Businesses can control the cash flow, cost – benefit, but if the inventory is “error rate”, the entire spinning reels operate will be deflected. In many businesses, especially manufacturing enterprises – commerce, inventory accounts for a large proportion in total assets, at the same time directly affect the cash flow and business performance. However, many businesses still see the light accounting, inventory, stopping only in the recording number which lack a strategic point of view as well as financial transparency.

The article below Lac Viet will help businesses clearly see the nature, the process, how accounted for, especially the numerical solution of effective to manage accounting and inventory in a professional way exactly flexibility in all market situations.

1. Overview of inventory accounting

1.1 accounting what is inventory?

Inventory accounting is the process to track and reflect the quantity and value of goods, raw materials, finished products and tools that businesses are holding in stock at this particular moment. This is an integral part of the system accounting can help businesses know they are nothing corresponding value out why.

Why is inventory important in business?

Inventory usually occupy a large proportion in the total assets of the business, especially with the unit operation in the field of production, trade, logistics. The managers do not closely can lead to:

- Shortages of raw materials, production interruptions;

- Inventory stagnant, wasting, the cost of storage increase;

- Deviations in financial statements, affect the governance decisions.

Therefore, business accounting, inventory plays a central role in controlling expenses to ensure effective operation and faithfully reflect the financial situation of enterprises.

Objects should be of interest to accounting inventory

- Accounting department: responsible for the recognition, establishment inventory report periodically.

- Parts inventory management: work closely with accounting to update the status of the actual commodity.

- Leadership: need information, inventory accuracy to a decision to enter orders, production, sales fit.

1.2. Role of inventory accounting in business

- Support control the flow of goods and materials: Through the accounting system, inventory, businesses can track the flow of goods out – to each day. This control helps to limit the maximum loss, confusion, and increase transparency between the relevant departments such as accounting, inventory, purchasing, production.

- Base to assess the operational efficiency of production, business: Inventory reasonably reflects the ability to coordinate goods and cash flow efficiency. If goods backlog too much, not rotating fast will lead to high capital costs, on the contrary, if the inventory too little can cause loss of business opportunity. From accounting data warehouse, business easily evaluate the effective use of resources, improved manufacturing processes, optimize inventory turnover ratio – a key indicator in financial analysis.

- Ensure transparency, accuracy in financial reporting: Accounting inventory helps record the exact value of the goods at the time of preparation of financial statements according to accounting standards and regulations (circular 200 or 133). This is extremely important when businesses need to present data to the tax authorities, shareholders or partners. The errors in the inventory recorded not only affects the profit targets that can lead to legal risk if the tax arrears of the declaration inaccurate.

- 10+ ERP Management Accounting Software with AI Compliant with Circular 99/2025 for Vietnamese Businesses

- 9 Accounting Software online cheap cost reduction for small and medium ENTERPRISES

- Inventory inventory done when? Regulation process & optimization methods

- Download report template inventory excel file/ggsheet ADEQUATE for the business

2. Accounting process inventory circular 200 and 133

Để đảm bảo kiểm soát hàng tồn kho hiệu quả tuân thủ quy định kế toán hiện hành, các doanh nghiệp cần thực hiện đầy đủ quy trình kế toán hàng tồn kho theo hướng dẫn trong Thông tư 200 và 133 của Bộ Tài chính.

Dưới đây là các bước cơ bản trong quy trình kế toán tồn kho:

Step 1. Establishment votes input – output – inventory

Each of the services warehouse import or export warehouse, accountants need to coordinate with warehouse to import receipts or warehouse in the prescribed form. The votes this should be made clear in the following information: name of goods, quantity, unit price, total value, the reasons for import/export, user – recipients – the establishment votes.

For example, When companies buy raw materials, parts purchase, delivery of documents for accounting, then the accounting establishment receipt to record the number of raw materials increase in the inventory account 152.

Step 2. Accounting into account 152, 153, 156 according to each profession

Depending on the nature of goods, accounting of use of the account in accordance:

- TK 152: Raw materials

- TK 153: tools

- TK 156: goods

The accounting must be based on votes income – purpose invoice certificate from the root. In this process, the accountant should determine the correct object recognition and corresponding values to ensure accuracy.

