Business inventory accounting is the set of activities recorded, tracked, as well as management of materials, goods, raw materials, tools – tools in business. The article provides detailed instructions on the import – export – inventory – transfer inventory – manage inventory, same method of accounting under circular no. 200/2014/TT-BTC & circular 99/2025/TT-BTC. Content that helps the organizations and enterprises understand the process and avoid errors, optimizing costs and improving the efficiency of inventory management.

Many businesses still have difficulty when performing accounting, warehouse, especially in the stitching as the valuation of stock, actual inventory, handling discrepancies or accounting loss. If done wrong, the business can be misleading price of capital, affect the profitability as well as the transparency of financial reporting.

So master the process and method of accounting professional accounting inventory not only helps businesses manage assets effectively, but also enhance the ability to control internal compliance with accounting standards. The same Lac Viet find out the details in the article below.

1. Overview of the accounting profession repository

1.1. Inventory accounting – Business accounting inventory what is?

In the organizational structure of the enterprise, parts warehouse role is coordination centre, material, perform the function of receiving, storage, safe and timely transfers of goods, raw materials (NVL), tool – kits (CCDC) according to the production requirements of business.

Inventory accounting is a department/function responsible to track and control the entire fluctuations in number, reflecting the value of the property inventory (at cost) in the system of bookkeeping of the business. The goal is to ensure that the value of the property inventory is shown in a transparent, accurate and comply with the accounting standards current.

Business inventory accounting is that all of these activities are related to the collection, processing, inspection, and record every transaction changes the quantity, the inventory value. This is a process chain to ensure the dovetail between the physical reality – financial data.

1.2. Role of inventory accounting

The well-organized accounting profession warehouse brings many practical benefits for business:

- Ensure data inventory accurate – timely: If data inventory on the books don't match with reality, warehouses, business may fall into shortage of goods (stock‑out) or excess air used to be. According to the survey from APQC noted: the cost of capital stock of the business have the correct level of inventory below can triple compared to other leading enterprises.

- Support financial reporting – management fees: When inventory is properly tracked, as well as timely updates of the value of inventory, raw materials, tools... is properly reflected in the financial statements, help with finance department – accounting ensure compliance with standards and transparency. At the same time, businesses also understand the cost related to stock – operate – import goods (for example, storage costs, losses, and losses) from which to take measures to better control.

- Control the risk of loss, damage, errors: If there is no clear process on data books (vouchers) good business to meet the condition: order lost, row is the wrong amount, or value – influencing profit and reputation. Research shows that when inventory of electronic documents are not synchronized, the business will lose the ability to forecast and operating efficiency.

2. The account in inventory accounting and how accounting (collated circular circular no. 200/2014/TT-BTC with circular 99/2025/TT-BTC)

The accounting for stock specified in the account group inventory (TK 15x) of the System account in the accounting business. Between Circular no. 200/2014/TT-BTC (No. 200) & circular 99/2025/TT-BTC (TT 99) has a number of notable changes regarding the name of the account in this group aims to clarity and neckline with international standards more.

Below is the aggregate of the account to the main depot, the contrast between the two circular along with principles of accounting basic.

| Code TK | Account name (According to TT 200/2014) | Account name (According to TT 99/2025) | Notes on changes (TT 99) |

| 151 | Goods in transit | Goods in transit | Keep the |

| 152 | Material, materials | Material, materials | Keep the |

| 153 | Tools | Tools | Keep the |

| 154 | The cost of production, unfinished business | The cost of production, unfinished business | Keep the |

| 155 | Finished products | Products | Change the name (neckline with international term “Finished Goods” and allows product details complete each stage, semi-finished products internal). |

| 156 | Goods | Goods | Keep the |

| 157 | Goods on consignment | Goods on consignment | Keep the |

| 158 | Cargo warehouse | Raw materials in warehouse | Change the name (properly Reflect the reality of business processing, production, export or export processing). |

| 159 | (Not specified) | Provision for diminution in value of inventory | New code (converted from TK 2294 old) |

2.1. Method of accounting for stock base

All accounts belonging to the group (TK 15x) are asset account, have the general structure is as follows:

- External Debt: Reflects the value of inventory increase (warehousing).

