In the context of transformation of increasingly become the preferred strategy of many businesses, artificial intelligence (AI) is emerging as an indispensable tool to optimize your operation, increase productivity, enhance competitiveness. Especially in the field of accounting – financial, where processing large volumes of data requires high accuracy, the impact of AI to accounting is not merely support the work that is gradually reshaping the way business financial management.

The following article Lac Viet Computing will analyze the specific impact of positive – negative of WHO to accounting, simultaneously giving hints to help the business effective application of this technology in practice.

Overview of the AI development and its relationship to the field of accounting

In the last few years, artificial intelligence (AI – Artificial Intelligence) has ceased to be a far fetched concept that is increasingly clarity in life and business activity. From the support customer care using chatbot, analyze consumer behavior to predict market trends, WHO is taking steps to become “assistant technology” of many businesses in the transition number.

Own in the field of accounting – financial, the presence of AI becomes more noticeable. Fund accounting is the department that handles large volumes of data periodically, requiring high accuracy, strict compliance with the provisions of law. With the ability to handle fast data, analysis, logic, and continuously learn, WHO are open a completely new approach for accounting operations: automation of the process repeated, detect errors, potential support, financial forecast and make recommendations more accurate in business management.

According to the report of PwC in the year 2024, about 50% of big business in Asia – pacific have started integrating AI into one or more process accounting and finance. This number is expected to increase quickly once businesses realize the value that AI brings: minimize risk, save time, increase ability to make decisions based on data.

- 9 Accounting Software online cheap cost reduction for small and medium ENTERPRISES

- Core Banking is what? Solution upgrade the core system safety, speed, flexibility

- Convert numbers in the banking sector: The state, challenging & strategic solutions

- 10+ accounting software ERP admin most popular AI for enterprises

1. AI in accounting what is it?

AI in accounting is the application of technologies such as machine learning (machine learning), processing natural language (NLP), image recognition (OCR),... on the process of accounting profession in order to increase processing speed, automation operation, reduce errors, and support decision making more accurate.

Other with accounting software thông thường vốn chỉ xử lý theo lập trình cố định, AI có khả năng “học” từ dữ liệu, nhận biết mô hình (pattern), phát hiện bất thường đưa ra gợi ý cải thiện theo thời gian. Ví dụ: hệ thống AI có thể tự động nhận biết một hóa đơn sai sót về thuế suất, hoặc cảnh báo khi chi phí vượt ngưỡng ngân sách đã đặt ra.

Why AI strong impact on the accounting jobs? There are three main reasons:

- The volume of data growing complexity: accounting not only handle stock from, but also synthetic financial data, trend analysis reports. ANYONE help shorten the duration of increased accuracy in the entire chain handle this.

- Demand decisions based on data is increasingly urgent: financial Management modern't just stop at the record, which requires accounting to forecast cash flows, determine the breakeven point, planning to spend. WHO provides the tools, data analysis, real-time business support timely action.

- The level of legal compliance to increasingly strict: The app WHO help ensure consistency, transparency, ease of access, reduced risk violating accounting standards or tax rules.

2. The impact of AI to accounting according to each aspect

2.1. WHO changed the method of processing accounting data

The accounting field is fastened with data from invoices, vouchers, payroll to financial statements. Ago, most of this data was entered and processed manually, just time consuming moderate potential flaws. WHO is to completely change this approach by automating the entire process of processing accounting data in real time.

Ví dụ cụ thể: thay vì kế toán viên phải nhập tay từng thông tin trên hóa đơn đầu vào, một hệ thống tích hợp AI có thể sử dụng OCR để trích xuất thông tin từ hóa đơn scan, sau đó áp dụng NLP để phân tích phân loại nội dung. Hệ thống còn có thể đối chiếu dữ liệu này với định mức chi phí, hợp đồng hay quy định thuế để kiểm tra tính hợp lệ. (See giải pháp kế toán LV-DX Accounting tích hợp AI từ Lạc Việt).

