In the digital era today, artificial intelligence (AI) has become one of the breakthrough technology, plays a key role in the conversion of numbers for many industries, in which the banking sector. AI applications in banking is becoming an indispensable solution to help the bank optimize the operation process, improve customer experience.

For banks wishing to integrate AI into data system, understanding the potential of this technology will play a key role in the transition of sustainability. This article Lac Viet Computing will go deep into the analysis of the specific application of AI in the banking industry, helping financial institutions to seize the opportunity optimize operational efficiency.

The same theme:

- 7 Technology AI & artificial intelligence in education Current highlights

- Artificial intelligence in medical what can be done?

1. Real state app artificial intelligence in banking in the world and in Vietnam

Artificial intelligence (AI) is no longer a strange concept that has become the core technology in many areas, especially the banking sector. AI is defined as scientific and technical help to create the computer system has the ability to simulate human intelligence. Activity based on data, AI can analyze, learn from experience, make decisions and interact with humans. Thanks to this ability, AI is gradually changing the way banks operate, opened opportunities to optimize processes, enhance the customer experience.

Follow Tapchinganhangin the context of transformation of the bank in the world and Vietnam are application acceleration AI in financial activities. In particular, the outbreak of pandemic Covid-19 has driven the process of digitizing more powerful. According to research by PwC (2021), more than 50% of banks in the Uk have realized the importance of AI, Machine Learning (ML) and data science in improving operational efficiency. Report of McKinsey (2019) also pointed out that nearly 60% of business finance has deployed at least one application AI to improve operational efficiency.

This trend suggests that AI is not just a technology support but also the main driving force to promote the development of the bank number.

On the global AI in banking is promoted to improve customer service, enhance operational efficiency, enhance competitiveness.

- According to the report of Business Insider Intelligence, 80% of big banks the world has invest in AI technology, in 2020.

- Deloitte study also pointed out that 60% of financial institutions global has integrated AI into core activities such as manage risk, detect fraud, improve customer service.

- Follow UBS forecasts, by 2030, AI could help the banking sector cost savings of about 1,000 billion USDthanks to automate processes, optimize operations.

In Vietnam, many large banks have pioneered in the application of AI, creating a turning point in providing banking services number. According to the survey of The state bank of Vietnam, more than 50% of the commercial bank tested or applied AI in some aspects of operation, from customer support, data analysis to detect fraud.

The bank as Vietcombank, VPBank, TPBank have and are investing heavily in AI to develop the chatbot virtual assistant, bringing trading experience quick, convenient for customer.

Specific examples:

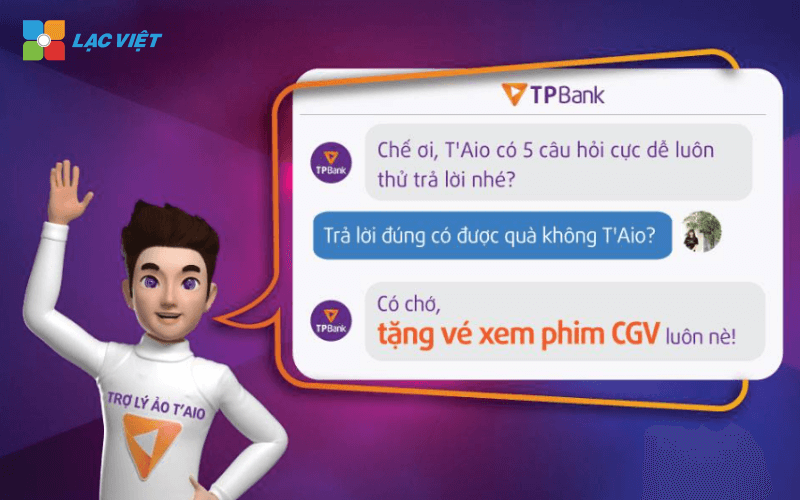

- TPBank is one of the first bank in Vietnam to deploy chatbot AI called T’Aio. Chatbot is capable of 24/7 customer support, answer questions about services, accounts, transactions, loan product. TPBank also use AI in process, credit approval, to help reduce the approval time from 3 days to minutes.

- VPBank use AI to detect the fraudulent transactions, monitor millions of transactions per day. System, AI have helped the timely detection of unusual transactions, minimize the risk of financial losses for the bank.