- Sides Are: Reflects the value decreased inventory (stock).

- The balance of the Debt: Reflects the value of inventory is still at the warehouse.

Accounting entry stock (Increase): When materials, goods, tools, or finished products are enter warehouse:

- Debt TK 152, 153, 155, 156... (value added warehouse, no VAT)

- Debt TK 133 (input VAT if available)

- Have TK 331 (Must be paid by the seller) or TK 111, 112 (cash payment/deposit)

Accounting of stock (Up): When the warehouse inventory used for the purpose of:

| Purpose export warehouse | Accounting (Basic) |

| Production (Raw materials) | Debt TK 621 (MATERIAL Cost, direct) |

| Production (C. C, D. C) | Debt TK 627 (Cost MANUFACTURING general) or TK 242 (allocated) |

| Sales | Debt TK 632 (cost of sales) |

| Manager DN | Debt TK 642 (Cost manager DN) |

| Have TK 152, 153, 155, 156... (Value of stock) |

This is the basis for enterprises to implement the account inventory accuracy, ensure data inventory transparency.

2.2. Collated circular 200/2014 & circular 99/2025

| Content change | Circular no. 200/2014/TT-BTC | Circular 99/2025/TT-BTC | Meaning change |

| Name TK 155 | Finished products | Products | In accordance with international practices (IFRS). The term “products” more broadly, including the final product and semi-finished/finished products, each phase, which helps to reflect the price of more accurate for the business of producing multiple stages. |

| Name TK 158 | Cargo warehouse | Raw materials in warehouse | Accurately reflect the nature of materials in the warehouse is often the raw materials imported by the business processing, machining, instead of just “cargo”. Easy collated with customs records. |

| Account provision for decline in inventories | TK 2294 (provision for diminution in value of inventory), located in the group long-term Assets (TK 2xx). | TK 159 (provision for diminution in value of inventory) is located right in the group inventory (TK 15x). | Major reforms: Take backup account on near the root account (TK 15x) to express the essence is the deduction value of the property on the short-term Assets, helping financial statements more transparent and true to the standards IFRS. |

Circular 99/2025/TT-BTC effective from 01/01/2026 and apply for financial years starting on or after this date, marking a significant step in the reform of accounting Vietnam.

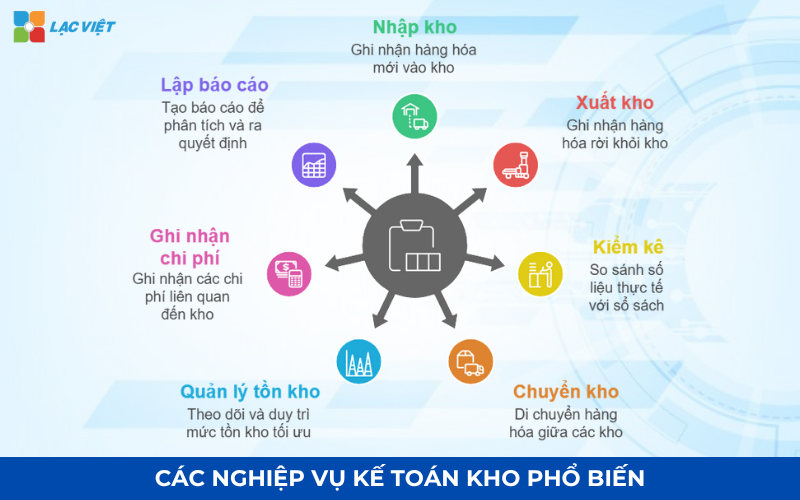

3. The accounting profession stock common in business

In business, warehouse not only the storage of supplies, raw materials and goods, but also to regulate the flow of raw materials – products in the production and business. Effective inventory management to help control inventory, reduce losses, optimize costs, and to support timely decision-making. The accounting profession warehouse, from import, export, inventory, stock transfer to reports, ensure data transparency, accuracy as well as compliance with circular no. 200/2014/TT-BTC.

