In any business, from production, trade services, cash flow always plays a key role in maintaining stable operation, long-term development. One of the factors that directly affect the cash flow is accounting and public debt.

However, practice shows that many businesses are still faced with the situation collated liabilities false, delay payments or to backlog the provision for doubtful debts. So, embrace the concept of management accounting public debt not only are the responsibility of the accounting chamber, which is also math strategy for the machinery business management.

This article Lac Viet Computing will give you the most complete information about accounting public debt: from basic concepts, classification, specific to the implementation process and technology solutions to help optimize debt management efficiency.

1. Public accounting what is debt?

Kế toán công nợ là quá trình ghi nhận, theo dõi quản lý các khoản tiền mà doanh nghiệp phải thu từ khách hàng, phải trả cho nhà cung cấp, đối tác hoặc cơ quan chức năng. Nói cách khác, đây là hoạt động giúp doanh nghiệp biết mình đang nợ ai, ai đang nợ mình, nợ bao nhiêu, đến hạn chưa và đã thanh toán hay chưa.

For example, when business sales for the customer but have not yet received the money right then that is the “receivables”. Conversely, when business goods or services but not yet paid, there is the “pay”. If not accurately track the account, this business is very easy to fall into a state not forget to collect the debt, deferred repayment or uncontrolled financial situation real.

Accounting public debt acts as a “bridge” between the business operations, finance. Help business:

- Control transparency, financial situation and current.

- Planning, payment, debt collection efficiency.

- Reduce the risk of bad debts to avoid loss of property.

- Create favorable conditions for loans, work with the bank or investors because there are system public debt clear.

When liabilities accounting is made, it business not only protects cash flow, but also enhance competitiveness through the optimal relationship with customers and suppliers.

2. The type of public debt in the popular business

In the process of operation, the business incurred a lot of debt different. Understanding each type of not only helps control the flow of money effective, but also assist in taking financial decisions right. Below are the types of liabilities common that most businesses are encountered in practice:

2.1. Receivables customers

This is the type of public debt most frequently arises when a business sells goods or provides services, but the customer has not paid immediately. The work for the customer owes the money is normal in business, especially the purchase and sale contracts or policies, discounting of deferred payment.

For example, A furniture company delivered 100 sets of tables and chairs for customers on 1/4, according to the contract, the up to date 15/5 new customers have to pay the full value of the order. In the period from 1/4 to 15/5, that funds are recorded as receivables.

Worth bringing back when good management:

- Businesses can plan to recover the exact amount to avoid misappropriation of funds too long.

- Reduce the risk of bad debts thanks to follow tight deadlines, payment status.

- Improve relationships with customers through prompt professional debt on time.

2.2. Accounts payable supplier

In contrast to the receivables and liabilities arise when businesses purchase goods, materials, or use the services from suppliers but has not paid immediately. This is a form of “debt” to help businesses have more time rotation of capital that is still guaranteed to be first into production or business.

For example, An apparel company purchased 10 tons of fabric from the supplier get the goods on the date 20/3, but to date 30/4 new payment. In this stage, the funds to purchase the fabric is recorded as accounts payable.

Worth bringing back when good management:

- To help businesses proactively plan payments, avoid being late lead to lose credibility.

- Advantage of credit policy from the provider to optimize cash flow short term.

- Avoid dropping, sperm, underpayment or payment in the wrong order.

2.3. Liabilities advance, internal, tax and insurance

Besides the two main types mentioned above also many types of other debt also plays an important role:

- The advance debt: arises when a business app money for staff go to work, shopping or work done before, then new stock from. For example: Employees are the first 20 million to go to work, Ha Noi, this amount is the advance debt until there is evidence from settlement.

- The internal debt: Is the account financial transactions between branches or departments in the same company system. If not recorded for projectors timely, easy-to-happen to lose balance internal.

- Liabilities taxes and social insurance: including accounts payable for the tax such as VAT, corporate income tax, personal income tax, payables to insurance for workers. This is the type of public debt should be especially noted for related to legal obligations.

