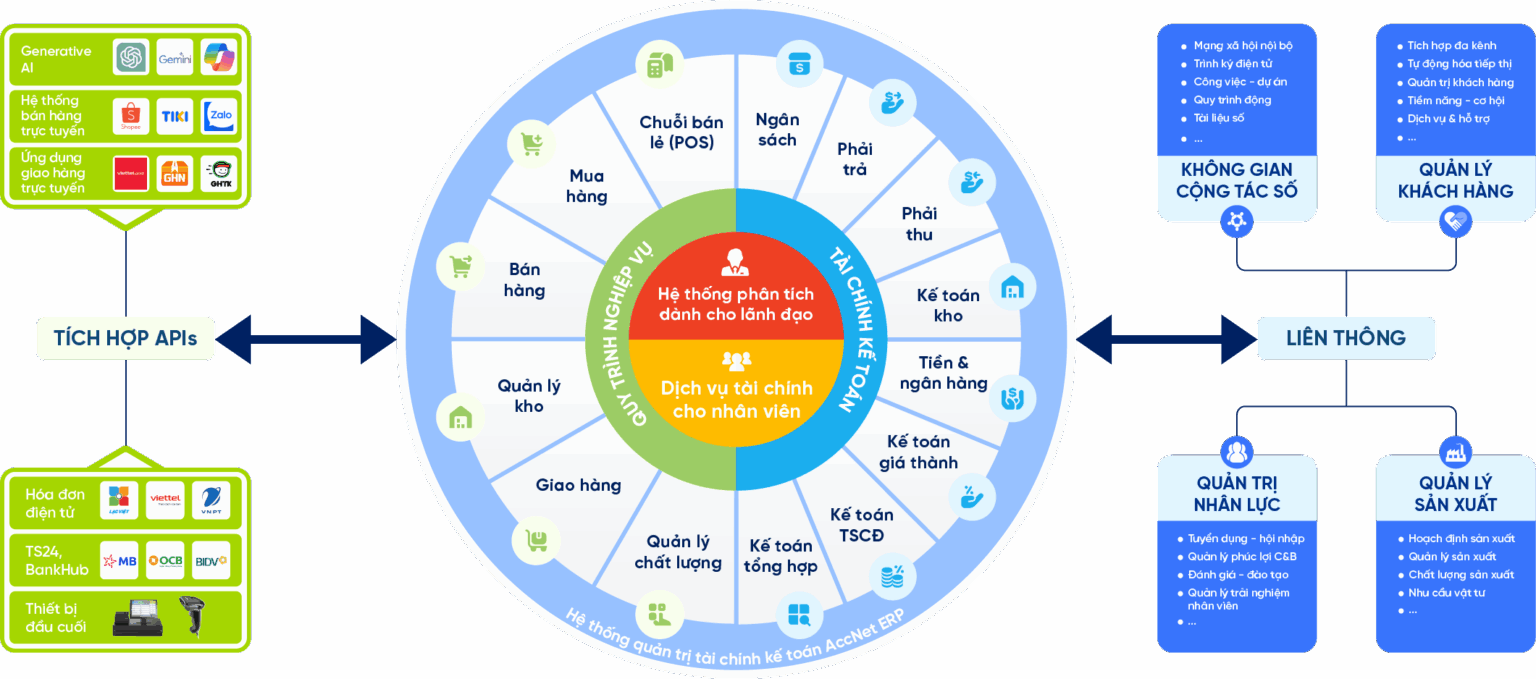

AccNet ERP is designed to directly address these issues, in particular in accordance with the business manufacturing – trade are in need of standardized accounting and finance tied to the actual operating. AccNet ERP lies not only in the features service, which in the ability to support decision-making based on reliable data as:

- Automatic aggregation and allocation of costs according to each product, order, stage production or project. Help reduce our dependency on manual handling, limit deviations in the calculated price.

- Contact information closely data between the subsystem accounting – manufacturing – warehouse – sale. Ensure the price, the price of capital is calculated consistently, the right time and properly reflect actual operation.

- Provide reporting systems administrator, multi-dimensional, allowing the leader board tracking the cost – revenue – profit under each product, each sales channel or each project. From that decision the executive timely, more accurate.

- Enhance reliability of financial reports, management reports. Effective support for working with banks, investors, partners, as well as serve the inspection and audit.

