Accounting adjustment invoice is the recorded decrease in the account as 511 (sales revenue)/ 632 (cost of goods sold)/ 3331 (output VAT) by debiting the account of this same record Can account related as 131 (customer receivables).

However, many businesses, especially the new units deployed accounting adjustments, often have difficulty in determining accounting, account selection, consistent and updated data the right way. The accounting mistake or omission can lead to financial reporting is not accurate, affect the decision management as well as potential legal risks.

The same Vietnam learn in detail about the steps recorded, principles of account, how to handle each situation adjusted revenue, price, capital tax, VAT as well as the important note help businesses implement business recorded adjustment invoice correctly efficiently.

1. Adjustment invoice what is?

Adjustment invoice is the invoice type is set to reduce the value of the original invoice has to accurately reflect the change in revenue, price, capital, taxes, VAT, or the number of goods. When a business detects errors in price, quantity, tax, VAT or apply the discount, promotional, after invoicing, the invoice tune up will help to update accounting data as well as tax reporting factual.

The important role of the adjustment invoice:

- Ensure financial data is accurate: accounting adjustment invoice revenue and VAT helps balance sheet, reports business results reflect the true fact.

- Legal compliance: According to the VAT Law & circular no. 200/2014/TT-BTC, to invoice adjustment when there are errors.

- Debt management & inventory: When accounting for reduced merchandise sales, business updates right value inventory, avoid deviations in the management of materials, raw materials and products, and adjust the debt with customers true fact.

2. How accounting adjustment invoice under circular no. 200/2014/TT-BTC

Circular 200/2014/TT-BTCaccounting adjustment invoice is an important step to ensure accounting data accuracy, to help businesses manage public debt, inventory, cost, and compliance with tax laws.

In fact, organizations, businesses are finding out information about recorded adjusting entry reduces common situations, such as adjustable output (sales) – input (purchases). Here are detailed instructions each case.

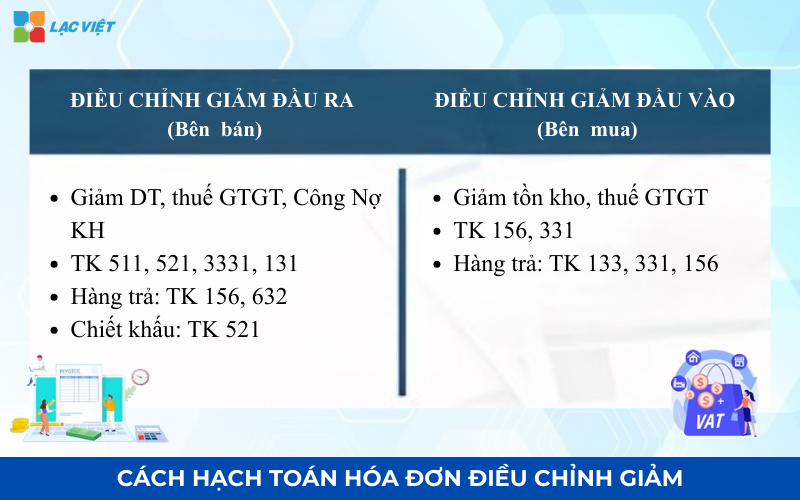

2.1. The case of adjustments to reduce the invoice output (the seller)

When a business detects errors in price, quantity or VAT on the bill was, to keep up sales tax, VAT output, debts and customers.

- Journal:

- Debt TK 511, 521 (revenue)

- Debt TK 3331 (output VAT)

- Have TK 131 (customer receivables)

Adjustable related warehouse: If the customer returns the goods sold, in addition to the accounting adjustment invoice revenue, accounting also to reduce the inventory value and price of capital:

- Debt TK 156, 155, 154 (inventory value according to the method of business accounting applied)

- Have TK 632 (cost of sales)

- At the same time perform warehouse inventory to update the quantity and value of goods.

