Accounting calculating cost of product construction and installation is the case, allocation of construction costs to determine the price of the reality of each work item or mass acceptance. This work helps businesses control costs in comparison with the estimate, review profit and loss account according to the project as well as cash flow management efficiency. Applying the right method, process accounting is the foundation to limit the risk team costs and improve business efficiency.

However, practice shows that many construction enterprises still have trouble calculate the product price construction due to costs incurred at the site has not been updated promptly allocating the cost is not really consistent. This make the price not reflect the fact, reducing the effective cost management and potential risks affecting corporate profits.

The same Lac Viet Computing find detailed understanding of the core content from the peculiarities prices in industry, construction and installation to the method of price calculation are applied. Through that support businesses improve the efficiency cost management, project finance.

1. Overview of accounting calculating cost of product construction

1.1 Workflow Definition

Accounting calculating cost of products construction is the process of collecting, sorting and allocate the entire cost incurred in construction to determine the price of the reality of work or work items in each stage. This activity helps businesses control costs in comparison with the estimates as well as timely reviews the effect of profit and loss of the process, not only serve the settlement, which also supports cost management throughout the construction process.

In practice, corporate governance construction, the role of accounting prices bring specific values following:

- Control construction costs compared with the original estimate: through the track the price of product construction and installation according to each work, leaders can timely detect the expenses beyond the level to adjust the construction measures or schemes use resources.

- Reviews financial performance in each work, project: Price is the basis to determine the exact interest – hole, instead of just looking at the revenue contract.

- Support contract negotiation & management cash flow: price Data into real-world business grounded when adjusted unit price, payment schedule or work with the investor.

- Reduce the risk of loss costs in the market: When costs are recorded timely and transparent, the possibility arises cost control is greatly reduced.

1.2 peculiarities of prices in the construction industry

Compared with other manufacturing industries product price construction have a very special comes from the structure, operation, manner of construction such as:

- Products bearing units & non-standard products: Each of the works or items are a separate product, different in scale, materials, and construction conditions, it is difficult to compare directly with each other. So, the accounting staff must follow as well as accounting details in each work, can not synthesize general as the model of mass production.

- Construction time prolonged, the cost incurred through many of the accounting period: construction is usually done in long time, costs incurred repeatedly through many states, should the accountant to expense tracking progress in each stage to determine the period price matching progress, acceptance, and payment.

- Costs incurred dispersed in the schools: Many direct costs as materials, labor, construction machines arise at the school, so accountants need to organize, collect vouchers as well as data updates in a timely manner to avoid delay information affecting financial decisions.

The peculiarities this shows the accounting cost product construction does not stop at the recorded cost, which is an information system management important, to help businesses overcome the situation recorded cost slow, classification not yet clear, as well as limit deviations between the estimates with the actual construction.

2. Construction business are difficulties when calculating the price?

Difficult to control the actual cost compared with the estimates

- Costs incurred not be timely monitoring: Many expenses arising directly at the market, but stock from about slow, prompting accounting data do not correctly reflect the real situation at the time of the management to make decisions.

- Deviations between the estimates – the actual construction: The initial payment is usually set according to the plan, while the actual construction under the impact of fluctuations in the price of materials, labor, and field conditions. Lead to a big difference if no tracking, comparison often.

Embarrassing in the set cost according to the items

- Confused general costs – direct costs: Due to the classification criteria clear, many business recorded the wrong essence cost, distort the price structure of the product construction.

- Cost allocation lack of consistency: Each states apply a how to allocate various causes of material price stability, difficult to use for comparison, as well as evaluating the effectiveness between the works.

Prices do not properly reflect the effect works

- Calculate the price of slow – decision making passive: Prices are synthesized only when the construction is near completion or end of the accounting period, lost the admin role of accounting calculating cost of products.

- No reviews are interest – holes in each project: When not track the cost of each work, business difficult to determine project efficiency, project, any potential risks, directly affects investment decisions, as well as resource allocation.