3.1. Accounting entry stock

Import warehouse is the first step in the management of materials, goods or raw materials. This is the moment business is recorded exactly the physical property new on stock, the basis for the inventory control, production planning cash flow management. All warehousing are based on business accounting and inventory vouchers books include the receipt, invoice and contract of sale.

Meaning of accounting:

- Ensure data inventory on the books match the reality.

- Is the basis for calculating the cost of inventory, evaluate the effectiveness shopping as well as forecasting the demand for raw materials.

- To help businesses reduce the risks of loss, errors, and improve transparency in the management repository.

How to account under circular no. 200/2014/TT-BTC:

- Debt TK 152 (Raw materials) or TK 156 (cargo): reflects the value into the treasury.

- Have TK 331 (Must be paid by the seller): when a business purchases unpaid.

- Have TK 111/112 (Cash/bank deposit): when purchase paid immediately.

Illustrative examples: Business and get batches of raw materials worth 100 million from suppliers, payment after 30 days. Journal:

- Debt TK 152: 100,000,000

- Have TK 331: 100,000,000

3.2. Accounting of stock

Export warehouse is the recorded materials, goods out of stock production service, sales or stock transfer. This step is important in accounting inventory to determine the exact price of capital and related costs.

Meaning of accounting:

- Control lines out into the warehouse.

- Determine the price of goods sold or cost of production.

- Business support avoid loss and confusion to maintain data inventory accuracy.

How to account under circular no. 200/2014/TT-BTC:

- Debt TK 632 (cost of goods sold) or TK 154 (Cost of production): reflects the value of stock.

- Have TK 152/156: reduction in value of assets in the repository.

Illustrative example: the Enterprise 50 million raw materials for production.

Journal:

- Debt TK 154: 50,000,000

- Have TK 152: 50,000,000

3.3. Inventory

Inventory is professional accountant compare actual figures with the window list to detect deviations of, wastage or damage. This is important step in risk management – internal control.

Meaning of accounting:

- Timely detection of deviations, loss or damage.

- Ensure data inventory accurate service, auditing and financial reporting.

- Process optimization, inventory management, loss reduction as well as improving operational efficiency.

How to account under circular no. 200/2014/TT-BTC:

- Case excess warehouse:

- Debt TK 152/156: actual value excess

- Have TK 338 (other income) or TK 711 purchase policy, business

- Case of shortage of stock:

- Debt TK 632/154/811: costs incurred

- Have TK 152/156: reduction in value of assets inventory

Illustrative example: Due to inventory periodically, detect missing 5 million goods. Journal:

- Debt TK 632: 5,000,000

- Have TK 156: 5,000,000

3.4. Stock transfer

Stock transfer is professional accountant recorded the movement of goods and supplies between the depots or branch. This step is important to data inventory at all points always accurate.

Meaning of accounting:

- Help business control lines, and internal purchase.

- Avoid excess in this repository and the shortage in inventory.

- Support reporting inventory accuracy by each warehouse.

How to account under circular no. 200/2014/TT-BTC:

- Debt TK 152/156 – warehouse receipt: increase the value of inventory at the warehouse receipt

- Have TK 152/156 – stock export: reduce the value of inventory at the warehouse creampie

Illustrative examples: Business transfer 20 million of goods from the warehouse Ha Noi to stock Ho Chi Minh. Journal:

- Debt TK 156 – store HCM: 20,000,000

- Have TK 156 – warehouse HN: 20,000,000

3.5. Inventory management

Inventory management is business, accounting, inventory, track the status of supplies of goods in the warehouse to avoid deficiency or excess, at the same time support business decision-making import/ export/ storage.

Meaning of accounting:

- Maintain inventory levels, logical, optimal cash flow.

- Reduce the costs of storage, limiting damaged.

