Accounting tax contractor is the process of recording the value added tax (VAT) & corporate income tax (CIT) related to foreign contractors in bookkeeping (including price, Net and Gross). The accounting right help businesses effectively manage service costs/debts and ensure compliance with the legislation and transparent financial reporting. At the same time, the classification of costs and taxes will obviously support the decision billing optimal control, tax obligations, minimize legal risks.

So master the principles, ways and methods recorded contractor tax is essential requirement for business control costs, manage cash flow effectively and maintain credibility with international partners.

The same Lac Viet find out detailed accounting of withholding tax under the 200/133, from determining tax obligations to record accounting entries, to ensure the implementation of regulations and effective in business.

1. Overview of tax accounting services contractors in the business

1.1. Contractor tax what is?

Withholding tax or foreign contractor withholding tax is a type of tax applies to organizations, foreign individuals to provide services, goods, technology transfer or implementation of the contract in Vietnam. Vietnamese enterprises are responsible for withholding and paying taxes instead of contractors if they do not declare and pay the tax directly at Vietnam.

Withholding tax can be calculated in two common forms:

- Tax treatment contractor according to the net price: the contract Price is not including tax. Business need more VAT as well as corporate INCOME tax to recognise the true cost of services and taxes to be paid.

- Tax treatment contractors gross: contractual Price already includes tax. In this case, businesses need to split the tax out of the contract price to account on the service charges and tax obligations correctly.

1.2. Accounting tax what is contractor?

Accounting foreign contractor withholding tax is the process of recognition of taxes related to foreign contractors in bookkeeping of the business. The goal is not only legal compliance, but also help businesses manage costs, liabilities and cash flow efficiency.

Important role in business:

- Classification of the cost of the contract clear: the Cost of services from foreign contractors are properly accounted account, help track actual costs and separation is the contract cost with tax obligations.

- Recorded tax correctly: input VAT to be accounted for in TK 133, withholding tax on TK 3338. With contract gross-up, the accountant should separate service costs and the tax filing change to reflect true costs and liabilities.

- Debt management – cash flow: The recorded tax contractor to help businesses accurately track payables, active payment plans and limited risk overdue, penalty interest.

- Transparency in audit – financial statements: Recorded in full, the right time to help businesses get ready for audit and tax settlement, at the same time enhance the reliability of financial reporting.

- Optimal cost – decision-making: accounting for the exact cost, tax and interest-free loans to help businesses analyze the efficiency of the contract, from that selected payment option is optimal.

With the accounting for this business have practical basis to manage expenses and control cash flow and compliance with legal regulations. At the same time, the recognition of the right help optimize costs and maintain credibility in cooperation with foreign partners.

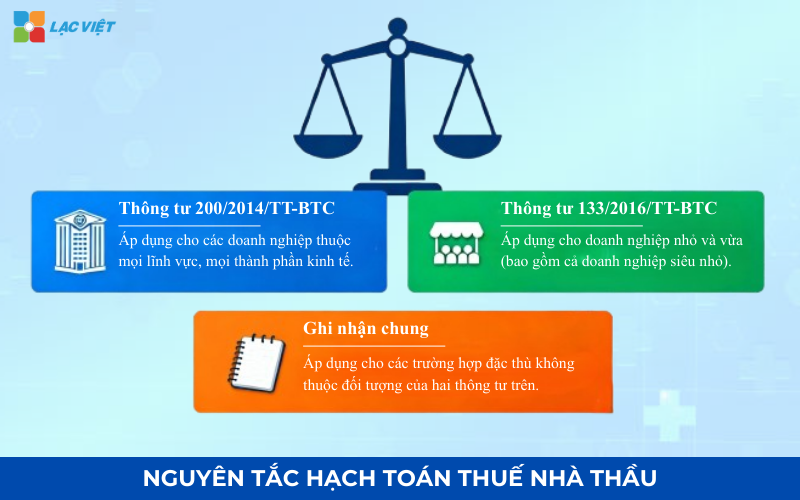

2. Principles of accounting foreign contractor withholding tax according to the standard circular

Accounting tax contractor not only meet legal obligations but also business support cost control and cash flow efficiency. Applying the right principles help payments to foreign contractors are managed transparently and clearly.

2.1. Accounting principle under circular no. 200/2014/TT-BTC

Vietnam business when signing contracts with foreign contractors need to comply with the provisions of circular 200 to ensure the recorded tax and accurate cost:

- VAT paid on your behalf (if available): Recorded at TK 133 to track tax deductible.

