In the context of competition is increasingly fierce, and the economy fluctuates unpredictable, enterprises can not only rely on good product or sales strategy sharp to sustainable development. As practice shows, many businesses have high turnover, but still falling into crisis just because of weaknesses in financial management. Financial management is not merely track income and expenditure, which is a strategic system to help control the flow of money, optimize resources, decision-making based on data.

This article Lac Viet Computing will help you to understand financial management what is enterprise, the core elements, the way of practical application to create competitive advantages in the long term.

1. Financial management what is a business?

1.1 Workflow Definition

In a nutshell, financial management business is the process of planning, organizing, coordinating all activities related to money in business – including the arrangements for capital allocation, use of capital, cost control, performance evaluation, financial guarantees of solvency.

Other than accounting – capital nature of recording and fairly reflect the transactions happened – financial management role, forecasts, guidance, help businesses make the right decisions about investing, spending or adjust business operations.

Financial management good business “survive” in difficulty, create a solid foundation to expand the market, increase in enterprise value in the eyes of investors, partners and banks.

- Minimize the risk of losing financial balance

- Increased ability to mobilize capital and capital success

- Business decisions based on clear data, not feelings

- To optimize costs, maximize profits

1.2. The role of financial management in business activity

Financial management is not just accounting profession extension, which played a key role in the strategic direction, operating, raise the competitiveness of the business. Here are 4 prominent role:

Is the “backbone” guaranteed cash flow without fracture

Though the business that the business model attractive to now, but if not, ensure cash flow rotated regularly, every operation will be stalled. Financial management helps enterprises:

- The forecast is the time of deficiency or excess capital.

- Active rotation, cash production service, pay short-term obligations.

Is the basis of decision making for leaders

Every decision on expansion, investment, cut or navigation strategies are required based on financial analysis clear. Through the system of financial management, business leaders can:

- Get effective each business segment.

- Cost analysis – profitability of the distribution channel, product or market.

Help increase financial health and capacity call capital

A business has the financial system clear, transparent, well-controlled will create trust for banks, investors, strategic partners. This is the deciding factor helps enterprises:

- Easy loans with preferential interest rates.

- Be appreciated when calling capital, IPO, or investment cooperation.

Increase resilience in crisis

Phase Covid-19, or the fluctuations, interest rates are allowed to try with every business. Business management financial lessons will:

- Prevention of financial risks better.

- Proactive adjustment strategies spending and investment.

2. Objectives and principles of financial management business

2.1 the objective of The financial management business

Establishing clear goals in financial management is the foundation for enterprises to better control resources, from which stable operation and sustainable development. Here are 3 key goal:

- Ensure financial safety and liquidity: financial Security means that the business has enough cash flow to maintain operations often do not fall into the status of “overspending”, or reliance on debt short-term loans. Good liquidity to help businesses active in payroll, tax, supplier, avoid “trapped capital”, although there is profit on the books.

- Maximize enterprise value for shareholders: target not only is there interest, which is to create added value sustainably for shareholders and owners. This is reflected in indicators such as net asset value, capital efficiency, profitability from equity (ROE). Business management financial well will put off the decision to invest smart, optimize costs, enhance financial capacity long term.

- Efficient use of capital and savings: capital Resources are always limited. So, businesses need to clearly define should allocate funds for activities that would bring the rate of return highest, at the same time avoid investment or spending a lack of control. This is vital, especially with small and medium businesses or the expansion phase scale.

2.2 principles of financial management efficiency

To achieve the above objectives, the enterprises need to build a system of financial management based on 3 core principles:

Principles control the flow of money

Manage cash flow plan cash flow forecast the cost (tax, salary, repayment), from which the project mobilized in a timely manner. Positive cash flow continuous help enterprises actively seizing investment opportunities or prevention of crisis.

Businesses can use accounting software integrated cash flow management by week/month to capture the point “bottle neck”, adjust financial plan in a timely manner.

Principles of transparency and regulatory compliance

Transparency is the key element to create trust with shareholders, business partners, banking, state agencies. Financial management efficiency should ensure:

- Records fully and clearly

- Recorded services properly accounting standards

- Compliance with the law on taxation, finance and investment

Principles of measurement and evaluation of financial performance

Can't manage well what you don't measure. Businesses need to periodically monitor the index as:

- Gross profit net profit

- ROA, ROE, debt

- The collection cycle, cash cycle inventory

From that assessment operational efficiency, each department, each project – decision support timely adjustment.

3. The core elements of financial management

A system of financial management effective indispensable factors platforms play the role of “backbone” in all decisions and run your business. The following four elements are the main focus to help businesses control over financial firm, from stable operation to sustainable development.