- Support forecasting and planning of production/sales.

How to account under circular no. 200/2014/TT-BTC:

- Inventory management is primarily recorded and evaluated, does not arise journal entries individually, but may be related to a business, the account inventory accounting when adjusting inventory practice.

Illustrative example: Due to forecast demand, sales, high business adjust enter an additional 50 million raw materials to maintain a minimum of inventory. Accounting entry stock taken as 3.1.

3.6. Recorded the related costs

The costs related repositories, such as transportation, unloading, storage and wastage must be recorded full to calculate the price accurately.

Meaning of accounting:

- Properly calculate the inventory value and cost of production.

- Decision support cost optimization warehouse.

- To help businesses comply with accounting policies/ laws.

How to account under circular no. 200/2014/TT-BTC:

- Costs incurred when entering warehouse:

- Debt TK 152/156

- Have TK 111/112/331

- Costs incurred when inventory or damage:

- Debt TK 632/811

- Have TK 152/156

Illustrative example: the Cost of shipping the shipment of 10 million from suppliers warehouse:

- Debt TK 152: 10,000,000

- Have TK 111: 10,000,000

3.7. Report – analysis

Reporting – analyze inventory helps businesses track inventory, evaluate the effectiveness of management and business planning.

Meaning of accounting:

- Provide transparent information for leadership.

- Support inventory control – cost optimization.

- Help prepare for the audit of the financial statements for strategic decisions.

How to perform:

- Set up inventory report details according to the inventory item type.

- Report inventory.

- Situation analysis of fluctuations, the proposed optimization.

Illustrative example: inventory report month 10 shows of raw materials A inventory last months longer 200 million, while the demand forecast production year 11 is 250 million. Business decide to enter additional 50 million of raw materials to ensure production.

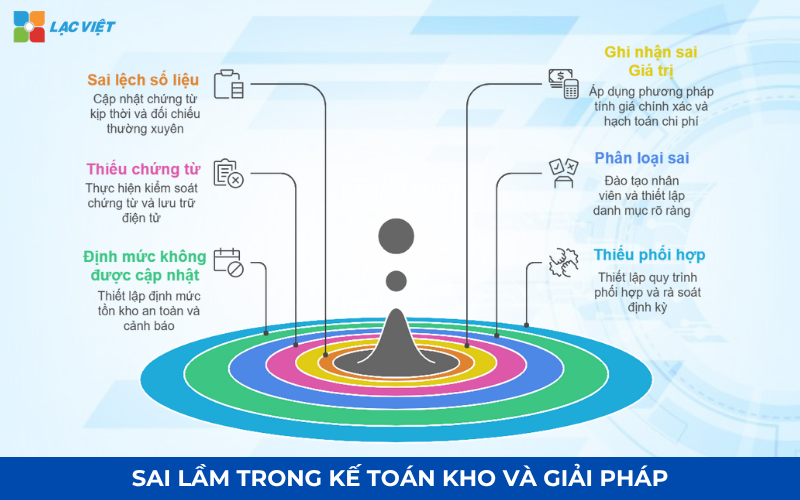

4. Common mistakes in inventory accounting and how to fix

In fact, although there have been management process clearly, many businesses are still experiencing errors in accounting inventory due to the lack of synchronization between the accounting department and the warehouse, or due to limitations in management tools. Below are the common errors, as well as solutions to overcome the effect:

4.1. Common mistakes in accounting stock acquired

- Deviations between metric books – inventory practice: Evidence from input – output is not updated timely, enter the wrong code, unit or value of inventory and for regular screenings between warehouses with accounting.

- Recorded in wrong value inventory: Apply the wrong method, calculate the price (weighted Average, FIFO, LIFO...), not accounting for the full purchase cost (the shipping, loading, unloading, import tax...) on the value of inventory or the wrong account the import – export – transfer.

- Teen vouchers or voucher is invalid: Missing signature confirmation of the stakeholders (the warehouse, accounting, recipient of the goods), import – export establishment the wrong time or lack of supporting documentation (invoices, receipts) and storage symptoms from not properly regulated lead to misplaced records.

