In many businesses, especially small and medium enterprises, not least business owners still signed approval of financial statements periodically a “procedure” that has not really understand how to read financial statements of each part leads to the business not timely detection of the signs of financial irregularities, miss a chance to adjust business strategy or difficulty when working with banks, investment partner.

The financial statements do not merely is a table of data of accounting set out, which is the “language expressed health” of the business. Reflects the ability to make a profit, use of capital, the level of financial safety, effective cost management. If how to read financial statements correct financial statements will become admin tools powerful business:

- Reviews the performance each stage

- Detection and control of financial risks timely

- Given the investment decisions, cut costs or raise capital correctly, strategy

This article Lac Viet Computing will guide how to read each section in its financial statements from the balance sheet, the statement of the business to cash flow and theory with practical examples, simple. Through it, you will understand his business is “strong or weak” to adjust what to sustainable development.

1. Financial statements what is? Why need to read right?

1.1 the Concept of financial statements

Financial reporting is a collection of synthetic forms of data, financial accounting, reflecting the comprehensive situation of assets, liabilities, equity, revenue, expenses, cash flow of the business in a given time period (usually quarterly or annually).

In simple words, financial statements show:

- Business owns what (assets)

- How much debt and debt ai (liabilities)

- Making a profit or loss (business results)

- Cash flows that are sufficient to maintain active or not (cash flow)

Objects using financial statements, not just accounting or tax authorities, which includes:

- Board of directors, business owners to make operating decisions

- Banks and investors to assess financial capacity

- Trading partners to determine the level of reliability when cooperation

So, despite having no expertise in accounting, any head of any business should also understand how to read financial reports to understand your business now, should go about any direction.

1.2 objectives and role of financial reporting

Financial statements help the recorded past, is the basis for future planning. Specific help in business:

- Evaluate business performance: report, results of operations, business know yourself, create, how much revenue, how much interest, the profit margin is how much percent.

- Control solvency and cash flow: The cash flow statement will show that the business has enough cash to maintain operations, pay salaries, pay off debt, or investing in marketing or not.

- Analysis of financial structure: the balance Sheet helps to determine the ratio of debt/equity, the level of financial security, efficient use of capital.

- Early detection of financial risks or deviations plan: If the revenue decreased but the cost still increases, or inventory not quick turnaround, businesses can detect early, adjust the strategy in a timely manner.

- Work more efficiently with audit, banking, investors: Business understand financial statements will be more active when access to capital, capital investment or the inspection agency.

- Financial statements, what to include? 5 Types of financial statements company 2025

- [FULL] the Sample financial statements, financial situation excel file according to the circular, 200 and 133

- Financial statements consolidated what is? Instructions for setting up and reading effective for business

- Guide to writing a financial report according to circular 200 details for the business

2. Guide how to read financial statements in each section

Financial statements to include multiple forms, indicators and accounting, but when approached properly, the reader does not need to be financial experts can still capture the panorama of business. Here are specific instructions for effective reading each part of the financial statements.

2.1 How to read balance Sheet

The balance sheet represents the assets (what the business owns), capital (source form should that property). This report reflects the financial status of your business at a specific point in time.

Property: distinguish short-term assets, long-term

- Short-term assets include cash, inventory, accounts receivable... are those assets that can be converted into cash within 12 months.

- Long-term assets are buildings, machinery, vehicles, real estate, used long production service business.

For example easy to understand: If you have 5 billion in inventory are raw materials, standard production equipment, which is short-term assets. Also the machine worth $ 3 billion users in 5 years, which is the property long-term.

Business need note: asset structure should be consistent with the peculiarities industry. If short-term assets so high that efficient use is low, can cause wasting of working capital.

Liabilities: Read the loans, short-term debt, long-term

- Short-term debt: is the account to be paid within 12 months, such as tax debt, wage loan short term.

- Long-term debt: usually bank loans, bonds, or financial obligations on the 1 year.

Suggestions analysis: the Ratio of debt to pay too high compared to the total assets are warning signs of financial risks, especially when interest rates rise. On the contrary, a debt level case management can help businesses leverage is financial leverage.

Equity: Understanding the contributed capital, retained earnings, investment and development fund

This is the part that reflects the real value that business owners or shareholders are owners in the business.

- Capital: due to owners or shareholders to contribute to

- Profit after tax has not distributed: is the retained earnings after dividend or pay tax

- Fund development: profits drawn to re-invest

Rate, equity premium: that the business has the financial foundation stable, less dependent on borrowed capital, to attract investment, expand the scale.

