In operation personnel administration, allowance is an important part of remuneration policy the welfare of the business. Allowances not only help encourage employees to work efficiently, but also reflect the interest of the business to the real needs of workers, as travel expenses, lunch, phone or seniority.

However, not all types of allowances are mandatory social insurance (SI). The classification accuracy of the allowances to help businesses optimize cost and transparency in management, personnel management, at the same time avoid the legal risks as the agency of SOCIAL insurance check.

This article Lac Viet Computing will provide a list of the kinds of allowances't get to explain in detail each item and attached example illustrates the fact, noted important legal help enterprise organizations can apply the effect in 2025.

1. Allowances not SOCIAL, what is?

Allowances not SOCIAL là những khoản tiền doanh nghiệp trả thêm cho người lao động nhưng không phải tính vào tiền lương để đóng BHXH bắt buộc. Mục tiêu của các khoản phụ cấp này là hỗ trợ người lao động thực hiện công việc, bù đắp các chi phí phát sinh trong quá trình làm việc mà không ảnh hưởng tới quỹ BHXH.

Distinguished allowance to SOCIAL insurance contribution

| Allowance, SOCIAL insurance contribution | Allowances not SOCIAL |

| Include the allowances calculated on the basic salary or bonuses have high wages, for example: the allowance position of supplies, work, reward productivity. The account will be charged to the salary of SI required. | Usually the account supports the fact, for example, allowances for lunch, gasoline, telephone service jobs, allowances responsibility peculiarities. The account is not calculated into wages, SOCIAL enterprises need to declare clearly and in compliance with the regulations (if any). |

Illustrative examples easy to understand

Business A pay 1,500,000 VND/month for lunch allowances and 1,000,000 VND/month for travel allowances. This money is not SOCIAL synonymous with the business't have to pay an additional 8% (the rate of SOCIAL insurance contribution for the employer) on the account, this saves significant costs that still ensure the benefits for the employees.

2. List the types of allowances not SOCIAL 2025

The organizations and enterprises are finding out information about the type of allowance is not successful are often interested in the allowances would actually not get to just help optimize costs, while ensuring employee benefits. Below is the common account 2025 with instructions to apply:

2.1 allowances lunch ca

This is the amount of money businesses pay to support staff meals during working hours. Allowances are intended to ensure energy work, increase performance, reduce absenteeism without permission, due to personal reasons.

Legal note: According to circular 111/2013/TT-BTC, allowances for lunch not included in salaries SOCIAL insurance if paid according to the actual invoice or under the regulatory regime of the business, the support level of reasonable transparency.

Practical example: Business A pay 1.200.000 VND/month/employee for lunch allowances. Thanks to this, employees are support costs and businesses save 8% the SOCIAL insurance fund must close on allowances this than if calculated on the basic salary.

Benefits: Reduce the cost of SOCIAL insurance and improved the experience of staff and increase the level associated with the business.

2.2 allowance gasoline car, go back

Allowances are intended to support travel costs for staff when working at the company, or make work, work outside the office.

Conditions are not SI:

- Allowances must pay as agreed in the labor contract or statute bonus.

- Businesses need to keep invoices, vouchers, legal or confirm the actual cost.

Illustrative example: employee B is supported 1,500,000 VND/month for travel expenses. This doesn't have to pay SOCIAL insurance contribution, help businesses significantly reduce the cost must pay SOCIAL insurance monthly.

2.3 mobile phone allowance, internet service job

Explanation: this funding is intended to cover the cost of phone or internet use for work, such as calling customers, exchange, internal or access software remote work.

Conditions apply:

- Allowances apply only when proof of service work.

- Does not apply to personal expenses.

Benefits: Helps our staff to work effectively, at the same time business is not incurring costs of SOCIAL insurance on allowances this budget-saving.

For example: employee C is supported 500.000 VND/month for the cost of phone and internet. This doesn't to pay SOCIAL insurance contribution.

2.4 allowance of responsibility, seniority

This is allowance for the position assumed responsibility over, or for longtime employees to recognize contributions.

Conditions are not SI:

- Senior secondary levels is not SOCIAL if not calculated on the basic salary or wages under the contract.

- Businesses need clear rules in regulation of salary bonus.

Illustrative example: Employees D work on 10 years are entitled to allowances seniority 1.000.000 VND/month. Due to this account don't count on wages in SOCIAL enterprise saving 80,000 VND/month cost of SOCIAL insurance.

2.5 other allowances not SOCIAL

Explanation: consists of the particular industry or private agreement, for example, allowances toxic level to the level of training support.

Note to apply 2025:

- Must be based on labor contracts, statutes, salaries and bonuses of the business.

- To comply with the Decree, the latest circular to avoid legal risks.

For example, A business technology pay 800,000 VND/month for employees working in hazardous environments. This account is not SOCIAL but still ensure employee benefits.

3. The legal note when applying the allowances not SOCIAL

When applying the allowances not SOCIAL institutions, businesses are finding out information about the type of allowance is not SOCIAL to note the legal provisions to avoid audit risk, disputes with employees to ensure transparency in personnel management.

3.1. Reference documents the latest legislation

Allowances are not paying SOCIAL insurance should be based on the current regulations, including:

- Law of 41/2024/QH15 specify the amount to pay to return the item support does not count. With effect from January 01, 7 year 2025.

- Decree 158/2025/ND-CP detailed instructions on SI.

- Decree 02/2025/ND-CP to amend and supplement a number of things about health INSURANCE.

- Circular 12/2025/TT-BNV instructions about the allowances, benefits, bills, vouchers related effect from the date 01/7/2025.

