In the system of financial reporting of enterprises, the often overlooked even just be copied according to the form available that do not properly reflect the real situation. However, if properly understand the role of the this business will get out this is not part european, which is one critical piece to help explain the nature of numbers on financial statements.

Notes to financial statements as “bridge language” between business and the people who read the report as auditors, investors, banks, tax authorities, the board of directors internal. Help the reader understand businesses are using accounting policies which? Why a norm left to increase or decrease power? The factors which affect the financial results?.

In the context of business is a growing need for transparency to sustainable development, access to capital better, the establishment presents notes to financial statements correctly obviously requires not to be missed.

This article Lac Viet Computing will help you:

- Understand the notes to financial statements what is

- Get content should be in the

- Know how to present overs reasonable, transparent regulations

- App modern tools to simplify the process of analysis report

1. Notes to financial statements what is? Businesses are required to set up no?

1.1 notes to financial statements what is?

Notes to financial statements is part presents additional, detailed explanation of the information that has been expressed in three main financial statements: the balance sheet reports the results of business activities report cash flows.

If 3 reports is the “part number”, then notes is “the word” come help the reader understand:

- The principles and accounting policies that businesses are adopting

- Content details of the account large items: assets, liabilities, equity, revenue, expenses, profit...

- Special issues such as financial commitment, risk, potential policy changes in usa, the events after the end date accounting period...

For example: On the balance sheet recorded “fixed Assets: 5 billion”. But the notes will clarify: it is the machine worth $ 3 billion, workshop 2 billion, accumulated depreciation is how much business are applicable depreciation method linear in 10 years.

1.2 the meaning, role and practice of systems, financial statements

- For internal business: leadership of the chief accountant, the other departments to properly understand the nature of financial business to the correct decision.

- For auditors: the basis for assessment audit compliance and truthfulness of financial statements.

- With respect to the tax authorities and investors: overs is evidence that business transparency, professional.

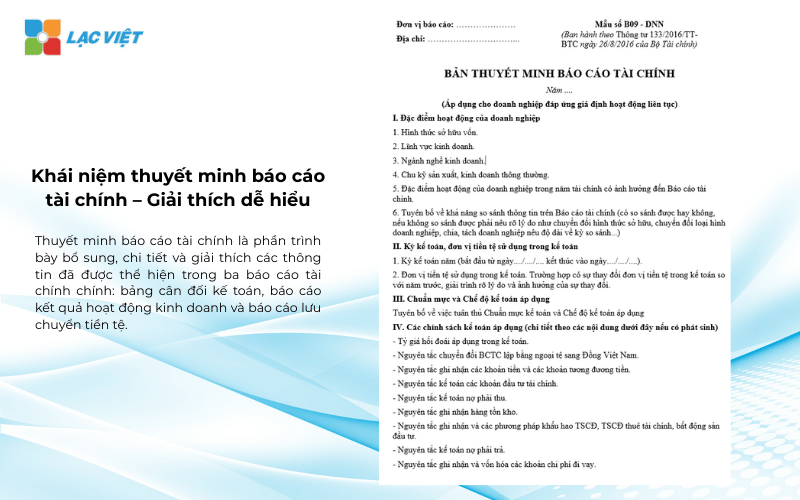

1.3 legal Regulations: any Business need? Set according to the sample?

According to the regulations of the Ministry of Finance:

- All the business activities under the Enterprise Law must be set, complete presentation of the notes to financial statements in the reporting period of the year.

- Business application Circular 133/2016/TT-BTC (small and medium enterprises) will present notes to form separate, more simple.

- Business application Circular no. 200/2014/TT-BTC (big business, listing, there is audit) will use the template more detail, more particular requirements analysis, explanation and additional information.

Note: disclosures should be consistent logic with the data you have shown in the financial statements. Any deviations between the “number” and the “letters” are able to make statements were rated as lack of transparency or not valid.