Worth bringing back when good management:

- To avoid risk of administrative fines due to late payment of taxes or insurance.

- Ensure transparency, balance sheet between departments, branches.

- Strengthen compliance reputation with authorities.

Each type of public debt have own characteristics directly affect the financial performance of the business. Understanding the nature and apply methods appropriate management help enterprises to actively control risks, optimize cash flow, increase competitiveness on the market.

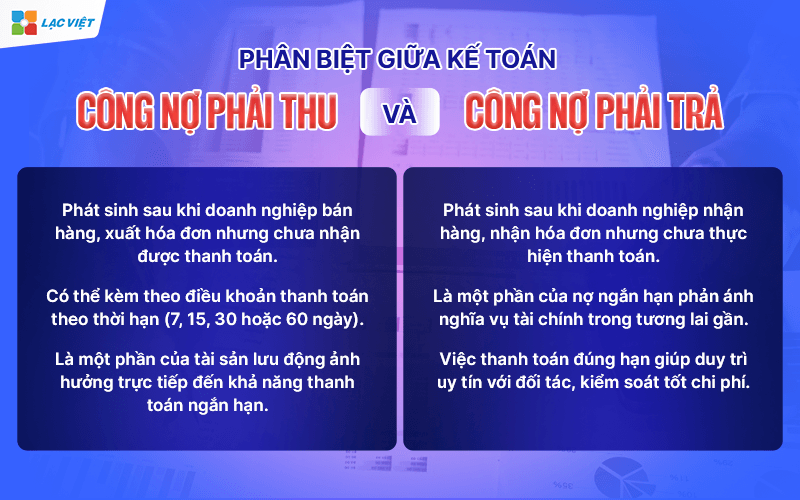

3. Distinguish between accounting accounts receivable and accounts payable

In business accounting, the clear distinction between the accounts receivable and accounts payable not only technical accounting, but also is an important basis for cash flow management, control financial risks, improve the efficiency of business operations. Below is the detailed analysis helps businesses understand the correct order to efficiently manage the two types of debt this.

3.1. The debt to income: Business as a creditor

The debt to income is the amount that businesses have the right to receive from the customer, dealer, or partner after has to offer goods and services. This is the property of the business, but temporarily has not been cashed.

Characteristics

- Incurred after the business sale, the invoice but have not yet received payment.

- May be accompanied by the payment according to the term (7, 15, 30 or 60 days).

- Is a part of the assets directly affect the ability to pay short-term.

For example: company A sells shipments worth $ 200 million for customer B, the agreement for payment after 30 days. In the time waiting for payment, 200 million are recorded as receivables of company A.

Importance of management

- If well managed: the business will collect the money right term, limiting bad debt, maintain steady cash flow.

- If poorly managed: prone to misappropriation of funds, loss of liquidity, affect the operations, production and business.

3.2. Accounts payable: the Business is the debtor

Accounts payable is the amount that the business is obliged to make payment to the supplier, carriage unit, partners or institutions and other individuals after received of goods and services.

Characteristics

- Incurred after the business goods receipt, invoice but have not yet made payment.

- Is a part of short-term debt reflects the financial obligations in the near future.

- The payment due date helps to maintain credibility with partners, good cost control.

For example: company X buys raw materials from supplier Y worth $ 100 million, paid within 45 days. During this time, the sum of 100 million is the liabilities of the company X.

Importance of management

- If good management: leveraging the time of payment to optimize cash flow without affecting the partnership.

- If poorly managed: easy-to-penalties for late payment, take a chance get the discount or preferential price, do bad business image.

Solution recommendations

- Planned payment according to the term specified in order not to omit or delay term.

- Priority of payment on the account there is interest, penalty or discount.

- Optimized purchase policy to extend the time for payment of reasonable without affecting the partnership.

