Accounting for interest on bank deposits is the process of accounting recorded, tracked, as well as reflect account interest income arising from the business money deposited in the bank, used primarily account 112 (bank deposits) to the recorded combined sales account (515) or other income (711) and the tax account (if any) to reflect the exact same profit cash flow from investing activities financial idle of the business.

The accounting mistake or omission can lead to financial reporting is not accurate, affect the cash flow projections, plans, investment management, capital idle. The same Lac Viet find out details about professional accounting interest on deposits, principles applied, pen payments illustrated and the important note help accountants make professional, accurate, efficient.

1. Interest on bank deposits in business accounting

Interest on bank deposits is the business income received from the deposit at the bank, including the two main types: term and term. Non-term interest is the interest accrued from deposits can be withdrawn at any time, in the interest term is interest from deposits under the agreement fixed duration (1 month, 3 months, 6 months, 12 months).

The role of accounting interest on bank deposits:

- Accurately reflect the financial income: When properly accounted, business know the exact profit from the deposit, from which to plan spending and reasonable investment.

- Support cash flow management efficiency: accounting for interest on deposits to help accurately forecast the revenues from which avoid the shortage or excess capital idle. This is especially important with the small and medium enterprise, where the sources of working capital has a direct impact to the ability to pay, as well as to expand production.

- Compliance with accounting standards & taxes: recognition of interest according to circular 133/200 help financial reporting transparency, meet the requirements of the audit to ensure the tax declaration regulations, to avoid risks, legal and tax.

Thus, the accounting of interest on deposits not only is the task of records, which also provides important information for business decision-making, investment and management of capital efficiency.

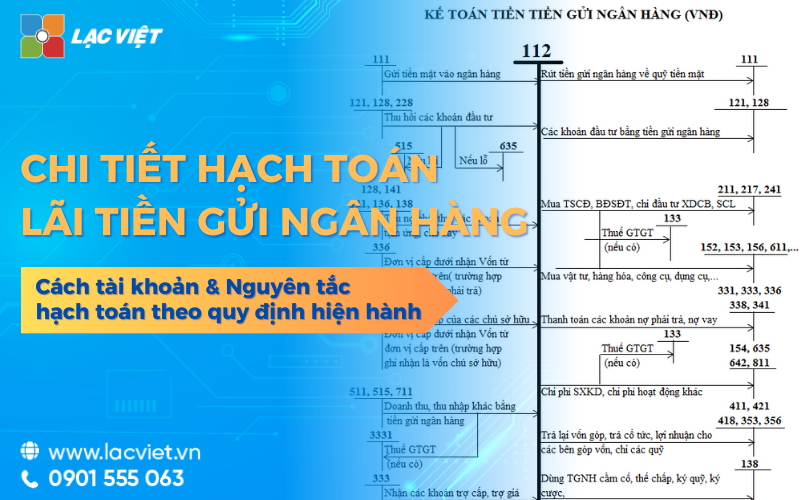

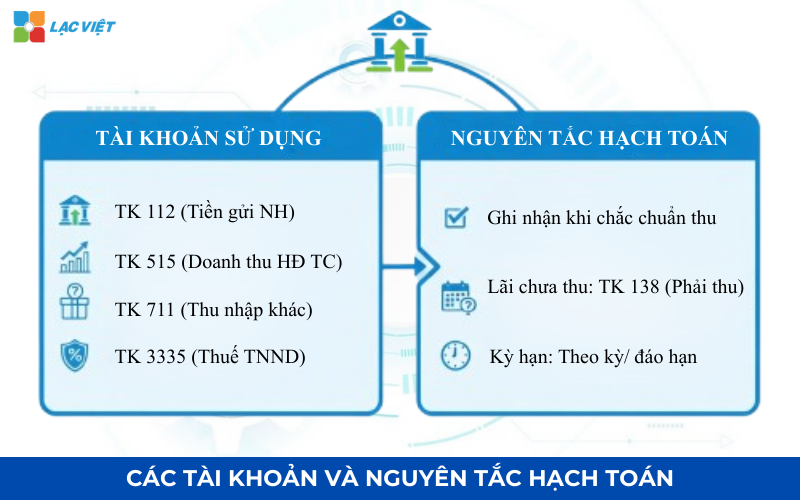

2. The account usage & accounting principle interest on deposits

2.1 accounts use accounting

To ensure accuracy and compliance with the accounting standards (as TT200/TT133), the recognition rates on bank deposits is needed to use rationally the dedicated account the following:

- TK 112 (bank deposits): Recorded the original amount increases when receive interest reduction when withdrawing money.

