Regulation compensation is an important foundation not only is the tool that helps the organizations and enterprises ensure fairness and transparency in remuneration policy, which is also the key element to attract, retain talent, at the same time prevention of legal risks.

In this article Lac Viet will provide details from the concept, constituent components, to the building steps and update regulations on remuneration latest to help businesses practical application in an efficient way.

1. Regulation of salary bonus what is? Why we need to build?

1.1 Regulation of salary bonus what is?

Regulation salaries and bonuses is the text's internal business regulations specific principles, methods, criteria to pay salary and bonus as well as the benefits for workers. This document is a legal requirement to be issued official publicity in the organization, to ensure that all workers and employers have the reference base clear.

The difference of this regulation in comparison with the regulations or the agreement is not official, located in transparency has legal value. When is text, the regulation salaries and bonuses help:

- Business: avoid the condition applied arbitrarily, reduce the risk of disputes, creating consistency in human resource management.

- Employees: understand the rights, obligations, from which the peace of mind working, motivated long-term commitment.

Practical examples: A manufacturing company applies template rules, the salaries and bonuses of the company, with clear criteria as to pay wages on time, bonus based on productivity, there is allowance night shift. When staff have any questions about the bonus, the leader board just for lighting regulation, to explain transparency, from which restrictions are contradictory and keep satisfaction in the collective.

Thus, one can see regulation salaries and bonuses not only the legal requirements but also is a strategic tool to enhance effective personnel administration, building enterprise culture fair, professional.

1.2 Benefits when business building regulations salary, bonus transparent

A regulation on the compensation transparency not only meet legal requirements but also bring more real value for the business. Specific:

- Increase motivation work: When employees clearly understand the level of wages, conditions, review, bonus, benefits of themselves, they are motivated to strive to achieve the goal. Transparency also helps to eliminate psychological comparison, speculation between departments.

- Attract retain talent: A model regulation on remuneration clear fair will help businesses better compete in the recruitment market.

- Limited labor disputes: disputes about wages, bonus, account for a large proportion in the service of the labor in Vietnam. When businesses have regulations on salary transparency is internal communication clear, every questions are the basis to answer, from which minimize complaints.

- Enhance brand image recruitment: apply now form the salaries and bonuses of company transparency, mounted salary with work efficiency will create trust with candidates. Not only attract candidates good but also help business branding recruiters reputation, professional.

In summary, construction of public regulation salary transparency is an investment strategy. This is not the cost, which is the business consolidation, cultural fair, motivational development, optimize human resources to achieve effective sustainable business.

- 15 software HRM integration of AI in human resource management optimization

- 15 Payroll Software employee oldest standard business manager salaries

- [Download Free] Sample confirmed salary company standard latest legal

- Salary 3P what is? Distance calculator & excel Template STANDARD construction systems salary 3P

2. The legal basis of the regulation salaries and bonuses

To ensure the legality applied in practicality, regulation, compensation must be based on the provisions of the labor law current. Currently, two bases, the most important include:

- The Labor code 2019: regulatory principles payroll forms payroll, time limit, responsibilities of business in the public transparency policy salary and bonus.

- Decree 145/2020/ND-CP: detailed instructions on the building, issued public regulation on the payment of wages, bonuses in the business.

According to the law, business required to build and public regulation salary at work for laborers to know. This is not only a legal obligation but also as a base to protect the rights of workers in the event of a dispute.

Practical example: A service company has issued model regulation on the remuneration of the company with full regulation of wages, bonus and welfare. When complaints about the bonus pay by revenue, company can rely on this regulation to prove that the pay was strictly regulated, thereby limiting the risk of dispute ensure compliance with the law.

With respect to the organizations and enterprises are to find out information about the regulation wage, bonus, to know the legal basis not only helps avoid violations, but also is the foundation to build a text transparency, fairness, creating peace of mind for staff, improve the reputation of business on the labor market.

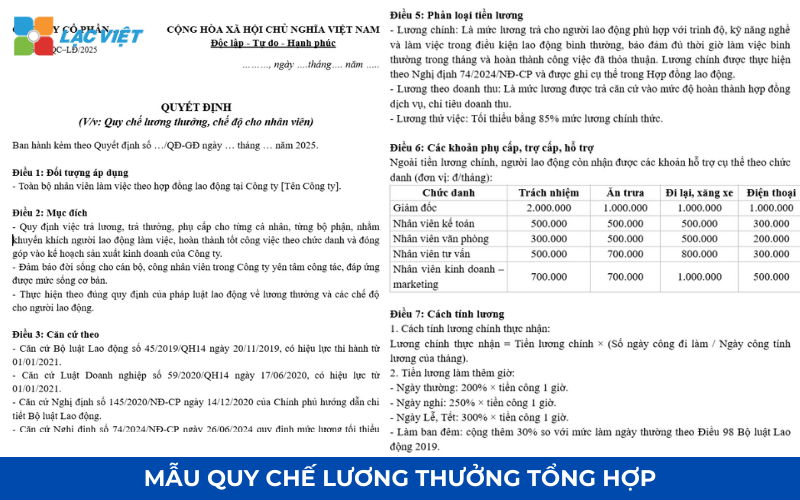

3. Standard structure of a model regulation luong full bonus

A model regulation on remuneration should not be just a document is dry. There must be a clear documentation on how enterprises identify and pay wages, bonuses, demonstrating the fairness and transparency; at the same time help workers understand their rights. Below is the standard structure that the business should build apply.

3.1 Scope and subjects of application

The scope of application is the first part of any model regulation compensation whatsoever. This is where clearly identify who in the organization will apply the rules on salaries and bonuses.

- The scope should clearly state the hr team (full-time, part-time, contract, internship if any), exceptions (employees, job advice, freelance partner), if applicable, different.

- Determine the range to help avoid disputes later when a group of personnel not clear about the rights or the payroll bonus.

When businesses specifies the range object to apply, people will know they're getting something, use this regulation as the standard test rights, responsibilities, per month.

3.2 principle of pay, bonus pay

This section should present the basic principles business follow when pay rewards, for example:

- Fair: Apply uniformly on the same ranks and titles.

- Transparency: Every recipe, the only goal payroll bonus must be clearly announced to employees.

- Legal compliance: Not lower than the minimum wage, the provisions of the labor law.

The main principle is “platform thinking” of the regulation. A regulation only came into existence is valuable when employees perceive fairness and transparency in pay. This supports reduce complaints and increase confidence mount. This is also a factor to help businesses reduce legal risks related to salary.

3.3 How to specify salary

This is the most important part of any model regulations on remuneration and usually people search the most.

Basic salary

Base salary is the fixed salary that the business pay for employees under contractual agreement. This is the base to calculate the other account as bonus, allowances, insurance.

A salary structure reasonable, often classified according to the ranks/titles clear, for example, employee A (basic salary of 10 million), B (basic salary of 12 million), assigned according to seniority or KPI.

Allowance

Allowance is the additional terms not included in the basic salary but support workers, for example, return travel allowance, mobile phone allowance, allowance toxic...

In the model regulations on remuneration should list the types of allowances are to apply and how to calculate, for example:

- Travel allowances fixed monthly 500,000 VND.

- Mobile phone allowance 300,000 VND, if required jobs that need regular contact.

The publication clearly allowance help employees understand why they get more of this clause, when this clause is not applied.

The additional payments

Include the account as overtime allowance toxic, salary working the night shift, the money to support the... this Section should identify how conditions are entitled to.

The section “How to specify salary” to help businesses standardize formulas paid on all parts, avoiding the need for each department is different, conflicting.

3.4 Regulations on bonus

Bonus section in the model regulations on remuneration should be clearly presented because this is one of the most important elements motivational work.

- Bonus work efficiency: this is usually based on the results of work at the department or individual. For example, completion of sales targets, promoting productivity growth. Business should be clearly stated criteria evaluation, calculation of reward and time to pay.

- Bonus KPI: KPI (Key Performance Indicators – indicators evaluating the effectiveness of the work) are popular tools to mount income with work efficiency. KPI must: easy to measure, there are clear data from time and attendance system, sales, production... The mounting KPI in bonuses help individual organizations towards the goal of general strategy in a transparent way.

