Accounting materials at apparel company focused closely manage the type of MATERIAL, such as fabric, thread, buttons, key (TK 152) of the same materials, tools and supplies (TK 153) to accurately reflect the input – output – inventory, direct cost (TK 621) and the product price. Process accounting include procurement, warehousing, production NVL according to the level of production, inventory, handle excess – or details window under the original price, use the account 152, 153, 331, 621 helps cost control, decision support in strategic management.

Many textile business is experiencing challenges when managing NVL diverse, from identifying the original price, selection method warehouse to handle NVL excess or stagnant. Errors in accounting not only deflects the cost of production but also affect the financial statements and the ability to strategic decisions.

The same Lac Viet learn in detail how accounting for raw materials garments in the business, from sorting NVL, accounting principles, a method warehouse to process inventory and handling incurred.

1. Overview of accounting materials in the sewing business

1.1. Classification of raw materials in textile trading company

With respect to the organizations and enterprises are to find out information about accounting materials in apparel companies, the classification of raw materials is the first step to design the system of management accounting suitable. Here are the main raw materials:

- Main raw materials: Is the composition of products such as fabrics (cotton, khaki, jean...), just sew. This is the element drain largest in the cost of production has direct influence on the price. Keeping track of the exact volume as well as volatility of this group help accounting reflects the true cost of the actual production.

- Filler material: Consists of the supporting parts like buttons, zippers, labels, chun, building, sewing chalk. Though the cost per unit smaller than the main raw material, but the total cost, according to each order can be large, especially in large-scale production.

- Supplies: such As sewing machine needles, bobbin, machine oil, are often not on the product directly, but is the cost of support is important to maintain production capacity.

- Fuel: Gasoline for generators or boilers if the business can use, property, operating costs, but still need to control in order to avoid losses.

Clear classification help accounting, management, capture is the focus cost to process optimization reserve – purchase – use. Avoid inventory exceeds actual demand, causing stagnant working capital. This is consistent with management principles and effective financial help businesses reduce the costs of storage and improve cash flow.

1.2 the Role of accounting materials in the sewing business

In the apparel business, raw materials accounted for a high proportion of production costs, directly affect the price. Accounting and management, precision raw materials, help transparent accounting data, the optimal cost-efficient use of capital. The role of accounting, the raw material can be seen through the following aspects:

- Track the cost of raw materials, precision: accounting materials recorded accounted for right price of capital, faithfully reflect the cost of production. Especially important with the main material as fabric, sewing for occupying the bulk of the costs as well as directly affect the profit of each order.

- Inventory management efficiency: track detailed import – export – inventory help businesses balance production needs with resources and cash flow, avoid shortages of raw materials influence the progress or excess inventory cause stagnant capital.

- Support cost allocation & reporting: accounting materials provided data to allocate a reasonable cost according to the product, order, or project, at the same time reporting the accurate profit. Support leadership decision making strategies, optimal production costs.

Thus, accounting raw materials not only recording professional but also support management to help businesses control costs, improve production efficiency and transparency of financial statements. Good management of raw materials is the foundation for enterprises to sustainable development, sustain competitive advantage, as well as resource optimization in the production chain.

