For imported goods, there is a VAT refund not? Conditions are fully tax imports like? Let's Lac Viet find out information about refund vat on imported goods details by the following article:

1. Refund VAT on imported goods is what?

When businesses import goods and services, which, in addition to the payment of import taxes. Businesses still have to make the payment of input VAT for the goods. This tax amount is deducted according to the number of output vat arises in the states, or refunded for enterprises in certain cases.

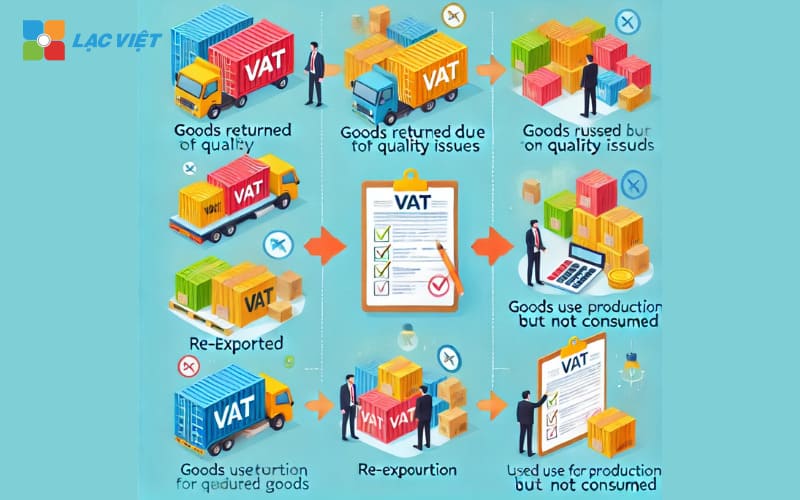

2. The business case is refund vat on imported goods

A number of cases where the goods enter the stage and regulations tax refund include:

2.1. Imports in domestic consumption

Goods imported for commercial purposes, sold domestic or internal consumption. Businesses pay input VAT according to the rules. When sold if qualified, complete the enterprise can proceed to offer refunds.

To offer refunds business needs to satisfy the following conditions:

- Business license was issued business registration certificate, investment legal

- Registered to pay VAT according to the method of deduction

- Establish and maintain accounting books, accounting documents according to the rule of law

- Have deposit accounts with the bank of business

2.2. Imported goods, then the exporter is refund vat on imported goods

Pursuant to Paragraph 6 of Article 1 of Decree no. 100/2016-ND/CP rules:

“Base business is not a tax refund for the case of imported goods and then exports, exported goods do not perform the export at the customs operations under the provisions of the Customs Law and the guidelines.”

Thus, the business case of imported goods, then bring exports, or goods not exported at local customs operations according to the regulations. Then the Business is not VAT refund was filed in the import stage.

2.3. Imports to production machining exports

To be specific, we will review according to each specific case as follows:

Case 1: Business imported raw materials production, export, according to the meeting concluded with foreign parties:

According to Paragraph 20 of Article 5 TT219/2013/TT-BTC specified objects are not subject to VAT are mentioned as follows:

“20. Cargo transshipment, transit through the territory of Vietnam; goods temporarily imported for re-export; goods temporarily exported for re-import; material import to production, processing export goods according to contract manufacturing, export, signed with foreign parties.”

So: imported goods according to the regulations on contracts concluded with foreign parties are objects that are not subject to tax business if already paid VAT on imports will be refund vat on imported goods submitted. When exporting if the business has to pay output VAT, the general application is completed, tax it.

Case 2: the Business of imported raw materials production, export, not according to the contract signed with the foreign

This case, goods, raw materials importing business, not under contract no not subject to tax. Therefore, the business is still conducted declare and pay VAT upon importation as often, when exports subject to tax rate of 0%, the business is VAT refund stitch directory as specified.

2.4. Imports overpaid, paying the wrong tax is refund vat on imported goods

Organizations and individuals importing goods when paying VAT at import stage that number has filed greater than the number to be filed or have been filed but the fact of non-payment, deductible or reimbursement, in particular:

- For the importer already registered to pay VAT according to the method of deduction: the amount of tax overpaid, paying mistake is calculated on the number of input VAT is deductible. If goods imported through trustee: the trustee is tax deductible.

