In the business environment today, every financial decision should be built based on clear data. One of the index key to business-oriented operational risk control is the breakeven point.

The catch point to help managers answer these core questions such as: “the Business needs, how many products to not anal?”, “At any price, then business started to have words?”, or “fixed Cost there are currently creating financial pressure too big or not?”

However, many businesses, especially small and medium enterprises still no conditions for investment in the system management software, financial depth. Therefore, use Excel template calculate the breakeven point become a versatile option, save workable. See more posts from Lac Viet Computing to get the sample standard file below.

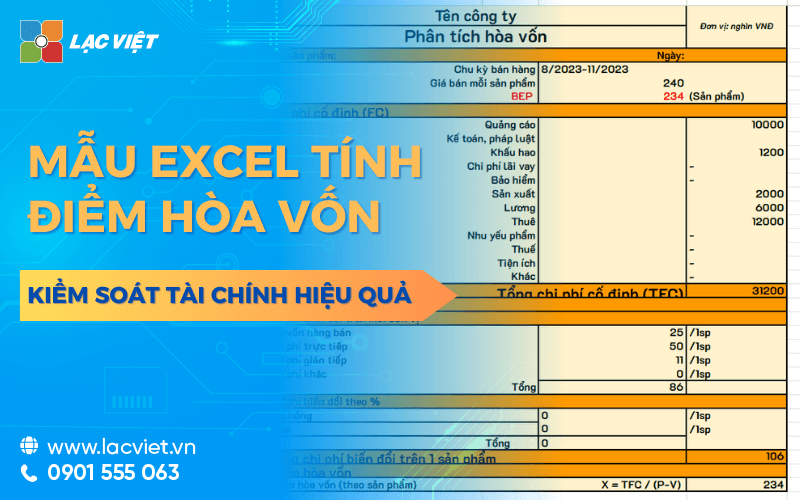

1. Excel template calculate the breakeven point is what?

Excel template calculate the breakeven point is a file workbook pre-designed to help businesses easy entry of input data automatically calculate the breakeven point as output or revenue needed to achieve the level of profitability of 0 (no hole, no interest). This tool is simple but incredibly effective to business self-assessment of the profitability of business operations.

Basic structure of an Excel template calculate the breakeven point:

Input information:

- Fixed costs are the sum does not change according to the number of sales as rent, staff salaries fixed, depreciation of equipment.

- Variable costs on each product as raw material, packaging costs, sales commissions.

- Price units: price level of business expected to sell out each and every product or service.

Formula:

- According to the output:

The breakeven point (output) = fixed Cost / (selling Price unit variable Costs unit)- According to revenue:

The breakeven point (sales) = fixed Cost / Rate of gross profit

Outputs:

- Yield or revenue breakeven is automatically calculated and displayed clearly.

- Some models also integrate the visualization chart (the cost – revenue intersect at point).

DOWNLOAD SAMPLE FILE CALCULATE THE BREAKEVEN POINT IN THIS

2. Instructions how to use Excel template calculate the breakeven point

Excel template calculate the breakeven point is a simple tool, but very useful for enterprises to determine the threshold of financial security to the decision in accordance with business practice. To effectively use this template, business need to follow three main steps: enter the input parameters, understand the formula for calculating the analytical outputs.

2.1. Determined to enter the correct input parameters

The input parameters are the basis of all calculations in Excel template. So, the first step and most important is to correctly identify each item:

- Fixed costs (Fixed Costs): This is the expenditures do not depend on production or sales, such as rent, salary administration, asset depreciation. For example: Business luxury office with a 30 million/month, cost management is 20 million/year → fixed Costs = 50 million.

- Variable costs per unit of product (Variable Cost per Unit): Is the extra cost when the business sold a product, including raw materials, shipping, sales commissions... For example: If each product needed 70,000 coins raw materials and 10,000 shipping, variable cost = 80,000 vnd/product.

- The selling price of products or services (Selling Price per Unit): Is the price the business expects to sell one unit of product/service on the market. Need to ensure this price was calculated based on the survey of needs, competitiveness. For example: selling Price of a product is 150,000.

After you complete input the data into the Excel template, the recipe will automatically return the result.

2.2. Interpret formula is integrated in the file

Excel template usually include two ways of calculating the breakeven point in terms of output and by revenue. Businesses can choose the method appropriate to the specific operation.

- Formula for calculating the breakeven point in terms of output:

Output breakeven = fixed Costs / (selling Price – variable Costs)

For example: for a fixed cost of $ 100 million, the sale price 150.000, variable costs 80.000

→ Output breakeven = 100.000.000 / (150.000 – 80.000) = 1.429 products.

- Formula for calculating the breakeven point in revenues:

Revenue breakeven = fixed Cost / Rate of gross profit

The rate of gross profit = (selling Price – variable Costs) / selling Price

→ Rate = (150.000 – 80.000)/150.000 = 0,4667 → revenue breakeven = 100 million / 0,4667 = ~214 million.

- Analysis of the breakeven point under scenarios (Best – Base – Worst):

Business can create more 3 workbook with different situations:

The optimistic scenario (Best case): a high selling Price, low cost → point low.

Scenario average (Base case): current Data.

The pessimistic scenario (Worst case): increased Costs, price decline → point higher.

The construction of this script helps business is not as volatile market.

3.3. Read the analysis results show

After template Excel automatic calculation, businesses need to interpret the results to make decisions in business:

How to read the results: display results normally include:

- Minimum output need to sell to breakeven.