Note 3 the Decree implementing the Law on social insurance lapsed from 01/07/2025:

- Decree 115/2015/ND-CP: guide SOCIAL insurance mandatory. Effective: 01/01/2016. Expire: 01/07/2025. Replaced by: Decree 158/2025/ND-CP

- Decree 143/2018/ND-CP: guide SOCIAL insurance mandatory for foreign workers in Vietnam. Effect: 01/12/2018. Expire: 01/07/2025. Replaced by: Decree 158/2025/ND-CP

- Decree 33/2016/ND-CP: guide SOCIAL insurance mandatory for military personnel, public safety and the weak muscles salary as military personnel. Effect: 26/06/2016. Expire: 01/07/2025. Replaced by: Decree 157/2025/ND-CP

At the same time, the Law on social insurance 2014 expires been replaced by the Law on social insurance 2024, with effect from 01/07/2025.

3.2. Avoid audit risk and disputes

If allowances are paid incorrectly specified or there is no evidence from transparency, businesses can see:

- Audit SOCIAL insurance: agency may close additional accounts on SOCIAL insurance, if you determine the allowances actually pay.

- Disputes with employees: employees may require additional INSURANCE or compensation if rights are affected.

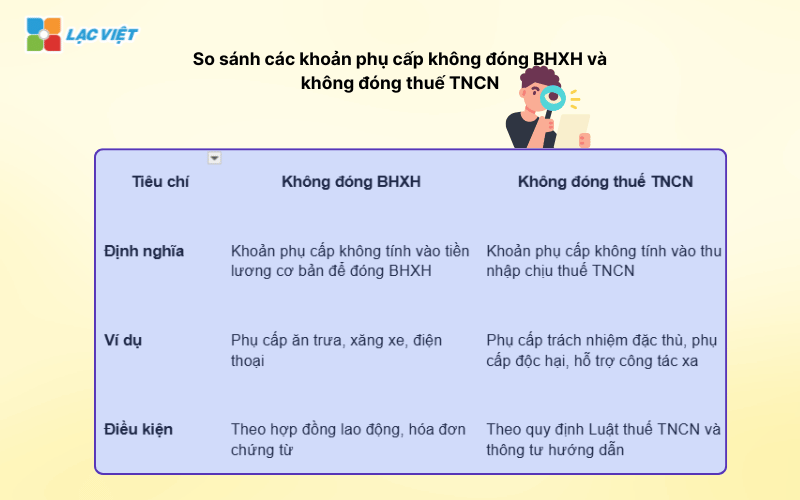

4. Compare allowances are not SOCIAL and do not pay personal income tax

Many businesses confuse allowances are not SOCIAL and do not close the personal income tax (PIT). The clear distinctions to help optimize cost and management remuneration policy of transparency.

4.1 distinguish allowance not SI vs not pay personal income tax

| Criteria | No SI | Do not close the PIT |

| Definition | Allowances not included in base salary to SOCIAL insurance contribution | Allowances don't count on income subject to personal income tax |

| For example | Lunch allowances, gasoline, telephone | Allowances responsibility peculiarities, allowance toxic, support the far |

| Conditions | According to labor contracts, bills, vouchers | In accordance with the Law on personal income tax and circular instructions |

| Value for business | Cost savings of SI | Reduced tax liabilities for employees, keeping employee satisfaction |

4.2 allowances just don't get to just not pay personal income tax 2025

Some of the most popular, the year 2025 just don't get to just not pay personal income tax, business help optimize costs, and improve employee benefits:

- Travel allowances, lunch, according to the regulations and bills to prove the fact.

- Mobile phone allowance, internet service work.

- Allowances responsibility peculiarities (in addition to base salary, according to the contract).

- Allowances work away in the scope of the actual cost.

Illustrative examples: Business B pay 1.000.000 VND/month for staff phone and internet working remotely. This doesn't into SOCIAL insurance and not subject to personal income tax, help employees get more welfare to the fact that business-at no additional cost, tax, or SOCIAL insurance.

- Download free personnel management in Excel, comprehensive for the enterprise

- Planning, human resources, what is? Roles, processes, close up, the effect for DN

- 15 Payroll Software employee oldest standard business manager salaries

- Human resource management by AI can help BUSINESSES reduce costs, increase performance?

