Overtime is a common situation in most businesses, especially in the peak period of production, or when you need to complete the project folded. However, salary increases, shift the problem is easy to cause controversy if the business does not understand the legal regulations and there is no formula calculation of transparency in payroll process.

Determining the right level of pay for overtime hours not only to ensure the rights of workers but also to help businesses comply with the law, building professional image, motivational positive workplace for employees.

This article Lac Viet will guide the detailed formula for calculating salary overtime according to the latest regulations of The Labor code, the analysis of the specific case and accompanied the Excel file to help businesses calculate the right – enough – quickly.

1. Overview of payroll increase in ca what is?

1.1 Salary increase in ca what is?

Salary increase ca (also known as salary, overtime) is income workers is the business to pay when they work beyond the working time standards of the day, the week or in the special moment like the night, on vacation, holiday. The payments are intended to compensate for the effort and duration of labor increased, demonstrating compliance with the provisions of the labor law.

For example: An employee works administration 8 hours/day. When asked to stay another 2 hours to finish the job this time is counted as “overtime”. Meanwhile, businesses have to pay the wage increase shifts according to the minimum rate of 150% compared with salaries normal working hours.

Need to distinguish between wages overtime and allowances overtime.

- Salaries overtime is mandated, is calculated based on the provisions of The Labor code.

- Allowance for overtime is the added support of the business (if any) to encourage the spirit of work of employees, not mandatory legal.

Properly understand about salary increase ca help businesses avoid risks violation of the law, at the same time increase transparency, increase the confidence of employees with respect to remuneration policy. This is the problem many organizations and businesses are looking for information about how to calculate salary increase of ca to improve the rules, pay hr effectiveness more than fair.

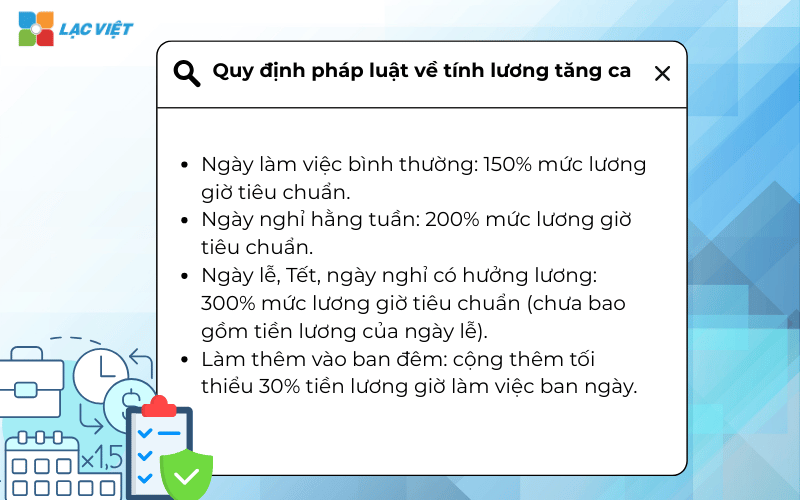

1.2. Legal grounds the latest on wage increases ca

According to The Labour code 2019 (Article 98), wages, overtime is specified rate of pay the minimum as follows:

- Do more on the normal working day: at least 150% compared to the unit price of wage or wages actually paid by the job is done.

- Do more on a day off every week: at least 200%.

- Do more on the holidays, new year or holidays may enjoy salary: at least 300%, not including the salaries of holidays and new year there.

- Do more at night: is paid at least 30% compared with wages working day.

The detailed rules are instructions in the Decree 145/2020/ND-CP, in particular limits the number of overtime hours maximum principle agreement between the employer and the employee. Specifically, the total number of overtime hours shall not exceed 40 hours in 1 months, 300 hours in 1 year (according to paragraph 2 of Article 107 of The Labor code).

Reference source official:

- The Labor code 2019 – Article 98 and Article 107

- Decree 145/2020/ND-CP guiding the details of The Labor code

Mastering legal grounds not only help businesses build process payroll accurately, but also ensure compliance with state regulations, restrictions, labor disputes and demonstrate professionalism in human resource management.

2. Guide how to calculate salary increase ca in basic business

2.1. Formula for calculating the salary increase ca basic

To calculate the exact salary increase ca, enterprises need to identify three basic elements: hourly wage actually paid, the percent applied for this type of ca is added, the number of overtime hours practice.

Standard recipe according to the regulations:

Salary increase ca = hourly Wage actually paid × Rate % by type ca × Number of overtime hours

In which:

- Hourly pay = Salary reality / Number of hours worked standard in months (usually 26 days × 8 hours = 208 hours).

- Rate % by type ca is regulated in The Labour code 2019 (Article 98).

- Number of overtime hours is the number of hours exceeding the working time standard (after deducting the break).

Illustrative example: employee A wage months 10,000,000, do another 2 hours on weekdays.

- Hourly wage = 10.000.000 / 208 = 48.076/hour.

- The rate of wage increase ca normal days = 150%.

- Salary increase ca = 48.076 × 150% × 2 = 144.228 copper.

Thus, the total income of staff in January will include basic salary 10 million and salary increase ca 144.228 copper.

The correct application of the recipe the same ratio to help businesses avoid errors in calculations, ensure compliance with the law, increasing transparency in the pay – factors directly affect the satisfaction of employees. Many organizations and businesses are looking for information about how to calculate salary increase ca often have difficulty in step determine the hourly wage actually paid, so that the standardized formula right from the start is very important.

2.2. Percentage paid overtime in accordance

According to Article 98, The Labour code 2019, workers are paid overtime according to the minimum the following:

| Kind of time do more | Rate of pay minimum | Explanatory – illustrative examples |

| Normal working day | 150% | Do more after hours, for example from 17h to 19h. |

| Weekly holidays | 200% | Do more on the 7th or Sunday. |

| Holidays, new year, or days of paid holidays | 300% | If a holiday falls weekly day plus 100% of salary that day. |

| Do more at night | +30% compared with daytime | If you work the night shift of the holidays are all 300% and more 30%. |

Specific example: employee B do 3 more hours on holidays lunar new Year, month salary 12.000.000 vnd.

- Hourly wage = 12.000.000 / 208 = 57.692 copper.

- Rate = 300%.

- Salary increase ca = 57.692 × 300% × 3 = 519.228 copper.

If you work 3 hours at night holidays, the total ratio is 300% + 30% = 390%, respectively 674.388 same wages increased by ca.

According to statistics from the General confederation of Labor of Vietnam (2023), more than 42% of workers who have complaints related to the payment of overtime because businesses do not properly apply the specified percentage, time salary calculator. Understanding and correctly applying these rates to help businesses significantly reduce the risk of labor disputes to ensure compliance with the law.

3. 5 Ways payroll, overtime, overtime, night, Sunday, 7 SUN, holidays according to each case

3.1. How to calculate overtime on weekdays

Make more hours in the day is often the case workers who work out of hours in the normal working day under a contract of employment. This is a common situation in the business of manufacturing, services workload spike.

Legal basis

- Article 98 of The Labour code 2019: workers doing more hours in the day usually pay at least 150% of the actual hourly wage of a normal working day.