- Financial statements, what to include? 5 Types of financial statements company 2025

- [FULL] the Sample financial statements, financial situation excel file according to the circular, 200 and 133

- Financial statements consolidated what is? Instructions for setting up and reading effective for business

- Guide to writing a financial report according to circular 200 details for the business

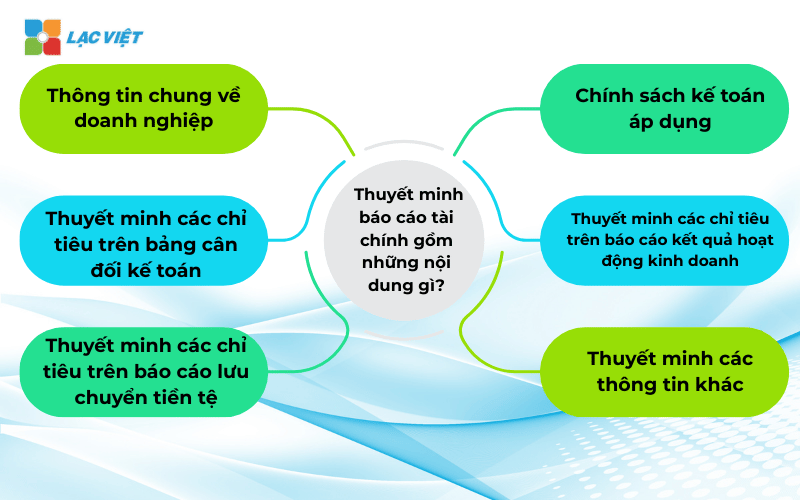

2. Notes to financial statements, including the content, what?

A report full financial indispensable part overs. Notes is a place to show transparency, logic, consistency between the numbers practical operation of the business. Below is the the main content section in the narrative according to the current regulations:

2.1 general information about the business

The general information is usually placed at the beginning of the demonstration aims to give readers a look at the brief but full on institutions financial reporting. This is the part help determine the legal scope, scale and nature of operations, the report states, from which the basis for the reader to understand the true, accurate assessment of the subsequent information in the report.

The mandatory content presented include:

- Full name and abbreviated name of the business

- Industry primary business (for example: production of electrical equipment, domestic trade, logistics...)

- The ownership of capital (state-owned enterprises, joint-stock company with foreign capital investment company limited,...)

- Headquarters address, branch (if available)

- Accounting application (financial year: from 01/01 to 31/12 or any other)

- The monetary unit used to report (usually in English or a foreign currency if the business has international transactions mostly)

Illustrative example in particular:

- Co., LTD. ABC Vietnam

- Major industry: manufacturing carton packaging, industrial packaging

- Form of ownership: Limited liability company with 100% private capital

- Headquarters address: Lot B2, industrial Zone, Tan Phu Trung, TP. Ho Chi Minh

- Accounting period: From 01/01 to 31/12 each year

- Unit of currency used in the report: Vietnam dong (VND)

2.2 accounting policies applied

Accounting policy is the expression “the way businesses understand and apply the accounting standards” in practice. Depending on the business scale, the field of operation in which the policy can be flexible within the framework allowed by the circular 200 or 133.

The content is often presented in this section include:

- Principles of revenue recognition and cost

- Methods of assessment inventory (FIFO – first-before, a weighted average, actual purpose of the...)

- Methods of depreciation of fixed assets (linear, according to the number of products)

- Principles recorded foreign currency processing, exchange rate differences

- Principles of fully enter the room

For example: Business apply the method of weighted average to determine the value of inventory. Fixed assets tangible be depreciated according to the linear method, for a period of 10 years for machinery and equipment, production equipment, 5 years for means of transport. Revenue is recorded when the ownership of the products has transferred to the customer, has the ability to recover the money.

Enterprise value received:

- Help auditors understand the foundation establishment report, from which assess the reasonableness of the item

- Avoid controversy when there are differences of data between the states (due to changes in policy or method of calculation)

- To increase comparability and transparency between the states report, or with businesses in the same industry

2.3 notes to the criteria on the balance sheet

This is the “decoder” for the big numbers are present a summary on the balance sheet. The reader will often interested in “the business, how much assets” property, which included what came from where there is a risk or not.

The group norms need overs depth include:

Short-term assets:

- Cash and cash equivalents: specifies bank account, cash, term deposits short

- Accounts receivable customer: detailed object, amount, term debt, reserves for bad loans

- Inventory: analysis by group of goods (raw materials, finished products...), stating the method of calculating the price

Long-term assets:

- Fixed assets: classification of visible – invisible original cost – residual value – accumulated depreciation

- Investment long term financial: shares hold, account, capital contribution venture

Capital:

- Loans and debt: analysis of short-term debt – long-term interest rates, collateral (if any)

- Equity: recorded the amount of capital contributed to the fact, profits not distributed, investment and development fund

Business benefits received:

- Help audit to verify, collate each item

- Create trust with partners and investors about the detail, transparency

- Limited risk when inspector, thanks to information has been overs clear from the beginning

2.4 overs the only goal on the reported results of operations, business

Report results of business activities provides an overview of the situation profitability of the business during the period. However, to understand more deeply about causes changes in profit, the revenue structure, or the nature of the expense, of the notes to be indispensable factor.

