In an era where every business decision should be supported by data and effective use of resources, financial management, business no longer is the work of accounting that becomes a survival skill of any business. This is the key to help enterprises to operate smoothly, scale, investment in the right time, good tolerance before the market volatility.

Many businesses today are still operating based on “emotional financial” – i.e., spend, invest or expand based on intuition instead of being driven by the numbers. As a result, when cash flow becomes deficiency, cost overruns control or the ratio of debt to increase height without timely detection and businesses fall into the status of “fire air” without treatment.

This article Lac Viet Computing will help the organizations and enterprises are in the stage of starting, growing or restructuring can view more systematic about:

- Financial management what is and why do we have to post-deployment version?

- What elements constitute a system of financial management effective?

- The practical skills that managers need to have.

- Applying technology in improving the financial performance of the business.

1. Financial management what is a business?

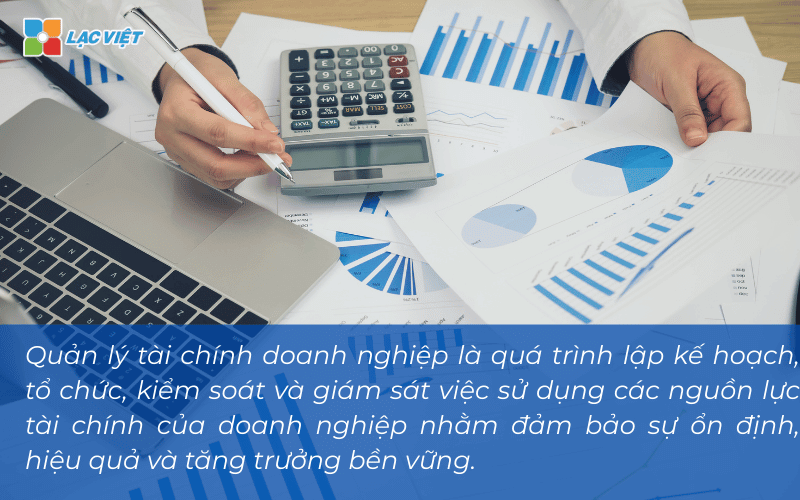

Financial management business is the process of planning, organising, controlling and monitoring the use of financial resources of the enterprise to ensure the stability, efficiency, sustainable growth. Simply said, this is the way business answer the questions:

- We are how much money?

- The money is going where to do what?

- Need to do to optimize cash flow, enhancing the efficient use of capital?

Difference between financial management and accounting

A common mistake is for that accounting is financial management. Fact, these two concepts are related but different in essence:

- Accounting is recorded, reported the financial – economic happened.

- Financial management is the act of management, cash flow, analysis, effective decisions based on accounting data.

Illustrative example: accountant may report revenue months 3 is 5 billion, the cost is 4 billion. But financial management will ask the question: “why profitability is still low? Customers pay the right term yet? There should invest more to increase the capacity not?”

2. Financial management business efficiency by scale

2.1 financial Management in small business and startups

Characteristics stages: In stage startups or businesses were small, revenue is often not stable, markets are experimental, while the cost of the initial investment (marketing, hr, technology...) arise constantly. So, the math is the largest expenditure control as closely as ensuring cash flow is not sound.

Common problems:

- No forecast is the time of lack of money.

- Not to closely monitor debt to income leads to “hug the public debt”.

- Costs incurred in addition to the plan (run ads, repairs, hire out) is not recorded in a timely manner.

- Borrowed personal confusion between personal financial business.

Target financial management at this stage:

- Set report cash flow week by week/month: know the month in which collected many, I need to prepare to spend.

- Determine the breakeven point: helps to know from the sales would start to take interest.

- Optimal public debt: specified payment term with customers, monitoring.

- Preferred equity or capital interest (borrowing from relatives, angel investors) to avoid pressure to pay interest right from the start.

Practical solution:

- Use Excel template cash flow available or accounting software simple to track income and expenditure each day.

- Use the detailed budget, list each expense by month and set limits for each category.

- Set general report on public debt customers, suppliers, periodically updated weekly.

- Applied software AccNet or the free tool has the ability to create automated reports simple.

2.2 financial Management at the stage of scaling

Characteristics, phase: Business had revenue stability, starting extension personnel, open more branches or develop more new products. However, the complexity also increase: the cost of higher operating pressure control efficiency greater investment.