2. Accounting principles account 152 in company apparel

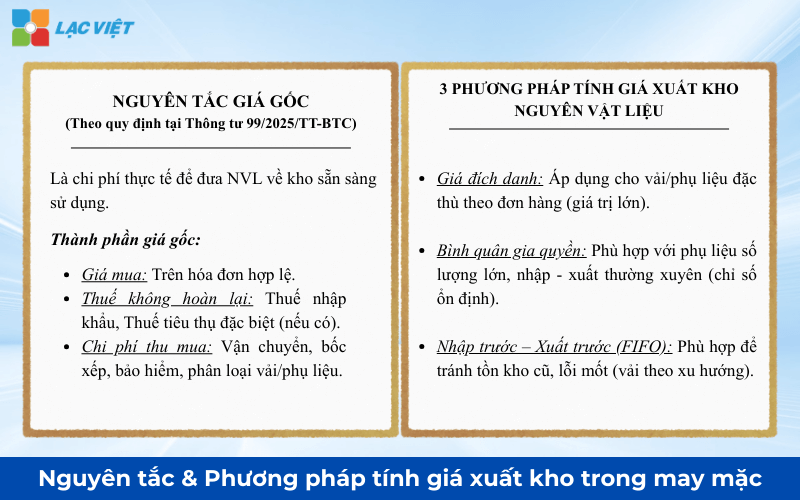

Principles of accounting materials in company apparel – materials specified in Circular 99/2025/TT-BTC. Accounting import – export – inventory must comply with the principle of cost according to the accounting standards on inventory.

The original price is the actual cost incurred to bring the raw materials to the warehouse and ready to use. Compliance with this principle helps accounting data transparency, regulations, and support business apparel, expense management, inventory control, and optimize cash flow.

2.1. Accounting principles of accounts 152 – original price & accounting inventory

Account 152 used to reflect the value of inventories and the volatility of raw materials, materials in business based on the actual cost incurred. The recorded input – output – inventory materials must comply with the principle of the original price, according to accounting standards “inventory”.

The original price of raw materials, materials purchase, including:

- The purchase price shown on the invoice.

- Tax not refundable (such as import tax, excise tax, value-added tax in case of non-deductible).

- The cost is directly related to purchasing as shipping, handling, preservation, classification, and insurance from the place of purchase to the business.

Accurately determine the original price of raw materials is the basis to the recorded value of inventory right practice, since it directly affects the cost of production, sales, cost analysis and financial reporting. If noted, teen, shipping fees, or taxes are not refundable, inventory costs will be lower than the actual leads to false when the price of capital and profits.

2.2. The method of calculating the price of stock materials

To obtain data, the price of stock reflects the true cost of using raw materials in the period, the business must select and apply one of the methods of pricing the inventory is circular 200/2014/TT‑BTC & accounting standards allow.

- Rating method, purpose of the: Apply when a business determine the exact cost of each batch of raw materials, match raw materials peculiarities or large value (for example: fabric income under the contract). When stock, accounting properly use the actual price of the lot accurately reflected the cost of production and management, the price of capital goods.

- Method weighted average: the Price of stock is calculated based on the average of the entire raw material in stock, can be calculated after each entry or end of the period prescribed business. This method is suitable with business apparel are quality raw material, import – export regularly, helps to stable data, as well as reduce bias due to short-term price fluctuations.

- The method first in – first out (FIFO): the assumption of imported materials warehouse will be prerendered. Suitable when the price NVL change over time, helps reflect the order using the fact avoid inventory old. FIFO often be widely applied in warehouse management manufacturing enterprises.

Businesses need to choose the method of calculating the price of raw materials in accordance with the peculiarities of operation as well as administrative requirements, at the same time applied consistently throughout the accounting year in order to ensure comparability and reliability of financial statements.

In accounting, inventory raw materials (NVL), business apparel can apply two accounting system key: declare regular & inventory periodically. Depending on the scale, the level of automation systems, ERP/KPX that suitable option to ensure data faithfully reflect value, quantity, raw materials and service decision management.

3. Accounting materials by the method of

3.1 Purchase of raw materials, materials, warehousing

| Profession | The account (Debt/Available) | Notes |

| Buy NVL in water (with VAT) |

|

Applied to the method of deduction. |

| Buy NVL in water (no VAT) |

|

Apply when buying from a business, or not subject to tax. |

| Goods in transit |

|

Recorded when there was bill, but not on stock. |

| Cost of acquisition, transportation, loading and unloading |

|

Charged directly to the cost of the NVL enter the warehouse. |

| Return or discount sale |

|

Need the return form and invoice adjustments. |

| Trade discount (after) |

|

If NVL was used, reduced cost of works respectively. |

| Payment discount (enjoy) |

|

Note: Discount, payments recorded in the financial turnover (515), not recorded in 152 or 511. |

| Import NVL |

Debt TK 152 Have TK 331

Debt TK 152 Have TK 3333

Debt TK 1331 Have TK 33312 |

Import tax increases cause price; import VAT is deducted separately. |

Note: In part payment discount, according to accounting standards and this amount is regarded as revenue from financial activities (TK 515), not deductions price of capital or revenue sales (TK 511).