The above difficulties are common problems that organizations and businesses are finding out information about the prices of products and construction needs identification, soon to have solutions accounting organization and administration costs accordingly.

3. Object collection costs & object costing in construction

In accounting calculating cost of product construction, identifying the right audience set the cost as well as objects work is the foundation decided accuracy of data, helps businesses properly assess the effect the decision making process management suit.

3.1. Object set cost

Object collection cost is the range that business monitored, recorded, and whole set of costs incurred in the construction process. Depending on the characteristics of organization of construction, the scale of the project or contract terms, business construction can choose one of the following subjects:

- Construction: as object set cost popular for the independent works, scale, medium, small. All costs incurred are accounted for separately according to each work, to help businesses control costs, collated with the draft early identification of risks exceed expenses or losses.

- Work items: Applicable for major works includes many items can experience gained independence as the foundation, the body, the electricity and water systems. Set the cost on each item to help businesses accurately assess the effectiveness each part of construction as well as timely adjust construction measures, allocate resources appropriately.

- Construction phase: in accordance with the contract acceptance, payment-in-progress. Costs are set according to each stage associated with mold test to help business control costs in the cash flow as well as the risk of incurring a large cost but not yet recorded revenue.

As practice shows, many construction enterprises have difficulty in accounting calculate the price by the cost too general, not separated clearly by the process or items. Identifying the right audience set the cost right from the start helps reduce errors when calculating the price, as well as create a platform for analysis, comparison of results between estimates and actual costs.

3.2. Object calculate the price of product construction

If the object set costs answer the question “costs incurred now”, then object calculate the cost of answering the question “the price is determined for something.” In the construction business objects, the calculated price is usually determined in two main ways:

- Calculate the price according to the complete works: Apply with the construction works of package, only acceptance and handover when finished. Price is determined at the time the qualified recognition of revenue, consistent with short-term projects, small-scale, but limited ability to track profit and loss account in the construction process.

- Calculate the price according to the volume of test: Apply common with the works execution time is long. Price is determined by the volume has experience of each stage, to help businesses track financial performance-in-progress, cost control, as well as proactive cash flow management during project implementation.

This suggests that, in accounting calculating cost of product construction, the selection of objects, calculate the price of need in accordance with the contract, the method of test and objective internal management, not only to serve the settlement at maturity.

4. The item cost in the accounting calculating cost of product construction

In accounting work, the classification correct the item cost, the decision accuracy of the price. If determine wrong from the start, the resulting price is skewed. Under current regulations, the cost of construction includes four items the following:

4.1. The cost of raw materials directly

The cost of direct material is the total value of materials used directly for the operation, construction, associated with the formation should work, or work items. This item usually accounted for the largest share in the price of product construction and installation, including:

- Main material: cement, steel, sand, bricks, stone, concrete and other type of material constituting the structure.

- Filler material: additives, finishing material, consumable materials for construction services but does not directly create the main structure.

- The loss of supplies in the level permitted: the material shrinkage is determined by design, norm engineering, construction measures are approved.

About angle, administration, keeping track of costs direct material in each work item help business quick comparison between norm estimation and consumption, realistic, timely detection of the loss or use of materials for improper purposes, and as a basis for tuning construction methods as well as selection of suitable suppliers.

For example, At a construction works, civil, cost of steel, concrete often accounts for a large proportion in the total price of the product construction. If not well controlled sewn – used – inventory materials in the market, just shrinkage beyond the level a small percentage, can also significantly reduce the profit the process.

4.2. Costs directly

Cost of direct labour is the expenditure is directly related to the labor involved construction and installation. This item includes salaries and wages of workers directly, construction, allowances, overtime as required progress and construction conditions. At the same time, the cost also includes deductions from wages as specified as covered as well as the free union.

In fact, management, business need to distinguish two groups of workers to control the cost efficiency:

- Workers internal: workers on the payroll business is timekeeping, payroll, and cost allocation according to each work item specific.

- Workers exchange of teams or subcontractors get exchange by volume or time, the cost was often recorded under the contract, acceptance of reality.

