Debt management is one of the important activities in the operation of financial business, especially in the context of business and competitive pressure cash flow is growing. However, many businesses still haven't actually build is a system for managing public debt, it leads to a situation of public debt overlooked, withdraw slowly, take control bad debt or spending too much time for projectors that do not bring real effect.

Therefore, this article Lac Viet Computing will help the business especially as the organization is in the process of setting up or optimizing processes, financial management, capture a sufficiently easy to understand:

- The concept of debt management roles in business.

- The implementation process is effective and the only number to track.

- The support tools from the Excel file to a software solution advanced integrated artificial intelligence.

- Guide the choice of solutions to suit each stage of development business.

1. Debt management is what?

1.1 Workflow Definition

Debt management is the process monitored, recorded, collated recovery of sum of money that a business must collect from the customer or pay for a provider. The goal is to ensure that the liabilities are paid on time, avoid losses and optimize cash flow to operate.

In business, public debt is often divided into two main types:

- The debt to income: Is the account that the customer or partner has received goods or services but not yet paid. For example, a design company has already delivered products to customers at the beginning of the month but the payment is after 30 days, the account had become receivable.

- Accounts payable: Is the account to which the business has to get goods and services from suppliers but has not paid immediately. For example: business buying raw materials production and will be paid after 15 days according to the contract.

1.2. Why debt management important?

Public debt direct impact on cash flow – the lifeblood of business. If the business of slow money from customers, but paying the correct term for suppliers, negative cash flows will occur, leading to shortage of funds, affect the operations, production and business.

In addition, debt management good also help:

- Minimize the risk of bad debts: Avoid to accounts receivable backlog for too long, difficult recovery.

- Increase corporate reputation: When timely payment to suppliers, business gain more credibility in the partnership.

- Optimal capital efficiency: can balance the cash flow to invest the right time.

- Decisions more accurate: Based on data public debt, the leader can adjust the sales policy, the credit limit or payment term fit.

Suppose you are the cfo of a distribution company. Each month you shop for dozens of agents allows payment after 20 days. If there is no tracking system obviously, you won't know exactly who has maturity, who owed how much is very easy to fall into a state of “sell more, but not obtained the money”. In that case, the investment in new or payment of wages to employees also become a burden.

- 10+ Accounting software ERP admin popular have AI for enterprises

- File debt management in Excel free Download template board public debt professional

- Public accounting what is debt? Process, the role and the optimal solution for business

- Instructions to report the debt receivable and payable customer details

2. The role of debt management in financial activity business

Debt management is not merely an accounting profession that is vital in maintaining cash flow healthy to ensure liquidity, advanced financial credibility of the business. Especially in the business environment today, as stiff competition, the cost of capital increasingly expensive, the control of public debt in a basically help businesses be more active in the business plan investment.

- Direct impact on cash flow: cash Flow is the life blood of business. The sale but not obtained the money by the deadline will cause the business faced with the situation of weight loss for finance. Meanwhile, the financial obligations such as payroll, pay suppliers, pay taxes still have to make the right term. If the debt is “congestion”, business, though profitable on paper can still fall into cash to operate.

- Increase the efficient use of capital: When the debt is recovered right term, businesses can use this cash flow is to re-invest, expand operations, or take advantage of the opportunity to purchase early payment discount from supplier. Conversely, if the debt prolonged business to short-term loans to cover cash flow has increased financial costs, have created pressure for interest rates.

- Contribute to improving financial credibility of the business: A business is knowing how to control public debt effect not only ensure the ability to repay the loan but also build trust with partners, suppliers, all financial institutions. The systematic management of public debt clear transparency is also a big plus point when evaluating the operational capacity of the business, especially in the cooperation or to raise capital.

- Minimize the risk of bad debts loss of property: If there is no process to track reminds term public debt, tight business is very easy to fall into a state of not knowing who owes the debt, how much and when. Overdue debts extends not only difficult recover, but also leads to the possibility of losing white, affect the outcome of the actual business.

According to the survey report VCCI 2024, with up to 38% of small and medium enterprises in Vietnam are facing financial difficulties due to the customer late payment or non-payment by the due date. In it, 15% of the business must temporarily cease operations just because not processed in a timely receivables.

In summary, management of public debt is a “lever silent” but strong in financial management business. Doing good will help the business increase the autonomy, flexibility financially; do poorly will cause business loss control, cash flow, fall into the passive in every business decision.