Illustrative examples:

- When purchasing goods worth $ 50 million (excluding VAT), accounting record:

Debt TK 156: 50.000.000

Debt TK 1331: 5.000.000

Have TK 331: 55.000.000

- When goods sold to the customer:

Debt TK 632 (cost of sales)

Have TK 156 (value of stock)

Step 3. Update details window – ledger

After the accounts, record transactions, accounting need to update:

- Window details inventory: Keep track of each item, each stock, accurately reflect the number and value according to each moment.

- Ledger accounts, 152, 153, 156: To synthesize the increased volatility – up in the states.

The update details window often helps the business to control inventory effectively, avoid losses, waste and grounded analysis of the price of capital accurately.

Step 4. Collated with actual data periodically (inventory)

The end of each accounting period or upon request, the business must conduct an inventory of the actual inventory at the warehouse. Inventory results will be collated with the data of the books to detect the difference (if any) as the excess, deficiency, loss, damage,...

If the detected difference, the accountant should record the inventory, make accounting adjustments in accordance with the regulations in circular 200 or 133.

For example, If inventory items missing due to natural shrinkage, the accountant can record:

Debt TK 632 (price of capital)

Have TK 156 (goods)

Step 5. Set up inventory report, notes to FINANCIAL statements

The end states general accounting data to set the type of inventory report, including:

- Table synthetic import – export – inventory item code

- Balance sheet: Reflect inventory at targets 140

- Notes to financial statements: presentation of detailed policy, accounting, inventory, pricing methods, inventory, handle the difference...

Inventory report not only serves the purpose of settlement tax, auditing, but also help the leader board decision to enter orders, regulate the production or distribution that fits.

3. Accounting accounting and inventory circular 200

3.1. Overview of inventory circular 200

According to Article 23 of Circular 200inventory includes:

- Materials (NVL)

- Tools (CCDC)

- Goods in transit

- Goods (for commercial enterprise)

- Finished products, semi-finished products (manufacturing business)

- The cost of production, unfinished business

Principles noted: inventory is recorded at cost and are accounted for according to the method declaration, regular or inventory periodically (due to business choice, but must be consistent).

3.2. Account used when accounting for inventory

| Account | Account name | Function |

| 151 | Goods in transit | Record the receipt of goods purchased but not yet warehousing |

| 152 | Raw materials | Track the price value NVL in stock |

| 153 | Tools | Track the price value CCDC in stock |

| 154 | The cost of production, unfinished business | Set the cost to calculate the cost of products produced unfinished |

| 155 | Finished products | The finished product, enter the pending sale |

| 156 | Goods | Use for commercial business – goods warehousing for resale |

| 157 | Goods on consignment | Goods sent to agents, branch but not yet identified as sold out |

| 611 | Purchase (only used if the business select inventory periodically) | Record the cost of purchases in the period when using a method of inventory periodically |

3.3. Accounted for by the method of

This is the most common method in accordance with enterprise-scale, medium and large. Here are a number of services typical:

Purchase of raw materials, goods warehousing

- Debt 152, 153, 156

- Debt 133 (if VAT is deducted)

- There are 111, 112, 331 (depending on payment method)

Cumshot NVL for production, or export of goods sold

- Debt 154 (if for production)

- Debt 632 (if for sale)

- There are 152, 153, 156

Enter the warehouse of finished products after finishing production

- Debt 155

- 154

The shipping cost of after sales

- Debt 632

- There are 156, 155 (if the goods or finished products)

3.4. Method of determining the price of stock

Circular 200 allows business to select one of the following methods to calculate the value of inventory used or sold:

- Method the weighted average (by month or by time)

- The method first in – first out (FIFO)

- Method enter the following – prerendered, (LIFO)

- Methods the destination list (used in business have merchandise peculiarities, easy to follow plot)

Note: Businesses must register method, apply and maintain consistency in accounting.

3.5. A number of important note when accounting for inventory

- For goods and raw materials purchased but not yet about the end of the period, need accounted for in TK 151 and only switch to 152/156 when receiving goods practice.

- The cost of shipping, handling, shrinkage in the rate is calculated on the original inventory.

- Inventory loss of product quality, damage exceeds the need to make a record, handle and can be recorded in other expense (TK 811) or discounted capital depending on the case.

4. Accounting accounting and inventory circular 133

Below is a guide to accounting for inventory under Circular 133/2016/TT-BTCapply for the small and medium enterprises (SMES) according to the accounting of the Ministry of Finance.

4.1. Overview of inventory circular 133

As prescribed in circular 133, inventory include:

- Materials (NVL)

- Tools (CCDC)

- Goods

- Unfinished products

- Finished products

- Production costs unfinished business

Business can choose one of two methods of inventory accounting:

- Method of

- Methods of inventory periodically

However, circular 133 recommended to apply the method declaration regularly for compliance with requirements management, update statistics police more realistic.