If no separation is these two groups, the cost of workers vulnerable to allocate spreading when a construction teams participated in many projects at the same time, distorting the price of product construction makes it difficult to assess the effectiveness each work.

4.3. Cost of used construction machine

Cost of used construction machine as the expenses directly related to the operation of machinery used in construction, including:

- Fuel, power use for the machine.

- Depreciation of machinery and equipment.

- Cost of repair and maintenance during use.

In accounting calculating cost of product construction, cost of construction machines often arise in the construction and infrastructure works have mass earthwork, leveling or big concrete.

The most important part of this item is allocation of the cost of the machine in a reasonable manner between the works, often under:

- Hours actual machine use.

- The volume of work completed.

If allocation is not correct, the cost of construction using many machine will be lower than the reality, while the other works the “burden” cost does not belong to her.

4.4. The cost of production in common

Production overhead is the costs service operations management, organization and construction, including:

- Salary commander in chief, technical staff, management.

- Cost tents, electricity, water, protect the public market.

- Cost management service directly for construction.

Characteristics of the production cost is generally not associated directly with a volume of construction and installation specific. So that should be allocated for the works or items according to the principle of logical consistency.

To choose the allocation formula easy to understand, stable over time (for example: according to the direct costs, according to workers, according to the time machine), business need:

- Ensure product price construction reflect the level of resources used.

- Avoid price fluctuations of abnormal middle of the accounting period.

With respect to the organizations and enterprises are to find out information about accounting calculating cost of product construction and installation work, good cost control, joint production is the key element to keep in stable profit margins, particularly in the context of costs management and indirect costs increasing day by day.

5. The method of calculating the price of products construction popular today

In accounting calculating cost of product construction and installation, there are no methods which apply to every business. The selection should be based on the characteristics of works, the scale, the way of acceptance – payment and target cost management. Here are the methods that are being commonly applied in practice.

5.1. The method of calculating the cost of works

This method is applicable when each process is identified as an object calculate the price of independence. The entire cost incurred in the construction process is set directly for each of the works until completion and handover. In essence, the cost incurred for the work which will be charged in full at the cost of the process.

Formula for calculating the cost of the project:

(The cost of the project = Cost of direct material + Cost of direct labour + Cost of used construction machines + production overhead allocated to work)

In which:

- The cost of raw materials, direct materials and used exclusively for work.

- Cost, direct labour: wages, allowances of construction works.

- Cost of used construction machines: Fuel, depreciation, machinery repair, construction services.

- Production overhead: Cost management, labor safety, electricity, water, common expenses and other allocated.

Illustrative example: the works A is the cost incurred in the construction process are as follows:

- The cost of direct material: 3,2 billion

- Costs directly: 1.1 billion

- Cost of used construction machines: 0,9 billion

- Production overhead allocated: 0,8 billion

The cost of the project is determined: = 3,2 + 1,1 + 0,9 + 0,8 = 6,0 billion

This method helps:

- Easy to organizational development, business suit, there are number of works no more.

- Price reflects relatively close actual cost, favorable for the settlement construction.

- Help leaders quickly identify the work risk exceeds the total estimate.

Limitations of method: With the construction of the long-term, the only valuation of completion that businesses do not track is interest – hole in the process of implementation. The fluctuating cost of unusually often only discovered at the last stage, reducing the ability to control and handle risks in a timely manner.

5.2. The method of calculating the cost of each work item

This method is consistent with the big ones, there are many items construction independent, can experience and evaluate separately each part. Instead of just specify a price in general for the whole works, the business price calculation separately for each item.