- Điều 95, 96 BLLĐ 2019: Doanh nghiệp phải công khai, minh bạch cách tính lương và không được thấp hơn mức lương tối thiểu vùng.

Principles payroll

- Must have the agreement with the employee prior to overtime.

- Overtime pay = wage, normal hours × rate of 150%.

- Not be included with the bonus which must be calculated separately salary increase ca.

Formula:

Salary Increase Ca = hourly Wage × Number of overtime hours ×150%

In which: hourly Wage = Wage month / Number of days the standard in the month / Number of working hours/day.

For example:

- Employees have salary: 10.000.000 VNĐ.

- Of the date of preparation: 26 days; 1 day 8 hours.

- Hourly wage = 10.000.000 / 26 / 8 = 48.076 VND/hour.

- If employees do 3 more hours on weekdays:

Salary increase ca =48.076×3×150%=216.342 VND

Enterprise object apply

- Business manufacturing, processing, processed timely service.

- Service businesses need hr support hours (example: customer care, logistics).

- The company has the volume of work increased irregularly during the day usually.

3.2. How to calculate overtime on weekend (Saturday, 7-Sunday)

Overtime on weekends (usually the 7th or Sunday) occurs when businesses require workers to work out of hours to stay fixed to ensure the progress of production – business.

Legal basis

- Article 98 of The Labour code 2019: workers do more on weekends are paid at least equal to 200% actual hourly wage of a normal working day.

- Article 111 ART 2019: workers are entitled to at least 1 day/week if work on holiday, this must pay extra overtime pay according to the regulations.

Principles payroll

- Must have the consent of the employee.

- Overtime pay = wage, normal hours × rate of 200%.

- In addition to wages, businesses can weigh layout compensatory to ensure workers ' health.

Formula:

Salary Increase Ca = hourly Wage× Number of overtime hours ×200%

For example:

- Employees have salary: 12.000.000 VNĐ.

- Of the date of preparation: 26 days; 1 day 8 hours.

- Hourly wage = 12.000.000 / 26 / 8 = 57.692 VND/hour.

- If employees do more 4 hours on Sunday:

Salary Increase Ca = 57.692×4×200% = 461.536 VND

Enterprise object apply

- Retail business, commerce, catering – hospitality, logistics usually have active demand all weekend.

- Business production hasten delivery, need to increase the ca at the end of the week.

- The industry peculiarities must maintain continuous operation (health, protection, transport...).

3.3. How to calculate overtime on holidays, new year, holidays paid

This is a form of extra hours on special days prescribed by law is on vacation enjoying raw wage. Therefore, in addition to the salary holidays/new year, workers who do more are also extra minimum of 300% of salary hours of a normal working day.

Legal basis

- Article 98 of The Labour code 2019: added holidays, new year, holidays are entitled to pay at least 300% of salary hours, not including wages holiday pay.

- Article 112, 113 ART 2019: workers are entitled to 11 days holidays and sabbatical year to enjoy raw wage.

Principles payroll

- Overtime pay = 300% hourly wage × number of overtime hours.

- In addition, workers still receive 100% of wages, holidays according to mode.

- Total can reach 400% of salary now, if all the wages holidays.

Formula:

Salary Increase Ca = hourly Wage × Number of overtime hours × 300% + Salary holidays

For example:

- Employee monthly salary: 9.000.000 VNĐ.

- Date of prepared: 26 days, 8 hours/day.

- Hourly wage = 9.000.000 / 26 / 8 = 43.269 VND/hour.

If you work 8 hours on the lunar new year:

- Overtime pay = 43.269 × 8 × 300% = 1.038.456 VND.

- Salary Tet enjoy raw wage = 9.000.000 / 26 = 346.154 VND.

The total income that day = 1.384.610 VND.

Enterprise object apply

- Business production, exports need to maintain the delivery schedule.

- Service sector (supermarkets, hotels, restaurants, transportation) operates the holidays.

- Business characteristics: power, medical, security.

3.4. How to calculate overtime pay in the night (22h – 6h next morning)

Make the night's work ranges from 22h to 6am the following day, including weekdays, holidays, or holidays. The law requires an employee to work the night must be paid at least 30% of daylight hours, i.e. a total of 130% hourly wage.

Legal basis: Article 98 of The Labour code 2019: workers night work is paid at least 30% compared with wage working day.

Principles payroll

- Salary make the night = 100% hourly + 30% extra.

- 't distinguish normal days, vacation days or holidays – always be plus at least 30%.

- If the medium is the night has just fallen on holiday/festival then also be added according to the growth rate ca.

Formula:

Nighttime pay = hourly rate × hours Of the night × 130%

For example:

- Employee monthly salary: 13.000.000 USD.

- Date of prepared: 26 days, 8 hours/day.

- Hourly wage = 13.000.000 / 26 / 8 = 62.500 VND/hour.

- If 6 hours night: Dreary night = 62.500 × 6 × 130% = 487.500 VND.

Enterprise object apply

- Business produced by ca (textiles, aquatic products processing, electronics).

- Industry transportation, logistics, warehousing, protection, health.

- The service sector is active 24/7 (center, customer care, hotel, casino).

3.5. How to calculate overtime at night (increase ca + night)

This is a special case: the workers took an extra hour, just to frame night (22h – 6h). Therefore, in addition to overtime pay, they are also added to the allowances night and an additional 20% according to the law.

Legal basis: Article 98 of The Labour code 2019: overtime at night = wages overtime (150%/200%/300%)

- + 30% of daylight hours

- + 20% of the daytime hours on the extra night.

Principles payroll

- Overtime pay, night = overtime pay (on normal days/holidays/celebrations) + allowances night + an additional 20%.

- Business to separate clear each section to transparency.

Formula:

Salary increase ca night = (hourly rate×multiplier days)+(hourly rate×30%)+(hourly rate×20%)

In which: The number of days = 150% (normal days), 200% (for weekends), 300% (holidays/new year).

For example:

- Employee monthly salary: 15.600.000 VND.

- Date of prepared: 26 days, 8 hours/day.

- Hourly wage = 15.600.000 / 26 / 8 = 75.000 VND/hour.

Make 4 more hours at night on normal day:

- Overtime pay according to regular day = 75.000 × 150% = 112.500.

- Plus 30% = 75.000 × 30% = 22.500.

- Plus 20% = 75.000 × 20% = 15.000.

- Total 1 hour = 112.500 + 22.500 + 15.000 = 150,000 VND/hour.

- 4 hours extra night = 150.000 × 4 = 600,000 VND.

Enterprise object apply

- Business production, export, to increase the ca through the night to keep up with the progress.

- Industry 24/7 continuous operation such as transportation, logistics, oil and gas, protection, health.

- Business service in high point spring festival, lunar new year (super market, commercial center, travel).

Download sample excel file/Google Sheet payroll increase ca overtime

For many businesses, especially those units scale hr or working pattern according to ca, the calculation of overtime on paper or by the formula of discrete, often leading to errors and time consuming test. To solve this problem, File tool Excel calculating salary overtime automatically be built in accordance with current legislation, helps to standardize the whole process of calculation.

Excel File is designed on the platform easy to use, does not require the user to have the skills in-depth Excel. Businesses only need to enter input data such as basic salary, overtime hours, type shifts (weekdays, weekends, or holidays) – the system will automatically calculate salary increase ca respectively based on the percentage specified in Article 98, The Labour code 2019.

