In operation personnel administration financial and accounting advance of wages to employees is an important profession that any business would also need to master. Implementing the right process accounting not only helps businesses ensure transparency in fund management salary, but also create peace of mind for workers when the benefits are clearly recorded.

The same Lac Viet find out details about accounting for advance salary in this article.

1. Accounting for advance salary for the employees?

Advance salary is the amount of money that the business pays in advance for the employee, usually based on practical needs (such as cost of living, the cost incurred unscheduled) and is deducted from the states official salary. This is a form of financial support, timely, express interest to the life of workers.

Accounting for advance salary is the process of recognition, reflecting the account of advance this in the bookkeeping of the business. In other words, this is step to ensure transparency and rationality in the management of the pension fund, to avoid confusion between the payments, at the same time to help businesses have the exact look about cash flow.

Practical example: A staff member please advance 5,000,000 previous pay period. Accounting'll accounting of this money on account of the advance (TK 141), when to pay official salaries, the amount of the advance will be deducted out of the total wages payable (TK 334). Thus, both the business and its employees understand cash flow and avoid disputes or errors later.

For businesses, the accounting advance salary standard also carries great significance:

- Financial management efficiency: control the amount of the off balance for cash flow operations.

- Reduce legal risks: by the rules of payroll, including advance, are clearly stipulated in The Labour code 2019 and circular no. 200/2014/TT-BTC.

- Increase the satisfaction of employees: when rights are guaranteed obviously, business is also at the same time strengthen credibility, professional image.

In other words, accounting for advance salary not only a professional accountant, but also as strategic solutions in hr management, direct impact on operational efficiency, the long-term commitment of the workforce.

2. Legal regulations related to advance on my salary

In order to ensure rights for workers, transparency in financial management, the accounting advance wages for employees who need strict compliance with the provisions of current legislation. This is the base helps the organizations and enterprises are to find out information about accounting for advance salary for staff to avoid legal risks, and to enhance their reputation in the labor relations.

2.1. The right to an advance of wages according to The Labour code 2019

According To Article 101, The Labour code 2019workers have the right to advance wages in some special cases, such as:

- When vacation every year: The labor is to advance an account of wages corresponding to the number of vacation days.

- When there are unscheduled event, the workers can deal with business to be the wage ago.

This reflects the principle: money, salary, not just income, but also a source of financial help workers secure life. So, the meet the requirements of the wage timely is the way show business social responsibility and attention to the staff.

2.2. Obligations of the business when employees request advance

Enterprises need to build a regulation clear about:

- Condition is advance: For example, staff have worked enough 1 month or more.

- Term advance level: typically ranges from 30-50% of the monthly salary.

- Repayment period: the amount Of the advance will be deducted in the pay period to the next.

If the business refuses without justifiable reasons, this may violate the principle of protecting the rights of labor. According to the report of the Organization the international Labour (ILO, 2023), approximately 46% of the labor in Asia said they encountered difficulties when approaching the account of advance wages or financial support from business, leading to financial stress and reduced work performance (source: ILO Global Wage Report 2023). This suggests a policy the reasonable wage is tool for businesses to enhance the satisfaction of employees.

2.3. Distinguished advance salary, pay loans

- Advance salary: Is the amount the employee received before then will be deducted from any official salary. This is not to cost more for business, which is only “advance” a part pension fund.

- Pay: Is paying full income for workers on the wage agreed upon in the contract.

- Internal loan: Is a form of loan by money, can be profitable or not, and are not specified in The Labour code. This case should have the loan contract independent, completely different than the advance salary.

The clear distinction between these concepts help businesses accounted for accurately, to avoid confusion in the financial statements, at the same time comply with the accounting standards (circular no. 200/2014/TT-BTC).

3. Accounting advance wages for employees in accounting

To perform the accounting of advance wages for employees correctly, businesses need to understand accounting accounts use, processing vouchers, how to record journal entries. This step is important helps to ensure financial transparency, avoid errors when the audit, at the same time support the organizations and enterprises are to find out information about accounting advance of wages to employees managing wages fund more efficiently.

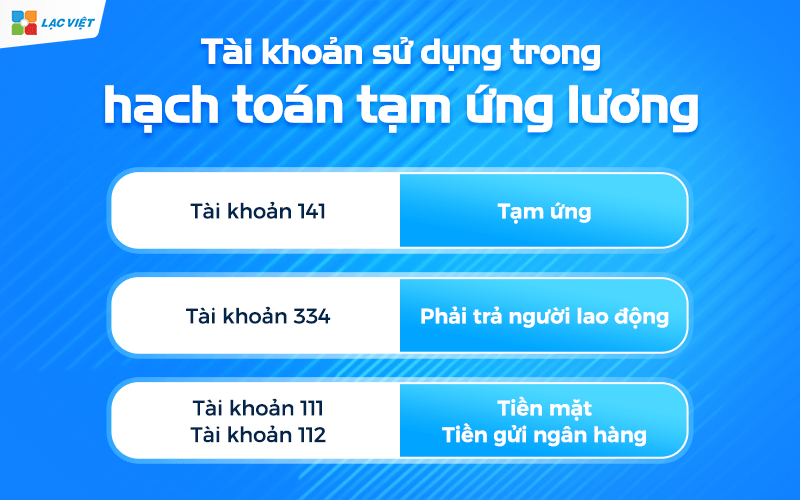

3.1. Accounts used in accounting

In the accounting system under circular no. 200/2014/TT-BTC, service advance salary mainly use:

- Account 141 – advance: Record the number of business cash advance for employees. This is considered as a sum of the short-term debt which the employee to reimburse through the deduction in salary next.

- Account 334 – pay workers: Recorded amount of salary, bonus and allowance that businesses have to pay for staff.

- Account 111 – Cash or 112 – bank deposits: to reflect the source of money real business cost the salary.

The relationship between these accounts can be understood simply as follows: When an advance on my salary, the money spent is recorded in 141 to follow. To pay period, the amount of the advance will be deducted from 334 (wages payable), ensure there is no difference in the total salary.

