13th month salary has long become one of the main books are the workers most interested in the end of year. However, not any business also understand the rules of 13th month salary, how to pay, as well as the construction of spreadsheet templates monthly salary 13 stars for transparency exact match law. In fact, many businesses still perplexed in determining the object to be enjoyed, recipe calculator, or manage costs reasonable.

This article Lac Viet will give the organizations and enterprises are to find out information about spreadsheet template monthly salary 13 the full content: from concept, legal regulations, how to calculate 13th month salary (including Excel formula) to suggestions spreadsheet template standard and optimal process management software personnel.

1. 13th month salary what is? Businesses are required to pay?

13th month salary is a bonus that many businesses pay for workers on the occasion of the end of the year, usually associated with the time of the lunar new Year. In essence, this is not the account of the basic salary or allowances required, which is a form of extra bonus to acknowledge the dedication of staff throughout the working year.

Therefore, many people are often confused between the 13th month salary and “bonus Year”, while these two concepts can completely segregated: some businesses pay both, the others just apply a policy.

Legally, under Article 104, of The Labour code 2019, bonus is an amount that employers reward workers based on the results of production and business, the level of completion of the work. As such, the law does not oblige businesses to pay 13th month salary, but the pay will be specified in the contract labor agreement, collective labour or bonus regulations of the company.

From the perspective personnel administration, policy formulation and 13th month salary transparency, clarity will help businesses:

- Ensure internal and avoid disputes.

- Convenient in management, especially when the need to audit or reconciliation with tax authorities.

- Increase the confidence of employees, contributing to improved productivity, the long-term commitment.

2. Rules of 13th month salary business need to know

With respect to the organizations and enterprises are to find out information about spreadsheet template monthly salary of 13, before the construction of the calculation formula or deployment pay, understanding legal regulations is mandatory elements to ensure transparency avoid legal risks.

2.1 13th month Salary are compulsory or not?

According to Article 104, The Labour code 2019, bonus is an amount due to the employer to decide based on business results and the level of completion of work of the employee. This means that the law does not stipulate mandatory pay 13th month salary. Businesses only pay if in labor contracts, collective labor agreement, or regulation internal bonus can specify this clause.

For example, If in the contract of employment has stated “employee is entitled to 13th month salary on the occasion of lunar new Year”, then responsible business done. Conversely, if there is no commitment in writing, 13th month salary only recommended.

2.2 Đối tượng được hưởng lương tháng 13 là ai?

Businesses often applied 13th month salary for employees working full 12 months of the year. However, to ensure fair, many companies also calculated in proportion to the time worked.

- Staff work well enough, 12 months: enjoy according to the formula rate = (Number of months at work / 12) x Wage may 13.

- Employees leave before the moment of payment: will not be received, unless agreed otherwise in the contract.

This should be clearly stated in the sample spreadsheet 13th month salary to avoid controversy, at the same time help the hr department easily applied when handling cases quitting midway.

2.3 conditions to receive 13th month salary

Businesses have the right to set out the conditions to receive 13th month salary as ensure transparency and not contrary to law. A number of criteria are usually met:

- Staff does not violate discipline seriously in years.

- Complete good KPI or the rating work performance.

- Worked enough days in the year in accordance with internal regulations.

3. Cấu trúc của một mẫu bảng tính lương tháng 13

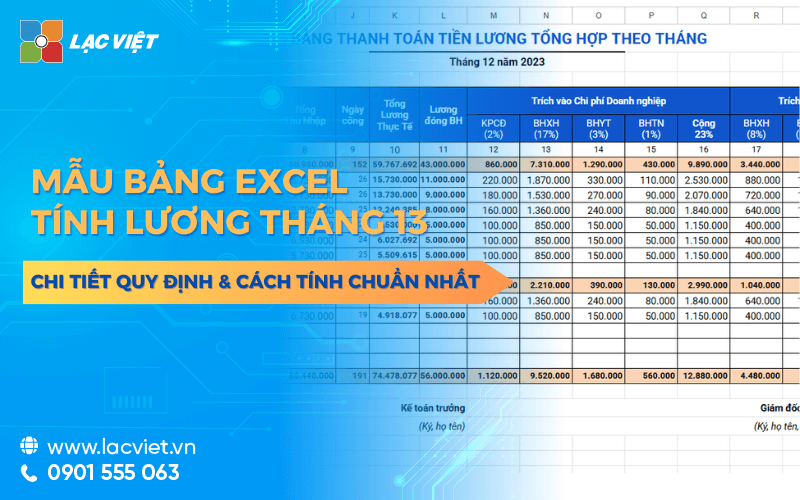

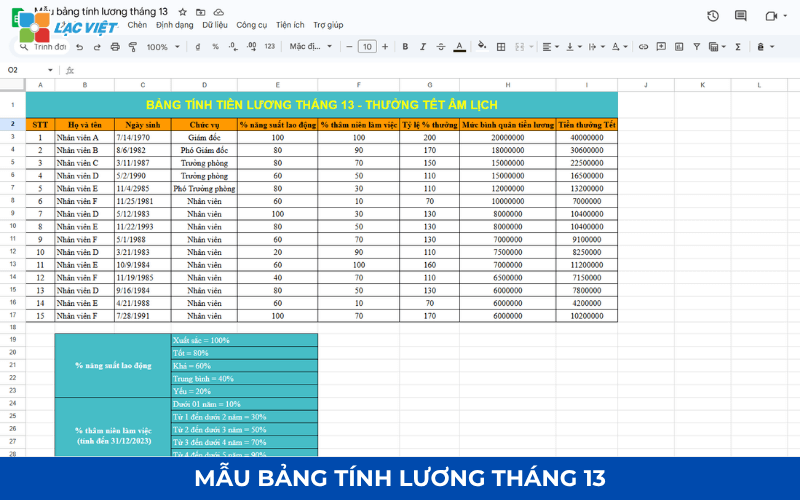

To help businesses calculate 13th month salary transparency, accurate, easy-to-follow, a sample spreadsheet 13th month salary Excel are often designed with the basic columns following:

- Name: personal information of employees.

- Departments: Help categorize expenses salaries in each department, support for task management accounting.

- Basic salary: salary Was officially recorded on the labor contract, the basis for calculation.

- Allowance: The account support add as level of responsibility, lunch, travel, etc. (if business is included on 13th month salary).

- Rewards: recognition of the bonuses other than the 13th month salary to business management in a clear way.

- The number of months actually worked: Used when calculating 13th month salary in proportion to the number of months worked during the year.