Trade discount/discount sales: If the adjustment of the discount or promotion:

- Recorded at TK 521 (Reduced turnover)

- End of the period, the switch to TK 511

- Pen payment: Debit TK 511 / Have TK 521

Illustrative examples: Business sell 100 products, the price of 1 million copper/products applies a discount of 10% after invoice:

- Debt TK 511: 10 million

- Have TK 521: 10 million

- VAT 10%: Debt TK 3331: 1 million, There is TK 131: 11 million

2.2. Case accounting adjustment invoice input (purchase invoices)

In the case of purchase invoices have errors about value or input VAT, accounting adjustments need to be made to ensure costs as well as inventory reflect the true fact

Flaws of the value of goods:

- Reduce inventory value, input VAT

- Pen payment: Debit TK 131 (if unpaid) / Yes TK 156, 133 (VAT deductible)

Goods returned:

- Reduce input VAT: TK 133

- Decrease pay: TK 331

- Reduce inventory value: TK 156

The accounting right of entry this help business debt management provider, correct, update inventory, the actual cost, at the same time reducing tax risks arising from the invoice input.

Illustrative examples: Business buy 50 products total value of 500 million, then check out detect the actual price only 480 million:

- Debt TK 131: 20 million (up to pay suppliers)

- Have TK 156: 20 million (reduced inventory value)

- Have TK 133: 2 million (reduced VAT deductible)

3. The general process for setting adjustment invoice standard for accountants

Invoice adjusted to reduce not only is the complete information on the software but also is an important step to ensure data accounting and tax properly reflect reality. Below are the steps accounting adjustment invoice to avoid errors, reduce tax risks, as well as debt management, inventory efficiency.

Step 1: make a memorandum of agreement/memorandum of adjustment (legal basis)

Confirm the agreement between the seller – the buyer on the adjustment of the original invoice.

The content should be on the minutes:

- Name, tax code, address of the seller and the buyer.

- Information original invoice is adjustable: symbol, invoice number, date setting.

- Reason for adjustment: clearly (for example, overproduction row, need to adjust reduce the number in the correct actual delivery or the reduced price of goods under the contract...).

- Content adjustment: specifies the target would be adjusted (Name of goods, quantity, unit price, tax rate, cash tax, VAT amount).

- Value adjusted discount: Must specify the total amount of reduced (before taxes – after-tax).

Requirements: records must be both the seller – buyer sign, seal (if applicable) to make the base storage as well as for reference.

Step 2: perform accounting (Recorded on the books)

After minutes, the accountant should perform accounting adjustment invoice on accounting software.

Principles: recognition of number or pen recorder math backwards compared to pen initial payment to reduce turnover, reduce public debt and reduce taxes payable.

- Adjustable reduction of revenue & VAT:

- Debt TK 131 (customer receivables) or 111, 112 (Cash/Bank) (Recording)

- Have TK 511 (sales revenue) (Recording)

- Have TK 3331 (VAT payable) (Recording)

- (Or you can record accounting entries reversed not recording: Debt 511, Debt 3331/ There are 131...)

Note: entry must be based on the correction value decrease was recorded on the minutes.

Step 3: On the invoice and invoice adjustments.

Access to the software released electronic invoice

- Look to the “manage bills” or “electronic invoice”.

- Select the function “invoice adjustment” or “create new invoice adjustment”.

Step 4: Select the original invoice to adjust.

- The software will ask the user to search and select the original invoice was set up wrong/need to adjust.

- Users need to enter the information like signs, invoice number, date original invoice to the affiliate system.

- Ensure the adjustment is closely linked with the original invoice under the provisions of the general department of taxation.

Step 5: Enter the information specific tuning (new invoicing)

The system will create a screen to set up new bills, but with purpose is adjusted up.

Type of bill: Select “adjustment invoice”.

Required information:

- Section notes/interpretation: required to specify: “tuning up for the invoice number [invoice Number original], symbols [symbol root], date [Date original invoice] according to adjust the date [Date of record]”.

- The details of goods:

- Just enter the flow of goods, services, needs tune up.

- How to record: Record the name of goods/services, as properly as on the original invoice, but enter the number or price (or both) is negative number to show the adjustment reduced.

Check total money: Make sure the total amount before taxes, VAT amount and the total payment on the invoice adjustment is a negative number matches the adjusted value decrease on record.

Step 6: release the adjustment (Register number & Send the tax agency)

- Last checked: Ensure the information on the original invoice, reason adjusted and adjusted value reduction is correct.

- Register number: Made up of (electronic signatures) to issue an invoice adjustment.