New financial challenges arise:

- 't understand operational costs each department → 't know which parts are underperforming.

- Cash flow unevenly between the units → where excess money, where lack of money.

- Investment decisions extensions not based on the rate of payback or asset efficiency.

Target financial management at this stage:

- Set budget in units, departments, or projects.

- Calculate and analyze the ratio of the cost on revenue, determine the “point of congestion finance”.

- Measuring investment performance according to metrics: ROI, Payback period, IRR, if possible.

- Control inventory, depreciation of fixed assets, avoid waste.

Practical example: A furniture company expanded from ho chi minh CITY.CITY to Binh Duong and Dong Nai. If not, analyze the cost of shipping, personnel, premises in each area, the business will meet the condition: total revenue up but profit decreased due to the cost of expanding beyond control.

Proposed solution:

- Using software, financial management, capable of tracking branch, according to the project as AccNet ERP.

- System settings report, budget – real periodically to compare, adjust.

- Apply KPIs finance for each department, help leaders gave a quick, effective decisions timely adjustment.

2.3 financial Management for big business and corporations

Characteristics, phase: Business step into the adult stage, may have had many subsidiaries, product lines, operate in many different markets. Raising capital, working with shareholders, investors, or preparation of the IPO requires standardized whole system of financial management.

Main challenge:

- Financial data dispersed, difficult to synthesize in real-time.

- Analysis report merger between parent company and subsidiaries complex.

- The risk of financial risks due to higher loan debt, market volatility, exchange rates, legal, tax...

Target financial management at this stage:

- Standardized reporting system, financial consolidation, according to the standard VAS, towards IFRS if plans call international capital.

- Maintain financial indicators safety: as the ratio of debt/equity, liquidity ratios short-term profitability on the capital.

- Optimal capital structure to reduce the cost of using capital.

- System settings control the financial risks.

Technology solutions:

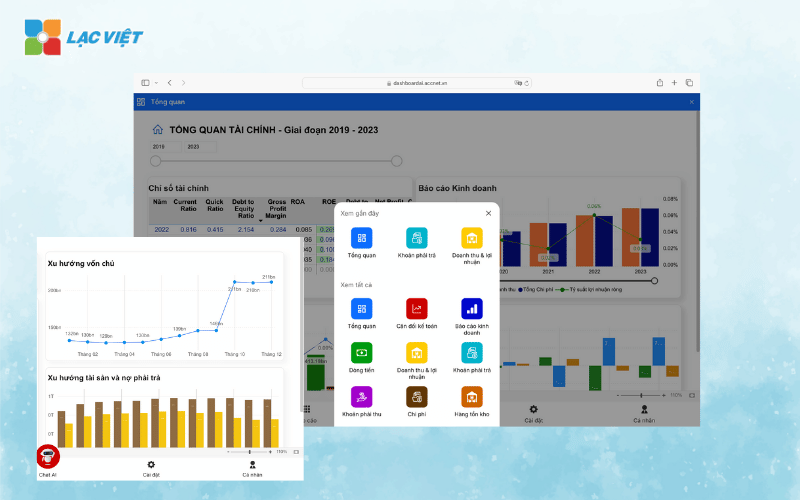

- Application ERP system is fully integrated accounting – financial – budget – merge, as AccNet ERP version company.

- Deployment LV Financial AI Agent to automatic synthesis report according to each unit region. Analysis financial spread in real time. Hint allocation plans, cash flow efficiently between the member companies.

Benefit received:

- Leadership has panoramic financial in real time, not waiting for the end of the month/quarter.

- Investment decisions, restructuring or call capital more easily because there is data that supports transparency.

- Increase in enterprise value in the eyes of investors, the credit institution.

3. Skills needed to manage business finances efficiently

Financial management is the job of the accounting department. In a modern enterprise, every leader – from the chief executive officer (CEO), chief financial officer (CFO) to head board – all need equipped with the financial skills essential. Because, all strategic decisions are related directly or indirectly to money: investment, expansion, cut, recruiting or even stop a project.

Below are the core skills that help managers actively operating financial performance, not passive in situations of risk.

3.1 thinking, strategic financial

Thinking financial strategy is the ability to see finance as a part of business strategy, business need anything from this thinking?