- Contractor tax payable: Tax and taxes related recorded at TK 3338.

- Cost of services of the contractor: accounted for in TK the corresponding expense (627, 641, 642...).

- Contract gross – business filing tax change: The corporate INCOME tax filing change are not included in deductible expenses according to provisions.

2.2. Principles of accounting according to the circular 133/2016/TT-BTC

For the small & medium business apply circular 133, basic principles, including:

- Determine the account application details: Need to check TK 133, 3338 and TK cost to recorded contractor tax on the cost of regulations.

- Classification of taxes, liabilities, costs clear: Help books transparent, convenient for control the flow of money, according to financial statements.

- Recorded an advance payment – debt right time: effectively Manage cash flow, to avoid incurring interest expense is not necessary related to the payment of contractors.

2.3. Recorded general when performing recognition of tax contractor

To ensure accounting accuracy, enterprises should comply with the following principles:

- Check the contract carefully: Identify the contract according to the price, net or gross, VAT or not, who taxable.

- Collated evidence from adequate: include contracts, invoices/invoice, payment receipt vouchers, advance, stock from paying taxes.

- Recorded right time incurred costs – taxes: Avoiding burn husband or omissions, help manage debt and cash flow accurately.

- Storage public debt – the amount of tax payable: business Support control public debt, financial reporting as well as preparation, tax settlement quickly.

Compliance with these principles help the organizations and enterprises are to find out information about professional contractor tax full recognition of expenses, manage cash flow effectively, at the same time support tax accounting services contractor interest on the loan/gross/according to the net price regulations, to minimize legal risks and optimize costs.

3. Method of tax calculation in the popular business

Depending on the contract as well as the conditions for declaration of contractors and businesses will apply one of the following methods:

- Method of deduction: applying when qualified contractor tax declaration according to the Law. Business only role deductible when paid, reducing the risk of errors. This method facilitate the recognition of professional tax accountants contractors on costs in a clear, transparent.

- Direct method/fixed rate: if contractor is not eligible to declare, Vietnam business tax deduction at source as a percentage on the sales contract.

- Mixed method: The case of VAT declaration according to the method of deduction (if eligible) and pay tax according to the rate of turnover. Businesses can deduct, pay changes according to the contract, through which control the accounting and tax contractors gross/net, reducing legal risks and optimize cash flow.

Choosing the right method of tax calculation not only help businesses comply with the law but also bring practical benefits: cost management, public debt transparency, planning, billing optimal and create credibility with foreign contractors.

4. How to calculate withholding tax by each type of services/ contract

Before recorded, the accountant should determine the right type of contractor services provider (consulting, construction, technology transfer, transport, lease, copyright...). The correct classification is the basis to apply the correct rate of VAT and CIT, ensure accounting foreign contractor withholding tax right cost and tax obligations.

4.1. Contract according to the net price (price is not including tax)

When the contract net, businesses have to tax arising to recorded in the books. Specific:

VAT (if any) = revenue contract × the Rate of VAT according to the rules

CIT contractors = revenue contract × the Rate of corporate INCOME tax according to the type of service

For example: Business contract consulting services with a foreign contractor, the total value of 100 million contract, excluding VAT & INCOME tax contractor.

Step 1: Calculate tax arising

- VAT (if applicable) = $ 100 million × 10% = 10 million

- CIT contractor = $ 100 million × 5% = 5 million

Step 2: Record the journal entries accounting

- When receiving the invoice from the contractor:

- Debt TK service cost: 100 million

- Debt TK 133 – VAT is deductible: 10 million

- Have TK 331 – paying bidders: 115 million (100 + 10 + 5)

- When payment to the contractor and pay the tax change:

- Debt TK 331 – paying bidders: 115 million

- Have TK 112 – bank deposits: 115 million

- Debt TK 3338 – CIT contractor: 5 million

- Have TK 112 – bank deposit: 5 million

4.2. Contract according to the price gross price (tax included)

When the contract gross contract price already includes tax. Accountants need to split the tax and the cost of services actually pre-recorded.

Cost actual service = Contract Price Gross/(1 + VAT Rate + Rate CIT)

For example: Business contract consulting services with a foreign contractor, the total contract value of 110 million, has included: (VAT: 10% – corporate INCOME Tax-house bidders: 5%).

Step 1: Split the cost of services and the tax from the gross.