3.2 Raw material outsource machining processing

- When NVL unit for machining:

Debt TK 152 – NVL rent machining

Have TK 152 – Raw materials

- Recorded machining costs incurred:

Debt TK 154 – Cost manufacturing business

Have TK 331 / 111

- Re-enter the warehouse after machining according to the actual value after machining:

Debt TK 152 – Raw materials

Have TK 152 – NVL rent machining

3.3 Raw materials homemade

- Warehouse export of raw materials to processing:

Debt TK 154 – Cost BUSINESS

Have TK 152 – Raw materials

- Enter the warehouse after processing (according to the value of products/semi-finished products):

Debt TK 152 – Raw materials

Have TK 154 – Cost BUSINESS

3.4 Handling of raw materials, excess, lack, stagnant after inventory

| Case | The account (Debt/Available) | Explain |

| NVL excess unknown causes |

|

Recorded temporarily in order to investigate the cause. |

| NVL excess was clearly the cause |

|

Recorded directly in other income (or discounted capital if by mistake export warehouse). |

| NVL teen unclear cause |

|

Reduced stock to match actual data before waiting for processing. |

| NVL deficiency in the norm |

|

Charged to cost of production and business in the states (usually TK 632 or 642). |

| NVL lack of personal loss |

|

Individual or collective compensation for the damage value. |

| NVL stagnant, non (liquidation) |

|

Reflect revenue from the sale, liquidation. |

| The price of capital NVL liquidation |

|

Reduced value NVL sold in store. |

Note: For income from surplus goods, accountants often use TK 711 (other income) instead of 416 (TK 416 is not in the system account in circular 200). Similarly, the cost of processing orders usually take into TK 632 (if in the norm) or TK 811 (if unusual).

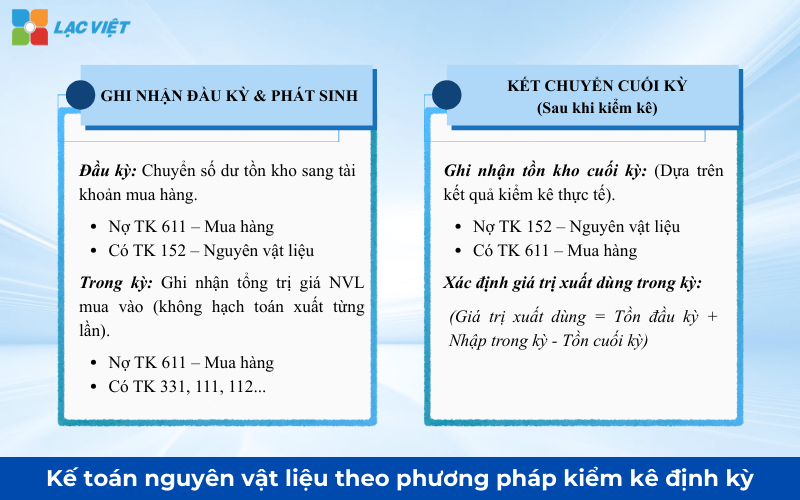

4. Accounting materials by the method of inventory periodically

4.1 Recorded the first states arose in the states

- Transfer inventory, head to your account to reflect the total incurred during the period:

Debt TK 611 – Purchase

Have TK 152 – Raw materials

- Recorded total purchase NVL incurred in the period (not updated by each command SX):

Debt TK 611 – Purchase

Have TK 331 – paying the seller

4.2 Determine the inventory end of period after inventory

(End of period, after the inventory fact, the recorded value NVL inventory closing ledger)

Debt TK 152 – Raw materials

Have TK 611 – Purchase

Note: the Method of inventory periodically need inventory tight, but not constantly updated, so little business suit garment, large, multi-type NVL.