- Send the tax authorities: The software will automatically send the bill this adjustment to the tax office to be issued a code (for bill has the code) or notification (for invoice no code).

- Send for our customers: Send the adjustment invoice has been successfully released to the buyer for them to store and declaration adjusted.

4. Risks commonly encountered when accounting adjustment invoice & how to avoid them

In the process of doing accounting, invoice processing adjust up always requires caution because directly related to revenues, expenses, VAT, and inventory. These are all risks that can be avoided if done the right process.

The risks commonly encountered:

- Do not adjust the VAT when invoicing adjust up: Occurs when only reduce revenues or costs that forget to update the corresponding VAT. This mistake makes tax figures do not match the bill was adjusted, potential risks violation of the tax law.

- The omission of the debtor, customer or supplier: when adjusting bills occur when a business only adjust revenues or goods that forget to reduce the public debt customer or supplier. Flaws, this financial report is not accurate cause difficulties in cash flow management.

- Accounting the wrong account accounting: Occurs when businesses do not properly distinguish quality service, especially with adjustment invoice revenue, cost, or goods. This makes figures reported do not reflect reality, affect analysis and decision making management.

How to prevent risk:

- Use inspection checklist before accounting: Checklist helps accountants reviewing the entire process, including translation adjustments, revenue, cost, tax, VAT, inventory, public debt.

- Carefully check the data before issuing the invoice adjustment: revise the criteria as price, number of goods, VAT, sales policy, help reduce errors.