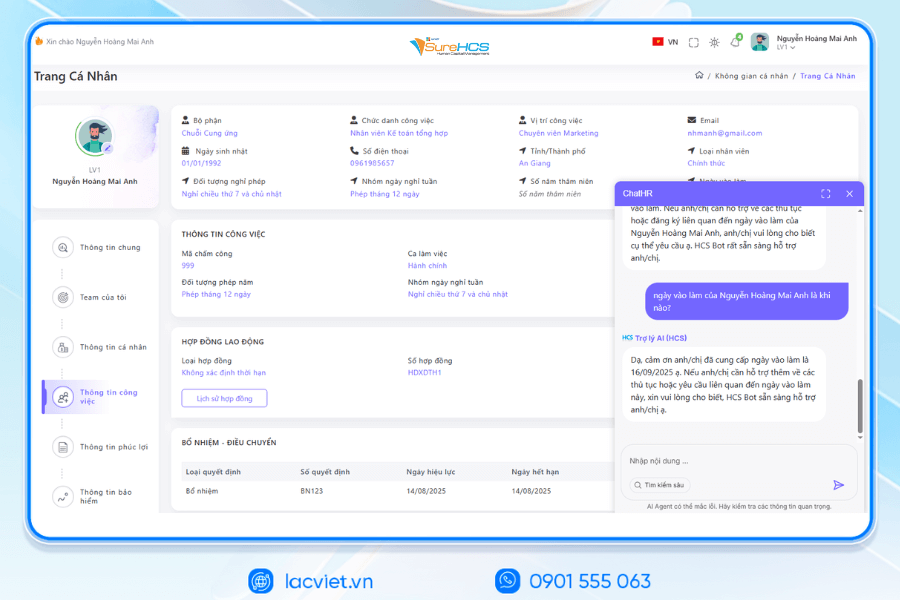

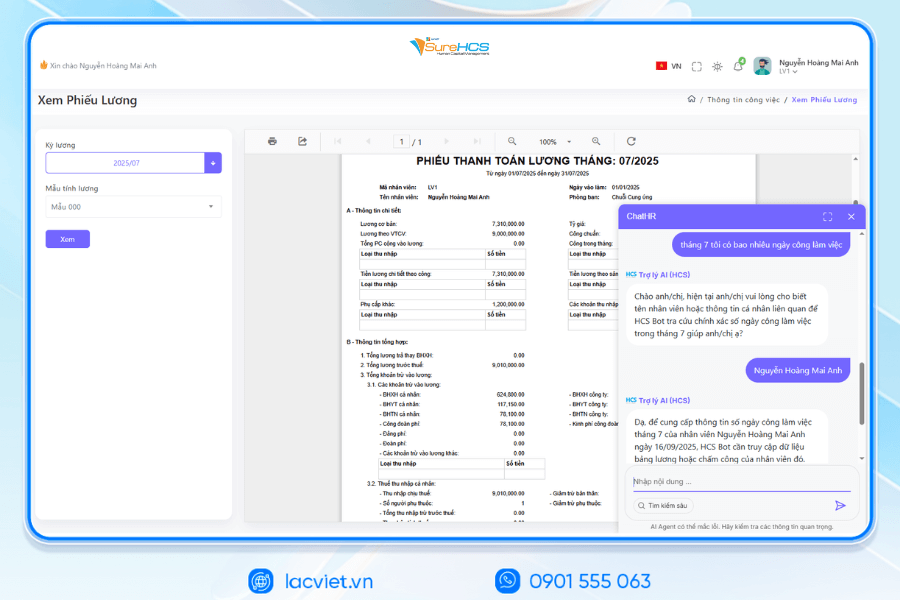

5. Benefits manager with comprehensive Lac Viet SureHCS HRM

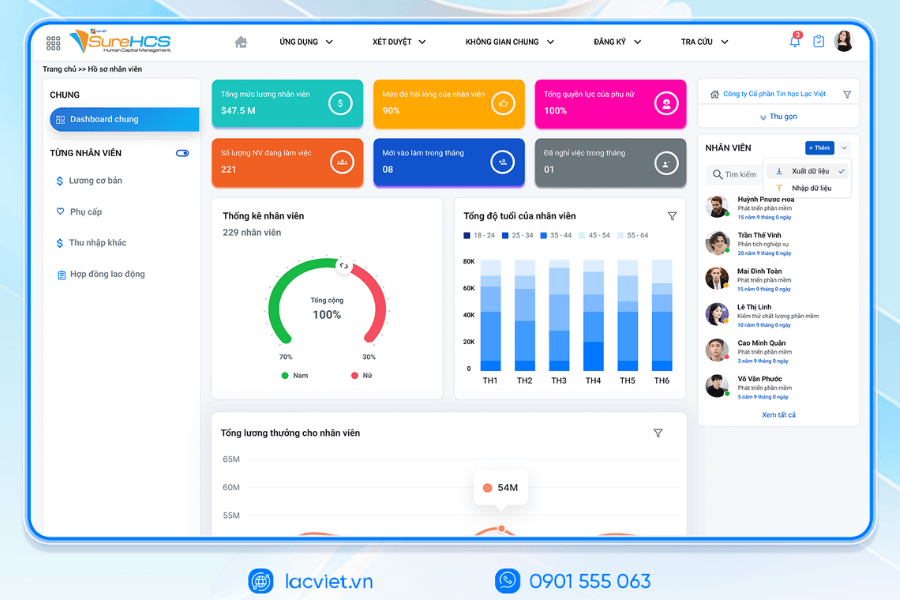

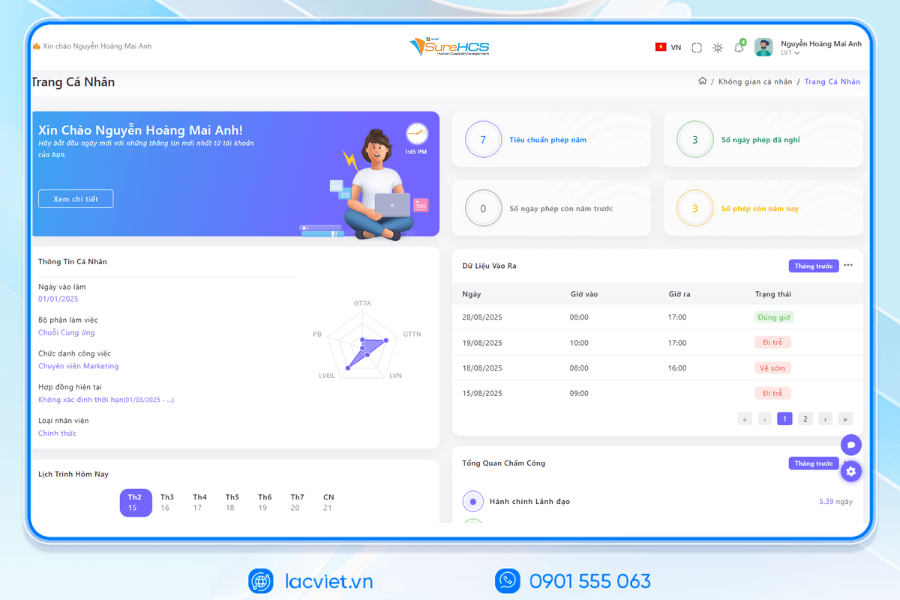

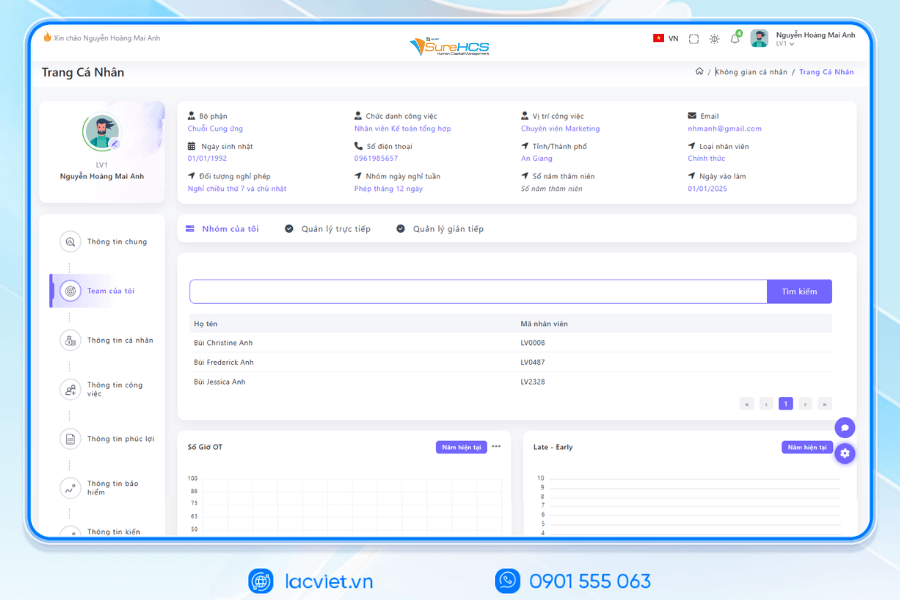

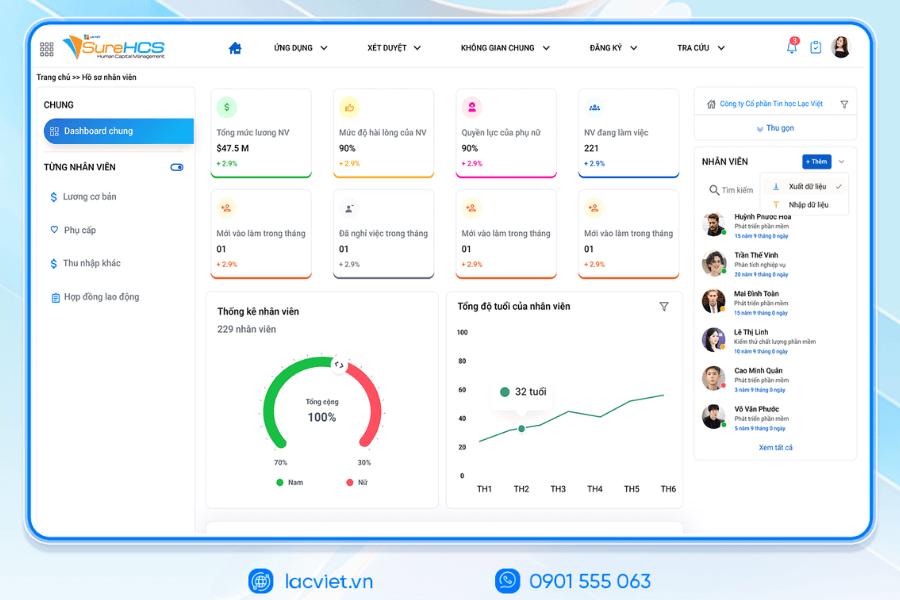

Lac Viet SureHCS HRM is the management solution, hr comprehensive help businesses