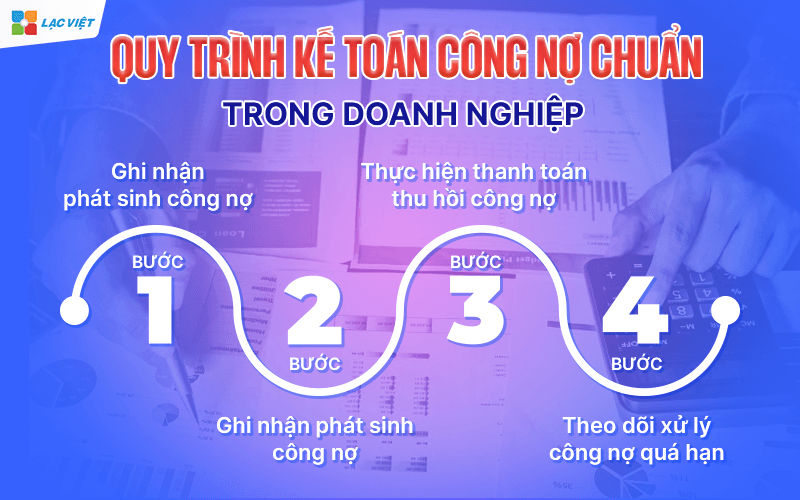

4. Processes liabilities accounting standards in the business

An accounting process, public debt, it clearly does not only help businesses better control the income and expenditure account but also minimize the risks of financial, avoid errors in the transaction maintain credibility with partners. Here are 4 basic steps in the accounting process, the debt that every business should master:

Step 1: recognition of incurred liabilities

As soon as they arise business buying and selling goods, providing services or delivery advance whether paid or not, the accountant should record public debt into the system. Here is the step platform to help businesses control exactly each debt.

Illustrative example: A retail business, the shipment value of 150 million for guests wholesale and agreement, customer will pay after 30 days. Accountants need to set up votes recorded receivables updates into the system right in the date of the transaction.

Actual value:

- Avoid miss or forget to follow public debt.

- Is the database for the steps for projectors, debt collection later.

- Increase transparency in the entire financial operations.

Step 2: collate public debt periodically

Periodically (usually monthly or quarterly), enterprises need to collate data debt with each customer, suppliers to confirm the accurate amount, time of payment, discount (if have), status of bills and vouchers.

For example, Before closing the debt month, accounting send the aggregate liabilities for each customer. If the guest agreed with the data, the two parties will confirm. If there are deviations, to coordinate treatment promptly to avoid lasting effects to payment.

Actual value:

- Help detect timely correction of errors in recorded public debt.

- Increase in reliability between enterprise and partner through transparency.

- Is the legal basis important when disputes occur.

Step 3: make The payment, debt collection

As to payment term, accountants need to actively track remind customers of payment (for receivables), in coordination with finance department to handle the account to pay to the supplier the right term.

Actual value:

- Help ensure a steady cash flow for the business.

- Avoid penalties and interest for late returns or loss of privileges from the supplier.

- Maintained a reputation for good relationship with customers and partners.

Step 4: track processing of overdue debt

Not all debts are paid on time. When the debt is overdue to happen, businesses need to have processes to handle clear: classification of debt (easy recovery, difficult to recover), remind him of his debt several times, apply the policy to withdraw or handle legal if necessary.

Actual value:

- Increase the ability to recover the debt uncollectible.

- Minimize financial losses from the debt out of control.

- Contribute to holding effective operation of financial business.

5. Business accounting liabilities in the business

Accounting for public debt is the process of recognition, reflecting keep track of account receivable and payable of the business with customers, suppliers and other stakeholders. This is one of the business critical in accounting and finance because it directly affects the balance sheet, cash flow, and solvency of the business.

5.1. Accounting receivables customer

Receivables arise when businesses sell goods and provide services, but have not yet collected the cash immediately.

Situations, for example, Businesses that sell products worth $ 100 million for A customer, not to collect cash.