3. Indicators need to follow in the management of public debt

The management of public debt can not stop at the level of tracking accounts receivable, payable in a discrete way. Enterprises need to build a system of specific indicators to assess the effectiveness of management, early detection of risks and take out the adjustable fit. Here are the three most important indicators that any business should also be monitored regularly whether you are using the Excel software, accounting software or solution liabilities integrated AI.

3.1. Old debt on average (DSO – Days Sales Outstanding)

DENSO for know on average how long does it take to business earned money from customers from the date of sale. This is the index reflects the rate of recovery of the debt.

Distance calculator:

DSO = (receivables and average / net Sales) × Number of days in the period

Illustrative examples:

- Net sales January 5: 3 billion

- Receivables average monthly 5: 1,2 billion

- The number of days in period: 30 days

→ DSO = (1,2 / 3) × 30 = 12 date

Actual value:

- DENSO lower cash flow as stable.

- DENSO high can be warning signs: customers deferred credit policy loose, or recovery process weakness.

3.2. The bad debt ratio

Is the public debt was long overdue almost can't recall if there is no interventions strong (as sue, liquidation of contract,...).

Distance calculator:

The bad debt ratio = (Total debts past due over 90 days / Total receivables) × 100%

Illustrative examples:

- Total receivables: 5 billion

- Of which overdue over 90 days is 800 million

→ The rate of bad debt = (0,8 / 5) × 100% = 16%

Actual meaning:

- If the bad debt ratio of over 10% is the need to note.

- Bad debt means a joint assets of the business risk can not be converted into cash.

3.3. The rate of recovery of the debt by the deadline

Is the percentage of liabilities to be obtained about the right or pre-term commitment.

Distance calculator:

Recovery rate, the right term = (amount Of the right term / Total amount due in the period) × 100%

Illustrative examples:

- In January, the total amount due is 2 billion

- Business collecting the correct term is 1.6 billion

→ Recovery rate, the right term = (1,6 / 2) × 100% = 80%

Practical value:

- The rate of as high efficiency recovery as possible, to help reduce the pressure cash flow.

- If this indicator low elongation, businesses should review the capacity to collect the debt, sales policies or creditworthiness of the customer.

3. Process debt management efficiency for business

A process of debt management efficiency not only helps businesses control cash flow, but also prevent the financial risks arising from the income and expenditure of lack of control. Here are 5 step core process that any business can apply, whether large or small scale.

Step 1: setting up partner profiles, clear

Right from the start cooperation relations with customers or suppliers, enterprises need to build a record detailed information, including:

- Legal information (company name, tax code, agent).

- Payment terms: the number of days the debt, form of payment (wire transfer, cash, note, windows,...).

- Credit limit granted if there is (ie business accept to customers debt to a maximum of how much money).

Benefits: The set limit terms of clarity helps avoid the “dim responsibility” at the same time is the basis to handle if a partner abuses committed payment.

Step 2: fully recognize the incurred liabilities under each transaction

After each transaction of sale or purchase, accountants need to fully update the system or panel track public debt. Data need to specify:

- The date of the transaction.

- Code invoice or contract number.

- Worth paying.

- Amount paid, how many are left.

Illustrative examples: Business sales for A dealer on the day 1/5, worth $ 100 million, to be paid in 30 days. Instantly, this transaction must be recorded in the system receivables to track progress and collect money.

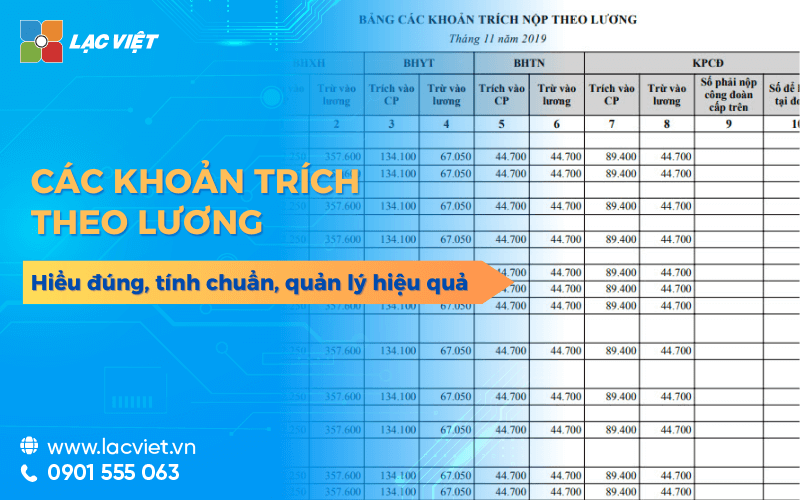

Step 3: Keep track of deadlines, debt, age classification of debt

Old debt is the period of time from the time of the transaction to the current time or date of actual payment. Age classification debt help businesses know what's coming due, account has expired, from which timely planned treatment.