The content need detailed explanations, including:

- Structure of revenues: Explain the revenue came from where, according to the products, services, geographic areas or groups of customers. If revenues increase or decrease compared with the previous period, should be clearly stated cause.

For example: revenue increased by 20% compared with the previous year, mainly due to expansion of the export market to Japan, accounting for 35% of total revenue. - Financial costs: Details, loan interest, and losses due to exchange rate differences, the cost arising from financial instruments, if any. If financing costs rise, should explain clearly to avoid misunderstandings business are “losing control cash flow”.

For example, the financial Cost is 520 million, an increase of 180 million compared with the previous year because of interest from loan investment, construction and factory at Long An. - Cost of sales, cost management business: presented reasons for increase/decrease each type of cost (advertising, promotion, personnel, depreciation of office equipment...). Specify the terms, mutations, if any.

- Income and other expenses: The account does not come from the main business activities such as liquidation of assets, fines contract, gains from sale of financial investment... should be overs unknown origin nature is regular or irregular.

- Explain fluctuations profit: comparison of net profit after tax states this with the previous period, clarify the main factors that lead to change. This is content auditors, investors are interested in.

Actual benefits businesses get:

- Help leaders evaluate the effectiveness of business activities through the number of total, through each component.

- Support accountability, transparency with tax authorities, auditing, partnership when there is unusual fluctuations.

- Is the tool to adjust the cost structure revenue, from which optimize the profit for next period.

2.5 notes to the statements of cash flows

Statements of cash flows shows the cash flows fact into – out of the business during the period. The role clarify the revenues – expenditures valuable, unusual or does not correspond with business results.

The content should overs:

- Cash flow from business operations: If the negative cash flow, although profits remained positive, need to explain (for example: business increase in receivables and inventory investment...). In contrast, positive cash flow abnormalities should indicate the source (client, the sharp reduction in costs...).

Example: cash Flow from business operations, pussy, 1.5 billion due to increase in inventory investment service export orders first quarter of the following year. - Cash flow from investing activities: detailed expenses for the investment of fixed assets, stock purchase, or collecting money from liquidation of assets. The new investments need overs clear purpose, plan payback.

For example: Business cost 2.2 billion to buy production line packaging new expectations payback after 18 months. - Cash flow from financing activities: clarify flow of money coming from where: increasing equity, bank loans, issuing bonds, cash flow, what this is going forth: pay the original debt, pay dividends.

For example: In the states, business loans more 3 billion from BIDV to replenish working capital and repay 1 billion for the old loan at Vietcombank.

Business benefits received:

- Can evaluate the possibility of actual payment based on the profit on the books.

- More active in the management plan, cash flow, avoid deficiency as to any repayment or need to spend big.

- Help partner bank understanding business can control the flow of money or not, thereby improving the ability to borrow capital.

2.6 overs other information

In addition to the financial data basic business there are other factors, “offline” can affect the financial situation, but are not reflected directly on the report. This section needs detailed explanations to ensure the full, honest.

The main contents include:

- Financial commitment: As financial lease long-term bank guarantees for subsidiaries, the collateral for the loan. These commitments have not incurred costs immediately, but potential financial obligations in the future.

For example: Business is mortgage of land use rights, worth 8 billion in the bank to guarantee loans 4 billion term of 36 months. - Backup: specify the reason for setting up reserves, amount, method of calculation. Disclosures must be made clear that business proactive risk assessment, appropriated accordingly, instead of waiting until risk happens reflect the cost.

For example: provisioning 300 million for liabilities customer is overdue on the 120-day, there are signs of insolvency. - Financial risk: includes exchange rate risk (with business import/export), liquidity risk, interest rate risk if you have multiple loans floating. Work proactively identify, presented help raise the prestige, the ability to prevention of the business.

For example, the Business has a loan in USD value $ 200,000, the rate increased by 2% in states that financial costs corresponding increase to 100 million.