5. The important note in the raw material garment business need to know

In the accounting industry raw materials in garment company raw materials (NVL) accounted for a large proportion in the cost of production directly affect progress, product quality and financial performance. So, management NVL need to include cost control, calculate the price of capital as well as support decision governance.

- Bill: Businesses need to ensure bills buying NVL legitimate, full information like tax code, date, description, amount, and name of the seller. This just ensures vouchers valid for accounting, just to avoid the risk of the tax arrears or exclude costs, especially with NVL imported or purchased from many sources.

- Inventory management: Because NVL in the garment industry diversity fluctuations by order of production, businesses need to closely monitor the import – export – inventory. Control techniques help to avoid deficiency, interruption of production, excess inventory costly. At the same time support demand forecasting, optimal order, reducing working capital stagnant.

- Allocation of expenses: The costs related to NVL such as purchasing, shipping, storage, machining or processing needs to allocate reasonable according to orders, products or projects. Allocate clear help calculate the price accurately, support planning, selling price, profit and strategic decisions.

- Inventory – handling NVL excess, teen, stagnant: Do NVL may arise excess or lack in comparison with books business needs inventory periodically, clearly classify each case. Each student must acknowledge the right account to ensure cost transparency, avoid misleading financial statements.

The note not only does this accounting materials in company apparel accurate but also to optimize costs, improve production efficiency, control cash flow, decision support administrator. Management NVL basically is the platform for businesses to maintain stable operation, sustainable development, use resources efficiently.