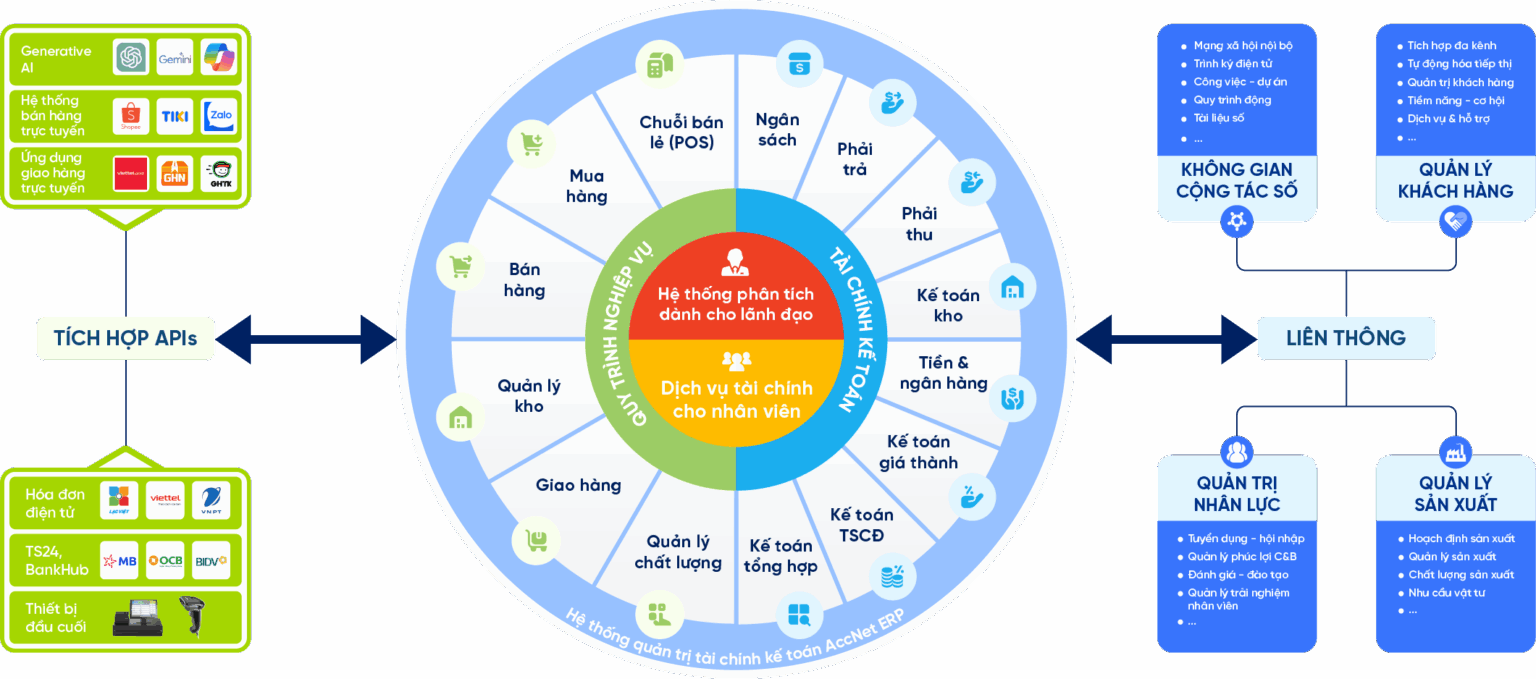

5. Build process accounting standard with accounting software Accnet ERP

To optimize the process of accounting adjustment invoice, businesses can apply accounting software Accnet ERP to help automate, ensuring compliance with standard VAS:

- Automatic recognition accounting adjustment invoice: The software automatically recorded the pen payments arising from the adjustment invoice according to the standard VAS, reducing the risk of errors crafts save time for accounting.

- Update data connection: linking closely with the sales department, warehouse and accounting, assurance data, revenue, public debt, as well as cost to be synced, avoid discrepancies due to input manually.

- Track bill status: Businesses can monitor all the adjustment invoice in real time, receive alerts when there are bills not yet accounted or not properly vouchers and ensure compliance with legal provisions.

- Automatically set up accounting allocation & adjustable: The software automatically sets the adjustments and revenue, liabilities or related expenses to help accountants make the right standards, minimize errors.

- Detailed reports & multi-dimensional: provide reports adjustment invoice according to many criteria (customer, time, type of bill), support, analysis, control revenue as well as to take timely decisions.

ACCOUNTING SOLUTIONS ACCNET ERP INTEGRATED AI AUTOMATE ALL BUSINESS

AccNet ERP is a software solution financial accounting integrated in the management system, comprehensive enterprise, which is developed by Lac Viet corporation. Difference highlights of AccNet ERP is the app artificial intelligence (AI) in many accounting process to help businesses:

- Automation of accounting and classified documents.

- Improving the accuracy in data control.

- Shorten processing time business accounting – financial.

Thanks to that, AccNet ERP not only is support tool but also a “smart assistant” with the business in financial management transparent effect.

Feature highlights:

✔️ Automatic accounting vouchers, collate public debt thanks to AI.

✔️ Manage your finance – accounting multi-branch, multi-subsidiary.

✔️ Financial statements consolidated standards of Vietnam & international (VAS, IFRS).

✔️ Cash flow management, budgeting, forecasting the exact cost.

✔️ Connect with the manure management system, hr, production, sales to sync data.

✔️ Integration of AI in data analysis, risk warning and proposed optimal scheme.

TYPICAL CUSTOMERS ARE DEPLOYING ACCNET ERP

- Nitto Denko – control production costs thanks to the application of accounting costing: Nitto Denko has chosen solution AccNet ERP to deploy the system accounting calculating cost ofhelp business control costs more effectively in the production process. After a period of use, company, highly effective, practical system that brings, as well as the degree of stability superior to other software in the market.

- ANTESCO – restructuring process works with management accounting operation: At ANTESCO, our team of consultants and deployment of AccNetERP has collaborated closely with the business in the first phase, reset the standard process and construction work-flow related departments throughout. The solution has helped ANTESCO significantly improve management capabilities, operating in a synchronized way and versatile

- Khatoco – expansion pack solution AccNetC after the successful implementation of original: Lac Viet has successfully deployed package solution AccNetC for trade co., LTD Khatoco in Nha Trang, according to the agreement signed on 29/07/2014. After the system is first put into operation efficiency, Khatoco intends to continue cooperation and expand the distribution finance – accounting and retail management with AccNetC, expressing the deep trust in implementation capacity and quality of service from Lac Viet.

