In the environment of modern business, financial data, not just numbers dry but also is an important resource to optimize performance business. However, the majority of businesses are still struggling with the processing of accounting data, financial, craft leads to time-consuming, easy to errors and no timely look on the business situation.

The solution AI analysis of financial statements to help businesses automate the entire process synthesis, analysis, data visualizations, turn financial data complexity into useful information.

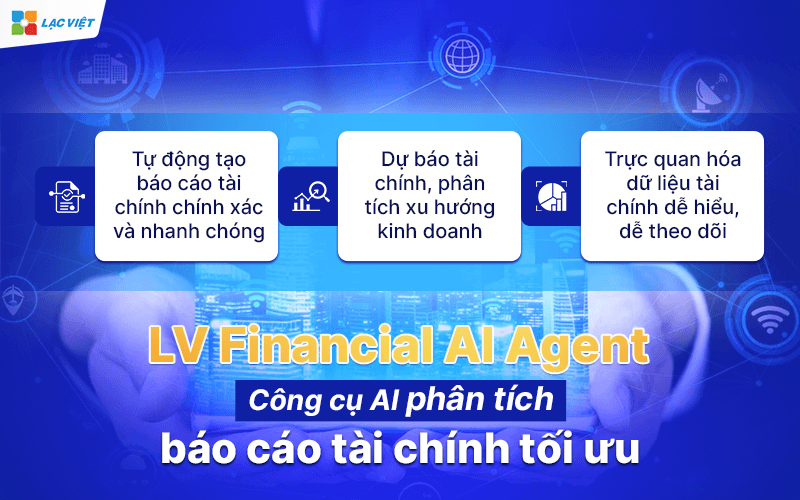

In which, LV Financial AI Agent is one of the optimal system to help businesses:

- Create financial statements in just a few seconds, no need to wait for the accounting department handle manually.

- Data updates in real-time, ensuring data is always accurate latest.

- Trend forecasting financial help leaders quickly identify risks and business opportunities.

- Support quick decisions to help business flexible responses to market volatility.

The same Lac Viet Computing track details in this article.

1. AI analyze financial statements, what is?

1.1. Definition

AI analysis of financial statements is the app artificial intelligence (AI) to automate the process of synthesis, processing, analysis of financial data. Instead of having to rely on traditional methods, with the participation of personnel, financial accounting, AI can automatically extract the important information from the report, trend detection, risk warning and propose solutions suitable finance.

This technology helps enterprises not only have a comprehensive view of the financial situation, the current that can accurately forecast future trends, support timely decision-making efficiency.

For example, If a business regularly experiencing a slow recovery of the debt, AI can analyze data receivables in the past, detection, customers tend to pay slow to give early warning to businesses to take measures to recover the fit.

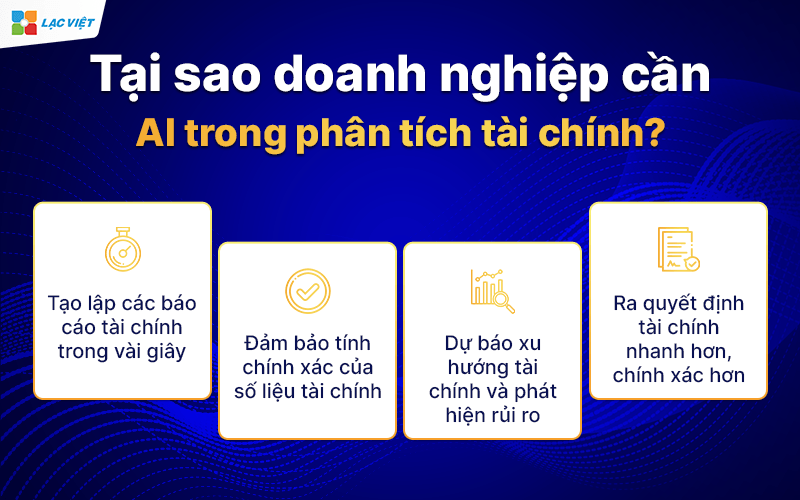

1.2. Why business need AI in financial analysis?

In the context of business increasingly have to handle the amount of financial data giant, the general analysis crafts is no longer relevant.

****

Here are the reasons AI analyze financial statements become a solution of the weak:

- Save time: With the ability to process data automatically, AI can create financial reports in seconds rather than take hours or days to synthetic crafts help enterprises shorten the duration of decision-making, faster response, before market movements.

- Reduce errors in reporting: errors in financial accounting can lead to serious consequences, from the false report charges, wrong estimation of budget to the risk of tax penalties. AI remove elements, sensuality, input errors of human help ensure the accuracy of financial data.

- Forecast trends in the financial – detection risk: AI not only help businesses analyze current data but also can predict trends, revenue, cash flow and financial volatility in the future. This helps enterprises to actively respond to the financial risks instead of just react passively.