- 13th month salary the field: The final result that employees receive.

The standardized structure, this helps businesses easily collated with the provisions of 13th month salary, at the same time limit confusion when calculating manually.

Example illustration template spreadsheet 13th month salary Excel

| Name | Departments | Basic salary | Allowance | Enjoy | The number of months worked | 13th month salary the field |

| Nguyen Van A | Business | 15.000.000 | 2.000.000 | 0 | 12 | 17.000.000 |

| Tran Thi B | Accounting | 12.000.000 | 1.500.000 | 0 | 9 | 10.125.000 |

| Le Van C | Hr | 10.000.000 | 1.000.000 | 0 | 6 | 5.500.000 |

In the example above:

- Employees A work full 12 months should be getting enough basic salary + allowances.

- Employee B worked 9 months, 13th month salary is calculated according to the formula rate (basic salary + allowance) x 9/12.

- Staff only work 6 months should receive the 13th month salary corresponding 6/12.

Excel sheet as on help business transparency in calculations, easy to adjust when there is a change in how to calculate monthly salary of 13 or more updates to the bonus account.

TẢI MẪU BẢNG TÍNH LƯƠNG THÁNG 13 MIỄN PHÍ TẠI ĐÂY

4. Cách tính lương tháng 13 phổ biến tại doanh nghiệp

Đối với các tổ chức, doanh nghiệp đang tìm hiểu thông tin về mẫu bảng tính lương tháng 13, câu hỏi lớn nhất thường xoay quanh cách tính sao cho minh bạch, công bằng và dễ triển khai trong thực tế. Hiện nay, có ba recipe payroll phổ biến được các doanh nghiệp áp dụng, tùy thuộc vào quy mô, chính sách và thỏa thuận với người lao động.

5.1 calculation of 13th month salary according to average salary

Here's how to be more business apply to ensure fairness to those employees whose salary fluctuations during the year. The formula is commonly used:

13th month salary = (salary 12 months) / 12

For example, An employee whose salary actually received in the year 2024 as follows:

- First 6 months: 12.000.000/month

- 6 months later: 15.000.000/month

The total salary the year = (12.000.000 x 6) + (15.000.000 x 6) = 162.000.000 dong

13th month salary = 162.000.000 / 12 = 13.500.000 dong

This helps businesses accurately recorded efforts of staff in both years, at the same time avoid controversy from the case there is a change in wages in the year.

4.2 Cách tính lương tháng 13 theo tỷ lệ thời gian làm việc

In fact, many employees join or leave mid-year. Meanwhile, businesses often apply the formula calculated according to the proportion of time:

13th month salary = (Salary 13 full section) x (Number of months actually worked / 12)

For example: An employee to work from months 5/2024 with salary 10,000,000/month. Thus, the working time of the year is 8 months.

13th month salary = 10.000.000 x (8/12) = 6.666.000 dong

This recipe ensure fairness, just encourage employees stick long, medium to help businesses save costs in the case of employees leave early.

4.3 Cách tính lương tháng 13 theo ngày làm việc thực tế

In some special cases, the employee has not done enough year round or on leave without pay, long days, businesses can calculate 13th month salary based on the number of days actually worked. The formula is applied as follows:

13th month salary = (Salary / Number of days the standard in months) x the Number of days actually worked during the year

For example: An employee whose basic salary 12.000.000/month specified date the standard is 26 days. In the years, this employee only works after the fact 280 days.

- Pay date = 12.000.000 / 26 = 461.538 dong

- 13th month salary = 461.538 x 280 = 129.230.640 copper / 12 ≈ 10.769.220 dong

This creates fairness absolute, especially suitable in the production environment or the industry can control the date closely. At the same time, the way based on working days also helps to restrict state employees leave or long holidays but still get enough 13th month salary as people go to work enough.

4.5 Cách tính lương tháng 13 cho người nghỉ thai sản

One of the common questions that organizations and businesses are to find out information about spreadsheet template monthly salary of 13 are often posed is: employees on maternity leave receive a 13th month salary not?

Under the provisions of the law, the duration of maternity leave is time off entitled SOCIAL insurance and don't count on working time wage from the business. Therefore, the payment of 13th month salary for employees on maternity leave depends on the policy of each company.

There are two ways of calculating popularity:

- No vacation time, maternity

Businesses only pay 13th month salary based on the number of months the employee actually worked during the year. Recipe: 13th month Salary = (Salary 13 full section) x (Number of months actually worked / 12)

For example, Employees on maternity leave for 6 months, the basic salary 15,000,000. Time actually worked 6 months. 13th month salary = 15.000.000 x (6/12) = 7.500.000 dong

- Have time on maternity leave

Some businesses want to show their interest, retain talent, will pay 13th month salary, although employees on maternity leave. This calculation is usually clearly stated in the rules of 13th month salary or welfare policies internally.

5. Lợi ích khi dùng mẫu bảng tính lương tháng 13, vì sao doanh nghiệp cần?

Sample spreadsheet 13th month salary as the tool is now set to sum, calculate management bonuses, October 13 for staff. Usually, this template is built as Excel file, or a built-in software, hr management (HRM).

In it, the important information such as their name, employees, departments, basic salary, allowances, the number of months worked during the year, the number of bonus fact are clearly shown.

Điểm mấu chốt của một mẫu bảng tính lương chuẩn không chỉ nằm ở việc “ghi nhận con số” mà còn ở giá trị quản trị nhân sự mà nó mang lại. Đối với các tổ chức, doanh nghiệp đang tìm hiểu thông tin về mẫu bảng tính lương tháng 13, một bảng tính minh bạch, chính xác sẽ giúp:

- Save time, reduce errors: Instead of calculations, worksheets are pre-set recipe will help managers only need to enter input data (salary, allowances, the number of months worked) is possible the final result.

- Ensure transparent, fair: When all numbers are clear recipe easy to verify, the employee will trust more on the bonus policy of the business. This helps to minimize complaints, increase engagement and improve internal images.

- Convenient when audit reports: Business can easily store all the data when needed for screening with the law or in the financial audit.

If the comparison between in Excel and use the software management personnel can see:

- Excel business suit small, less staff, but to flaws if large quantity.

- Software HRM back to optimal for small and medium sized businesses thanks to its ability to automate, data link from attendance and calculate the salaries, allowances, cumshot template spreadsheet 13th month salary just by few taps.

Thus, the construction investment spreadsheet template monthly salary 13 not only help businesses comply with regulations, 13th month salary, but also enhance management efficiency, reduce operational burdens create satisfaction for workers.

