Financial statements not only is the profile required to submit to the tax authority, which also is the “mirror reflection” the financial realities of business. The correct setup, full financial statements, ensuring compliance with legal support, internal controls, analysis, business performance, governance decisions more accurate.

Circular no. 200/2014/TT-BTC be the Ministry of Finance issued to standardize the accounting system business in Vietnam, neckline with international accounting, in particular in accordance with the enterprise-scale, medium and large. The preparation of financial statements according to circular 200 this business:

- Professional, fiscal transparency, in the eyes of partners, banking, investor

- Risk reduction inspection, arrears of taxes due to errors in accounting

- More confidence when the need to raise capital, appraisal capacity credit, or preparation of the IPO

If you are a person conducting a business but not sure how to set up financial statements according to circular 200, this article Lac Viet Computing will help you step by step to understand the process, form, how effective application of circular 200 in actual operation.

1. Circular 200 what is and apply for the any business?

1.1 overview of the circular 200/2014/TT-BTC

Circular no. 200/2014/TT-BTC is a text guide mode, business accounting, by the Ministry of Finance, with effect from the financial year 2015. This circular replacement for the Decision 15/2006 and is an important innovation, aims to improve the transparency, consistency, easy comparison of financial information between businesses.

The main objective of the circular 200:

- Standardized system of accounts, accounting principles, form, financial statements

- Create favorable conditions for enterprises to apply the reporting standards international financial future (IFRS)

- Advanced ability to use financial information for stakeholders such as investors, banks, auditors, shareholders...

1.2 application objects and differences compared with circular 133

Circular 200 is applied to the following businesses:

- Business medium and large scale

- Joint-stock company, business listing on the stock exchange

- - Invested enterprises, foreign investment

- The unit has high requirements for financial transparency, report consolidated

For small business and Set Financial recommendations apply circular 133 – a mode of accounting, more simply suit the needs recorded basic.

The basic difference between circular 200 and 133:

| Criteria | Circular 200 | Circular 133 |

| Applicable objects | Medium and large business | Small business and small |

| System account | Full details classification | Minimalist, easy to practice |

| Report forms | Standard, multiple criteria analysis | Brief, little, norm |

| Request a presentation | The higher, suitable consolidated report | Simple guide to internal |

- Financial statements, what to include? 5 Types of financial statements company 2025

- [FULL] the Sample financial statements, financial situation excel file according to the circular, 200 and 133

- Financial statements consolidated what is? Instructions for setting up and reading effective for business

- Guide how to read financial statements easy to understand for business want to manage financial efficiency

2. Guide to writing a financial report according to circular 200 step by step

Financial reporting is not merely “the data” end states, which is a multi-step process to ensure that the indicators reflect the actual financial – business of the business. If properly implemented, the financial statements help businesses comply with the law, become admin tools extremely useful.

2.1 Preparation of accounting data input

Before embarking on financial reporting, the first important step is to check, to standardize the entire accounting data in the states. The reporting accuracy depends on the data entry, accounting right from the beginning.

The work should be performed:

- Check balances beginning and end of all accounts in the ledger. For example: account 111 (cash) or 131 (receivable) to be reviewing if it matches the votes income – expenses, bills or not.

- The balance sheet test: This is the internal report helps to check the total Debt and Have in the states can balance not, thereby to detect errors accounted for.

- Collated data between windows synthesis, details window: Ensure the balances in the ledger coincides with the details window as creditors, customers, inventory, and fixed assets.

- Reviewing the evidence from key end states: Bill hasn declaration, asset depreciation, interest payable, taxes payable... need to be treated prior to reporting.

Values bring: Step prepare this helps businesses to avoid errors necklaces at the same time ensure the report set out firmly grounded, are the tax authorities, auditing accepted.