- Analyze financial trends over time: cost, revenue, profit, rate of return.

- Connect financial goals with business plan: for example, want to grow by 20%, then need how much investment, expectations of cash flow and how.

- Know, “selective risk” instead of dodging the risk.

Practical example: A business e-commerce growth, but after 6 months, the profit still. Executives are thinking financial strategy will focus not only on sales, which analyzes the cost structure, marketing, rotation of inventory performance in order to take optimal decisions capital investment.

3.2 planning Skills and financial forecast

No financial planning i.e. are operated business “blind”. This is the skills to help business proactive instead of reactive is automatically upon the occurrence of crisis.

Consists of 2 main contents:

- Financial planning: including the budget revenue – costs, capital planning, cash flow.

- Financial forecasting: Forecast fluctuations in cost, cash flow, profitability under different scenarios (optimistic, base, caution).

Simple tool to apply:

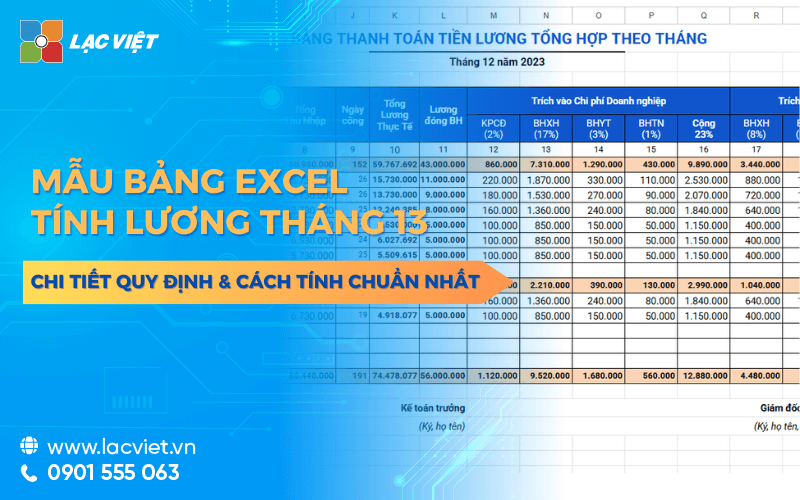

- Table budget in Excel by month/quarter

- Sample cash flow forecast for simple week by week

- Software support such as AccNet ERP helps to automatically synthesize, compare plans – practical

Practical value:

- Help the business know when need to adjust the plan, avoid the deficit cash flow.

- Limit depends on the borrowed folding or investment at the wrong time.

3.3 reading Skills to understand and analyze financial statements

Even when there is no accounting expert, executives also need to understand the financial indicators basic to make the right decision.

Skills required:

- Read the balance sheet: Know the businesses are “heavy debt” or “strong”.

- Understand reports business results: cost analysis which accounts for a large proportion? Net profit come from?

- Read the statements of cash flows: interest, but there are lack of money?

Support for non-professionals:

- The financial software such as LV Financial AI Agent has the ability to “translate the language of accounting” to report concise, easy to understand.

- Sample financial chart illustrates clearly the trend of increase or decrease over time.

Values bring:

- Moderator decisions not just by “intuition” which by the financial data specific.

- Increase effective coordination between the finance department, other parts.

3.4 Skills, risk control and financial decisions

Every business can meet fluctuations: drop in revenue, the cost increases abruptly, customers delay payments. This skill helps to reduce the impact of risks, maintaining financial stability.

Includes:

- Identify financial risks: debt, bad, negative cash flow, loan exceeding the limit...

- Risk analysis by the model or indicator (as of current payment).

- Make decisions based on data: should continue to invest, cut, or re-structure?

Typical example: In outbreak COVID-19, many businesses are forced to choose: pay cuts, suspend projects, or search for capital relief. The business has control skills good risk has prepared contingency fund or scheme of financial flexibility from ago – thanks to that survive, recover faster.

In summary, equipped with the financial skills not only dedicated to the accounting department or CFO, that element is mandatory if the business want to active growth, sustainable. In the digital era, the combination of people skills, tools, financial technology will be the “shield” and the “launchers” to help businesses go further.

4. Common mistakes in financial management in business English

Though aware of the role of finance in business activities, many businesses in Vietnam – especially small and medium enterprises – are still mistakes repeated in financial management. These errors are usually not appear immediately on reporting business results, but will silently build up, seriously affecting the ability to survive, grow in the long term.

