Payroll software is automatically system to help businesses automate from step attendance, the general public, to payroll – taxes – insurance, limiting the maximum flaws help operate smoothly even when the salary policy is more variable.

In many businesses, payroll process still depends on Excel, data entry, craft and aggregated from various sources timekeeping different. This is why pay period often lasting, easy to errors that cause disputes between employees with the hr department. When the scale of personnel increased, the pressure on with a team of C&B as big, making maintaining accuracy, transparency is almost impossible if there is no tool support.

The same Lac Viet find out whether automation capabilities from software to bring benefit to the business in this article.

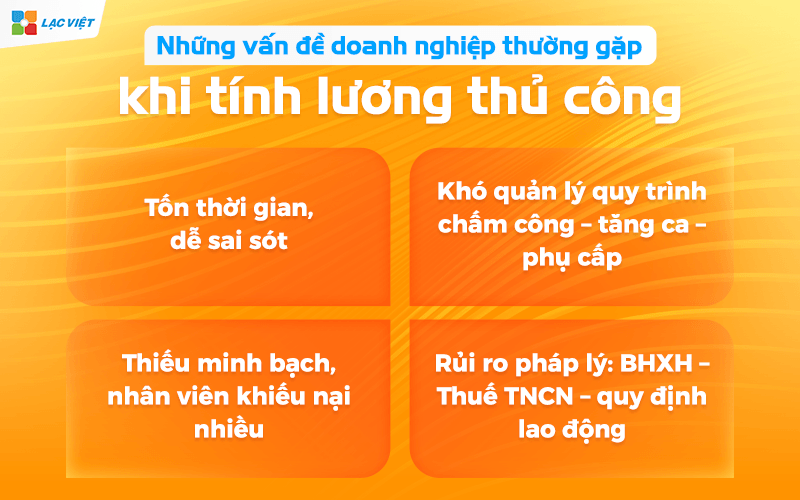

1. The problems enterprises often encounter when payroll manually.

The whole point of many businesses is for the most part they only think about the deployment of the software when the workload becomes overloaded or errors occur continuously. This stems from the fact that payroll is not just a business administration, which are clues related to working time, attendance, internal policies and legal compliance. When done manually using Excel, the risks increased significantly.

1.1 time-Consuming, easy to errors

Salary calculator in Excel depends entirely on the manipulation of hr C&B. this makes the process prone to errors such as the wrong formula, enter the wrong data, or for control between the parts. .

Not only errors, the processing time payroll each period is also prolonged. With business from 200-500 employees, parts C&B usually takes 3 to 7 days just to synthetic data, attendance, overtime, allowances and run the version table different salaries to check out. This is the reason why many businesses feel “stuck” on repeat cycle every month, there's no time for improving the experience employees or optimal welfare policies.

1.2 Difficult process management attendance – increased ca – allowance

When the scale hr increased or model operated diversity (follow ca, make production according to the project), business to handle many types of data timekeeping different. Each of the principles of work of each department comes own rules: overtime, shift changes, go to ca fracture coefficient, ca, allowance change according to the time...

The control data from the Excel file from the department head or table stool ca craft easily cause misalignment. The organizations and enterprises are finding out about payroll software automatically often share that they take the most time at the stage of checking the entire data overtime and leave, because just 1 line wrong is affecting both the payroll.

1.3 legal risks: SI – PIT – regulated labor

Payroll is not just numbers to pay for staff, which is directly related to the obligation to comply with the law. When done manually, personnel very easy to lack of updates the change:

- The SOCIAL insurance contribution calculated according to the salary the new facility.

- The circumstance of the PIT.

- Regulations on wages when working in the night or holidays.

- The effective time, the level of arrears.

The current state of many businesses had arrears or administrative fine due to errors in payroll calculation process, tax obligations. This is the risk that no organization would want to have happen, especially with business, labour force, large.

1.4 Lack of transparency, employees complain much

When data is heterogeneous or calculations are not consistent, the hr department is difficult explanations when employees questions about wages, hours of work or deductions. This reduces the confidence of employees in the wage system – enjoy and directly affect the experience of personnel in business.