- Lac Viet SureHCS C&B paid by the customized products according to specific business

- 12 Common methods for calculating employee salaries, along with detailed formulas.

- Which payroll calculator should I choose to replace Excel to reduce errors and ensure compliance with regulations?

- File excel payroll according to the products & how to calculate standard SMV company may, production

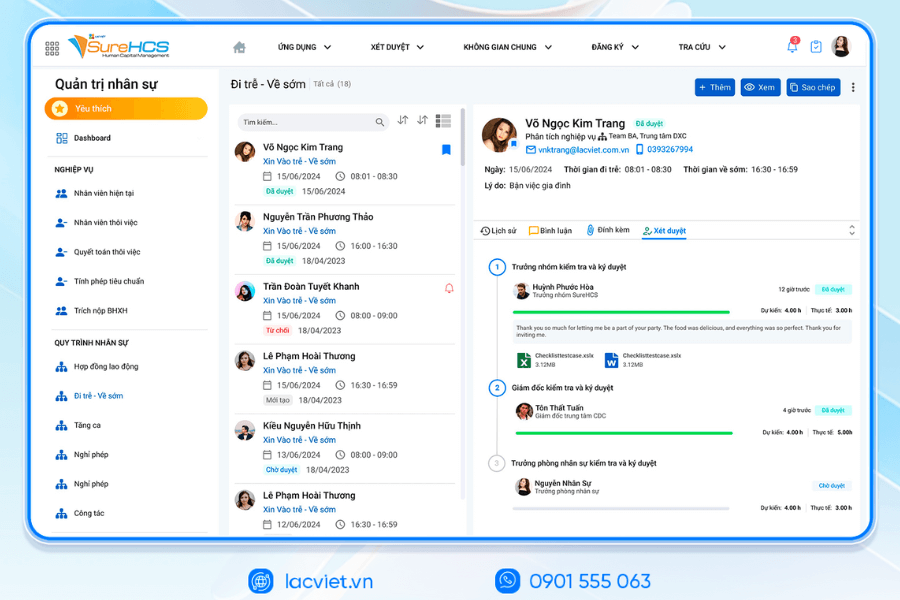

6. App hr software payroll in the payroll month 13

Mặc dù công thức tính lương tháng 13 Excel khá tiện lợi cho doanh nghiệp nhỏ nhưng khi số lượng nhân viên tăng lên hàng trăm hoặc hàng nghìn người, việc quản lý bằng Excel tiềm ẩn nhiều rủi ro: file dễ sai sót, mất dữ liệu hoặc khó tổng hợp báo cáo.

