Accounting salary is the process recorded handle the payments for workers in business, including basic salary, allowances, bonuses, insurance and personal income tax. This is an important part in human resource management & accounting helps the business to ensure the accuracy of pay, comply with the law optimize personnel costs.

This article Lac Viet will provide information about accounting salary overview about the process, methods, practical benefits when performed accounting for expenses salaries accurate. Understanding the correct application of accounting will help businesses improve the efficiency of management personnel to reduce errors, risk, legal risk.

1. Accounting salary what is?

Accounting salary is the process documented handle the payments for employees in business. This process includes the calculation of the account to the basic salary, allowances, bonuses, social insurance, medical insurance, unemployment insurance and personal income tax.

Accounting payroll costs not only help the business to ensure the accuracy of pay but also the grounds for the establishment financial statementsit is next to perform the obligations tax.

Illustrative example: suppose an employee whose basic salary is 10 million, lunch allowances and 500,000 bonus productivity 1 million. Deductions from wages, including social insurance (8%), health insurance (1,5%), unemployment insurance (1%), personal income tax (under the progressive). Payroll accounting will help determine the amount of money actually received by the employee and the amount of money a business must pay for the insurance premiums tax.

Accounting salary plays an important role in:

- Ensure accuracy in payroll spending to Help businesses pay the right enough for workers, avoid to cause loss of confidence led to complaints.

- Compliance with tax obligations, insurance: accounting salary and deductions from salary to help businesses identify the right deductions from wages ensure compliance with laws and regulations, taxes, insurance.

- Management personnel budget efficiency: Help business expense tracking personnel from which to make decisions about recruitment, training, remuneration reasonable.

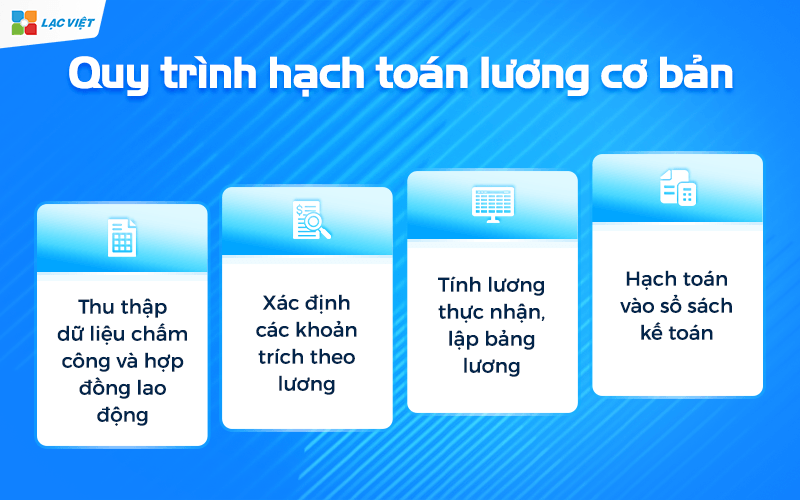

2. Process accounting salary and deductions from salary professional standard

Step 1. Collect attendance data and contract labor

The first step in the accounting salaries are collected attendance data, contract labor. This data is the basis for payroll accuracy, avoid errors and complaints from employees.

- Importance: If the timesheet data is missing or incorrect, the wages actually received by the employee will be false, leading to loss of faith and can arise labor disputes. At the same time, flaws also affect deductions from wages as social insurance, health insurance or individual income tax rise to legal risks.

- Illustrative example: An employee working 24 days in the month, but attendance data recorder teen 2 days. If salary based on data not updated, the business will pay shortages and have to adjust additional, time-consuming and affect credibility.

The business can use software attendance management integrated with the system of accounting salaries to reduce errors while saving time data processing.

Step 2 Determine deductions from wages

After the data accurate timekeeping, the next step is to determine deductions from wages. This is the business required to pay in accordance with laws, at the same time directly affects the amount of wages actually received by the employee.

The deductions include:

- Social insurance (SOCIAL insurance): the Extract at a ratio of 8% of basic salary (due to workers close).

- Health insurance (health INSURANCE): Extract 1.5% of the basic salary.

- Unemployment insurance (UI): Deduct 1% of the basic salary.

- Personal income tax (PIT): Charged according to the progressive each section.

Determine the correct deductions to help businesses comply with the law, avoid risk inspections or violations. At the same time, help business budgeting, personnel more accurate.

Step 3 Calculate the salary actually received, tabulated wage

The next step is to calculate the salary actually received by the employee, i.e. the amount of money they received after deducting deductions from wages, personal income tax.

How to calculate basic: food get = basic Salary + allowance + Bonus – (SI + health INSURANCE + UI + PIT)

Illustrative example: An employee whose basic salary of 10 million, allowance 500,000 bonus 1 million, deductions from wages total 1,35 million, then:

Food get = 10.000.000 + 500.000 + 1.000.000 – 1.350.000 = 10.150.000 copper

The establishment payroll clarity, transparency helps employees trust increase satisfaction, while reducing labor disputes and audits after this.

Step 4 accounting to bookkeeping

Finally, the account of wages, deductions from wages need accounting to bookkeeping to ensure compliance with accounting standards legislation.

Pen basic math:

- Debit wage costs of the business.

- Credited to the accounts payable employee, deductions filed under payroll (SOCIAL insurance, health INSURANCE, personal income tax).

Illustrative examples: Business pay monthly salary 8 for staff:

- Debt TK wage Costs 12.000.000 dong

- Have TK To pay employees 10.150.000 dong

- Have TK To pay SOCIAL insurance, health INSURANCE 1.350.000 dong

Accounting accurate business reports, financial transparency, avoid errors when the audit, at the same time ensuring legal and effective hr management.

3. Guide to accounting for deductions from wages each account

In the accounting of wages, deductions from wages are the business account required to submit in accordance with the law, at the same time directly affects the amount of wages actually received by the employee. The accounting accurate the account will not only help businesses comply with labor laws, the tax but also optimal personnel budget increase transparency with employees.