Nhiều doanh nghiệp thừa nhận rằng từ khi áp dụng software attendance management, tính lương tự động, số lượng khiếu nại giảm rõ rệt vì nhân viên có thể tự tra cứu lịch sử chấm công và bảng lương chi tiết. Điều này cho thấy minh bạch là yếu tố cốt lõi giúp ổn định nguồn nhân lực.

2. Payroll software automatically?

After recognizing the practical difficulties above, businesses are often raises the question: “is There any solution helps reduce processing time payroll that still ensure the accuracy and compliance with the law?” From this demand, payroll software automatically birth to become the inevitable trend in human resource management modern.

Payroll software automatically is the system that helps business automate the entire process from collecting attendance data, synthetic work shifts, apply formulas, salary calculator, allowances – deduction, until the last salary. All done based on the rules that businesses set up in advance.

Other than Excel, where personnel have to directly enter data, and build formulas, payroll software will automatically:

- Automatically retrieve data from a timekeeper or mobile application.

- Automatically apply the formula wages over time, according to the product, according to the shift.

- Automatically calculate tax and SOCIAL insurance, the account required.

- Reduction depends on the individual, limiting flaws manipulation.

In other words, the software plays the role replaced the entire process input and for control, help businesses operate correctly more transparent.

Tại Việt Nam, xu hướng sử dụng software hr management tăng trung bình 20–25% mỗi năm, đặc biệt ở nhóm doanh nghiệp sản xuất, bán lẻ, dịch vụ có số lượng nhân sự lớn. Lý do chính:

- Need to reduce personnel costs to operate.

- Required to comply with the law increasingly tight.

- The need of transparency, experience staff.

- Pressure on productivity, especially when the business expanded scale.

The organizations and enterprises are looking for solutions payroll software automatically increasingly interested in the possibility of right – and complete – the timeliness with high accuracy, instead of depending on the Excel file complex.

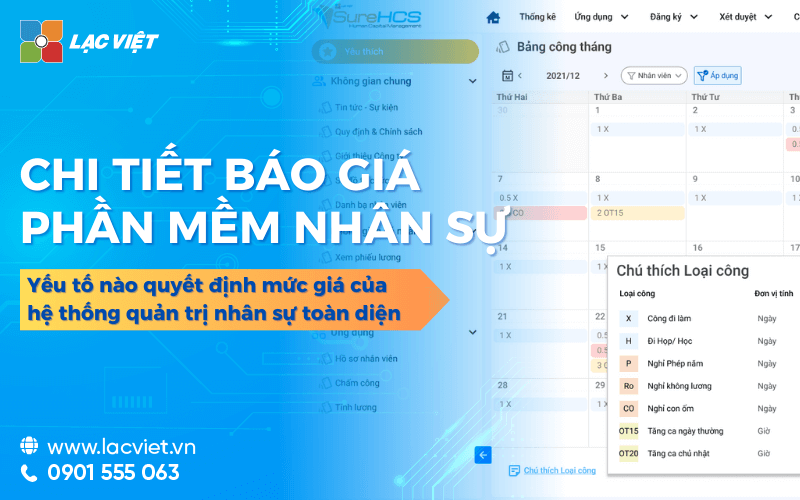

3. Automatic processes, from attendance to payroll

The majority of the organizations and enterprises are to find out information about payroll software automatically are questioned: “this System is operated by what process? Can replace how much the work of C&B?” To answer, need to understand the principle of operation is standardized into 4 main steps: data acquisition – processing payroll – check – pay. The standardization is to help businesses reduce risk, increase processing speed, ensure consistency in the entire cycle, timekeeping, payroll automatically.

Step 1: collect data – increased ca – allow – shift

The software will automatically connect to the timekeeper, mobile application or device face recognition to retrieve the data current in/out of employees in real time. With business systematic shifts, complex (ca fracture, night shift, shift, flexible week by week), the software will apply the table of ca is set up to calculate the accuracy for each employee.

The system also automatically records the number of hours of overtime, annual leave, vacation, paid or unpaid based on the provisions of the business. This helps to reduce the deflection data from multiple sources – common cause businesses take a lot of time for control.