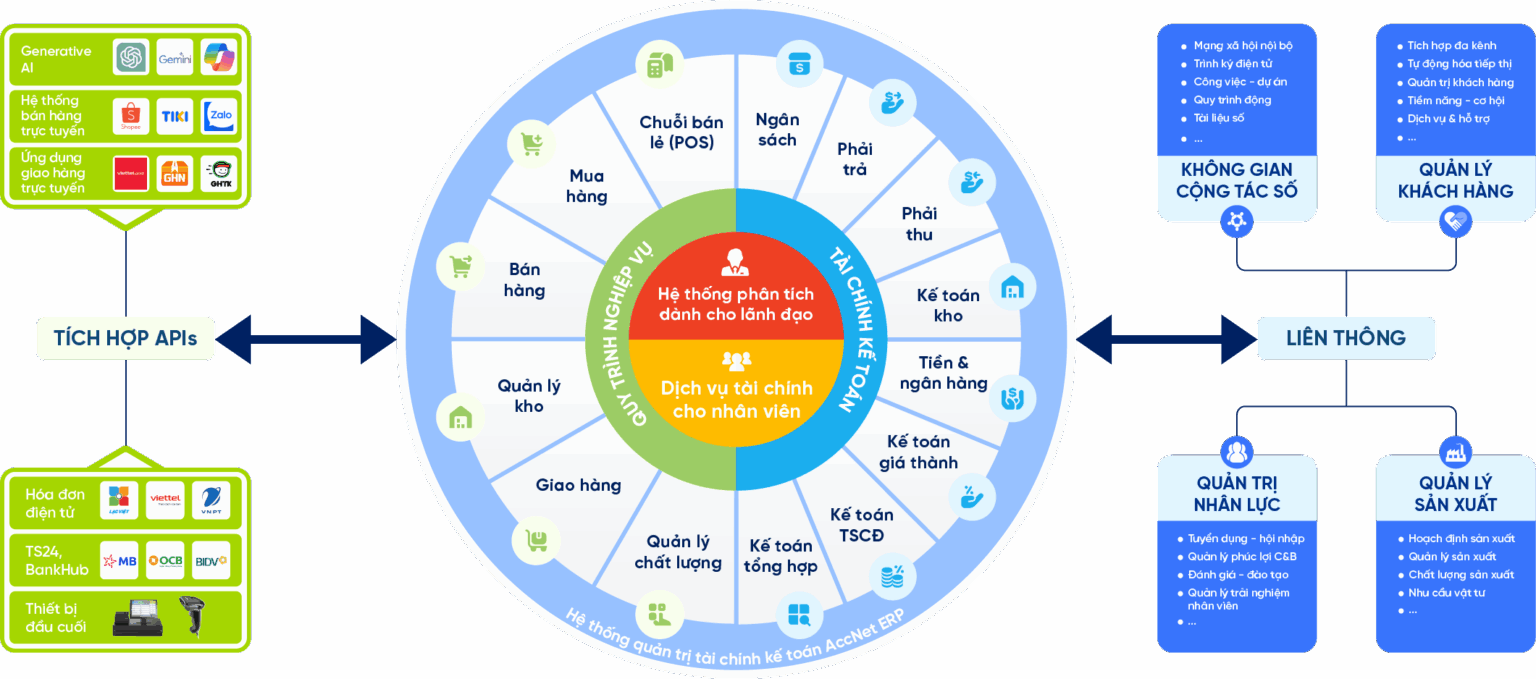

ACCOUNTING SOLUTIONS ACCNET ERP INTEGRATED AI AUTOMATE ALL BUSINESS

AccNet ERP is a software solution financial accounting integrated in the management system, comprehensive enterprise, which is developed by Lac Viet corporation. Difference highlights of AccNet ERP is the app artificial intelligence (AI) in many accounting process to help businesses:

- Automation of accounting and classified documents.

- Improving the accuracy in data control.

- Shorten processing time business accounting – financial.

Thanks to that, AccNet ERP not only is support tool but also a “smart assistant” with the business in financial management transparent effect.

Feature highlights:

✔️ Automatic accounting vouchers, collate public debt thanks to AI.

✔️ Manage your finance – accounting multi-branch, multi-subsidiary.

✔️ Financial statements consolidated standards of Vietnam & international (VAS, IFRS).

✔️ Cash flow management, budgeting, forecasting the exact cost.

✔️ Connect with the manure management system, hr, production, sales to sync data.

✔️ Integration of AI in data analysis, risk warning and proposed optimal scheme.

TYPICAL CUSTOMERS ARE DEPLOYING ACCNET ERP

- Nitto Denko – control production costs thanks to the application of accounting costing: Nitto Denko has chosen solution AccNet ERP to deploy the system accounting calculating cost ofhelp business control costs more effectively in the production process. After a period of use, company, highly effective, practical system that brings, as well as the degree of stability superior to other software in the market.