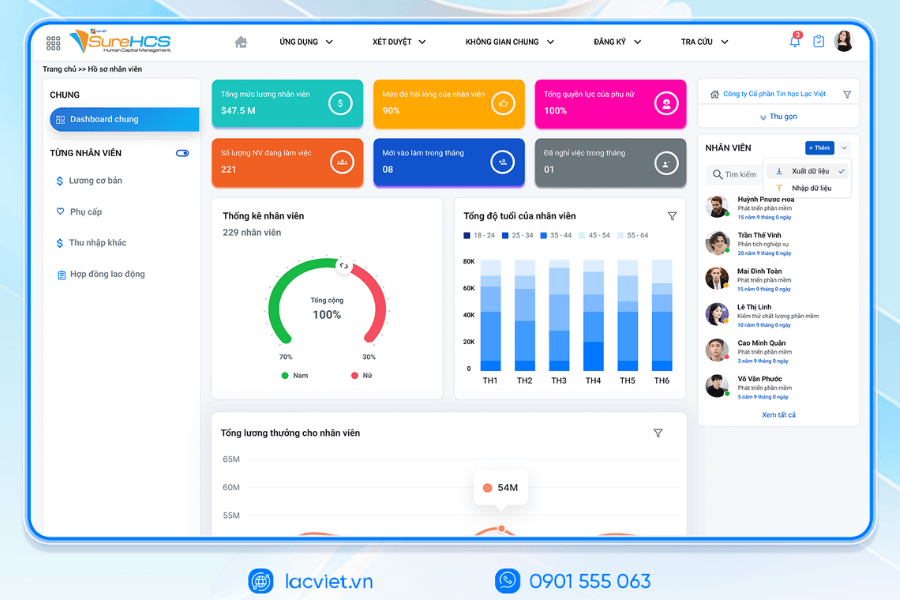

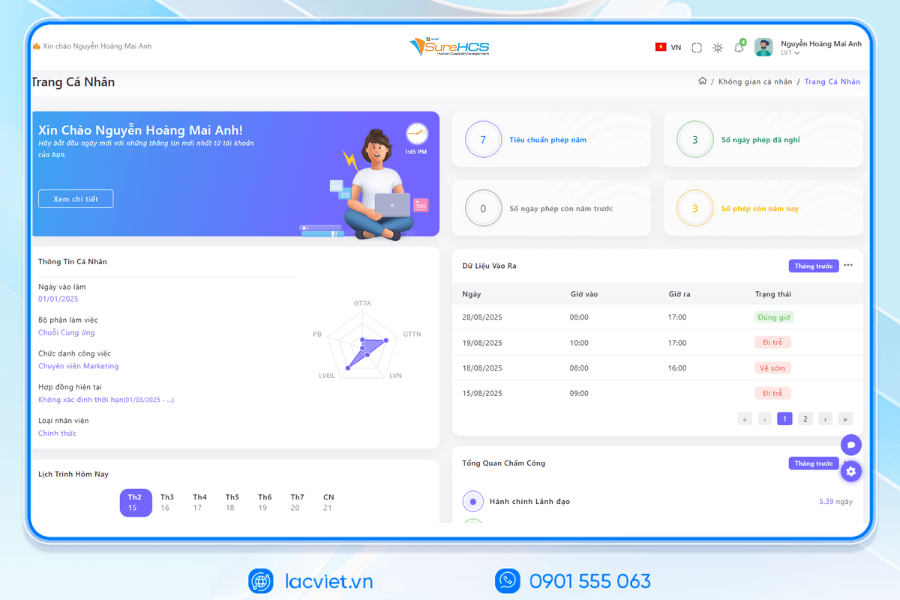

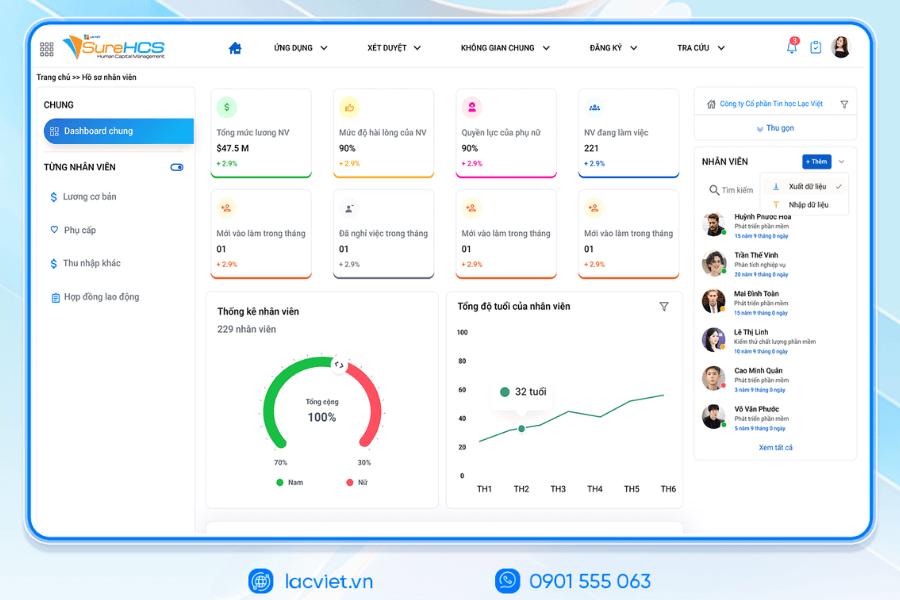

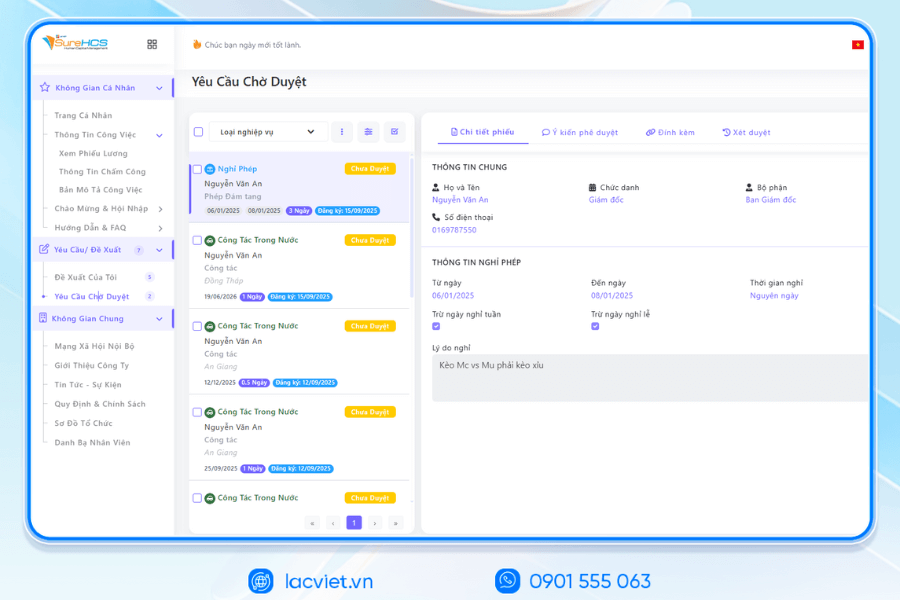

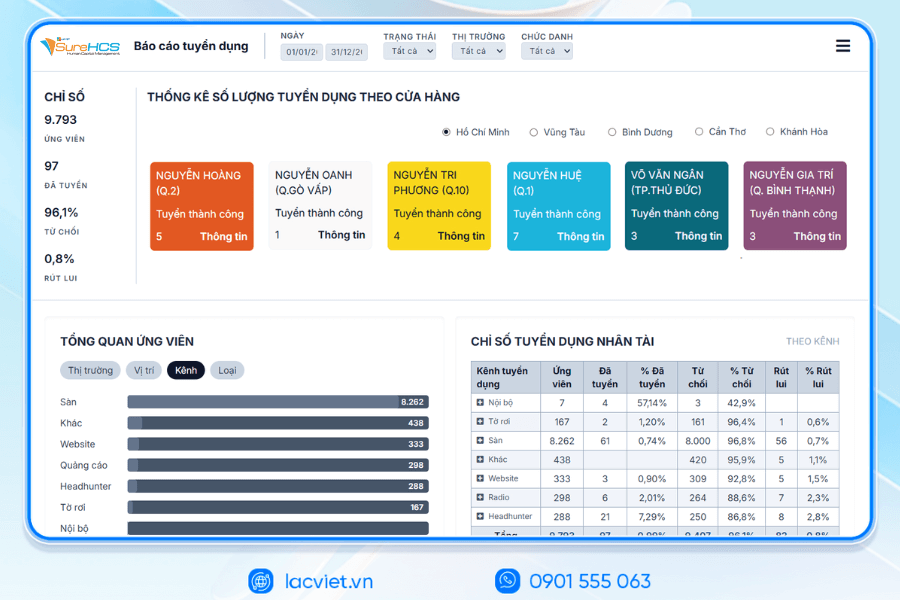

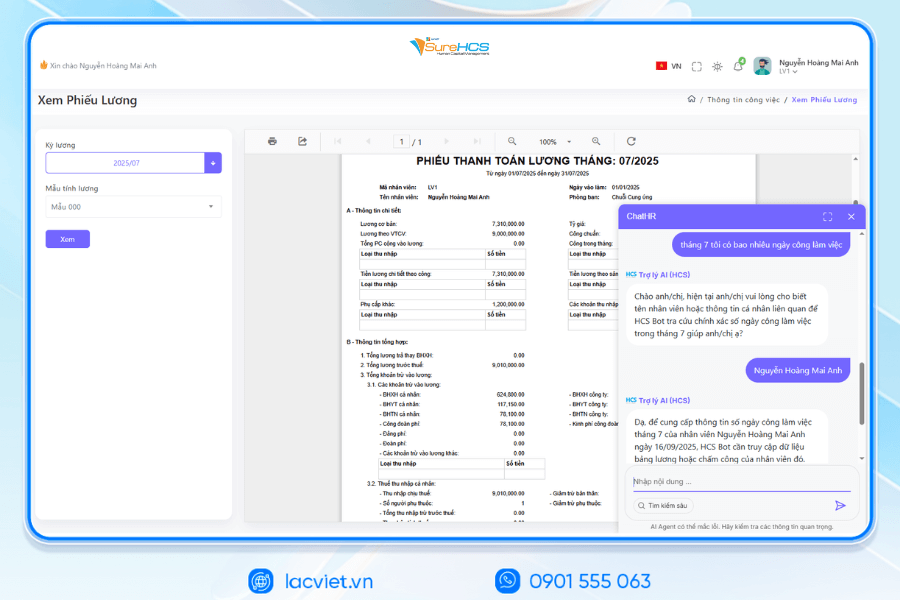

This is when business should consider using software hr management as SureHCS HRM. Compared to Excel, software salary SureHCS C&B this brings the outstanding universal value:

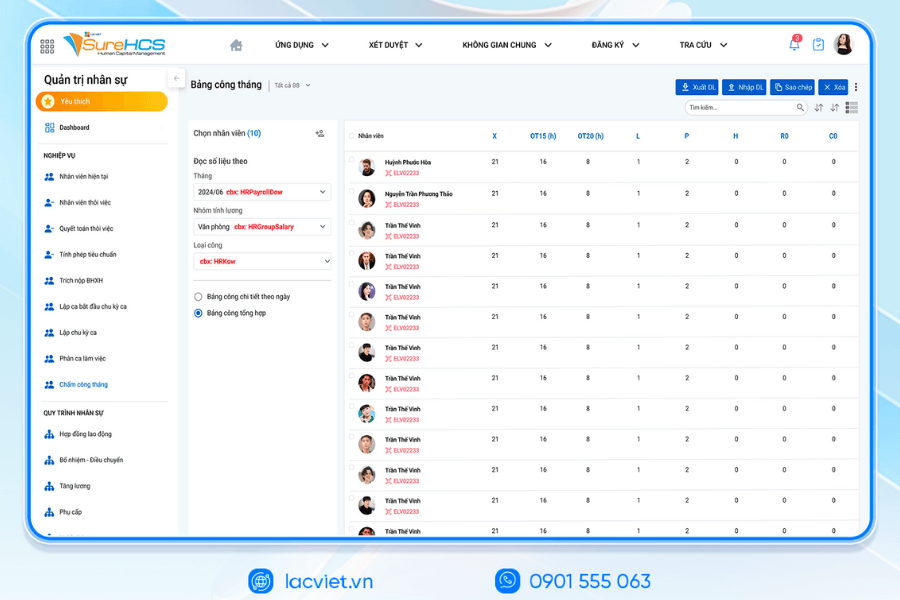

- Automate the entire process: the System automatically retrieves the data, timesheet, salary, allowances, deductions... to compute 13th month salary with just a few taps.

- Accurate transparency: minimize errors manually, ensure fairness between employees.

- Save administration time: Businesses do not need to enter data multiple times, the software allows to export reports quickly according to the requirements of leadership.

- Compliance with legal regulations: the System always updated according to the regulations, 13th month salary and new policies to help businesses peace of mind when performing.

LAC VIET SUREHCS – HR MANAGEMENT SALARY C&B CUSTOM DEPTH FOR BIG BUSINESS

Lac Viet SureHCS is software HRM personnel management comprehensive, developed by Lac Viet – unit more than 30 years of experience in the field of management software business in Vietnam with international standards such as CMMI Level 3, ISO 9001:2015 and ISO 27001:2013.

SureHCS not only meet the professional personnel standards, which are designed to handle the hr – C&B – wages complex, large-scale, multi-company, multi-sector, in particular in accordance with FDI enterprises, corporations, factory, logistics, aviation, hotel, trade – in service.

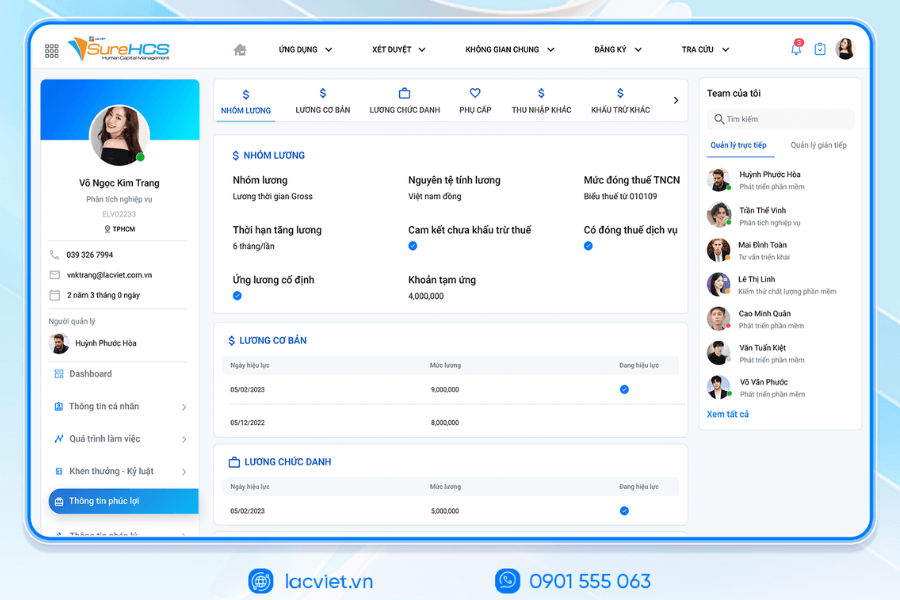

The system is flexible deployment On-premise or as a custom model in depth, to help businesses automate the entire process hr – attendance – payroll – benefits – insurance, complete replacement job management using Excel discrete.

The module's core hr software lacviet SureHCS:

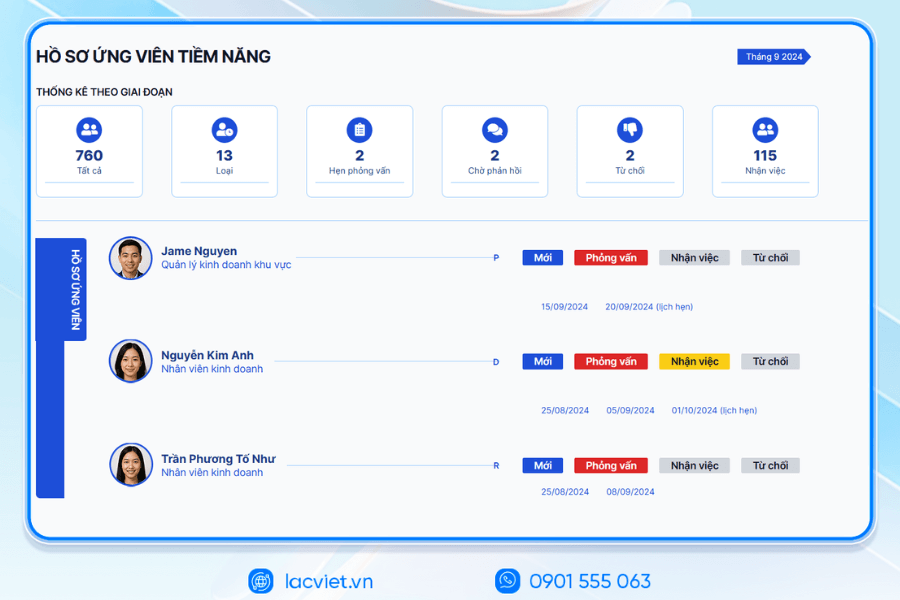

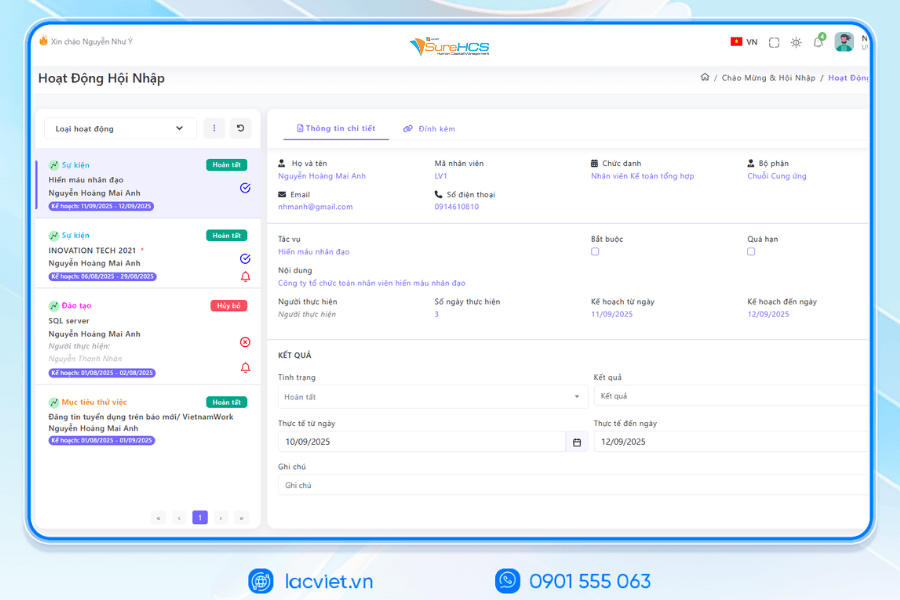

- The Recruit – Training: Management throughout the recruitment, integration, training, hr support and build the Talent Pipeline for large-scale enterprise.

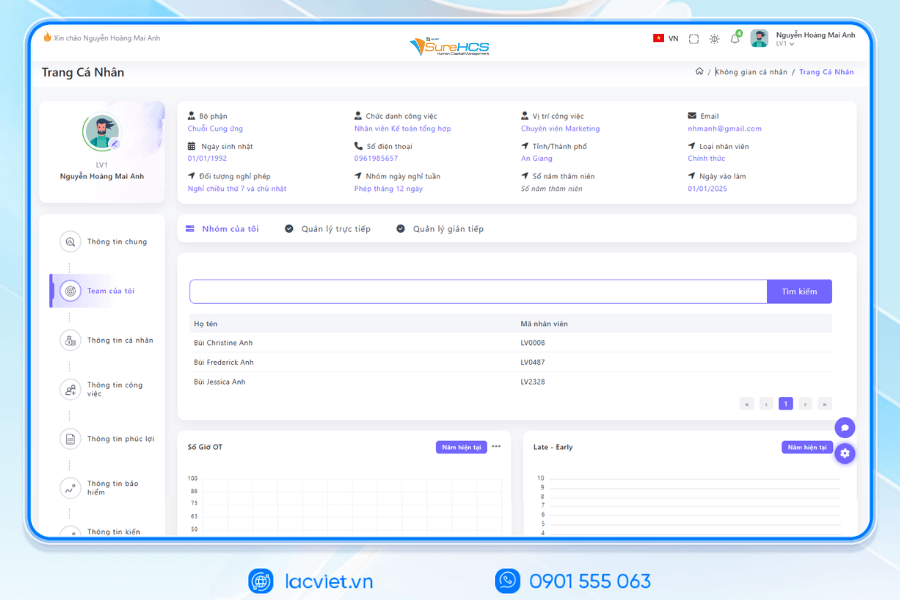

- Port information & records Management personnel: Store personnel records, electronic focus, portal self-service for employees and contract labor power on the system.

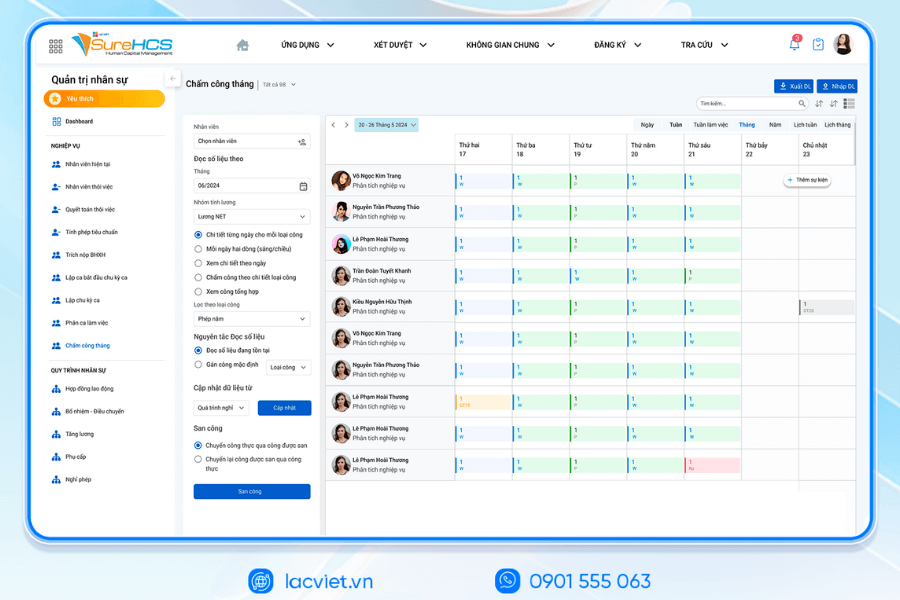

- The timekeeper: Dots, multi-form (fingerprint, face recognition, Face ID, GPS, Wifi, online), connect many types of timekeeper, support attendance by the hour, shift flexibility for the plant, and hotels.