Typically, the age group debt, including:

- Under 30 days (longer term).

- 31-60 days (almost overdue).

- On 60 days (delinquent or at high risk).

Worth getting: The classification according to the old debt help business focus resources recovery right priorities, minimize the possibility of incurring bad debt.

Step 4: Remind term debt comparison, recall the right plan

Businesses need to establish processes, prompt payment prior to maturity (for example: phone call, email ahead for 3-5 days). In addition, should reconcile public debt periodically between the accounting department and customers to avoid false data.

Practical tip: there Should be incentives for customers to pay early or on time (discounting 1-2%). At the same time, there should also be sanctions if regular customers the payment delay.

Benefits for business:

- Increase the proportion of collecting the correct term.

- Create good habits for the customer.

- Reduce financial pressure internal.

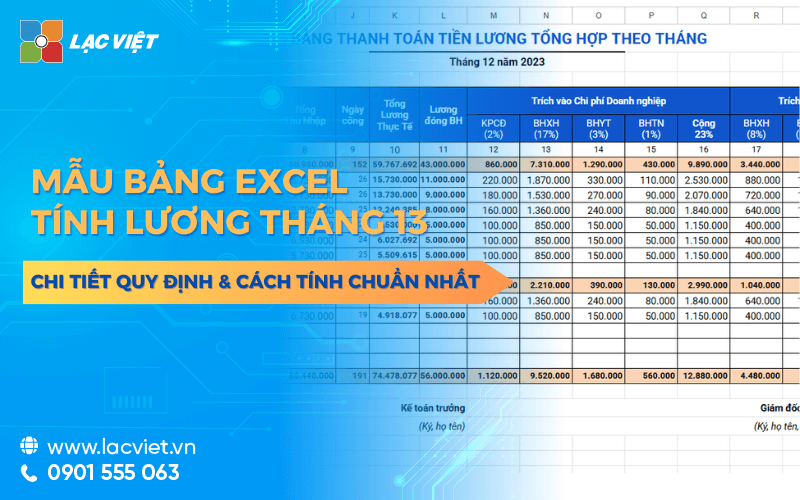

Step 5: Set up general reports, analysis, public debt periodically

Finally, businesses need to aggregate public debt by week/month to trend analysis:

- Customer do the payment due date highest?

- Who often late for appointments?

- Total public debt is how much risk are not?

These reports should be shown in tables or charts, easy-to-follow help leaders make decisions on policy adjustments, sales credit limit or scheme of withdrawal.

4. How to manage debt effectively in business

Debt management efficiency does not depend on a single tool, which is a combination of the standard process, information transparency, assign clear responsibility, application technology fit. Businesses want to better control public debt need to start from building an “ecosystem management” with the core principles follows:

4.1. Building public policy, debt clear right from the start

- Set payment terms clear in the contract: the number of days the debt, payment policies, discounting early or late penalty.

- The partner classification according to the degree of credibility to grant credit limit accordingly.

- Do not apply the general policy for every customer which need flexibility in your payment history and the scale of cooperation.

Benefits: Business risk control right from the stage of sales, limiting the debt can not be recovered.

4.2. Standardized recovery process for debt comparison

- The set up process 4 steps:

- Recorded –

- Reminds term –

- Collate –

- Recovered – and clearly assigned for each related department (accounting, business, customer care).

- Periodically (weekly/monthly), the organization for internal projector, for projector with customers.

- Apply the method of prompt payment, professional, right time, right concrete – avoid causing discomfort.

For example: Send reminders of gentle 5 days ago-term, accompanied by a debt comparison to the present moment to the customers arrange payment.

4.3. Track analysis indicators public debt often

- Maintain follow-up table according to the date of maturity, age group debt and the status of each account.

- Calculate the index: DENSO (aged debt on average), the share of overdue debt recovery rate, the right term to detect bad trend.

- Warning internal when there is debt unusual or customer signs of delayed payment, repeat.

Benefits: From the data collected, the business not only handle current situations but also analyze the behavior payments in the past to forecast risk in the future.

4.4. App intelligent software to automate processes

With business scale just above, the large volume of transactions, the use of the software is required to:

- Automation prompt term.

- Integrated with the accounting system.

- Born liabilities reported in real time.

Should prioritize the solutions have the ability to analyze data risk warning such as Vietnam Financial AI Agent business support actively control the correct decision.