- Unexpected bonus, holiday bonus: Here is the bonuses in addition to KPI's, is leadership decided to celebrate special achievements or holidays. The goal is to increase the mount workers with the business.

3.5 process, pay salary, handle errors

A model regulation on remuneration should clearly define the process to pay to ensure discipline and transparency. For example:

- Collect data: attendance, KPI, sales...

- Synthesis and approved by: department Head test, then send the Office of Finance and accounting to calculate.

- Pay: the Money is paid in due time, with itemization (payroll, bonuses).

- Handling errors: mechanisms reflect, correct errors when discovered flaws in the salary/bonus.

To help businesses reduce the risk of errors, especially the errors can cause troublesome for employees (lack of pay, paid the wrong). When clear process, employees can know who is responsible at each step and how to request a correction.

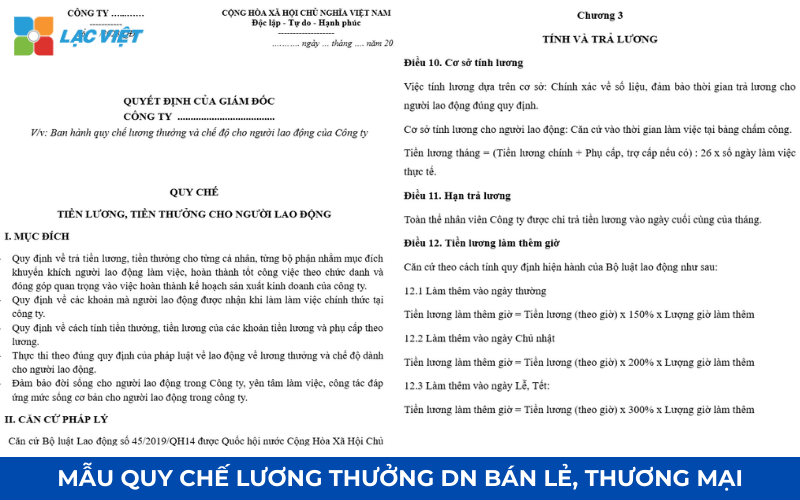

4. 9 regulation of salary bonus full latest for free company

A model regulation on the compensation standard medium businesses comply with the law while ensuring transparency, fairness in pay salaries and bonuses. Below is the basic structure that the organizations and enterprises are to find out information about the regulation compensation may refer to:

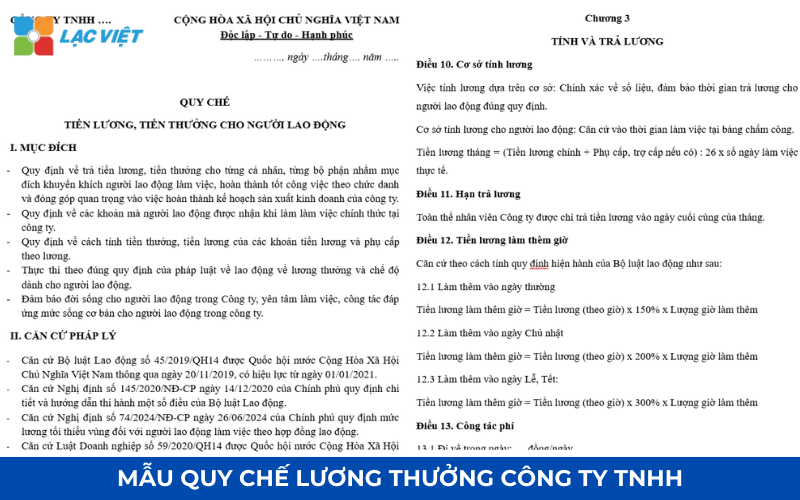

4.1 Model regulation salary co., LTD.

Public Liability company (LTD) is a kind of popular in Vietnam, often operate according to structure, manage less rank than corporation. This directly affects the way the building model regulations salary:

- Structure simple, transparent: With the number of shareholders limited, decisions about salaries and bonuses are unified easier, no need to through the general meeting of shareholders. This helps process, approving the regulation on the remuneration quick easy to deploy.

- Regulation should be flexible: Due to the organizational structure small, human multitasking model regulation should allow for flexible adjustment between base salary and bonus items to match the seasons or business projects.

The content should be in the model regulation on the compensation for co., LTD.

- Determine the basic salary by location, experience level.

- Specified allowances (such as travel allowances, expertise) with the criteria, conditions enjoy.

- Rewards based on work performance or KPI associated with department objectives to promote personal contribution and general.

- Terms adjusted when changes in business strategy or market fluctuations.

Note about cost management: Because the company usually has a scale hr small to medium cost compensation can occupy a large proportion in the total cost of operation. In order to effectively control costs, enterprises need to:

- Clearly define the norm of work to be achieved before bonus.

- Set out the threshold time to reflect before bonus (for example: after the end of the quarter/ financial year).

- Sub-optimal level according to each type of work in order to avoid the expense is not necessary.

This helps business to maintain financial balance, while maintaining the motivation to work for employees

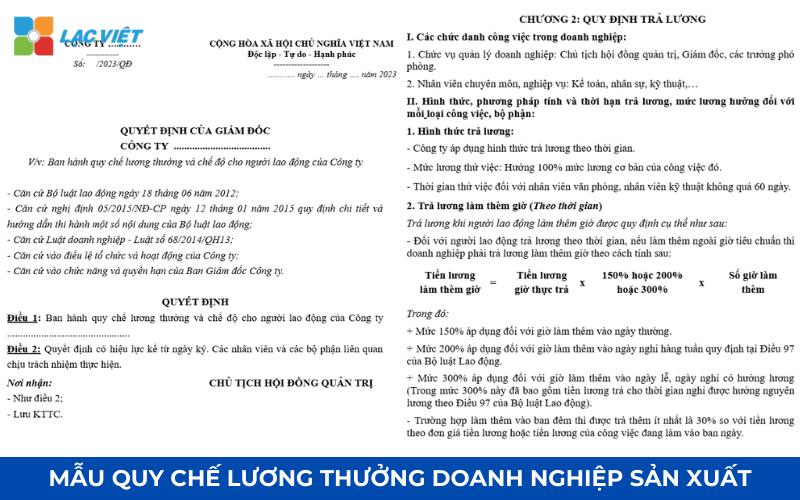

4.2 Model regulation on the remuneration of company shares

Associated with business performance

Joint stock company usually has many shareholders, business goals by quarter/year more clearly. So, model regulations on remuneration should closely tied to financial results, development strategy of the enterprise:

- Salaries and bonuses not only pay according to work, but also to reflect business performance.

- A reward for Board of directors, staff may be based on corporate profits exceeded the plan aims to create consensus between the interests of staff and shareholders.

Related dividends, profit

Unlike LIMITED companies, joint stock company can contact directly rewards with the resulting after-tax profit. Specifically, a part of the profit can be extracted to reward employees according to the contribution rate or KPI individual. This is spiritual to share the results of trading between shareholders and employees.

Model regulation on the compensation for the corporation should be specified:

- Percentage of the profit used for the bonus (for example, 5-10% profit after tax).

- Conditions get rewards for each rank.

- Time to pay (usually after shareholders through financial statements).

The detailed rules help people to understand how bonus from profit, create consensus, long-term connection.

4.3 Model regulation salaries for business manufacturing industry

Peculiarities payroll over time, according to the output

In the field of production, the work is usually divided according to the organization/ ca production, with the characteristics:

- Some suitable position with salary over time (office staff, technical supervision).

- The direct production usually apply salary according to the output (i.e. paid based on the number of finished product) or a combination of salary, time and wages of production.

This ensures fair, because people do more good quality products, you'll get income worthy, not because of the time limit fixed.

Allowance shifts, overtime

Due to the peculiarities of production 3 ca with output request exceeds capacity, model regulations should specify:

- Allowance shifts: more money for staff working in the special (such as night shift).

- Salary increase ca: if the employee overtime overtime rules, the pay must comply with labor laws and internal rules of the enterprise.

Clear rules that help avoid disputes salary due to the nature of work is not tied to certain hours, at the same time ensuring compliance with labor laws prevailing in pay, increases ca.

4.4 Mẫu quy chế lương cho doanh nghiệp bán lẻ / thương mại

Basic salary + sales

Retail businesses often operate the store point of sale with target sales of consumable products. Model regulations on remuneration should be harmony between:

- Basic salary to ensure a minimum income for employees.