- Do not clearly distinguish between goods, raw materials & tools: accounting record all kinds of supplies on common stock without separating type, leading to confusion between the account 152, 153, 156, causing distortions in financial statements.

- No updates norms & inventory safety: Business't build the consumption of supplies or inventory, minimum, at the same time there is no mechanism alerted when items expire or residues too much.

- Lack of coordination between accounting warehouse & stock: accounting, warehouse & storekeepers work independently, do not cross-check the data, and lack of reporting process and confirmation of stock from clear.

4.2. How to fix mistakes

- The set up process for screening periodically (weekly, monthly) between the warehouse and the accounting; use warehouse management software integrated accounting to update data automatically; conduct an inventory periodically, making a difference to handled promptly in accordance with internal regulations.

- Specified method of pricing inventory in the accounting system; training, inventory accounting master the principles noted the price of capital goods; set check out the account automatically on the software to detect the error variances.

- Building control process vouchers before accounting; applied electronic signature or confirmation online to reduce errors crafts; storing electronic documents are decentralized, ensuring fast access when you need audit.

- Staff training, accounting distinguishing characteristics and intended use of each type of asset; set up your portfolio investment – goods according to the account team on accounting software; organize inventory separately for each group (cargo, NVL, CCDC) to ensure accuracy.

- Set the inventory levels of safety for each item or group of items; application software inventory management functions of inventory alert to proactively plan, import – export; coordination with purchase department – production to adjust the level according to the actual needs.

- Set coordination procedure of three steps: Import – validate – Record window; clearly stated responsibility – authority of each position; held a meeting to review periodically between accountant, storekeeper and accountant general to sync data.