- 9 Accounting Software online cheap cost reduction for small and medium ENTERPRISES

- Core Banking is what? Solution upgrade the core system safety, speed, flexibility

- Convert numbers in the banking sector: The state, challenging & strategic solutions

- 10+ accounting software ERP admin most popular AI for enterprises

2. App NOBODY in the bank what is?

2.1. Concept

App AI in banking is the financial institutions use artificial intelligence (AI) to automate business process, big data analysis, improving the customer experience and business decisions more efficiently.

AI in banking is the use of machines or software ability to “learn”, “analysis” – “predict” human-like to:

- Detect fraudulent transactions

- Graded credit

- Personalize customer service

- Automate repetitive tasks such as searching for information, processing loan documents...

For example easy to understand: Instead of the bank employees have to read hundreds of profiles loan to value each customer, AI can synthesize information such as income, credit history, consumer behavior and give a credit score automatically. From there, the bank just check back the special case instead of processing each record manually.

AI not only helps save time – cost but also support bank decisions more accurate, faster response to the market, while enhancing customer experience across both traditional and digital.

2.2. Why the banking sector is one of the industry application, AI the earliest?

The banking sector is ideal field for the application AI by some reason peculiarities:

- The data volume is extremely large, continuous updates: From card transactions, transfer funds, send the save to the interaction with customers via phone, website, mobile app... the bank that owns the database giant variety. AI can analyze fast and deep these data to identify trends, anomalies or latent needs of customers.

- The level of security requirements, high precision: In finance – bank, a little mistake can cause major damage. AI helps oversee trading system 24/7, early detection of signs of fraud (fraud detection), minimize risks in handling business.

- Competition is fierce, needs continuous innovation: The banks are competing not only with interest, but by service intelligence, processing speed, customer experience outstanding. AI is the tool that help to personalize the services according to each customer, from which retain and increase the value lifecycle customer (Customer Lifetime Value).

The ability to profit from big data: Different with traditional industries in banking, data privacy is the property can mining profitability. AI helps banks transform data into information, and then from there into action to bring the financial performance practice.

3. 3 AI technology important application is in the active bank

The AI technology, popular in the banking industry today include:

- RPA (Robotic Process Automation – 36%): Automate operational processes structured, help reduce the load of manual work.

- Virtual assistant & conversational interface (32%): Improve the quality of customer care through the chatbot, voice assistant.

- Machine Learning (25%): Support fraud detection, risk management, underwriting.

3.1 RPA – automation

RPA is the technology that uses software robots to automate the task iconic repeated, help the bank reduce operating costs, reduce errors, improve processing speed. RPA does not replace humans completely, which support handling processes are structured based on the rules set.

Technology application of RPA in banking

- Automatically handle financial transactions: Handle transfer, payment confirmed, access your balance quickly.

- Loan approval: automatic collect, record reviews, credit, shorten the processing time up to 60%.

- Detect fraud & regulatory compliance: Monitoring unusual transactions, supporting the regulations, anti-money laundering (AML).

- Open account number: Support e-KYC, check out the customer profile, account opening faster.

3.2 AI Chatbots & Conversational AI

Virtual assistant bank is the chatbot or AI systems are integrated on our website, mobile app, total stations to assist customers handle the request transaction, service provider, financial consultant 24/7.

Application of virtual assistant in bank

- Consultancy customer care Support: check balances, open an account, answer questions instant.

- Support bank transaction number: Chatbot make transfers, pay bills, recharge your phone.

- Personalized customer experience: behavior analysis, product suggestions in accordance with financial needs.

- Fraud prevention: account tracking, warning, unusual transactions.

3.3 Machine Learning (ML)

Machine Learning (ML) is one of the AI technology, the most important are applications in the banking industry to fraud detection, risk management, financial forecasting and personalize customer service.

Application of Machine Learning in banking

- Detect fraudulent transactions: ML monitor millions of transactions in real-time to detect signs of abnormalities such as repeat transactions, suspicious, shopping from strange position or credit card fraud. This technology helps the bank blocked 80% transaction fraud before losses occur.

- Scoring credit & risk management loans: ML analysis, financial records, spending history, behavior loans to assess the repayment ability of the customers. The system can predict the risk of rupture of debt, help the bank reduce the rate of bad debt.

- Trend forecasting financial & investment: ML processing volume data to predict market movements, support the bank in investment strategy.