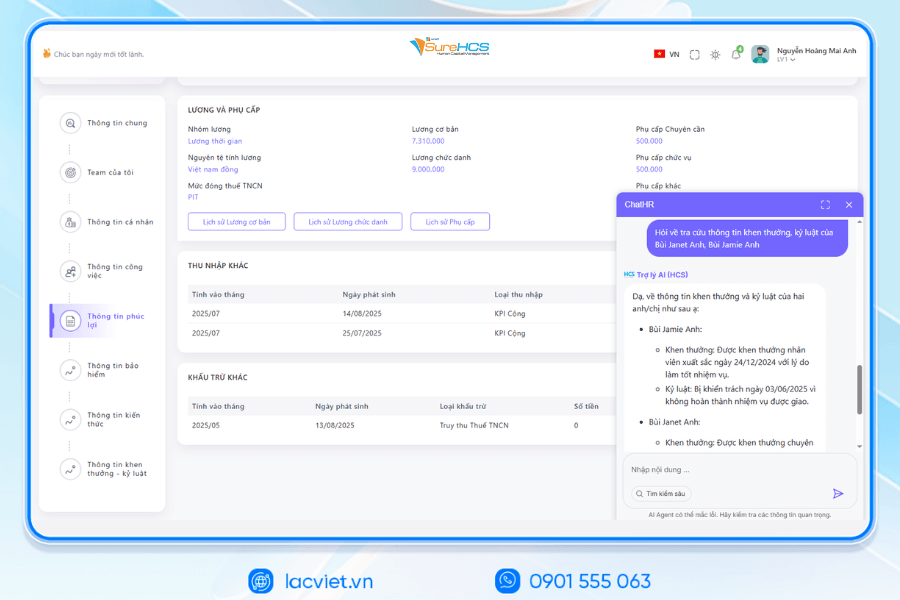

- The payroll & C&B: Automatic salary calculation according to many models (hour, shift, product, 3P, KPI performance...), link directly attendance data – performance – welfare, completely replace the salary calculator using Excel.

- Welfare – SOCIAL insurance – salary: Management benefits flexible, integrated iVAN connect SOCIAL and electronic Bank Hub salary automatically, support pay multi-currency for FDI.

INTEGRATED AI ACCELERATED CONVERSION OF HUMAN RESOURCES MANAGEMENT

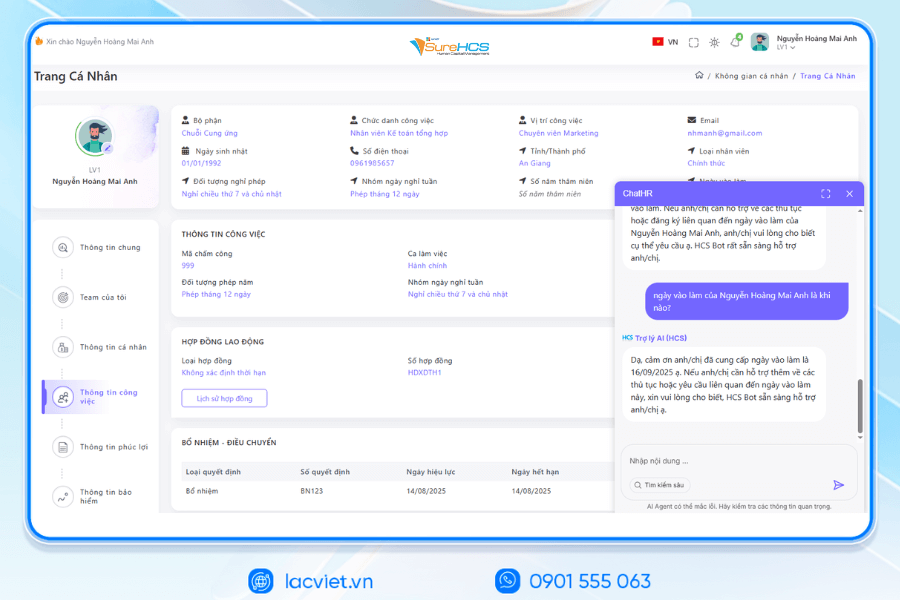

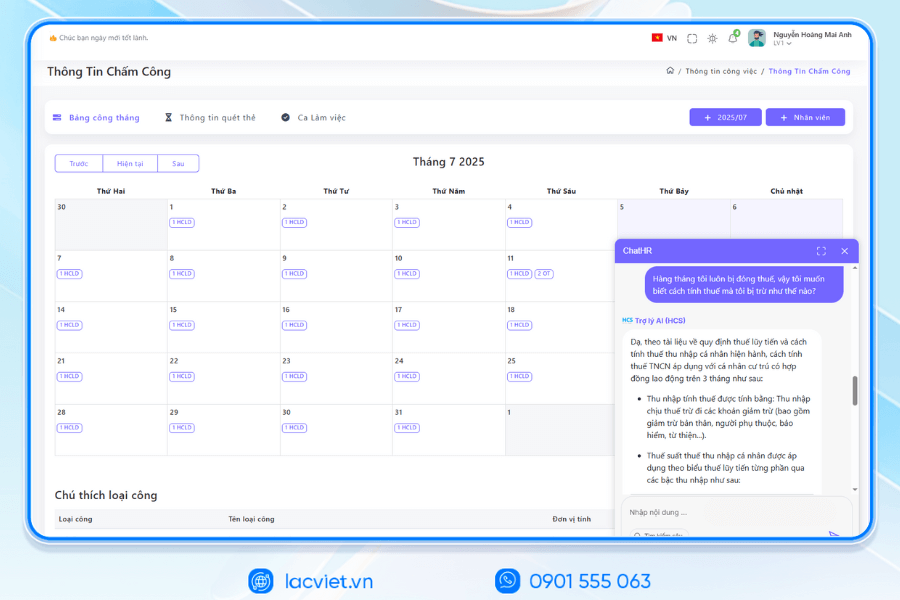

Lac Viet has officially launched The 3 AI assistant hr deeply integrated into the LV SureHCS including LV-AI.Docs, LV‑AI.Resume and LV‑AI.Help to automate the task administration, standardized data enhanced experience personnel

- LV‑AI.Docs: automatic dissection transfer data from documents such as CCCD, windows, SOCIAL insurance, by level of digital records, standardized