automate the process of timekeeping, payroll management, benefits, and ensure compliance with the law on labour and SOCIAL insurance. Management software, human resources of Lac Viet is designed specifically to meet the needs of the organization medium and large volume of data, personnel, many, requires high accuracy.

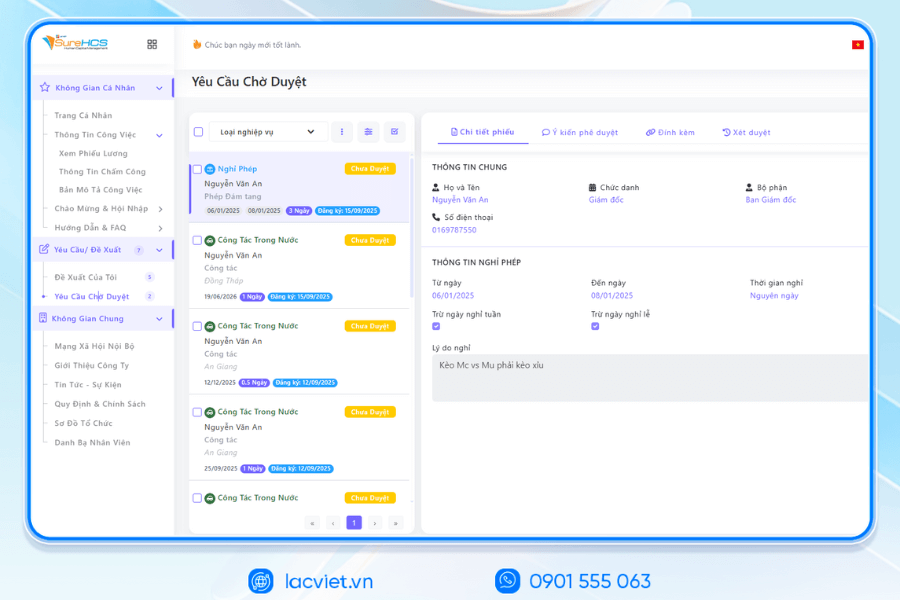

With SureHCS HRM, businesses can:

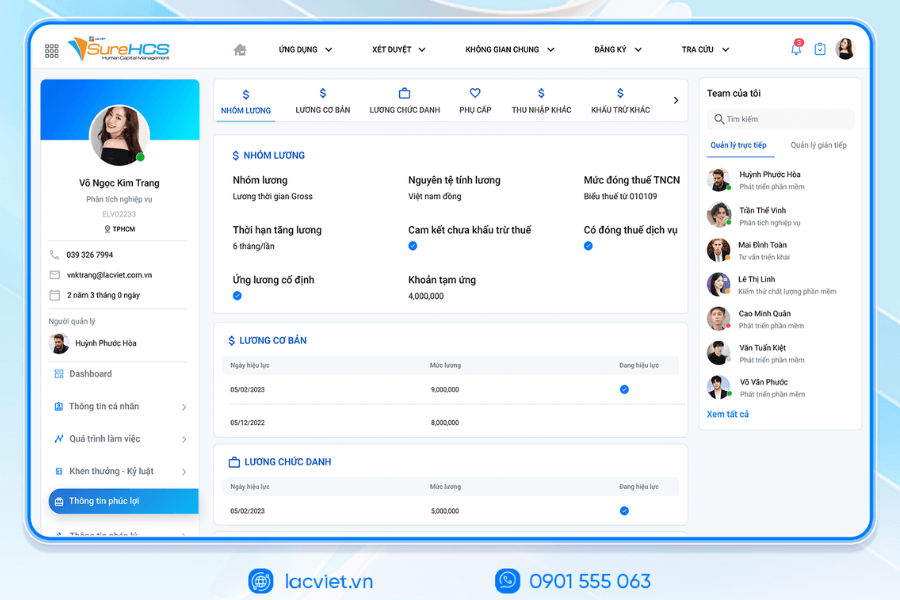

- Track management allowances, bonus, pension in a transparent manner, including the terms do not get to not pay personal income tax.

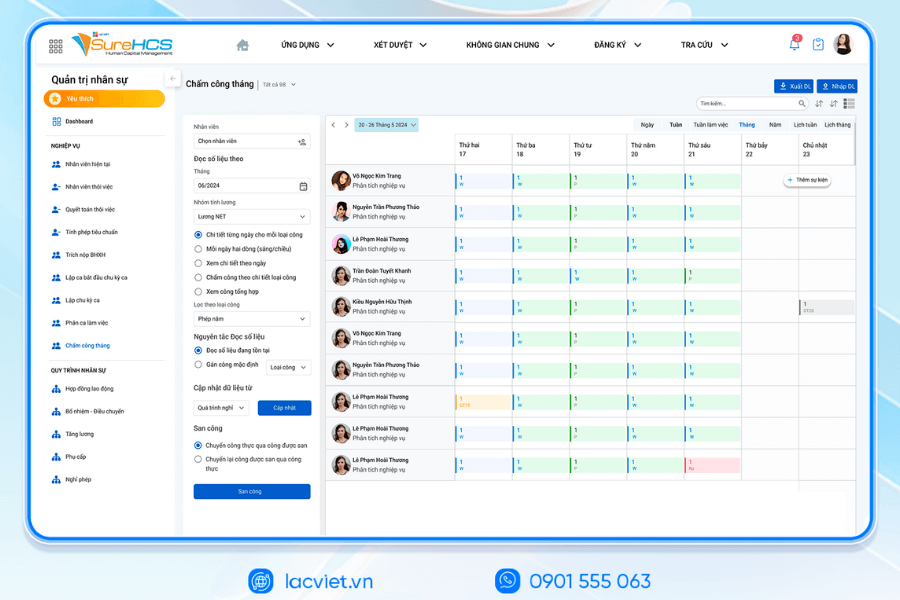

- Automatic payroll accuracy by many different mechanisms (basic salary, salary 3P, salary, according to the product), reduce errors, save time.