2.2 Establishment of each report according to the standard process

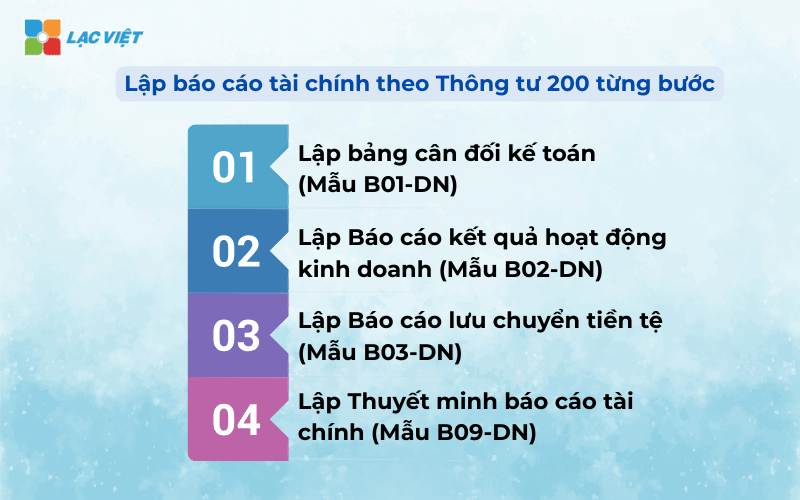

The financial reporting should follow logical sequence, because the reports are linked together. A number of indicators in this report is the input of the other reports, so need to set up in the following order:

Step 1: Set up the balance sheet (Model B01-DN)

Function: Reflects the entire assets, liabilities, equity of the business at a certain time (usually the end of the accounting quarter or year).

The structure consists of 2 parts:

- Property: Includes short-term assets (such as cash, inventory, receivables), long-term assets (such as machinery, real estate, investment property).

- Sources of funds (liabilities and equity): Reflects the source form of the property on including debt, loans, accounts payable, share capital, real have their owners.

Note

- Based on your account balance, last states to recognise the asset (accounts 111, 112, 131...), liabilities (331, 341...), equity (411, 421...).

- Correct classification between short-term and long-term is a prerequisite to report reflect the liquidity of the business.

Step 2: report the results of business activities (Form B02-DN)

Function: Record the total revenue, cost, profit in the accounting period.

The only important goals:

- Net sales: The sales revenue after deducting deductions as discount, returned goods.

- Cost of goods sold: the Costs directly related to the creation of products/services.

- Gross profit, net profit, profit after tax: To know the effect produced – real business of business.

Points need to distinguish:

- Accounting profit before tax: Is profit before taxes corporate income.

- Profit after tax: Is the actual remains after one has completed obligations to The state.

Note:

- Collection of data from the sales account (511), price of capital (632), cost (641, 642), other income (711) other costs (811) to calculate the profit before tax, after tax.

- Note check the correct sales deductions, deduction expenses properly to avoid false profit.

Step 3: reporting cash flows (Model B03-DN)

Function: the flow of money into – out of business in 3 main activities: business, finance and investment.

Setting method:

- Direct method: Listing details each account cash in/out (understandable, but need track engineering daily).

- Indirect method: starting from accounting profit and adjusted according to the account non-cash (often used in practice).

Errors frequently:

- Not separated clearly investing activities, financing, leading to wrong cash flow net.

- High profits, but cash flow negative due to not well controlled public debt or inventory.

Note:

- Can choose the direct method or indirect, but it should be used indirectly if the accounting data has not tracking cash flow details.

- Cash flow from business activities should be contrasted with profit after tax from reports the results of business activity to check the coupling logic.

Step 4: Set up notes to financial statements (Form B09-DN)

Function: detailed explanation of the indicators on the financial statements, presents accounting policies applied.

Important content:

- Introduction business degree in finance

- Accounting (method of revenue recognition, depreciation...)

- Details of the item are large fluctuations

- Financial commitment, risk events arising after the reporting date

Note when set up:

- No need to present the entire data but only selectively, and interpret the accounting policies applied, explain the items that fluctuations really need to clarify for the reader.

- Can be quoted in detail the items as large as the cost of construction in progress, to be uncollectible assets finance lease...

- Should be presented in tabular or short to easy-to-follow.

Important note: Keep the rules consistent, reciprocal between the report. For example: profit after tax in the reporting business results must coincide with the target after-tax profit in the balance sheet.

2.3 test, review and improve

A financial report is only considered complete when has undergone the process of cross-checking thoroughly. This step is to decide the accuracy and rationality of the report.