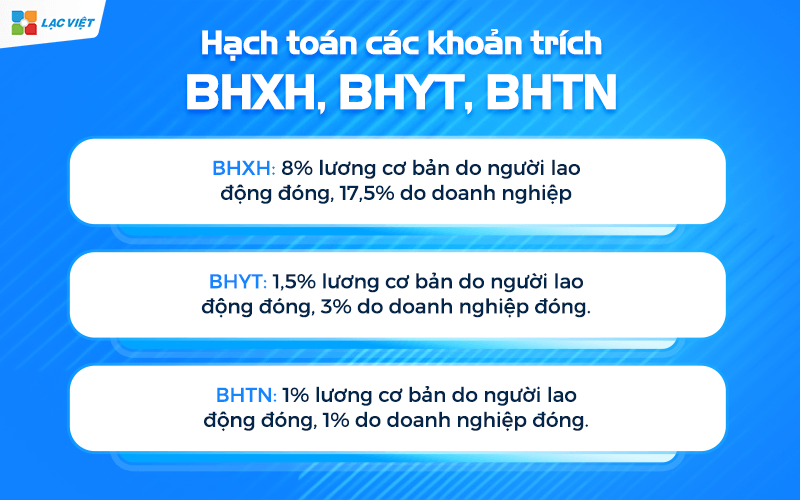

3.1 Deduct SOCIAL insurance, health INSURANCE

Includes:

- SOCIAL insurance (social insurance), health INSURANCE (health insurance), UNEMPLOYMENT insurance (unemployment insurance) is the account mandatory that businesses, workers must close.

- This is a part of accounting salaries and deductions from wages.

How to calculate accounting:

- SOCIAL insurance: 8% of the basic salary of workers close up of 17.5% of the business (depending on industry).

- Health INSURANCE: 1.5% of the basic salary of workers, close up 3% due to business closure.

- UNEMPLOYMENT insurance: 1% of the basic salary of workers close, 1% of the business.

Illustrative example: Employees have a basic salary of 10 million:

- SOCIAL insurance: employee 800,000 businesses 1.750.000 dong

- Health INSURANCE: employee 150,000 businesses 300,000

- UNEMPLOYMENT insurance: employee 100,000 businesses 100,000

Properly account for deductions to help businesses avoid fines violation of the law, time management, budgets, insurance effective. This also helps employees peace of mind because rights are guaranteed.

3.2 the personal income Tax (PIT)

PIT is a tax that workers pay based on taxable income includes salary, bonus, allowances are taxable.

Distance calculator:

- Charged according to the progressive part, with the different income levels will apply the tax rate is different.

- Minus the deductions as circumstance and compulsory insurance.

Illustrative example: employee has taxable income 15 million vnd/month: after, except insurance and circumstance, the rest charged according to the progressive tax 5%-35%.

Properly accounted PIT helps to avoid risks, inspection and construction working environment, transparent, reliable. At the same time, ensure accounting staff salaries accurate, thereby improving the satisfaction of employee engagement.

3.3 allowances and bonuses

Bonus is the additional terms in addition to basic pay, which may include: allowance, lunch allowance gasoline car, bonus, productivity bonus holiday/new year.

How accounting:

- Identify account any taxable account does not taxable according to the regulations.

- Clearly recorded in payroll, bookkeeping.

For example: allowance gasoline 500,000/year bonus, productivity 2 million. The total amount of this was recorded in wage costs, business and rewards taxable to charge into the PIT.

Accounting the correct allowances, bonus help:

- Management, cost transparency, avoid inflation cost or confusion.

- Enhance motivation and satisfaction of employees, contributing to reduce the rate of the holiday.

4. Common problems when accounting for expenses wages and deductions from wages

4.1. Errors in the data timekeeping

Cause: errors in the attendance data can be due to employees not forget timekeeping, attendance system does not sync or input the incorrect hands.

Consequences:

- Salary calculator is not accurate, resulting in employees get salary wrong.

- Affect deductions from wages as social insurance, health insurance, unemployment insurance, individual income tax.

- Cause loss of confidence and complaints from employees.

Solution:

- Use timekeeping software automatically integrated with the payroll system to minimize errors.

- Training employees about the process timesheets, check the data regularly.

- Set the approval process attendance data before payroll.

4.2. Confused in determining the deductions from wages

Causes:

- Not timely updates of changes to the social insurance, medical insurance, unemployment insurance, individual income tax.

- Confused in determining the applicable objects of the extract different.

Consequences:

- Businesses can be fined for non-compliance with legal regulations.

- Employees may be missing benefits or have to pay the tax is not properly level.

Solution:

- Frequent updates, the legal provisions on insurance and tax.

- Use management software, payroll automatic updates of the quotes according to the latest salary.

- Training accounting staff about the rules relating to deductions from wages.

- Salary 3P what is? Distance calculator & excel Template STANDARD construction systems salary 3P

- Understand correctly the deductions from salary to calculate correctly and manage effectively

- How to build stairs payroll standard with excel template for business

- 4 How to manage payroll for business from crafts to digitize automatic

5. Lac Viet SureHCS HRM – support System of accounting salaries effective

Management salaries and deductions from wages is one of the professional complex to errors if done manually. In particular, with the organizations and enterprises are to find out information about accounting, salary, applying system personnel management support is a practical solution to increase the accuracy, transparency, efficiency in management, hr and accounting.

