In the context of increasingly many businesses scale model group, owned from one to many subsidiary or affiliate only based on financial reporting individual of each company is not enough to capture financial situation overall. At that time, reported consolidated financial become an imperative tool to meet legal requirements, to help businesses recognize the true power of the entire system.

However, with many businesses, especially those new units developed according to the model group, company, concept, process, reporting, financial consolidation is still quite strange to confusion, errors. This article Lac Viet will help you to understand from nature, objects applied to the core differences between the consolidated report and financial statements usual.

1. Financial statements consolidation is and what business how to set up?

1.1 the Concept of financial statements consolidated under current regulations

Financial statements consolidation is a general report on the entire financial situation, business results, cash flows of the parent company, the subsidiaries are presented as if the entire group of companies as a single entity.

Other financial reporting normal of each unit, consolidated report noted the numbers individually, made to exclude intra-group transactions between companies within the same system. For example, if the parent company sales for the company, the revenue that will be excluded from consolidated report because it does not create real value for the whole group.

Actual value the business receives:

- Panoramic view of the financial health true of all corporations.

- Increase transparency with shareholders, investors and banks.

- Limited risk misinterpretation business results due to “puff out” from insider trading.

1.2 Who must draw up financial statements consolidated?

Not every business needs financial reporting consolidation. Follow Circular no. 200/2014/TT-BTCbusiness mandatory reporting financial consolidation when:

- Is the parent company owns, directly or indirectly, over 50% of charter capital or voting rights in the subsidiary.

- Have the right to govern or control of financial activities, the appointed leader or accounting policies in other units, even when the ownership percentage lower than 50%.

A number of cases, businesses do not need to set up the most if are exempt as specified (for example: the parent company is also a subsidiary company owned by a larger corporation and was incorporated at higher levels).

Businesses should note: The non-financial reporting consolidated when subject to mandatory may lead to violation of the law, misleading in the information disclosure to partners, shareholders or agency audit.

1.3 differences between financial statements consolidated and individual reports

| Criteria | Financial reporting individual | Financial report consolidated |

| Range | Reflects only activity of a single company | Reflects the entire group of companies (parent + subsidiary companies) |

| Insider trading | Recorded normal | To exclude to avoid recognition of revenue or expense “virtual” |

| Benefits't control | Not mentioned | To articulate the benefits belonging to minority shareholders |

| Target use | Serve internal control in each unit | Serve the decision at the level of the group or parent company |

For example illustrated easy to understand: suppose company A is the parent company owns 100% of company B, 70% Of company C. In the year, A sales for B worth 5 billion B re-sale to customers in addition to 10 billion. If you only look at the individual reports, the sales of A and B will accrue up to 15 billion. But on the consolidated report, only 10 billion last to be recorded, also insider trading 5 billion excluded – because this is not worth arises indeed from external customers.

- Financial statements, what to include? 5 Types of financial statements company 2025

- [FULL] the Sample financial statements, financial situation excel file according to the circular, 200 and 133

- Guide to writing a financial report according to circular 200 details for the business

- Guide how to read financial statements easy to understand for business want to manage financial efficiency

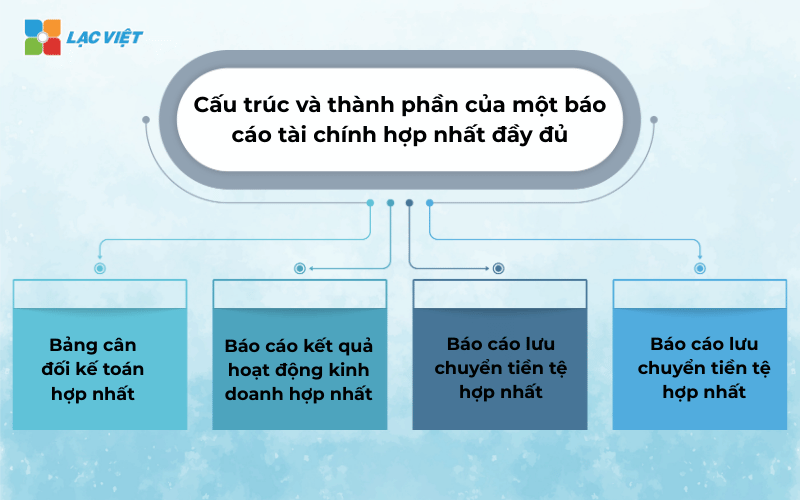

2. Structural components of a financial report consolidated full

The financial report is a reporting system designed to comply with the fiscal nature of the group as a single economic. As prescribed in circular 202/2014/TT-BTC, dated financial statements consolidated consists of 4 main components:

- Balance sheet consolidated: Reflects the entire assets, liabilities, equity of the group at the time of the end states. A special feature is the account public debt, investment in internal between parent company and subsidiary will be removed to avoid record duplication.