Download sample excel file/Google Sheet payroll overtime overtime at here

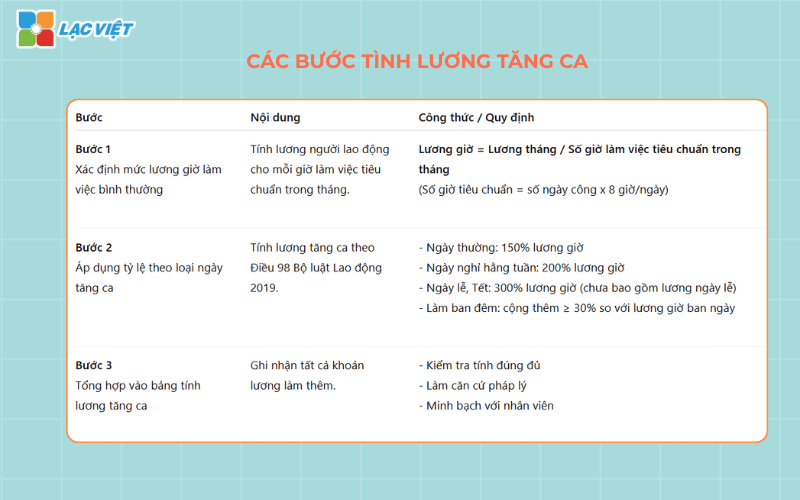

4. A 3-step process to help hr C&B, payroll overtime standards for business

To calculate salary increase ca exactly transparent, business need to perform sequentially the 3 steps, ensure both regulatory compliance law just optimal management personnel costs.

Step 1: Determine the salary, normal business hours

First, need to know the wages workers receive for every hour of work standards.

- Recipe: hourly Wage = Salary / Number of hours worked standard in January

- Explanation: the Number of hours of work the standard is often determined according to the work schedule of the business (for example: 26 days x 8 hours/day = 208 hours/month).

- For example: employee has salary 12.000.000 copper, work 208 hours/months, then hourly wage = 12.000.000 / 208 ≈ 57.692/hour.

Step 2: Apply a percentage according to the type of rose day ca

According to Article 98 of The Labour code 2019, business-wage workers now, with the percentage match:

- Normal days: 150% of the hourly wage.

- Weekends: 200% of salary hours.

- Holidays: 300% of salary hours (not including salaries holidays).

- Do at night: plus a minimum of 30% of daylight hours.

Illustrative example: the employee in the above example increases ca 3 hours on weekdays:

- Wage overtime = 57.692 x 150% ≈ 86.538/hour.

- Total cash increased ca = 86.538 x 3 = 259.614 copper.

Step 3: synthesis on payroll overtime to control the transparency

After each account increased ca, enterprises need integrated into payroll overtime to:

- Check out right enough of each ca do more.

- Do legal grounds when authorities inspections or when addressing complaints.

- Transparency with employees, increase trust and engagement.

5. Examples illustrate how to calculate salary increase ca

To help businesses visualize more clearly about how to apply the formula, we see a real situation.

Situation: employee A wage months 12.000.000 copper, working according to the standard calendar 26 days/month (208 working hours). In January, the staff are incurred overtime:

- 5 hours on a normal working day

- 4 hours on weekends

- 2 hours on holidays

Step 1: Determine the hourly standard

Hourly wage = 12.000.000 / 208 ≈ 57.692/hour

Step 2: Apply a percentage according to the type of rose day ca

- Normal days: 150% x 57.692 = 86.538/hour

- Weekends: 200% x 57.692 = 115.384/hour

- Holidays: 300% x 57.692 = 173.076/hour

Step 3: Calculate the money an increase in ca for each type of date

- Money overtime regular day = 5 hours x 86.538 = 432.690 dong

- Money overtime vacation days = 4 hours x 115.384 = 461.536 dong

- Money overtime holidays = 2 hours x 173.076 = 346.152 dong

Step 4: synthesis of the spreadsheet wage increases ca

| Type date | The number of hours of overtime | Hourly overtime (gay) | Of money (gay) |

| Normal days | 5 | 86.538 | 432.690 |

| Holiday week | 4 | 115.384 | 461.536 |

| Holidays, new year | 2 | 173.076 | 346.152 |

| Total | 11 hours | – | 1.240.378 |

- Lac Viet SureHCS C&B paid by the customized products according to specific business

- 12 Common methods for calculating employee salaries, along with detailed formulas.

- Which payroll calculator should I choose to replace Excel to reduce errors and ensure compliance with regulations?

- File excel payroll according to the products & how to calculate standard SMV company may, production

6. Hr solutions Vietnam SureHCS optimal calculate the salary for business

Calculating salary overtime according to the method on Excel often potential risks: errors in data entry, apply the wrong amount by each type, days, or forget extra night shift. As a consequence, the hr department take a lot of time reviewing businesses to meet disputes with workers. Meanwhile, demand increased ca often arise at the time of peak production, requires treatment process payroll staff overtime must be quick, accurate, transparent.