4.2. Account used when accounting for inventory under TT 133

Other than circular 200, circular 133've streamlined and collect an account number, to help simplify the process of accounting. Specific:

| Account | Account name | Function |

| 152 | Raw materials | Track NVL in stock |

| 153 | Tools | Track CCDC inventory |

| 154 | The cost of production, unfinished business | Set the cost of production to calculate the price of |

| 155 | Finished products | Recorded-finished products warehouse after production |

| 156 | Goods | Track the goods purchased for sale (often used in commercial ENTERPRISES) |

| 611 | Purchase (use only if applicable inventory periodically) | Set the cost of buying goods in the states |

Note: do Not use the account 151 (Goods in transit), which accounted directly to 152 or 156 when there is full invoice vouchers.

4.3. Accounting inventory according to the method of

Declaration method often helps constantly updated fluctuations of inventory, reflecting the fact and in accordance with business needs inventory control closely.

Purchase of raw materials, goods warehousing

- Debt 152, 156

- Debt 133 (if VAT is deducted)

- There are 111, 112, 331 (depending on payment method)

Production raw materials for production

- Debt 154

- 152

Warehousing of finished product

- Debt 155

- 154

Export of goods to sell

- Debt 632 (cost of sales)

- 156

Revenue recognition sales

- Debt 111, 112, 131

- There are 511, 3331

4.4. Accounted for by the method of inventory periodically

Fit small business, less incurred and no need to update inventory regularly. Accordingly:

- In the states, not accounting of import – export warehouse

- End of the period, to conduct an inventory of fact and determine inventory last states, from which calculates the price of capital as follows:

The price of capital = inventory the beginning of the period + Purchase in – inventory end of period

Final accounting:

- Debt 611

- There are 152, 156

4.5. The method of calculating the price of stock circular 133

Businesses are allowed to select 1 of the 3 following methods:

- Weighted average

- First in – first out (FIFO)

- Purpose of the

The methods chosen need to apply consistency in the financial year and in accordance with the characteristics of goods management process of the business.

4.6. A note on accounting for inventory under circular 133

- The original price of the inventory include: purchase price, cost of transportation, unloading, insurance, trade discount (if have).

- Case has damaged, the loss exceeds the must have written and handled in accordance with accounting on other expenses (TK 811) or burn up the inventory value.

- With tools and supplies worth big can allocate gradually over many states after the user (via TK 242 – prepaid Expenses).

5. The method of inventory accounting downloads

Accounting inventory not only is the recorded number of goods but also related to the way that reflects the value of goods out – on correctly aligned. Thus, depending on the operational characteristics, the scale industry, each business can choose one or a combination of the method of inventory accounting below to ensure efficiency and compliance with regulations.

5.1. Method of

Method declaration is often the way recorded continuously transactions related to inventory on the ledger. Every time there is professional import – export warehouse (import of raw materials, production, sales, export user...), accounting have to update now.

Illustrative example: entering 100 beverage cartons in stock, accounting recorded an increase in inventory during the day. When sold out 30-barrel system, recorded export warehouse and reduced the number of values, respectively.

| Advantages | Restrictions |

|

|

5.2. Methods of inventory periodically

With the method of inventory periodically, business not recorded inventory often. Instead, just make actual inventory at the end of the period (usually the end of the month or quarter). Value of stock is calculated by the formula:

The first viable states + Enter in – The-end = Export warehouse in the states

Suitable with any business?

- Small-scale business, with little variation warehouse.

- No conditions or needs to track inventory in detail by day.

| Advantages | Restrictions |

|

|

5.3. The method of calculating the price of stock

In accounting, inventory, determining the value of goods of stock directly affects the price of goods sold, profit, financial reporting. There are many ways to calculate the price of stock, the most common include:

- Method weighted average

Value of stock is calculated according to the average price of inventory at each time point. Businesses can, on average, by month, or after each item entry.

For example, Business income of 100 product price 10,000 and then enter the next 100 products price 12.000 copper. The average price is 11.000 copper. When the warehouse, every products is calculated according to this price.

Pros: simple, easy to apply to the goods the most.

Limitations: do Not accurately reflect the price movement if price earnings change much.

- The method first in – first out (FIFO)

Bonded goods before will be output first. Price of stock is the price of the shipment to enter first.

