In financial management the business, the break-even point is one of the analysis tools platform, but is often overlooked or misunderstood. This is not just a figure of theoretical, which is a clear boundary between the “maintenance survive” and “start a profitable”. The catch app right concept this helps businesses to avoid many decisions sentiment increased capacity planning business on the basis of actual data.

The same Lac Viet Computing learn the details of the relevant knowledge about the breakeven point in this article.

1. The breakeven point is what?

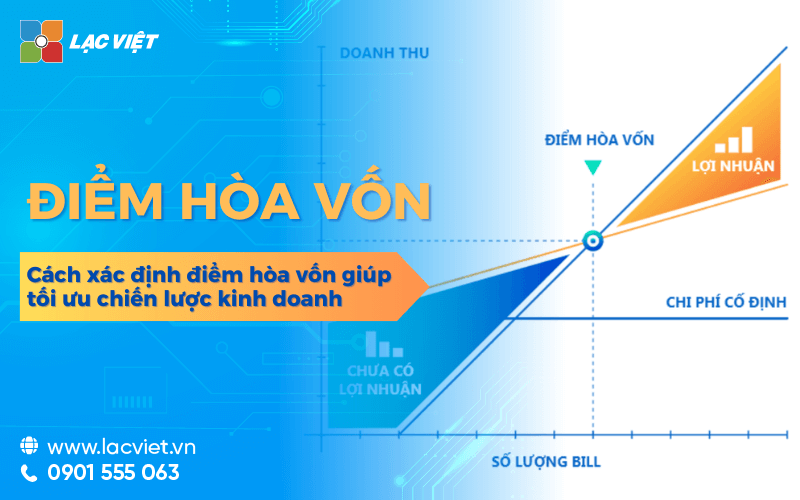

The breakeven point (break-even point) is the level of revenue or minimum output at which business just enough to offset the entire cost, not to suffer losses, but also have no interest. When revenue pass this point, the business begins generating profit. Conversely, if sales below the breakeven point, businesses are operating in a state of sound cash flow.

In other words, this is the minimum threshold for businesses to operate “no losses”. All sales surpass the breakeven point will generate profits.

This is especially important to:

- Enterprises need to calculate exactly how long it can breakeven.

- Manufacturing enterprises need to forecast volume consumption, minimal to offset fixed costs big.

- Service businesses need to assess the effectiveness each package of products, services, before launching in the market.

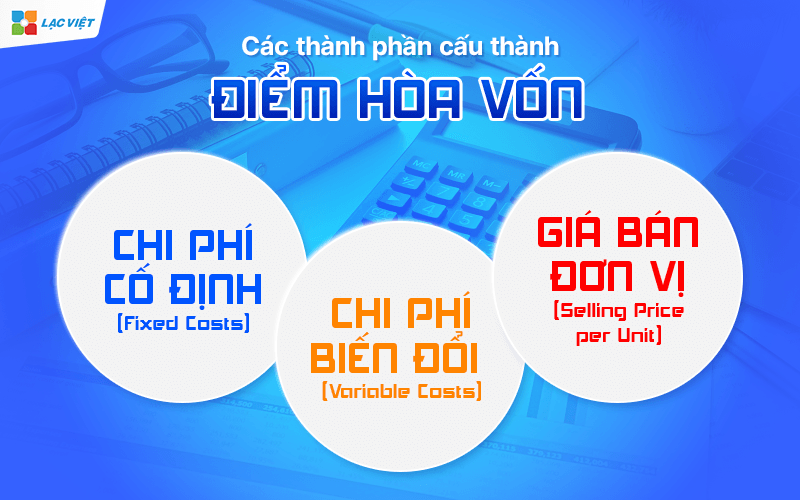

2. The composition of the breakeven point

To accurately determine the breakeven point, businesses need to master three basic components: fixed costs, variable costs and the selling price unit. Not only are the inputs in the formula, but also is the key to analyze the structure of optimal financial strategy, operational risk control. Understanding the correct application flexibility, these three factors will help the business to avoid mistakes in pricing, production or resource allocation.