- ANTESCO – restructuring process works with management accounting operation: At ANTESCO, our team of consultants and deployment of AccNetERP has collaborated closely with the business in the first phase, reset the standard process and construction work-flow related departments throughout. The solution has helped ANTESCO significantly improve management capabilities, operating in a synchronized way and versatile

- Khatoco – expansion pack solution AccNetC after the successful implementation of original: Lac Viet has successfully deployed package solution AccNetC for trade co., LTD Khatoco in Nha Trang, according to the agreement signed on 29/07/2014. After the system is first put into operation efficiency, Khatoco intends to continue cooperation and expand the distribution finance – accounting and retail management with AccNetC, expressing the deep trust in implementation capacity and quality of service from Lac Viet.

SIGN UP TO RECEIVE DEMO NOW

INTEGRATED AI ACCELERATION CONVERTER OF ACCOUNTING

AI in AccNet ERP't just stop at automate data entry, but also:

- Identification & classification certificate from smart: AI scan, read & sort invoice, voucher, receipt, limit errors due to input manually.

- Financial forecasting & budget: the system uses algorithms machine learning to forecast cost, revenue, business support decision fast.

- Warning risk accounting: AI to detect abnormalities in the book, from which timely warning of false or fraud risks.

- Reports assistant smart: AI suggested report template, automatic data aggregation support, leadership, financial analysis instant.

BUSINESS IS WHAT WHEN IMPLEMENTING ACCOUNTING SOFTWARE LAC VIET?

- Experience more than 30 years develop software solutions business management in Vietnam.

- Ecosystem of comprehensive: AccNet ERP easily connect with other solutions of Lac Viet (HRM, Workflow, Portal...).

- Advanced technology: Integrated AI support, cloud & on-premise flexible.

- Services dedicated support: A team of knowledgeable professionals with accounting – finance in Vietnam, companion throughout the deployment.

- Trust from thousands of customers in many areas: finance, banking, manufacturing, trade, services.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: accnet@lacviet.com.vn | Website: https://accnet.vn/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

According to a survey by Deloitte (2024), more than 61% of business applications AI in processing accounting data for know was reduced by at least 30% of the time do periodic reports at the same time, early detection of errors related to accounting for expenses and taxes.

Values bring:

- Minimize the risk of errors due to manual action.

- Save time, help accounting focus on the analysis instead of data entry.

- Increase reliability and transparency of data accounting – financial.

2.2. AI improves productivity, accuracy in accounting work

WHO doesn't just replace the repeated actions, which also contributes to improving the quality check analysis accounting.

A typical example is in the process of internal audit, capital spending lots of time and manpower. With the support of AI, businesses can establish the analysis model of anomalies: the system will actively reviewing and flag these transactions exceeded the threshold, signs, duplicate, or different than history. This helps accounting for rapid detection of flaws or signs of potential fraud instead of just check manually by model selected.

According to the report of McKinsey (2024), AI can help businesses reduce up to 80% of the time handle the accounting profession repeat, as for lighting bills, the cost account or check your balance.

Values bring:

- Improve productivity work in the accounting department.

- Ensure accuracy, consistency of the business finance.

- Limited risk, audit, compliance, legal.

2.3. The impact to the role skills of accounting students

One of the common misunderstandings is “WHO will replace accountants”. Fact, the AI does not replace completely, which changes the role of accounting in the organization.

When the task repeats are automation, accounting personnel will transition to a consulting role analysis to support financial decisions. To meet this change, the accountant is required to add new skills such as: understanding how AI works, skills data analysisusing dashboard reports and coordinate with the IT department.

According to the survey of ACCA global (2023), 79% of employers in the field of financial – accounting desire to have the ability to use digital technology, a basic understanding of AI.

Values bring:

- Help business, team building, accounting, strategy instead of just operating.

- Increase effective coordination between accounting – finance – executive.

- Increase the ability to adapt ahead of the technology trends in future.

2.4. App ONE of the modern accounting

AI is not only applied in data entry that are present throughout the distribution system accounting. Some examples typically include:

- Budgeting financial forecasting: AI data analysis history, consumer behavior, market volatility to predict cash flow, operating costs, or investment performance.