Pros: Reflects the cost of monitoring the actual value of the goods older.

Limitations: In the period of price increases, FIFO makes profits high accounting, tax payable may increase accordingly.

- Method enter the following – prerendered, (LIFO)

Import the following is output first. Price of stock is the price of a shipment, enter the most recent.

Pros: LIFO help reflect the price of the capital close to the current market, often fits in the inflationary phase.

Restrictions: No longer are accepted in a number of accounting systems internationally.

- Rating method, purpose of the

Business determine the specific shipment to be going, and how much.

For example, a company selling mobile phones, have the product code, IMEI number private. When selling a car, the accountant recorded properly by price, enter the original.

Pros: accurate, absolute, consistent with high-value goods, identifying separately.

Limitations: Not suitable for goods in large numbers, homogeneous.

Important note: The choice of method of inventory accounting should be based on the characteristics, operation, system accounting software are using as well as requires internal administration. At the same time, enterprises need to ensure compliance with accounting standards in Vietnam (VAS)the general guidance is as circular 200 or circular 133.

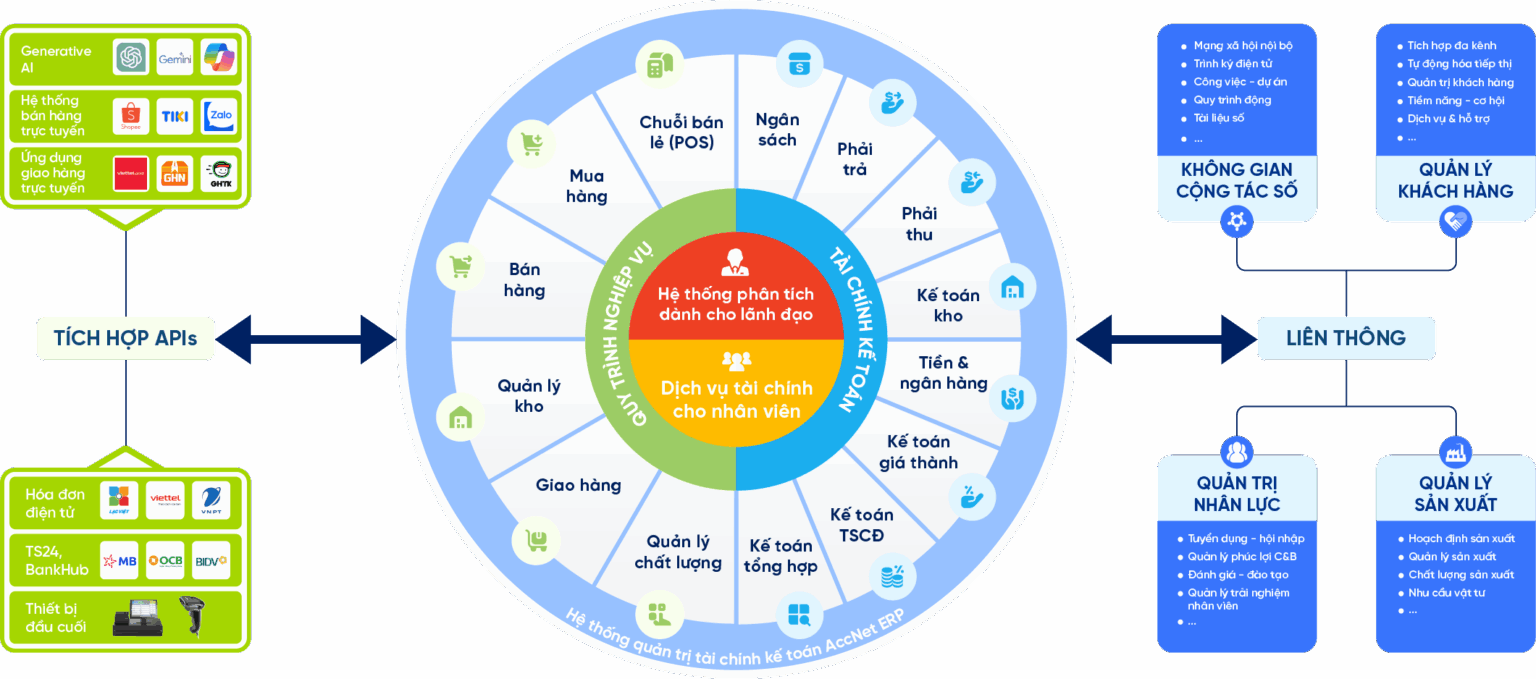

ACCOUNTING SOLUTIONS ACCNET ERP INTEGRATED AI AUTOMATE ALL BUSINESS

AccNet ERP is a software solution financial accounting integrated in the management system, comprehensive enterprise, which is developed by Lac Viet corporation. Difference highlights of AccNet ERP is the app artificial intelligence (AI) in many accounting process to help businesses:

- Automation of accounting and classified documents.

