In an era where technology is developing rapidly, the application of artificial intelligence (AI) has become the key element to the business finance maintaining a competitive advantage. AI not only helps to improve operational efficiency, but also completely changed the way businesses approach data, risk management, and resource optimization. For businesses that are looking for opportunities to optimize operational processes to increase profit, the Application of AI in finance not only is a trend that is the key to breakthrough.

The same Lac Viet Computing find out details in this article.

The same theme:

- 4 Application artificial intelligence in education highlights

- 5 Application artificial intelligence in medical

- 7 application AI in banking

1. Painting app digital technology in the financial sector

- 83% of the chief financial officer (CFO) have and are investing in AI technology

- Improve performance up to 20%, while reducing operating costs from 10-25%

- Increase efficiency, financial forecast up to 76%reduce time data processing at 50%

- By 2025, average savings 40% of operating costs

- Help increase the accuracy up to 85% when predicted trend financial risk management

The financial industry is undergoing a revolution thanks to technology, especially artificial intelligence (AI). According to the report of McKinseythe business finance application AI can improve performance up to 20%, while reducing operating costs from 10-25%. The process of financial capital complex, easy to errors when done manually can now be automated with high accuracy, help businesses reduce risk, increase cash flow management, decision making based on real-time data.

Report of Accenture 2023 also pointed out that 83% of the chief financial officer (CFO) have and are investing in AI technology to optimize financial processes to improve efficiency.

The application AI data analysis in finance brings significant opportunities. AI has the ability to analyze financial data giant, given the forecast, optimize the process as important as financial planning, risk management. Follow PwCthe application AI in financial analysis can help businesses increase efficiency, financial forecast up to 76%reduce time data processing at 50%.

However, the biggest challenge lies in the cost of the initial investment and the ability to integrate AI into the current system. According to estimates, the business can cost about 7-10% of the budget IT for the deployment of AI in finance in the early stages. Added to that, security issues, legal compliance should be a top priority, particularly in the context of the rules on data security financial increasingly demanding.

App AI in finance not only help business save cost, but also bring long-term benefits. Gartner forecasts that by 2025, the business to adopt AI in financial management will save an average of 40% of operating costs. AI automates the accounting process, from invoice processing to check the risks, help reduce errors and increasing processing speed work.

In addition, AI also supports businesses in predicting financial trends, manage risks, to help increase the accuracy up to 85% according to the study of Forbes Insights in the year 2023. More importantly, AI also help ensure compliance with the law, especially as businesses increasingly have to face the strict rules about financial protection of customer information.

- 10+ ERP Management Accounting Software with AI Compliant with Circular 99/2025 for Vietnamese Businesses

- 9 Accounting Software online cheap cost reduction for small and medium ENTERPRISES

- Core Banking is what? Solution upgrade the core system safety, speed, flexibility

- Convert numbers in the banking sector: The state, challenging & strategic solutions

2. App AI in the financial highlights 2025

2.1 Application AI analyze financial data in real time

AI has the ability to handle large amounts of data from various sources such as financial statements, cash flow, economic indicators help businesses make decisions fast, accurate. Follow Deloittethe AI system can be reduced to 80% of the time data processing compared with manual method. For example, bank JP Morgan has deployed AI systems to analyze millions of transactions every day, help them identify investment opportunities and manage risks in a timely manner.

2.2 AI trend forecasting and financial planning

AI business support accurate forecast, trends in finance, from which long-term planning based on analysis of historical data and the market data in real-time. Follow PwCbusiness application AI in financial forecasting can improve performance up to 20-30%. An example is Microsoft use AI to process optimization, financial forecast, helping them reduce the time to plan a budget at 50% compared to the past.

2.3 application AI, process automation accounting

AI combined with OCR technology (Optical Character Recognition) ability to automatically import materials and dissection data from the invoices, vouchers, help accountants save time, minimize errors. Follow Gartnerapps , AI in accounting can reduce 90% error errors and data entry, compared with the manual method. Typical example is the Siemens company, has deployed AI to automate test procedures and data entry, bills, help reduce 30% processing time financial documents.

2.4 risk analysis and fraud detection

AI has the ability to analyze millions of transactions to detect the abnormal behavior, from which warns of the activity potential fraud. Forbes reported that AI can improve the ability to detect fraud up to 95% compared with the traditional system. A successful example is PayPal, where AI is used to analyze the trading behavior of users, helping to reduce 33% of fraud in online transactions.

2.5 application AI analysis and control of financial risks

AI help businesses identify potential risks by analyzing historical data, market data and economic models. The AI system has the ability to take out the prediction of the risk of loss or market fluctuations with higher accuracy. Follow McKinseythe use of AI to manage financial risks to help reduce 10-15% losses due to the incident unforeseen financial. For example, the bank HSBC has used AI to improve the ability to assess credit risk, reduce the rate of bad debt from 8% at 5% in the next two years.

2.6 prevention of credit risk

AI has the ability to assess the credit profile of the customer based on behavioral data, financial history, from that make a decision reasonable credit. Follow Accenturethe bank applied AI in the analysis of credit has reduced the proportion of bad loans at 20-30%.