- Personalization financial products: Based on consumer behavior, ML helps banks create the package credit, insurance, investment fit with each customer.

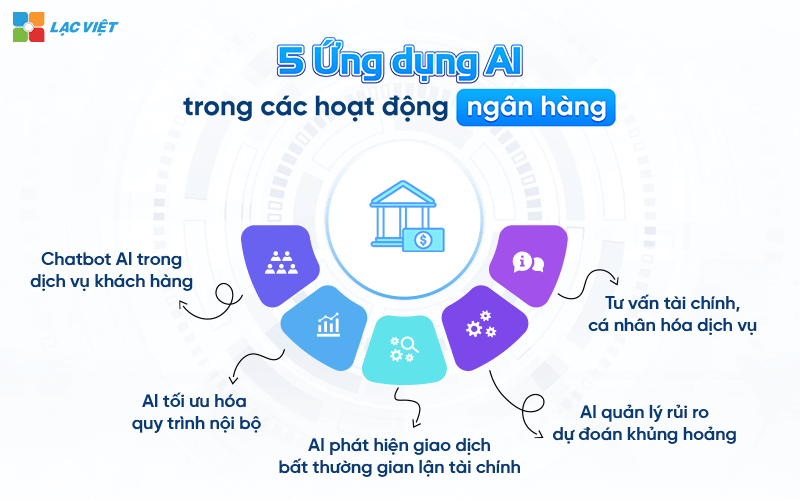

4. 7 apps AI in banking IMPORTANT most striking 2025

Application AI has been widely deployed in many aspects of the bank focus on areas such as:

- Applications of AI in service support 24/7 customer care

- Applications of AI in the analysis to detect fraud in banking transactions

- Applications of AI in risk management in the way of banking operations

- AI helps automate the process profile approval loan

- Enhancing efficiency, asset management, cash flow

- Applications of AI combined OCR in dissection data, enter data automatically

- Applications of AI in personalization products customer service

App AI in banking IMPORTANT most striking 2025

4.1 application AI in service support 24/7 customer care

Chatbot AI 24/7 customer support: currently, the requirements of the customers about the ability to support fast, wherever are increasingly high. AI chatbot plays a pivotal role providing services 24/7 customer support from answering the basic questions to handle the request complex transaction. A study from Accenture indicates that about 53% of the banks in the world have integrated AI chatbot to improve customer experience, helping to save millions of dollars each year thanks to minimize personnel handle directly.

Process optimization, auto-reply, information-processing for fast, accurate: AI applications in banking help automate the process of customer service from the update account information, checking of balance, to support open a new account. Customers do not have to wait long when all queries can be processed quickly and accurately through AI. According to McKinsey, the bank can save up to 25-30% of the operating costs through the application AI to these services. This not only improves the processing speed but also increase the satisfaction of customers.

Practical examples from the bank has successfully implemented chatbot AI:

- Bank of America: With virtual assistant, Erica, this bank has supported more than 10 million users in just one year early deployment. Erica has the ability to solve millions of transaction requests per day from the lookup account to investment advice.

- DBS Bank: Bank of Singapore has this app chatbot AI can solve 82% request from the client, without the intervention of humans, help save $ 30 million per year in the cost of customer support.

4.2 Application AI in the analysis to detect fraud in banking transactions

AI has the ability to handle large amounts of data, analyze the trading behavior of customers in real-time to detect the signs of abnormalities. Algorithm machine learning (machine learning) can learn from patterns of fraud earlier to determine the behavior repeat. A report by J. P. Morgan for see application ai to analyze data help detect fraud with higher accuracy by 27% compared with the traditional method, minimize losses due to fraud amounted to 30%.

Using AI to detect unusual transactions risk warning: AI can analyze transactions in real time to detect unusual signs, such as transactions in excess or from locations strange. The integration of AI into security systems not only help risk warning early but also helps to anti-money laundering (AML) effective.

The ability to protect data, systems, network security: AI not only detecting fraud, but also have the ability to protect the system from network attacks. With the ability to analyze the behavior detection system models new attack help the bank to stop the attack before it causes damage. According to IBM, the security system, AI can detect attacks faster than 60% and help reduce response time down to seconds, instead of several hours as the old method.