- Cost actual service = 110 million ÷ (1 + 10% VAT + 5% CIT)

- The ratio of total tax = 10% + 5% = 15%

- Cost actual service = 110 million ÷ 1.15 to ≈ 95,65 million

- VAT = Cost of actual services × 10% ≈ 95,65 × 10% ≈ 9,57 million

- CIT contractors = Cost of actual services × 5% ≈ 95,65 × 5% ≈ 4,78 million

Step 2: Record the journal entries accounting

- When receiving the invoice from the contractor:

- Debt TK service cost: 95,65 million

- Debt TK 133 – VAT is deductible: 9,57 million

- Have TK 331 – paying bidders: 110 million

- When the payment and pay the tax instead of contractors:

- Debt TK 331 – paying bidders: 110 million

- Have TK 112 – bank deposits: 110 million

- Debt TK 3338 – CIT contractor: 4,78 million

- Have TK 112 – bank deposits: 4,78 million

By accounting for this recognition accounting contractor tax gross accurate, guaranteed financial statements properly reflect the costs and obligations tax support businesses control cash flow effectively.

5. Instructions recorded business tax foreign contractor

5.1. Accounting tax contractor according to the Net price

The Net price is the contract price is not including tax. Vietnam business as payment for the contractor to additional withholding tax (VAT + CIT) to ensure contractors get the right price on the Net.

Accounting details:

| Profession | Accounting |

| Recorded service cost |

|

| Recorded contractor tax payable |

|

| When filing taxes |

|

Note: INCOME Tax paid on behalf according to the contract Net is charged at a reasonable cost, be subtracted when calculating the corporate INCOME tax of business (Article 6 of circular no. 78/2014/TT-BTC).

5.2. Accounting tax contractor by price Gross

When the contract record price Gross (including tax), business't need to gross-up.

Accounting accounting:

- Debt TK 627, 642: the value of the contract after deduction of withholding tax

- Debt TK 133: VAT deductible

- Debt TK 811: corporate INCOME tax (not included in deductible expenses)

- Have TK 331: pay the bid (price to pay)

- Have TK 3338: general contractor tax payable

When filing tax:

- Debt TK 3338, There is TK 112 (or 111 if cash)

5.3. Accounting recorded withholding tax paid on behalf

If the business paid on behalf of withholding tax for foreign contractor:

| Profession | Accounting |

| Service cost + tax |

|

| Recorded tax filing change |

|

| When filing taxes |

|

Note: clearly distinguish the service cost (Net price), and the tax filing change. CIT filing change is calculated on the cost reasonable.

5.4. Professional tax service contractor when the contract excluding VAT

If the contract hasn cup of VAT (and possibly CIT), business need accounting foreign contractor withholding tax based on revenue before tax, then the accounting details are as follows:

Step 1: Determine the sales tax

- Taxable revenue = revenue excluding tax / (1 – percentage % tax applicable) if required gross-up

Step 2: accounting for cost, service – tax (non-filing change)

- Debt TK 627, 642: cost of services (contract price Net)

- Debt TK 133: VAT deductible

- Debt TK 627, 642 or 811: CIT (depending on Net or Gross)

- Have TK 331: pay contractors

- Have TK 3338: withholding tax payable

Step 3: accounting if the business paid on behalf of withholding tax

- Debt TK 627, 642: cost of services (contract price Net)

- Have TK 331: pay contractor (contract price before tax)

- Debt TK 331: the total number of taxes paid on behalf

- Have TK 3338: tax contractor to submit change

Step 4: When the taxpayer contractor

- Debt TK 3338

- Have TK 112 (or 111 if cash)

Note: When filing change the tax, the corporate INCOME tax is calculated on the cost reasonable, but if the contract is Gross, the corporate INCOME tax are not counted the cost.

6. Solution management accounting, effective with software Accnet ERP

To optimize the detection process tax contractors and businesses can apply accounting software Accnet ERP to help automate and transparent the whole process:

- Automatic classification of contracts, Net/Gross, tax, VAT & CIT: software identification, type of contract, calculate the exact tax arises, support, accounting, tax contractor according to price, net or gross, reducing the risk of errors crafts.

- Create journal entries automatically: the System automatically allocates service costs, liabilities and taxes on the consistent account (TK 133, TK 3338, TK expenses), to help accountants save time to ensure proper recognition rules.

- Voucher management – public debt, prompt tax payment due date: Accnet ERP hosting, e-vouchers, track debt and automatically prompt tax payment extension, reduces the risk of penalties for late and tightly controlled professional contractor tax, including interest on the loan.