- Bonus sales to motivate sales staff to promote sales.

This model is usually applied to the counter staff/cashier/sales staff directly. Bonuses can be of a percentage of sales exceeding targets set out in the month/quarter.

Bonus target store

In addition to the individual model regulation compensation should also be specified target store:

- If the store reaches sales objectives all month/quarter, the entire store employees can be added to a bonus account can.

- This does not only boost sales but also enhance team spirit.

Pattern pay salary to get under business number, and only target store help retail business, create a competitive environment healthy at the same time retaining good employees by income, attractive fair.

4.5 Mẫu quy chế lương cho phòng Sales / Kinh doanh

Parts Sales/business is hr team generate revenue directly, so the regulation of wages need to ensure both a stable income, just create motivation spurt in sales.

Salary structure popular

- Basic salary: pay a fixed monthly, ensuring a stable income of minimum.

- Salary effective (rose): calculated according to the sales contract concluded or profits brought about.

- Enjoy exceeding targets: apply when sales reach or exceed KPI sales by month/quarter.

Principle building regulations

- Business number higher income as increases in proportion to the clarity.

- Recipe commission to be transparent, easy to self-check.

- Avoid the status of “run the numbers but not be rewarded” by the vague provisions.

Illustrative examples: sales Staff have the basic salary of 8 million vnd/month. KPI sales month is 500 million.

- Reach 100% KPI: 2% commission sales.

- Exceed 120% KPI: commissions increased 3% of the excess.

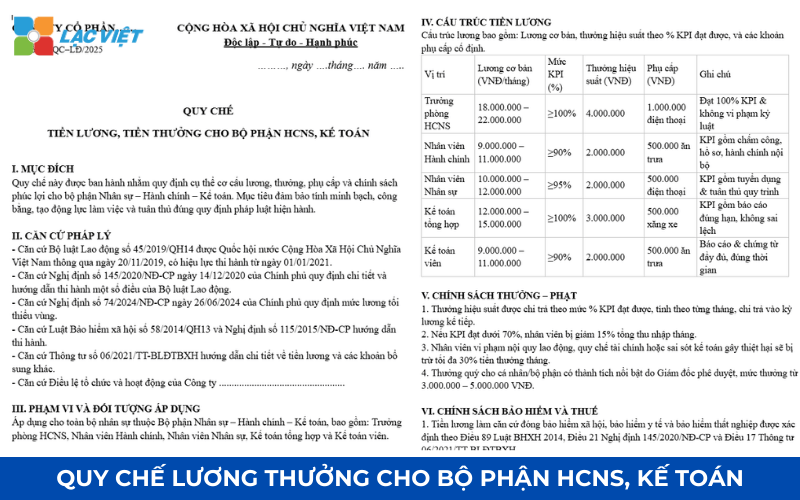

4.6 Mẫu quy chế lương cho phòng HCNS, Kế toán

HCNS – accounting is parts support operate, do not generate revenue directly, but affect the stability, compliance of the business. Therefore, the regulation of wages need to focus on the quality of work and responsibility.

Salary structure suitable

- Basic salary according to the position, seniority.

- Allowances responsibility (if part-time, management).

- Enjoy efficient work periodically (quarter/year).

Criteria for evaluating effective

- Complete the work on time, the correct process.

- Not going to happen serious flaws on record, figures, legal.

- The level of timely support for the other parts.

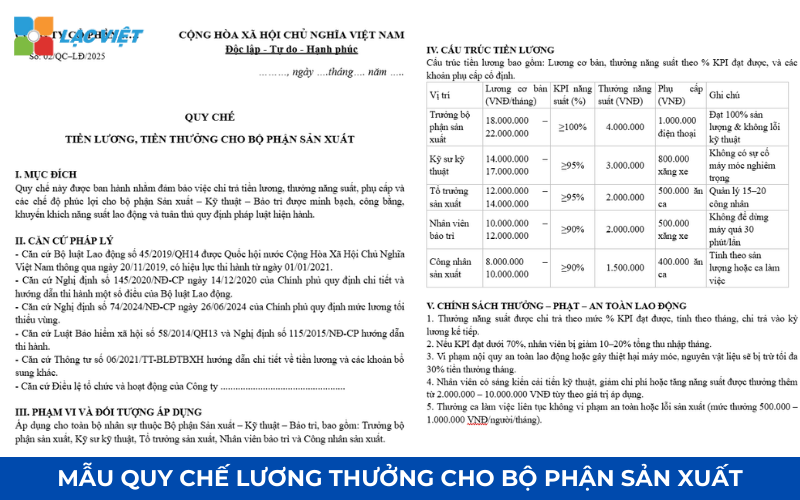

4.7 Model regulation on wages for production parts

Production department usually has the number of employees working in shifts, according passes, so the regulation of a simple – clear – easy to control.

Form paid downloads

- Pay over time: apply for the team leader, technical supervisor.

- Salary according to production: apply for workers directly involved in production.

- Allowance, night shift allowance, toxic (if available).

Important principles

- Do more, do better, then higher income.

- Output must be associated with the quality standards.

- Wage overtime, night shifts to comply with the law.

Illustrative example: workers are paid according to the product standard:

- Unit price 10,000 per product.

- If the product error exceeds the allowed rate will be excluded from production payroll.

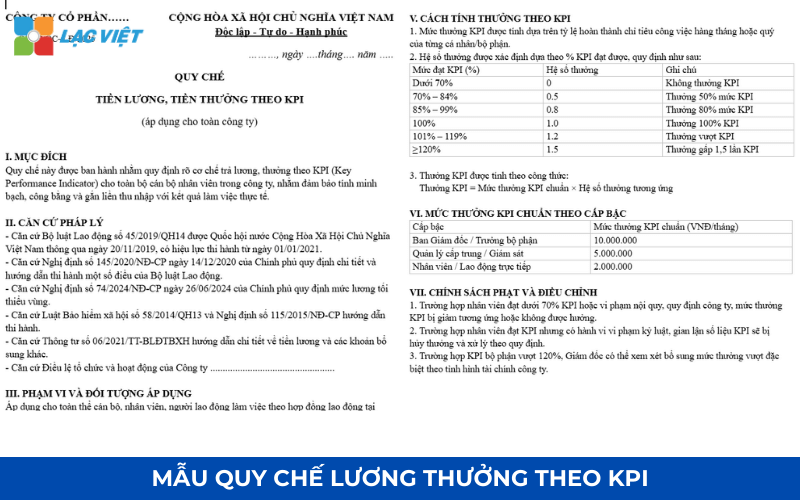

4.8 Model regulation salary according to KPI

Model regulation salary according to KPI in accordance with the business want to admin using the data attached income with results specific job.

KPI what is? KPI is the index measuring work efficiency, is pre-determined and can be measured by data.

Structure income

- Basic salary: pay fixed.

- Bonus KPI: pay based on completion rate target.

Principles applied

- KPI should be clear, measurable, have verifiable data.

- Do not put the KPI is too high, causing employees to lose motivation.

- KPI individual needs associated with KPI parts, your business goals.

Illustrative example: Employees reach:

- 90% KPI: get 80% bonus KPI.

- 100% KPI: get the full 100% bonus.

- On 120% KPI: get rewarded beyond the proportional increased.

4.9 Model regulation payroll, general

Model regulation on the compensation sum is material overarching policy income of the business, consistent with medium and large business or are standardized hr system.

Main content

- Specified base salary by location.

- Allowance, the additional terms.

- Bonus KPI bonus trading results.

- Holiday bonus (13th month, holidays).

- Process payments, handle complaints.

Why businesses should use the form synthesis?

- Avoid each department a policy type.

- Staff easy to understand the whole of his income.

- Parts HCNS easy to manage, update, internal communications.