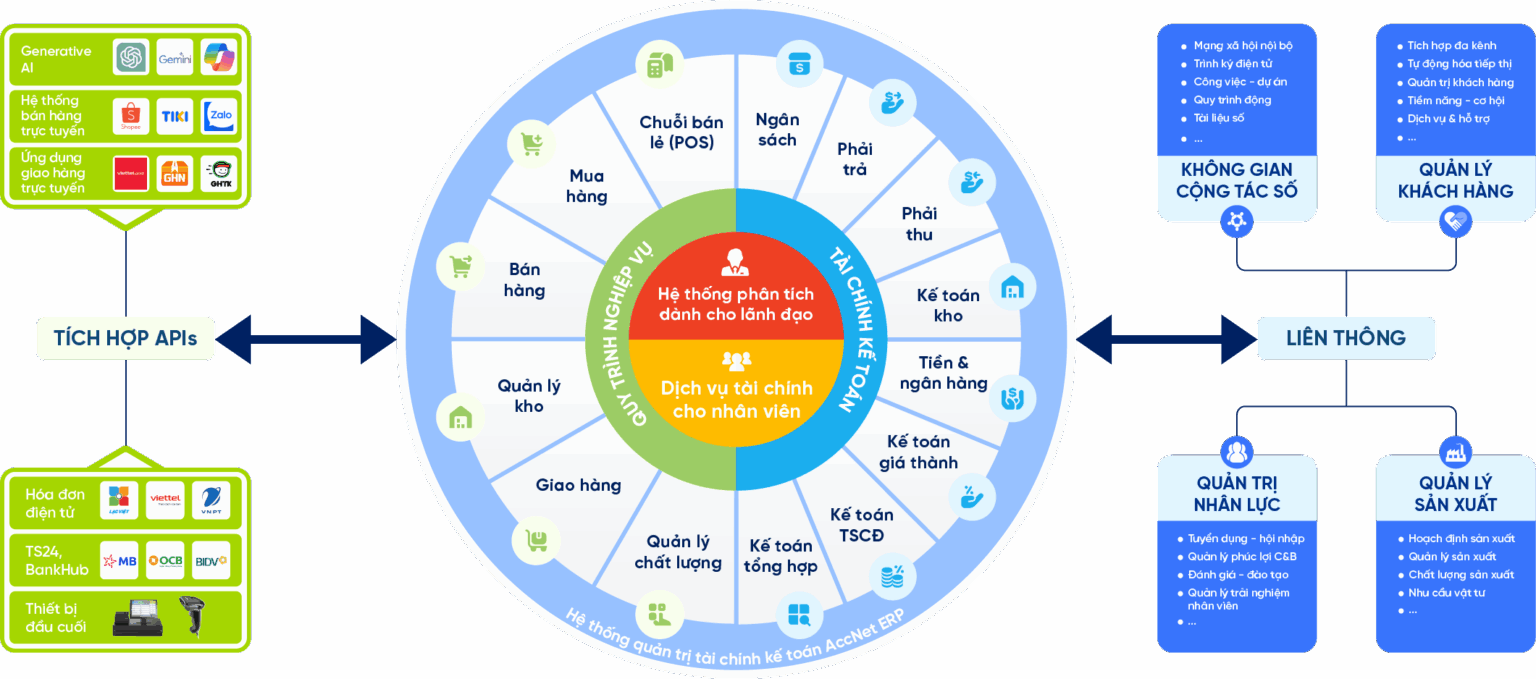

6. Application software accounting Accnet ERP customized according to specific business may

Materials management efficiency in business may not only require accounting procedures accurately but also need tools to support timely to control inventory, cost, schedule production. In this context, accounting software Accnet ERP stand out as a comprehensive solution, is designed to be flexible, in accordance with the characteristics garment industry and demand for modern management.

Accnet ERP allows businesses to:

- Track import – export warehouse constantly as each batch of raw materials, ensuring accurate control of quality, value, cost incurred. This is especially important with business production, multi-category, when the raw material fluctuations in each order, production order.

- Updates the inventory in real time, help management accounting manufacturing catch the exact number of NVL, from which planning, order entry, allocation, production and forecast cost effective. This feature helps avoid shortages of raw materials or excess inventory, and optimize working capital.

- Automatic invoice processing – vouchers – pen math related help reduce errors, save time, accounting, at the same time ensure compliance with tax rules, in particular when businesses buy NVL domestic or imported.

- Support strategic decisions to tools to analyze data, including inventory, debts, prices, capital, cash flow and reporting the cost of production batches or project. Thanks to that, businesses can evaluate the effective use of NVL, optimal cost as well as improve the efficiency of production and business.

ACCOUNTING SOLUTIONS ACCNET ERP INTEGRATED AI AUTOMATE ALL BUSINESS

AccNet ERP is a software solution financial accounting integrated in the management system, comprehensive enterprise, which is developed by Lac Viet corporation. Difference highlights of AccNet ERP is the app artificial intelligence (AI) in many accounting process to help businesses:

- Automation of accounting and classified documents.

- Improving the accuracy in data control.

- Shorten processing time business accounting – financial.

Thanks to that, AccNet ERP not only is support tool but also a “smart assistant” with the business in financial management transparent effect.

Feature highlights:

✔️ Automatic accounting vouchers, collate public debt thanks to AI.

✔️ Manage your finance – accounting multi-branch, multi-subsidiary.

✔️ Financial statements consolidated standards of Vietnam & international (VAS, IFRS).

✔️ Cash flow management, budgeting, forecasting the exact cost.

✔️ Connect with the manure management system, hr, production, sales to sync data.

✔️ Integration of AI in data analysis, risk warning and proposed optimal scheme.