- Reporting the results of operations consolidated business: said the situation in profit and loss of the entire group in states. The sales transaction internal, for example, parent company sales for the company, will be excluded from the revenue, the cost to retain only the portion of the value created from the outside.

- Statements of cash flows consolidated: Recorded cash flow actually out on the group from active business, investment, finance. Only the cash flows between the group with party Tuesday, newly – expression- money move back and forth between the internal unit will be excluded.

- Notes to financial statements consolidated: Provides detailed information, explain the criteria important accounting policies applied, large transactions or unusual. This is the section help readers better understand the financial picture the most.

3. The basic principles to be followed when preparing financial statements consolidated

The consolidated financial statements between the parent company and the subsidiary must comply with the principle of accounting system. These principles help ensure consolidated report reflect the true quality financial situation, business results of the group, is not “puffed out” due to intra-group transactions or misallocation of economic interests between stakeholders.

3.1 principle of control

A unit is considered a subsidiary if the parent company has control unit that is capable of directing the policies of financial activity of the subsidiary in order to obtain economic benefits.

The expression of control include:

- Holds, directly or indirectly, over 50% of the voting rights in the subsidiary.

- Have the right to appoint or dismiss a majority of the members of The board or the executive Committee.

- Have control over fiscal policy, business operations, through the charter, contract or agreement.

Specific example: company A holds 60% of the capital of company B and has the right to appoint the general director, decided to financial planning's annual B → B is defined as subsidiaries, must be brought into the scope of consolidation.

3.2 exclusion principle insider trading

In the process of operation, the company in the same group often arise transactions with each other as buying and selling goods, loans, internal cost allocation... However, when reporting the most, these transactions are not considered to be transactions with the outside should be excluded to avoid making “puff” of revenues, expenses, assets or liabilities.

The account that should be excluded include:

- Revenue, price of capital from selling goods, providing services between the companies in the group.

- Unrealized profits in the property transfer internal longer inventory period end.

- The internal debt as receivable – payable between the parent company and its subsidiaries or between subsidiaries.

- The capital investments of the parent company to subsidiary.

For example easy to understand: company A (parent company) sales for company B (subsidiary) for $ 5 billion. If this item has sold out, but is located in the company B, then your revenue 5 billion this does not create real value for corporations → should be excluded to avoid the “illusion” of revenue.

3.3 principle of allocation of benefits does not control

When the parent company does not own 100% subsidiary, capital contribution and results of the business belongs to shareholders't control should be recorded separately – this is called the benefit't control (Non-controlling Interest).

Content allocation include:

- Profit or loss in the period of the subsidiary is split according to ownership percentage.

- The equity does not belong to the parent company in the subsidiary.

Specific example: company A owns 80% of company B. During the year, company B profit after tax 1 billion.

→ 800 million will be recorded in the results of the business of company shareholders mom

→ 200 million remaining recorded a benefit is not controlled in the consolidated report.

Note:

- Not recorded properly benefits are not controlled can lead to misinterpretations that the parent company is entitled to all the profits of the subsidiary.

- The fluctuations in the percentage of ownership in the states (to buy more shares, divestment...) also need to be updated timely to allocate the right.

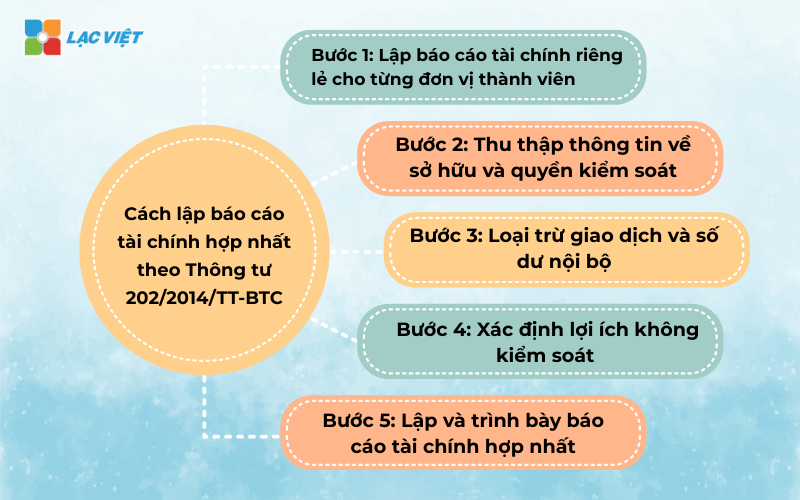

4. Guide to writing a financial report consolidated circular 202/2014/TT-BTC

The financial reporting consolidation is not merely cumulative numbers from the unit member. It is a technical process includes many steps clear, demanding the accuracy of the information gathering, processing excluded, the data presented. Here are detailed instructions step by step:

Step 1: preparation of financial statements separately for each unit member

Before proceeding with the merge, each company within the group (including the parent company and the subsidiary) need to fully complete the separate financial statements according to current regulations.