3.2. Process accounting for advance salary

A standard process usually consists of 3 steps:

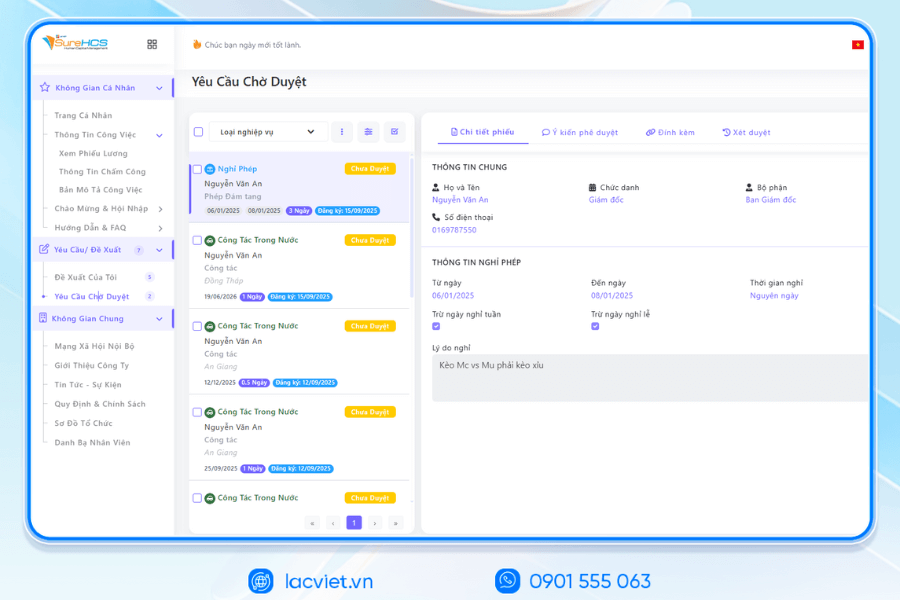

- Staff recommends advance: employees filing a provisional application, stating the reason and the desired amount.

- Approved voucher to spend money: the hr department/accounting test conditions, the board of directors for approval. Then set up payment cash or transfer.

- Recorded in the books accounting: accounting made pen payments into the account 141 and the related account, ensure your advance payment be tracked separately.

According to a survey by Deloitte 2023, have to 67% of enterprises have difficulty in controlling the account of advance wages, while still using the manual method in Excel (source: Deloitte Global Payroll Benchmarking Survey 2023). This indicates compliance with the accounting standards, applicable tools modern management is the key element to avoid deviations.

3.3. The accounting entries accounting for advance salary

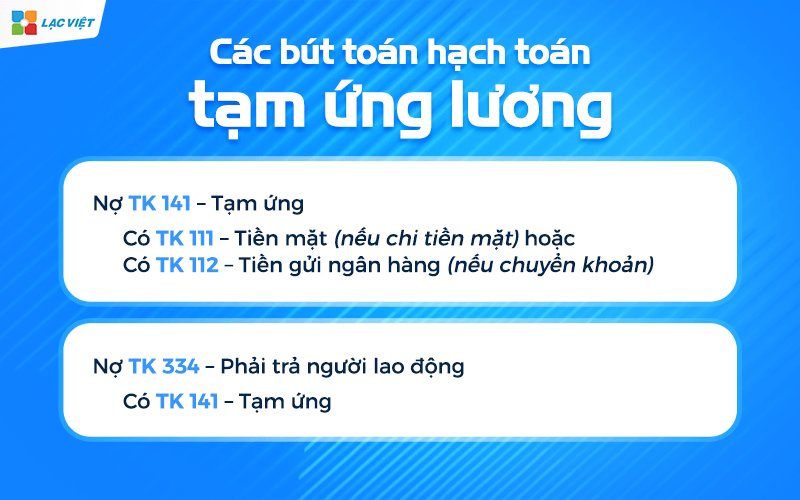

When professional advance in salary, accounting will be recorded as follows:

When the advance on my salary:

- Debt TK 141 – advance

- Have TK 111 – Cash (if paying cash) or TK 112 – bank deposits (if transfer)

When deducted from the wage next period:

- Debt TK 334 – pay workers

- Have TK 141 – advance

Illustrative example: Date 10/5, advance business for staff, A number of money 5,000,000 by bank transfer. Accounting recorded:

- Debt TK 141: 5.000.000

- Have TK 112: 5.000.000

To pay day 30/5, real wages of the employee A is 20,000,000. The accounting will exclude 5.000.000 has to advance, the journal noted:

- Debt TK 334: 5.000.000

- Have TK 141: 5.000.000

Results: employees A get 15,000,000 food received, at the same time the book accurately reflects the fund salaries and liabilities advance.

The correct application of these steps to help businesses:

- Avoid deviations in financial statements.

- Ensure transparency in pay salaries.

- Create trust where employees because management clearly and accurately.

- Salary 3P what is? Distance calculator & excel Template STANDARD construction systems salary 3P

- Understand correctly the deductions from salary to calculate correctly and manage effectively

- Accounting salaries and deductions from wages, standard circular 200

- How to build stairs payroll standard with excel template for business

4. Solutions manager salaries to software management personnel salaries Vietnam SureHCS HRM

In fact, many businesses have trouble processing accounted for advance salary for employees. If done manually using Excel, accounting have to enter data multiple times, easy to confuse the advance, official salary, not to mention the debt comparison between hr and accounting department typically takes more time. This is the reason the organizations and enterprises are to find out information about accounting for an advance on my salary should consider application system manager salaries.