- TK 515 (revenue financing activities): Recorded account of interest on deposits received (usually used for large COMPANIES according to TT200

- TK 711 (other income): Recorded account of interest on deposits has incurred but has not to fall (not yet received).

- TK 3335 (corporate income Tax): Recorded INCOME tax (if any arise, but interest TGNH of DN are often charged on TN subject to corporate INCOME tax at maturity).

2.2 principles of accounting interest on deposits

According to circular 200/133, when accounting for interest on bank deposits should adhere to the following principles:

- Revenue recognition interest when the right to be ascertained: Only recorded when the bank has confirmed the interest accrued. This avoids recorded interest assumption, assurance reports properly reflect the actual cash flows.

- Interest not recorded as accounts receivable (TK 138): With the account interest not to get businesses are not counted in revenue to the fact that recorded in the form of assets receivable, help distinguish interest has the right to collect interest and no right to collect.

- Interest on term deposits recorded in each period or at maturity: this ensures financial statements properly reflect the value of interest fact, avoid misjudging effective financial investment.

These principles are the basis for the organizations and enterprises perform accounting of interest on bank deposits according to circular 133/200 ensures data transparency and manage cash flow effectively.

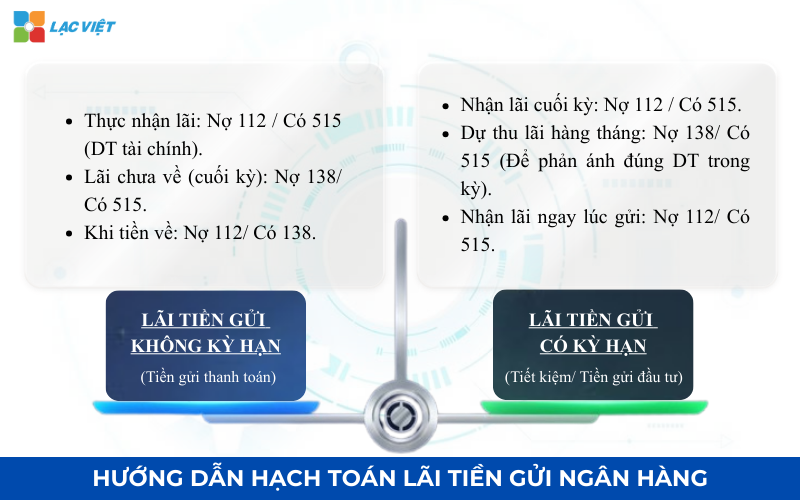

3. Guide to accounting for interest on bank deposits

Accounting for interest on deposits is an important step for businesses to determine the exact profit from the deposit, at the same time managing cash flow effectively. The implementation of the right not only to meet accounting standards circular 133/200 but also help the organizations and enterprises make decisions investment and use of funds idle in a reasonable manner.

3.1. Accounting for interest on bank deposits term

Non-term interest arising from deposits that businesses can withdraw at any time, often used to ensure short-term liquidity.

The steps of accounting:

| Profession | Accounting |

| Casting money (if interest paid by cash) |

|

| Withdrawal of bank deposits: When the interest is transferred from the bank to the company account |

|

| Interest income on deposits |

|

| Interest not to states |

|

Example entry:

Situation 1: the Business received interest 2,000,000 from the bank into the account, the interest can be withdrawn at any time.

- Accounting recorded upon receipt of interest:

- Debt TK 112 (bank deposits): 2.000.000

- Have TK 515 (revenue financing activities): 2.000.000

Scenario 2: Interest 1.500.000 yet to get bank has transferred the money.