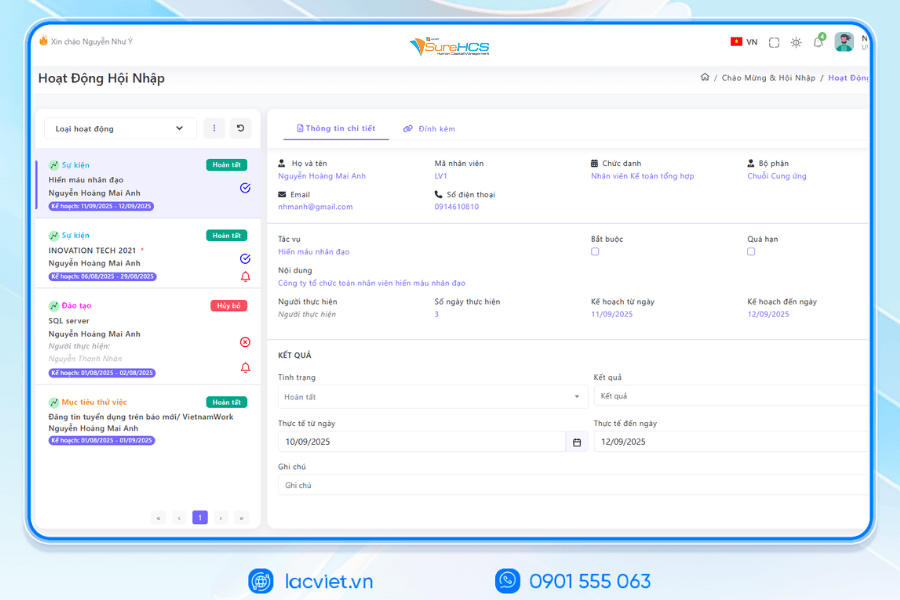

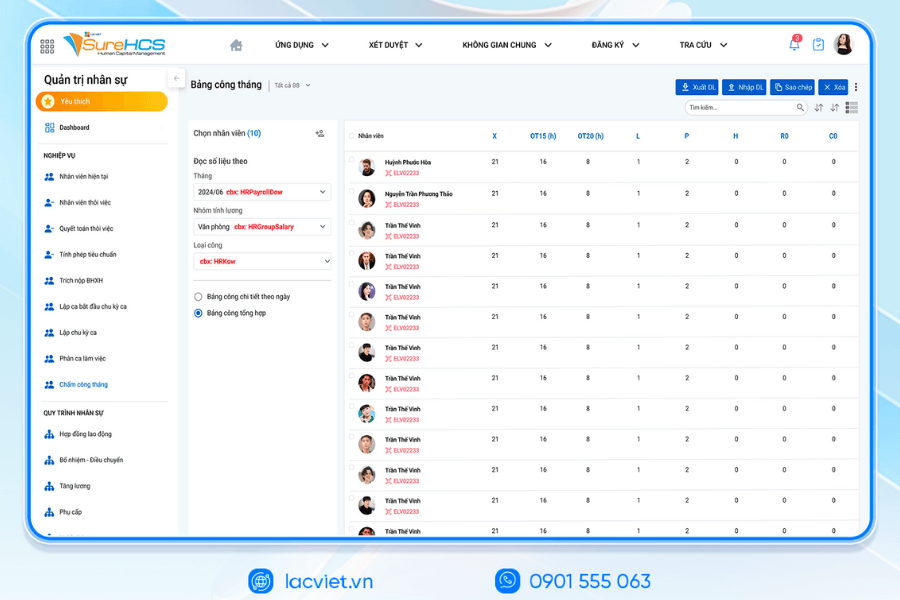

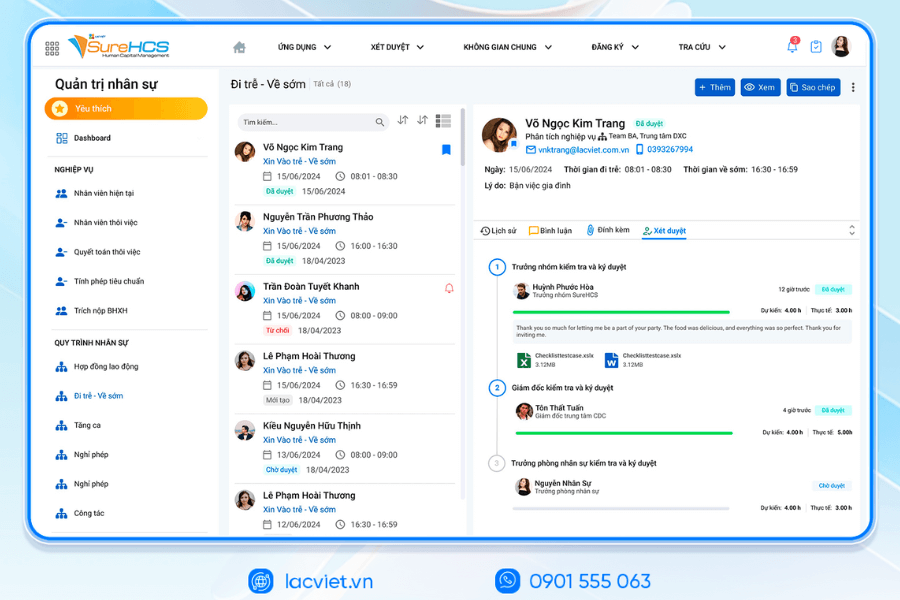

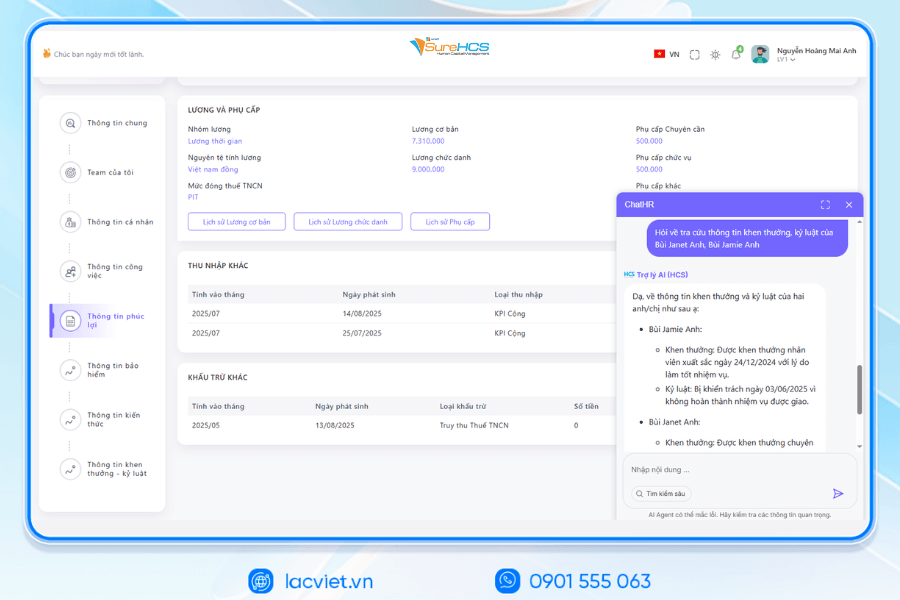

- Management process timesheets and absent effective support, performance evaluations, reward and punishment in a timely manner.

- Constantly updated regulations, the latest legislation on SOCIAL insurance, personal income tax, to help businesses comply with policies without losing the track craft.