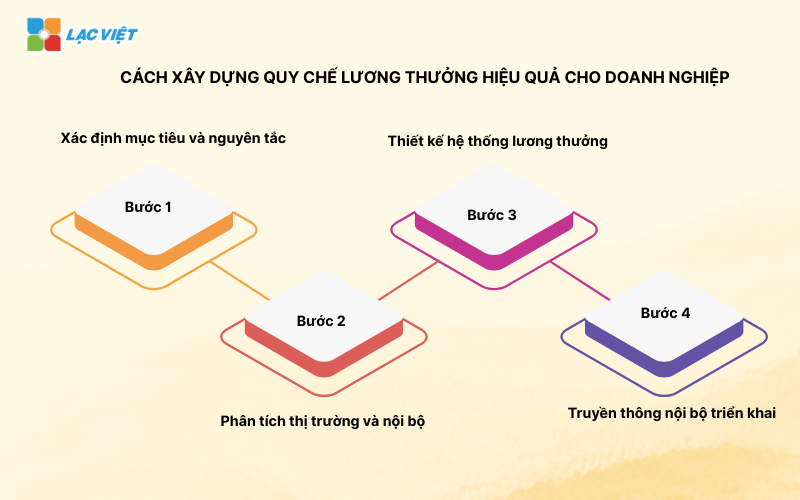

5. How to build a regulation salaries and bonuses for corporate efficiency

To build a regulation on the compensation, effective, businesses need to follow the steps the system, ensure both compliance with the law, have created real value for employees and optimize effective management.

Step 1. Determine the objectives and principles

Before construction, businesses need to clearly define the objectives of the regulation on the salary: ensuring fair, transparent, and encouraging employees to complete work objectives. Basic principles include:

- Fair, transparent: All employees are entitled to benefits under the same standard with the same position.

- Compliance with law: Regulation must be consistent with The Labor code, the Decree, avoiding legal risks.

- Attached to strategic hr and business: For example, the business wants to focus on developing sales team can prioritize sales bonuses, while innovative businesses can emphasize initiative bonus.

Illustrative example: company X sets the goal of reducing the rate of absenteeism by 15% in the year by adjusting regulations rewards associated with working efficiency, benefits, supplements, motivation, employee engagement long term.

Step 2. Market analysis and internal

This step helps businesses set salary bonus reasonable, moderate competition in the market just fit the internal capacity.

- Market survey: consider the average wage in the industry, the region to ensure the business does not pay too low or too high, avoid losing balance the budget.

- Internal evaluation: capacity analysis, job location, current performance of employees. This helps to identify groups salary, pay scale, criteria, award reasonable.

Step 3. System designer salaries and bonuses

After analysis, enterprises need to design stairs payroll, reward mechanism:

- Construction pay scale: specifies the basic salary, allowances, the additional terms in each position and rank.

- Set reward mechanism associated with KPI, performance of work or business results. For example, employees reaches 100% KPI receive a bonus 10% of your salary month, reaching 120% KPI receive 15% of the monthly salary.

- Combine welfare system, including training, working environment, mode resort... The account is, however, not directly with money, but increase the experience, staff, reduce the rate of absenteeism, improve productivity.

Sample application rules bonus latest help enterprises deploy fast, save the construction time from the start to ensure compliance with the law.

Step 4. Internal communications deployment

A regulation best be communicated clearly to effective implementation:

- Ensure employees understand and consent: Explain how to calculate salary, bonus, benefits to employees seen by transparency.

- Create a channel feedback: Employees can reflect, questions about salary, from which business adjust the fit as needed.

The end result is that business has a regulation on the compensation transparency, fair, flexible, helps to increase employee motivation, reduce disputes enhance effective hr management.

- Understand correctly the deductions from salary to calculate correctly and manage effectively