Accounting:

- When revenue recognition and receivables

- Debt: 131 – customer receivables: 100.000.000

- Have: 511 – sales and service provider: 90.909.091

- Have: 3331 – VAT payable to: 9.090.909

- When customer payment cash/bank transfer

- Debt: 111/112 – Cash/bank deposit: 100.000.000

- Have: 131 – customer receivables: 100.000.000

5.2. Accounting accounts payable supplier

Accounts payable arise when businesses get goods and services from suppliers but has not paid immediately.

Example situations: Business buys raw materials from supplier B with invoice value is 200 million, unpaid.

Accounting:

When the recorded accounts payable and warehousing raw materials

- Debt: 152 – Raw materials: 181.818.182

- Debt: 1331 – VAT is deductible: 18.181.818

- Have: 331 – pay supplier: 200.000.000

Upon payment of public debt to suppliers

- Debt: 331 – pay supplier: 200.000.000

- Have: 111/112 – Cash/bank deposit: 200.000.000

5.3. Account the advance, collection, disbursement (the internal debt)

For example: an employee is an advance of 10 million to go to work.

When advance:

- Debt: 141 – advance: 10.000.000

- Have: 111/112 – Cash/bank deposit: 10.000.000

When completing applications, or settlement costs:

- Debt: 642 – Cost management business (or account the cost of fitting)

- Have: 141 – advance

5.4. Accounting receivables, other payables

In addition to customers and suppliers, business can also incurred debt, liabilities, such as: recovery of personal loans, payment of fines, asset liquidation,...

For example, a company for employee loan of 50 million, then recovered enough.

When the loan:

- Debt: 138 – other receivables: 50.000.000

- Have: 111/112 – Cash/bank deposit: 50.000.000

When recovery:

- Debt: 111/112 – Cash/bank deposit: 50.000.000

- There are: 138 – other receivables: 50.000.000

6. The difficulty often encountered when managing liabilities accounting

Although accounting public debt is an integral part of the financial management business but the fact is that many organizations are still encountered a series of difficulties in the process of deploying operating system and public debt. These problems not only comes from human factors, but also due to process loose, lack of tool support fit.

- Confused data, collate public debt delay: One of the common causes leading to misleading the public debt is the data entry manually, the missing link between the departments. Information about order, delivery, invoice and payment is not synchronized updates that accounting must collate the craft, take more time to occur confused.

- Depends on Excel, lack of professional management: Many businesses, especially the unit small and medium are still using Excel to manage your debt. However, this tool is familiar, easy to use, but when data is growing, Excel no longer afford tightly controlled to ensure information security. Business can't tap liabilities reported in real time, no tracking is fluctuating public debt according to the customers or suppliers, which leads to a lack of information when needed financial decisions.

- Uncontrolled debt, bad, directly affect cash flow: When the debt is overdue without measure recovery or timely warning, debts that are at risk of becoming bad debts – that is irrevocable or only recovered part. This is a big threat to cash flow and liquidity of the business. According to reports from Vietnam Report 2024, more than 37% of small and medium enterprises in Vietnam said they each lost revenue because no control over the accounts receivable correct term, of which 19% is the loss on 5% revenue every year because of bad debt.

Debt management is not effective, not merely false bookkeeping. In the context of fierce competition, the economic risk is ever-present consequences from the loose, this work may entail a series negative impact on the entire business operations.

- Loss of reputation with customers suppliers: frequently to public debt is misleading, delay payments or you don't have clear explanations will cause the business to lose trust from partners. A customer is notified wrong number, public debt will feel is doubt. A supplier is late payment can will stop deals or limited delivery.

- Legal risk trade disputes: The errors in the recorded track, collate public debt can become the cause lead to trade disputes, even litigation if it is not solved satisfactorily. In many cases, the business may be responsible for the legal, if not prove to be obligations or rights of their own finances.