SIGN UP TO RECEIVE DEMO NOW

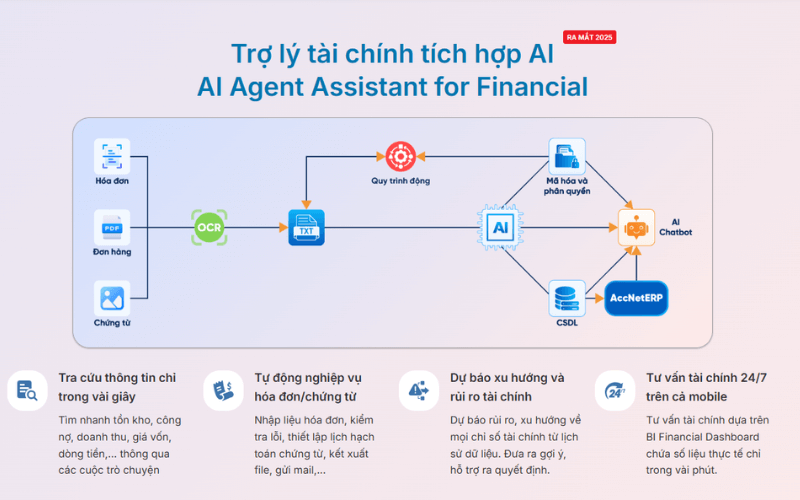

INTEGRATED AI ACCELERATION CONVERTER OF ACCOUNTING

AI in AccNet ERP't just stop at automate data entry, but also:

- Identification & classification certificate from smart: AI scan, read & sort invoice, voucher, receipt, limit errors due to input manually.

- Financial forecasting & budget: the system uses algorithms machine learning to forecast cost, revenue, business support decision fast.

- Warning risk accounting: AI to detect abnormalities in the book, from which timely warning of false or fraud risks.

- Reports assistant smart: AI suggested report template, automatic data aggregation support, leadership, financial analysis instant.

BUSINESS IS WHAT WHEN IMPLEMENTING ACCOUNTING SOFTWARE LAC VIET?

- Experience more than 30 years develop software solutions business management in Vietnam.

- Ecosystem of comprehensive: AccNet ERP easily connect with other solutions of Lac Viet (HRM, Workflow, Portal...).

- Advanced technology: Integrated AI support, cloud & on-premise flexible.

- Services dedicated support: A team of knowledgeable professionals with accounting – finance in Vietnam, companion throughout the deployment.

- Trust from thousands of customers in many areas: finance, banking, manufacturing, trade, services.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: accnet@lacviet.com.vn | Website: https://accnet.vn/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

The application software Accnet ERP helps business process optimization, accounting adjustment invoice, improving the efficiency of financial management, control public debt and ensure compliance with standards VAS correctly, transparent.

Accounting adjustment invoice is an important step to ensure accounting data, financial reports accurately reflect the business activities. The proper implementation process not only helps businesses control over revenues, expenses, VAT and inventory efficiency, but also reduce legal risks, as well as avoid errors in accounting. Besides, transparent processes also enhance the working performance of the accounting department, form the basis of reliable data for leadership decisions.

Related questions (FAQs)

Accounting adjustment invoice to any?

According to current regulations (circular no. 200/2014/TT-BTC), adjustment invoice must be accounted for in the period incurred adjusted, i.e. states that business invoicing adjustments, not recorded backwards states original invoice.

Note:

- If adjustment invoice arise after you have set up tax reporting, business need to declare additional or adjusted tax reports of states arising bill adjusted.

- This ensures figures sales tax, VAT and liabilities reflect the reality at the time of adjustment.

Accounting adjustment invoice, like how?

Accounting adjustment invoice depends on the type of bill (output or input) and related services (sales revenue, price of capital, tax, expenses, inventory).

Adjustable reduction of single output (the seller)

- Pen basic math:

- Debt TK 511 / 521 (revenue)

- Debt TK 3331 (output VAT)

- Have TK 131 (customer receivables)

- If returned goods:

- Debt TK 156, 155, 154 (inventory)

- Have TK 632 (cost of sales)

Adjustable reduction of single input (purchase invoices)

- Flaws of the value of goods:

- Debt TK 131 (reduced pay) / Yes TK 156 (inventory reduction)

- Debt TK 131 / Have TK 133 (reduced VAT deductible)

- Goods returned:

- Debt TK 331 (up to pay suppliers)

- Have TK 156 (inventory reduction)

- Have TK 133 (reduced VAT deductible)