- Accounting salaries and deductions from wages, standard circular 200

- How to build stairs payroll standard with excel template for business

- 4 How to manage payroll for business from crafts to digitize automatic

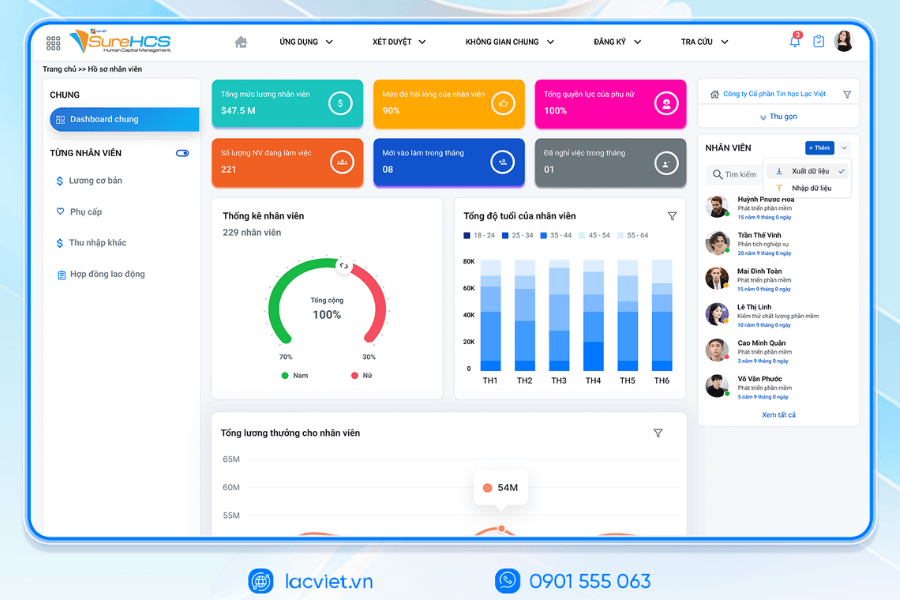

6. Application software personnel management in the construction and administration regulation salaries and bonuses

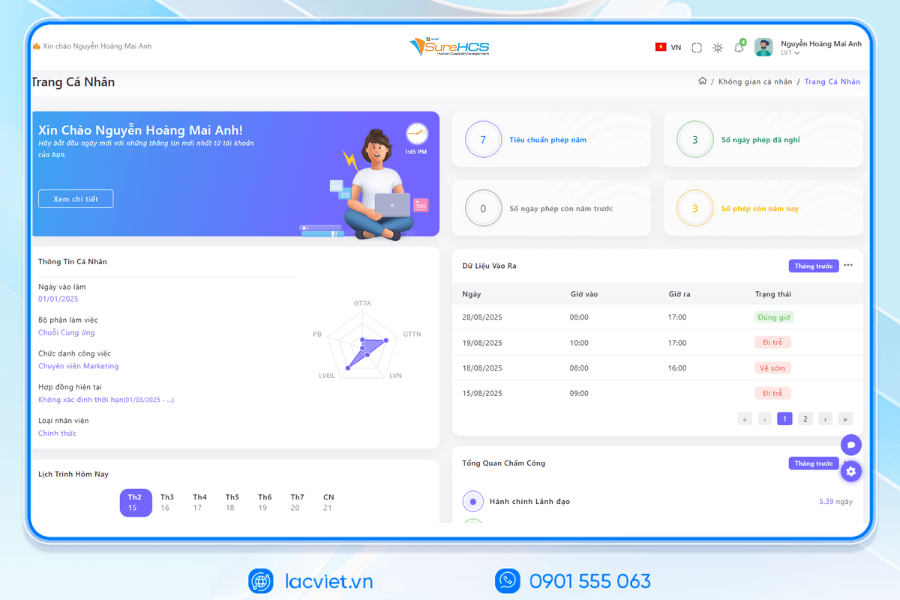