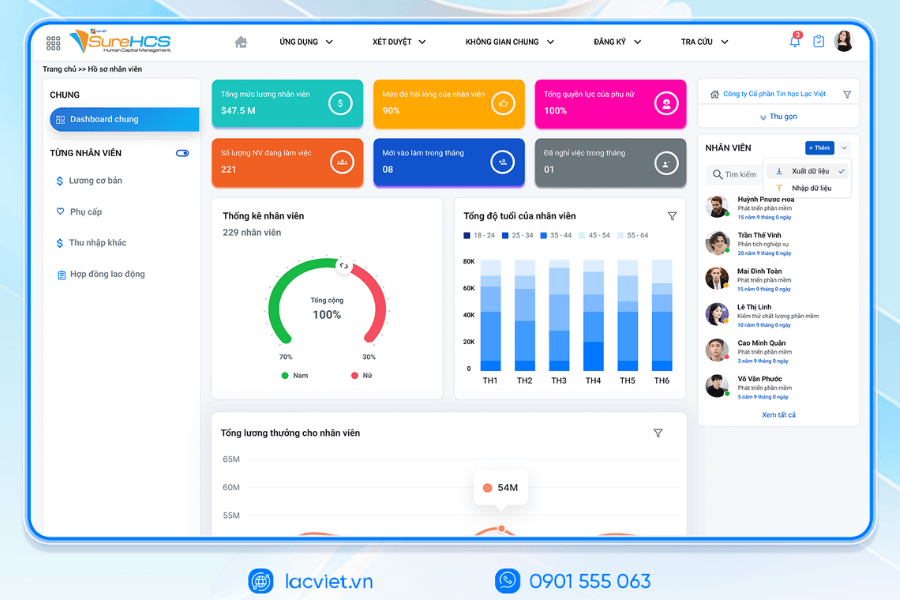

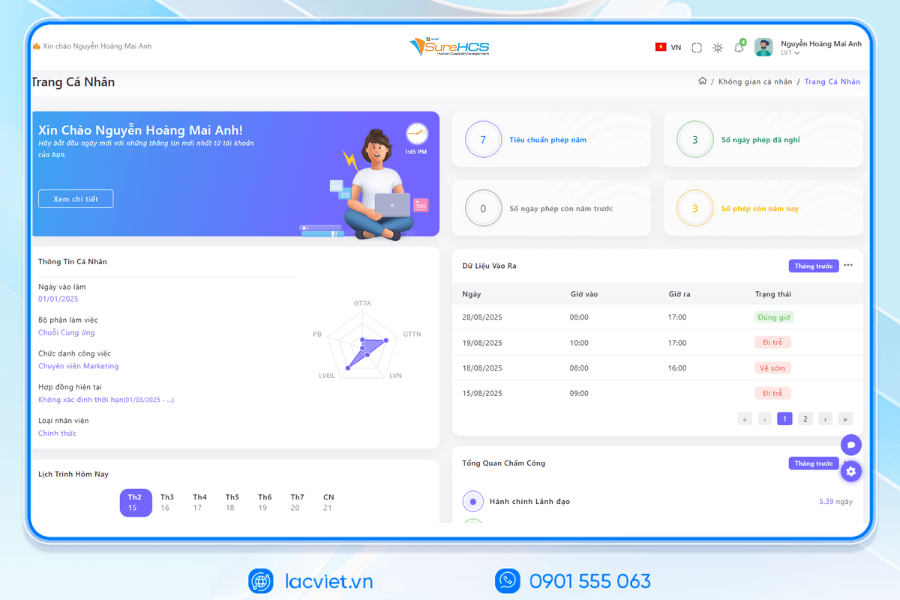

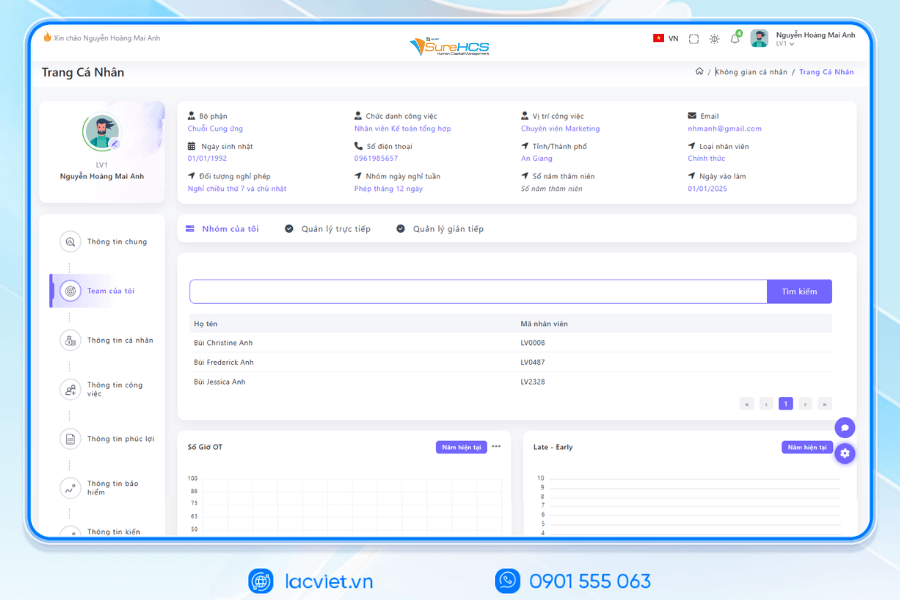

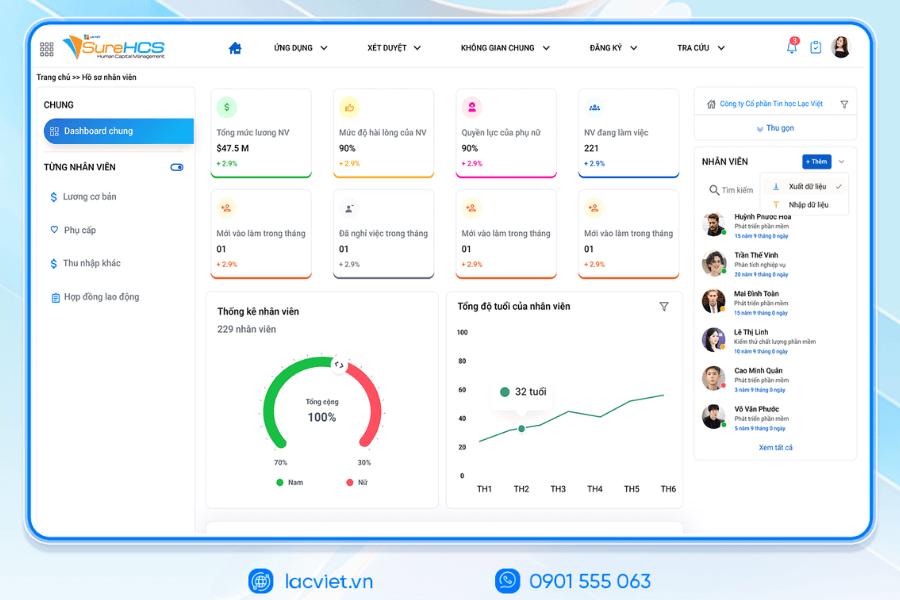

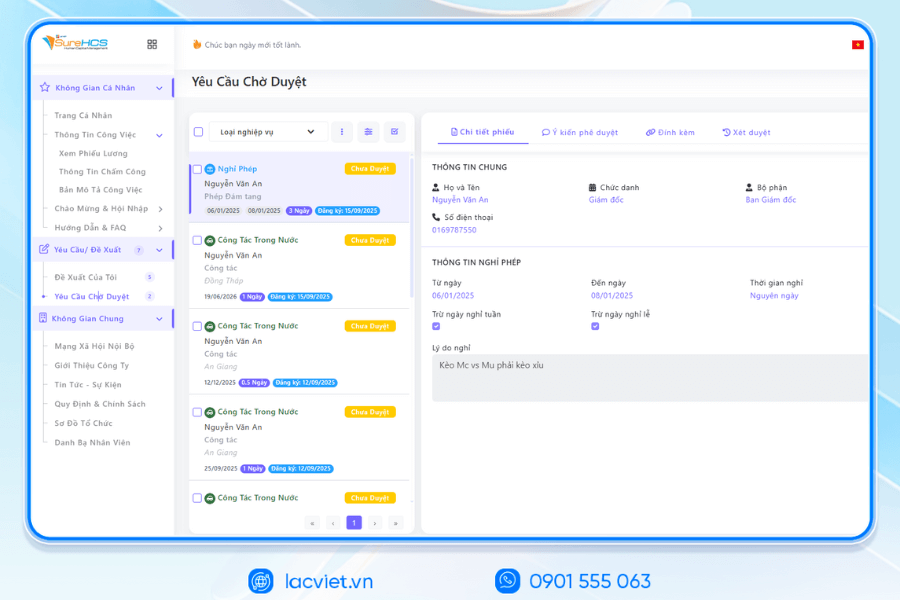

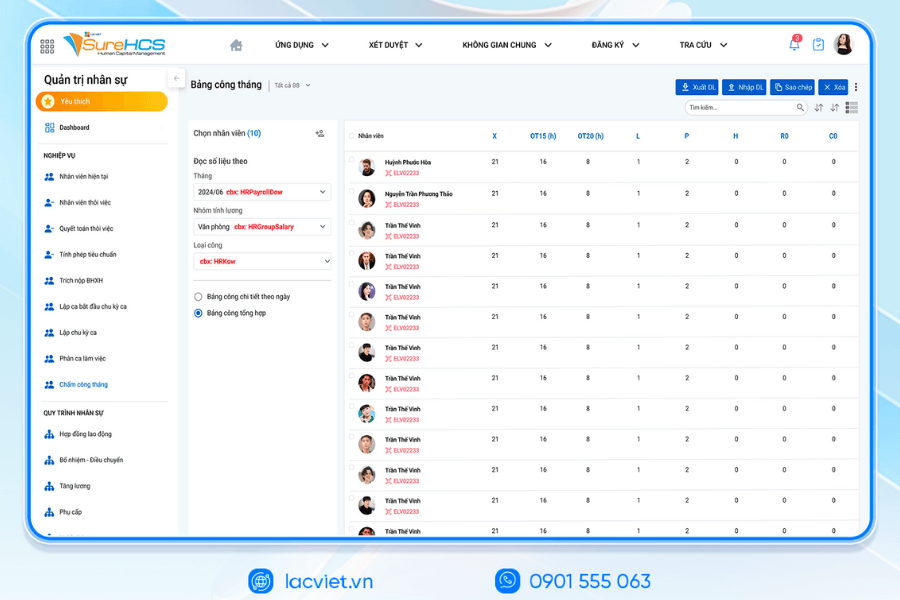

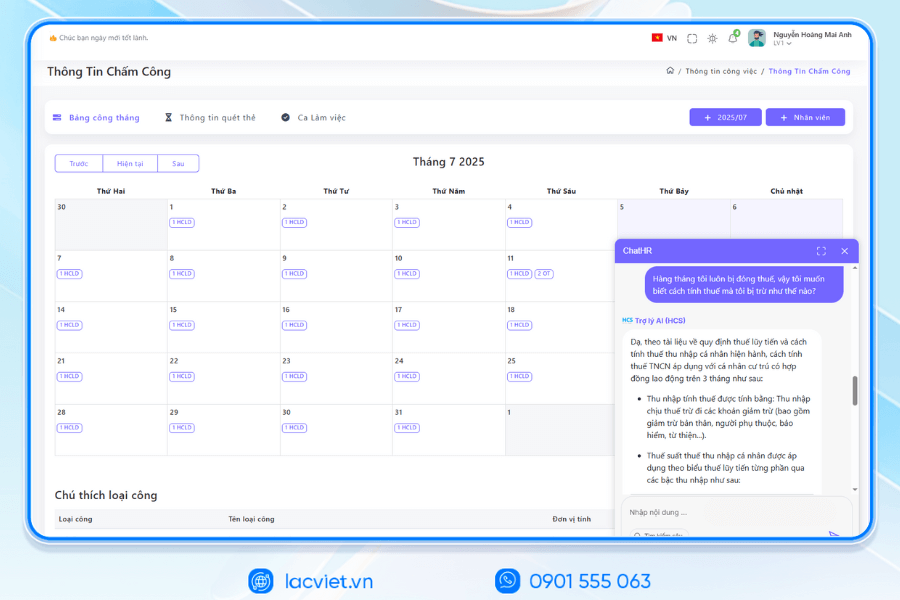

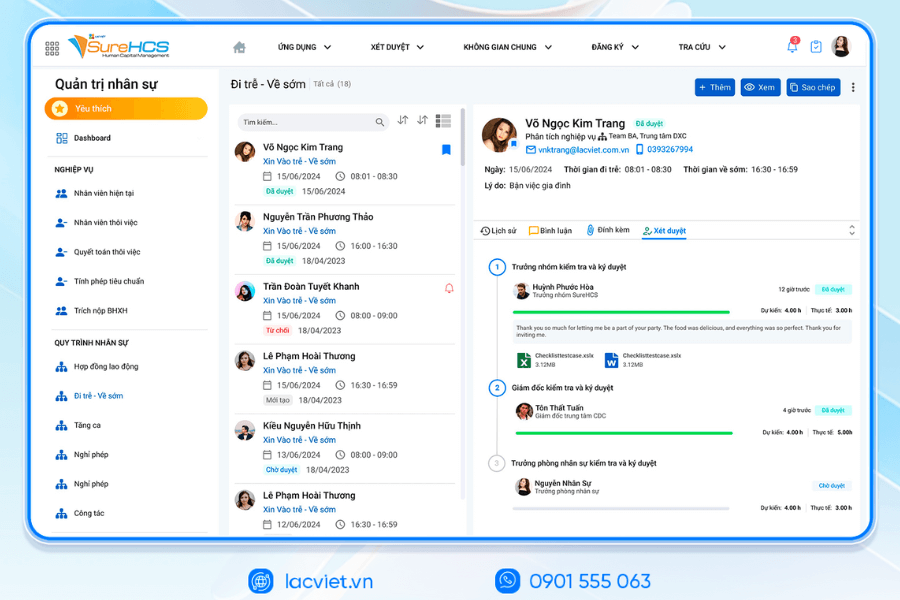

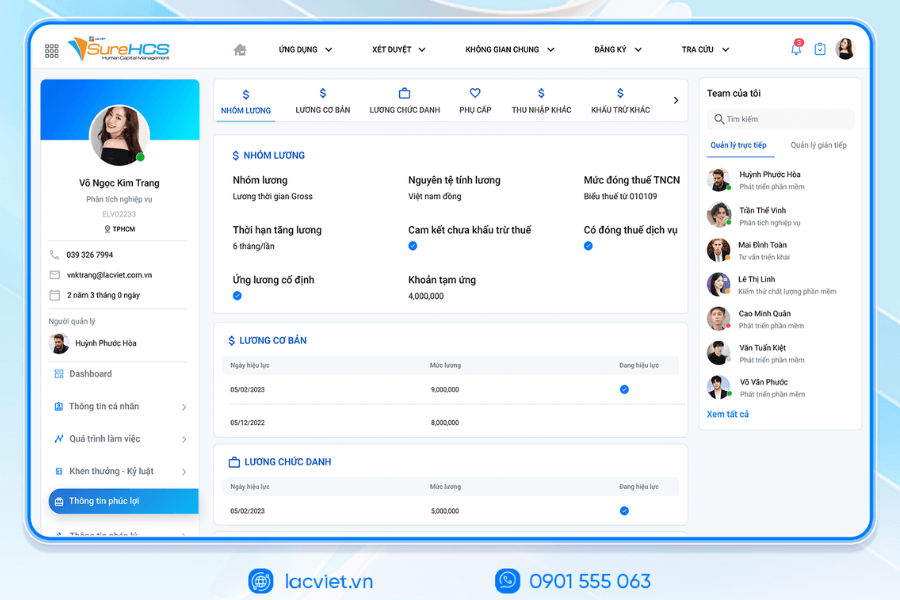

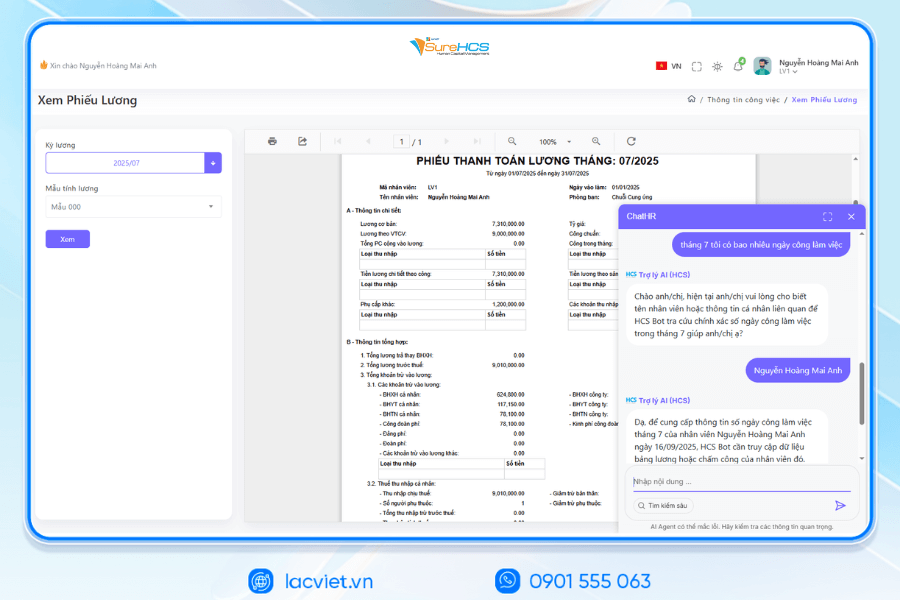

Effective solution currently is app human resource management software and payroll automatically, such as Lac Viet SureHCS HRM. This system helps businesses:

- Automatically apply the formula and the coefficient of increase in ca right under the provisions of The Labour code 2019, including overtime pay, night, holiday, holidays.