4.3 Application AI in risk management in the way of banking operations

- Automate the process of risk assessment, credit, financial forecast: App AI in the bank help automate the process of credit analysis based on the historical data, assessing repayment ability of the customers with high accuracy. According to a report from Deloitte, AI can reduce the time credit rating from 7 days down to just a few hours, to help the bank decide quickly improve the speed of processing the loan request.

- Analyze customer data to make decisions suitable loan: AI uses big data analytics (Big Data) to provide more insight about the customer, thereby making the loan decision based on many factors such as income, credit history, spending habits. Banks such as Wells Fargo, CitiBank has apps, AI to take out loans more flexible for customers, help to increase the rate of approved loans of up to 15-20%.

- Improve model risk management, minimizing bad debts: Thanks to AI, the bank can continuously monitor the financial health of the customer, automatic alert when there are signs of decline in solvency. This helps banks active in the management of bad debt risk reduction. Report by Moody's Analytics, said the bank application AI has reduced bad debt ratio to below 3%, compared with an average of 6-7% ago.

4.4 AI helps automate the process profile approval loan

One of the applications AI in banking important is the ability to automate the process of handling profile approval of the loan, which helps shorten the processing time from several days down to a few hours. AI can analyze handle thousands of profiles loan in short time thanks to the ability to identify classified information automatically. According to a report by McKinsey, the bank has applied AI can reduce the time of processing the loan to 60%, while reducing the percentage of errors in approved up to 25%. This not only helps the bank processing the loan request quickly but also increase the satisfaction of customers.

A typical example is HSBCthe bank has applied AI technology, to process credit approval and processing millions of records of loan each year. As a result, the processing time profile is reduced from 5 days down to 24 hours, saving millions of dollars in operating costs each year.

4.5 Enhanced efficiency, asset management, cash flow

The AI algorithms can analyze data, transaction history, financial market trends, in order to optimize the asset allocation, cash flow projections. Help banks not only improve investment performance but also make financial decisions more accurate. A study from the Boston Consulting Group showed that banks use AI to asset management can increase yield investment up 15%, while reducing 10% of the cost of managing cash flow.

4.6 Application AI combined OCR in dissection data, enter data automatically

Technology OCR (Optical Character Recognition) combined with AI to help the bank automatically crawls the data from paper documents such as loan contracts, invoices and statements. AI has the ability to handle large volumes of data to help banks reduce manual work, avoid errors during data entry. According to estimates from KPMG, the application of OCR technology combines AI can save up to 80% and processing time reduced by 50% input errors compared with traditional methods.

JP Morgan bank system has been implemented OCR AI for processing the contract, help analyze more than 12,000 cases each year in just a few seconds, instead of requiring thousands of hours of craft work.

4.7 application AI in personalization products customer service

Analyze user behavior to personalize the customer experience: AI can track transaction history, habits, consumer online behavior of customers, thereby providing the financial service is personalization. A study from IBM showed that 79% of customers are likely loyal to the bank than when the service experience is personalized.

For example, Capital One have applied AI to analyze customer behavior and suggest the appropriate services as increase the credit limit or deliver the package to save peculiarities, thereby increasing revenue product sales up 25%.

Proposed financial products is suitable based on big data analytics (Big Data): AI help banks not only understand our customers, but also can auto-suggest financial products is suitable, such as package loan, credit card or investment program. Using big data to analysis, AI can predict the financial needs of each customer, and make recommendations accordingly a more accurate way.

AI applications in marketing, cross-selling products (cross-selling): Through the analysis of customer data, AI can identify opportunities to sell additional products based on shopping behavior and use of services. For example, if a customer has open a savings account, AI can propose more investment products or insurance accordingly. Wells Fargowith the AI system automatically analyzes customer data, has increased the success rate of campaigns, cross-selling, up 15% compared with traditional methods.

In addition, AI also has the ability to optimize marketing campaigns, help the bank reach the right customers with the right message.