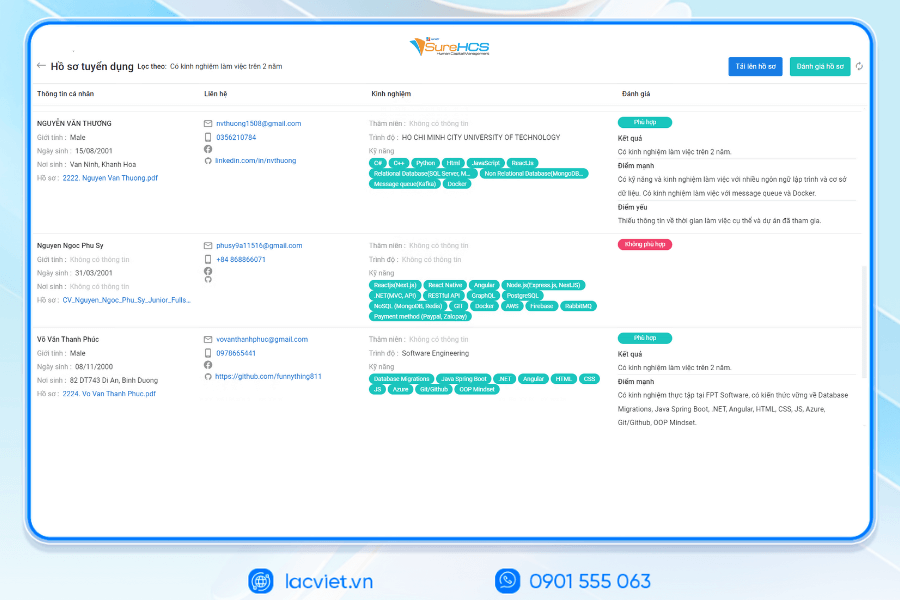

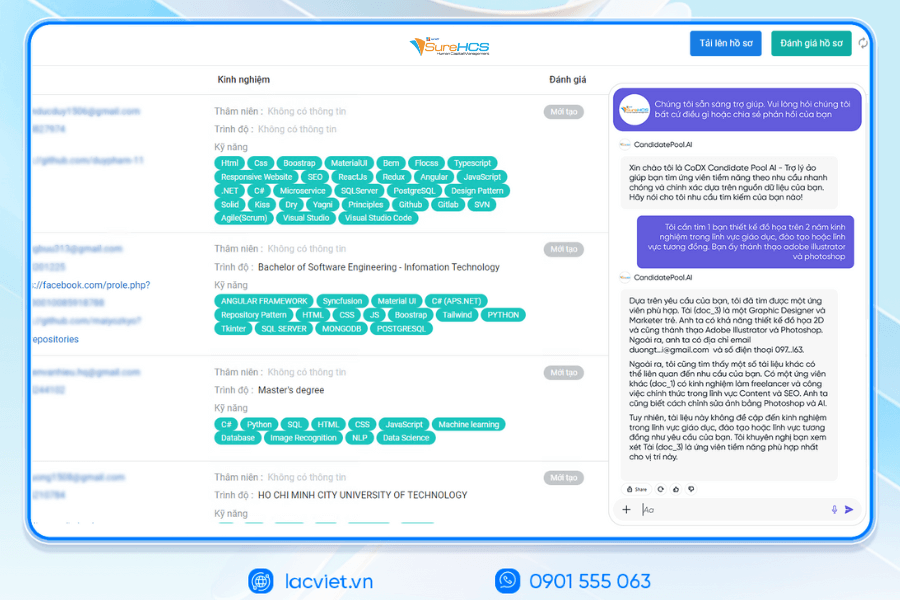

- LV‑AI.Resume: automatic dissection CV any format, analyst CV auto, construction, candidate profile, find people with the right criteria by prompt intelligent data mining candidate pool efficiency

- LV‑AI.Help: chatbot internal support, answer questions HR 24/7 access form process quick contextual user

TYPICAL CUSTOMERS DEPLOYING LV SUREHCS HRM

SureHCS are trusted and used by many large enterprises and leading corporations such as: Coca-Cola, Takashimaya, Textile SuccessfulPlastic Long Thanh Phu Hung Life, Airports of Vietnam (ACV)the business belonging to the SGCthe FDI enterprises in the fields of production, logistics, trade – in service.

- Coca-Cola Vietnam: System deployment LV SureHCS to digitize comprehensive human resource management group has standardized the data, the optimal operating HR according to international model.

- Textile company Success (TCM): Application LV SureHCS to manage hr, payroll, benefits, timekeeping and capacity profile for nearly 5,000 employees across 5 areas of activity – from textiles and fashion to real estate.

- Total company air Port, Vietnam (ACV): Choose to trust LV SureHCS to operate the system large-scale personnel with over 10,000 employees, 24 subdivisions, solved the problem of complex business of modeling state-owned companies.

SureHCS particularly suitable for:

- Large-scale enterprise, from 300 to 10,000 hr

- Corporations and enterprises multi-company, multi-branch

- FDI, manufacturing, factory, logistics, aviation should attendance – analysis ca – salary calculator complex

- Businesses are C&B peculiarities, need custom depth according to the actual operating

- Businesses are personnel management using Excel, many types of timekeeper, need automate the entire process

SIGN UP TO RECEIVE DEMO NOW

WHY BUSINESSES SHOULD CHOOSE TOUCH THE SUREHCS?

- Customized according to the actual business, no pressure mold as packaged software.

- Handle the personnel – salaries complex that many software HRM other does not respond.

- Deep understanding operated business English & FDI, ensure compliance with legal Vietnam (labour, SOCIAL insurance and personal income tax).

- Ecosystem integration strength: attendance – payroll – bank – SI – electronic contract.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: surehcs@lacviet.com.vn

- Website: https://lacviet.vn | www.surehcs.com

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

The construction sample spreadsheet 13th month salary not only help businesses ensure fairness and transparency in remuneration, but also contributes to strengthening the trust and engagement of the employee's permanent. However, when the number of workers is increasing, management by Excel can cause errors take much time. Select software hr management as SureHCS HRM will help business process automation, compliance with legal provisions, at the same time efficiency optimization manager salary bonus.

- How to calculate salary increase ca in accordance with spreadsheets, Excel file/GG sheet

- 15 Attendance software employee HRM PRECISE management, good pay

- The function calculate salary in Excel to quickly calculate the standard save time

- Provisions salary calculator holidays: legal Grounds & how to calculate STANDARD