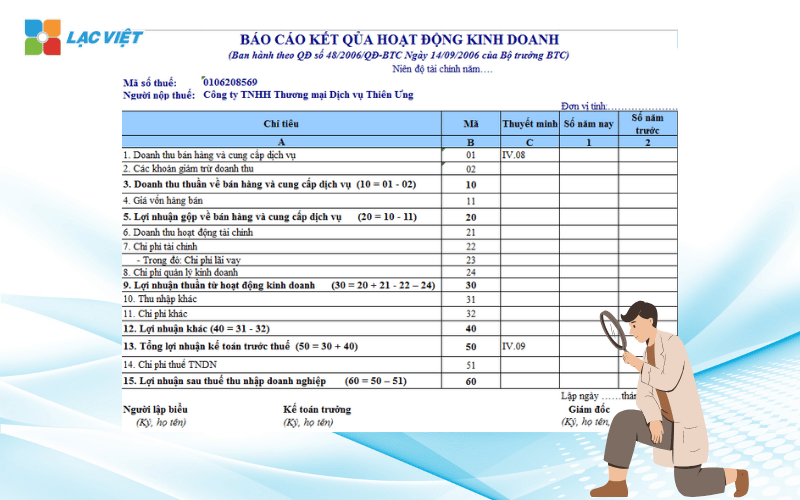

2.2 How to read the report on the results of business activities

This report shows the business making a profit or loss in a period of time (month, quarter, year). This is the report easy to read, often business leaders interested in the most.

Revenue and gross profit: Understanding effective core activity

- Net sales = sales revenue – Discount – Every bounce – VAT

- Gross profit = net Sales – cost of goods sold

Actual value: the gross profit to help businesses evaluate the effectiveness main activity – production or sales are generating surplus value or not.

For example, If revenue increases, but gross profit does not increase, respectively, may be due to input costs increase or decrease production performance.

Operating costs and net profit: Determine the level of cost control

- Cost, sales management, business: demonstrating the ability to reduce operating costs

- Net profit: the rest after deducting all expenses from revenue

Businesses need to pay attention: Costs rising faster than revenue is an indication that the need to revise the system of management, marketing or hr.

Profit after tax: capacity Assessment student last words

This is the only number that reflects most clearly the results of operations of the business. The ratio of profit after tax/revenue higher business as efficiently.

Hint: compare the after-tax profit of more consecutive periods to identify trends, combined with overs to know the causes increase – decrease (due to good sales, cut costs, or due to extraordinary profits).

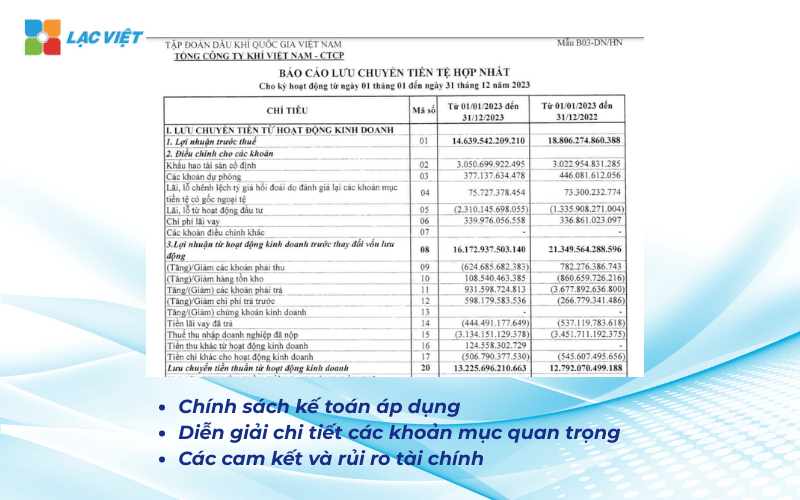

2.3 How to read the statements of cash flows

Reported cash flow help businesses answer the question: “Business earn how much actual cash, the money is flowing in – come from?”. Many profitable business, but lack of cash, which will be made clear through this report. Three groups of cash flow, the need to read

Cash flow from business operations

This is the cash flow core, reflect the ability to generate cash from operations production – daily business.

Meaning: If cash flows from business activity and stability, which is a good sign. If continuous, though profitable, can businesses are having problems in the recovery of the debt, inventory, or take control costs.

Cash flow from investing activities

Including the purchases of fixed assets, investments in other companies, or collect the money from the sale of the property.

Meaning:

- Negative money flow is normal if the business is expanding production.

- However, it should ensure the appropriate investment with cash flow business, avoid the investment exceeds the financial possibilities.

Cash flow from financing activities

Express cash flow related to capital: bank loans, repayment of the original capital contribution, dividend...

Meaning:

- Positive cash flow typically comes from the loan capital or increase capital.

- Negative cash flow can do business to pay the debt or dividend.

Note when reading this report

- Don't just look at the total amount at maturity. See each cash flow to know the business that is life with real money or “paper profits”.