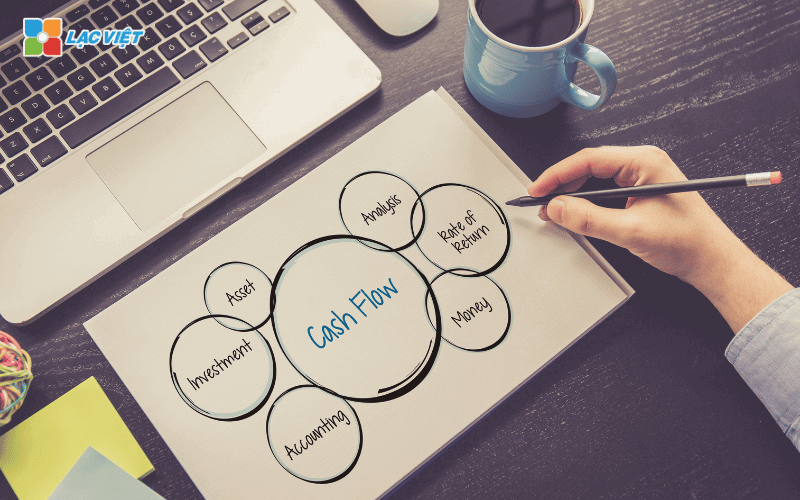

3.1 Management of cash flow (Cash Flow Management)

Cash flow management is the capacity to track, forecast, regulate the flow of money out – to for businesses to ensure liquidity, avoid falling into the status of “interest-virtual – money's not there”.

Why is cash flow important?

- Business can be a large margin on the report, but still go bankrupt if not enough cash to pay short-term obligations.

- Many cases contracted, but collect the money slowly, while still must advance the cost of raw materials, labor, tax...

Application in real business:

- Set plan cash flow weekly/month to know the time need to rotate or short-term loans.

- Control public debt closely: track receivables – payables under the age of debt, early warning when there is risk of slow payment.

- Optimal payment terms with customers and suppliers.

For example, A furniture company project implementation 10 billion, but the payment under schedule 3 installments. In the first 2 months, the cost of construction exceeded 6 billion while only collect 2 billion. If there is no plan reasonable cash flow businesses to borrowers fold with interest, high influence profitability, cash flow risks, pussy stretching.

3.2 cost control (Cost Control)

Cost control is the art of maintaining effective functioning but still make sure to use the optimal financing. Difficulties faced by many businesses not because of lack of revenue, but because of high operating costs unnecessarily.

Costs should be controlled how?

- Classification group expenses: fixed, variable, arising out plan.

- Determine the cost to create value (costs, generate revenue, increase productivity), the cost can be cut without affecting operation.

- Apply only the budget: each department has limited the level of detail separately, there are reports comparing budget – real periodically.

Actual value:

- Maintain the profit margin stable even when the market fluctuates.

- Increase competitiveness through product price optimization.

For example: Business production check back logistics costs, detection costs to 15% for shipping. When switching to the contract periodic with unit huge logistics cost reduction of 30% that speed of delivery while ensuring – from that net profit increased markedly without increasing the selling price.

3.3 Management and capital investment (Capital Management)

Managing capital is the business to ensure there is enough capital right time and use the capital one effective way to grade.

The two important aspects:

- Raising capital: select funds fitting (equity capital, bank loans, issuance of bonds/shares). Need to balance between the cost of capital, financial risks, the ability to control.

- Capital allocation: Determine the project activities, which have rates of return highest priority cash flow for that area.

Strategy comes:

- Calculate the cost of using capital in order not to “pour money” into the investment payback slow.

- Performance monitoring use of funds under each accounting period, re-evaluate as needed.

For example, the Business has 10 billion in retained earnings. Instead of sending bank, the finance department proposed 5 billion investment into the production line automatically – estimated increase productivity by 30%, save labor. After 18 months, the capital refundable, help reduce fixed costs in the long term.

3.4 assess the financial performance (Financial Performance Evaluation)

Reviews the financial performance step is measuring the “health” holistic of the business through the financial indicators – from that orientation tuning strategy business, raise capital, or to improve operation.

The index of core should track:

- Net profit margin (Net Profit Margin): reflects the ability to create interest after deduction of all expenses.

- ROE (Return on Equity): measure the efficient use of capital owners.

- Coefficient of current liquidity: said the possibility of business to pay short-term debt.

- Inventory turnover, debt: reflect operational efficiency.

Why regular reviews are important:

- Early detection of point congestion finance (inventory increase revenue, leveled, high debt ratio...).

