Build a payment process tight, efficiency is essential in every business. With respect to the accounting department, the payment process not only ensures transparency, apparent in every transaction, but also help minimize financial risks, avoid errors should not be. However, to operate an accounting process payments smoothly, the staff accountant should master each step in the process. So, where is the critical step in the accounting process payments? Let's Lac Viet read through the article below.

1. Why enterprises should build the payment process

In the operation of any business, the payment process plays an important role in ensuring a seamless, transparent financial. A process of payment accounting, effective not only help businesses avoid the financial risk but also to strengthen the control and cash flow management.

Construction payment process closely will help:

- Minimize errors: Limit the errors arising due to errors in paperwork, payment information, help design payment processing, and more.

- Enhanced transparency: All transactions are in control, avoid payment status is not clear.

- Save time: optimization step approval, prepare vouchers help to minimize processing time, especially when businesses use automation software.

- Regulatory compliance: With the standard process, business easily comply with the regulations on financial, tax as well as legal policy to another.

- 10+ ERP Management Accounting Software with AI Compliant with Circular 99/2025 for Vietnamese Businesses

- 9 Accounting Software online cheap cost reduction for small and medium ENTERPRISES

- Convert numbers in accounting optimal efficiency? Why BUSINESSES should start?

- The impact of AI to accounting, industry accounting, audit have been replaced?

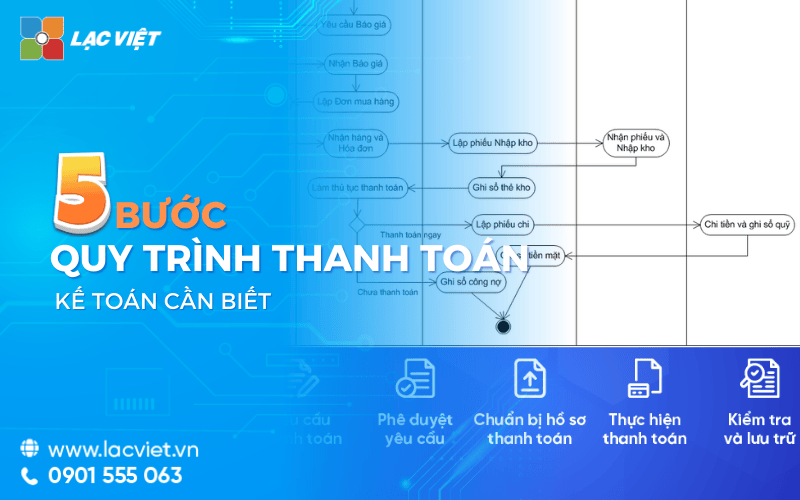

2. 5 basic steps in the payment process

To process payments in business goes smoothly, adherence to standard procedure is necessary.

The payment process includes 5 important steps below:

- Step 1: request for payment

- Step 2:Approval

- Step 3: Prepare payment vouchers

- Step 4: Make payment

- Step 5: inspection and storage

2.1. Step 1 – payment request

The payment process starts from step to establish payment proposals from the departments or individuals involved. Sample form request for payment usually is a general rule in business, including clear criteria, providing sufficient information about the reasons for, and the amount and support documents such as contracts or purchase invoices.

2.2. Step 2 – Approved

After receiving the payment request, the next step is the approval process. Head of department, director or person responsible will thoroughly review the evidence from the budget, internal rules to make decisions. Depending on the business that the approval process can be decentralized value-based payment, assurance payment activity is optimal under strict control.

2.3. Step 3 – Preparation of billing records, credential details

When the payment request is approved, in combination with the required payment, the accountant should prepare full stock related words. These documents include invoices, receipts, warehouse or any document necessary for the payment process.

2.4. Step 4 – make The payment

After the voucher has already been prepared, the business can choose other payment methods like bank transfer, cash or payment through the electronic platform. All transactions need to be accurately recorded on the books to ensure financial transparency.