Enterprise value received:

- Help stakeholders assess the full, honest about the financial possibilities, including those factors has not yet appeared on the books.

- Proactive in governance, risk, from which it can plan preventive and adjustable fit.

3. Why notes to financial statements are important to managers, investors and audit?

3.1 with Respect to business insider: help control and clear explanations

In business insider, notes to financial statements is a tool to help the department of finance and accounting explained in detail the numbers have presented, at the same time help directors understand the nature of the item, the change finance in the states.

For example, if net profit for the year declined sharply, though sales remained stable, the notes may clarify the cause came from the financial cost increase due to interest on loans higher, or from the account of irregular expenses incurred. The analysis thus helping businesses:

- Control the financial risks, thereby regulating business plan timely

- Explanation easy with the relevant department when you have questions about financial data

- Decisions on investment, expansion, cost reduction based on the information complete, accurate

3.2 with Respect to the tax authorities, auditing: clarify the nature of the financial criteria

When financial statements are sent to the tax authority or independent audit of the notes to privacy is grounded to collate, assess the reasonableness of accounting data.

If reports are those items large or unusual fluctuations (for example, preventive public debt rising, reduce the cost of depreciation of a sudden...), the audit authority will not be able to evaluate the level of accuracy without the accompaniment.

Business as theory transparent clear, grounded, consistent, then as:

- Reduce the risk excluded comments when audit

- Advantageous when the process with the tax authorities, avoiding the risk of arrears or penalty due to wrong data

- Save time processing profile, especially in any settlement

3.3 For investors bank: increased reliability and the ability to raise capital

Investors and banks do not only look at the total profit or revenue. They need to know:

- Business is doing based on the source of it?

- Costs incurred are sustainable not?

- Cash flow real stable?

For example, If profits rise sharply, notes can specify that the cause is thanks to the liquidation of assets, or enter the room, i.e. not coming from the core business. This information is extremely important in evaluating the long term health of the business.

In summary, a narrative clear, complete, coherent, help businesses:

- Build trust with external

- Increase your chances loans, call capital success

- Assert transparency, professionalism in financial management

4. How to set notes to financial statements-effective for business

Notes to financial statements, not just an administrative procedure, which is an important part of helping transparency of financial data, explanations accounting policies, providing sufficient context for the reader to understand properly about the financial situation – business of the business. However, to narrative really promote values, enterprises need to build a process of drawing, avoid common errors, presented in a way easy to understand, suitable with many objects.

4.1 the process of: data collection, analysis, presented in the correct form

A narrative good can't be hastily written on the last minute of the reporting period. Below is the process of overs in basic step by step:

Step 1: collect data from the accounting system

- Retrieve data from the accounting software, the ledger, general reports

- Collation of data between financial statements, the window details (e.g., balance, fixed assets, liabilities, revenues, expenses)

Step 2: Reviewing the accounting policies are applied

- Determine the correct accounting methods that businesses are using for each indicator (e.g. method of depreciation, inventory valuation...)

- Record full consistency to ensure the logic between the states

Step 3: Write notes according to the standard sample

- Follow the form prescribed in circular 133 (for small and medium enterprises) or circular 200 (for large businesses)

- Each part of explanation should be tied to a specific targets, with brief explanation, proof data

Step 4: Check out, review

- Check that the data matches the main financial statements do not

- Ensure there is no room contradiction between the “number” and the “word”

4.2 The common error: no match data, lack of information, use overly technical language

In the process support the business establishment, financial statements, we recorded many common errors in the guide to assessment standards, or misleading to the reader:

- Error 1: Not joint data between reporting and disclosures

For example: balance Sheet, recorded in the fixed assets is 10 billion, but the back just listed a total of 8.5 billion due to lack of information or has not updated the data depreciation. This makes reporting suspected of accuracy.

- Error 2: the Lack important information

Some businesses skip the explanation for items as big as receivables long day, reserves or changing accounting policies. This makes the reader does not understand the financial picture in an adequate way.

- Error 3: Using technical language too complex or presentation tangles

Many explanations are written according to the type of copy from the private, academic, making it difficult for managers, investors do not specialize in finance. Notes should be written in concise, there are illustrated examples, couched in language that is easily understood.

4.3 Hints template clearly presented, easy to read, easy to understand

To ensure the notes to be accepted by regulatory agencies, stakeholders, businesses should adhere to some principles presented below:

- Each content should have a title, clear, for example, “notes receivables customer,” “policy, depreciation of fixed assets”...