- Base is presented with banks, investors, partners, when the need to raise capital or participate in the tender.

For example, A retail business can profit increased steadily but ROE decreased continuously for 3 years. Analysis shows that capital investment in warehousing are being “detained money” that does not generate more sales → business restructuring, asset transfer part to outsource, ROE improved in the following year.

4. The main functions of the financial management business

Financial management business is a chain operations, strategic – from planning, coordinating resources to investment decisions and risk control. Each function below, if correctly implemented, will become important lever to help business stability, sustainable development.

4.1. Financial planning short term

This plan often have cycles from 1 month to 1 year, focusing on:

- Set up a detailed budget for each department, each item (salaries, rent, marketing, production...).

- Cash flow forecast in – out, week by week or month.

- Calculate loans, debt repayment, fixed costs – variable.

Business knowing beforehand the time any cash shortages, from which actively embodiment balance or negotiating with partners.

Financial planning long-term

Lasts from 3 to 5 years, long-term plans focused on growth strategy:

- Expected to scale revenues and profits according to each stage.

- Oriented investment in fixed assets, expanded factories, branches.

- Determine the demand for capital raising and financial restructuring.

For example, A business of producing plastic financial planning 5 years to invest in new plant worth $ 50 billion, of which 30% is capital, 70% is capital long-term loans. Detailed plan enables the leader board control risks pay off debt, track investment performance each year.

4.2. Analysis and cost control

Cost analysis is the process of evaluating how entrepreneurs use resources, specify the account details which really bring value.

- Analysis of expenses by department (Cost Center): Costs are allocated according to each unit such as sales, production, administrative... help determine which parts are to operate effectively, certain parts need to regain control.

- Cost analysis by product/project: Businesses can know exactly each product are consuming how much cost marketing, shipping, discount... from that evaluates the profit margin of each product line.

- Control and optimize cost: financial Management the need arises “threshold control”, mechanism and approval for expenditures beyond the budget. Besides, to regularly review the expenditures less effective or possible replacement.

4.3. Financial decisions

This is the function to a strategic decision directly to the efficient use of capital, the direction of the business. Every financial decision should be based on data analysis, not feelings.

- Investment decisions: Business should assess the rate of payback (ROI), payback period, the level of risk... before investing in a project, property or new channel.

- The decision to mobilize capital: includes the choice between bank loans, issuing stock, or using retained earnings. Each scheme has cost the use of capital, affects the control of different.

- Decided to dividend or retained profits: Businesses are in expansion phase may choose to retain the profits to re-invest instead of dividend – this is decision-oriented long-term.

4.4. Forecasting financial risk, and local construction project prevention

Financial risk factors is not inevitable, but can fully manage, mitigate, if have the tools and a clear plan.

The types of risks common

- Risk-cash flow: cash Flow, pussy stretching, shortage of working capital.

- Bad loan risks: Customers delay payment of, accounts receivable, but not recovered.

- Interest rate risk, exchange rate: Especially with foreign currency lending business or imported raw materials.

- Legal risk audit: irregularities in, financial statements, lack of transparency.

Prevention

- Set the financial reserve fund for emergency situations.

- Build script “worst” to prepare plans to respond.

- Use the tool early warning as to WHO or financial analysis according to the index early warning (Early Warning Signals).

Practical example: use Business management software, financial integration AI to track the ratio of debt to collect overdue. When this ratio exceeds 20%, the system immediately alerts for finance teams put out of action, debt collection soon.

5. The common challenges in financial management business today

Though aware of the importance, many businesses still have difficulty when deploying financial management the way. Here are 4 common issues:

Teen financial data promptly and in full

Many businesses are still operating in a “view report”, i.e. only understand the financial situation after the accounting period has ended. The lack of data in real time makes leadership:

- Slow response with fluctuations.

- Don't understand the effect each activity in a short time.

For example: marketing Campaign spend hundreds of million but not effective. If there is no report analyzed in detail within 1-2 week, the business can continue to waste budget.

Cash flow management inevitably leads to deficiency of capital

A lot of businesses, although there is interest but still have to borrow to pay salaries, taxes, import goods. The cause lies not in profit, but due to cash flow is not monitored, controlled surveillance.

Consequence:

- Short-term loans, often with high costs.

- Dependent on financial partner, lose the initiative in the executive.

Processes, discrete cause errors

Many businesses still use spreadsheets Excel to aggregate data from multiple parts. This leads to:

- The data is duplicate errors due to enter the hand.

- Difficult to control history edit, collate between departments take time.