- Compared with the previous year to see cash flows that are sustainable not.

Actual value: The cash flow statement is the administration tool, cash flow, to help businesses proactively plan repayment, investment and profit distribution more efficient.

2.4 How to read the notes to financial statements

Notes to financial statements like the detailed explanations for the figures in the main report. If read-only financial statements that omit overs, business will easy to understand wrong or missing important information.

Accounting policies applied

This section explains how business accounting items. The business select asset depreciation by the method of fast or linear will directly affect the cost, profit.

Actual value: Helps the reader understand the “rules of the game” accounting of the business to not misunderstand the nature of data.

Details of items important

For example:

- Revenue increased because there are big contract

- Financial expenses increased due to additional loan to expand the factory

- Debt to income rose because of renewed public debt to customer strategy

Hint: Businesses should be especially carefully read the notes related to large fluctuations or item has extraordinary value.

The commitment and financial risk

Many items are not directly reflected on the balance sheet as: commitment, guarantee, lease financing, litigation is going... will be presented in this section.

Meaning: to Help businesses or investors assess the potential risks, thereby making prevention strategies in a timely manner.

3. The index to track when reading financial statements business

When have read and understand the structure of financial statements, the next step is to analyze the financial indicators are the numbers speak for current situation, and help forecast future business. Here are 3 important metrics that every business should be monitored periodically.

3.1 Group liquidity indicators

The liquidity indicators help businesses evaluate the possibility of payment of financial obligations in the short term, to avoid the risk of losing their ability to pay.

Liquidity ratios current

Recipe: liquidity ratios current = short-term Assets / short-term Debt

Meaning: If number > 1, the enterprise has the ability to pay the short term debts. In contrast,

System of fast payments

Formula: (current Assets – inventory) / current Liabilities

Meaning: exclude inventory (usually takes time to sell), this indicator reflects the ability of liquidity actually of the business.

3.2 metric operational efficiency

This metric group said the business operate efficiently to where there used to optimum property or to the line, which had been “detained” in the inventory, debts and...

Inventory turnover

Formula: cost of goods sold / inventory value average

Meaning: high index shows business sales faster, less inventory, rotation of capital efficiency. Only the low warning order backlog, misappropriation of funds.

Spin receivables

Formula: net Sales / Accounts receivable average

Meaning: this indicator reflects the rate of recovery of the debt from the customer. Spin as fast, then business as having good cash flow, less risk of losing your capital.

Businesses need to note:

- Compare with credit terms for customers (for example for arrears of 30 days, which collect money takes 60 days is not okay)

- Track combining the bad debt ratio to risk assessment

3.3 Group profitability index

No metrics more important than profitability – at the core of all business activities. Group this indicator reflects the efficient use of assets, equity and the ability to maintain profit after deducting costs.

ROA – Rate of return on total assets

Formula: ROA = profit after tax / Total assets average

Meaning: ROA higher business as to use assets efficiently to generate profits.

ROE – Rate of return on equity

Formula: ROE = profit after tax / Equity average

Meaning: To know every capital of business owners create, how many profits. This is the most important indicator for investors.

Margin net profit

Formula: net profit after tax / net Sales

Meaning: to Reflect the “net interest” on every dollar of revenue. Bien higher business as effective in controlling costs.

In summary, keep track of financial indicators not to “report for beautiful”, but to help businesses proactively detect anomalies optimal operation decisions more quickly. With just a few index core is analyzed properly, the business will have a “compass finance” reliable in the development process.

4. Note when reading and analyzing financial reports business

4.1 comparison over time and between enterprises in the same industry

A financial figure itself has no meaning if not to be put in the context of comparison. Therefore, enterprises need to:

- Compare according to string duration: at Least 3 – 5 years to identify trends, growth, decline or unusual fluctuations.

For example, If net profit after tax in the year 2024 is 1.2 billion, compared to 900 million by 2023, 1.4 billion by the year 2022, you will see the year 2023 is the point to consider thoroughly about the causes of decline. - Compare with businesses in the same industry: An indicator of profitability of 10% might be good in the construction industry, but low compared to industry standard software.

Therefore, businesses need to put yourself in the “common ground” to accurately assess the operational efficiency.

Practical benefits: Helps enterprises is not optimistic or pessimistic bias, thereby making financial plans in accordance with the scale, industry, stage of its development.

4.2 Read the notes and check consistency

Financial statements is a logical system should be cross-checked. Reading report efficiency requires:

- Parallel reading notes: Many items need overs understand true nature, for example, costs spike due to expanded investment, rather than due to operate poorly.

- Consistency check: If revenues increase, but the money back, it is a sign need investigation skills. Can businesses sell more, but has not obtained the money, which leads to shortage of liquidity.

