In any organization, the pay not only the cost but also the important levers to maintain and develop human resources. Payroll management therefore become a core part in strategic hr business help ensure both transparency, just comply with the law while improving the satisfaction of employees.

In the context of competition increasingly fierce, many businesses are finding out information about payroll management to improve internal systems. This article Lac Viet will clearly analyze the concept, role, challenges as well as solutions that help business process optimization manager salary hr.

1. Management salary what is?

Payroll management is the process the organization, operation, control entire activities related to the payment of salary, bonus, allowance and other welfare regime for employees in business. Management here doesn't just stop at the exact calculation which also includes the construction of policy, fair wages ensure compliance with the law, creating incentives for employees.

Other than payroll usual, which only focus on the final number that the employee received salary management in business more inclusive. It includes many stitch:

- Set structure, salaries, bonuses, allowances based on the development strategy.

- Track attendance data, performance of work, the deduction under the law.

- Budget control salaries to optimize personnel costs.

- Ensure transparency to employees believe in the policy to pay wages.

The role of management payroll personnel in strategic human resource management is very clear:

- To help businesses maintain fairness internal to avoid conflict complaints.

- Enhance the experience of employees, thereby increasing the level of sticking reduce the rate of the holiday.

- Create database accurate to leadership, cost analysis, forecasting decisions.

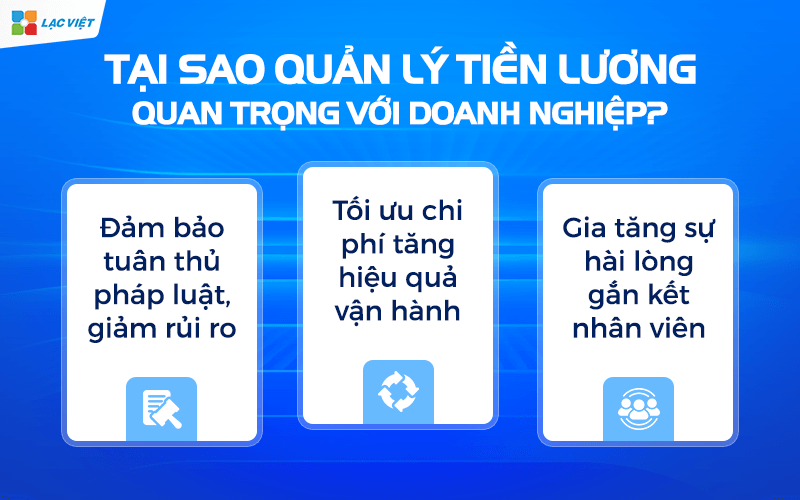

2. Why payroll management important to business?

For many organizations and businesses are to find out information about management salaries, the biggest question usually revolves around: “why do we need to invest in management payroll personnel, while still being able to maintain how to make crafts or craft sale?” The answer lies in three aspects key: legal compliance, optimize costs and improve satisfaction of employees.

2.1. Ensure legal compliance, reduce risk

Payroll management is associated with many legal regulations from the Ministry of Labor law, personal income tax (PIT) to social insurance (SOCIAL insurance). If the business is not managed closely, risk of occurrence of errors that lead to violations of administrative or out is very high.

According to the report of the Organization the international Labour (ILO, 2023), more than 30% of small and medium enterprises in the Asia – pacific encounter difficulties in complying with regulations on salary deduction insurance (ILO Report 2023). A system for payroll management standards will help businesses minimize risk, legal risk, while protecting brand reputation.

2.2. Optimal costs, increase operational efficiency

Payroll management in business is not just spend how much but also how to optimize line personnel costs to bring business efficiency. Deloitte (2022) for know, the business application management system, payroll modern can save 20-30% on operating costs thanks to reduced processing of handmade, reduce errors, and shorten the duration of the pay table.

For example, a retail company with thousands of employees working in shifts, if still manage salary will lose hundreds of hours every month for the synthetic data, timekeeping, and payroll. Meanwhile, the application of the system, payroll management, hr automation can shorten the processing time down to just a few days, help the hr department to focus more on the strategy work.

2.3. Increase satisfaction mounting employees

Wages are factors directly affect the engagement of employees. A policy of transparency, paid exactly the right term to help build trust, reduce complaints and increase the level of satisfaction.

Survey of SHRM (2023) found that 61% of employees considered transparent about salaries are important factors leading to the decision long-term commitment to the business (SHRM Employee Benefits Report). When business management payroll personnel good employees feel recognized and fair from which the rate of the holiday significantly reduced.

3. 4 How to manage payroll for business from crafts to digitize automatic

3.1. Manager salaries craft using a spreadsheet (Excel, Google Sheets)

For many years, this is the common way that organizations and small business use to manage salaries. Most new businesses established in often choose Excel because it is easy to manipulate, without the cost investment software is suitable when the number of employees less. The hr department or accountant will collect attendance data, allowances, deductions, insurance, income tax... and enter manually into the spreadsheet to calculate monthly salary.

However, this method exist many limitations when business starts to scale. Part of the error payroll in small businesses stem from mistakes when entering data manually. Minor flaws not only does this affect employee benefits but also makes the business more time-consuming test, collate, bug fixes.

On the management salary in Excel, lack of confidentiality, the ability to control data. When the Excel file is shared internally via email or Google Drive payroll data of employees may be unauthorized access or edit unintended. In addition, the storage craft makes parts C&B difficulty when auditing or reporting aggregate personnel costs.

From the perspective of value, the business can remain this way if the scale below 30 employees, remuneration policies not complicated. However, when the volume of data increases, the switch to the management system, payroll automation is inevitable in order to save time, reduce errors and improve accuracy.

3.2. Manager salaries semi-automatically by accounting software or HRM single

When the business development stage from 50 to 300 employees, managing payroll in Excel become less effective. At this time, many institutions began to switch to accounting software or hr software (HRM) to semi-automate the process of payroll. The software popular in Vietnam such as MISA, Bravo, FAST or some HRM internal help businesses reduce the work load calculations, create reports, payslips and data storage easier.

Advantages most pronounced of this model is the ability to reduce the time, payroll processing from several days down to just a few hours, at the same time limiting the calculation error. According to research by Gartner HR Tech Trends 2024, the business application software, accounting or HRM shortened by an average of 40% processor time process salary compared to forms of craft.

However, because of data between the system still discrete, for example, timekeeping software, accounting, tax not connected to the collated information still need to enter manually or export Excel file intermediate. This easy to lead to false when synthetic data, especially in the pay period that much variation as overtime, vacation, bonuses or allowances.

Security issues and distribution rights is also a challenge. Many software single only managed according to general users (admin), no separate get access of personnel, accounting and management. This can cause a risk of information leakage compensation or confusion of personal data.

Even so, management salaries semi-automatic still is a significant step to help businesses form data system financial – hr structured, ready to integrate up platform fully managed (HRM or ERP). When demand analysis, cost, personnel, budget planning or sync data increases, businesses should consider switching to solutions manager salaries automatically integrated for optimal performance, ensure transparency.

3.3. Payroll management automatically by software HRM integrated (All-in-one)

In the context of the conversion of the strong current, institutions, businesses are finding out information about payroll management increasingly prevail systems HRM integration (Human Resource Management). Here is the solution to help connect the entire hr data from attendance, benefits, insurance, tax to accounting on a single platform to ensure payroll process takes place accurate, transparent and timely.