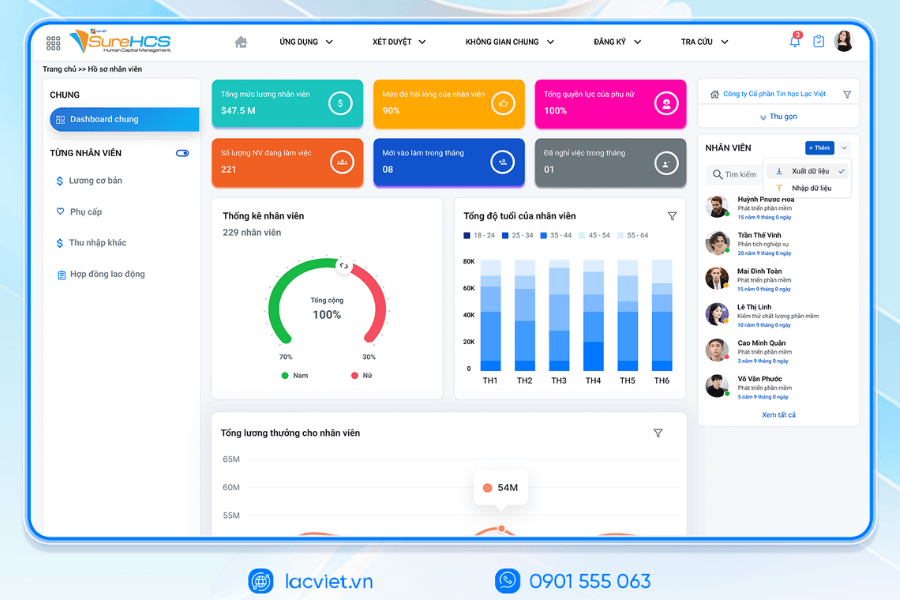

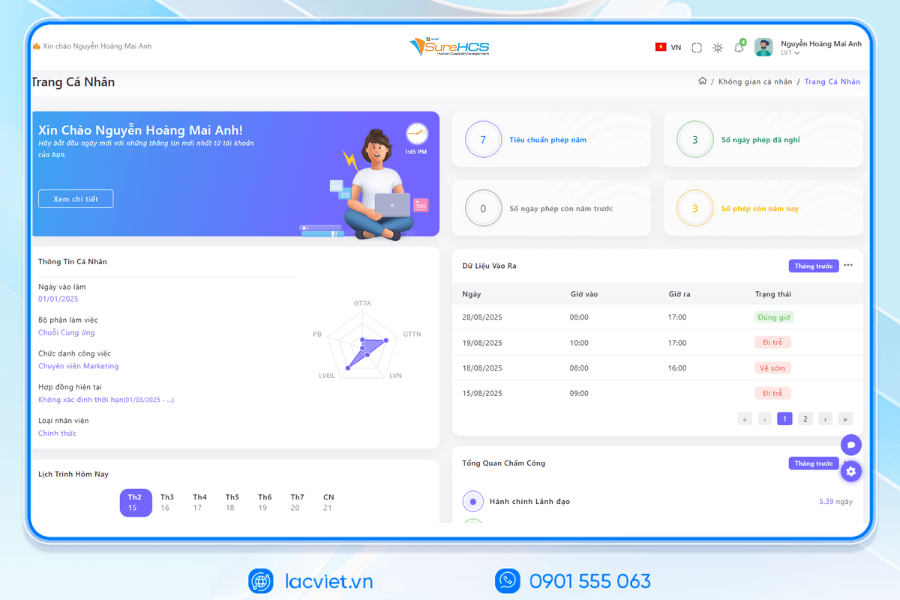

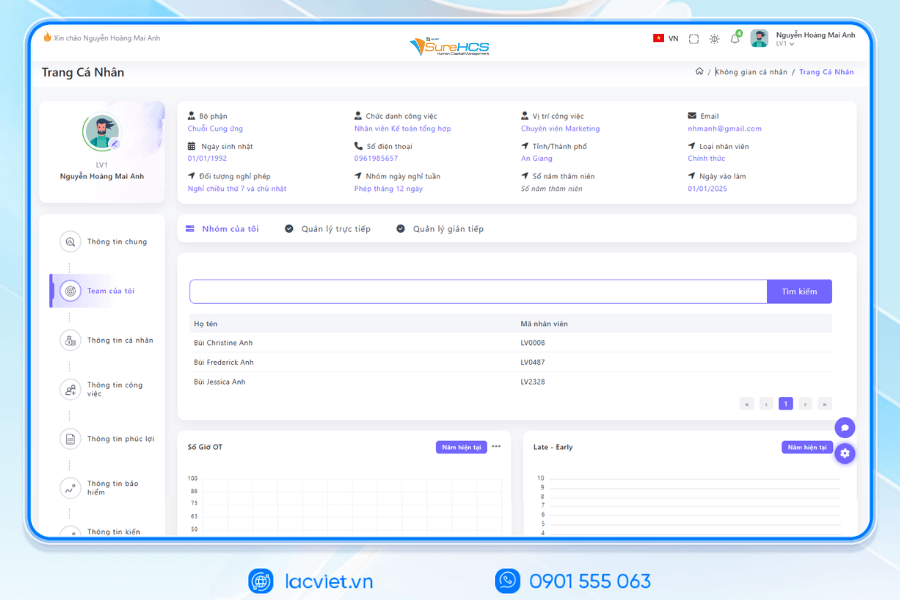

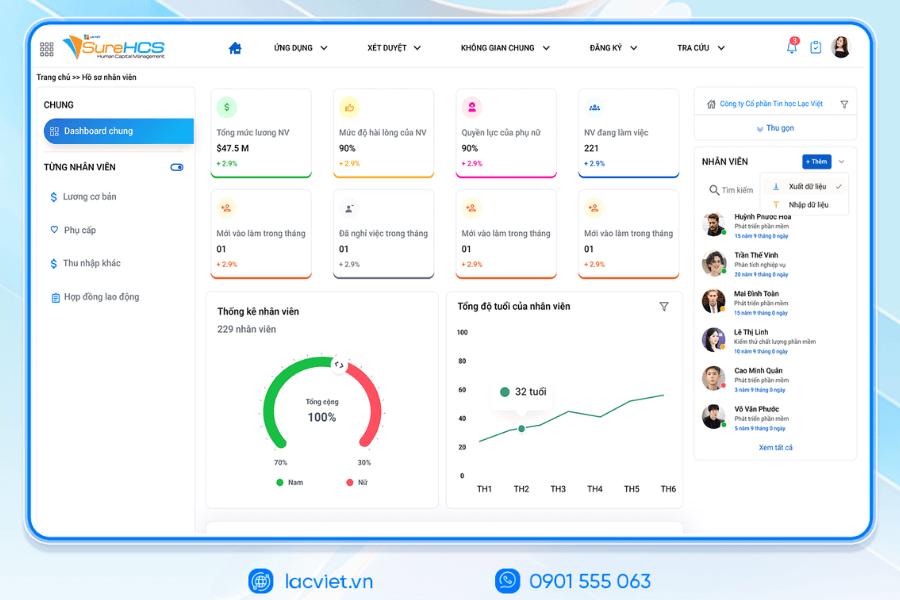

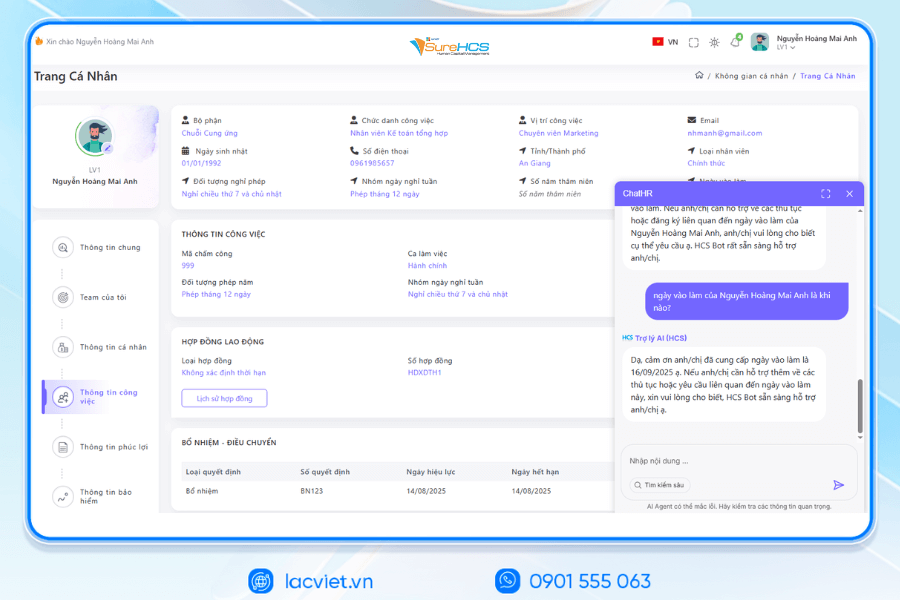

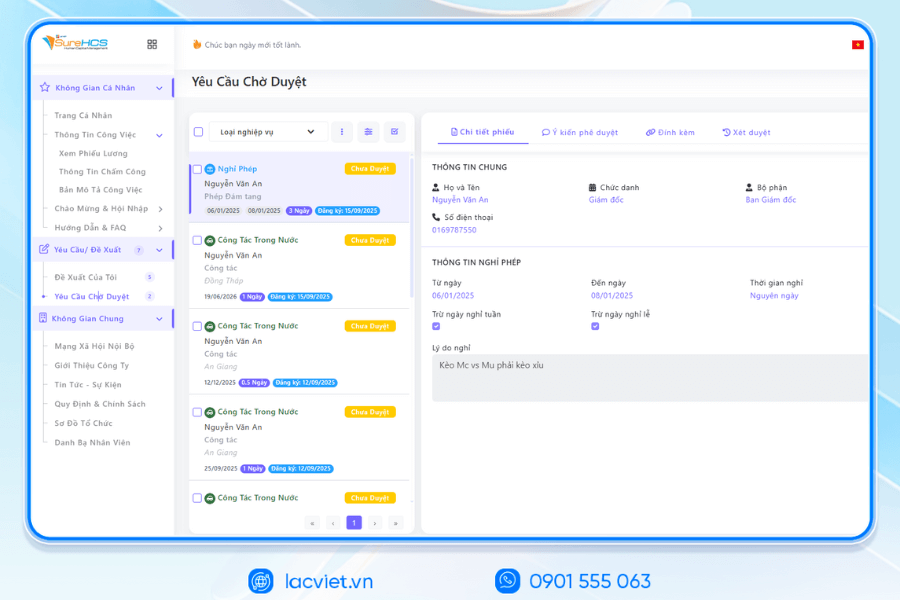

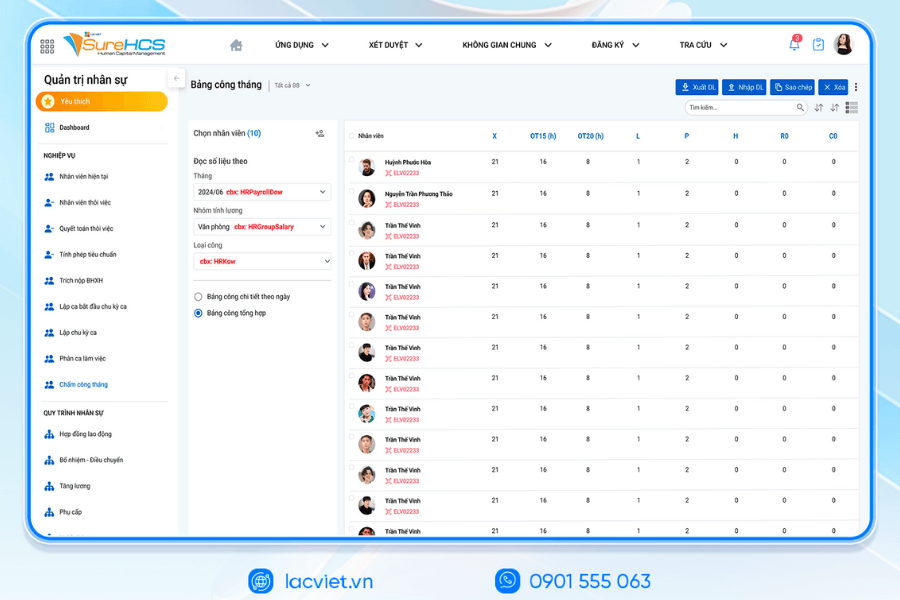