Formula:

(Price of item i = CP NVL directly i + CP workers directly i + CP construction machine i + CP manufacturing general allocation for category i)

Write compact form formula:

Zᵢ = CPNVLTTᵢ + CPNCTTᵢ + CPMTCᵢ + CPSXCᵢ

In which:

- Zᵢ: the Price of item i

- CPSXCᵢ: production overhead allocated to items i

If the cost of joint production needs to allocate, can determine:

(CPSXCᵢ = Total CPSXC × (The final allocation of the i / Total target allocation formula)

Illustrative example: A project has The nail, the actual cost as follows

- CPNVLTT = 2,5 billion

- CPNCTT = 1,2 billion

- CPMTC = 0,8 billion

- CPSXC allocated = 0,5 billion

Then: Z(nails) = 2,5 + 1,2 + 0,8 + 0,5 = 5,0 (billion)

Businesses continue to charge the same for each item as soon as texture, perfect... to have the painting costs in detail the entire work.

The current solution according to the work item help:

- Business efficiency rating details each part of construction, instead of just look at the general result of all works.

- Easy detection of the arising costs unreasonable to timely adjust the construction measures.

- Limit status “take interest in this category offset by other items that cause unknown”.

With respect to the organizations and enterprises are to find out information about accounting calculating cost of product construction, this is the method to bring value management, particularly with business and construction of large-scale projects.

5.3. The method of calculating the cost of each volume complete

This method is applied to the works of acceptance, payment in stages or milestones progress. The price of product construction and installation is determined according to the volume of construction was completed, tested in the states. Costs are allocated and calculate the corresponding mass fraction reality is accepted, instead of waiting until the process is complete the whole.

Formula:

[The price for the completed volume = Total actual cost incurred × (Mass acceptance in the period / Total volume according to the draft)]

Written recipe: Zₖ = CPTT × (KLHT / KLDT)

In which:

- Zₖ: the Price of the finished mass in the states

- CPTT: Total actual costs were incurred

- KLHT: the volume of construction was completed, tested and

- KLDT: Total volume according to the estimate or contract

Illustrative example: A project has a total volume according to the estimate of 10,000 m2, the total cost actually incurred to the current time is 20 billion. In the states, the business completed and tested 3,000 m2.

Then: Zₖ = 20 × (3.000 / 10.000) = 6 (billion)

Thus, the price of the volume completed during the period are 6 billion, as the basis recorded the price of capital, determine the gain – stage and set up a payment profile with the investor.

Value methods brought to the business:

- Fastened prices with the construction schedule, cash flow and active capital plan payment.

- Allows to monitor, evaluate profit and loss in each stage, the leader board support timely adjust construction methods when the cost of volatility.

- Business suit construction projects in parallel, large-scale, real-time is long and the pressure of high capital.

5.4. A quick comparison of the method of calculating the price of product construction

In fact business should not choose the method of rigidly, which should be based on:

- Scale & characteristics of business: small Business, independent works generally in accordance with the method according to works. Big business should weigh according to category or the finished mass.

- Manner of acceptance, payment: If the payment according to the schedule, the calculation method according to the completed volume will closely reflects more realistic.

- Target cost management internal: If the goal is control in detail each part of construction, the method according to item to bring efficiency markedly.

Practice shows, many construction business current flexible combination, the method of calculating the price of product construction and installation to just meet the requirements of accounting – finance, both raise the effective cost management and profitability.

6. Accounting process calculates the price of product construction and installation standard business

In fact, many businesses have grasped the method of calculating the price of products construction but still having deviations due process is lacking or not consistent between the works. An accounting process, the price of clarity, consistency will help businesses control costs more active, as well as limit the risks hole project.

Step 1: Identify the right audience set cost & object price

This step is the foundation in accounting calculating cost of product construction and installation. Businesses need to define clear from the beginning:

- Object set cost: according to each work, each work item or in the construction phase, based on the scale of the project, how to organize construction and method of acceptance.

- Object price calculation: calculated by the program completed or according to the volume of construction and installation acceptance test in accordance with payment terms as well as target cost management.

Determine the correct help the entire costs incurred are recorded properly “address”, to avoid cost of this work is credited to other works. With the organizations and enterprises are to find out information about accounting calculating cost of this step is often overlooked, but the greatest influence on the accuracy of the price.