Clear benefits: Reduced time manipulation craft, increase the accuracy of data given early action instead of “run as” account debtor has expired.

4.5. Training personnel building a culture of responsibility with public debt

- Hr, accounting, sales and management need to understand that debt is not just numbers on the report, which is the cash flow survival of the business.

- Organize internal training periodically about the process of debt management, negotiation skills, recovery skills, risk assessment.

- Mounting KPI or payoff related to the ratio of public debt is collecting the correct term to increase the autonomy of the individual.

5. Common mistakes in debt management businesses need to avoid

Debt management efficiency based not only on the track of the income and expenditure account but also depends on how business organizations, processes, distribution of responsibilities, maintaining the constant updates. However, in fact, many businesses still suffer from these common mistakes ideas small, but consequences to cash flow and operational efficiency.

- There is no recovery process public debt clear: Many businesses focus only on sales that have not yet build process, debt collection specific. There is no person in charge of privacy, no calendar, reminder term, no method of processing when the limit that the debt collection becomes passive.

- Noted the lack of accurate, do not update often: entering the wrong amount, wrong payment date or not timely updates after the customer has to pay money to make data public debt is false. This easy to lead to disputes, misunderstandings or loss of credibility with customers.

- Not collate public debt periodically between the parts: If the department of accounting, business and cashier every where keep a track table, but not for projector periodically, easily lead to conflicting data. This affects not only financial statements but also cause difficulties in handling debt slowly.

- Too dependent on Excel spreadsheet crafts: Excel can fit in the early stages, but when the amount of data increases, spreadsheet system becomes complex, heavy to error. Just a recipe wrong or a mistake, the entire board public debt may be false that is not discovered.

6. Solution debt management smart AI Lac Financial AI Agent

In the context of business need to handle hundreds, even thousands, of transactions, debt each month, based on Excel spreadsheet or accounting software tradition is no longer enough to meet the requirements of strict control, fast processing, predict risk accurately. Solution Lac Financial AI Agent created to solved comprehensive problem of managing the public debt does not just stop at the track, but also support the business actively take financial decisions based on data.

- Automatic track analysis, age of debt: as Soon as a transaction, the system of Financial AI Agent will automatically record update statistics public debt. Analysis of the age of the debt is made, instant share get each group: debt to longer-term debt coming due, the debt was overdue.

- Warning bad debt, prompt payment according to real time: One of the strong points of Financial AI Agent is the ability to set smart alerts, according to many levels. When a debt coming due, the system will automatically send a notification to the relevant department or to the customer if one is connected. In case of any signs become bad loans (past due on 30, 60 or 90 days), the system also give recommendations, risk analysis, based on past data.

- Reporting system intuitive, decision support, financial fast: Financial AI Agent provides the interface panel (dashboard) helps users to easily track the entire public debt in each object, duration, mode of payment,... the report is presented using charts, tables can be customized according to the needs leadership.

If the business you are seeking to control public debt, it more transparent, more efficient, let's start by one simple step. Experience right solution Financial AI Agent to receive advice tailored to scale, industry and business model of you.

Visit here to get advice demo: https://lacviet.vn/lac-viet-financial-ai-agent/

Lac Viet Financial AI Agent to solve the “anxieties” of the business

For the accounting department:

- Reduce workload and handle end report states such as summarizing, tax settlement, budgeting.

- Automatically generate reports, cash flow, debt collection, financial statements, details in short time.

For leaders:

- Provide financial picture comprehensive, real-time, to help a decision quickly.

- Support troubleshooting instant on the financial indicators, providing forecast financial strategy without waiting from the related department.

- Warning of financial risks, suggesting solutions to optimize resources.

Financial AI Agent of Lac Viet is not only a tool of financial analysis that is also a smart assistant, help businesses understand management “health” finance in a comprehensive manner. With the possibility of automation, in-depth analysis, update real-time, this is the ideal solution to the Vietnam business process optimization, financial management, strengthen competitive advantage in the market.

SIGN UP CONSULTATION AND DEMO

Through this article, we went deep into the concept, role, process, index, mistakes to avoid and especially the support tool in the modern management of public debt. From this it can be seen, the business should not just stop at the recorded liabilities that need to switch to a thinking, active management: monitor – analysis – forecast – informed decisions based on real data.

If you are looking for a clear direction, a tool support smart to upgrade active debt management – Financial AI Agent of Lac Viet is the solution worth to experience. Not only help you automate the process, risk warning, which also brings a comprehensive perspective on cash flow, to help businesses better control over growth more resilient.