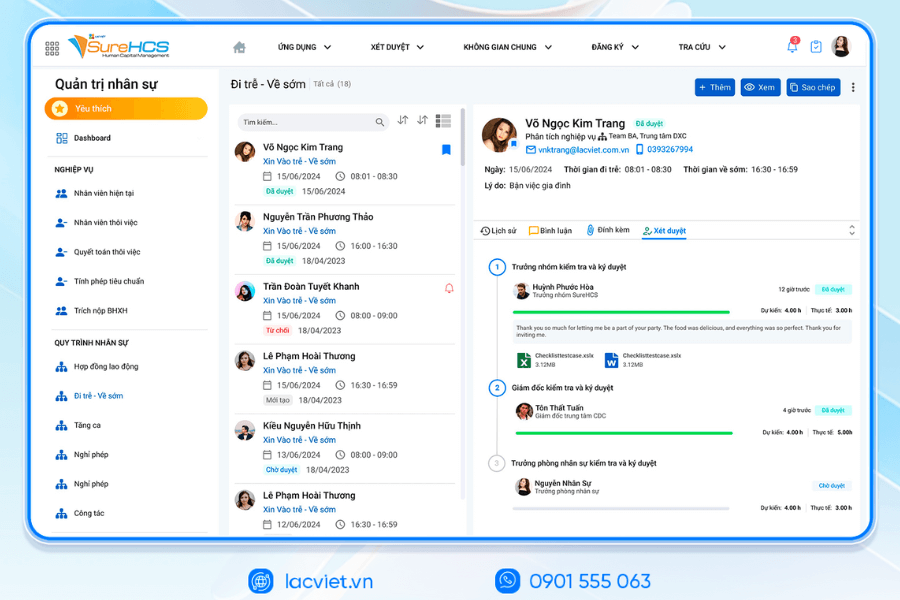

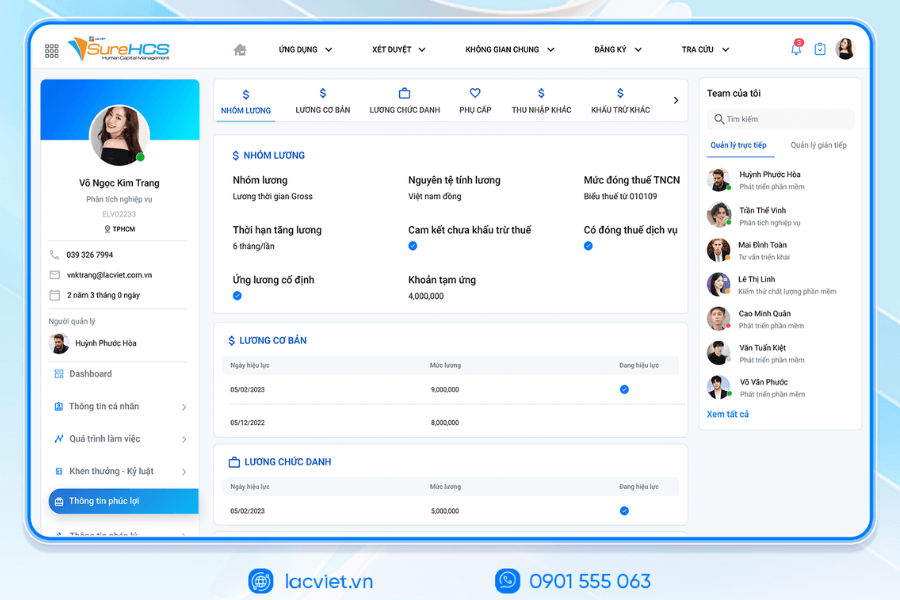

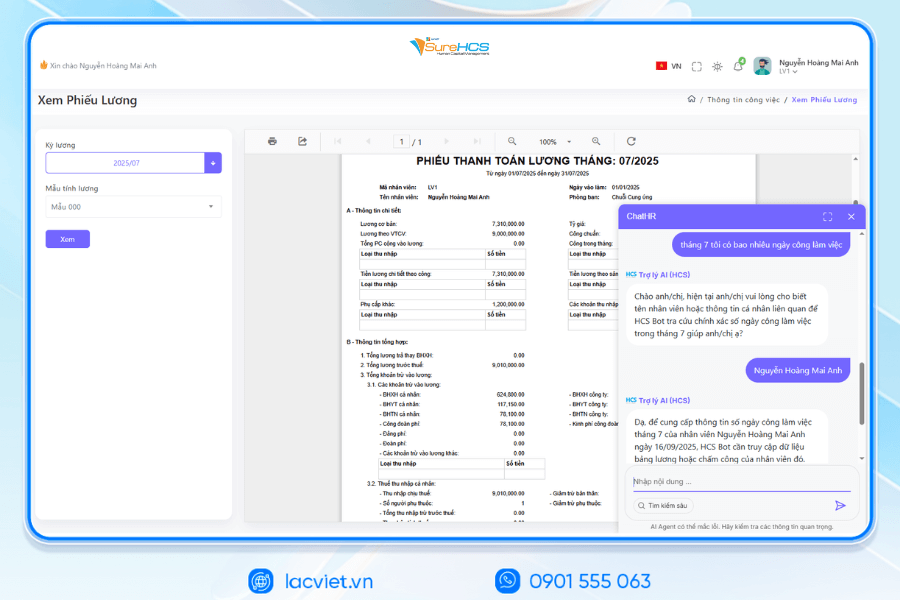

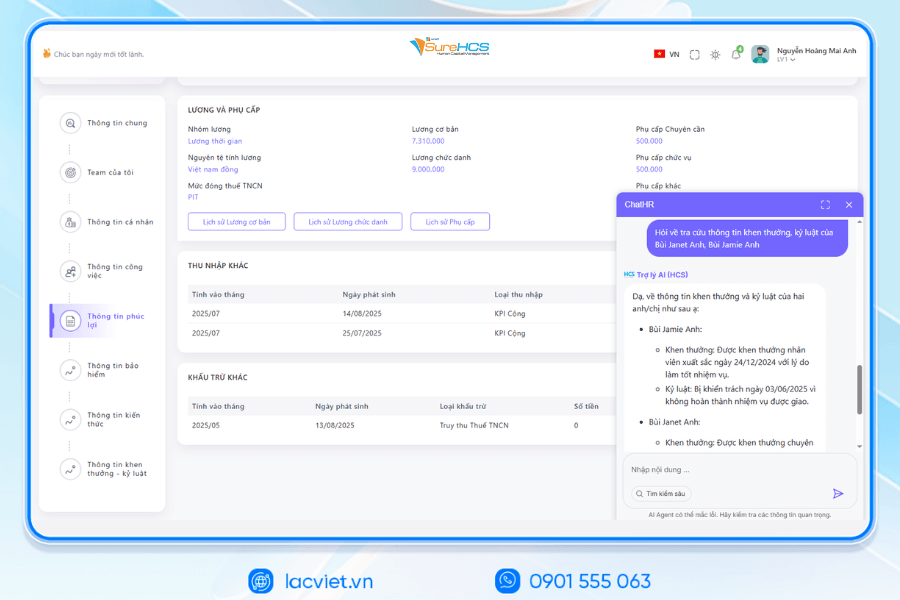

LV SureHCS HRM is solution human resources management the whole interface is designed to support enterprise organizations in the salary management, timesheet, allowances, bonuses, deductions from wages correctly efficiently. The software integrates full features, from payroll automatically, accounting and payroll costs, set up payroll, to prepare financial reports in accordance with the law, including circular 200.