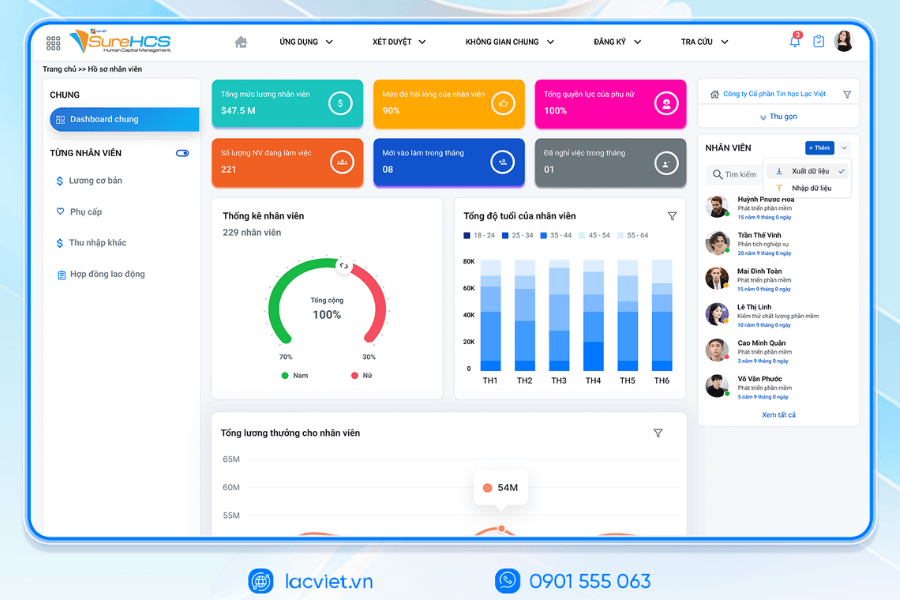

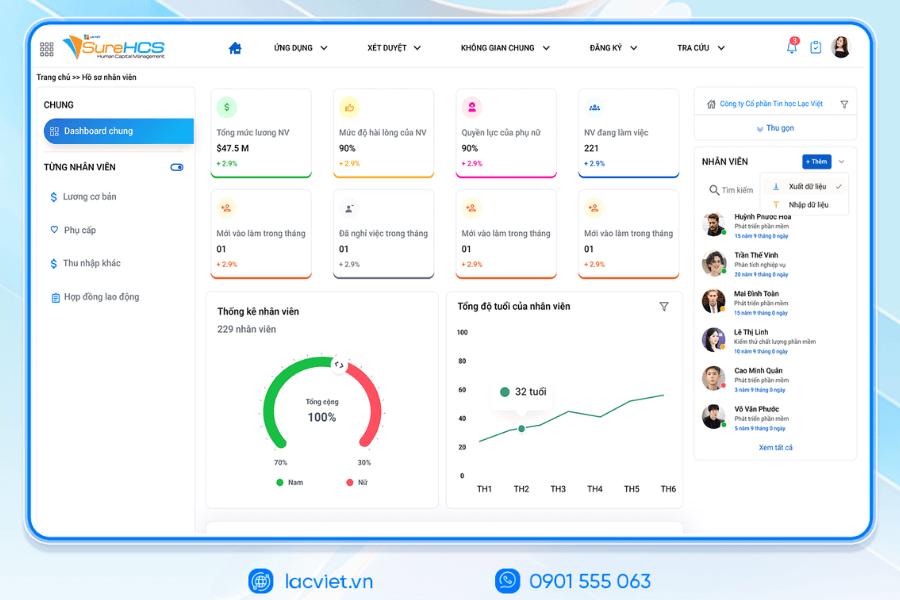

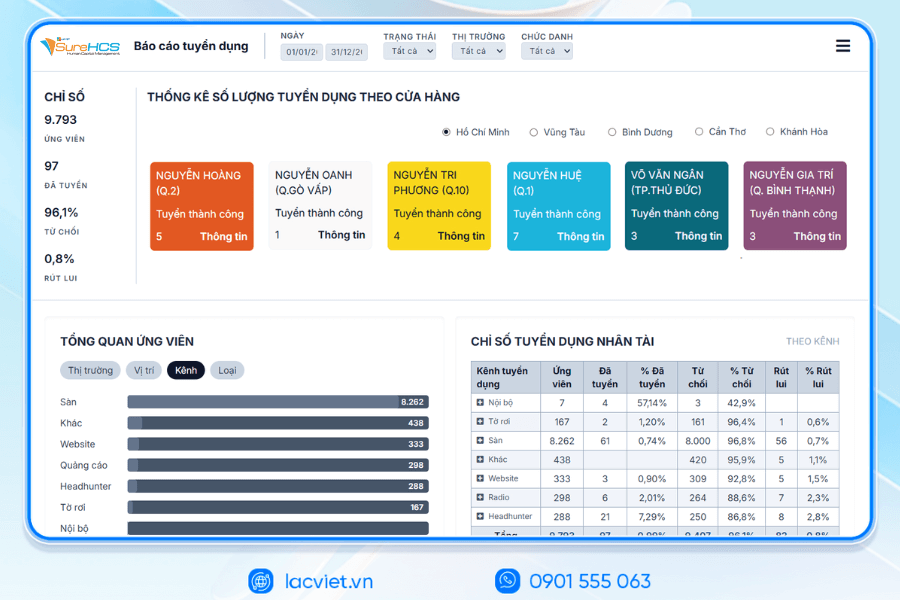

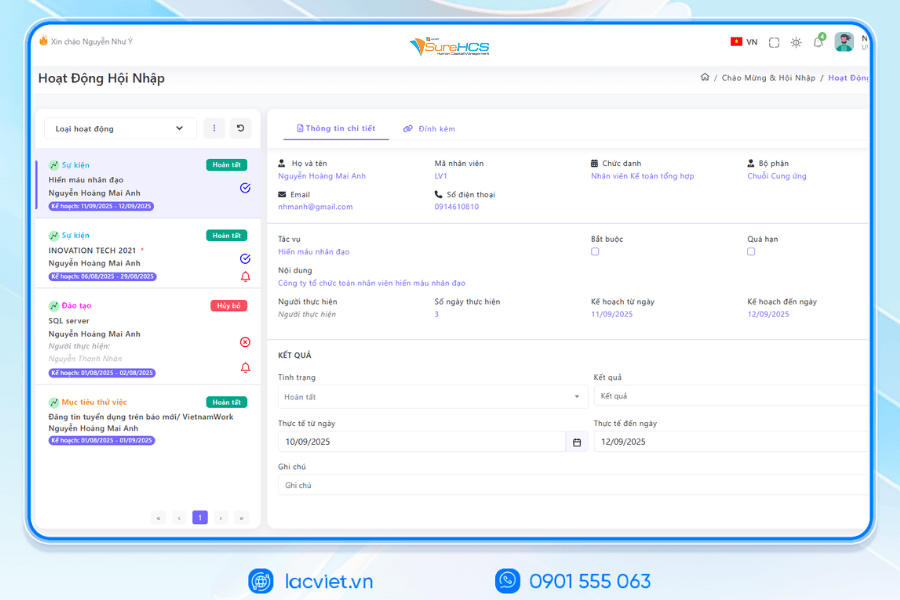

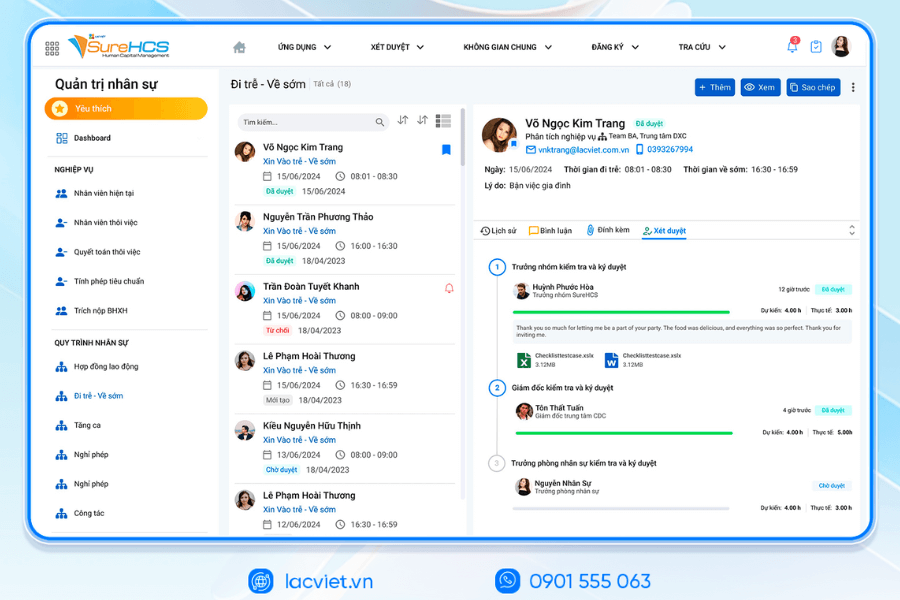

Softwares SureHCS HRM of Vietnam designed to automate the entire charging process, accounting salary. Specific:

- Automatic recognition pen advance payment – pay: When the business made in advance, the system will automatically create accounting entries, direct link with the monthly salary. Thus, while calculating a paycheck-end software automatically deduct the amount of the advance which do not need to enter the data again.

- Direct connection with the accounting system: SureHCS HRM has the ability to integrate with the accounting software downloads (as AccNet, MISA, SAP...), data is synchronized, limit deviations in financial statements.

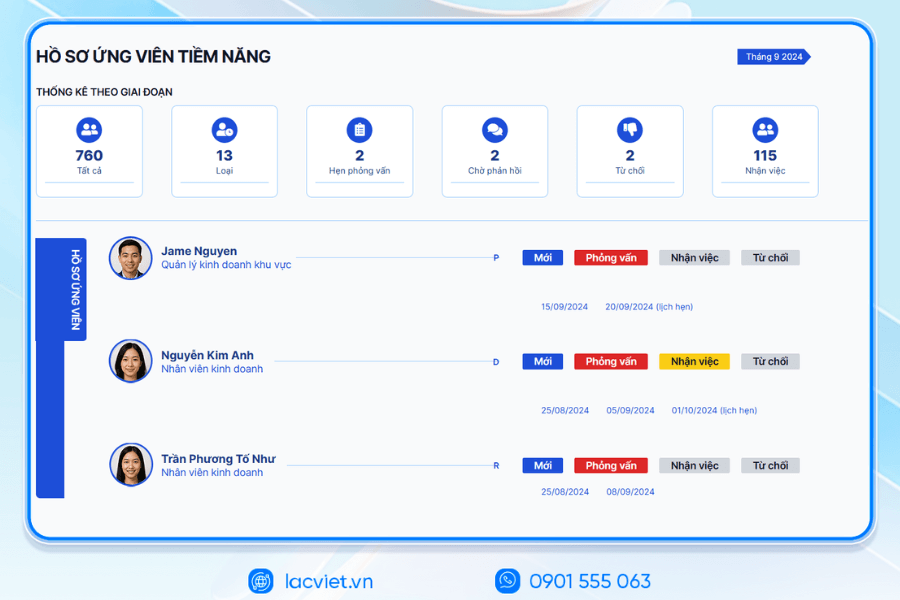

- Track the advance debt each employee: software support business management detail the number of times, amount and status advance according to each personnel, from that information transparency, easy for reference when need.

LAC VIET SUREHCS – HR MANAGEMENT SALARY C&B CUSTOM DEPTH FOR BIG BUSINESS

Lac Viet SureHCS is software HRM personnel management comprehensive, developed by Lac Viet – unit more than 30 years of experience in the field of management software business in Vietnam with international standards such as CMMI Level 3, ISO 9001:2015 and ISO 27001:2013.

SureHCS not only meet the professional personnel standards, which are designed to handle the hr – C&B – wages complex, large-scale, multi-company, multi-sector, in particular in accordance with FDI enterprises, corporations, factory, logistics, aviation, hotel, trade – in service.

The system is flexible deployment On-premise or as a custom model in depth, to help businesses automate the entire process hr – attendance – payroll – benefits – insurance, complete replacement job management using Excel discrete.