Other than semi-automatic models, software, HRM integration allows automation of the entire lifecycle manager salaries in the business. Attendance data is recorded in real time, information allowances, bonuses and penalties, insurance deductions, personal income tax are handling system, automatic calculation, not only helps to reduce errors due to data entry craft but also speeds up the approval and payment of wages.

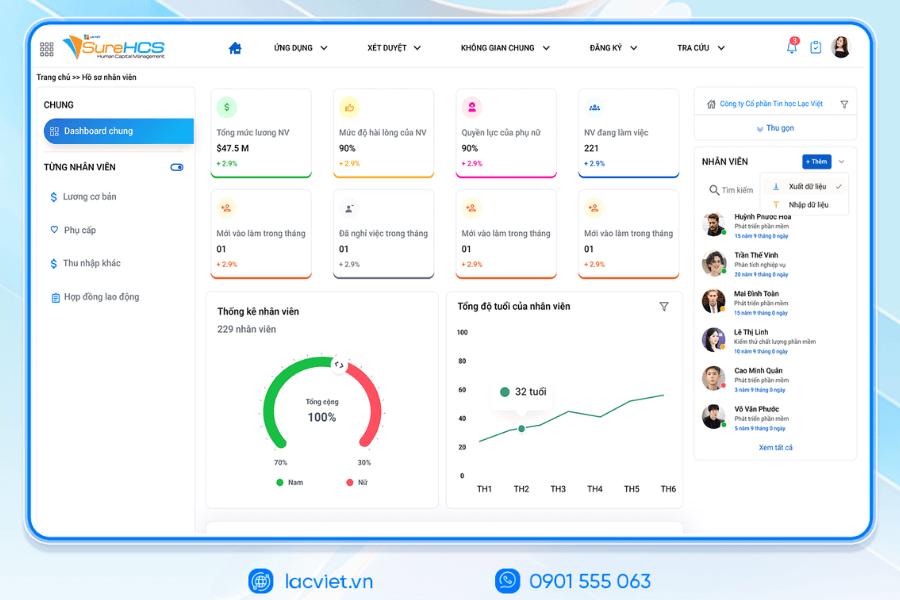

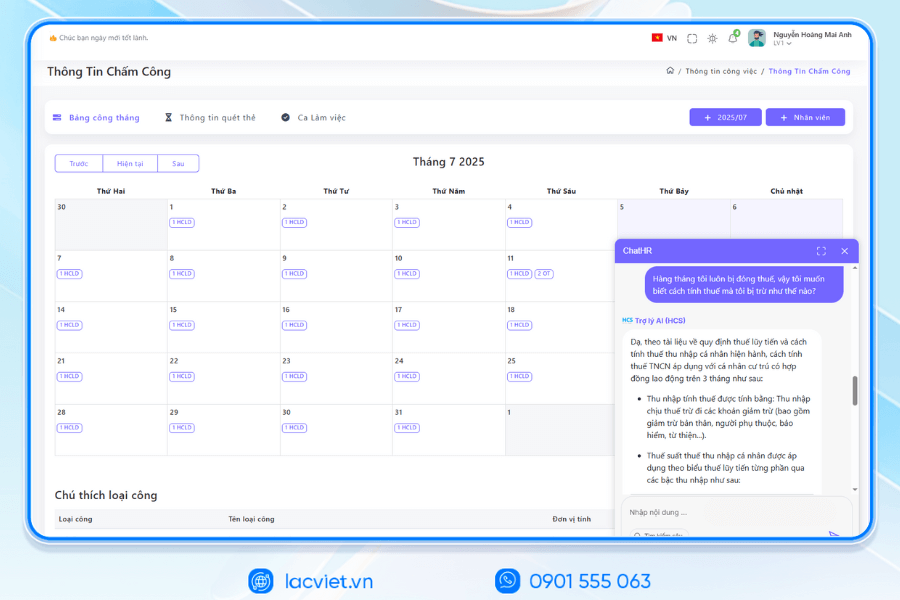

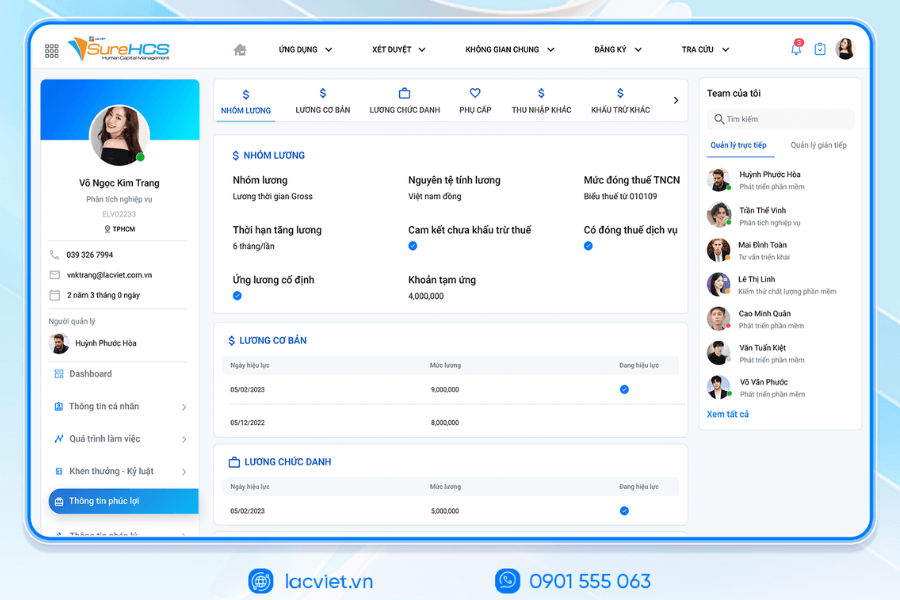

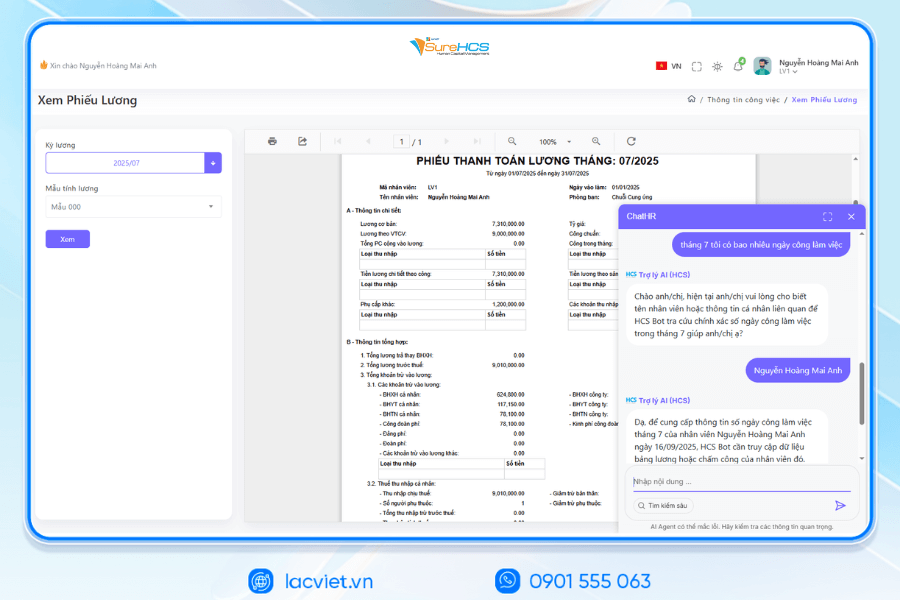

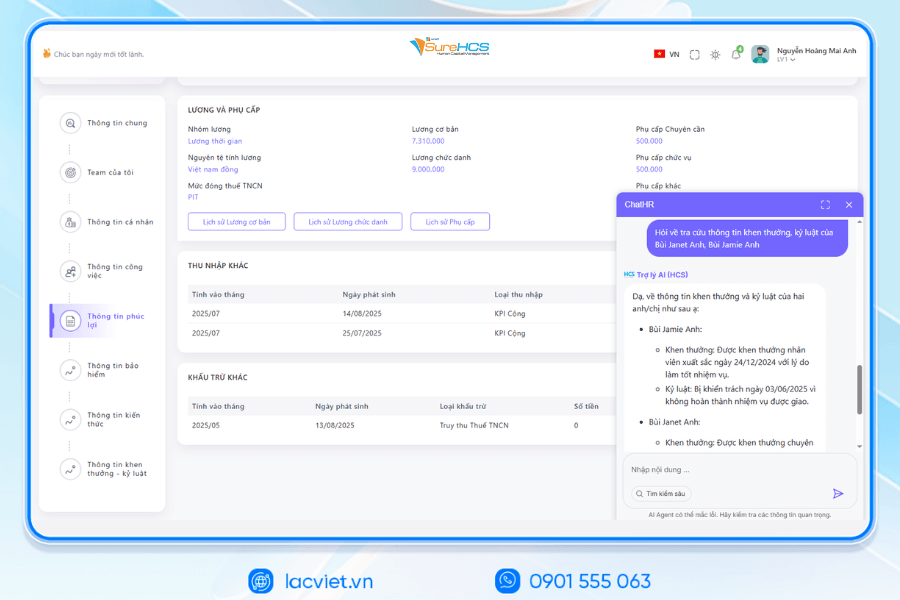

A practical example is software lacviet SureHCS C&B management solutions salaries in the business being more organized, Vietnam news user. This system not only supports attendance – payroll – insurance – taxation in an automated way that also integrates AI technology to identify data discrepancies, alerts exceed budget, to support approval of payroll online. In addition, employees can actively lookup payslip portal online, contribute to increased transparency and experience internal.

The value that business get not only lies in the “up-time payroll” but also in the ability to control the financial and legal compliance. When the system is automatically updated according to the new rules of the state tax, insurance, business will reduce the risks of violation, ensuring the rights of workers, maintaining brand reputation. This is also an important foundation to switch from “management of hr administrative” to “human resource management strategy”.

3.4. Payroll management outsourcing (Payroll Outsourcing)

Another trend are many businesses, especially companies, FDI, multinational corporations, the choice is to outsource management services salary. With this form, the whole process payroll, tax filing, insurance premiums and reporting will be assigned to a single service provider, C&B professional.

This approach brings clear benefits of optimal internal resources to ensure compliance. According to the survey of Deloitte Payroll Benchmarking 2024, there are 54% of business scale over 500 employees are using the service outsource a part or the entire payroll process help them lose an average of 25% of the cost of operating room personnel. In addition, the expert C&B of the service providers always update the latest books about the labor law, tax, insurance to help businesses avoid the legal risk is not worth having.

However, payroll management outsourcing also comes a number of challenges. Business must ensure the level of security payroll data, employee information, at the same time maintain the ability to control outputs. Feasible solution is to select the partner has certified international security such as ISO 27001, signed commitment to data security (NDA) and set the process control to ensure transparency.