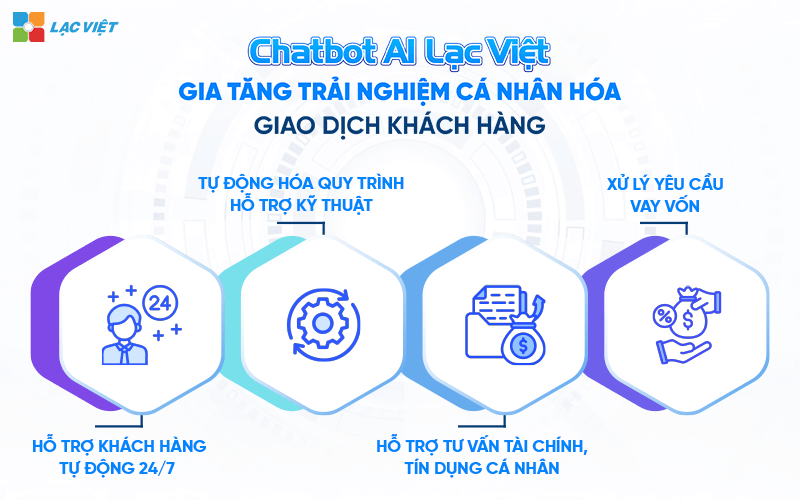

5. App Chatbot AI Lac support the bank optimal performance, superior

Chatbot AI Lac Viet is one of the Application of AI in banking bring superior performance in the customer support, process automation, improve user experience.

Below is a the specific features of chatbot AI Lac Viet, the bank can consult.

- Chatbot AI 24/7 customer support: Chatbot AI Lac Viet capable of answering the common questions of customers such as check account balance, account information, transactions, instructions on products and services the bank without the intervention of staff.

- Process automation technical support: Chat AI Lac Viet can handle the requirements related to engineering, such as the installation instructions app, troubleshoot login or helps to restore password to help reduce the workload of parts, technical support, and help customers quickly get the assistance you need.

- Support advice personal finance: Integrated chat AI Lac Viet to the database of the bank to analyze transaction data, financial habits of customers to give suggestions consulting personalization. For example, the chatbot can propose solutions to save based on your spending habits or making recommendations on investment products, in accordance with the financial records of the customers.

- Handle the request loans, credit counseling: Chatbot AI can help customers apply for loans, providing information about the type of loan, credit conditions at the same time answer the question about the interest rate or payment schedule. Chatbot Vietnam also can guide customers to prepare the necessary documents to complete the loan process.

- Detectable warning fraudulent transactions: Chatbot AI that can detect and warn about the unusual transactions in the account of the customer. When the current transaction has signs of fraud, the chatbot will immediately notify the customer via sms or banking application requires authentication transaction.

Do you know businesses are spending a lot of money to pay for staff looking for information?

- Of 1.8 hours per day employees spend out to search and collect information, the equivalent of 9.3 hours per week

- Business loss 500 hours per year for employees to perform searches for information for work

- 63% leadership said the sharing of knowledge and information internal trouble, reduce the productivity of the business

Lac Viet Chatbot AI assistant – Freeing up personnel to focus on creative work

- Virtual assistant process – approved LV Chatbot AI for Workflow: Access quick information, content summary, revise errors on file the signed

- Virtual assistant accountant LV Chatbot AI assistant for Finance: remove input crafts, bring the data to the correct input, automatically prompt-term LIABILITIES – PAYMENTS, cash flow forecasting, warning of financial risks

- Virtual assistant customer care LV CareBot AI assistant: Integrated Chat on multi-platform, feedback and customer requests quickly, consulting, flexible, not being constrained by fixed script

- Virtual assistant hr LV Chatbot AI for HXM: save 70% time for HR and leadership, extract the entire database of candidates any file format, faq auto welfare policies, rules, regulations 24/7, statistical, personnel, resources, business in few seconds.

CONTACT INFORMATION:

- Lac Viet Computing Corporation

- Hotline: 0901 555 063 | (+84.28) 3842 3333

- Email: info@lacviet.vn – Website: https://lacviet.vn

- Headquarters: 23 Nguyen Thi Huynh, P. 8, Q. Phu Nhuan, Ho Chi Minh city

6. The bank Vietnam typical application WHO

Here are a number of banks in Vietnam typical in the application of artificial intelligence (AI) on business operations/customer service:

- VPBank – pioneer in the number of goods and customer experience

VPBank has been actively applying AI to enhance operational efficiency, improve customer experience. Banks use AI in areas such as foreign currency transactions, personal credit, bank number. In particular, VPBank has deployed chatbot customer support help reduce waiting time, improve the quality of service.

- MB Bank – strengthen customer interaction via virtual assistant

MB Bank has invested in the banking system number and deploy virtual assistant AI in mobile app MB App. This virtual assistant customer support lookup the account, transfer funds, check transaction history, hints of financial products is suitable, enhance the user experience.