Step 2 automation formula for calculating the salary, allowances, deductions

After enough data timekeeping, payroll software will automatically apply the salary formula has been installed from previous:

- Salary period

- Salary according shifts

- Salary according to the product

- Allowances fixed (eat ca, responsibility)

- Allowance according to ca or follow output

- Deductions (leave without pay, advance,...)

Instead of C&B have to write formula in Excel – capital to the wrong fault operation – software to ensure consistency between the wage and the reduction depends on the individual. This is to change the core business help maintain seamless operation even when the personnel in charge of the holiday or personnel changes.

Step 3 Calculate personal income tax – SOCIAL insurance – those mandated by law

One of the most important values of payroll software is automatically ensure legal compliance. The system automatically updates the SOCIAL wage base, circumstance, and the latest regulations of the Labor Law.

Accounts receivable – payable as:

- PIT

- SOCIAL INSURANCE, HEALTH INSURANCE

- Union free union

- The deduction under the internal rules

Are calculated automatically based on the current law.

Step 4 Check – control – approval – pay

Before payroll finally, the support system for control, multi-tier:

- Manager inspection department of the staff of the range management

- Hr review all the data

- Director or leader board approved pay

After approval, the pay table to be exported in many formats (PDF, Excel), or transferred directly to the bank to make payment. Employees can check the pay right on the app. This helps to reduce complaints and increase transparency.

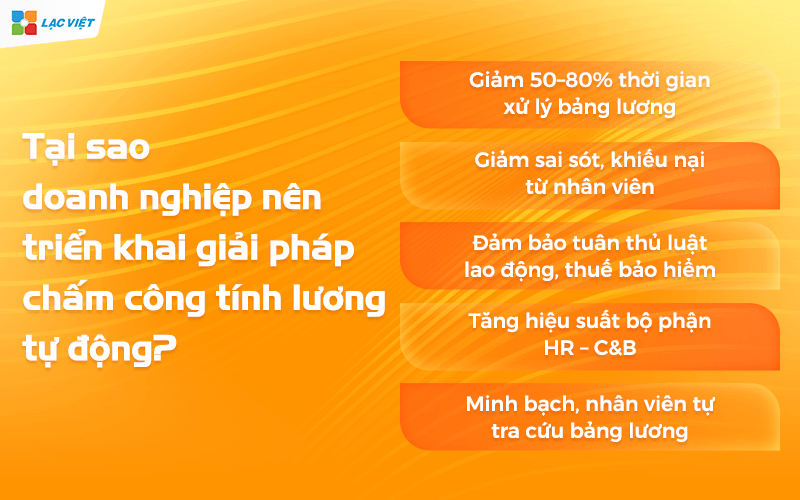

4. Why businesses should deploy solution, timekeeping, and payroll automatically?

If section 3 focuses on the principle of operation, then section 4 goes into the actual value that the business receives. This is also the factor that the search for the keyword “payroll software automatically” most interested in: this System can help them to reduce the load, reduce errors and increase efficiency not?

Reduced 50-80% of the time, payroll processing

- Automation can reduce up to 80% of the time, payroll processing compared to Excel. The reason is that software, completely remove the step input crafts, collate check each line of data.

- For enterprises with from 300 hr back-up time, payroll processing can withdraw from 5-7 days to 1-2 days.

Reduce errors and complaints from employees

Errors such as wrong formula Excel, deflection attendance data, enter the wrong overtime accounted for 54% errors salary according to EY. Payroll software automatically helps minimize these errors thanks to:

- The formula is set standard fixed

- Data are taken from single source

- WHO warns the unusual case

Since then, the number of complaints decreased, employees believe more in the wage system.

Ensure compliance with labor law, tax, insurance

The biggest risk of payroll is wrong rule, leading to arrears or administrative penalty. Software that helps automatically apply the correct latest regulations about:

- PIT

- The level of SOCIAL insurance, health INSURANCE, UNEMPLOYMENT insurance

- The coefficient of salary do more

- Regulation of paid holidays, new year

Thus, businesses minimize risk, legal risk – factors directly affect the reputation and operating costs.