This embodiment is particularly suited to the business is in a stage of restructuring or expanding market. When the hr department needs to focus more on the human resource strategy instead of processing services, outsource payroll will help save time and cost significantly.

From practical perspective, the choice of model management wages would depend on the scale, needs the ability to control of each business. If the business needs the right proactive HRM integration is the optimal choice. If you want to save resources, ensure compliance with legal, outsource be flexible efficient.

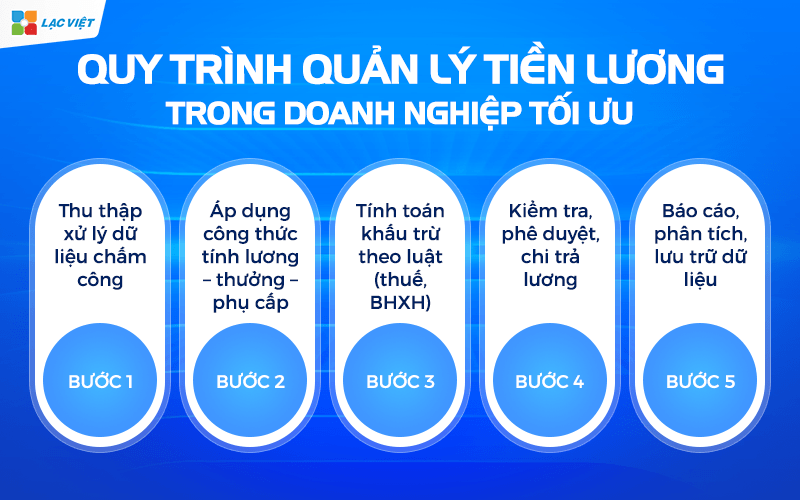

4. Process manager salaries in optimized business

A process payroll management science not only help businesses pay the right enough for workers, but also create the foundation for data transparency to cost control and decision support administrator. Here are five basic steps in the process management payroll personnel, accompanied by a value that businesses can get from each step.

Step 1. Collects data processing timesheets

This is a step platform, by any number of salary are starting from attendance data. Includes time worked, number of hours of overtime, vacation, sick leave, or maternity leave.

- With how to manage the craft, the synthesis from multiple excel table easily lead to errors or omissions.

- When the application manager system of wages in the enterprise, attendance data is automatically synchronized from the fingerprint, magnetic card or mobile app, helps to lose up to 90% of input errors.

Step 2. Apply the formula for calculating the salary – bonus – allowance

After the attendance data, the next step is to apply the formula calculate salary according to enterprise policy. This includes:

- Basic salary under the contract.

- Allowances such as gasoline, lunch, phone.

- Bonus productivity, KPI or sales commissions.

A management system, payroll personnel, modern allows flexible setting many types of formulas are suitable for both business production (paid according to the product), business services (paid by the hour or KPI). Providing value is high accuracy, transparency, save time for the hr department.

Step 3. Calculate the deduction under the law (tax, SOCIAL insurance)

This step is important to ensure compliance with the law. Business must calculate the deduction right regulations:

- Personal income tax (PIT).

- Social insurance (SOCIAL insurance), health insurance (health INSURANCE), unemployment insurance (UI).

Many small and medium business risks because not updated with the new rules. A system for payroll management is the design standard will automatically be applied to the insurance premiums tax current minimize the risk of penalties for declaration wrong.