2.5. Step 5 – Check and store

When complete payment, the accountant should check back process, store vouchers important. Accounting needs for projectors account has payment with stock from the root, at the same time, the entire document should be stored securely in accordance easy lookup when needed and comply with legal requirements.

3.Save the diagram of payment process in business

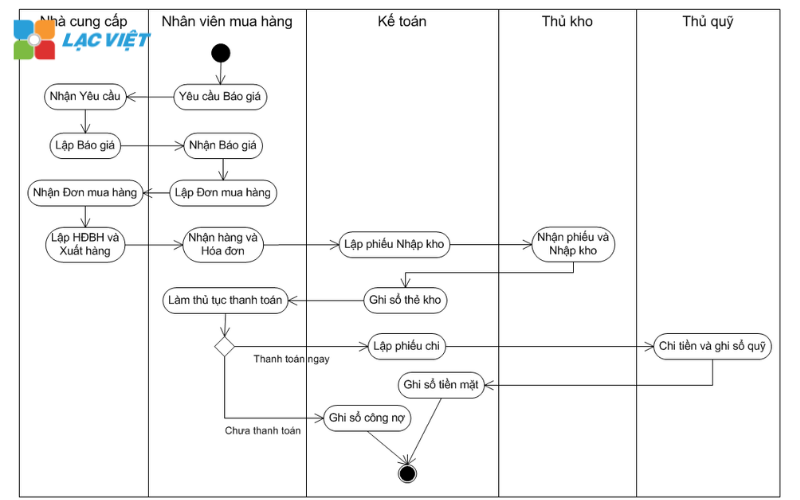

3.1 payment of purchase

In business, the payment process purchases often occur. The activities that need to process this as shopping payments internal payments, purchase of raw materials, production, payments of purchased service.... So the payment process purchase is one of the processes should be business soon standardized, clear, seamless.

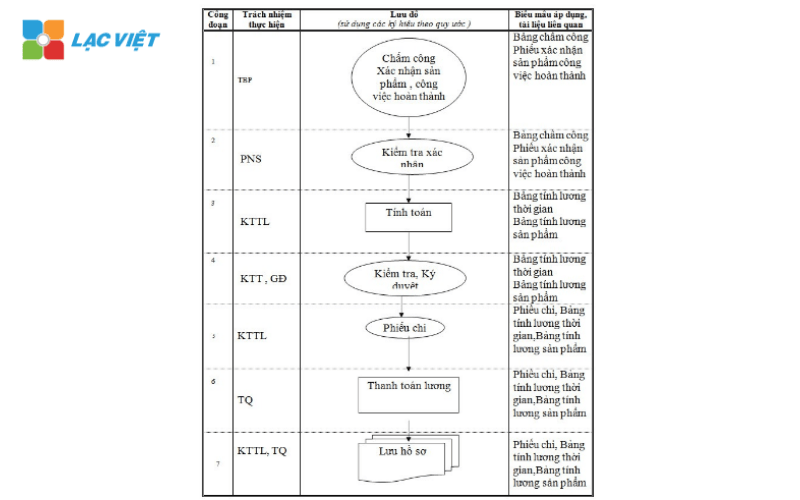

3.2 payment of staff salaries

Payment of wages to employees is the process monthly, require businesses to calculate accurate based on the information timekeeping, labor contracts and other allowances, bonus or deduction. Accounting will set up payroll, conduct the inspection and approval prior to payment via wire transfer or other methods. This process requires high accuracy, especially in the matter of compliance with tax regulations, social insurance.