For example, If AI noticed the cost of operating the business are rising faster than revenue, the system will automatically give a warning, proposed measures to optimize costs to maintain profitability.

- Financial decisions faster, more accurately: business Leaders do not need to wait for parts general accounting reports or attend the many meetings to retrieve the data. AI allows access financial data in real time, help leadership can picture overview of the financial health of the business immediately.

For example: A CEO need to consider the budget invested in a new project. Instead of having to ask the general accounting data from many different sources, ONE can create financial statements details right away, help the CEO make a decision fast more accurate.

Thus, the application AI in the analysis of financial statements not only help businesses speed up data processing, minimize risks, but also to support leadership decision-making, financial intelligence, based on data accurate scientific basis.

- 9 Accounting Software online cheap cost reduction for small and medium ENTERPRISES

- Core Banking is what? Solution upgrade the core system safety, speed, flexibility

- Convert numbers in the banking sector: The state, challenging & strategic solutions

- 10+ accounting software ERP admin most popular AI for enterprises

2. LV Financial AI Agent – engine AI analyze financial statements optimal

Lac Viet Financial AI Agent to solve the “anxieties” of the business

For the accounting department:

- Reduce workload and handle end report states such as summarizing, tax settlement, budgeting.

- Automatically generate reports, cash flow, debt collection, financial statements, details in short time.

For leaders:

- Provide financial picture comprehensive, real-time, to help a decision quickly.

- Support troubleshooting instant on the financial indicators, providing forecast financial strategy without waiting from the related department.

- Warning of financial risks, suggesting solutions to optimize resources.

Financial AI Agent of Lac Viet is not only a tool of financial analysis that is also a smart assistant, help businesses understand management “health” finance in a comprehensive manner. With the possibility of automation, in-depth analysis, update real-time, this is the ideal solution to the Vietnam business process optimization, financial management, strengthen competitive advantage in the market.

SIGN UP CONSULTATION AND DEMO

2.1. Automatically generate financial reports accurately quickly

Financial statements plays an important role in the assessment of the business situation of the business, however, the process of synthesis analysis report traditional usually takes a lot of time, easy-to-happen errors do not guarantee timely updates.

LV Financial AI Agent is the solution application AI to automate the process of creating financial reports to help businesses quickly get the important information without handle manually.

This technology helps businesses create a series of financial statements in just a few seconds, including:

- Balance sheet accounting – track the status of assets, liabilities, equity to assess financial health.

- Reporting cash flows – Help control the flow of money in/ out ensure that the business maintain stable liquidity.

- Report receivables – payables – Provides detailed information about the customer owes the business, the account need to pay for partners.

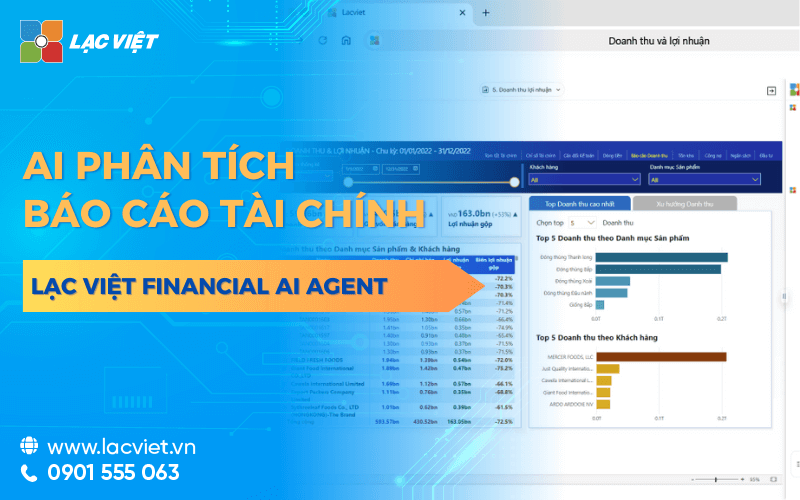

- Revenue report – profit – analysis of business performance, revenue comparison in real time to adjust strategy timely.

Practical benefits of AI in creating financial reports:

- Save 50% processing time reports help accountants and managers can focus on the work more strategic.

- Ensure high accuracy, minimize errors due to input manually.

- Update data continuously, no status, use of data error in the decision-making process.

For example, A business, electronic commerce, there are thousands of transactions per day, need synthetic data, revenue, profits weekly. Previously, the accounting must take 6-8 hours to handle this report, but with WHO, the whole process is performed automatically in a few minutes, help leadership can view the report immediately to adjust the business strategy.

2.2. Forecast financial analysis of business trends

One of the biggest benefits of AI in financial analysis is the ability to forecast financial trends based on historical data. Not only synthetic data, AI also identifies financial models help businesses predict the future in order to prepare the financial plan accordingly.