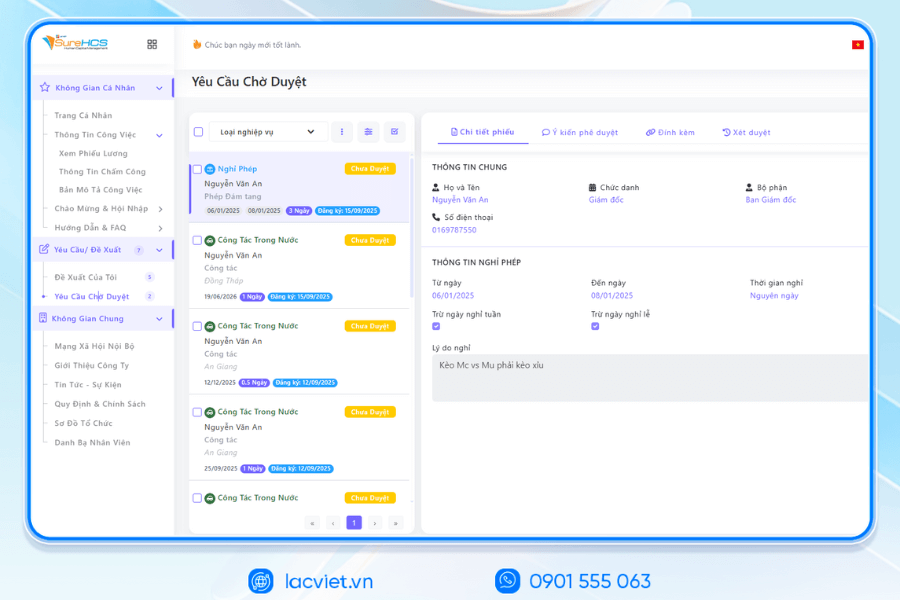

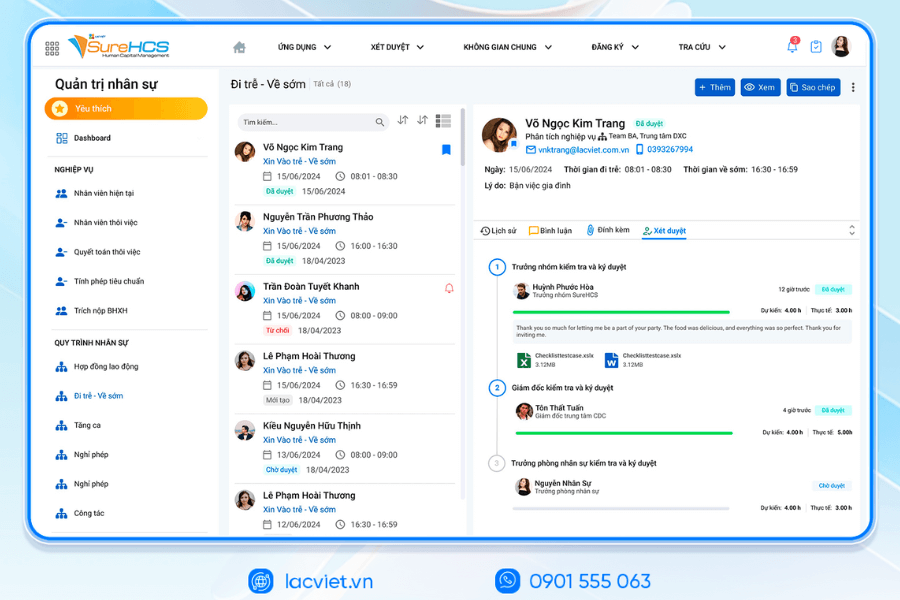

Step 4. Check, approve, pay, salary

Prior to payroll, hr departments need to collate, review to ensure there are no errors. In many businesses, this process often need the approval of the department head or the leader board.

- If there is no support system, the inspection usually takes several days.

- In contrast, when using software to manage payroll, hr, payroll reporting is automated, easy to control and submit to management for approval quickly.

When wages are paid timely, transparent, employees have more confidence in the institution from which long-term commitment over.

Step 5. Reports, analysis, data storage,

Payroll management in business don't end up in paying that need systems analysis reports to support decision making.

- Report helps businesses track personnel costs by department, project or branch.

- Data analysis salaries enables to forecast the budget, assess productivity, build remuneration policy accordingly.

In addition, the storage of data science also helps businesses easy access when the tax authorities, and insurance or labor inspection requirements. This is the key point to ensure transparency and long-term adherence.

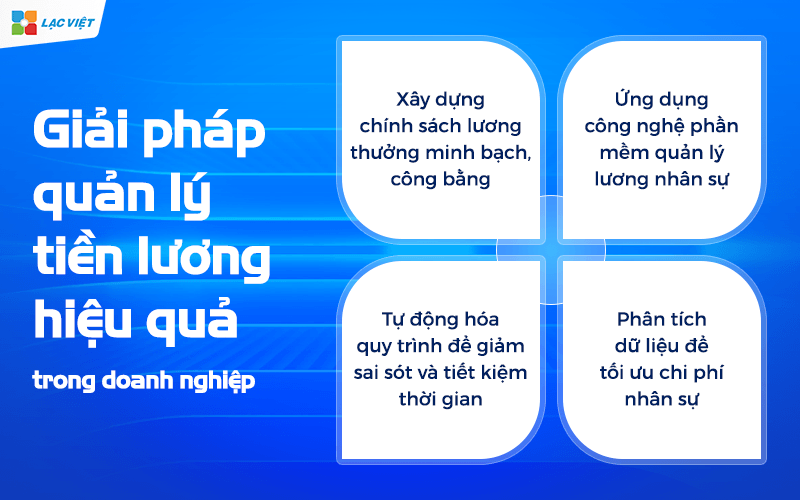

5. Solutions manager salaries effective in business

To management salaries actually become a tool to help businesses save costs, retain talent, enhance competitiveness, organizations need to deploy the solution in sync. Four pronged approach here is consistent focus for all scale business.

5.1. Build remuneration policy of transparent, fair

Wage policy transparency is the foundation to create trust with employees. A clear mechanism to help employees understand why I get the current salary at the same time to see the route increased pay or the opportunity to receive a bonus upon completion of the job.

- If the lack of transparency, business opposite condition discontent, compare internal and increase the rate of quitting.

- Conversely, a policy of wage fair will promote motivation and retain key personnel.

5.2. Technology application software, salary management personnel

Today's technology allows businesses to manage the entire process from timekeeping, payroll, tax deductions, insurance to reporting only on a single system.

- With small-scale business, software, helps save resources reduce operating costs.

- With big business system manager salaries in the business support processing large volumes of data, while ensuring the accuracy compliance with the law.

5.3. Automate processes to reduce errors and save time

Manager salaries crafts usually consume many hours of work of the personnel department, at the same time, potential errors due to data entry. The automation process, from sync attendance data to calculate the allowances, reward and punishment, help:

- Business shortening the processing time from weeks down to just a few days.

- Personnel in charge have more time to focus on the strategies such as policy development or data analysis.

A practical example: a retail company scale 2,000 employees have saved more than 400 hours per month after process automation salary management personnel.