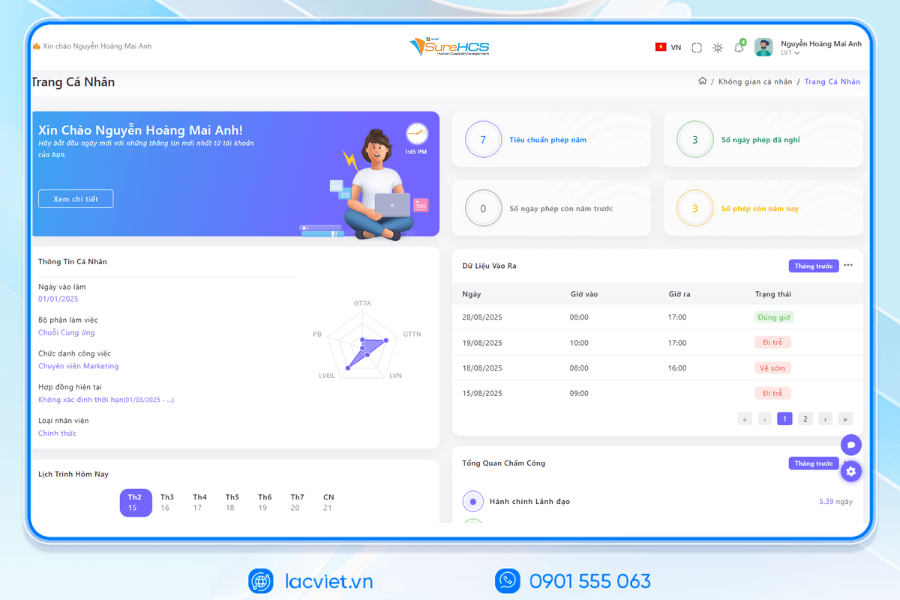

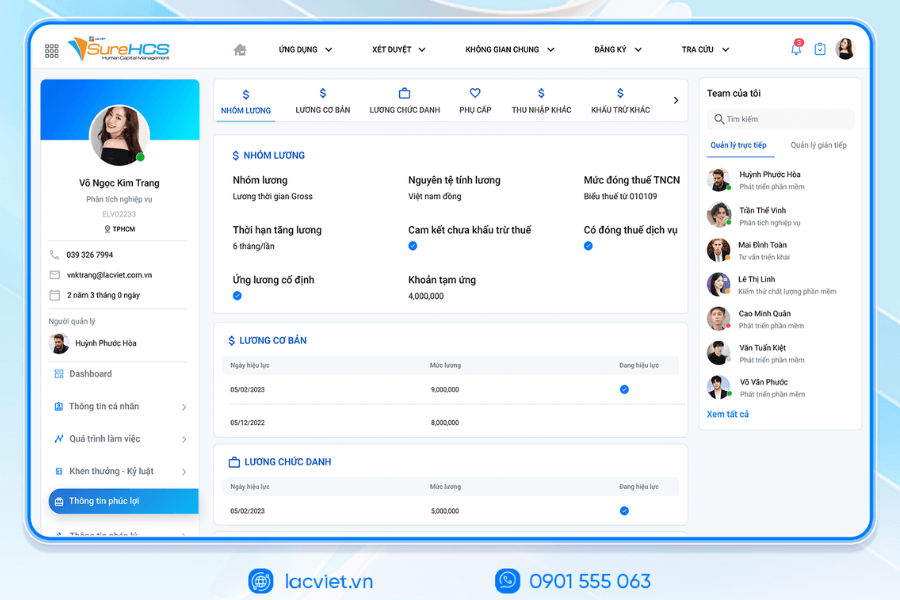

The module's core hr software lacviet SureHCS:

- The Recruit – Training: Management throughout the recruitment, integration, training, hr support and build the Talent Pipeline for large-scale enterprise.

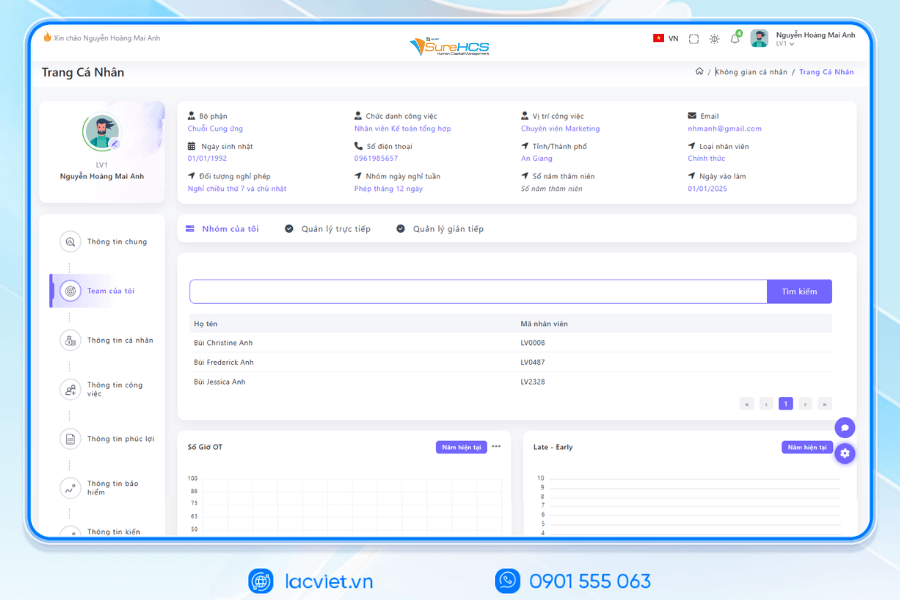

- Port information & records Management personnel: Store personnel records, electronic focus, portal self-service for employees and contract labor power on the system.