2.1. Fixed costs (Fixed Costs)

Fixed costs are those costs do not change as output, that is, whether the business produces more or less, this cost remains constant over a certain period of time.

Practical example:

- Rent studios monthly: 50 million regardless of business of producing 100 or 10,000 products.

- Staff salaries, office fixed.

- Depreciation of machinery and equipment.

Implications for the break-even point:

Fixed cost is the “burden” that the business must pay whether the revenue is earned or not. Therefore, as understood and well-controlled fixed cost business, the more easily determine the minimum turnover should reach to no losses. In addition, this is also the basis for enterprises to assess the ability to scale without increasing the cost of mutation.

2.2. Variable costs (Variable Costs)

Variable costs are those costs increase or decrease directly in production – sales. I.e., producing more, then the cost of this increased production, less the cost correspondingly.

Practical example:

- Raw material to produce a unit of product.

- Free shipping in orders.

- Commissions for the salesperson as a percentage of sales.

Implications for the break-even point: variable Costs determine the “profit margin” on each product. When businesses know the cost variation unit, they can easily calculate the net profit from each unit sold. This is the foundation to analyze the optimal selling price, volume, consumption and cost structure.

2.3. Sale price unit (Selling Price per Unit)

Sale price unit is of the proceeds from each product or service sold, not minus the cost. These are factors that directly affect revenue – input of the formula breakeven.

Practical example:

- A product sold at a price of 150,000 vnd/unit.

- A software service is subscription with a free 3 million vnd/month.

Implications for the break-even point: establishing reasonable selling price higher variable costs enough to offset fixed costs is a prerequisite to reach breakeven profitable. If the sale price is too low compared to the cost structure, the business can increase production, but still can not interest.

3. Formula for calculating the break-even point in business-to-business

After you have understood the point, the next step is to apply the formula to identify mold output or the minimum revenue that the business needs to achieve to no holes. This not only academic, which is precisely the tool orientation business strategy according to the data practices.

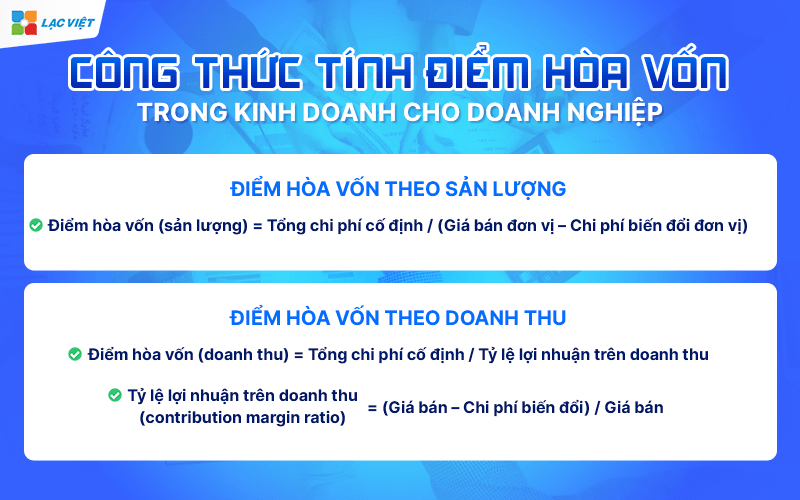

3.1. Formula for calculating the breakeven point in terms of output

This is a common approach to understand the most special with the manufacturing enterprise or business unit items.

Formula:

The breakeven point (output) = Total fixed costs / (selling Price unit variable Costs unit)

Explanation:

- Total fixed cost: cost is constant as output (office rent, basic wages, depreciation, insurance, etc.).

- Sale price unit: is the amount the business earned for each product or service sold.

- Variable cost unit: cost is incurred for each unit of production (raw materials, packaging, shipping...).

The value that business get:

- Knows exactly what to sell, how many products to start profitable.

- Is the basis to calculate the sales target fact, support set KPI suitable for the business department.