- Accounting recorded interest not collect:

- Debt TK 138 (other receivables): 1.500.000

- Have TK 515 (revenue financing activities): 1.500.000

- When, in fact, get interest:

- Debt TK 112: 1.500.000

- Have TK 138: 1.500.000

3.2. Accounting for interest on term deposits

Interest on the term arises from deposits under the agreement fixed duration (1, 3, 6, 12 months). This is a form of safe investment, the optimal profit from capital idle.

The steps of accounting rates on bank deposits with maturity:

| Profession | Accounting |

| Get interest periodically or at maturity |

|

| If interest not to get |

|

| Get rates when sending money |

|

Example of accounting rates on bank deposits with maturity:

Situation 1: Corporate deposits term of 3 months, interest 5,000,000, get on the end of the period.

- Interest not to get:

- Debt TK 138 (other receivables): 5.000.000

- Have TK 515 (revenue financing activities): 5.000.000

- At maturity, interest payment:

- Debt TK 112 (bank deposits): 5.000.000

- Have TK 138: 5.000.000

Situation 2: Business deal get rates when sending money term of 6 months, the interest 3,500,000 vnd.

- Accounting recorded once:

- Debt TK 112: 3.500.000

- Have TK 515 / 711: 3.500.000

4. The important note when accounting for interest on bank deposits

In fact, financial management, business, the recognition rates on bank deposits not only record data, but also help control the flow of money, optimal capital idle and ensure financial statements properly reflect reality. To perform correctly, the professional accountant should note the following points:

- Check the information of interest from the bank before accounting: Before the need to collate interest on deposits with bank statement to ensure proper recognition of the fact arise. This is very important with term deposits, helping to avoid recorded rates “virtual” and ensure accounting revenue interest only when the right to be ascertained according to the circular 200/133.

- Clear classification non-term interest – rate term – interest have not yet collected:

- Non-term interest: interest may withdraw at any time, it must be noted upon receipt of money or track your account has not collected.

- Any interest period: incurred in each period fixed, the need to properly account for and avoid recorded soon.

- Make sure to match the data between the ledger – bank statement which states: Detect deviations timely accounting of interest income on deposits. This is an important basis for setting management reports, evaluate the efficient use of capital idle and provides reliable data for managers.

- Real value for business: cash flow Forecast accuracy and prevent recognition rate deviations, ensure financial reporting transparency and compliance with standards. At the same time, enterprises can optimize accounting software to automate accounting, reduce errors and save time control data.