- Connect sync data from timesheetsregistration application increased the ca, to payroll synthetic, completely eliminate the data entry craft repeat.

- Integrated payroll increase ca in real-time, allowing hr and management check out as soon as they arise overtime.

- Salary calculator with software manager salary from SureHCS help reduce errors, increase transparency when all the data is stored, making it easy to retrieve, ready to serve inspector or resolve complaints.

LAC VIET SUREHCS – HR MANAGEMENT SALARY C&B CUSTOM DEPTH FOR BIG BUSINESS

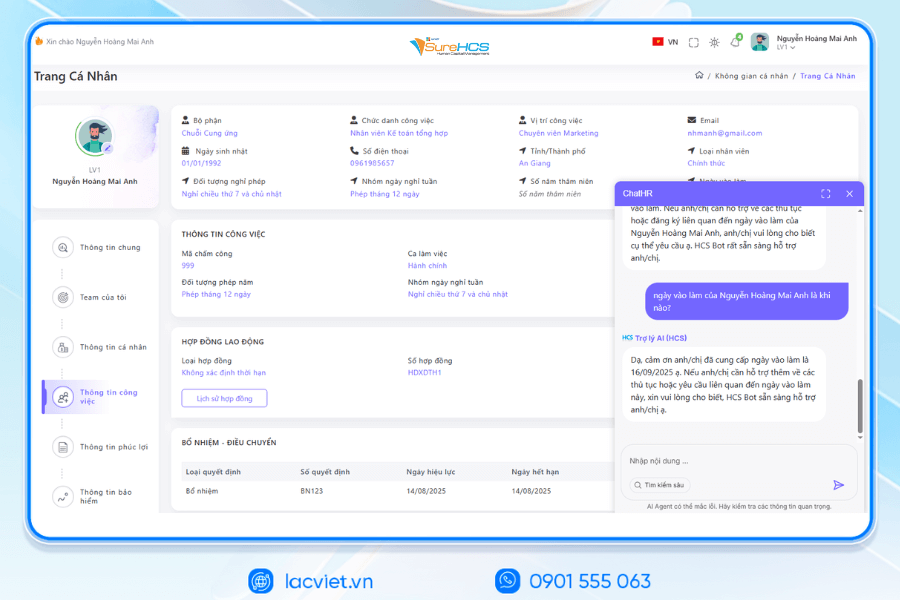

Lac Viet SureHCS is software HRM personnel management comprehensive, developed by Lac Viet – unit more than 30 years of experience in the field of management software business in Vietnam with international standards such as CMMI Level 3, ISO 9001:2015 and ISO 27001:2013.

SureHCS not only meet the professional personnel standards, which are designed to handle the hr – C&B – wages complex, large-scale, multi-company, multi-sector, in particular in accordance with FDI enterprises, corporations, factory, logistics, aviation, hotel, trade – in service.

The system is flexible deployment On-premise or as a custom model in depth, to help businesses automate the entire process hr – attendance – payroll – benefits – insurance, complete replacement job management using Excel discrete.

The module's core hr software lacviet SureHCS:

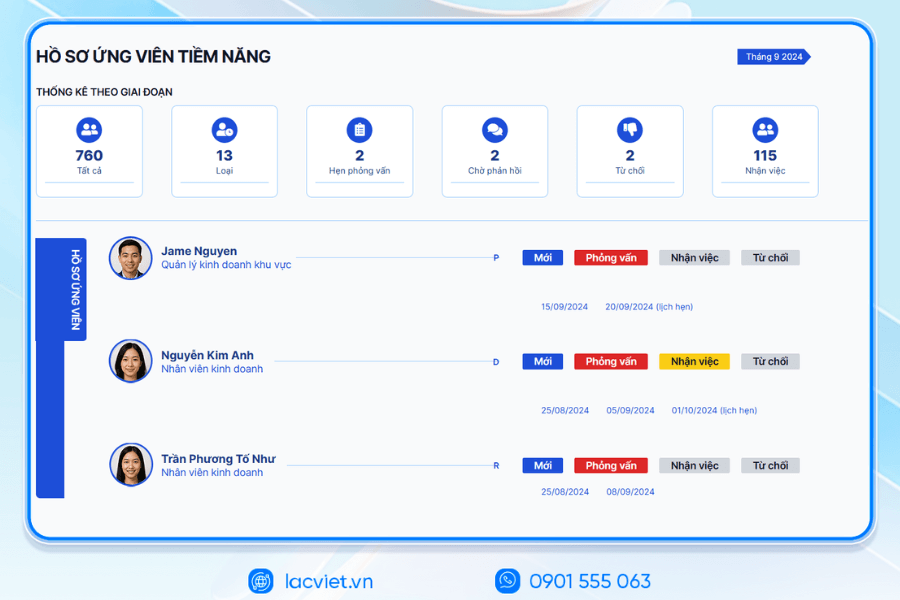

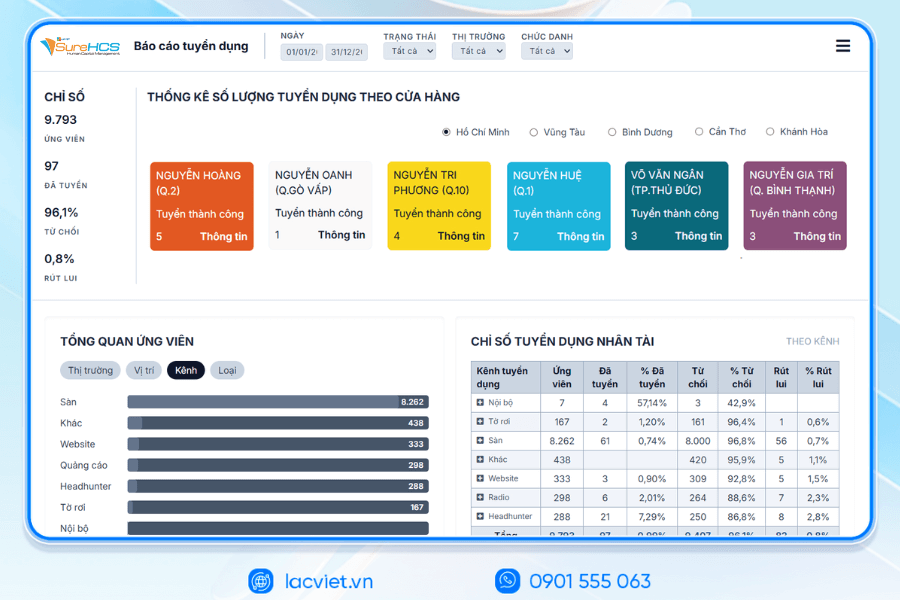

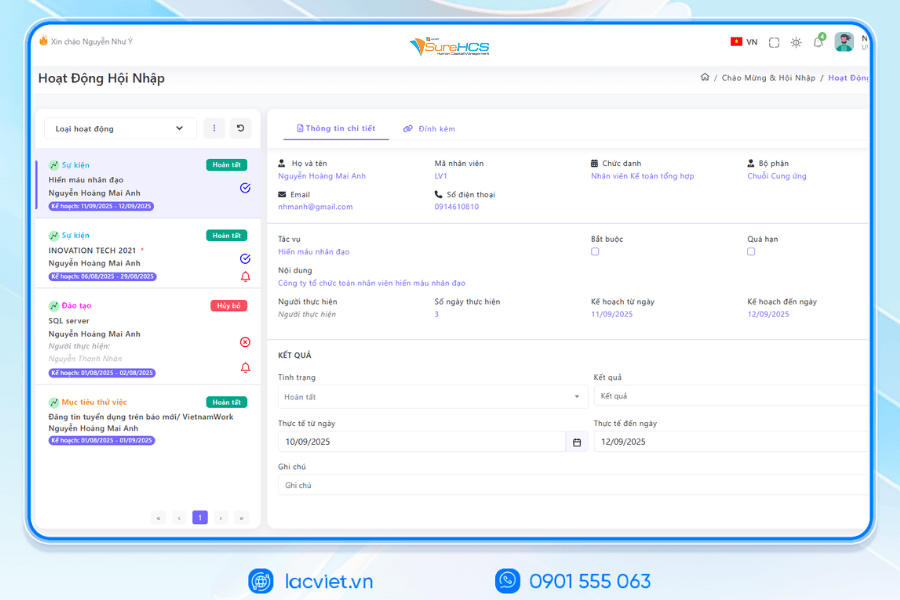

- The Recruit – Training: Management throughout the recruitment, integration, training, hr support and build the Talent Pipeline for large-scale enterprise.

- Port information & records Management personnel: Store personnel records, electronic focus, portal self-service for employees and contract labor power on the system.

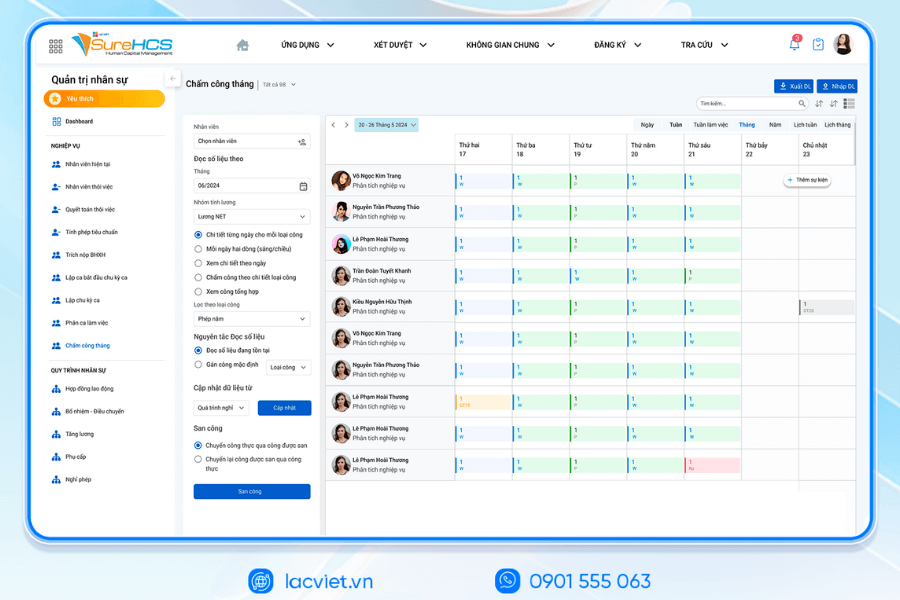

- The timekeeper: Dots, multi-form (fingerprint, face recognition, Face ID, GPS, Wifi, online), connect many types of timekeeper, support attendance by the hour, shift flexibility for the plant, and hotels.

- The payroll & C&B: Automatic salary calculation according to many models (hour, shift, product, 3P, KPI performance...), link directly attendance data – performance – welfare, completely replace the salary calculator using Excel.

- Welfare – SOCIAL insurance – salary: Management benefits flexible, integrated iVAN connect SOCIAL and electronic Bank Hub salary automatically, support pay multi-currency for FDI.