- Can adjust the cost – price – output to reach breakeven faster.

Examples illustrate the way in terms of output: the Business A manufactured glass with the following parameters:

- Fixed costs monthly: 200,000,000

- Variable costs per product: $ 20,000

- Selling price per product: 50,000

Apply the formula:

The breakeven point = 200.000.000 / (50.000 – 20.000) = 200.000.000 / 30.000 = 6.667 products

Interpretation: If the business sold a minimum 6.667 products/months, it will not be the hole. Products from Friday, 6.668 onwards, the business began to take interest.

3.2. Formula for calculating the breakeven point in revenue

This method is consistent with the business product portfolio/service, diversity, or want to calculate quickly on overall revenue.

Formula:

The breakeven point (sales) = Total fixed cost / Rate of profit on sales

In which:

The rate of return on revenue (contribution margin ratio) = (selling Price – variable Costs) / selling Price

Values bring:

- Business can quickly mold the minimum revenue, in accordance with the target by month/quarter.

- Matching business services, retail, many categories of goods, or efficiently track entire business activities without the need for separate products.

The example illustrates how by revenue

Information:

- Fixed costs month: 300 million

- The average selling price: 200,000 vnd

- Variable costs average: 120,000 vnd

The rate of return on revenue = (200.000 – 120.000) / 200.000 = 0,4 (news, 40%)

The breakeven point (sales) = 300.000.000 / 0,4 = 750.000.000 dong

Interpretation: Business to generate revenue minimum 750 million per month to not be the hole.

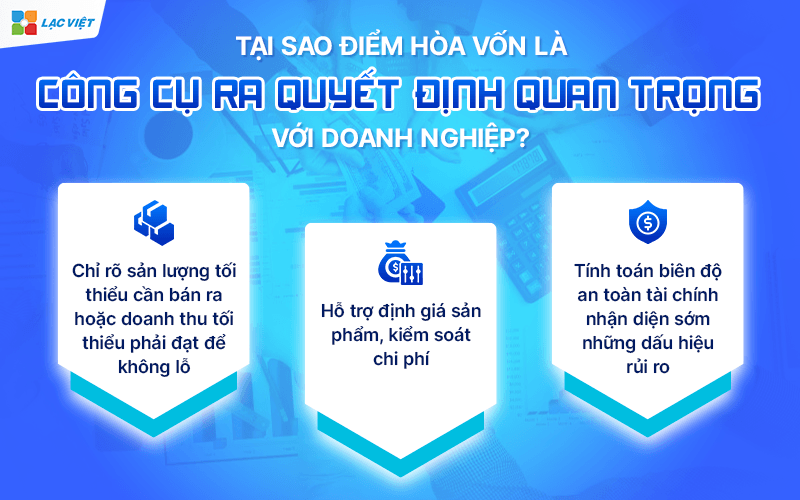

4. Why the breakeven point is the decision-making tools important to business?

In the business environment fluctuations, each financial decisions are need based on real data and indicators governance core. Among them, the breakeven point is a simple tool, but extremely useful to help business risk control, strategic planning, and operate more efficiently. Here are 3 practical value that the business will get when the application analysis of the breakeven point on the active decision:

4.1. Helps determine the minimum turnover to be achieved

One of the reasons businesses get stuck on cash flow is not defined “enough revenue to survive,” is how much. The estimated vaguely make business plan real lack easily lead to a state budget deficit even as the sales seem upbeat.

The breakeven point helps solve this problem by:

- Specify output minimum required sold or minimum turnover should reach to no holes.

- Help managers set the mold short-term goals and medium-term based on the actual capacity of the business.

- Avoid falling into the status of “sell as many holes as big” do not control good profit margin or cost structure.

4.2. Support product pricing, cost control

One of the most common mistakes is the price the product according to opponents or according to the sense, while not understand the cost structure of products and profitability reality.

When analysis of the breakeven point, the business will:

- Determine the minimum prices can sell out but still not the hole.