5.4. Data analysis to optimize personnel costs

Don't just stop at the pay, payroll management efficiently helps business to have the overall look of personnel costs. The analysis report from the wage system allows:

- Compare the cost of personnel between departments, branches, or project.

- Budget forecast salary for 6 months – 1 years to come.

- Determine competitive salary compared to the market to adjust policies to attract talent.

6. Business need anything to optimal management payroll personnel?

Payroll management in business is not merely ensure paid properly enough for the staff, but also as a strategy elements directly affect satisfaction, sticking of workers and operational efficiency general. To optimal management payroll personnel, enterprises need to focus on three key elements below:

6.1. Select tools/software in accordance with the scale

One of the greatest difficulties of the organizations and enterprises are to find out information about payroll management problem is to balance the cost and efficiency.

- Small business medium, the software management payroll personnel have reasonable cost, basic features like attendance, payroll, tax deductible – insurance is enough to solve the problem.

- With large-scale enterprise branches need integrated system of comprehensive support processing large volumes of data, and allows compliance with the legal regulations in many locations.

Choosing the right tools that fit will help businesses and cost savings, while ensuring the possibility of sustainable development.

6.2. Training personnel in charge of C&B

Although there are modern tools to where the human factor is still the key. Hr C&B (Compensation & Benefits) are not just proficient skills payroll, timekeeping, but also to understand legal regulations, tax policy, and insurance.

- The constant training that helps this department capture timely change in state policy.

- At the same time, employees, C&B has skills data analysis will help leaders closer look at personnel costs, labor productivity.

6.3. Continuously updated legal regulations

Management payroll personnel under the direct influence from the provisions of labor, personal income tax and social insurance. A little mistake in applying the law could lead to legal risks, arrears or administrative penalty.

- Businesses need to set up process to update the text of the new legislation, integrated and timely in the system management salary.

- The application software features automatic updating law is also the solutions that help minimize risks, ensure compliance.

- Salary 3P what is? Distance calculator & excel Template STANDARD construction systems salary 3P

- Understand correctly the deductions from salary to calculate correctly and manage effectively