- The minimum revenue needed to achieve

- Profit at the revenue level difference (if any side table). This is the base to determine the business goals minimum.

Suggestions planning from data:

- If the production of breakeven is 1,500 products/month → Delivery KPI for sales department at a high level more than 1,500 products.

- If the revenue breakeven is 300 million → budgeting, marketing, production revolves around revenue milestones this.

How to use chart: some models have line chart or column display:

- The revenue and the total cost intersect at point → easy to visualize when presented with leadership.

- Can create more chart emphasizes profit/loss at the output level, various help make decisions to expand or reduce.

3. Pros nhước of Excel template calculate the breakeven point

3.1. Pros: solutions start effective flexible for every business

- Free easy to reach: One of the reasons why Excel become a popular choice is because high availability. Most businesses have installed Microsoft Excel, or you can use the same tools, the online for free such as Google Sheets. The use does not require investment in new software, at no additional cost.

- Easy to use easy to customize according to industry: Other software with financial capital requires training template Excel allows user to flexibly change the recipe, table structure according to the peculiarities industry. V

- Not dependent on specialized technologies: Excel does not need network connection, does not depend on the host system. Therefore, business can be used anytime, anywhere, even when working offline.

- Help raise awareness for financial management: through the data entry and tracking, live results, the managers didn't even specialize in finance can better understand about fixed costs, variable costs, break-even point.

3.2. Limit: Warning before the business depends too much on Excel

- Not update the data dynamically: Excel works entirely handmade. Every time want to calculate the breakeven point, the user need to re-enter the entire revenue data, the cost of that work is repeated, loss of time, easy to miss if you forget to update.

- Easy to errors if you enter an incorrect formula or data: Just a wrong sign in the formula or enter the wrong data, the entire calculation results can be deflected serious. In fact, many small businesses't wrong decisions just because... a cell, Excel is the error that no one finds out.

- Lack of ability to connect with the parts related: Excel is just a tool independent, not linked to system sales, accounting, or inventory management. This makes business takes more time to synthesize data from multiple sources reduces the efficiency increased risk of false information.

- Does not support analysis, forecast or take risk warning: while many software modern finance has integrated features, forecasts, analysis scenario or warning when revenues decreased the level, then Excel is almost no likelihood that business is active before market movements.

4. Suggestion for improvement template Excel combined with financial software professional

Use Excel template to calculate the breakeven point is a good first step, especially for the small and medium business. However, when scale business expansion, financial data, increasingly need to update continuously, then the use of Excel craft began to reveal many restrictions. To solve this, businesses should consider switching from Excel template independent to a software solution, smart financial instruments as Financial AI Agent of Vietnam.

Lac Viet Financial AI Agent to solve the “anxieties” of the business

For the accounting department:

- Reduce workload and handle end report states such as summarizing, tax settlement, budgeting.

- Automatically generate reports, cash flow, debt collection, financial statements, details in short time.

For leaders:

- Provide financial picture comprehensive, real-time, to help a decision quickly.

- Support troubleshooting instant on the financial indicators, providing forecast financial strategy without waiting from the related department.

- Warning of financial risks, suggesting solutions to optimize resources.

Financial AI Agent of Lac Viet is not only a tool of financial analysis that is also a smart assistant, help businesses understand management “health” finance in a comprehensive manner. With the possibility of automation, in-depth analysis, update real-time, this is the ideal solution to the Vietnam business process optimization, financial management, strengthen competitive advantage in the market.

SIGN UP CONSULTATION AND DEMO

Reasons to switch:

- Automate the entire process of calculating data update: Different Excel to enter data manually, software as Financial AI Agent can connect directly with accounting software, sales system or data warehouse. Thanks to that, the information on revenue, fixed costs and variable costs are always updates the auto-correct in real time. Business't need to lose time synthetic or worry about data discrepancies.

- Analysis of the breakeven point in real time: Financial AI Agent not only calculate the breakeven point in a fixed way, but also continually re-calculate when there are fluctuations in price, cost or product quality. This helps business decisions faster, especially when need to change the business strategy unscheduled (reduce price, increase promotion, adjust costs...).

- Smart alert when revenue neckline the hole: Another prominent feature is the possibility of early warning. When actual revenue fell almost to the point of breakeven, the system will automatically send alerts to the administrator timely interventions: regulate the production, boost sales, cut costs, etc. This is something that Excel file completely and can't do.

In summary, if Excel template is a stepping stone to help businesses reach financial concepts basically, Financial AI Agent is what is metabolism important to help businesses digitize comprehensive governance finance.

Experience demo right financial solutions smart at: https://lacviet.vn/lac-viet-financial-ai-agent

In the context of competition increasingly fierce, understanding the breakeven point is no longer the skills of private finance department which is a tool of strategic decisions for the entire business. Excel template calculate the breakeven point is the first step simple but effective way to help managers get the angle clear view of costs, revenues and the safe minimum trading.

However, as businesses grow, data growing exponentially and the speed of decision making need to be quick, Excel, gradually becoming limited. This is when business should switch from computational thinking craft to the financial management initiative, the auto-correct in real time.

![[ĐẦY ĐỦ] Mẫu báo cáo tài chính, tình hình tài chính file excel theo Thông tư 200 và 133](https://lacviet.vn/wp-content/uploads/2025/04/mau-bao-cao-tai-chinh.png)