- Clearly see the impact of the increase – decrease variable costs or fixed costs profit.

- Have the facility to decide whether to cut cost type any price increase out stars that do not affect the purchasing power excessively.

Benefits: Not only helps in optimal pricing strategy, but also help businesses maintain profit margins stable, minimize the risk of “eats interest” by the expenses fixed no control over.

4.3. Is the basis to build the business scenario risk assessment

Turbulent market: demand changes, material price increases, reduced purchasing power – if the business is not prepared before the script is very easy to passive, given the decision “fire”.

Break-even analysis help businesses:

- Set up multiple business scenarios: if the sale is 70%, 100%, or 120% compared to the plan shall affect how profitable.

- Calculate the margin of financial safety (margin of safety), from which recognize early signs of risk.

- Has the facility to adjust the plan cost, product quality or product structure as soon as the inputs change.

For example, In the context of the price of inputs increase by 15%, if the break-even point increased to 20%, businesses need to decide right away: cut costs, increase prices, or reduce production?

In summary, the breakeven point is not merely a calculation accounting. It is the compass financial help business to locate the exact point of balance between existence and growth, between safety with risk. Business knows how to harness this tool will have a big advantage in making right decisions – fast – at least more wrong.

5. Application software for finance and accounting are integrated analysis of the breakeven point

With those businesses that have a larger scale, or would like to update analysis, in real time, instead of manually, the use of financial software, smart will be the optimal solution. In particular, the system features an integrated analysis of the breakeven point helps to connect directly with accounting data to ensure the accuracy constantly updated.

Lac Viet Financial AI Agent to solve the “anxieties” of the business

For the accounting department:

- Reduce workload and handle end report states such as summarizing, tax settlement, budgeting.

- Automatically generate reports, cash flow, debt collection, financial statements, details in short time.

For leaders:

- Provide financial picture comprehensive, real-time, to help a decision quickly.

- Support troubleshooting instant on the financial indicators, providing forecast financial strategy without waiting from the related department.

- Warning of financial risks, suggesting solutions to optimize resources.

Financial AI Agent of Lac Viet is not only a tool of financial analysis that is also a smart assistant, help businesses understand management “health” finance in a comprehensive manner. With the possibility of automation, in-depth analysis, update real-time, this is the ideal solution to the Vietnam business process optimization, financial management, strengthen competitive advantage in the market.

SIGN UP CONSULTATION AND DEMO

Vietnam Financial AI Agent is the foundation of financial analysis, smart, not only support the breakeven point automatically, which also allows:

- Data integration accounting – sales – cost real-time

- Automatically analyze business scenarios “good – average – bad” based on the breakeven point

- Early warning if the actual revenue risk not reach breakeven

- Visualization of data by dashboard helps leaders make decisions fast, accurate

Actual value the business receives:

- Business decisions based on data, not feelings.

- Easy to adjust financial planning and resource allocation.

- Proactive, effective monitoring each product line, or each branch, room board.

Experience free demo tool break-even analysis, financial planner, smart with Financial AI Agent at: https://lacviet.vn/lac-viet-financial-ai-agent

The breakeven point, whether it is a basic indicator but bring strategic value deep in the planning, financial planning, risk control, optimal operating business. From determining the minimum turnover to no holes to support product pricing, budgeting, or evaluate the effectiveness expand production break-even point analysis brings to the business a solid foundation to look clear, safe limits and the profit potential.

Whether you are operating a business of manufacturing, trading or service, small or large scale, applying flexible this tool will help you actively decided to increase the ability to survive sustainable in the long term.

If you've never used the tool calculate the breakeven point let's start with an Excel template simple or choice of integrated software as Financial AI Agent of Vietnam where all data is automatically aggregated analysis, alerts in real time.

![[ĐẦY ĐỦ] Mẫu báo cáo tài chính, tình hình tài chính file excel theo Thông tư 200 và 133](https://lacviet.vn/wp-content/uploads/2025/04/mau-bao-cao-tai-chinh.png)