The content need to scrutinize carefully:

For cross-reference between the report:

- Profit after tax in the reporting business results to match accounts 421 on the balance sheet.

- Flow net cash from operating activities must be related to the fluctuations in the account receivable and payable.

Check out the indicators unreasonable:

- Costs rise sharply, but the revenue does not change → need overs unknown.

- Loan debt exceeded short-term assets → can cause liquidity risk.

Reviewing time recorded revenue – cost: Guaranteed not to “stack” the revenue the following year about this year or omission of costs need to set aside.

Actual value: to Help businesses avoid risk of tax audits, increase reliability with partners, improve the ability to analyze internal. Besides, the thoroughly check also the platform to build the system of financial management professional.

In summary, the financial reporting according to circular 200 not only is the form, which is the process of creating tools financial management for effective business. Right from the preparation to the final inspection will help the business firm on the legal, fiscal transparency, and more active in sustainable development.

3. Important note when drawing up financial statements according to circular 200

3.1 accounting principles are required to adhere to

When drawing up financial statements according to circular 200, businesses need to adhere to the principles of basic accounting. This is a required legal guarantee the truthfulness, consistency of financial information.

- Principles of accrual: revenues and expenses must be recorded at the time incurred does not depend on the cash flow in/out. For example, if your sales in 12 months, but collect money month 1 year later, the revenue must still recorded in the old year.

- Guidelines caution: To provisioning for doubtful debts or discount of inventory, if there are signs of risk, to reflect the financial situation in an honest way, do not make beautiful figures.

- Principle of consistency: accounting Methods, the presentation of the report must be kept stable over the accounting period, to help the comparison, evaluation becomes more accurate.

Practical value: compliance with these guidelines helps business to limit errors in the report, increased reliability when working with banks, tax authorities or audit.

3.2 The common errors and how to avoid them

In the process of financial reporting, many businesses, especially small and medium enterprises, are predisposed to a number of common error below:

- Enter the wrong accounting period: The recognition of the wrong month or year can make the deviation, resulting in false profits, or cash flow. Therefore, need to carefully check the playback time of each service prior to accounting.

- Mismatched data between books and reports: For example, the balance of the cash account in the ledger does not coincide with the norm cash in the balance sheet. Causes are usually due to not for regular screenings or lack of updates window bank.

- Notes to financial statements sketchy: Many businesses just fill in the template which is not clearly explain the large fluctuations, causing the reader to not understand the essence operation. This can cause difficulties in the evaluation, prone to doubt when audit.

The solution prevention:

- There checklist review final report states

- Collated data cross between the report

- Perform internal audit periodically if there are conditions

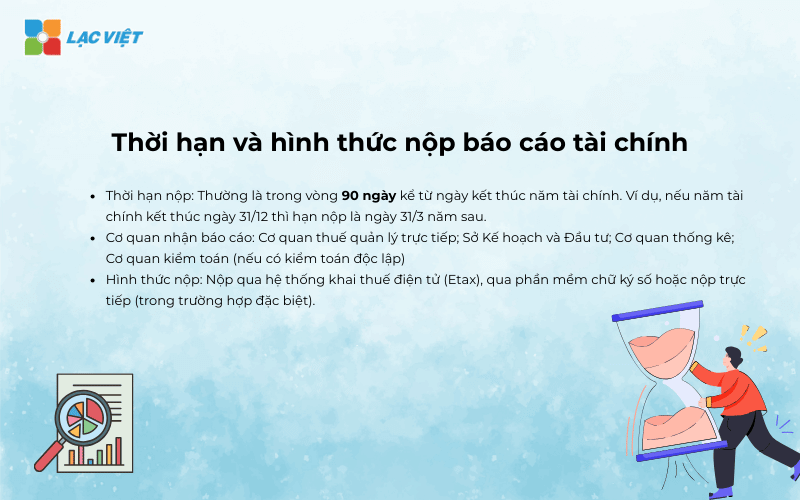

3.3 term and form of submission of financial statements

The filing of financial statements is required from the relevant state management is the base to determine the tax obligations, assess the transparency of the business.

- Deadline for submission: Usually within 90 days from the date of end of financial year. For example, if the fiscal year ending 31/12 then the deadline is the day 31/3 years later.