- Synthesis report cost, tax: software provides detailed reports, which helps leaders easily evaluate effective contracts with foreign contractors, compare the actual cost and tax obligations, from which strategic decisions more accurate.

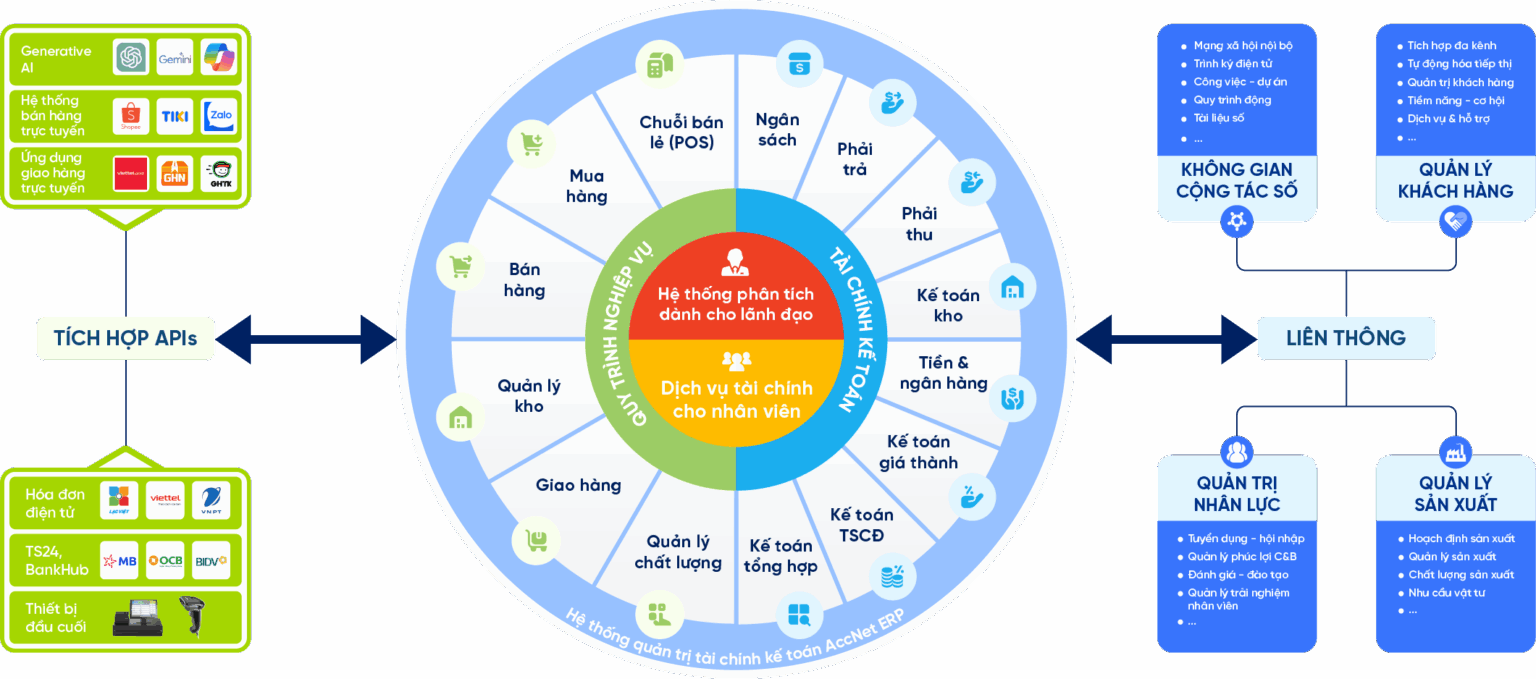

ACCOUNTING SOLUTIONS ACCNET ERP INTEGRATED AI AUTOMATE ALL BUSINESS

AccNet ERP is a software solution financial accounting integrated in the management system, comprehensive enterprise, which is developed by Lac Viet corporation. Difference highlights of AccNet ERP is the app artificial intelligence (AI) in many accounting process to help businesses:

- Automation of accounting and classified documents.

- Improving the accuracy in data control.

- Shorten processing time business accounting – financial.

Thanks to that, AccNet ERP not only is support tool but also a “smart assistant” with the business in financial management transparent effect.

Feature highlights:

✔️ Automatic accounting vouchers, collate public debt thanks to AI.

✔️ Manage your finance – accounting multi-branch, multi-subsidiary.

✔️ Financial statements consolidated standards of Vietnam & international (VAS, IFRS).