- Using charts to illustrate data, instead of interpreting the entire writing long lines. For example: table general fixed assets table details the debt...

- Language neutral, easy to understand, not to abuse the term or quote verbatim from accounting standards

- Presenting the science of font, font size, spacing for the convenience of printing, storage, audit

In summary, set up notes to financial statements effectively help businesses convey the right message finances, protect yourself when working with audit or tax agency, to build trust with investors or partners. The investment for the overs from the data, by writing to the presentation is totally worth it if the business wants to sustainable development, transparency in the competitive era.

5. Use the software tool support set notes to financial statements

5.1 Set automatically by the accounting software (AccNet, LV-DX Accounting...)

The establishment notes to financial statements, can be completely automated, thanks to the accounting software dedicated today. Instead of extracting data manually, businesses can:

- Automatically retrieve the data from the subsystem accounting: sales, purchases, debts, treasury, cash...

- Export reports in accordance with the form of circular 133 or 200 without the need for alignment, back

- Ensure consistency of data between financial statements and the notes

Values bring:

- Save time reporting from few days to few hours

- Limit the maximum arithmetic error, deviation indicators

- Fits both medium business, small or don't have a team of professional accountancy

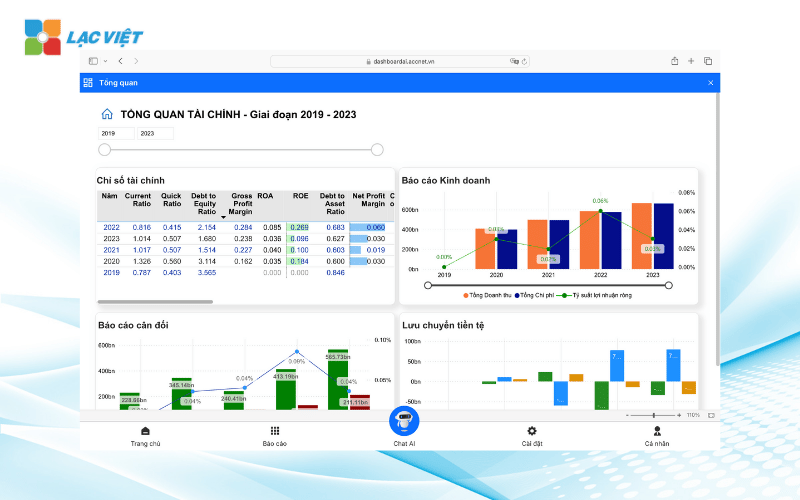

5.2 application LV Financial AI Agent

A further step in the management of business finance today is application WHO to support analysis and notes to financial data in a smart way. Tools such as LV Financial AI Agent is designed exclusively for businesses that want to:

- Automatically detect the indicators of anomalies: negative cash flow, revenue volatility, increased cost unreasonably high

- Hint reason, financial solutions based on machine learning models, data history

- Presented overs reports language, easy to understand, structured, which helps non-professionals still easily accessible

Lac Viet Financial AI Agent to solve the “anxieties” of the business

For the accounting department:

- Reduce workload and handle end report states such as summarizing, tax settlement, budgeting.

- Automatically generate reports, cash flow, debt collection, financial statements, details in short time.

For leaders:

- Provide financial picture comprehensive, real-time, to help a decision quickly.

- Support troubleshooting instant on the financial indicators, providing forecast financial strategy without waiting from the related department.

- Warning of financial risks, suggesting solutions to optimize resources.

Financial AI Agent of Lac Viet is not only a tool of financial analysis that is also a smart assistant, help businesses understand management “health” finance in a comprehensive manner. With the possibility of automation, in-depth analysis, update real-time, this is the ideal solution to the Vietnam business process optimization, financial management, strengthen competitive advantage in the market.

SIGN UP CONSULTATION AND DEMO

Notes to financial statements as core elements help business transparency of information, and build trust with stakeholders, increase access to capital, partners or investment opportunities. A narrative is set true enough, clear will help businesses ease the process control, financial risk, strategic decisions in a more accurate way.

![[ĐẦY ĐỦ] Mẫu báo cáo tài chính, tình hình tài chính file excel theo Thông tư 200 và 133](https://lacviet.vn/wp-content/uploads/2025/04/mau-bao-cao-tai-chinh.png)