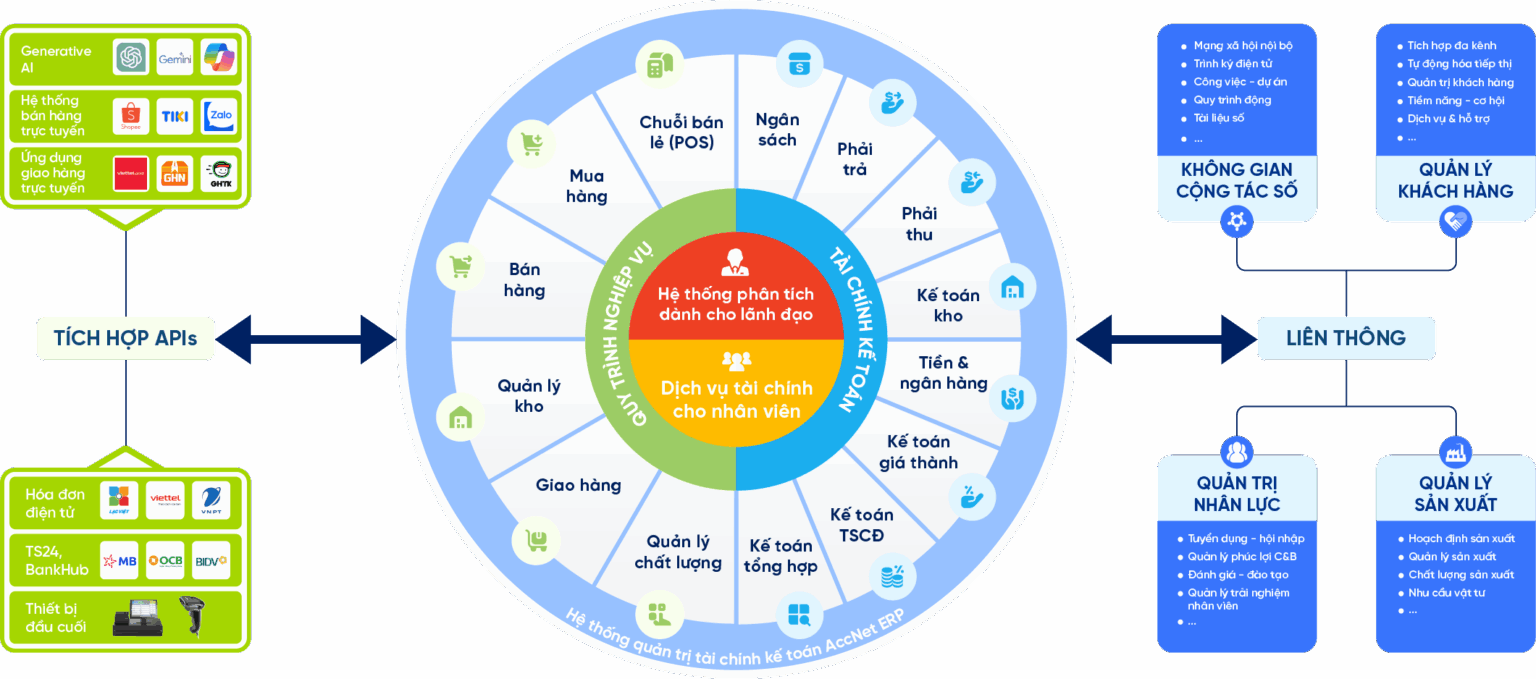

5. Chuẩn hóa nghiệp vụ kế toán kho với Phần mềm kế toán Accnet ERP

Many businesses today still maintain notes for business warehouse, leading to the common problems such as: wrong data update delays, lack of transparency and difficulties in the synthesis report management.

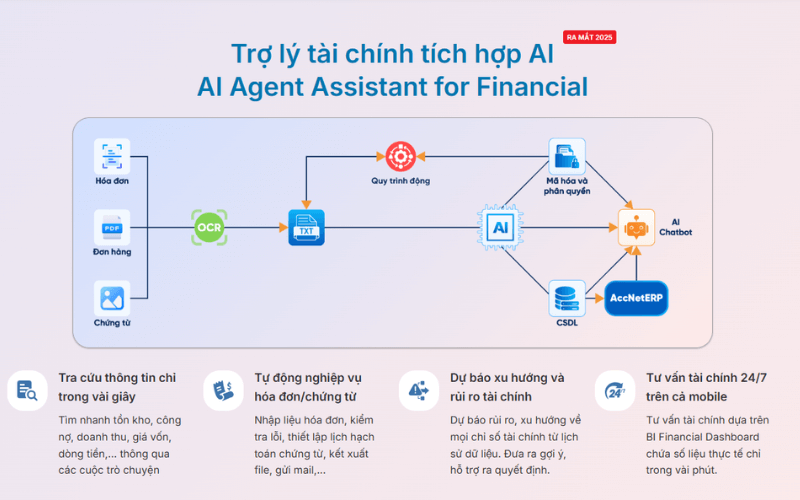

Ứng dụng Accnet ERP – phần mềm kế toán tích hợp công nghệ AI mới của Lạc Việt giúp tự động hóa toàn bộ nghiệp vụ kế toán kho, từ nhập liệu, kiểm soát chứng từ đến báo cáo tài chính, đồng thời tích hợp quản lý mua hàng, bán hàng và tài chính trên cùng một nền tảng.

Feature highlights:

- Auto-account professional warehouse: System recorded the transaction import – export – conservation, minimize errors due to input manually.

- Manage electronic documents: storage – lookup import/ export/ inventory quickly, ensuring information transparency.

- Updates the inventory in an instant: track the amount of inventory at each warehouse, branch, help businesses accurately capture data in real time.

- Financial statements – integrated management: Integrated data warehouse with financial statements – management, decision support, quick and accurate.

- Linked comprehensive services: seamless connection with the management buy – sales, process optimization, commissioning business.

ACCOUNTING SOLUTIONS ACCNET ERP INTEGRATED AI AUTOMATE ALL BUSINESS

AccNet ERP is a software solution financial accounting integrated in the management system, comprehensive enterprise, which is developed by Lac Viet corporation. Difference highlights of AccNet ERP is the app artificial intelligence (AI) in many accounting process to help businesses:

- Automation of accounting and classified documents.