Important note:

- Separate financial statements must be using accounting policies consistent between units (for example with using the method of depreciation, reviews, inventory...).

- Unit accounting corporations need to revise data from the unit member prior to the merge, avoid deviations from the input.

Practical example: The parent company uses the depreciation method of property in a straight line, there subsidiaries using the method declining balance. Before the merge, accounting to adjust the reported company to ensure uniformity.

Step 2: collect information about owner control

Businesses need to define the scope of consolidation by collecting the following data:

- The percentage of ownership of shares of the parent company, in each subsidiary (direct/indirect)

- Proportion of voting rights, if different from the proportion of ownership

- Time start – end control, especially in the year there is a merger, divestiture, dissolution...

Why is this step important? Specify false, the percentage of ownership or control will lead to:

- The most wrong object (do wrong report global)

- Misallocation benefits't control

- Deviation of cash flow consolidated

Step 3: exclude transactions and balances internal

This step is most essential in order to ensure the report reflects only transactions, balances arise with outside corporations. The account that should be excluded include:

- Revenue – cost internal: For example, parent company sales for the company and subsidiaries provide services to the parent company.

- Unrealized profits: When the goods has not consume out, the interest temporarily not be recorded.

- The internal debt: accounts receivables – payables between the company with each other or with the parent company.

- Investment internal: value of equity of the parent company to subsidiary.

For example: company A sells goods to company B for $ 2 billion. If the number of rows is still inventory in the B final states, then your interest respectively (for example, 500 million) has not done to exclude from profit of the group.

Practices effective processing:

- Set transaction list internal periodic expression patterns confirmed the internal debt.

- Use accounting software integration to collate, auto exclusion.

Step 4: Determine the benefits do not control (Non-controlling interest)

When the parent company does not hold 100% equity in the company, share capital, profits belong to the shareholders in addition to the parent company are called benefits do not control.

Need to determine exactly:

- The ratio of benefits no control over at the time of the beginning – end of period

- Profit or loss in the period allocated according to the percentage of ownership

For example, If the parent company holds 80% of the subsidiary, then the remaining 20% is beneficial not control. If subsidiary interest 1 billion, then 800 million recorded in the parent company, 200 million recorded in benefits not control.

Actual value: Help transparency report, avoid misunderstanding that the whole profit of the group belongs to the parent company.

Step 5: the preparation and presentation of financial statements consolidated

After completing the steps, data processing, accounting and conduct of consolidated report with full 4 parts:

- Balance sheet consolidated: Synthetic assets, liabilities and equity after exclude.

- Reporting the results of operations consolidated business: express revenue, cost, profit merge after adjustment.

- Statements of cash flows consolidated: Under the direct method or indirect, have been excluded, cash flow, internal.

- Notes to financial statements consolidated: Explain the items is important, special deals, accounting policies applied.

Note:

- Reports need to be established in the same period with the separate financial statements of the parent company.

- Should be compared with the previous year to assess development trends, financial volatility of the entire group.

5. The difficulty enterprises often encounter when reporting consolidated financial

The financial reporting consolidation is a complex process, requiring data system sync skills, in-depth analysis. In fact, many businesses – especially medium enterprises development model parent company – subsidiary company – meet not less obstacles.

5.1 Lack of accounting data consistent between the member companies

Each subsidiary can use system accounting software, different classifications of accounts inconsistency, leading to the synthesis of data, delay or deviation.

Common situation: The company using accounting software AccNet, the company you use Excel or other software. Upon consolidation, the accounting must enter the data manually, easy to errors, loss of time, lack of control.

Consequence: the aggregate Data do not match, report the most accurate, affect operating decisions or the results of the audit.

5.2 errors when excluded insider trading

This is common error and most severe in the consolidated report. Not remove the right of insider trading make revenue, profits or assets to be “inflated” in a way not really.

For example, The parent company sold machinery for companies with $ 3 billion. If not excluded, revenue parent company, company assets are increased, while the common property does not increase real.

Solution:

- Set transaction list internal track private

- Use of accounting software has the function to merge automatically excluded

5.3 Difficult to determine the exact benefits't control

When the parent company does not own 100% subsidiary, the profit does not belong to the parent company must be recorded separately. Identifying the wrong percentage of ownership or control can lead to the allocation of profits deviations.

Common problem:

- Not timely updates change the percentage of ownership shares

- Confused between shares held voting rights practice

Value of doing right: a clear distinction between profit belonging to parent company and other shareholders help report reflect the actual benefits, avoid disputes and ensure regulatory compliance audit.