- Accounting salaries and deductions from wages, standard circular 200

- How to build stairs payroll standard with excel template for business

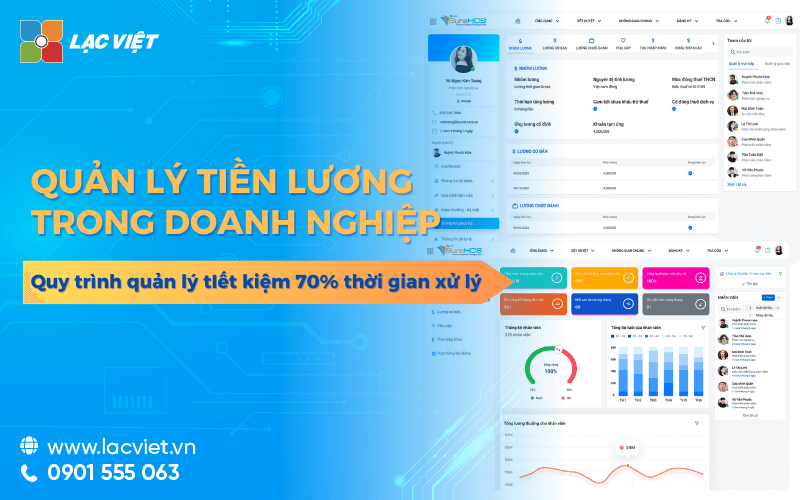

7. Solution Lac Viet SureHCS HRM – System management salary comprehensive

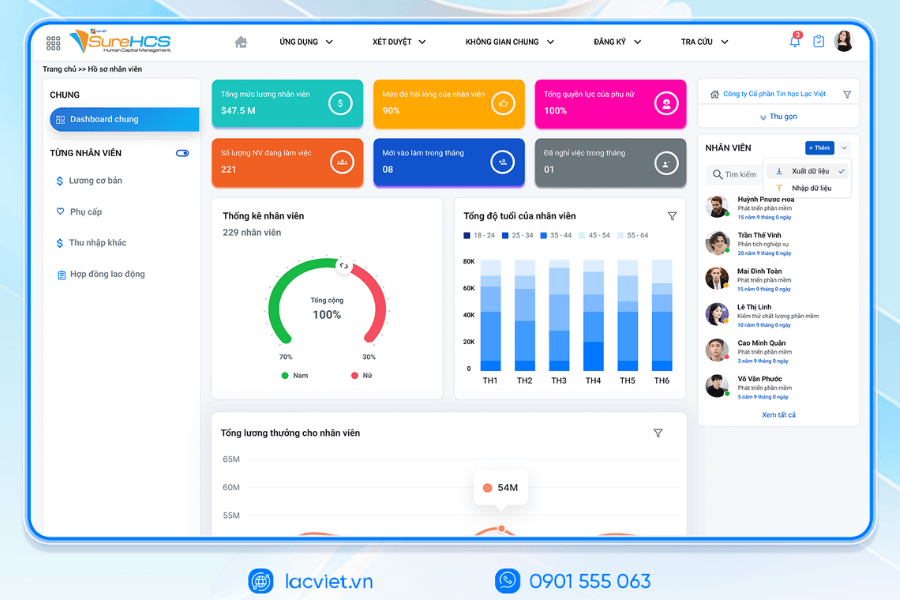

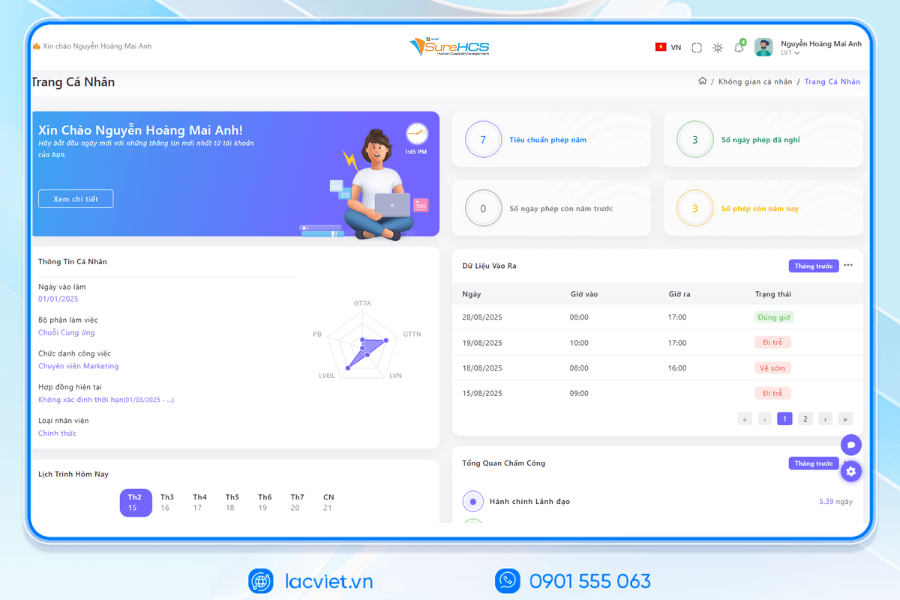

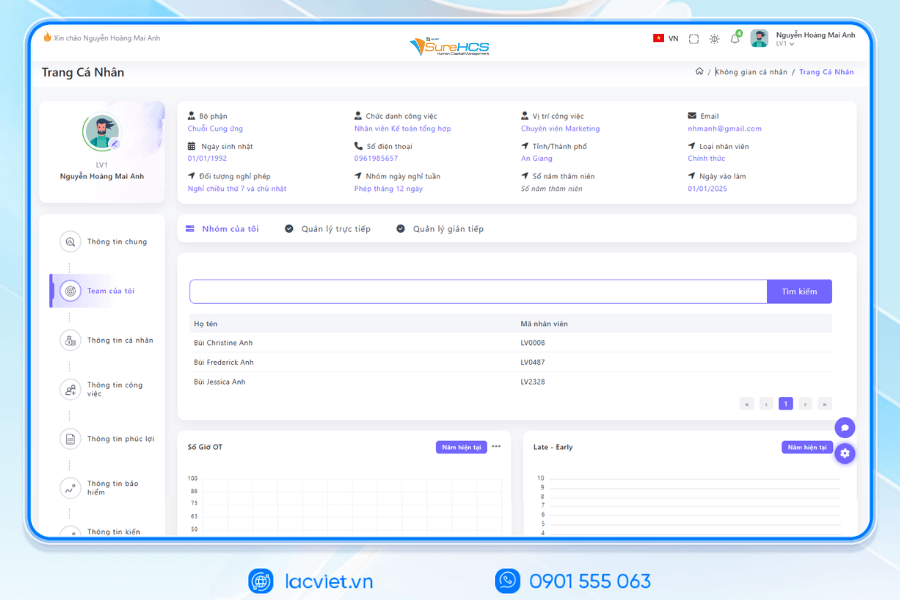

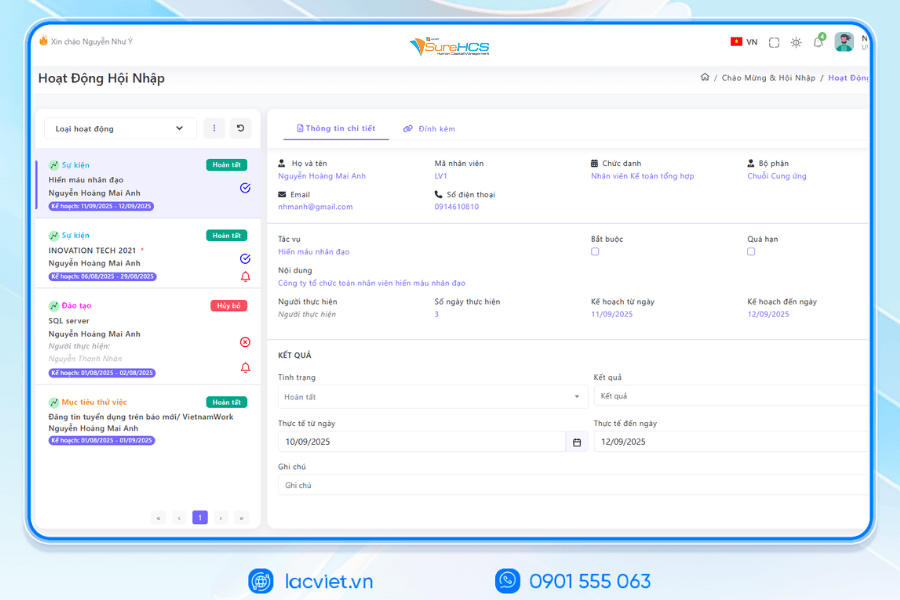

SureHCS is designed to radically solve the challenges in the management of wages in the enterprise, from the stage of timekeeping, payroll to report analysis. This is a system personnel management comprehensive, suitable for many models of different organizations.

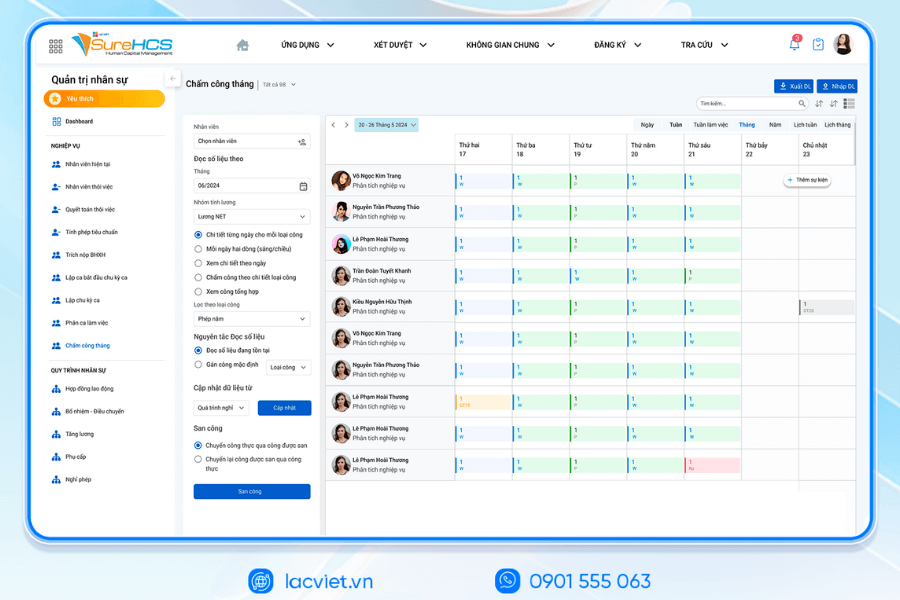

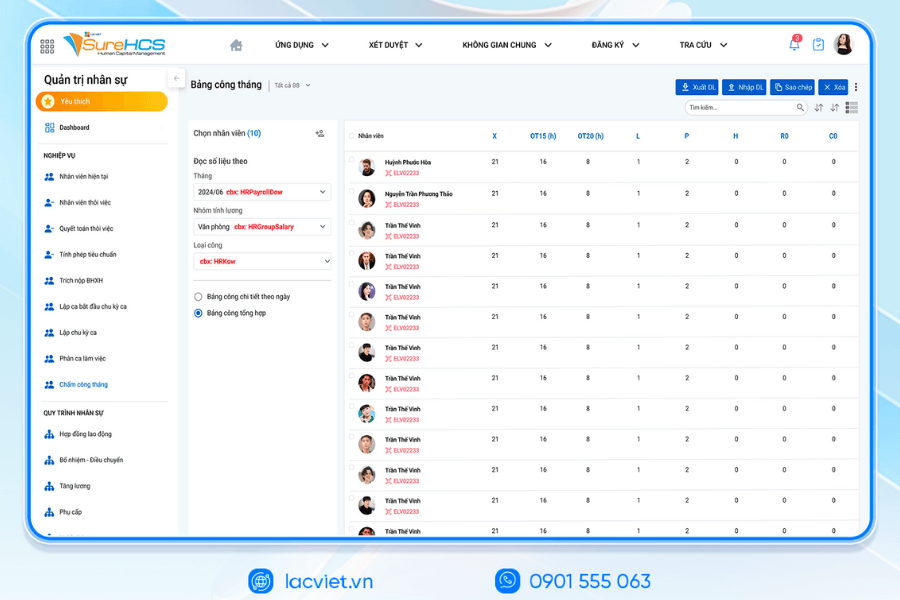

- Automation process timesheets – payroll: Data is synchronized directly from the timekeeper, minimize errors and data entry manually. The system automatically calculate salary according to many forms (from time to time, products, KPI...), which saves up to 70% of the processing time.