INTEGRATED AI ACCELERATED CONVERSION OF HUMAN RESOURCES MANAGEMENT

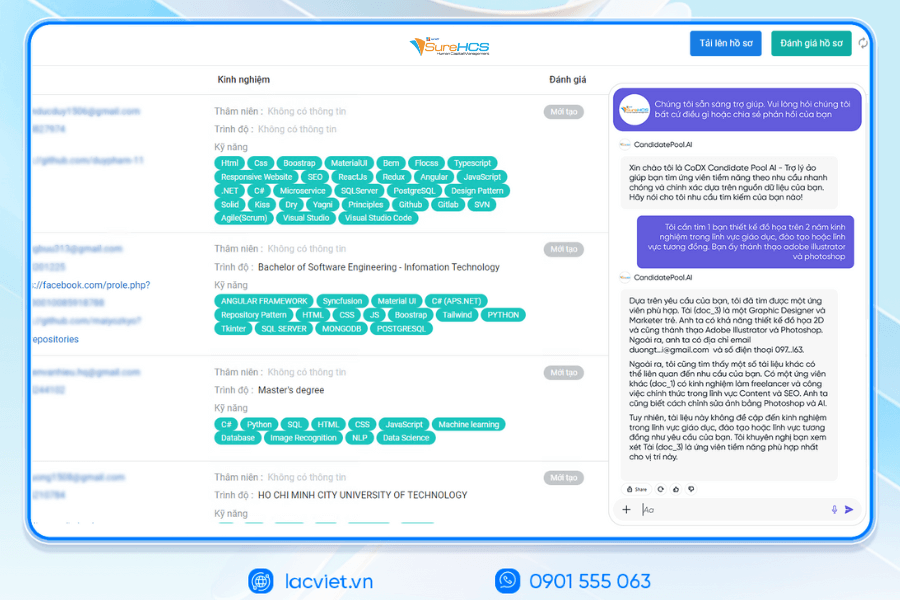

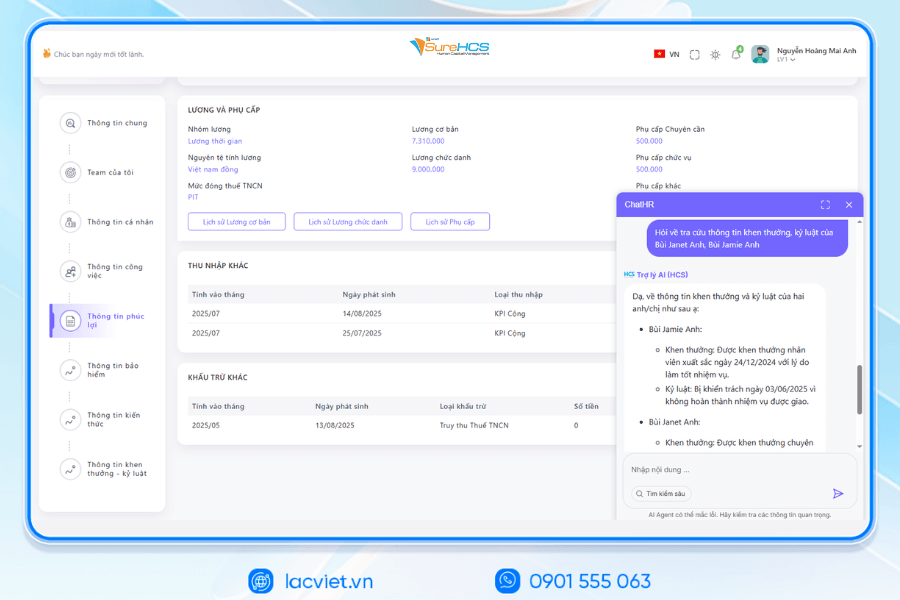

Lac Viet has officially launched The 3 AI assistant hr deeply integrated into the LV SureHCS including LV-AI.Docs, LV‑AI.Resume and LV‑AI.Help to automate the task administration, standardized data enhanced experience personnel

- LV‑AI.Docs: automatic dissection transfer data from documents such as CCCD, windows, SOCIAL insurance, by level of digital records, standardized

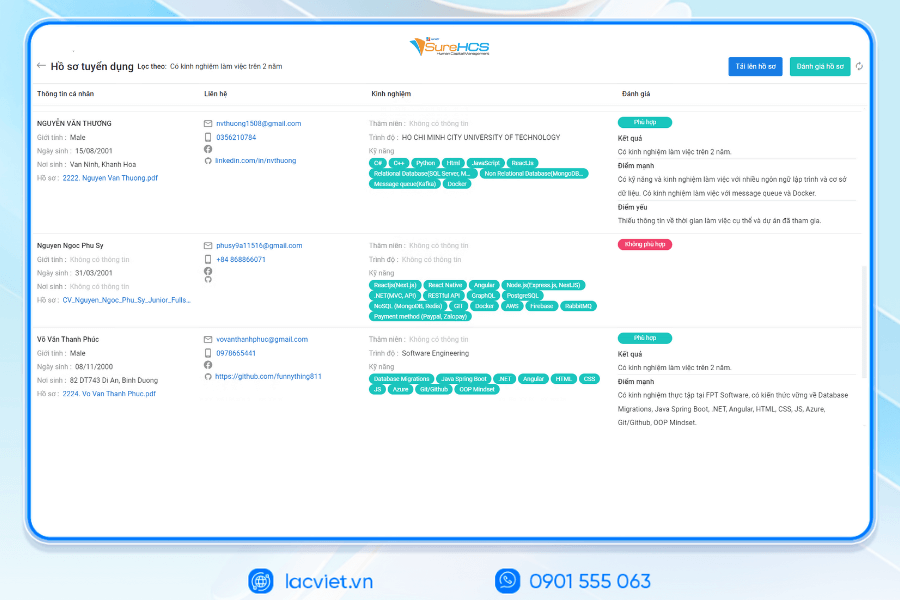

- LV‑AI.Resume: automatic dissection CV any format, analyst CV auto, construction, candidate profile, find people with the right criteria by prompt intelligent data mining candidate pool efficiency

- LV‑AI.Help: chatbot internal support, answer questions HR 24/7 access form process quick contextual user

TYPICAL CUSTOMERS DEPLOYING LV SUREHCS HRM

SureHCS are trusted and used by many large enterprises and leading corporations such as: Coca-Cola, Takashimaya, Textile SuccessfulPlastic Long Thanh Phu Hung Life, Airports of Vietnam (ACV)the business belonging to the SGCthe FDI enterprises in the fields of production, logistics, trade – in service.

- Coca-Cola Vietnam: System deployment LV SureHCS to digitize comprehensive human resource management group has standardized the data, the optimal operating HR according to international model.

- Textile company Success (TCM): Application LV SureHCS to manage hr, payroll, benefits, timekeeping and capacity profile for nearly 5,000 employees across 5 areas of activity – from textiles and fashion to real estate.

- Total company air Port, Vietnam (ACV): Choose to trust LV SureHCS to operate the system large-scale personnel with over 10,000 employees, 24 subdivisions, solved the problem of complex business of modeling state-owned companies.

SureHCS particularly suitable for:

- Large-scale enterprise, from 300 to 10,000 hr

- Corporations and enterprises multi-company, multi-branch

- FDI, manufacturing, factory, logistics, aviation should attendance – analysis ca – salary calculator complex

- Businesses are C&B peculiarities, need custom depth according to the actual operating

- Businesses are personnel management using Excel, many types of timekeeper, need automate the entire process

SIGN UP TO RECEIVE DEMO NOW

WHY BUSINESSES SHOULD CHOOSE TOUCH THE SUREHCS?

- Customized according to the actual business, no pressure mold as packaged software.

- Handle the personnel – salaries complex that many software HRM other does not respond.

- Deep understanding operated business English & FDI, ensure compliance with legal Vietnam (labour, SOCIAL insurance and personal income tax).

- Ecosystem integration strength: attendance – payroll – bank – SI – electronic contract.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: surehcs@lacviet.com.vn

- Website: https://lacviet.vn | www.surehcs.com

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

If businesses want to optimize right from pay period to the deployment of hr software lacviet SureHCS will be an option worth considering to help handle every situation from how to calculate salary increase ca to manage hr data overall in a single platform.

- Sample spreadsheet 13th month salary with the rules & How to calculate STANDARD MOST

- 15 Attendance software employee HRM PRECISE management, good pay

- The function calculate salary in Excel to quickly calculate the standard save time

- Provisions salary calculator holidays: legal Grounds & how to calculate STANDARD