6. Technology solutions to help businesses prepare financial reports the most effective

In the context of data increasingly dispersed, the accounting system at the company, members are usually not synchronized, the financial reporting consolidated handmade potential risks of errors, loss of time, difficult to control. Therefore, the application technology is a necessary step for businesses to ensure accurate, fast and comply with regulations in the process of consolidated financial statements.

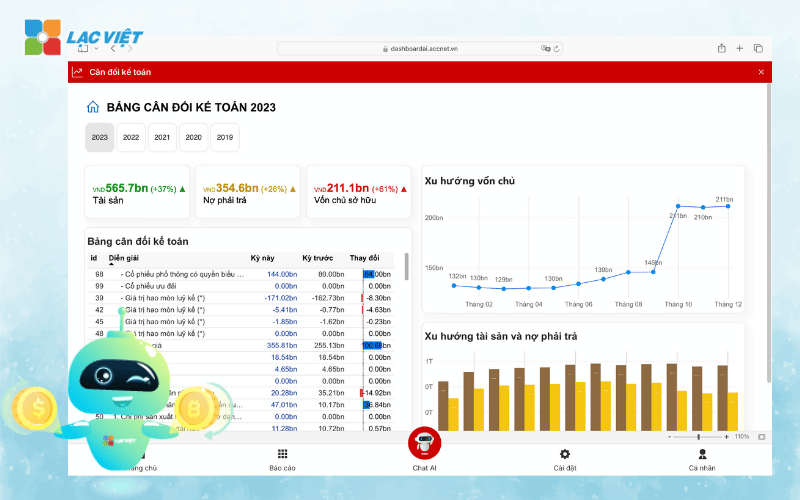

6.1 accounting software merge AccNet ERP

AccNet is ERP accounting solution business overall due to Lac Viet developed, designed specifically to fully meet the requirements of financial reporting consolidated circular 202/2014/TT-BTC. Other than the accounting software tradition, AccNet supports recognition accounting profession, automatic synthesis, processing data from multiple subsidiaries in the same system.

Highlight features:

- Sync your data between member companies: System connection through between parent company and subsidiary, ensure financial data is gathered in real time, in the correct standard format.

- Automatically merge statements in the correct structure, form circular 202: the balance Sheet reports the results of business, cash flows, notes.

- Detection alerts, insider trading has not excluded: When the system detects revenue or cost of internal't yet dealt with, the software will give a warning right on the interface, enabling users to control errors before the official report.

- Decentralize level company: Ensure data is security management according to each unit within the group, both flexible and secure.

Practical benefits for business:

- Up 70-80% of the time synthesis report consolidated financial

- Ensure data coupling logic, limit audit risk

- Business leaders get the picture, comprehensive financial that are not dependent on each department accounting

6.2 Assistant smart analytics LV Financial AI Agent

LV Financial AI Agent's assistant, financial analysis, smart integrated artificial intelligence (AI), play a role as an “advisor of” help the business in-depth analysis consolidated data after you have set the report, from it support financial decisions quickly, the more accurate.

The strong point of the LV Financial AI Agent:

- Automatic analyze the target consolidated financial: the System scan the entire report to detect anomalies such as revenue increased, but negative cash flows, or profitability, but receivables big unreasonably.

- Hint check the points not excluded thoroughly: If exist insider trading is alive in the consolidation process, WHO will propose to revise the individual indicators related help businesses proactively check before being discovered upon audit.

- To interpret the data according to the language easy to understand: WHO can interpret financial volatility in words, help leadership – though not in-depth accounting – still embrace the changes worth noting.

Lac Viet Financial AI Agent to solve the “anxieties” of the business

For the accounting department:

- Reduce workload and handle end report states such as summarizing, tax settlement, budgeting.

- Automatically generate reports, cash flow, debt collection, financial statements, details in short time.

For leaders:

- Provide financial picture comprehensive, real-time, to help a decision quickly.

- Support troubleshooting instant on the financial indicators, providing forecast financial strategy without waiting from the related department.

- Warning of financial risks, suggesting solutions to optimize resources.

Financial AI Agent of Lac Viet is not only a tool of financial analysis that is also a smart assistant, help businesses understand management “health” finance in a comprehensive manner. With the possibility of automation, in-depth analysis, update real-time, this is the ideal solution to the Vietnam business process optimization, financial management, strengthen competitive advantage in the market.

SIGN UP CONSULTATION AND DEMO

Financial statements consolidated requires not only legal compliance with respect to the business operations under the parent company – subsidiary company, but also as tools in strategic management help leaders clearly see the financial picture overall of the entire system. When done properly, this report will help business remove the “virtual numbers” of insider trading, reflecting realistic operational efficiency, while enhancing transparency in the eyes of investors, partners and regulatory authorities.

Instead of approaching manually, bulky, easy to errors, the application of technology solutions like accounting software to merge AccNet ERP and financial assistant WHO LV Financial AI Agent will help businesses save time, increase accuracy, optimum performance, financial control at the level of the group.