- Improving the accuracy in data control.

- Shorten processing time business accounting – financial.

Thanks to that, AccNet ERP not only is support tool but also a “smart assistant” with the business in financial management transparent effect.

Feature highlights:

✔️ Automatic accounting vouchers, collate public debt thanks to AI.

✔️ Manage your finance – accounting multi-branch, multi-subsidiary.

✔️ Financial statements consolidated standards of Vietnam & international (VAS, IFRS).

✔️ Cash flow management, budgeting, forecasting the exact cost.

✔️ Connect with the manure management system, hr, production, sales to sync data.

✔️ Integration of AI in data analysis, risk warning and proposed optimal scheme.

TYPICAL CUSTOMERS ARE DEPLOYING ACCNET ERP

- Nitto Denko – control production costs thanks to the application of accounting costing: Nitto Denko has chosen solution AccNet ERP to deploy the system accounting calculating cost ofhelp business control costs more effectively in the production process. After a period of use, company, highly effective, practical system that brings, as well as the degree of stability superior to other software in the market.

- ANTESCO – restructuring process works with management accounting operation: At ANTESCO, our team of consultants and deployment of AccNetERP has collaborated closely with the business in the first phase, reset the standard process and construction work-flow related departments throughout. The solution has helped ANTESCO significantly improve management capabilities, operating in a synchronized way and versatile

- Khatoco – expansion pack solution AccNetC after the successful implementation of original: Lac Viet has successfully deployed package solution AccNetC for trade co., LTD Khatoco in Nha Trang, according to the agreement signed on 29/07/2014. After the system is first put into operation efficiency, Khatoco intends to continue cooperation and expand the distribution finance – accounting and retail management with AccNetC, expressing the deep trust in implementation capacity and quality of service from Lac Viet.

SIGN UP TO RECEIVE DEMO NOW

INTEGRATED AI ACCELERATION CONVERTER OF ACCOUNTING

AI in AccNet ERP't just stop at automate data entry, but also:

- Identification & classification certificate from smart: AI scan, read & sort invoice, voucher, receipt, limit errors due to input manually.

- Financial forecasting & budget: the system uses algorithms machine learning to forecast cost, revenue, business support decision fast.

- Warning risk accounting: AI to detect abnormalities in the book, from which timely warning of false or fraud risks.

- Reports assistant smart: AI suggested report template, automatic data aggregation support, leadership, financial analysis instant.

BUSINESS IS WHAT WHEN IMPLEMENTING ACCOUNTING SOFTWARE LAC VIET?

- Experience more than 30 years develop software solutions business management in Vietnam.

- Ecosystem of comprehensive: AccNet ERP easily connect with other solutions of Lac Viet (HRM, Workflow, Portal...).

- Advanced technology: Integrated AI support, cloud & on-premise flexible.

- Services dedicated support: A team of knowledgeable professionals with accounting – finance in Vietnam, companion throughout the deployment.

- Trust from thousands of customers in many areas: finance, banking, manufacturing, trade, services.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: accnet@lacviet.com.vn | Website: https://accnet.vn/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

Ứng dụng cho doanh nghiệp: Accnet ERP hỗ trợ các doanh nghiệp chuyển đổi số nghiệp vụ kế toán kho, nâng cao hiệu quả kiểm soát – minh bạch thông tin, đồng thời rút ngắn thời gian lập báo cáo quản trị, giúp ra quyết định nhanh chóng, chính xác và tối ưu nguồn lực vận hành.

Management accounting warehouse efficiency is the key element that helps the business to control inventory, optimize costs and improve financial transparency. The application services the accounts, inventory accounting, standardized processes, for projection and vouchers regularly and use accounting software digitization will reduce errors, increase operational efficiency, and to support strategic decisions correct. Invest in solutions inventory management comprehensive help businesses comply with accounting standards create a solid foundation for sustainable development.