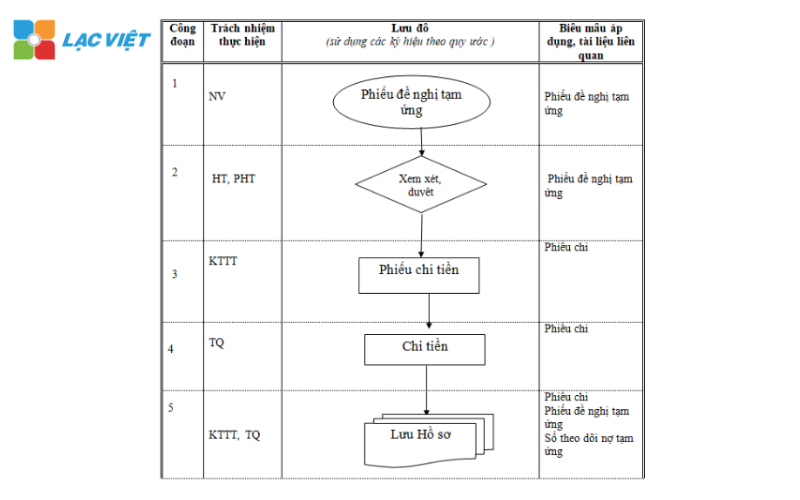

3.3 advance payment

Advance payment is process popular in the business when employees need a sum of money in advance to perform the tasks or activities of the company. This process includes many steps from step requires approval for the to complete advance and ensure compliance with financial policies.

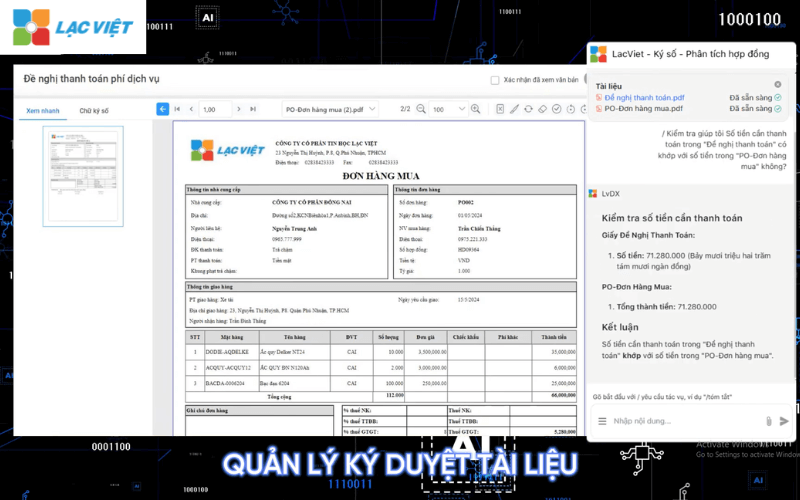

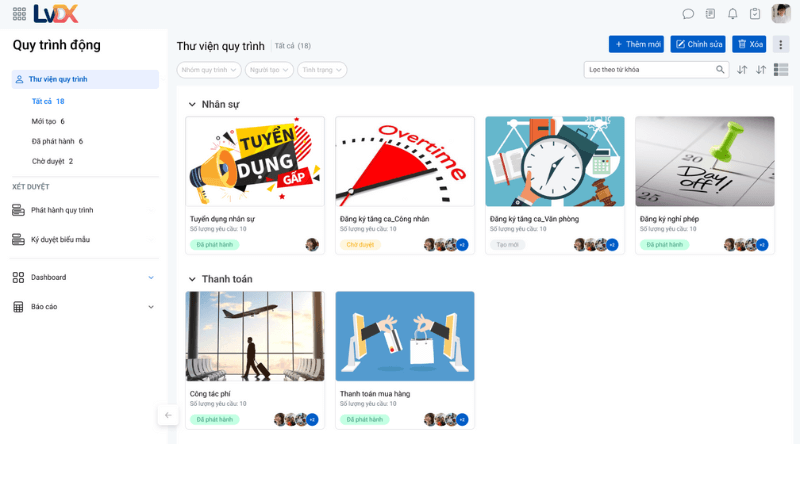

4. Standardized payment process software, LV-DX Dynamic Workflow

Management process payments easily lead to many mistakes and lost time, especially for those businesses that have large scale. To solve this problem, use automation software such as LV-DX Dynamic Workflow to help standardize and optimize the payment process, bring efficiency and transparency to the business.

LV-DX Dynamic Workflow allows businesses to establish process consistency, clear from the stitching required to approve and make payments. The steps in the process are defined, specific, helping to ensure all payments are compliant according to the process specified.