- Management allowance, reward and punishment, deduction, according to the law: All allowances, bonuses, benefits, taxes and insurance are calculated, accuracy, transparency in accordance with the law.

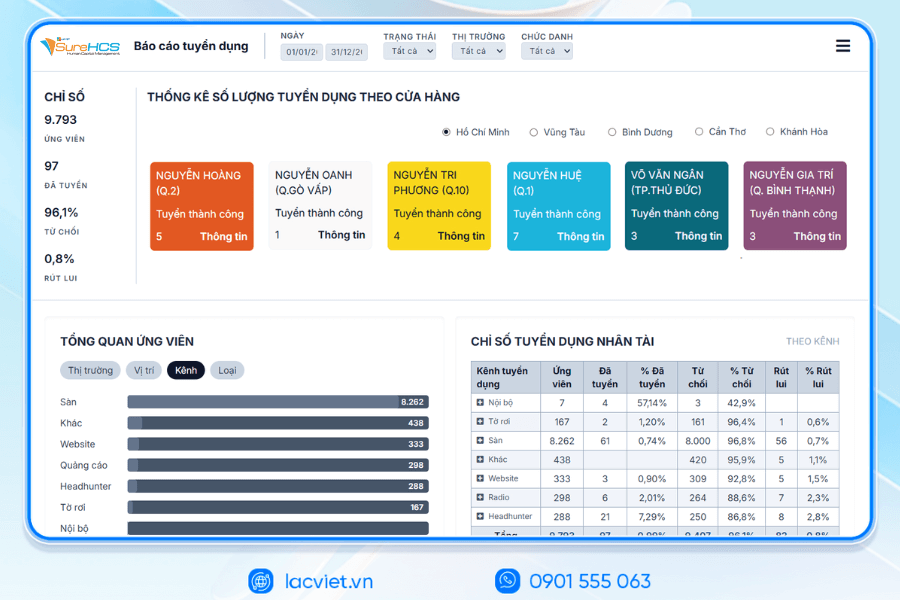

- Integrated visual reports: Businesses can track personnel costs by department, project, or company-wide. The report intuitive leader board support timely decision-making, budgetary control effectiveness.

LAC VIET SUREHCS – HR MANAGEMENT SALARY C&B CUSTOM DEPTH FOR BIG BUSINESS

Lac Viet SureHCS is software HRM personnel management comprehensive, developed by Lac Viet – unit more than 30 years of experience in the field of management software business in Vietnam with international standards such as CMMI Level 3, ISO 9001:2015 and ISO 27001:2013.

SureHCS not only meet the professional personnel standards, which are designed to handle the hr – C&B – wages complex, large-scale, multi-company, multi-sector, in particular in accordance with FDI enterprises, corporations, factory, logistics, aviation, hotel, trade – in service.

The system is flexible deployment On-premise or as a custom model in depth, to help businesses automate the entire process hr – attendance – payroll – benefits – insurance, complete replacement job management using Excel discrete.

The module's core hr software lacviet SureHCS:

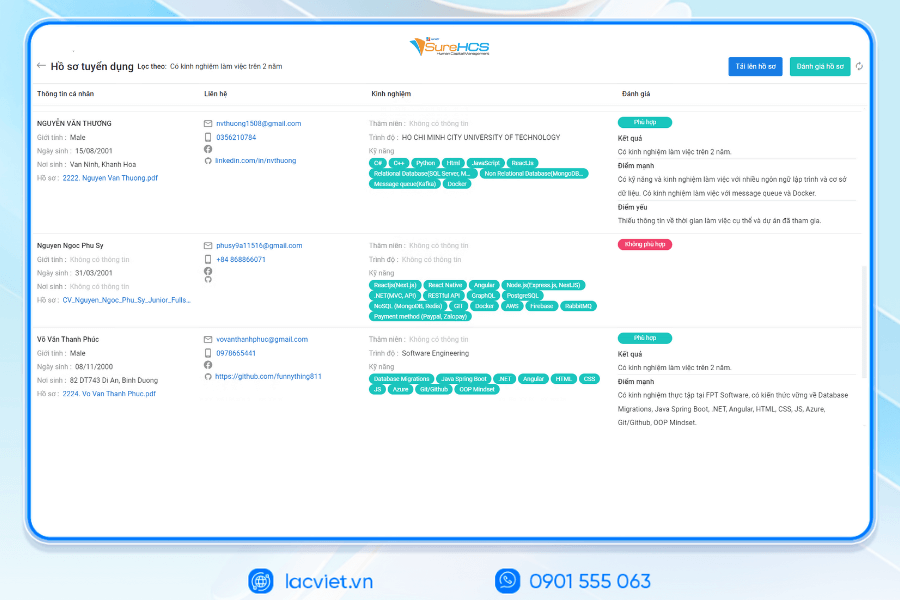

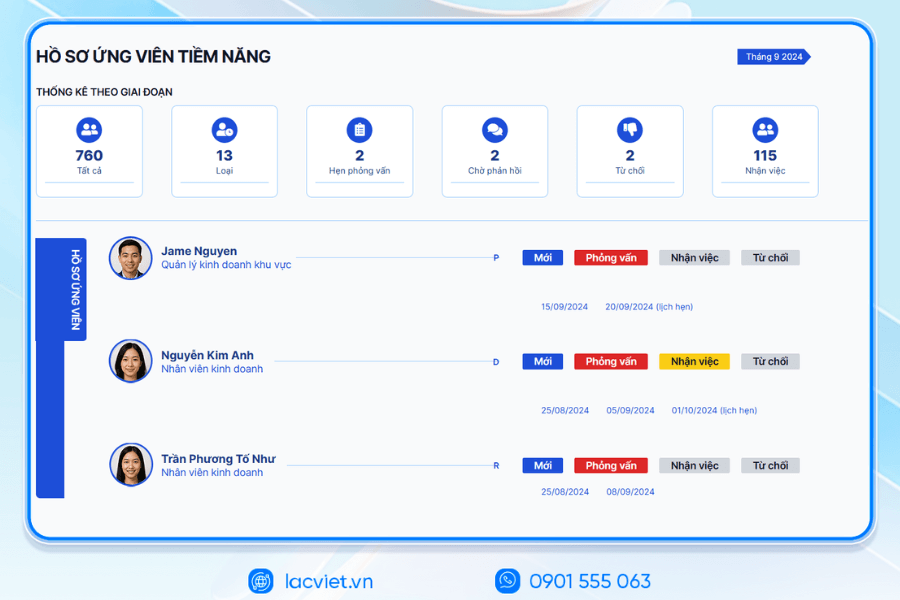

- The Recruit – Training: Management throughout the recruitment, integration, training, hr support and build the Talent Pipeline for large-scale enterprise.