- BIDV – process automation, control risks

BIDV application AI to automate the process of loan approval, risk control. The AI system, data analysis, finance, credit history, payment behavior, to assess the likelihood of repayment and early warning, risk, helps banks improve the efficiency of credit management.

- Techcombank – investment in infrastructure, data, intelligent analysis

Techcombank focus on building a big data platform and application of AI in various fields such as marketing, performance evaluation branch, fraud detection and operation management. The investment in infrastructure data to help the bank flexibility to adapt to the needs, in-depth analysis in the context of competition digitized.

- ACB – process automation improve the quality of service

ACB has apps, AI and RPA (automation processes by robot) for nearly 400 different process, with about 60 million task operation per year is completely automated. This helps banks to increase labor productivity, improve service quality, enhance risk management.

- Nam A Bank – Combine AI and security in customer service

Nam A Bank has applied AI in products and services geared to the quality of service 5 stars. Banks use AI in activities such as trading, consulting and customer support, while ensuring information security and data security.

- SHB – application of AI and blockchain in storage, data verification

SHB has partnered with VNPT AI to application technology, AI and blockchain in the storage, data verification. AI is also used to strengthen the security and safety for the user during electronic transactions, especially in solution determine the electronic eKYC.

The bank on is the typical example in the application of AI to enhance operational efficiency, improve customer experience, enhance risk management. The application of AI not only help the bank optimize processes, but also create competitive advantage in the digital era.

Deployment Application of AI in banking not only helps to improve operational efficiency but also improve the user experience, automate processes, enhance security. The chatbot AI is becoming an integral part of the modern banking help with optimizing customer service and risk management more effective.

CONTACT INFORMATION:

- Lac Viet Computing Corporation

- Hotline: 0901 555 063 | (+84.28) 3842 3333

- Email: info@lacviet.vn – Website: https://lacviet.vn

- Headquarters: 23 Nguyen Thi Huynh, P. 8, Q. Phu Nhuan, Ho Chi Minh city

Related questions

1. AI is used in banking and finance, what to do?

AI in banking and finance, help, process automation, data analysis, finance, enhance security and optimize customer experience. Specific:

- Fraud detection: AI analyzes unusual transactions to identify fraud in real time.

- Automate operational processes: RPA (Robotic Process Automation) support processing loan documents, credit approval, for control transactions.

- Forecast risk, scoring credit: Machine Learning assess repayment ability of the customers, optimize the loan portfolio.

- Virtual assistant personal goods and services: Chatbot AI 24/7 customer support, product recommendations, financial fit.

- Asset management – smart investment: AI analyze market data, providing investment recommendations in real time.

2. Examples of AI in the field of finance and banking?

- JPMorgan Chase use AI in the system Contract Intelligence (COiN) to automatically analyze financial contracts, saving thousands of hours of craft work.

- HSBC deploy AI to detect fraudulent transactions, reduce the risk of money laundering and terrorist financing.

- Bank of America launches virtual assistant “Erica” to help customers manage their personal finances, track expenses proposes to save.

- Wells Fargo app AI in credit analysis, help to assess the risk level of loans with higher accuracy.

- Citibank uses AI to automate the process of approving loans, portfolio management, investment personalization for customers.

AI in banking and finance, help, process automation, data analysis, finance, enhance security and optimize customer experience. Specific:

- Fraud detection: AI analyzes unusual transactions to identify fraud in real time.

- Automate operational processes: RPA (Robotic Process Automation) support processing loan documents, credit approval, for control transactions.

- Forecast risk, scoring credit: Machine Learning assess repayment ability of the customers, optimize the loan portfolio.

- Virtual assistant personal goods and services: Chatbot AI 24/7 customer support, product recommendations, financial fit.

- Asset management – smart investment: AI analyze market data, providing investment recommendations in real time.

- JPMorgan Chase use AI in the system Contract Intelligence (COiN) to automatically analyze financial contracts, saving thousands of hours of craft work.

- HSBC deploy AI to detect fraudulent transactions, reduce the risk of money laundering and terrorist financing.

- Bank of America launches virtual assistant “Erica” to help customers manage their personal finances, track expenses proposes to save.

- Wells Fargo app AI in credit analysis, help to assess the risk level of loans with higher accuracy.

- Citibank uses AI to automate the process of approving loans, portfolio management, investment personalization for customers.