4.1. Teen tracking and forecasting cash flow

Many businesses only focus on revenue – profit that missed the track line actual money. Meanwhile, cash flow is the “lifeblood” commissioning business every day.

For example: A construction company get large contracts, revenue recognition, the tens of billions. However, as customers deferred longer cost materials to advance, the business is not managed cash flow, forced to borrow money, leading to increased borrowing rates, loss of ability to pay.

Consequences: Lack of liquidity, loss of reputation with suppliers, slow wage employees, even loss of ability to pay short-term.

4.2. Investment decisions according to the sense

No little business to expand the market, the investment line, or hire more staff just because “feel the need”, which is not based on financial analysis specific.

For example: A chain of retail stores expanded massively to another province that has not rated operating costs, the purchasing power or the payback period. Results after 6 months, to be closed 2/3 of the new branch due to holes stretched.

Value drawn: Every investment decision should be based on data analysis clear: performance, profitability, payback period, possibility of growth, affect current cash flow.

4.3. 't control indirect costs

Indirect costs such as electricity, water, marketing, management, administrative... if not carefully controlled, can account for a large proportion in the total cost that the business doesn't get out.

Common practice: Many companies do not have table cost analysis details under each category or each division, make the cut when the need becomes difficult.

Solution: set system budget for each department, authorized to approve spending, periodically reviewing the comparison between the budget.

4.4. Depending on the individual instead of building system

The financial management depends on an individual – usually the chief accountant or business owner – is a common condition. When this person vacation or move the entire financial system disorders or stagnation.

Consequences: Loss of data, interruption of cash flow, there's no report in a timely manner when needed loans, bid or make decisions.

Solution: Businesses need to move from “managing in the” to “managed by system”, applied software to standardize data and processes.

5. Application of technology to improve efficiency, financial management

In the context of business need to operate fast – flexible – exactly, the application of technology is no longer a competitive advantage, which is the minimum conditions to financial management, transparency, efficiency, accurate decisions.

5.1. Use accounting software – financial professional use

The software as AccNet ERP helps businesses:

- Recorded every industry financial services accurate, complete, correct standard circular 133/200.

- Automatic synthesis report, financial report, balance sheet, accounting, reporting, cash flow...

- Tracking cash flow in real time, give a warning when there is unusual fluctuations.

Practical benefits: Reduced dependence on personnel, improve accuracy, save time processing of data.

5.2. Integrated artificial intelligence with LV Financial AI Agent

Tools LV Financial AI Agent is the solution modern financial help businesses:

- Analyze financial data automatically: Handle thousands of lines of data, displayed in chart form – index visually.

- Warning of financial risks: identify early indicators as bad as negative cash flow, the increased cost abnormal performance using low capital...

- Suggestion schemes balance the budget, investment: Based on financial history, trends, WHO propose suitable options to optimize profitability, cash flow.

Lac Viet Financial AI Agent to solve the “anxieties” of the business

For the accounting department:

- Reduce workload and handle end report states such as summarizing, tax settlement, budgeting.

- Automatically generate reports, cash flow, debt collection, financial statements, details in short time.

For leaders:

- Provide financial picture comprehensive, real-time, to help a decision quickly.

- Support troubleshooting instant on the financial indicators, providing forecast financial strategy without waiting from the related department.

- Warning of financial risks, suggesting solutions to optimize resources.

Financial AI Agent of Lac Viet is not only a tool of financial analysis that is also a smart assistant, help businesses understand management “health” finance in a comprehensive manner. With the possibility of automation, in-depth analysis, update real-time, this is the ideal solution to the Vietnam business process optimization, financial management, strengthen competitive advantage in the market.

SIGN UP CONSULTATION AND DEMO

Financial management business is not merely track income and expenditure, or to report on, which is the proactive process control, analysis, orientation use monetary resources in a smart way, effective. Although the business is at the stage of starting a business, expanding or has developed into a group, then a financial system, it is the foundation to ensure the sustainable, ready to face all market fluctuations.

The page is thinking financial strategy, combining skill, the right tools will help your business thrive in the long term.

Are you looking for a solution to help financial control, comprehensive automatic analysis, decision easier? Experience now LV Financial AI Agent – Assistant financial intelligence for modern business.