Increase performance parts HR – C&B

Instead of spending up to 70% of the time for data entry, check the Excel file, parts C&B can focus for the activities to be more strategic as the construction of welfare policy, the optimal cost of personnel or development experience staff. Reducing the work load also help the HR team limit state of stress every pay period.

Transparency, employees research payroll

When employees can see the history of timekeeping, overtime, pay on the app, they understand how each of the doubt on the transparency of the business. This enhanced experience personnel, while reducing the burden of accountability for HR departments.

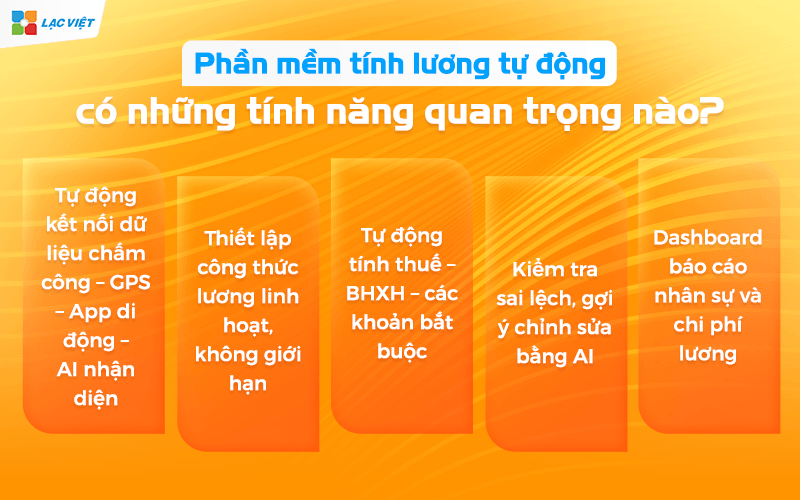

5. Payroll software automatically have these features important?

Đối với các tổ chức, doanh nghiệp đang tìm hiểu thông tin về phần mềm tính lương tự động, việc nắm rõ những tính năng cốt lõi là yếu tố quyết định giúp lựa chọn được giải pháp phù hợp. Một phần mềm tính lương tốt không chỉ tự động hóa các bước nhập liệu, tính toán, đối soát, mà quan trọng hơn là giúp doanh nghiệp giảm thiểu sai sót, tối ưu chi phí vận hành và nâng cao chất lượng quản trị nhân sự. Dưới đây là các nhóm tính năng doanh nghiệp nhất định phải xem xét.

5.1 automatic connection attendance data – GPS – mobile App – AI recognition

In many businesses, attendance data is dispersed across multiple devices: the fingerprint system scan cards, check-in app with your phone, point the via GPS or by camera AI. A payroll software automatic modern must ensure the ability to sync all this data on a single source.

Value bring to a business:

- Reduce over 70% of the time the general public each pay period (according to the survey of HrTech Weekly 2024: business user system synchronous real-time save an average of 8-12 hours/pay period).

- Remove deviations due to synthetic manually on Excel, as well as the public, teen, public, sai ca.

- Limit fraud: the check-in GPS mandatory in radius allows, AI FaceID help verify the correct face, avoid the dots black.

Illustrative example: A manufacturing enterprise 300 – 500 labor ago need 3 hr C&B processor clocking in 2-3 days. With connected multi-device and AI FaceID, duration reduced to less than 1 day, the data is updated in real-time, ready for payroll.

5.2 set the wages, flexible, unlimited

Payroll software automatically to allow to set all the wages popular in business: payroll time, piecework wage in exchange jobs, salaries, sales or combine multiple methods at the same time.

Enterprise value received:

- Change quick recipe, don't depend on IT.

- Payroll products in several levels: according to the passage, according to the organization, according to the group, according to the production standard.

- Standardized data to transparent when explaining the wage for workers.

Especially with business, manufacturing, retail, logistics – where pattern shifts constantly changing – the software should support:

- Automatic recognition of type shift: day shift, night shift, shift rotation.

- Automatically apply the allowance rate increase ca, toxic, responsible, reward productivity.

- Allows adjustment according to the internal regulations or labor laws every time.