- Cost management, valuations: AI automatically analyses the cost of production, operation and make recommendations adjust the selling price in order to optimize the profit margin.

- Chatbot AI support internal financial: Personnel can check the payment status, historical cost or process browser vouchers through virtual assistant AI.

Values bring:

- Advanced capability financial management.

- Increase the ability to forecast and control the budget.

- Help the leader board with timely information to the correct decision.

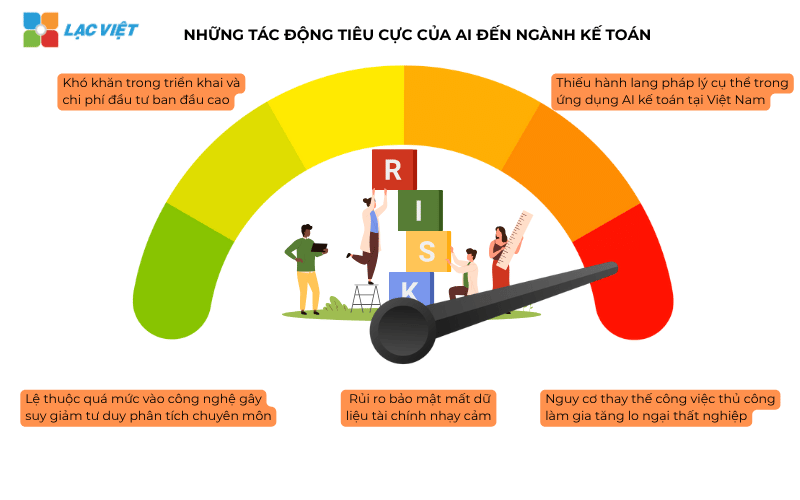

3. The negative impact of AI to the accounting industry

Whatever brings many benefits markedly, WHO also created no less negative impact on the accounting industry if the business, who do not have thorough preparation. Below are the main negative point to note:

3.1. The risk of replacing manual work, increasing fears of unemployment

WHO has the ability to automate the task of accounting repeat as data entry, reconciling invoices, set up recurring reports... this made many accounting position traditional risk being cut, especially with the role only perform the operation of machinery and does not require analytical thinking.

→ Consequence: Psychological fear of being replaced spread in the accounting team, especially with the long years have not been training number skills.

3.2. Depend too much on technology causes decline in critical thinking expertise

When business depends too much on the AI system that does not maintain control or independent evaluation from expert accounting, risk from the misinterpreted data or conclusions teen grounds can happen.

→ For example, An AI system can hint decide to cut costs based on historical data, but cannot identify the regulatory factors new or planning to expand markets in the offing.

3.3. Security risks of data loss sensitive financial

AI in accounting are usually data processing, financial details such as payroll, tax bill reports, profit... If not, ensure infrastructure security, business risk of information leakage attack the network or use the data for improper purposes.

→ Especially serious for business has not applied security standards (e.g. ISO/IEC 27001) or deploy AI on the platform, cloud uncontrolled access.

3.4. Difficulties in deployment and the cost of the initial investment is high

The integration of AI into the accounting system is useful not always smoothly. Business may encounter:

- Accounting system not compatible with AI technology.

- The hr team is not ready or the lack of skills in using new technology.

- Investment costs in infrastructure, software, training initially quite large, especially with small and medium enterprises.

→ If no deployment strategy according to the route clearly, business is prone to interruption of the operation or the waste of resources.

3.5. Teen corridor specific legal in-app AI accounting in Vietnam

Currently, the application AI in the field of financial – accounting has not yet been specified in the standards, the Vietnamese accounting or tax law. This causes difficulty in determining the legitimacy, accountability and auditing process when there are errors arising from the AI system.

→ Business easy to fall into a state of “twilight”, the unknown system ANYONE can use to now be accepted: when in the tax inspectorate and the state audit.

Summary:

WHO doesn't have to be the “magic wand” for the accounting industry, which is a powerful tool but needs to be properly implemented and objectives are in control. Businesses should:

- Re-training accounting team about the skill of thinking data.

- Building roadmap for apps ONE by each stage.

- Priority solutions WHO have high security, in accordance with the legal regulations in Vietnam.

- Maintain role analysis and criticism of people in the process of financial control.