Step 2: gather the cost of construction in accordance

After identifying the right audience, businesses need to organize the full set and promptly the costs incurred in the construction process in the correct expense items, including:

- The cost of raw materials directly

- Costs directly

- Cost of used construction machine

- The cost of production in common

The actual value of this step is to help businesses clearly see the cost structure of each work. For example, if the material cost accounted for the unusual compared with the estimates, leaders can soon check back norm, suppliers or construction process.

Step 3: allocate the cost of production in common, reasonable

The cost of production is generally group expenses easily cause deviations in the price of product construction and installation if there is no principle to allocate clear. Businesses need to choose the allocation formula in accordance with the actual construction, such as:

- According to the direct costs

- According to the workers

- According to current construction machines

The important thing is not just “allocation right,” but also to allocate consistency between the accounting period, to price reflects the true expense trends over time, serve to compare and analyze.

Step 4: Determine the price of the actual product construction

After you have the full set of costs and cost allocation joint production according to the principle of business conduct valuation of the reality of the product construction. This step is the final sum, reflect directly the cost-effectiveness of each work item or the volume of construction and installation experience fall in states.

Formula for determining the price:

(The price of the actual product construction = Cost of production uncompleted beginning of the period + Cost of production incurred during the period – Cost of production the unfinished end)

In which:

- Production costs of uncompleted states that the costs have been incurred but not yet tested in previous periods.

- Costs incurred in the period, including the entire cost of direct material, direct labour costs and production overhead has been allocated.

- Production costs unfinished end of the period is the cost corresponds to the volume of construction and installation has not completed or has not been test at the end of the accounting period.

Results rates of fact should be analyzed according to each work item or the stage of acceptance, focus on the content:

- Price comparison of actual with estimated prices initially to determine the level of difference.

- Analyze the causes of discrepancies come from the cost of materials, labor, construction or production costs in general.

- Assess the trend of price movements by the states to detect early risk team cost.

- Making the basis for determining the interest – hole works at the time of construction, service operating decisions and control costs in a timely manner.

Identifying the right analysis price fact not only meet the requirements of accounting, but also acts as a tool of financial management-important. Help construction business owners control efficiency projects throughout the entire lifecycle of construction.

7. Application software accounting Accnet ERP in construction field

Application software accounting AccNet ERP – ERP solution-intensive for business in Vietnam, bring value markedly for the construction business in governance costs, prices.

AccNet ERP helps businesses solve as:

- Expense tracking details in each work, items, stages: AccNet ERP allows businesses to organize data costs by the right audience set cost in construction such as buildings, items, stages of construction. This helps the product price construction is properly reflect reality, instead of being pooled cause deviations.

- Updates costs incurred timely, limiting the delay information: Cost of supplies, labor, construction machines arising in the market can be a quick update for system center. Thanks to that, accounting department, and leader boards don't have to wait to the end of the month or end of quarter new know the actual cost, reduce risk decision-making is dynamic.

- Automatic allocation of the cost – price calculation of precision: the System supports setting the final allocation of the cost of joint production in a consistent manner, reducing reliance on manual action. The price of product construction and installation according to the work item or the finished mass is perform a sync on the same system data.

- Provide reports, profit and loss account for each project, service management: AccNet ERP support analyst profit and loss details in each work, project, instead of just general statements. Thanks to that, leaders have the basis for evaluating the effectiveness of investment and adjust the plans, construction, cash flow, and decision-making bid accordingly.