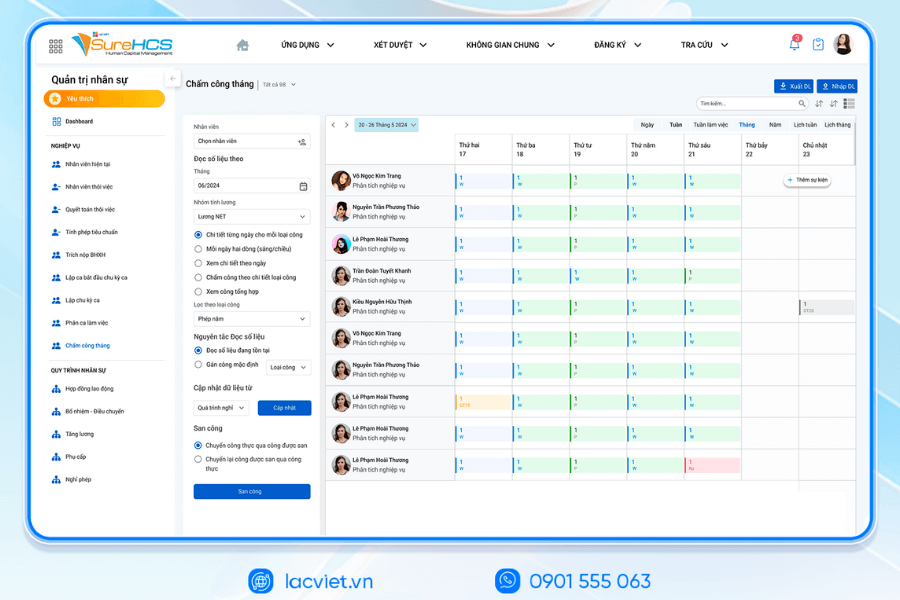

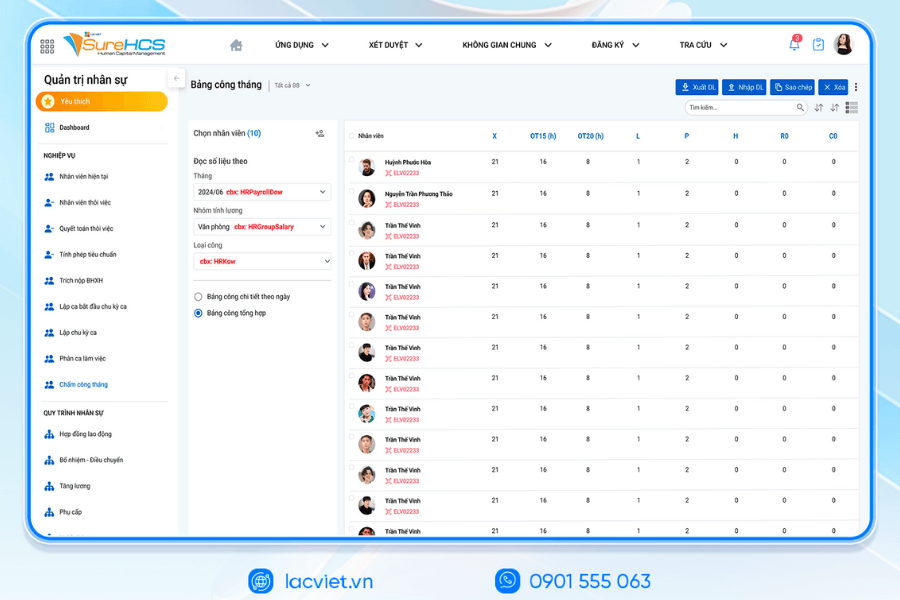

- The timekeeper: Dots, multi-form (fingerprint, face recognition, Face ID, GPS, Wifi, online), connect many types of timekeeper, support attendance by the hour, shift flexibility for the plant, and hotels.

- The payroll & C&B: Automatic salary calculation according to many models (hour, shift, product, 3P, KPI performance...), link directly attendance data – performance – welfare, completely replace the salary calculator using Excel.

- Welfare – SOCIAL insurance – salary: Management benefits flexible, integrated iVAN connect SOCIAL and electronic Bank Hub salary automatically, support pay multi-currency for FDI.