With LV Financial AI Agent, enterprises can:

- Predict turnover costs in the next period to plan and budget more accurately.

- Cash flow analysis to determine the time of the surplus or shortage of funds.

- Early warning of financial risks, such as signs customers delay payments or costs spike.

Practical benefits:

- 30% increase in accuracy in financial forecasting in comparison with traditional methods thanks to the ability to handle big data and identify performance trends.

- Help business owners adjust your financial strategy, limiting the shortage of cash flow or wasting budget.

- Offer suggestions based on data, help leadership make decisions lucid without losing too much time analyzing craft.

For example: A manufacturing company wants to expand the scale factory but not sure whether lines have enough money to invest or not. AI can analyze the data that financial history, to assess the growth, revenue and forecast the profitability of a project, from which help businesses make investment decisions more accurate.

2.3. Visualizing financial data easy to understand, easy to follow

One of the difficulties of the enterprise when analyzing financial statements is the reader to understand the table of data complexity. AI not only helps aggregate data, but also transform them into shape chart visually helps leaders easily track make decisions based on data intuitively.

LV Financial AI Agent support:

- Show the financial report chart form action to help businesses quickly identify trends and compare financial data between the periods.

- Allows customized reports according to your needs, to help each department business can analyze the data according to the matching criteria.

- Offers user friendly interface, does not require users to have in-depth knowledge of finance or technology.

Practical benefits:

- Leadership can view visual reports right on the dashboard, instead of having to analyze the spreadsheet is lengthy.

- Get fast interface anomalies, such as cost increases abnormally high or revenue decline.

- Help the department to better coordinate, because financial data is presented in clear, easy to understand for all levels of management.

For example, A service business would like to track business performance in each quarter. Instead of analysis Excel sheet with hundreds of rows of data, the AI automatically display a chart of revenue, expenses, profit helps leaders easily identify trends, growth, adjust strategy accordingly.

3. Benefits to business application LV Financial AI Agent

The application AI in the analysis of financial statements not only help businesses automate the process of data processing, but also bring value to the obvious fact help optimize financial operations support leaders in making strategic decisions. Here are the specific benefits that the business will get when deploying LV Financial AI Agent.

3.1 Reduced by 50% processing time financial statements

Previously, the synthesis of data from multiple sources, create financial reports and test data to take hours, even days. AI help shorten the processing time down to just a few minutes, which allows accounting staff/leaders have the right to report you need without having to wait.

For example, A manufacturing company must aggregate data from numerous plants to assess the financial situation of every month. If the former accounting take 2-3 days to process data, then with LV Financial AI Agent, reports can be automatically updated in real time, help leaders quickly capture, cash flow and business performance.

3.2 Increased by 30% accuracy in financial forecasting

One of the biggest risks of the business is predicted wrong financial trends, guide to planning the budget is not accurate or loss of control cash flow. AI can analyze historical data, identify the financial model to make forecasts more accurate help business financial planning effective risk reduction.

For example: A company's e-commerce revenue cycle seasonal fluctuations. Previously, they only rely on emotional experience, to financial planning, which leads to shortage of budget in the low season. With LV Financial AI Agent, the system can predict trends, revenue, based on historical data, the company actively adjust financial strategy, avoid risk capital deficit.

3.3 Support leadership decisions faster

Instead of waiting for the report from the accounting department, AI help leaders access data immediately, provided the overall picture of the financial health of businesses that don't need to lose time synthesis engine. This is especially important in the business environment fluctuations, where the speed of decision making can determine the success or failure of the business.

For example: A CEO need to consider the financial situation to decide whether to invest in an expansion project or not. Instead of waiting for the financial department provides the report, the CEO can use LV Financial AI Agent to see right indicators key financial forecasts, cash flow and future profits, then make informed decisions based on real data.

3.4 detection risk warning: the financial

A lot of businesses just discovered financial problems when it was too late, such as operating costs, spike, falling revenues, or customers delay payments. AI can analyze data in real time, detects unusual signs and send an early warning to help enterprises take measures for timely processing, avoiding losses should not be.

For example: A service company is the status customers delay payment affecting cash flow. Previously, accounting only discovered the problem when happened bad debt. With LV Financial AI Agent, the system will keep track of the debt in real time, detect customers tend to pay slow, and send alerts to finance department, helping the company take measures to recover the debt sooner, avoiding the risk of losing your capital.

Application AI analysis, financial reporting nineh not only help businesses automate processes, but also bring practical benefits clearly, from the accelerated data processing, improve accuracy in forecasting, decision support, financial faster to minimize financial risk. With LV Financial AI Agent, business can be proactive financial control, optimization, business strategy, improving performance in the long term.