- Improving the accuracy in data control.

- Shorten processing time business accounting – financial.

Thanks to that, AccNet ERP not only is support tool but also a “smart assistant” with the business in financial management transparent effect.

Feature highlights:

✔️ Automatic accounting vouchers, collate public debt thanks to AI.

✔️ Manage your finance – accounting multi-branch, multi-subsidiary.

✔️ Financial statements consolidated standards of Vietnam & international (VAS, IFRS).

✔️ Cash flow management, budgeting, forecasting the exact cost.

✔️ Connect with the manure management system, hr, production, sales to sync data.

✔️ Integration of AI in data analysis, risk warning and proposed optimal scheme.

TYPICAL CUSTOMERS ARE DEPLOYING ACCNET ERP

- Nitto Denko – control production costs thanks to the application of accounting costing: Nitto Denko has chosen solution AccNet ERP to deploy the system accounting calculating cost ofhelp business control costs more effectively in the production process. After a period of use, company, highly effective, practical system that brings, as well as the degree of stability superior to other software in the market.

- ANTESCO – restructuring process works with management accounting operation: At ANTESCO, our team of consultants and deployment of AccNetERP has collaborated closely with the business in the first phase, reset the standard process and construction work-flow related departments throughout. The solution has helped ANTESCO significantly improve management capabilities, operating in a synchronized way and versatile

- Khatoco – expansion pack solution AccNetC after the successful implementation of original: Lac Viet has successfully deployed package solution AccNetC for trade co., LTD Khatoco in Nha Trang, according to the agreement signed on 29/07/2014. After the system is first put into operation efficiency, Khatoco intends to continue cooperation and expand the distribution finance – accounting and retail management with AccNetC, expressing the deep trust in implementation capacity and quality of service from Lac Viet.

SIGN UP TO RECEIVE DEMO NOW

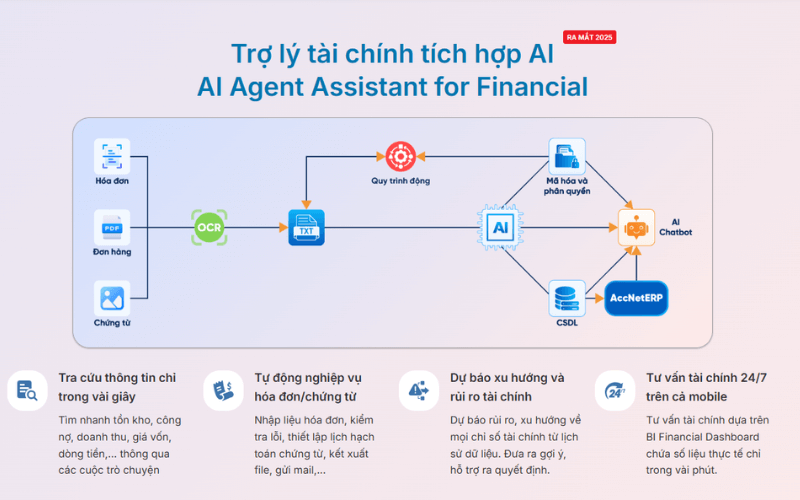

INTEGRATED AI ACCELERATION CONVERTER OF ACCOUNTING

AI in AccNet ERP't just stop at automate data entry, but also:

- Identification & classification certificate from smart: AI scan, read & sort invoice, voucher, receipt, limit errors due to input manually.

- Financial forecasting & budget: the system uses algorithms machine learning to forecast cost, revenue, business support decision fast.

- Warning risk accounting: AI to detect abnormalities in the book, from which timely warning of false or fraud risks.

- Reports assistant smart: AI suggested report template, automatic data aggregation support, leadership, financial analysis instant.

BUSINESS IS WHAT WHEN IMPLEMENTING ACCOUNTING SOFTWARE LAC VIET?

- Experience more than 30 years develop software solutions business management in Vietnam.