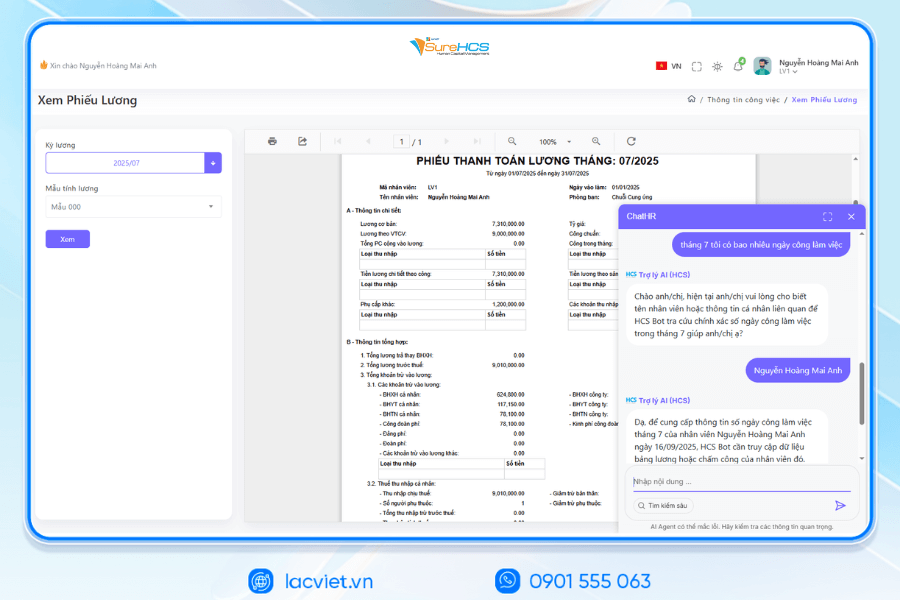

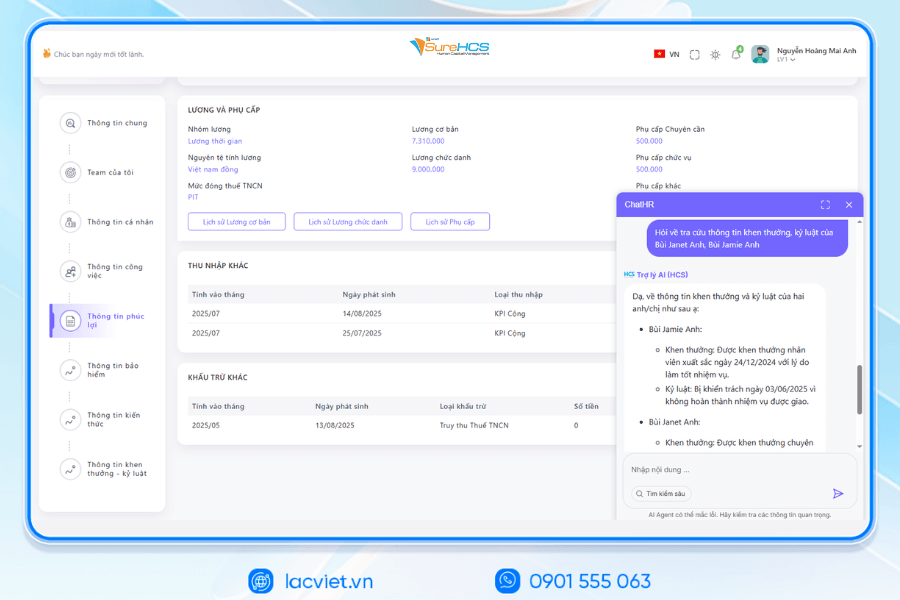

INTEGRATED AI ACCELERATED CONVERSION OF HUMAN RESOURCES MANAGEMENT

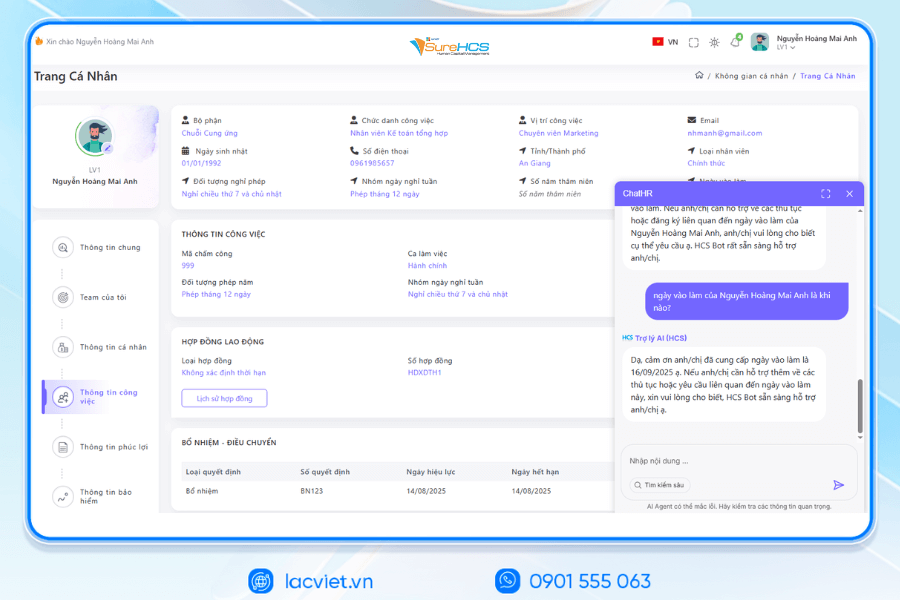

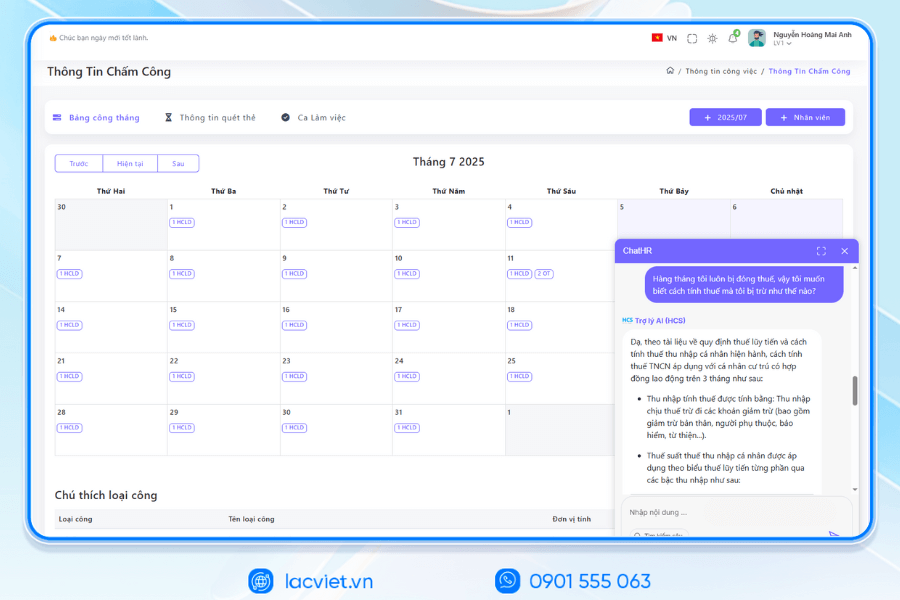

Lac Viet has officially launched The 3 AI assistant hr deeply integrated into the LV SureHCS including LV-AI.Docs, LV‑AI.Resume and LV‑AI.Help to automate the task administration, standardized data enhanced experience personnel

- LV‑AI.Docs: automatic dissection transfer data from documents such as CCCD, windows, SOCIAL insurance, by level of digital records, standardized