CONVERT THE NUMBER OF PERSONNEL WITH COMPREHENSIVE LAC VIET SUREHCS HRM

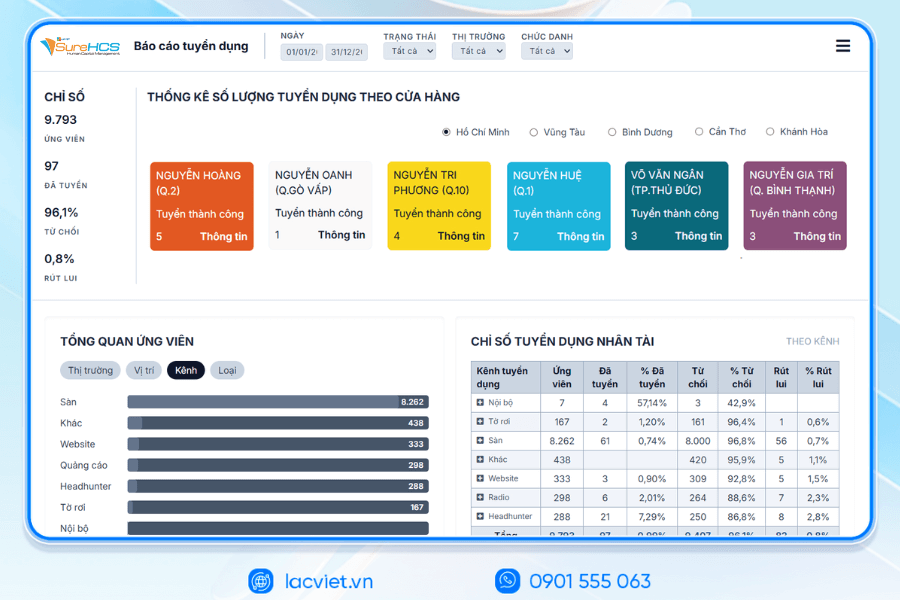

LV SureHCS HRM is the solution in hrm comprehensive (HRM) is developed by Lac Viet from 1998, now serves more than 1,000 businesses in Vietnam with international standards such as CMMI Level 3, ISO 9001:2015 and ISO 27001:2013. Platform help of optimized every aspect from recruitment to employment, improve the experience of staff and effective management of resources.

Feature highlights:

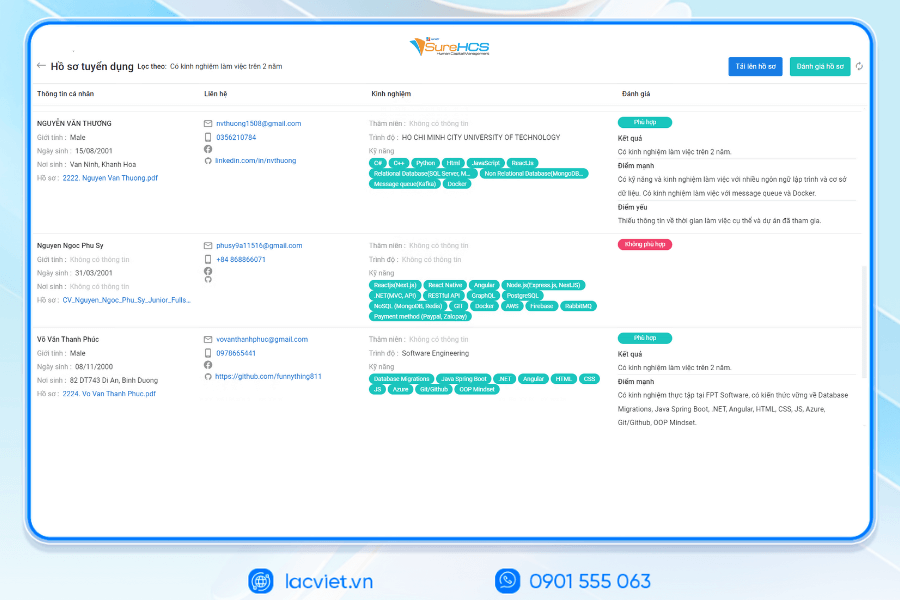

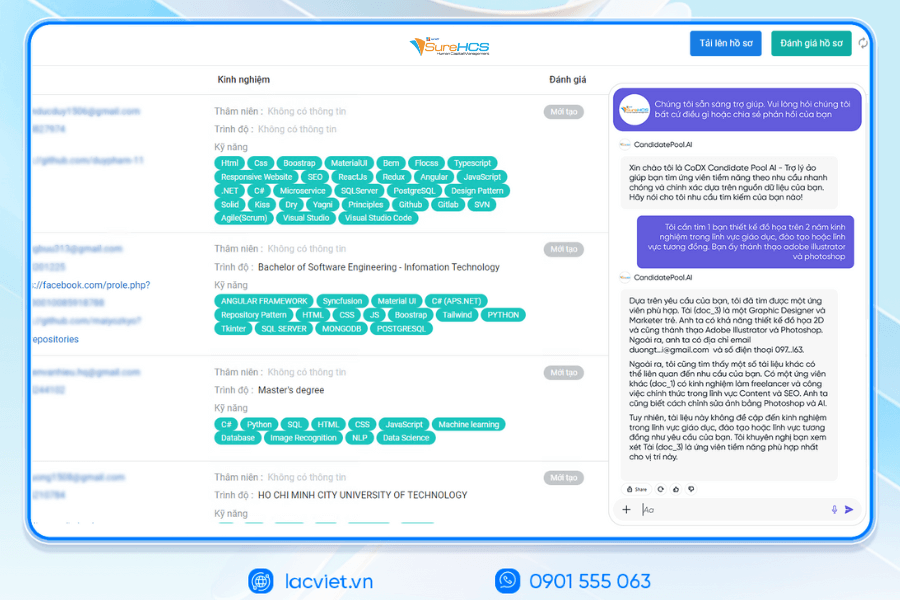

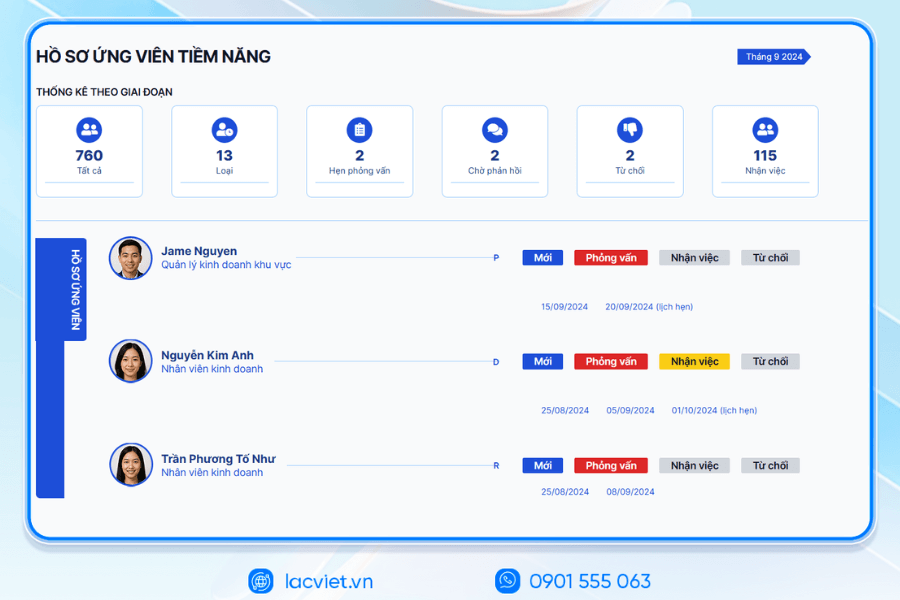

- Candidate Pool AI + AI Resume: automatic dissection CV any format, search for suitable candidates instant, a 70% increase quality, reduce recruitment time significantly

- Timekeeping software – payroll – C&B auto: integrated benefits, overtime, insurance, export report, payslip correct for business scale up to 10,000 employees

- Experience hr – wallet reward – ranking behavior – survey periodically: internal management, honor, mounted staff in real time.

- Assessment and capacity development: KPI/OKR flexibility, feedback 360°, the proposed route train personalization according to the evaluation results

- Internal training & LMS integrated AI: learning anytime, anywhere, content management, multi-modal with personalization from AI

- Dashboard BI + AI Advisor: real-time reports, suggestions leadership decisions based on data resources.

AI INTEGRATION ACCELERATES DIGITAL TRANSFORMATION OF HUMAN RESOURCES

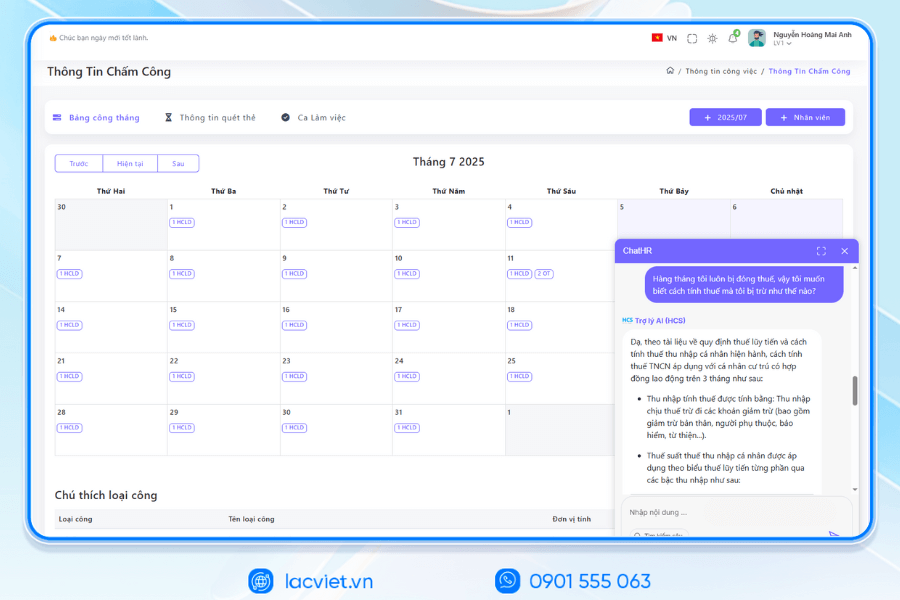

Lac Viet has officially launched The 3 AI assistant hr deeply integrated into the LV SureHCS including LV-AI.Docs, LV‑AI.Resume and LV‑AI.Help to automate the task administration, standardized data enhanced experience personnel

- LV‑AI.Docs: automatic dissection transfer data from documents such as CCCD, windows, SOCIAL insurance, by level of digital records, standardized

- LV‑AI.Resume: analysis of CV auto, construction, candidate profile, find people with the right criteria by prompt intelligent data mining candidate pool efficiency

- LV‑AI.Help: chatbot internal support, answer questions HR 24/7 access form process quick contextual user

- Coca-Cola Vietnam: System deployment LV SureHCS to digitize comprehensive human resource management group has standardized the data, the optimal operating HR according to international model.

- Textile company Success (TCM): Application LV SureHCS to manage hr, payroll, benefits, timekeeping and capacity profile for nearly 5,000 employees across 5 areas of activity – from textiles and fashion to real estate.

- Total company air Port, Vietnam (ACV): Choose to trust LV SureHCS to operate the system large-scale personnel with over 10,000 employees, 24 subdivisions, solved the problem of complex business of modeling state-owned companies.

SIGN UP TO RECEIVE DEMO NOW

WHAT DO BUSINESSES GET WHEN DEPLOYING LAC VIET SUREHCS SOFTWARE?

- Comprehensive solutions from A‑Z cover the entire process of HR from recruitment, profile, attendance, payroll, benefits, training, reviews, experience staff

- Highly customizable & flexible connection to suit any scale, industry, easy to connect with ERP, finance, office of chemical

- Save cost & performance enhancement help to lose 40-60% of the cost of operating personnel, retain talent, improve the work efficiency

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: surehcs@lacviet.com.vn | Website: https://www.surehcs.com/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

Mastering the kinds of allowances not SOCIAL helps businesses manage personnel costs efficiently, and ensure legal rights for employees. Properly apply the allowances prescribed not only saves the cost of SOCIAL insurance contribution but also enhance the work experience, motivation, and increase employee engagement with business.

To deploy effective, the business should build a regulation salary transparency, store stock from full-constant updates of new legal provisions most. At the same time, the application software personnel management automation such as Vietnam SureHCS HRM will help to track, calculate, manage allowances correctly, reduce errors and save time.