Another example is American Express, using AI to predict consumer behavior, the solvency of the customer from that process optimization browse credit card and risk control.

2.7 application optimised AI portfolio

AI has the ability to analyze the market volatility, from which the proposed investment strategies optimization based on the financial situation and objectives of the business. Follow BlackRockapps , AI on management portfolio can help your business increase profitability ratio up 15-20% compared with traditional strategies. For example, the investment company Bridgewater Associates were using AI to optimize the portfolio, help them increase profitability, manage risk effectively.

2.8 Robot Advisors

Robot Advisors is the application AI help investment advisory automatically based on the profile and financial goals of our clients. AI uses personal data, combined with complex algorithms to make decisions appropriate investment. Follow Statistamore $1.4 trillion the property is being managed by the Robot Advisors globally by the year 2023. For example, Wealthfront and Betterment are two of the platform Robots expert Advisors top today, to help customers optimize investment strategies with low cost but high efficiency.

The switch number in the financial sector is going strong and artificial intelligence plays a central role in this revolution. The Application of AI in finance not only to help businesses optimize existing processes, but also create the opportunity to increase long-term growth, from improving financial forecasting to optimize portfolio. For those businesses willing to embrace new technologies, AI will be the main motivation to help enhance performance and promote development. Let's start the journey app AI from today to ensure that your business not only keep up the trend, but also the lead in the play, convert the number.

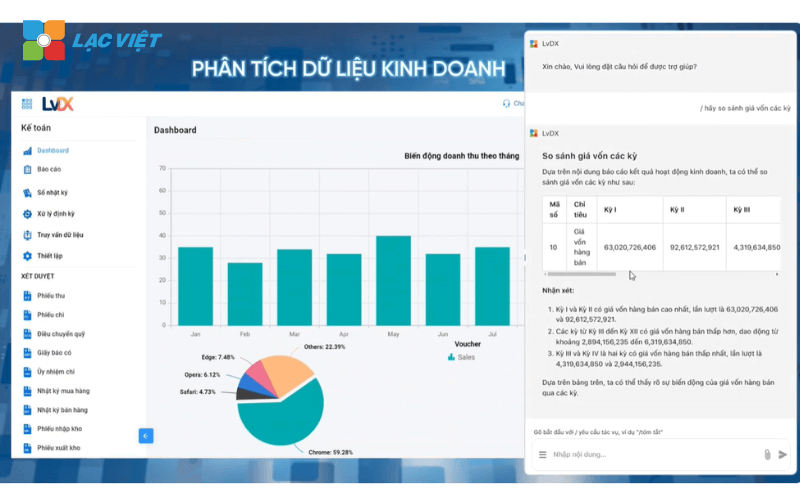

Lac Viet Financial AI Agent to solve the “anxieties” of the business

For the accounting department:

- Reduce workload and handle end report states such as summarizing, tax settlement, budgeting.

- Automatically generate reports, cash flow, debt collection, financial statements, details in short time.

For leaders:

- Provide financial picture comprehensive real-time help in quick decision making

- Support troubleshooting instant on the financial indicators, providing forecast financial strategy without waiting from the related department.

- Warning of financial risks, suggesting solutions to optimize resources.

Financial AI Agent of Lac Viet is not only a tool of financial analysis that is also a smart assistant, help businesses understand management “health” finance in a comprehensive manner. With the possibility of automation, in-depth analysis, update real-time, this is the ideal solution to the Vietnam business process optimization, financial management, strengthen competitive advantage in the market.

SIGN UP CONSULTATION AND DEMO

CONTACT INFORMATION:

- Lac Viet Computing Corporation

- Hotline: 0901 555 063 | (+84.28) 3842 3333

- Email: info@lacviet.vn – Website: https://lacviet.vn

- Headquarters: 23 Nguyen Thi Huynh, P. 8, Q. Phu Nhuan, Ho Chi Minh city

Related questions

AI can support what in the financial sector?

AI can help automation, data analysis, rapid detection, risk and optimize financial decisions. Specifically, AI support:

- Analysis of financial statements: the extraction, processing reviews financial data in real-time.

- Financial forecasting & risk management: cash flow analysis, predict business trends, identify potential risks.

- Detect financial fraud: identifying unusual transactions, control compliance regulations.

- Optimized portfolio: AI support build investment strategies based on big data (Big Data).

- Automation of accounting process: Reduce errors, improve work performance with RPA & NLP.

The outstanding application of AI in corporate finance 2025?

- Analysis financial intelligence: AI automatically synthetic, compare performance financial help CFOS make decisions faster.

- Cash flow forecast accuracy: Machine Learning to predict future cash flows, support liquidity management efficiency.

- Detecting accounting fraud & deals: AI, real-time monitoring to identify unusual to reduce financial risk.

- AI assistant finance: Chatbot & AI business support to answer queries, finance, optimal strategic cost management.

- Optimized investment strategy: AI reviews, market data, providing investment recommendations more accurate.