4. Industry accounting and auditing have been replaced?

4.1. WHO can replace part of the job accounting but not completely replace the industry

AI is very good in handling the task brings repeatability, based on fixed rules such as data entry, collating evidence from the calculations, the account reporting form. This is the part occupied much time in jobs accounting – audit, traditional, and also prone to errors if done manually.

However, WHO does not have the ability to replace the role requires critical thinking, strategic analysis, professional judgment – for example:

- Reviews complex transactions are elements of legal, commercial or international links.

- Risk analysis, finance, tax, proposed tuning solution.

- Strategic consulting for business accounting in accordance with the context of specific business.

According to the report of the World Economic Forum in the year 2023, the jobs accounting – audit has the ability to automate up to 56%, but the remaining part still depends on human factors.

4.2. WHO will “re-shape”, not “wiped” accounting – audit

Instead of being replaced, accounting – audit are shifting to a new role: strategic consulting.

For example, accounting not only “noted” the transaction, which must also:

- Analyze financial data to support a decision fast.

- Participate in risk management and internal control.

- Play a bridging role between the system technology – data – financial business.

Similarly, auditors future will not only test vouchers, but also know the application tool ANYONE to scrutinize unusual in the data, and combine skills human analysis to make a decision independently, have value.

4.3. Future trends: accounting – audit + AI = competitive Advantage

Business should not see WHO is the threat, which need to considered this is a strategic tool to upgrade our team of financial accounting. People who do need to learn to use AI as a AI assistant financialto know how to harness the data from the system to give financial advice more accurate, faster.

A study of ACCA and EY (2024) forecasts that by 2030, more than 70% of the work of accounting and auditing will be directly related to technology, data analysis and artificial intelligence. Those who are willing to adapt will soon not be replaced, but also become “difficult to replace than”.

WHO is not inclined to be transient, which is an essential part of the future of the accounting industry. Understanding the impact of AI not only helps business owners in transition strategies number but also the opportunity to improve financial performance, reduce risk and build a team of accountants have a more strategic role in the organization. Instead of fear to be replaced, be active, update, application development along WHO will be the ones who take the lead in the innovation wave modern accounting.

Are you looking for solutions app AI into the accounting system? Please contact consultants of Vietnam to get guide solutions most suitable for your business.

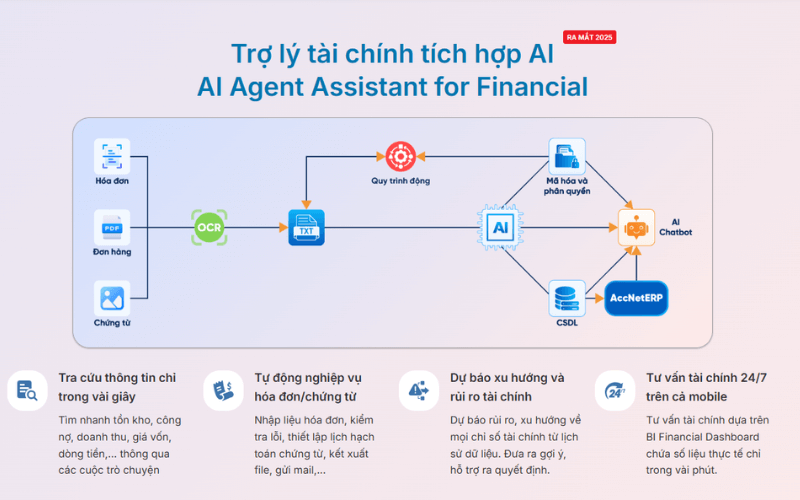

Lac Viet Financial AI Agent to solve the “anxieties” of the business

For the accounting department:

- Reduce workload and handle end report states such as summarizing, tax settlement, budgeting.

- Automatically generate reports, cash flow, debt collection, financial statements, details in short time.

For leaders:

- Provide financial picture comprehensive, real-time, to help a decision quickly.

- Support troubleshooting instant on the financial indicators, providing forecast financial strategy without waiting from the related department.

- Warning of financial risks, suggesting solutions to optimize resources.

Financial AI Agent of Lac Viet is not only a tool of financial analysis that is also a smart assistant, help businesses understand management “health” finance in a comprehensive manner. With the possibility of automation, in-depth analysis, update real-time, this is the ideal solution to the Vietnam business process optimization, financial management, strengthen competitive advantage in the market.

SIGN UP CONSULTATION AND DEMO