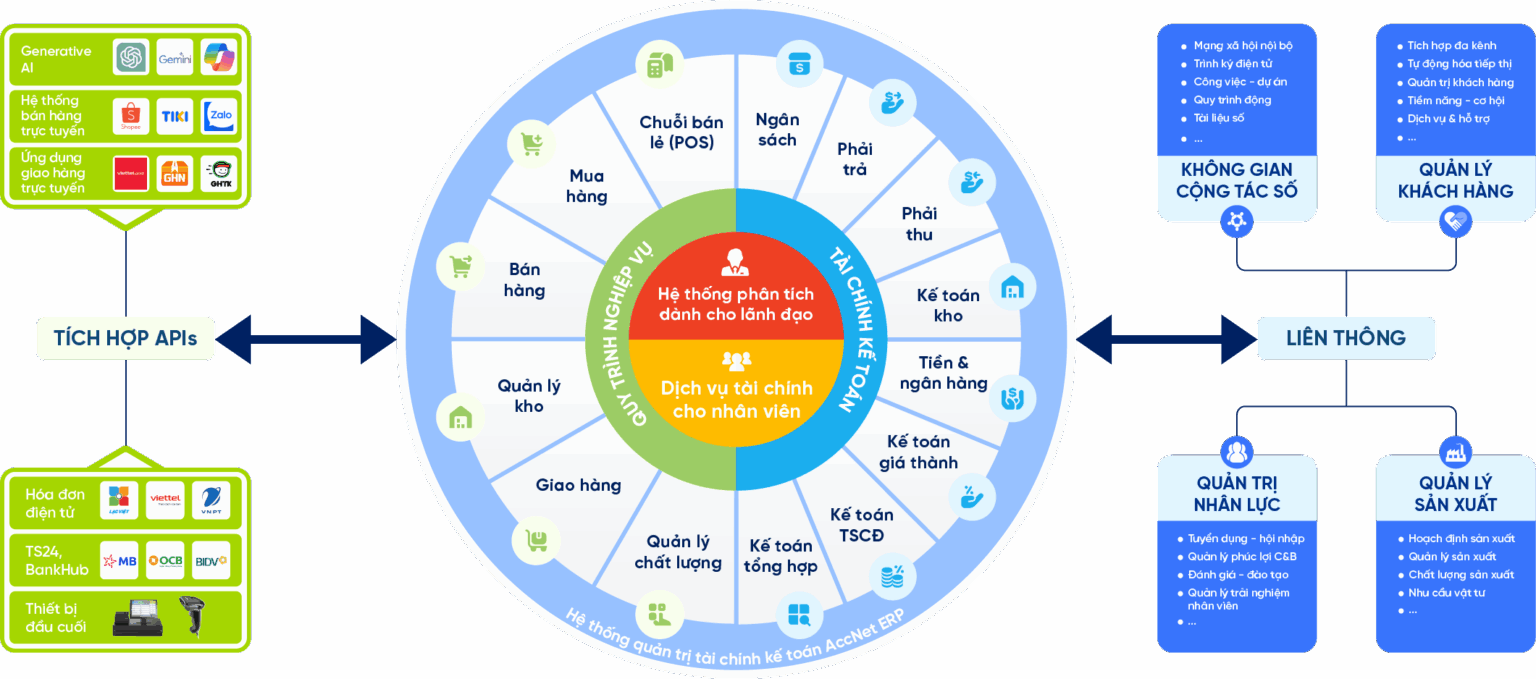

ACCOUNTING SOLUTIONS ACCNET ERP INTEGRATED AI AUTOMATE ALL BUSINESS

AccNet ERP is a software solution financial accounting integrated in the management system, comprehensive enterprise, which is developed by Lac Viet corporation. Difference highlights of AccNet ERP is the app artificial intelligence (AI) in many accounting process to help businesses:

- Automation of accounting and classified documents.

- Improving the accuracy in data control.

- Shorten processing time business accounting – financial.

Thanks to that, AccNet ERP not only is support tool but also a “smart assistant” with the business in financial management transparent effect.

Feature highlights:

✔️ Automatic accounting vouchers, collate public debt thanks to AI.

✔️ Manage your finance – accounting multi-branch, multi-subsidiary.

✔️ Financial statements consolidated standards of Vietnam & international (VAS, IFRS).

✔️ Cash flow management, budgeting, forecasting the exact cost.

✔️ Connect with the manure management system, hr, production, sales to sync data.

✔️ Integration of AI in data analysis, risk warning and proposed optimal scheme.