5.3 automatic tax calculator – SOCIAL insurance – the account mandatory

A payroll system standard to automatically calculate in full:

- Personal income tax according to the progressive tax each section.

- Deductions filing UNEMPLOYMENT INSURANCE.

- Deductions circumstance under current regulations.

According to the General department of Taxation Vietnam, bugs declaration of PIT occurs most often in small and medium enterprises is wrong tier tax, wrong number of working days deductions. The automation helps to reduce 80% risk of bias.

5.4 test deviations, hints edit by AI

This is very important trend in the stage business acceleration switch number.

The AI system will:

- Automatic scanning all data clocking – recipe salary – allowances.

- Comparison with previous periods to detect abnormal (increased ca mutant, production of abnormal, public, pussy, insects).

- Give hints edit, or send a warning before locking the pay table.

Practical benefits:

- Reduce the risk paid wrong – one of the leading causes cause complaints, the holiday unscheduled.

- Improve transparency payroll, increase the trust of workers.

5.5 Dashboard reporting, hr and payroll costs

A payroll software is not just the salary but also provides reporting system intuitive:

- Payroll costs by department, project, team.

- The productivity report according to the ca group, production line.

- The rate of overtime, the rate of absence, the indicator comply with the labor law.

- Trend volatility fund salary by month/quarter/year.

Dashboard help leadership decisions faster, avoid cost overruns plan or allocate personnel unreasonable.

- 12 Common methods for calculating employee salaries, along with detailed formulas.

- Which payroll calculator should I choose to replace Excel to reduce errors and ensure compliance with regulations?

- File excel payroll according to the products & how to calculate standard SMV company may, production

- Sample spreadsheet 13th month salary with the rules & How to calculate STANDARD MOST