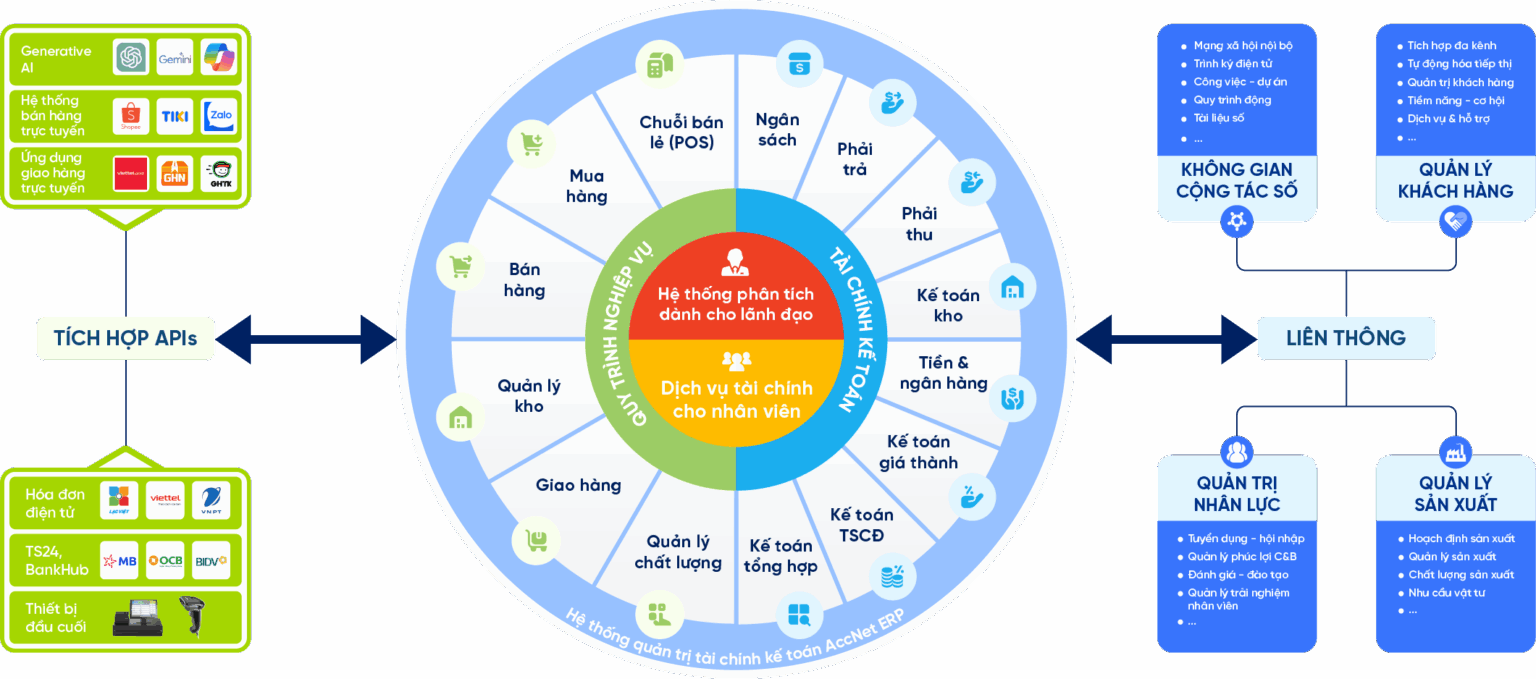

5. The optimal solution accounting profession with Accnet ERP

To optimize the process of accounting for interest on deposits, businesses can apply accounting software Accnet ERP help automate transparent the whole process of accounting:

- Automatic accounting of interest on deposits by type & term: The software allows businesses to choose accounting of interest on bank deposits non-term or term, automatically recorded in the accounting arises when interest is confirmed, reduce errors and ensure compliance with circular 133.

- Track gain hasn autumn & properly allocate states: Recorded interest not to get into accounts receivable, automatic switch to revenue when, in fact, get interest, help financial reports accurately reflect the flow of money and real profits.

- Data link related departments: System strong link between accounting – finance – bank, guaranteed data rates on deposits are synchronized, to avoid discrepancies due to input manually.

- Financial reporting & intuitive administration: The software provides reports of interest on deposits by states, type of deposit and state interest (earned, not collected), business support effective analysis, financial investment, optimal use of capital idle to forecast cash flow accurately.

- Compliance with accounting standards & tax: automatically accounted for by the circular 133, help business tax declaration regulations, to ensure transparency and reduce legal risks.