- Affect liquidity and operating businesses: cash Flow is the “blood vessels” of the business. If the debt is not well-managed, cash-flow-prone disorder: money not collected already due to pay, that business is shortage of liquidity serious. This leads to the risk to borrow temporarily, sale of assets, short-term or even loss of ability to pay.

7. The optimal solution liabilities accounting software combined with Vietnamese Financial AI Agent

In the context of business expanding volume of transactions increasing, the management of public debt by the method or Excel spreadsheet no longer fit. These methods are often implicit risks, errors, loss of control, delays in data processing. To completely overcome these problems, the application software, accounting software combined platform artificial intelligence (AI) is the direction modern bring practical value markedly for business.

7.1 automate the process of debt management

An optimization software that will help businesses to track warning the public debt in an automatic way from the time incurred until payment is completed. The system allows real-time updates accounts receivable, payable, tracking, payment term analysis, the age of the debt (the overdue time of the debt) and send notification reminders right time.

Values bring:

- Up to 80% of the time manipulation of accounting staff.

- Completely remove a forgotten debt, late payment, wrong time.

- To help businesses proactively manage cash flow plan cashflow clear.

7.2 synchronous links with related parts

A system for managing public debt effectively should be linked with data from other departments such as sales, purchase, inventory and accounting. Meanwhile, all transactions are instant updates into the system, avoiding duplicate or false information.

Values bring:

- Increase collaboration between departments and limit errors when comparing public debt.

- Management of public debt under each contract, orders, customers or suppliers in a systematic way.

- Leaders grasp the entire public debt in real time without the need to wait for reports manually.

7.3 application Vietnam Financial AI Agent – comprehensive Solution for debt management modern

If the business is looking for a platform to not only handle accounting, public debt, but also to support analysis, risk warning capacity,operating Lac Viet Financial AI Agent is the ideal solution.

Feature highlights in the management of public debt:

- Track debts and comprehensive: detailed analysis of receivables and payables; automatic alert when a payment is due or overdue.

- Analysis of the age of debt smart: the System uses AI to determine the debt risk risk, help enterprises take measures for timely processing.

- Dashboard specialized: allows leaders to track the account receivable and payable on the intuitive interface, real-time.

- Automatically prompt term: Send an alert to the person in charge when due for payment or need to collate public debt.

- Cash flow forecast: analysis of public debt combined with other factors to forecast fluctuations in cash flows in the short and medium term.

Why choose us Vietnam Financial AI Agent?

Not only is a software management, financial management, Financial AI Agent is also an “assistant of” smart support business decisions based on real data. With the ability to connect the accounting software, common, integrated Power BI and chatbot WHO bring a comprehensive perspective flexibility for businesses at any scale.

Lac Viet Financial AI Agent to solve the “anxieties” of the business

For the accounting department:

- Reduce workload and handle end report states such as summarizing, tax settlement, budgeting.

- Automatically generate reports, cash flow, debt collection, financial statements, details in short time.

For leaders:

- Provide financial picture comprehensive, real-time, to help a decision quickly.

- Support troubleshooting instant on the financial indicators, providing forecast financial strategy without waiting from the related department.

- Warning of financial risks, suggesting solutions to optimize resources.

Financial AI Agent of Lac Viet is not only a tool of financial analysis that is also a smart assistant, help businesses understand management “health” finance in a comprehensive manner. With the possibility of automation, in-depth analysis, update real-time, this is the ideal solution to the Vietnam business process optimization, financial management, strengthen competitive advantage in the market.

SIGN UP CONSULTATION AND DEMO

Accounting liabilities are often complicated if the business has the large volume of transactions. The accuracy in recognition, clarity in the projector and the active in payment are the three elements of survival in the management of public debt. With the support of the modern software such as LV Financial AI Agent, business not only ensure compliance with accounting principles but also enhance the financial performance overall.

![[ĐẦY ĐỦ] Mẫu báo cáo tài chính, tình hình tài chính file excel theo Thông tư 200 và 133](https://lacviet.vn/wp-content/uploads/2025/04/mau-bao-cao-tai-chinh.png)