- The agency received reports: managing tax agency directly; the Department of planning and investment; statistical agency; agency audits (if any independent audit)

- Submission form: Submission through the system of electronic filing (Etax), through software, digital signature, or submitted directly (in special cases).

Important note: Business late payment, wrong form, or incomplete may be sanctioned for administrative violations according to the Decree 125/2020/ND-CP.

4. Hint software and tools to support financial reporting easy

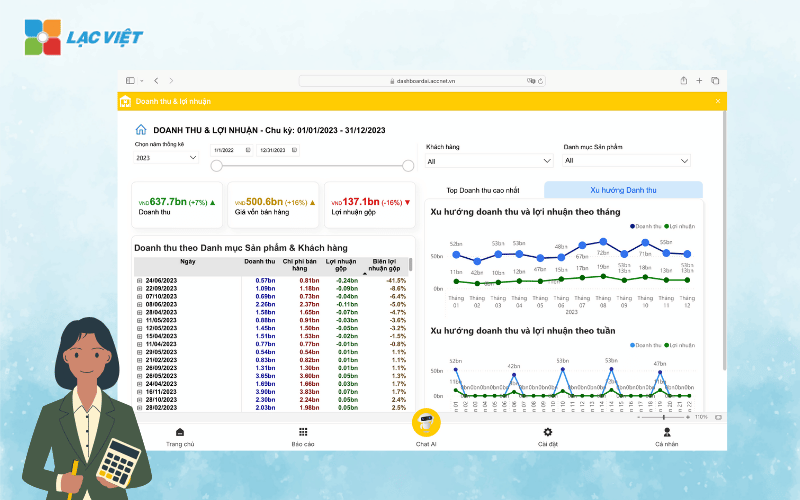

41 to Use accounting software AccNet standard circular 200

AccNet is accounting software for medium business and large due to Lac Viet developed, designed specifically to fully meet the requirements of circular 200. When used, help businesses save time, minimize the risks of errors in the reporting process.

Benefits when using AccNet:

- Automatic synthesis of data from the ledgers, diaries, window detail

- Export a report in standard form B01 – B09 circular 200

- Warning flaws accounting report balances unusual

- Supports multiple users working on the system under decentralization

Illustrative example: When the accountant entered the wrong the account input costs, the system can automatically detects and alerts help users fix before the report.

4.2 application AI – LV Financial AI Agent

LV Financial AI Agent's assistant, financial analysis, smart integrated AI helps businesses:

- Analysis report set: automatically detect anomalies, such as negative cash flows prolonged growth in revenue does not go the same profit

- Suggested tune: Give a warning if see profits increase unusual, but no corresponding increase in cash flow

- Interpret the target language, easy to understand, help lead the non-intensive accounting still understand the nature of financial business

Lac Viet Financial AI Agent to solve the “anxieties” of the business

For the accounting department:

- Reduce workload and handle end report states such as summarizing, tax settlement, budgeting.

- Automatically generate reports, cash flow, debt collection, financial statements, details in short time.

For leaders:

- Provide financial picture comprehensive, real-time, to help a decision quickly.

- Support troubleshooting instant on the financial indicators, providing forecast financial strategy without waiting from the related department.

- Warning of financial risks, suggesting solutions to optimize resources.

Financial AI Agent of Lac Viet is not only a tool of financial analysis that is also a smart assistant, help businesses understand management “health” finance in a comprehensive manner. With the possibility of automation, in-depth analysis, update real-time, this is the ideal solution to the Vietnam business process optimization, financial management, strengthen competitive advantage in the market.

SIGN UP CONSULTATION AND DEMO

How to create financial statements according to circular 200 requires not only bring comply with the law, but also as step strategy to help businesses build the financial foundation of transparency, basically, professional. When properly understood and properly implement process of the report, businesses can capture the whole financial picture interface, more active in governance, planning and business decisions.

![[ĐẦY ĐỦ] Mẫu báo cáo tài chính, tình hình tài chính file excel theo Thông tư 200 và 133](https://lacviet.vn/wp-content/uploads/2025/04/mau-bao-cao-tai-chinh.png)