With LV SureHCS HRMbusinesses can:

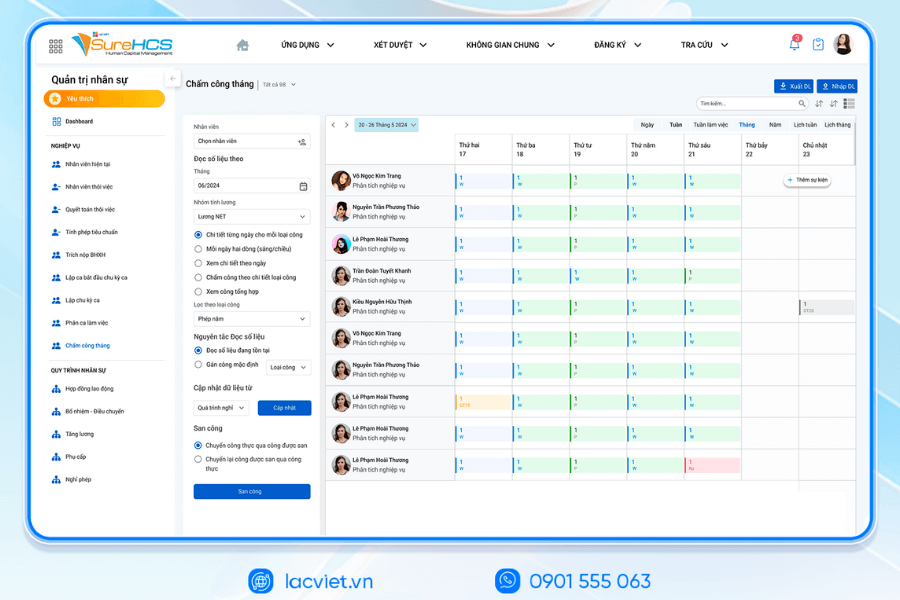

- Automatic salary calculation and accounting of wages: the System automatically aggregates the data and attendance, labor contracts, allowances, bonuses to calculate the salary actually received by each employee.

- Accounting of the cost of wages, deductions from wages: includes SOCIAL insurance, health INSURANCE, personal income tax, to help businesses comply with the law.

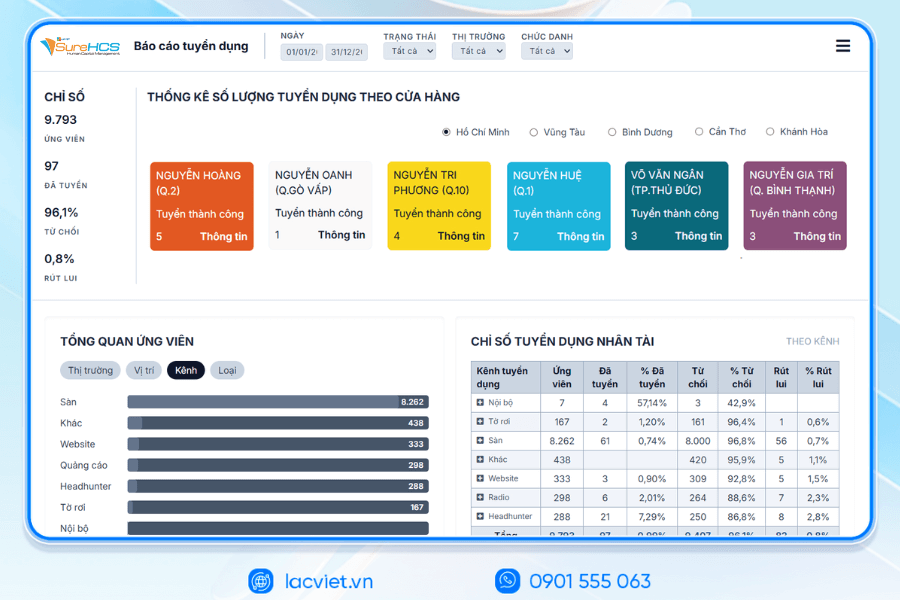

- Financial reporting quickly: the System generates periodic reports of salaries, personnel costs, deductions filed under payroll, accounting support and leadership decisions.

- Accounting for expenses paid by the circular 200: automatically apply the principles of account, wage, ensure compliance with regulations current accounting.

LAC VIET SUREHCS – HR MANAGEMENT SALARY C&B CUSTOM DEPTH FOR BIG BUSINESS

Lac Viet SureHCS is software HRM personnel management comprehensive, developed by Lac Viet – unit more than 30 years of experience in the field of management software business in Vietnam with international standards such as CMMI Level 3, ISO 9001:2015 and ISO 27001:2013.

SureHCS not only meet the professional personnel standards, which are designed to handle the hr – C&B – wages complex, large-scale, multi-company, multi-sector, in particular in accordance with FDI enterprises, corporations, factory, logistics, aviation, hotel, trade – in service.

The system is flexible deployment On-premise or as a custom model in depth, to help businesses automate the entire process hr – attendance – payroll – benefits – insurance, complete replacement job management using Excel discrete.