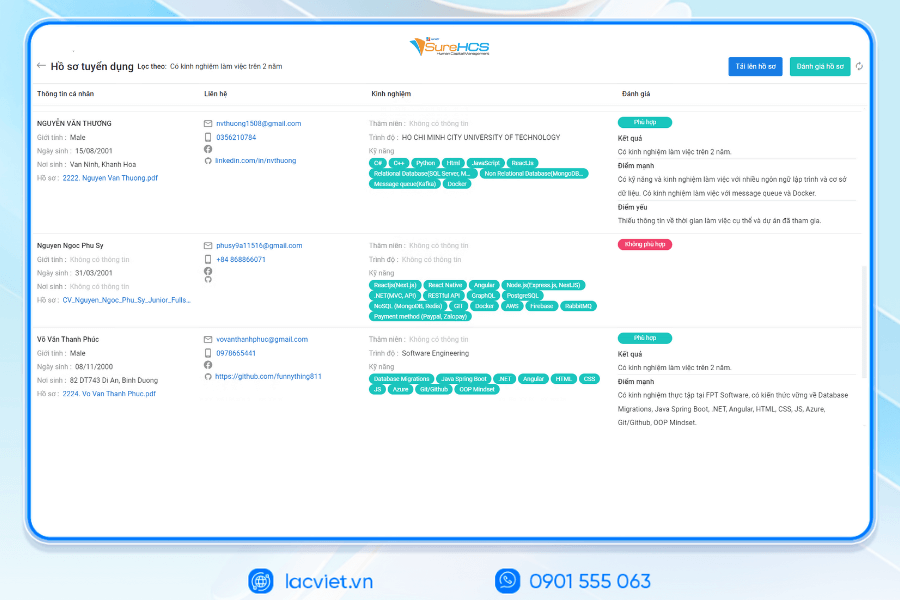

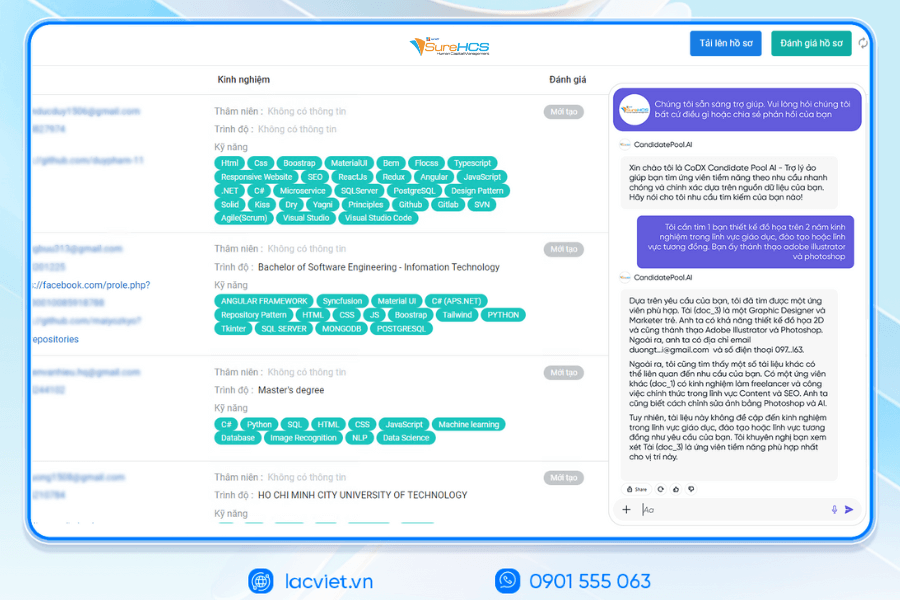

- LV‑AI.Resume: automatic dissection CV any format, analyst CV auto, construction, candidate profile, find people with the right criteria by prompt intelligent data mining candidate pool efficiency

- LV‑AI.Help: chatbot internal support, answer questions HR 24/7 access form process quick contextual user

TYPICAL CUSTOMERS DEPLOYING LV SUREHCS HRM

SureHCS are trusted and used by many large enterprises and leading corporations such as: Coca-Cola, Takashimaya, Textile SuccessfulPlastic Long Thanh Phu Hung Life, Airports of Vietnam (ACV)the business belonging to the SGCthe FDI enterprises in the fields of production, logistics, trade – in service.

- Coca-Cola Vietnam: System deployment LV SureHCS to digitize comprehensive human resource management group has standardized the data, the optimal operating HR according to international model.

- Textile company Success (TCM): Application LV SureHCS to manage hr, payroll, benefits, timekeeping and capacity profile for nearly 5,000 employees across 5 areas of activity – from textiles and fashion to real estate.

- Total company air Port, Vietnam (ACV): Choose to trust LV SureHCS to operate the system large-scale personnel with over 10,000 employees, 24 subdivisions, solved the problem of complex business of modeling state-owned companies.

SureHCS particularly suitable for:

- Large-scale enterprise, from 300 to 10,000 hr

- Corporations and enterprises multi-company, multi-branch

- FDI, manufacturing, factory, logistics, aviation should attendance – analysis ca – salary calculator complex

- Businesses are C&B peculiarities, need custom depth according to the actual operating

- Businesses are personnel management using Excel, many types of timekeeper, need automate the entire process

SIGN UP TO RECEIVE DEMO NOW

WHY BUSINESSES SHOULD CHOOSE TOUCH THE SUREHCS?

- Customized according to the actual business, no pressure mold as packaged software.

- Handle the personnel – salaries complex that many software HRM other does not respond.

- Deep understanding operated business English & FDI, ensure compliance with legal Vietnam (labour, SOCIAL insurance and personal income tax).

- Ecosystem integration strength: attendance – payroll – bank – SI – electronic contract.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: surehcs@lacviet.com.vn

- Website: https://lacviet.vn | www.surehcs.com

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

Clearly, accounting for advance salary if based only on method will be difficult to avoid errors take more resources to handle. The application software manager salary not only help automate processes to ensure the accuracy of transparency but also bring long-term value for the business in controlling costs and improve satisfaction of employees. If your business is looking for a comprehensive solution, safety standards, it was time to weigh system deployment hr software to create a new step in the human resource management – financial.