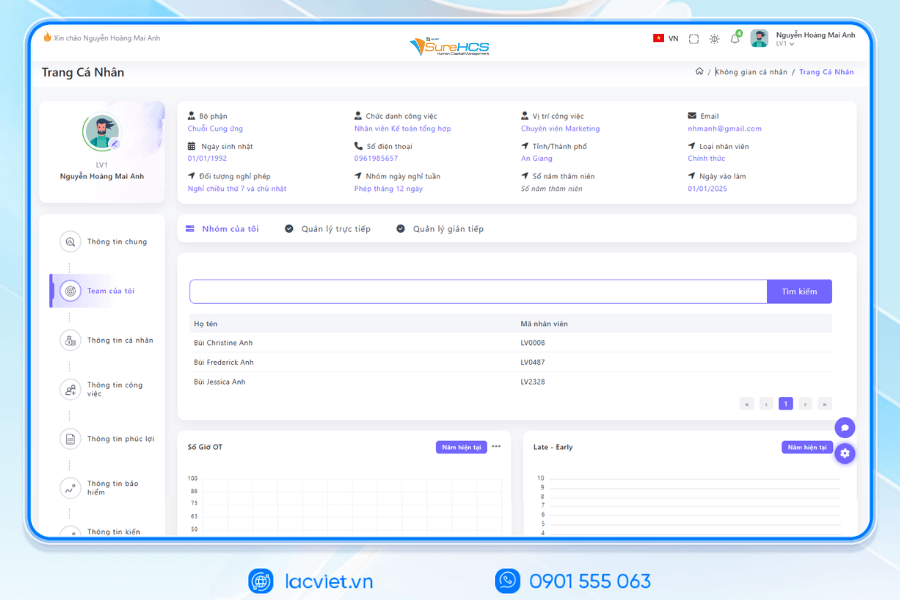

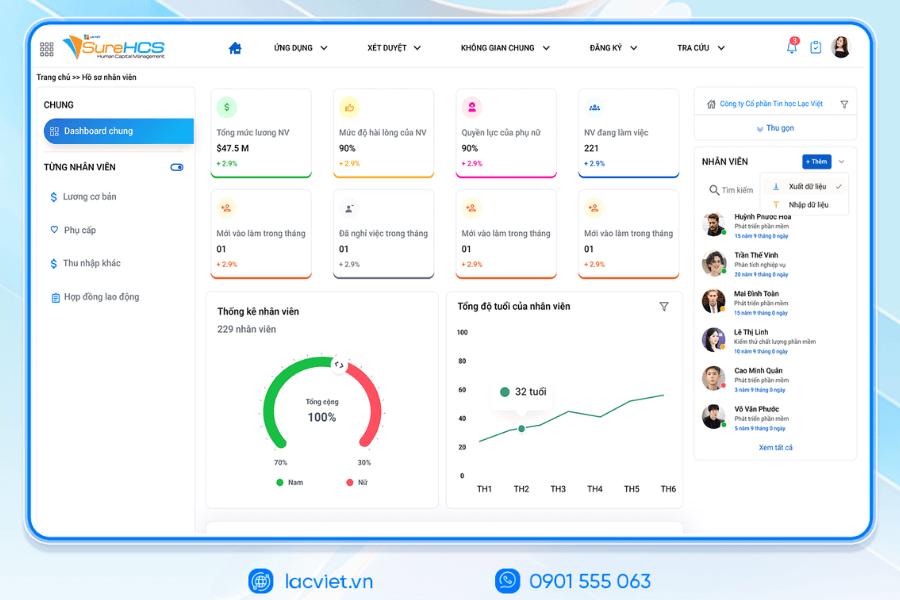

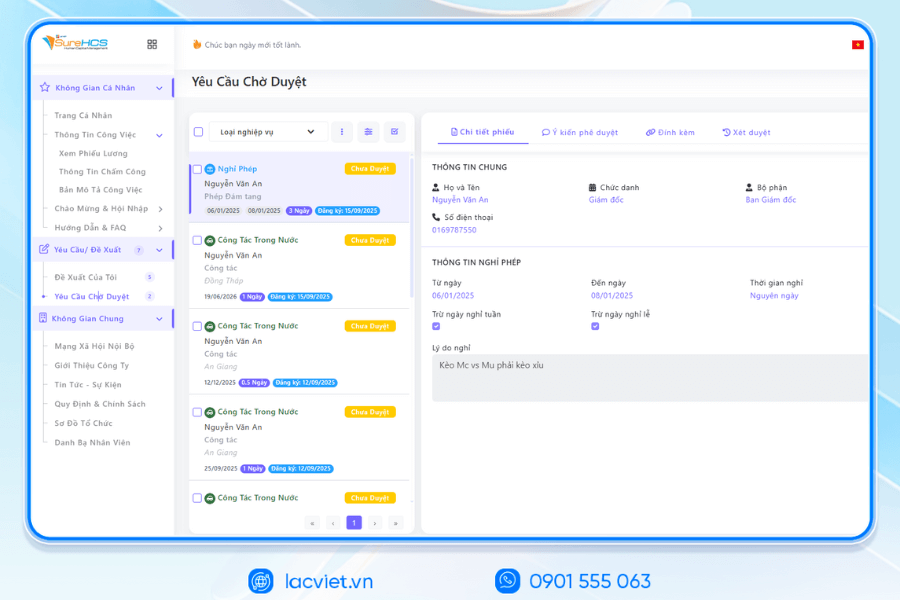

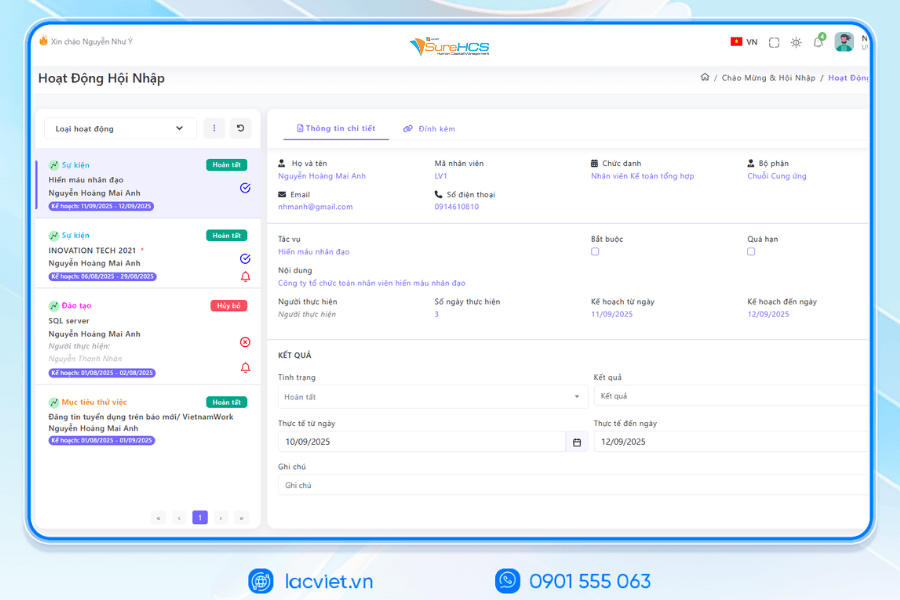

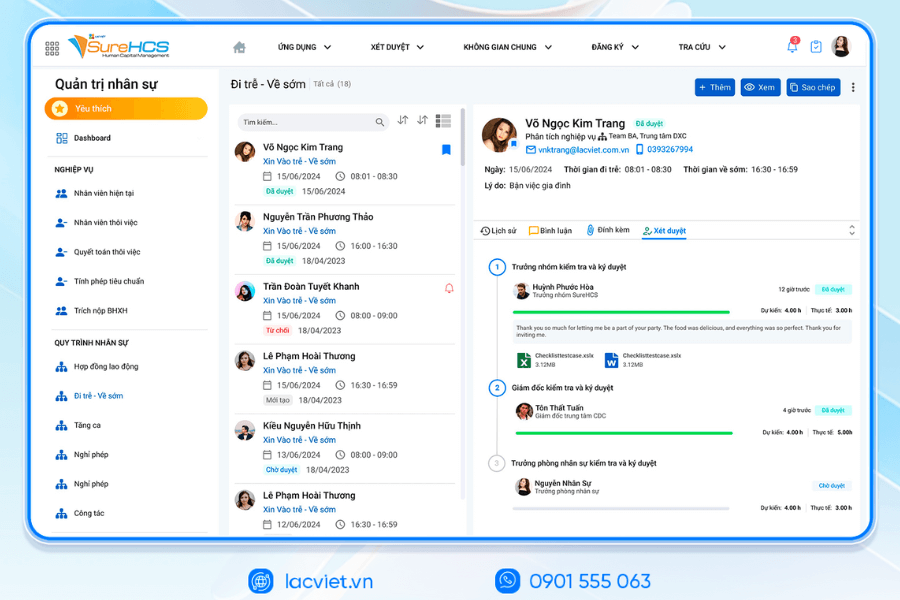

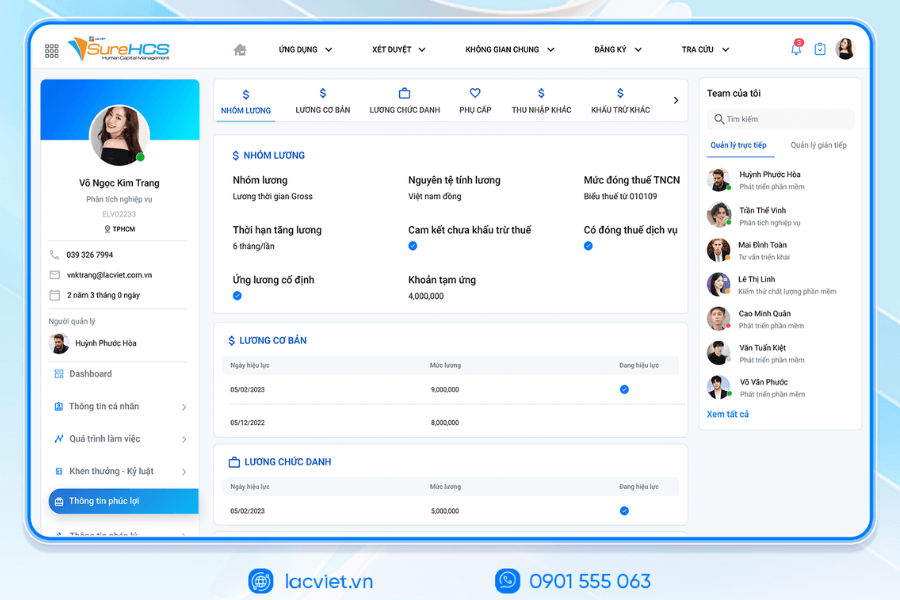

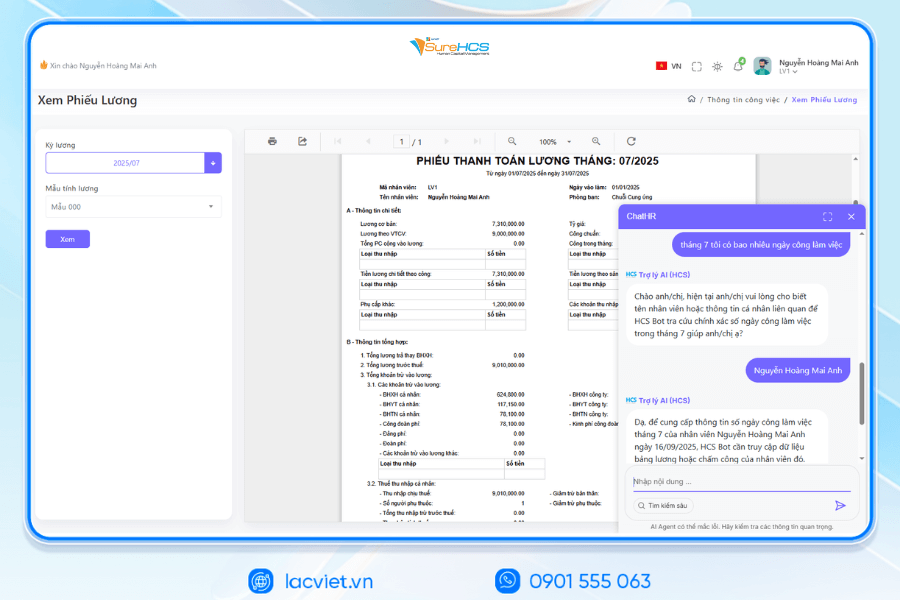

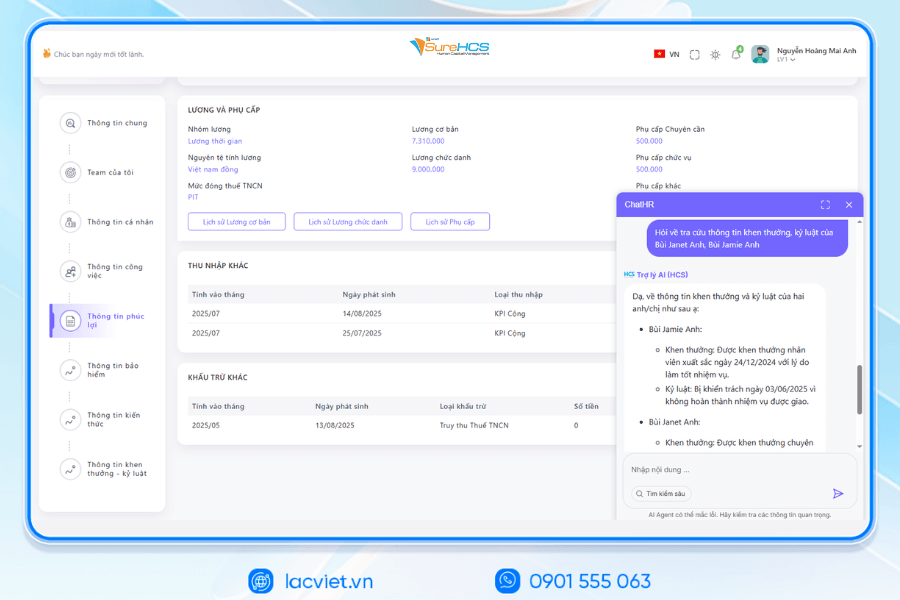

In the context of goods, the application human resource management software as LV SureHCS HRM bring many practical benefits:

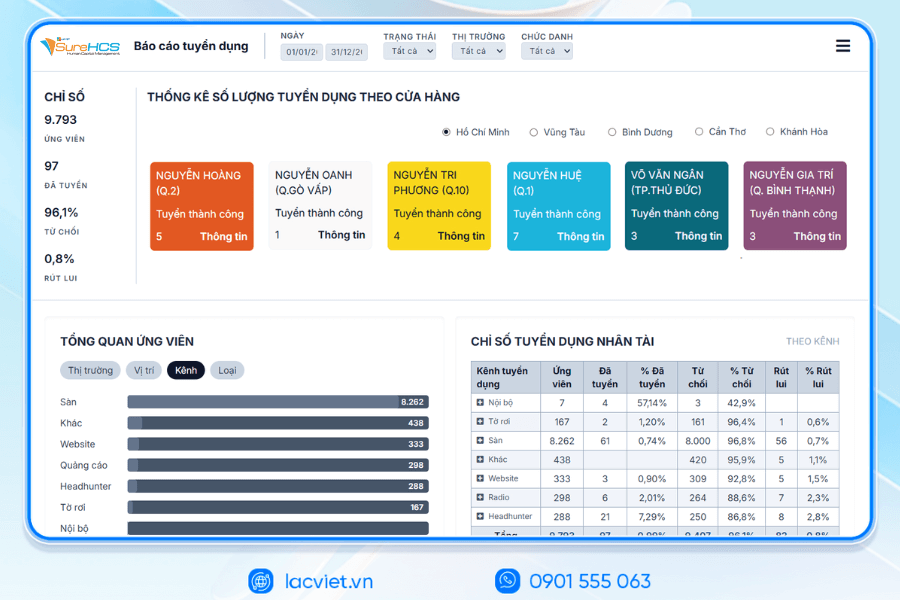

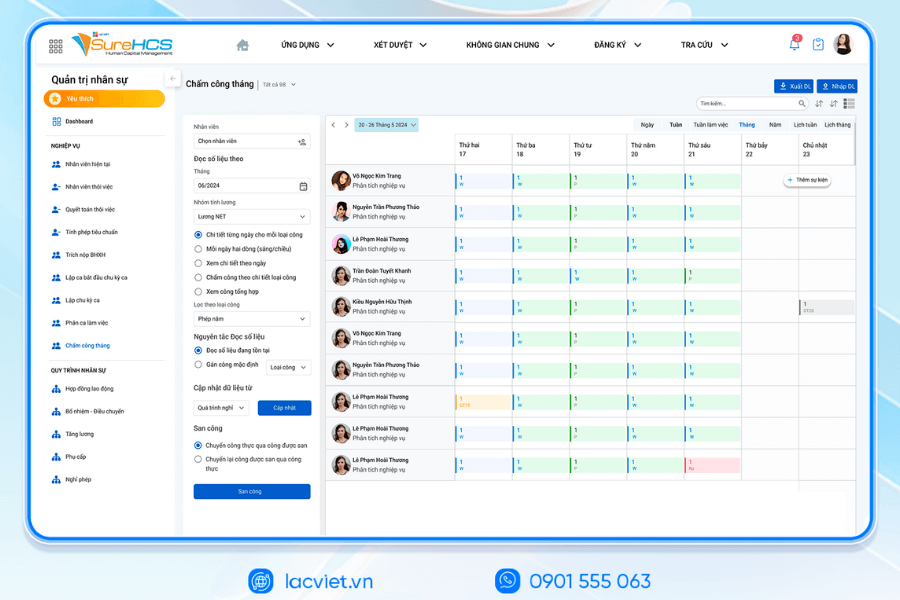

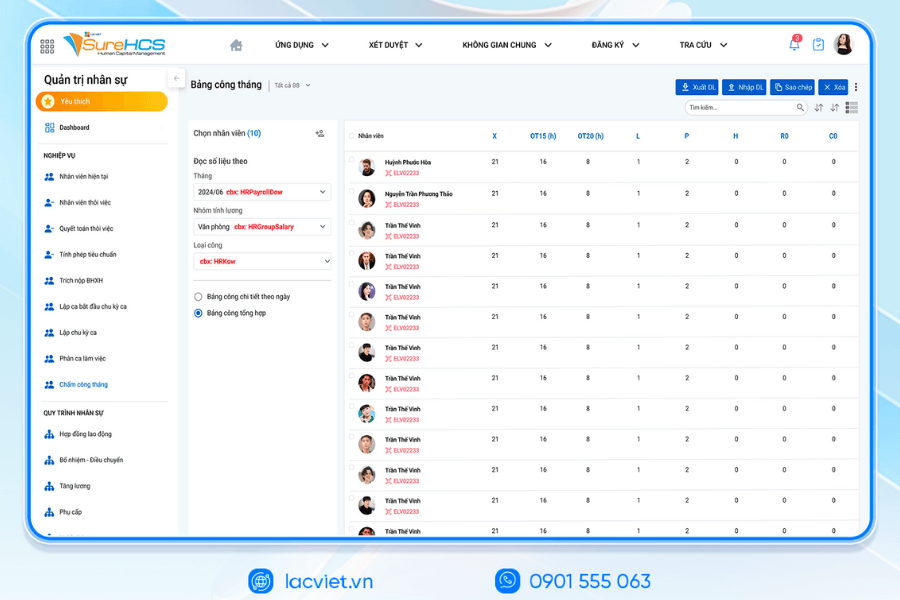

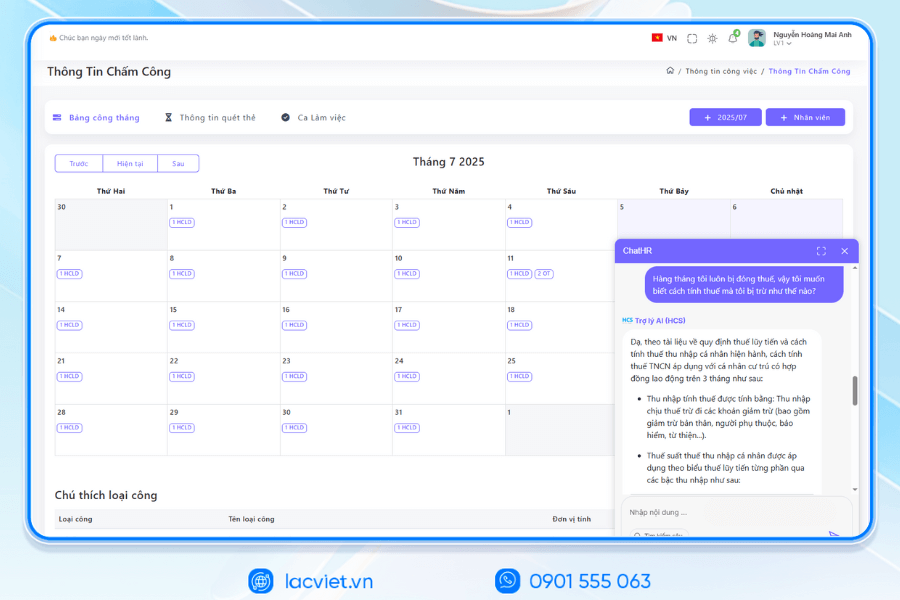

- Support process automation: automatic synthesis of attendance data, KPI, performance to salary, bonus and accurate. Minimize flaws craft, save time for the hr department.

- Transparent, fair: All information on salaries, bonuses, benefits stored access transparency. Employee easily lookup the salary, bonus, allowances and understand the criteria considered for rewards.

- Quickly update the new rules: subsystem software manager salary C&B allow adjustable regulation of salary bonus when there are changes to the law or internal policy. To help businesses comply with The Labour code 2019 and the decree guide.

- Enterprise value received: enhance effective management personnel, reduce disputes bonus. Increased experience staff, raising the stick loyalty. Business support building a culture of fairness and transparency in pay.

LAC VIET SUREHCS – HR MANAGEMENT SALARY C&B CUSTOM DEPTH FOR BIG BUSINESS

Lac Viet SureHCS is software HRM personnel management comprehensive, developed by Lac Viet – unit more than 30 years of experience in the field of management software business in Vietnam with international standards such as CMMI Level 3, ISO 9001:2015 and ISO 27001:2013.

SureHCS not only meet the professional personnel standards, which are designed to handle the hr – C&B – wages complex, large-scale, multi-company, multi-sector, in particular in accordance with FDI enterprises, corporations, factory, logistics, aviation, hotel, trade – in service.

The system is flexible deployment On-premise or as a custom model in depth, to help businesses automate the entire process hr – attendance – payroll – benefits – insurance, complete replacement job management using Excel discrete.

The module's core hr software lacviet SureHCS:

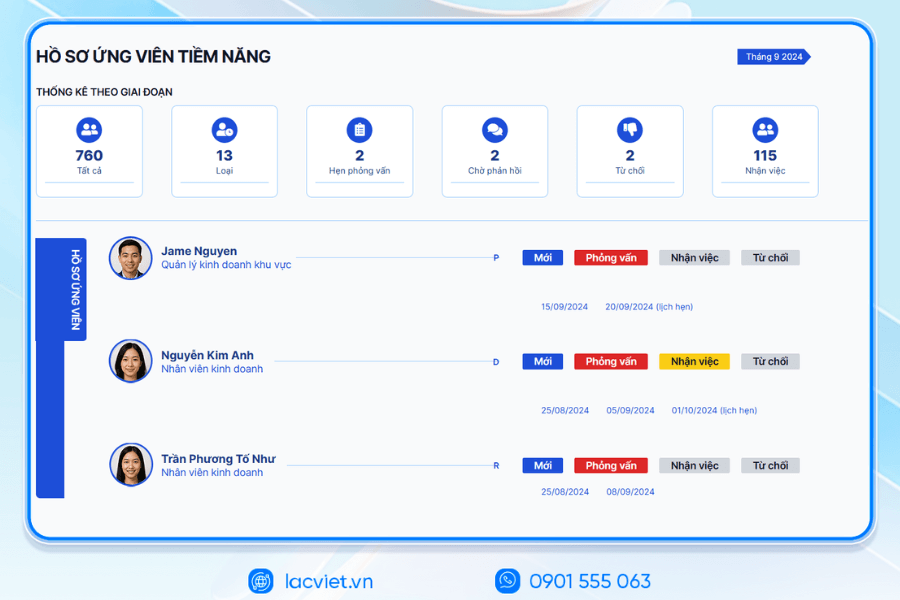

- The Recruit – Training: Management throughout the recruitment, integration, training, hr support and build the Talent Pipeline for large-scale enterprise.

- Port information & records Management personnel: Store personnel records, electronic focus, portal self-service for employees and contract labor power on the system.

- The timekeeper: Dots, multi-form (fingerprint, face recognition, Face ID, GPS, Wifi, online), connect many types of timekeeper, support attendance by the hour, shift flexibility for the plant, and hotels.

- The payroll & C&B: Automatic salary calculation according to many models (hour, shift, product, 3P, KPI performance...), link directly attendance data – performance – welfare, completely replace the salary calculator using Excel.

- Welfare – SOCIAL insurance – salary: Management benefits flexible, integrated iVAN connect SOCIAL and electronic Bank Hub salary automatically, support pay multi-currency for FDI.