The module's core hr software lacviet SureHCS:

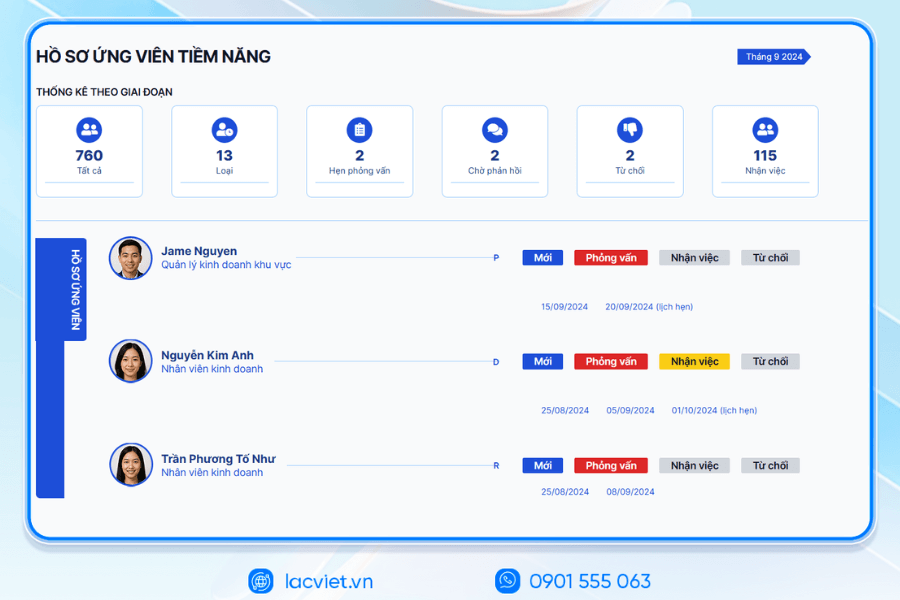

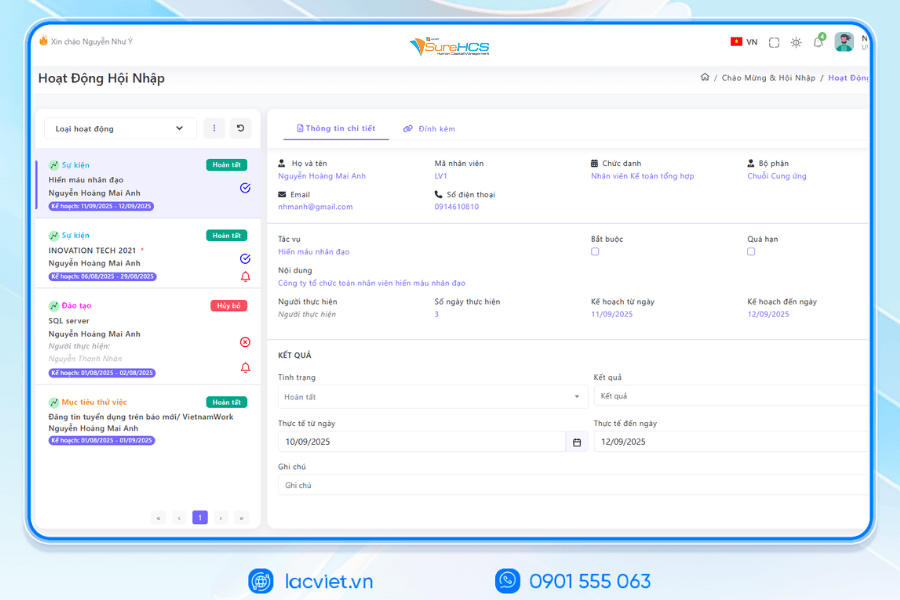

- The Recruit – Training: Management throughout the recruitment, integration, training, hr support and build the Talent Pipeline for large-scale enterprise.

- Port information & records Management personnel: Store personnel records, electronic focus, portal self-service for employees and contract labor power on the system.

- The timekeeper: Dots, multi-form (fingerprint, face recognition, Face ID, GPS, Wifi, online), connect many types of timekeeper, support attendance by the hour, shift flexibility for the plant, and hotels.

- The payroll & C&B: Automatic salary calculation according to many models (hour, shift, product, 3P, KPI performance...), link directly attendance data – performance – welfare, completely replace the salary calculator using Excel.

- Welfare – SOCIAL insurance – salary: Management benefits flexible, integrated iVAN connect SOCIAL and electronic Bank Hub salary automatically, support pay multi-currency for FDI.