Value from the fix: When switching to the financial system of goods (ERP or accounting software integration), businesses can reduce up to 80% risk data entry wrong.

Teen analytical tools effectively in real time

Financial management is the need to have the ability to:

- Trend analysis, revenue, cost, profit each array.

- Risk warning if financial indicators exceeded the safety threshold.

Proposed solution: application assistant finance as smart as LV Financial AI Agent, help businesses:

- Read and analyze financial statements.

- Give suggestions adjustments, warnings fluctuations in cash flow or performance of business unusual.

6. Solution and application of technology in financial management business

In the context of transition of going strong, the application of technology in financial management no longer is choice, which is a mandatory requirement if the business wants to operate efficient, transparent, proactive, prior to the volatility of the market. Below is the solution technology practical, can immediately apply in the small and medium enterprises to large-scale conglomerate.

6.1. Accounting software management intensive

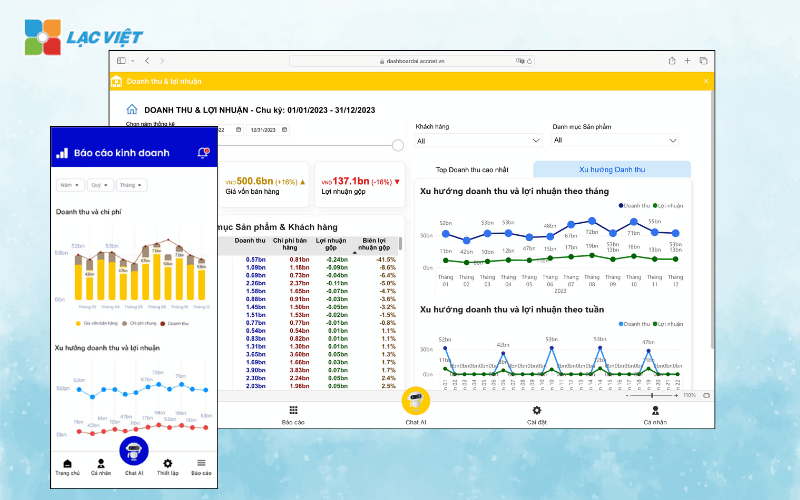

Accounting software management support, recognition, service and helps keep track comprehensive financial situation, business in real-time. AccNet ERP is a typical example is designed specifically for the Vietnamese market, in accordance with the business are adopting circular 200 or 133.

Some salient features of AccNet ERP:

- Set and track financial budget, compare actual with plan.

- Automatic analysis of interest – holes in each order, each project, room board.

- The data connection between the parts: accounting – sales – stock – buy – hr.

Values bring:

- Up to 70% of the time synthesis report manually.

- Help managers capture the right business performance according to each stage, instead of waiting until the end of the month.

- Easy financial decisions based on aggregated data immediately.

6.2. Integrated financial assistant smart – LV Financial AI Agent

LV Financial AI Agent is application solutions artificial intelligence to financial analysis to help business understand data, risk warning, proposed financial action specific.

The ability to stand out of the LV Financial AI Agent:

- Analysis report automatic: WHO read, synthesize, interpret financial reports such as balance sheet, reports business results, cash flow... as understandable language, no need of professional accounting.

- Warning risk cash flow: early detection of signs of imbalance, accounts receivable past due ratio, expenditures exceeded the plan.

- Proposed decision: Hint embodiment, adjustment costs, asset structure, or adjust investment plans on the basis of financial data, fact.

Lac Viet Financial AI Agent to solve the “anxieties” of the business

For the accounting department:

- Reduce workload and handle end report states such as summarizing, tax settlement, budgeting.

- Automatically generate reports, cash flow, debt collection, financial statements, details in short time.

For leaders:

- Provide financial picture comprehensive, real-time, to help a decision quickly.

- Support troubleshooting instant on the financial indicators, providing forecast financial strategy without waiting from the related department.

- Warning of financial risks, suggesting solutions to optimize resources.

Financial AI Agent of Lac Viet is not only a tool of financial analysis that is also a smart assistant, help businesses understand management “health” finance in a comprehensive manner. With the possibility of automation, in-depth analysis, update real-time, this is the ideal solution to the Vietnam business process optimization, financial management, strengthen competitive advantage in the market.

SIGN UP CONSULTATION AND DEMO

Financial management business is the foundation of survival for the stable development of the enterprise. From ensuring cash flow, cost control, to allocate capital, evaluate financial performance, all of which should be made available system updates from time to time. In the digital era, the combine between thinking financial strategy and solutions, modern technology will help businesses nbứt-breaking powerful.