TYPICAL CUSTOMERS ARE DEPLOYING ACCNET ERP

- Nitto Denko – control production costs thanks to the application of accounting costing: Nitto Denko has chosen solution AccNet ERP to deploy the system accounting calculating cost ofhelp business control costs more effectively in the production process. After a period of use, company, highly effective, practical system that brings, as well as the degree of stability superior to other software in the market.

- ANTESCO – restructuring process works with management accounting operation: At ANTESCO, our team of consultants and deployment of AccNetERP has collaborated closely with the business in the first phase, reset the standard process and construction work-flow related departments throughout. The solution has helped ANTESCO significantly improve management capabilities, operating in a synchronized way and versatile

- Khatoco – expansion pack solution AccNetC after the successful implementation of original: Lac Viet has successfully deployed package solution AccNetC for trade co., LTD Khatoco in Nha Trang, according to the agreement signed on 29/07/2014. After the system is first put into operation efficiency, Khatoco intends to continue cooperation and expand the distribution finance – accounting and retail management with AccNetC, expressing the deep trust in implementation capacity and quality of service from Lac Viet.

SIGN UP TO RECEIVE DEMO NOW

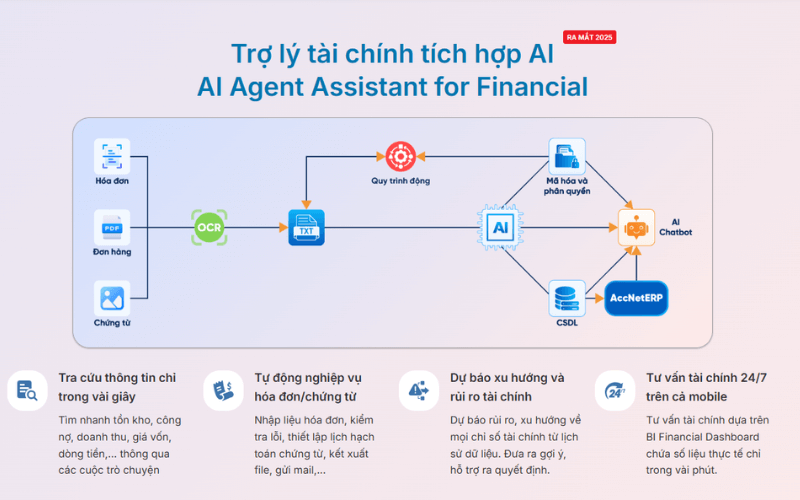

INTEGRATED AI ACCELERATION CONVERTER OF ACCOUNTING

AI in AccNet ERP't just stop at automate data entry, but also:

- Identification & classification certificate from smart: AI scan, read & sort invoice, voucher, receipt, limit errors due to input manually.

- Financial forecasting & budget: the system uses algorithms machine learning to forecast cost, revenue, business support decision fast.

- Warning risk accounting: AI to detect abnormalities in the book, from which timely warning of false or fraud risks.

- Reports assistant smart: AI suggested report template, automatic data aggregation support, leadership, financial analysis instant.

BUSINESS IS WHAT WHEN IMPLEMENTING ACCOUNTING SOFTWARE LAC VIET?

- Experience more than 30 years develop software solutions business management in Vietnam.

- Ecosystem of comprehensive: AccNet ERP easily connect with other solutions of Lac Viet (HRM, Workflow, Portal...).

- Advanced technology: Integrated AI support, cloud & on-premise flexible.

- Services dedicated support: A team of knowledgeable professionals with accounting – finance in Vietnam, companion throughout the deployment.

- Trust from thousands of customers in many areas: finance, banking, manufacturing, trade, services.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: accnet@lacviet.com.vn | Website: https://accnet.vn/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

Accounting materials at apparel company plays a key role in cost control, accurately reflect the product price. Classification NVL clear, apply proper accounting principles the same method suitable warehouse to help manage inventory effectively, avoid wasting. Process management NVL closely also support demand forecasting, balance production resources and improve productivity at the same time provides accurate data for strategic decisions to help business sustainable development.