INTEGRATED AI ACCELERATED CONVERSION OF HUMAN RESOURCES MANAGEMENT

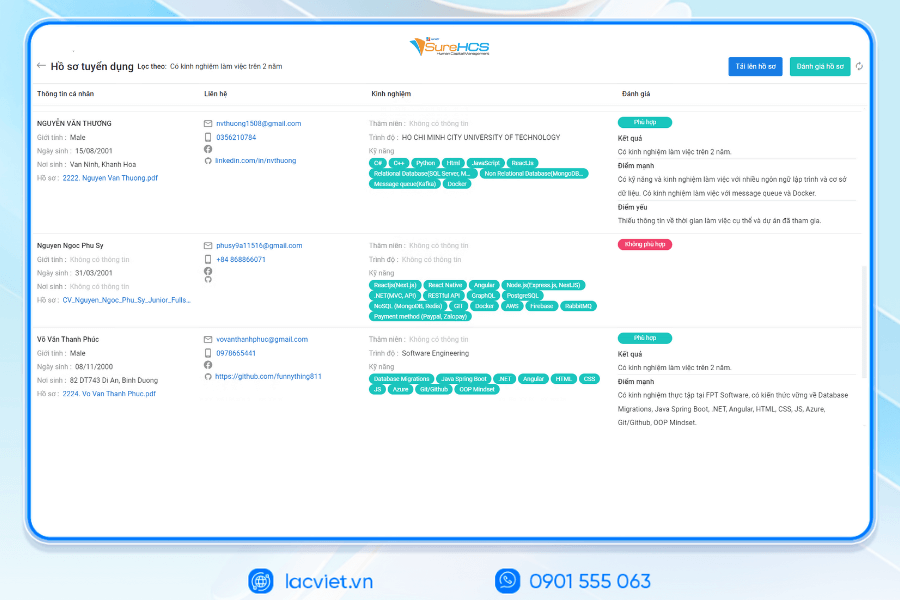

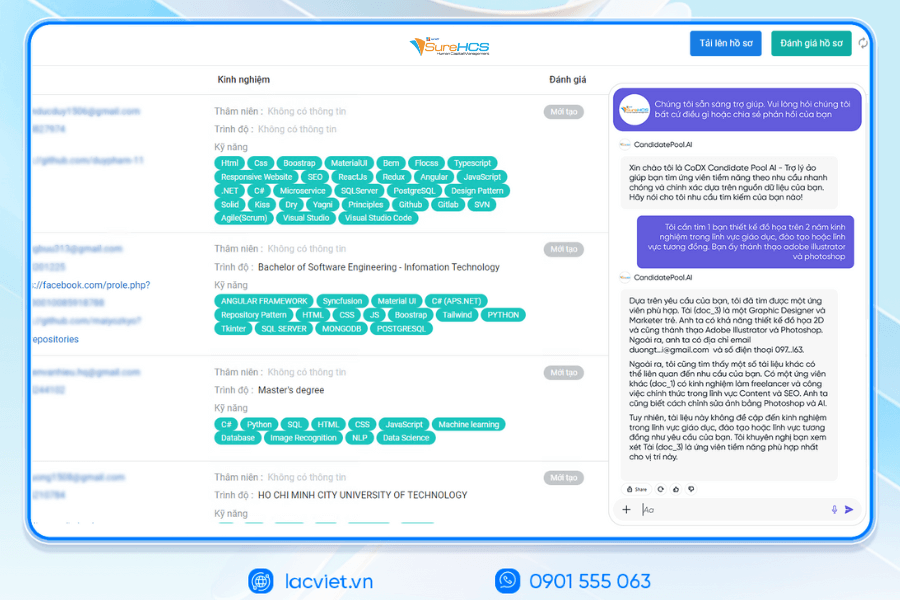

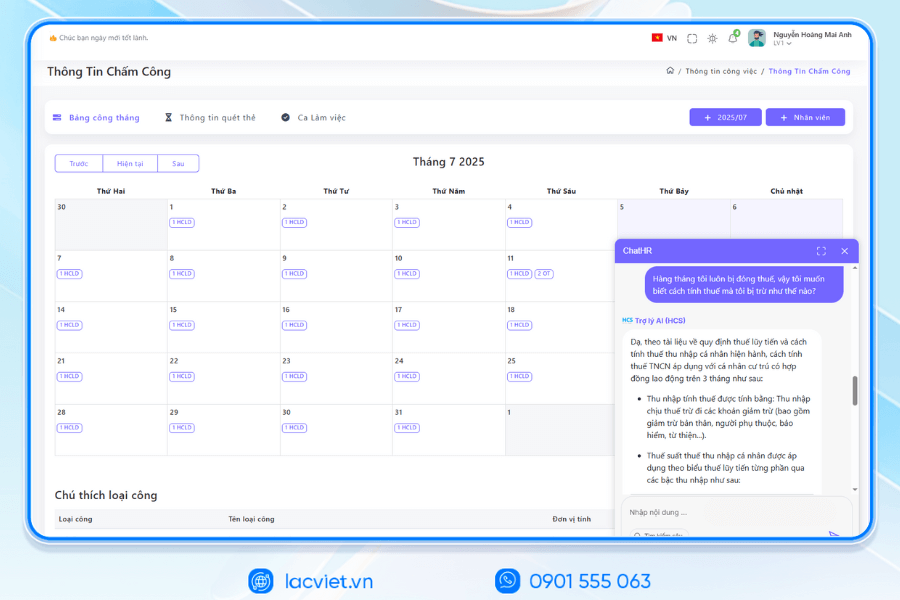

Lac Viet has officially launched The 3 AI assistant hr deeply integrated into the LV SureHCS including LV-AI.Docs, LV‑AI.Resume and LV‑AI.Help to automate the task administration, standardized data enhanced experience personnel

- LV‑AI.Docs: automatic dissection transfer data from documents such as CCCD, windows, SOCIAL insurance, by level of digital records, standardized

- LV‑AI.Resume: automatic dissection CV any format, analyst CV auto, construction, candidate profile, find people with the right criteria by prompt intelligent data mining candidate pool efficiency

- LV‑AI.Help: chatbot internal support, answer questions HR 24/7 access form process quick contextual user

TYPICAL CUSTOMERS DEPLOYING LV SUREHCS HRM

SureHCS are trusted and used by many large enterprises and leading corporations such as: Coca-Cola, Takashimaya, Textile SuccessfulPlastic Long Thanh Phu Hung Life, Airports of Vietnam (ACV)the business belonging to the SGCthe FDI enterprises in the fields of production, logistics, trade – in service.

- Coca-Cola Vietnam: System deployment LV SureHCS to digitize comprehensive human resource management group has standardized the data, the optimal operating HR according to international model.

- Textile company Success (TCM): Application LV SureHCS to manage hr, payroll, benefits, timekeeping and capacity profile for nearly 5,000 employees across 5 areas of activity – from textiles and fashion to real estate.

- Total company air Port, Vietnam (ACV): Choose to trust LV SureHCS to operate the system large-scale personnel with over 10,000 employees, 24 subdivisions, solved the problem of complex business of modeling state-owned companies.

SureHCS particularly suitable for:

- Large-scale enterprise, from 300 to 10,000 hr

- Corporations and enterprises multi-company, multi-branch

- FDI, manufacturing, factory, logistics, aviation should attendance – analysis ca – salary calculator complex

- Businesses are C&B peculiarities, need custom depth according to the actual operating

- Businesses are personnel management using Excel, many types of timekeeper, need automate the entire process

SIGN UP TO RECEIVE DEMO NOW

WHY BUSINESSES SHOULD CHOOSE TOUCH THE SUREHCS?

- Customized according to the actual business, no pressure mold as packaged software.

- Handle the personnel – salaries complex that many software HRM other does not respond.

- Deep understanding operated business English & FDI, ensure compliance with legal Vietnam (labour, SOCIAL insurance and personal income tax).

- Ecosystem integration strength: attendance – payroll – bank – SI – electronic contract.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: surehcs@lacviet.com.vn

- Website: https://lacviet.vn | www.surehcs.com

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

Accounting payroll is a core business in human resource management, accounting and business. When done correctly, the business not only ensure the rights of employees, compliance with the law on tax insurance, but also to optimize costs, improve the efficiency of personnel management.

Using the software LV SureHCS HRM helps the business organizations to automate the process of accounting of wages, deductions from wages reduce errors, save time and improve transparency in pay.