Practical benefits: Avoid misinterpretation of the nature of numbers, timely detection of potential risks, increase reliability when reporting to shareholders, banks, or audit.

4.3 Avoid misinterpretation due to changes in accounting policies

Many cases business saw profit or asset volatility, but not due to business performance that is due to changes in the way recorded data. For example:

- Business change from the method of accelerated depreciation to linear → profit this higher but not due to the revenue increase.

- Policy changes recorded revenue from “recorded when signing a contract” to “recorded delivery” → directly affect revenue and profit in each period.

Important note: Always review the section “accounting policies applied” in the statement. This is where clearly explain the principles affect the financial data.

5. Technology application to read financial statements easier

In the era of digitization, businesses do not need to handle the financial reports using complex spreadsheets. Instead, the application software and AI help save time, reduce risk flaws, enhance decision-making abilities.

5.1 Use accounting software smart (AccNet, LV-DX Accounting)

The accounting software the new generation as LV-DX Accounting not merely help business financial reporting standards circular 133/200, but also have the ability to:

- Automatic synthesis of data and periodic reports

- Warning errors, standard deviations, missing data, even when data entry

- Quick calculation of indicators such as ROA, ROE, profit margin, inventory turnover

Actual value: small Businesses can also set up reports professional as big business, to reduce dependence on outsourced accounting, financial control from early on.

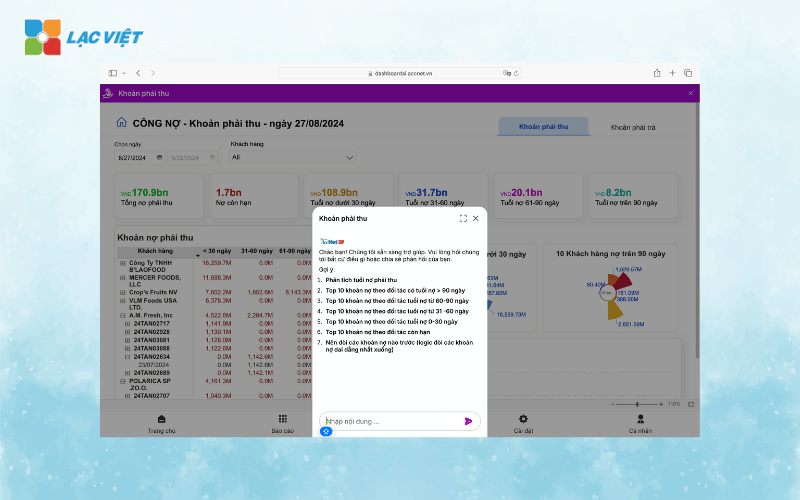

5.2 combining AI to analyze and make suggestions finance (LV Financial AI Agent)

LV Financial AI Agent is tools of financial analysis, smart due to Lac Viet developed to help business:

- Automatic detection of targets unusual, as profit growth is not in sync with the cash flow

- Early warning, risk, cash flow, debt harder to lose weight for capital

- Interpretation of the index in understandable language, to help leaders not in-depth about accounting also catch the situation.

Financial reporting is a strategic tool to help businesses look at yourself objectively, comprehensively. The read and properly understand financial statements to help leaders capture the financial picture, current development is the point of congestion in cash flow, assess profitability, from which actively adjust business strategy before the risk occurs.

Instead of just depends on the accounting department, let's start page for your business reading skills report in a systematic way – from how to understand a balance sheet, reports business results, to cash flow, the detailed explanations behind the numbers.

Lac Viet Financial AI Agent to solve the “anxieties” of the business

For the accounting department:

- Reduce workload and handle end report states such as summarizing, tax settlement, budgeting.

- Automatically generate reports, cash flow, debt collection, financial statements, details in short time.

For leaders:

- Provide financial picture comprehensive, real-time, to help a decision quickly.

- Support troubleshooting instant on the financial indicators, providing forecast financial strategy without waiting from the related department.

- Warning of financial risks, suggesting solutions to optimize resources.

Financial AI Agent of Lac Viet is not only a tool of financial analysis that is also a smart assistant, help businesses understand management “health” finance in a comprehensive manner. With the possibility of automation, in-depth analysis, update real-time, this is the ideal solution to the Vietnam business process optimization, financial management, strengthen competitive advantage in the market.

SIGN UP CONSULTATION AND DEMO

You want to shorten the time read – out – analysis of financial statements?

Try LV Financial AI Agent – engine support, business analysis, financial reporting, automatic risk warning and suggestions important indicator. Sign up for a free demo today to not miss an advantage finance of the business.

![[ĐẦY ĐỦ] Mẫu báo cáo tài chính, tình hình tài chính file excel theo Thông tư 200 và 133](https://lacviet.vn/wp-content/uploads/2025/04/mau-bao-cao-tai-chinh.png)