- Decentralization in the process are important factors to ensure the transparency and accountability in business. With LV-DX Dynamic Workflow step by step in the payment process is decentralized to the individual or right parts. Ensure that each person is responsible for the right part of his work but also easily follow the process.

- Giúp doanh nghiệp dễ dàng quản lý tất cả các loại chi phí, từ thanh toán mua hàng, lương nhân viên đến chi phí vận hành, chỉ với một hệ thống duy nhất. Việc này không chỉ đơn giản hóa quy trình mà còn giúp tối ưu quản lý tài chính, tạo ra sự liên kết giữa các bộ phận liên quan.

- The software also features integrated storage, the entire invoice and proof of payment with the management system documentation. This is a feature that makes easy business research, management, and ensure the legality of financial documents. Storage science and safety to help limit the risk of loss or damage to the document.

- With LV-DX Dynamic Workflow, business standardized process payments efficiently, minimize errors, and enhance financial control. From there, the business focus on core activities without worrying about the problems arising in the process of payment.

LV-DX Dynamic Workflow do to simplify the conversion process of?

Provides system management – standardized process of comprehensive

- Free build standardized processes for each business, based on the requirements given and the structure departments, by operation of business when BUYING a software package process of Vietnam.

- The system allows the storage of the entire workflow on a single platform, data is synchronized, unified, easy synthesis and analysis.

- Provide inventory process standard reference model for construction business.

Provides system management – standardized process of comprehensive

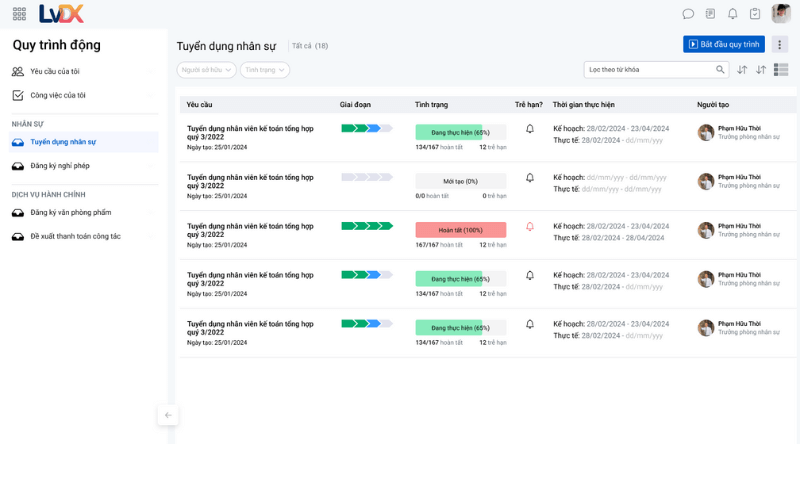

Every activity, work performance managed, tracked live realtime (real time) on the process

- LV-DX Dynamic Workflow integrated management software, job LV-DX Task to help work directly on the process.

- Automatic transfer of tasks to employees, the next division at the end of the 1 stage in the process.

- Track progress of implementation of the process, the work performance of each employee in real time.

- Warning system work smart, auto send notification to employees involved when a process is established, the transfer task alerts, overdue done, ...

Every activity, work performance managed, tracked live realtime (real time) on the process

Application AI to help optimize performance operating procedures business

- Integrated LV-DX eSign help job approval, signing a number of fast everything, everywhere on the process of. Leadership does not need to come to the company to make up for document browsing, now all operations can be performed remotely at all times with LV-DX Dynamic Workflow.

- Integrated chatbot AI Lac Viet to help the leader out of control, the accurate data on the file browser to help the number quickly, avoid reporting anything complicated, optimal time is work, leaders have more time to build your business strategy, long-term performance improvements for the organization.

Firm grip and properly perform each step in payment process bring to the operating throughout the accounting department, improving general performance. With the support of the software as LV-DX Dynamic Workflow, businesses can optimize this process, from which focuses on developing active core business, improve efficiency and competitiveness in the market.