TYPICAL CUSTOMERS ARE DEPLOYING ACCNET ERP

- Nitto Denko – control production costs thanks to the application of accounting costing: Nitto Denko has chosen solution AccNet ERP to deploy the system accounting calculating cost ofhelp business control costs more effectively in the production process. After a period of use, company, highly effective, practical system that brings, as well as the degree of stability superior to other software in the market.

- ANTESCO – restructuring process works with management accounting operation: At ANTESCO, our team of consultants and deployment of AccNetERP has collaborated closely with the business in the first phase, reset the standard process and construction work-flow related departments throughout. The solution has helped ANTESCO significantly improve management capabilities, operating in a synchronized way and versatile

- Khatoco – expansion pack solution AccNetC after the successful implementation of original: Lac Viet has successfully deployed package solution AccNetC for trade co., LTD Khatoco in Nha Trang, according to the agreement signed on 29/07/2014. After the system is first put into operation efficiency, Khatoco intends to continue cooperation and expand the distribution finance – accounting and retail management with AccNetC, expressing the deep trust in implementation capacity and quality of service from Lac Viet.

SIGN UP TO RECEIVE DEMO NOW

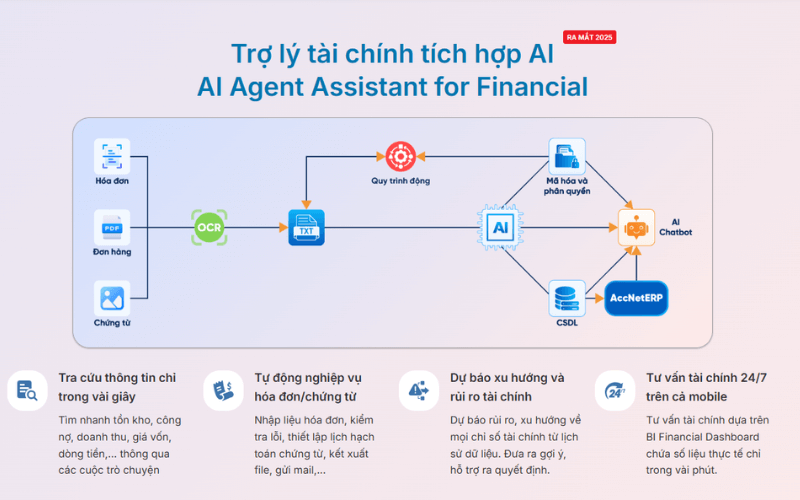

INTEGRATED AI ACCELERATION CONVERTER OF ACCOUNTING

AI in AccNet ERP't just stop at automate data entry, but also:

- Identification & classification certificate from smart: AI scan, read & sort invoice, voucher, receipt, limit errors due to input manually.

- Financial forecasting & budget: the system uses algorithms machine learning to forecast cost, revenue, business support decision fast.

- Warning risk accounting: AI to detect abnormalities in the book, from which timely warning of false or fraud risks.

- Reports assistant smart: AI suggested report template, automatic data aggregation support, leadership, financial analysis instant.

BUSINESS IS WHAT WHEN IMPLEMENTING ACCOUNTING SOFTWARE LAC VIET?

- Experience more than 30 years develop software solutions business management in Vietnam.

- Ecosystem of comprehensive: AccNet ERP easily connect with other solutions of Lac Viet (HRM, Workflow, Portal...).

- Advanced technology: Integrated AI support, cloud & on-premise flexible.

- Services dedicated support: A team of knowledgeable professionals with accounting – finance in Vietnam, companion throughout the deployment.

- Trust from thousands of customers in many areas: finance, banking, manufacturing, trade, services.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: accnet@lacviet.com.vn | Website: https://accnet.vn/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

Accounting calculating cost of product construction and installation tool is financial management important, to help businesses control costs as well as assess the effectiveness each work. The choice of the method of calculating reasonable price and organize the bookkeeping process closely will help data closely mirror the actual construction. From there, the business actively operating, project control risk to enhance business performance in a sustainable way.