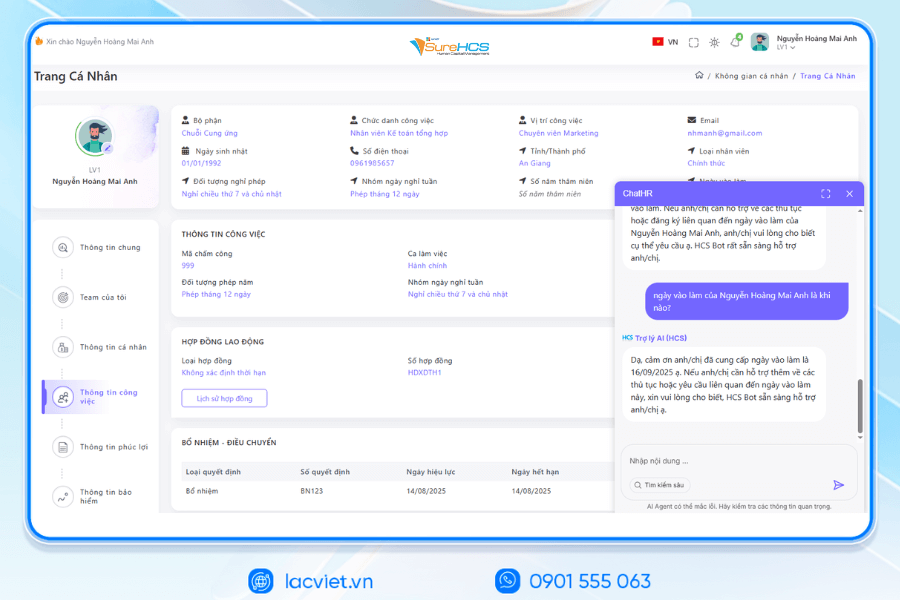

INTEGRATED AI ACCELERATED CONVERSION OF HUMAN RESOURCES MANAGEMENT

Lac Viet has officially launched The 3 AI assistant hr deeply integrated into the LV SureHCS including LV-AI.Docs, LV‑AI.Resume and LV‑AI.Help to automate the task administration, standardized data enhanced experience personnel

- LV‑AI.Docs: automatic dissection transfer data from documents such as CCCD, windows, SOCIAL insurance, by level of digital records, standardized

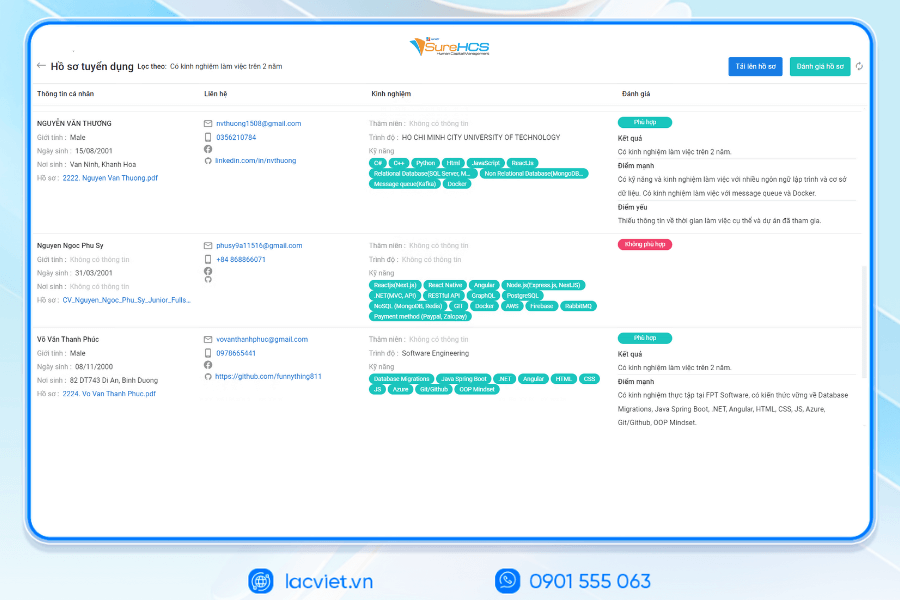

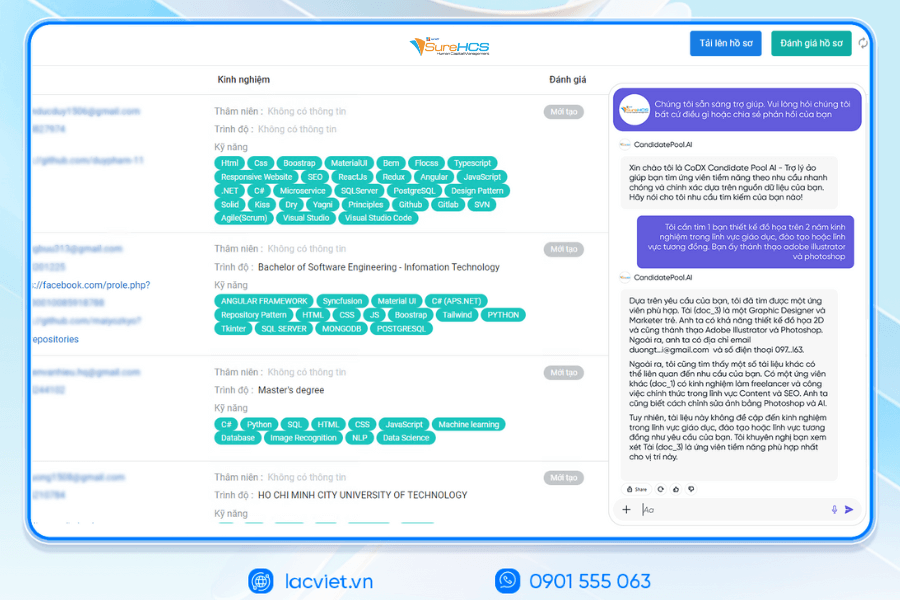

- LV‑AI.Resume: automatic dissection CV any format, analyst CV auto, construction, candidate profile, find people with the right criteria by prompt intelligent data mining candidate pool efficiency

- LV‑AI.Help: chatbot internal support, answer questions HR 24/7 access form process quick contextual user

TYPICAL CUSTOMERS DEPLOYING LV SUREHCS HRM

SureHCS are trusted and used by many large enterprises and leading corporations such as: Coca-Cola, Takashimaya, Textile SuccessfulPlastic Long Thanh Phu Hung Life, Airports of Vietnam (ACV)the business belonging to the SGCthe FDI enterprises in the fields of production, logistics, trade – in service.

- Coca-Cola Vietnam: System deployment LV SureHCS to digitize comprehensive human resource management group has standardized the data, the optimal operating HR according to international model.

- Textile company Success (TCM): Application LV SureHCS to manage hr, payroll, benefits, timekeeping and capacity profile for nearly 5,000 employees across 5 areas of activity – from textiles and fashion to real estate.

- Total company air Port, Vietnam (ACV): Choose to trust LV SureHCS to operate the system large-scale personnel with over 10,000 employees, 24 subdivisions, solved the problem of complex business of modeling state-owned companies.

SureHCS particularly suitable for:

- Large-scale enterprise, from 300 to 10,000 hr

- Corporations and enterprises multi-company, multi-branch

- FDI, manufacturing, factory, logistics, aviation should attendance – analysis ca – salary calculator complex

- Businesses are C&B peculiarities, need custom depth according to the actual operating

- Businesses are personnel management using Excel, many types of timekeeper, need automate the entire process

SIGN UP TO RECEIVE DEMO NOW

WHY BUSINESSES SHOULD CHOOSE TOUCH THE SUREHCS?

- Customized according to the actual business, no pressure mold as packaged software.

- Handle the personnel – salaries complex that many software HRM other does not respond.

- Deep understanding operated business English & FDI, ensure compliance with legal Vietnam (labour, SOCIAL insurance and personal income tax).

- Ecosystem integration strength: attendance – payroll – bank – SI – electronic contract.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: surehcs@lacviet.com.vn

- Website: https://lacviet.vn | www.surehcs.com

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

Sign up for a free trial software manager salary LV SureHCS HRM today to automation transparent, optimized management regulation compensation for business.