- Port information & records Management personnel: Store personnel records, electronic focus, portal self-service for employees and contract labor power on the system.

- The timekeeper: Dots, multi-form (fingerprint, face recognition, Face ID, GPS, Wifi, online), connect many types of timekeeper, support attendance by the hour, shift flexibility for the plant, and hotels.

- The payroll & C&B: Automatic salary calculation according to many models (hour, shift, product, 3P, KPI performance...), link directly attendance data – performance – welfare, completely replace the salary calculator using Excel.

- Welfare – SOCIAL insurance – salary: Management benefits flexible, integrated iVAN connect SOCIAL and electronic Bank Hub salary automatically, support pay multi-currency for FDI.

INTEGRATED AI ACCELERATED CONVERSION OF HUMAN RESOURCES MANAGEMENT

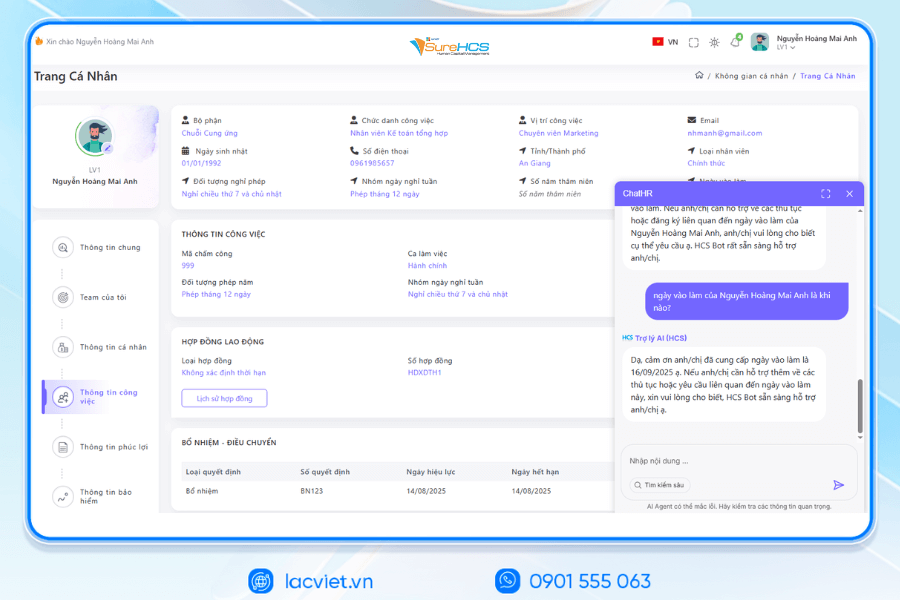

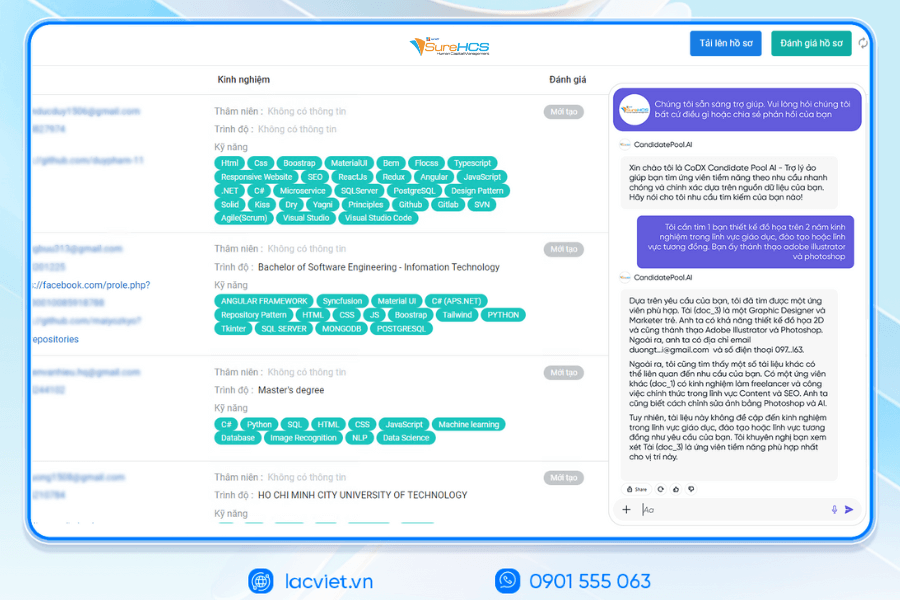

Lac Viet has officially launched The 3 AI assistant hr deeply integrated into the LV SureHCS including LV-AI.Docs, LV‑AI.Resume and LV‑AI.Help to automate the task administration, standardized data enhanced experience personnel

- LV‑AI.Docs: automatic dissection transfer data from documents such as CCCD, windows, SOCIAL insurance, by level of digital records, standardized

- LV‑AI.Resume: automatic dissection CV any format, analyst CV auto, construction, candidate profile, find people with the right criteria by prompt intelligent data mining candidate pool efficiency

- LV‑AI.Help: chatbot internal support, answer questions HR 24/7 access form process quick contextual user

TYPICAL CUSTOMERS DEPLOYING LV SUREHCS HRM

SureHCS are trusted and used by many large enterprises and leading corporations such as: Coca-Cola, Takashimaya, Textile SuccessfulPlastic Long Thanh Phu Hung Life, Airports of Vietnam (ACV)the business belonging to the SGCthe FDI enterprises in the fields of production, logistics, trade – in service.

- Coca-Cola Vietnam: System deployment LV SureHCS to digitize comprehensive human resource management group has standardized the data, the optimal operating HR according to international model.

- Textile company Success (TCM): Application LV SureHCS to manage hr, payroll, benefits, timekeeping and capacity profile for nearly 5,000 employees across 5 areas of activity – from textiles and fashion to real estate.

- Total company air Port, Vietnam (ACV): Choose to trust LV SureHCS to operate the system large-scale personnel with over 10,000 employees, 24 subdivisions, solved the problem of complex business of modeling state-owned companies.

SureHCS particularly suitable for:

- Large-scale enterprise, from 300 to 10,000 hr

- Corporations and enterprises multi-company, multi-branch

- FDI, manufacturing, factory, logistics, aviation should attendance – analysis ca – salary calculator complex

- Businesses are C&B peculiarities, need custom depth according to the actual operating

- Businesses are personnel management using Excel, many types of timekeeper, need automate the entire process

SIGN UP TO RECEIVE DEMO NOW

WHY BUSINESSES SHOULD CHOOSE TOUCH THE SUREHCS?

- Customized according to the actual business, no pressure mold as packaged software.

- Handle the personnel – salaries complex that many software HRM other does not respond.

- Deep understanding operated business English & FDI, ensure compliance with legal Vietnam (labour, SOCIAL insurance and personal income tax).

- Ecosystem integration strength: attendance – payroll – bank – SI – electronic contract.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: surehcs@lacviet.com.vn

- Website: https://lacviet.vn | www.surehcs.com

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

In the context of business increasingly attach importance to the experience of staff and effective internal management, the optimal payroll management in business no longer is choice, which is required to maintain the sustainable development. A system for payroll management hr professional as Lac Viet SureHCS HRM not only to help businesses save time, reduce errors, but also to build confidence cohesion from the labor.