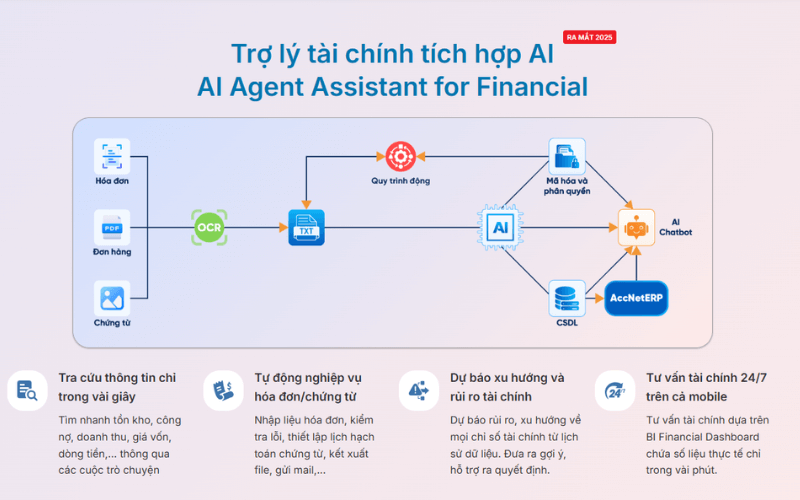

ACCOUNTING SOLUTIONS ACCNET ERP INTEGRATED AI AUTOMATE ALL BUSINESS

AccNet ERP is a software solution financial accounting integrated in the management system, comprehensive enterprise, which is developed by Lac Viet corporation. Difference highlights of AccNet ERP is the app artificial intelligence (AI) in many accounting process to help businesses:

- Automation of accounting and classified documents.

- Improving the accuracy in data control.

- Shorten processing time business accounting – financial.

Thanks to that, AccNet ERP not only is support tool but also a “smart assistant” with the business in financial management transparent effect.

Feature highlights:

✔️ Automatic accounting vouchers, collate public debt thanks to AI.

✔️ Manage your finance – accounting multi-branch, multi-subsidiary.

✔️ Financial statements consolidated standards of Vietnam & international (VAS, IFRS).

✔️ Cash flow management, budgeting, forecasting the exact cost.

✔️ Connect with the manure management system, hr, production, sales to sync data.

✔️ Integration of AI in data analysis, risk warning and proposed optimal scheme.

TYPICAL CUSTOMERS ARE DEPLOYING ACCNET ERP

- Nitto Denko – control production costs thanks to the application of accounting costing: Nitto Denko has chosen solution AccNet ERP to deploy the system accounting calculating cost ofhelp business control costs more effectively in the production process. After a period of use, company, highly effective, practical system that brings, as well as the degree of stability superior to other software in the market.

- ANTESCO – restructuring process works with management accounting operation: At ANTESCO, our team of consultants and deployment of AccNetERP has collaborated closely with the business in the first phase, reset the standard process and construction work-flow related departments throughout. The solution has helped ANTESCO significantly improve management capabilities, operating in a synchronized way and versatile

- Khatoco – expansion pack solution AccNetC after the successful implementation of original: Lac Viet has successfully deployed package solution AccNetC for trade co., LTD Khatoco in Nha Trang, according to the agreement signed on 29/07/2014. After the system is first put into operation efficiency, Khatoco intends to continue cooperation and expand the distribution finance – accounting and retail management with AccNetC, expressing the deep trust in implementation capacity and quality of service from Lac Viet.

SIGN UP TO RECEIVE DEMO NOW

INTEGRATED AI ACCELERATION CONVERTER OF ACCOUNTING

AI in AccNet ERP't just stop at automate data entry, but also:

- Identification & classification certificate from smart: AI scan, read & sort invoice, voucher, receipt, limit errors due to input manually.

- Financial forecasting & budget: the system uses algorithms machine learning to forecast cost, revenue, business support decision fast.

- Warning risk accounting: AI to detect abnormalities in the book, from which timely warning of false or fraud risks.

- Reports assistant smart: AI suggested report template, automatic data aggregation support, leadership, financial analysis instant.

BUSINESS IS WHAT WHEN IMPLEMENTING ACCOUNTING SOFTWARE LAC VIET?

- Experience more than 30 years develop software solutions business management in Vietnam.

- Ecosystem of comprehensive: AccNet ERP easily connect with other solutions of Lac Viet (HRM, Workflow, Portal...).

- Advanced technology: Integrated AI support, cloud & on-premise flexible.

- Services dedicated support: A team of knowledgeable professionals with accounting – finance in Vietnam, companion throughout the deployment.

- Trust from thousands of customers in many areas: finance, banking, manufacturing, trade, services.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: accnet@lacviet.com.vn | Website: https://accnet.vn/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

Accounting for interest on bank deposits is essential work, in financial management, business, helps accurately reflect the profit from the deposit and control the flow of money effectively. To comply with the accounting circular 133/200 not only ensure financial reporting transparency, but also to support business decisions investment and use of funds idle in a reasonable manner.