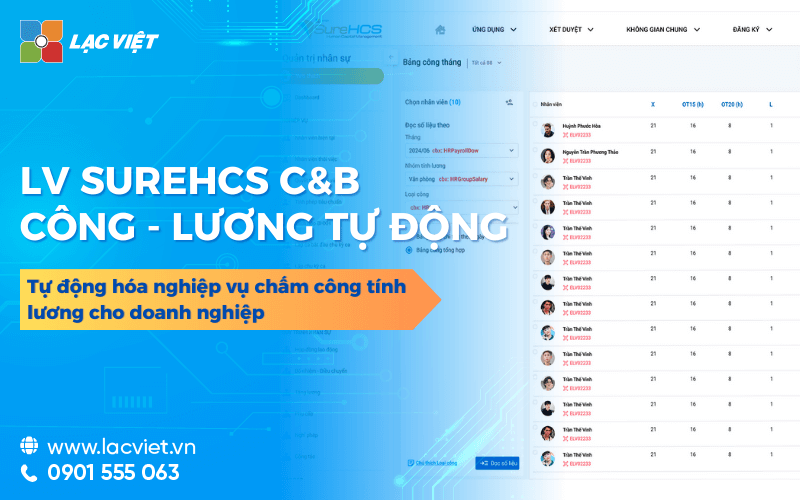

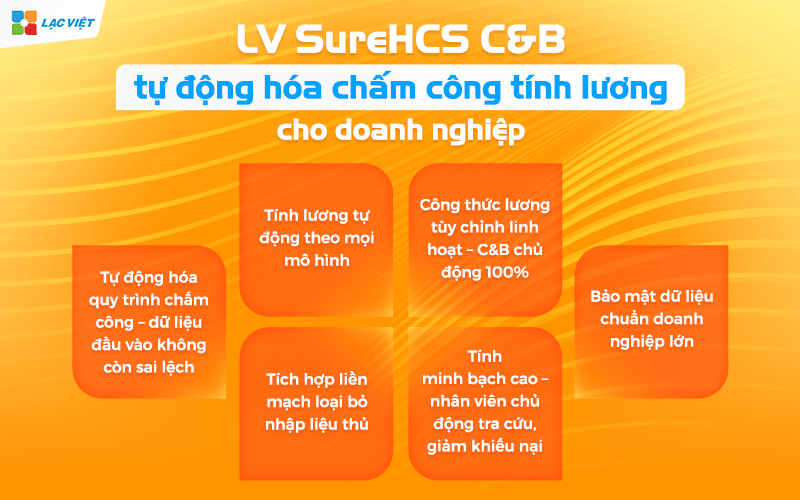

6. LV SureHCS C&B full automation, timekeeping, and payroll for business

In the context of business increasingly requires speed, accuracy and transparency in administration, hr, LV SureHCS C&B became one of the software solutions payroll automatically be many organization options. The difference of the system lies in the possibility of full automation interface, handles all the models pay the most complex as piecework wages, exchange, combining time – output, operate, multi-shift, multi-organization, multi-factory.

Below is content analysis details from the perspective expert C&B has been deployed for many business models.

6.1. Automate processes an input data no longer deviations

One of the causes of wrong common pay is attendance data non-standard: sai song, sai overtime, error timekeeper, coinciding hours, attendance teen... LV SureHCS C&B resolved this problem by:

- Automatic connection with the whole system timekeeper: machine fingerprint, FaceID AI, GPS, mobile, kiosk staff.

- Gross the smart, automatic type infections, detect abnormalities.

- Handle shift flexibility: ca administrative, ca rotate, ca fracture, ca, especially in production.

- Automatically synchronize overtime, work, permit year, stay paid – does not depend enter the hand.

Value bring to a business:

- Up to 80% of the errors attendance data – the root cause that caused the wrong salary.

- Duration synthesis decreased from 2-3 days down to a few minutes for business from 300-1.000 hr.

6.2. Payroll automatically according to every model

Other than the system only supports salary, duration, LV SureHCS C&B is designed for:

- Salary, duration, salary in ca.

- Salary KPI sales.

- Salary products according to each stage, the unit price is different.

- Salary exchange group/organization/line.

- Salary combine multiple models at the same time.

6.3. Recipe salary versatile custom – C&B active 100%

One of the strongest point of the LV SureHCS C&B is the ability to customize recipe salary:

- Library of functions payroll available.

- Allows grafting conditions, parameter, variable according to the particular business.

- No need to depend IT when change policy salary.

- Can simulate recipe before applying to avoid errors.

Practical benefits:

- Each policy change, C&B does not have to wait for IT edit.

- Avoid risks wrong the entire payroll due to the formula wrong.

- Active wage adjustments when plant expansion, increased ca new, more mature level.

6.4. Seamless integration eliminates data entry craft

The system supports automatic connection with:

- Timekeeper.

- System production management (MES).

- ERP – accounting.

- Bank Hub – link bank to transfer salary automatically.

- Management system, welfare, personnel management, performance reviews.

Eliminate 100% of lost data when importing from multiple sources. Data synchronization in real time between attendance – hr – payroll – benefits – bank.

6.5. High transparency – employee active lookup, reduce complaints

LV SureHCS C&B support:

- Lookup public hours, overtime allowed.

- Lookup payroll, salary slips, personal.

- Automatic notification of account changes in income.

- Save history access – high security for data salary.

Help create transparency, improve the confidence of workers. Increased experience staff in the period after paid.

6.6. Data security standard big business

LV SureHCS C&B application:

- Data encryption standard AES-256.

- Authorization by role, department, school data.

- Log manipulate to audit.

- Backup data automatically.

- Deployed on-cloud or on-premise upon request.

Automate payroll process not only helps enterprises reduce the time, operating costs, but also improve the accuracy to create a foundation for human resource management modern. When choosing payroll software automatically, businesses should prioritize tool has the ability to connect and attendance data, customizable recipe wage flexibility ensure absolute security for personnel information.

If your business is considering moving from Excel to system software, this is the right time to apply technology and completely remove flaws in the pay period. Sign up free demo or get advice 1:1 to choose the solution that best fits models hr of the business.

- How to calculate salary increase ca in accordance with spreadsheets, Excel file/GG sheet

- 15 Attendance software employee HRM PRECISE management, good pay

- The function calculate salary in Excel to quickly calculate the standard save time

- Provisions salary calculator holidays: legal Grounds & how to calculate STANDARD