- Ecosystem of comprehensive: AccNet ERP easily connect with other solutions of Lac Viet (HRM, Workflow, Portal...).

- Advanced technology: Integrated AI support, cloud & on-premise flexible.

- Services dedicated support: A team of knowledgeable professionals with accounting – finance in Vietnam, companion throughout the deployment.

- Trust from thousands of customers in many areas: finance, banking, manufacturing, trade, services.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: accnet@lacviet.com.vn | Website: https://accnet.vn/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

6. These flaws are often met, and how limitations in accounting inventory

Inventory accounting is one of the professional to develop flaws, most if not tightly controlled. Here are the common errors that many businesses often encounter and how to limit:

- Errors in the calculation of the price of stock

One of the common error is to choose the wrong method, calculate the price of stock (such as average price, first-out first – FIFO...). This leads to deviations in the price of capital, directly affect trading results of the business.

Businesses need to specify the method of calculating the price of stock right from the beginning of the financial year to ensure application consistency. When using accounting software should be configured pricing methods to automated software implementation, avoid manipulation craft confusing.

- Noted the lack or excess supplies of goods

The recognition of the wrong quantity of goods import – export or recorded a wrong code between the purchasing department, accounting, warehouse, easy to cause the difference between reality and books.

Should be made to cross-reference between the import – export, purchase invoices and data in software. In addition, should organize training periodically for parts input to minimize errors when updating stock from.

- Not collate the books and actual inventory periodically

Many businesses only inventory at the end of the year or when there are audit does not lead to timely detection of problems, such as loss, top errors, expired...

Businesses should set the calendar inventory periodically (monthly or quarterly), there are processes clear inventory, the inventory attached reconciliations between accounting – the warehouse – management.

7. Application accounting software to manage inventory effectively

The use of accounting software, modern not only helps in recognition business fast but also play an important role in the tightly controlled, optimized inventory – especially for businesses that have multiple items, more inventory, or supply chain complexity.

Benefits when the application software accounting specialist

- Process automation recorded input – output – exists: the software will update The data immediately after the entry accounting votes help reduce handcrafted limit errors ensure consistency between accounting and stock.

- Calculate the price of stock accuracy by the method of pre-configured: Businesses can choose between FIFO, average, last, or average, and the software will automatically calculate.

- Track inventory in real-time to Help businesses timely grasp the amount of inventory, making a decision to enter or discharge cargo more efficiently.

Integrated solutions: LV-DX Accounting and LV Financial AI Agent

LV-DX Accounting

- Inventory management, detailed commodity code, location, unit

- Automatic calculation of price of stock, allocation of cost of purchase

- The data link between purchasing department – accounting – inventory – sales, to minimize false information.

Integrated LV Financial AI Agent – progress in management inventory

- Automatic trend analysis, inventory: Based on historical data, the system can identify groups of speeds, rotation, slow or exceeded inventory safe.

- Early warning risk inventory or shortage of urgent Help businesses be more proactive in planning to purchase or promote sales.

- Support plan forecast import – export – inventory: Instead of relying on subjective experience, LV Financial AI Agent using real data to predict demand for decision support.

- Integrated reporting, multidimensional analysis, service management, inventory management by industry, region, the distribution chain or group product strategy.

Lac Viet Financial AI Agent to solve the “anxieties” of the business

For the accounting department:

- Reduce workload and handle end report states such as summarizing, tax settlement, budgeting.

- Automatically generate reports, cash flow, debt collection, financial statements, details in short time.

For leaders:

- Provide financial picture comprehensive, real-time, to help a decision quickly.

- Support troubleshooting instant on the financial indicators, providing forecast financial strategy without waiting from the related department.

- Warning of financial risks, suggesting solutions to optimize resources.

Financial AI Agent of Lac Viet is not only a tool of financial analysis that is also a smart assistant, help businesses understand management “health” finance in a comprehensive manner. With the possibility of automation, in-depth analysis, update real-time, this is the ideal solution to the Vietnam business process optimization, financial management, strengthen competitive advantage in the market.

SIGN UP CONSULTATION AND DEMO

Inventory accounting is not only professional technical but also as a tool to support financial management effective in business. When done right standard of transparency and application of technology fit, the business will be more active in cash flow, avoid losses and ensure stable supply for production activities – business. Don't let the flaws in the accounting inventory become “blind spots” in financial – be proactive capacity accounting and experience the solution digitized as LV-DX Accounting or LV Financial AI Agent to manage inventory effectively transparent optimal more each day.