✔️ Cash flow management, budgeting, forecasting the exact cost.

✔️ Connect with the manure management system, hr, production, sales to sync data.

✔️ Integration of AI in data analysis, risk warning and proposed optimal scheme.

TYPICAL CUSTOMERS ARE DEPLOYING ACCNET ERP

- Nitto Denko – control production costs thanks to the application of accounting costing: Nitto Denko has chosen solution AccNet ERP to deploy the system accounting calculating cost ofhelp business control costs more effectively in the production process. After a period of use, company, highly effective, practical system that brings, as well as the degree of stability superior to other software in the market.

- ANTESCO – restructuring process works with management accounting operation: At ANTESCO, our team of consultants and deployment of AccNetERP has collaborated closely with the business in the first phase, reset the standard process and construction work-flow related departments throughout. The solution has helped ANTESCO significantly improve management capabilities, operating in a synchronized way and versatile

- Khatoco – expansion pack solution AccNetC after the successful implementation of original: Lac Viet has successfully deployed package solution AccNetC for trade co., LTD Khatoco in Nha Trang, according to the agreement signed on 29/07/2014. After the system is first put into operation efficiency, Khatoco intends to continue cooperation and expand the distribution finance – accounting and retail management with AccNetC, expressing the deep trust in implementation capacity and quality of service from Lac Viet.

SIGN UP TO RECEIVE DEMO NOW

INTEGRATED AI ACCELERATION CONVERTER OF ACCOUNTING

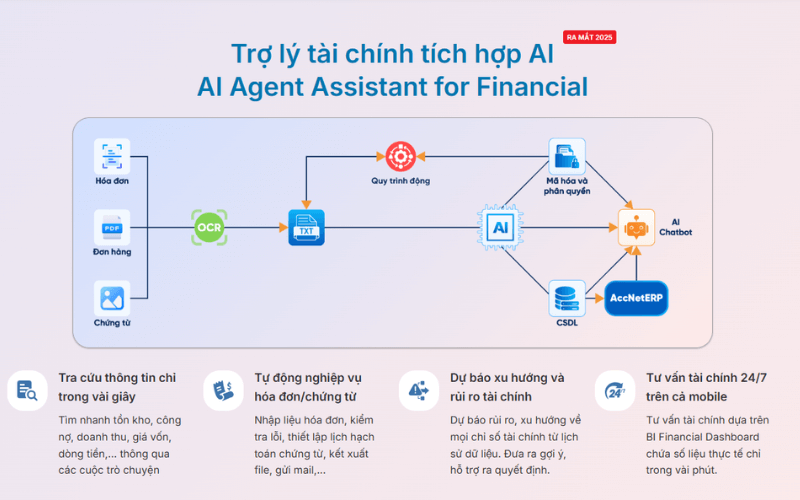

AI in AccNet ERP't just stop at automate data entry, but also:

- Identification & classification certificate from smart: AI scan, read & sort invoice, voucher, receipt, limit errors due to input manually.

- Financial forecasting & budget: the system uses algorithms machine learning to forecast cost, revenue, business support decision fast.

- Warning risk accounting: AI to detect abnormalities in the book, from which timely warning of false or fraud risks.

- Reports assistant smart: AI suggested report template, automatic data aggregation support, leadership, financial analysis instant.

BUSINESS IS WHAT WHEN IMPLEMENTING ACCOUNTING SOFTWARE LAC VIET?

- Experience more than 30 years develop software solutions business management in Vietnam.

- Ecosystem of comprehensive: AccNet ERP easily connect with other solutions of Lac Viet (HRM, Workflow, Portal...).

- Advanced technology: Integrated AI support, cloud & on-premise flexible.

- Services dedicated support: A team of knowledgeable professionals with accounting – finance in Vietnam, companion throughout the deployment.

- Trust from thousands of customers in many areas: finance, banking, manufacturing, trade, services.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: accnet@lacviet.com.vn | Website: https://accnet.vn/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

The application software Accnet ERP not only process optimization, accounting, tax contractor but also improve the efficiency of financial management overall business support, management cost, liabilities as well as cash flow in a transparent, accurate, and effective.

The accounting foreign contractor withholding tax correctly not only help business in full compliance with legal regulations, but also improve efficiency, manage costs, liabilities and cash flows. Recognition of expenses as well as tax transparency helps financial statements properly reflect the fact facilitate audit easily take strategic decisions. At the same time, strict management of tax obligations, as well as timely payment contributes to maintaining credibility with international partners.