- For the importer is not registered to pay VAT according to the method of deduction: number of overpaid tax, submit it wrong. refund vat on imported goods for the import. If goods imported through trustee: the trustee is the party is tax refund.

2.5. Imports for re-export pay client

According to the regulations of the General administration of Customs, for the business has to pay VAT upon importation, but then returns return home

- For export declaration prior registration date 01/07/2016: Customs authorities carry handle VAT amount overpaid in accordance with the regulations, in particular Paragraph 13, Article 1 of the Law on tax Administration no. 21/2012/QH13 rules:

“1. Taxpayers have a tax amount, amount for late payment fines already paid the larger amount, tax amount for late payment fines payable for each type of tax in a period of ten years from the date of payment to the state budget would be offset amount, tax amount for late payment, penalties overpaid amount, tax amount for late payment fines owed, including the clearing between the taxes together; or subtracted from the tax amount money for late payment fines to be paid by the time next tax payment; or a refund of vat on imported goodsmoney for late payment, penalties overpaid when a taxpayer does not owe tax money, slow money pay fines.”

- For export declaration registration from the date 01/07/2016 to 01/02/2018: business is not a tax refund, which made a tax deduction when enough of the stock from the import declaration, declaration, payment, memorandum of agreement to pay freight, vouchers and pay VAT upon importation, at the same time meet the conditions on proof of payment non-cash.

- For the export declaration registration after the date 01/02/2018: Customs authorities handled similar to the declaration of the pre-registration date 01/07/2016.

3. Condition refund the VAT on imported goods

Business refund vat on imported goods of goods and services for export (input tax) when there are all the conditions and complete the following procedures:

- Contract of sale of goods, processing of goods (for the case of machining of goods), providing services to organizations and individuals abroad. Slithering case trustee export: 's contract entrusted export and contract liquidation trustee directory (if the end of the contract) or a debt comparison periodically between the entruster and the entrustee directory, which specifies:

- The number, type, product value consignment was exported;

- Number, date of export contracts of the entrustee export signed with foreign countries;

- Number, date, amount stated on the proof of payment by bank with foreign countries of the entrustee directory;

- Number, date, amount stated on the proof of payment of the entrustee export payments to the trustee export;

- Number, date of the customs declaration of export goods of the entrustee directory.

- Customs declarations for imports and exports are done customs clearance. For establishments business directory software products in the form of documents, records, databases, hard-packed to be deducted, the refund of VAT input, business premises to ensure the procedure of customs declarations as for regular goods.

The following cases do not require a Customs declaration when refund vat on imported goods:

+ Base business directory service, the software via electronic means

+ Works construction and installation works abroad or in non-tariff areas.

+ Base business provides electric, water, stationery and goods served daily activities of the business, processing include: food, consumer goods (including labor protection: pants, shirt, hat, shoes, boots, gloves).

- Goods and services export must be payment via bank or payment considered, such as through a bank (as defined in Clause 3, Article 16 TT219/2013/TT-BTC)

- VAT invoices for the goods, services, or export invoices or bills for the amount of goods machining.

For example: base case business directory use the money to pay for goods and services exported to contribute capital to import facility in a foreign country is considered to be a payment through a bank, then the taxpayer must be eligible procedures and records as follows:

– Capital contribution contract.

– The use of money for payment of goods and services exported to contribute capital to import facility in a foreign country must be specified in the export contract.

– Where the amount of capital contributions smaller than the revenue from exports, then the difference amount payment must be made through the bank.

>>> Find out more related articles:

|

Refund VAT on imported goods is an important part of business processes, help business reduce costs/increase financial performance. Understand and comply with the rules on tax refund not only help businesses make the most of the benefits but also ensure compliance with the law, avoid the legal risks.

CONTACT INFORMATION:

- Lac Viet Computing Corporation

- Hotline: (+84.28) 3842 3333

- Email: info@lacviet.vn – Website: www.lacviet.vn

- Headquarters: 23 Nguyen Thi Huynh, P. 8, Q. Phu Nhuan, Ho Chi Minh city