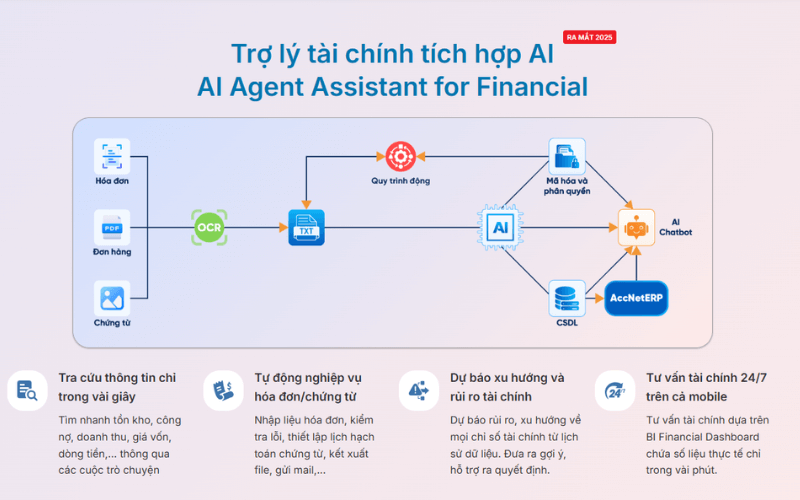

ACCOUNTING SOLUTIONS ACCNET ERP INTEGRATED AI AUTOMATE ALL BUSINESS

AccNet ERP is a software solution financial accounting integrated in the management system, comprehensive enterprise, which is developed by Lac Viet corporation. Difference highlights of AccNet ERP is the app artificial intelligence (AI) in many accounting process to help businesses:

- Automation of accounting and classified documents.

- Improving the accuracy in data control.

- Shorten processing time business accounting – financial.

Thanks to that, AccNet ERP not only is support tool but also a “smart assistant” with the business in financial management transparent effect.

Feature highlights:

✔️ Automatic accounting vouchers, collate public debt thanks to AI.

✔️ Manage your finance – accounting multi-branch, multi-subsidiary.

✔️ Financial statements consolidated standards of Vietnam & international (VAS, IFRS).

✔️ Cash flow management, budgeting, forecasting the exact cost.

✔️ Connect with the manure management system, hr, production, sales to sync data.

✔️ Integration of AI in data analysis, risk warning and proposed optimal scheme.

TYPICAL CUSTOMERS ARE DEPLOYING ACCNET ERP

- Nitto Denko – control production costs thanks to the application of accounting costing: Nitto Denko has chosen solution AccNet ERP to deploy the system accounting calculating cost ofhelp business control costs more effectively in the production process. After a period of use, company, highly effective, practical system that brings, as well as the degree of stability superior to other software in the market.

- ANTESCO – restructuring process works with management accounting operation: At ANTESCO, our team of consultants and deployment of AccNetERP has collaborated closely with the business in the first phase, reset the standard process and construction work-flow related departments throughout. The solution has helped ANTESCO significantly improve management capabilities, operating in a synchronized way and versatile

- Khatoco – expansion pack solution AccNetC after the successful implementation of original: Lac Viet has successfully deployed package solution AccNetC for trade co., LTD Khatoco in Nha Trang, according to the agreement signed on 29/07/2014. After the system is first put into operation efficiency, Khatoco intends to continue cooperation and expand the distribution finance – accounting and retail management with AccNetC, expressing the deep trust in implementation capacity and quality of service from Lac Viet.

SIGN UP TO RECEIVE DEMO NOW

INTEGRATED AI ACCELERATION CONVERTER OF ACCOUNTING

AI in AccNet ERP't just stop at automate data entry, but also:

- Identification & classification certificate from smart: AI scan, read & sort invoice, voucher, receipt, limit errors due to input manually.

- Financial forecasting & budget: the system uses algorithms machine learning to forecast cost, revenue, business support decision fast.

- Warning risk accounting: AI to detect abnormalities in the book, from which timely warning of false or fraud risks.

- Reports assistant smart: AI suggested report template, automatic data aggregation support, leadership, financial analysis instant.

BUSINESS IS WHAT WHEN IMPLEMENTING ACCOUNTING SOFTWARE LAC VIET?

- Experience more than 30 years develop software solutions business management in Vietnam.

- Ecosystem of comprehensive: AccNet ERP easily connect with other solutions of Lac Viet (HRM, Workflow, Portal...).

- Advanced technology: Integrated AI support, cloud & on-premise flexible.

- Services dedicated support: A team of knowledgeable professionals with accounting – finance in Vietnam, companion throughout the deployment.

- Trust from thousands of customers in many areas: finance, banking, manufacturing, trade, services.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: accnet@lacviet.com.vn | Website: https://accnet.vn/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

Price and the price of capital are core elements that need to be managed efficiently through the selection of accounting software pattern matching operation, as well as scale business. Instead of running to follow the trend, businesses need to weigh the ability to control data, flexibility, cost-effectiveness of each solution. When accounting data service directly for executive decision-making, appreciating the current state as well as development orientation is very important. Choose right from the beginning will help optimize operation, creating the foundation for sustainable development.