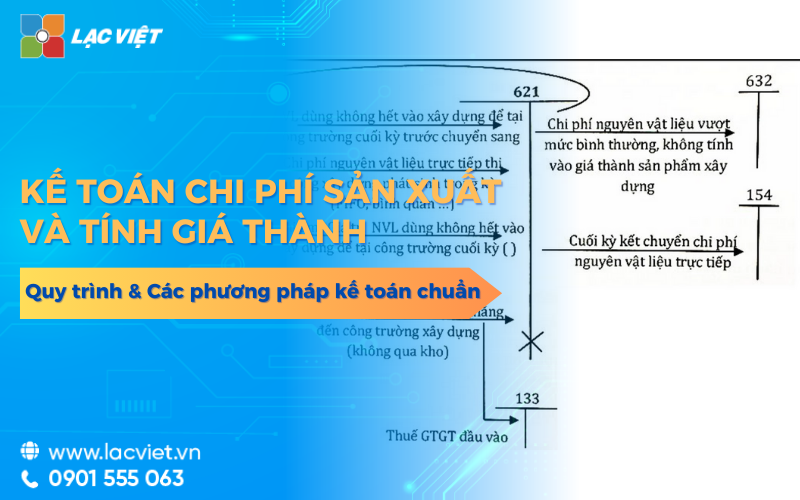

Accounting production cost and price calculation system is recorded, allocated costs incurred in the manufacturing process to accurately determine the actual cost of each product, orders, or process. This activity helps the business understand where the money is being used where, can create value or not, as well as impact how to profit.

In fact, many enterprises still face difficulties when implementing accounting costs and prices of service-oriented administration. Cost data dispersion, the distribution is not reasonable, the accompanying statements price to slow that financial information is reliable. This reduces the quality of decision-making as well as increased risks in cost control, profit.

The article below Lac Viet will help the organizations and enterprises are to find out information about accounting costs of production and prices have a look systems, practical, easy to apply on operation management.

1. Accounting cost of production and price is what?

1.1. Cost accounting what is the production?

Cost accounting production is the process of recognition, sorting, aggregation, tracking the entire costs incurred in the manufacturing process of business.

These costs are generally divided into three main groups:

- The cost of raw materials direct: is the cost for the material elements directly constitute products, such as fabric, only document in the tailoring business; steel, cement in the construction business.

- Cost, direct labour: as salaries, allowances, insurance of workers directly engaged in manufacturing, machining or construction.

- Production costs general: is the cost of servicing as well as support the production process as depreciation machinery and equipment, the cost of electricity, water, cost management, factory, maintenance machinery.

In terms of management, cost accounting not only to recorded data that aims to help businesses know the money is being used now, account, how to create value and terms that cause waste. When the cost is track transparency, the leader has the facility to control resources, as well as adjust the production plan, spending time.

1.2. Calculate the product price is what?

Costing is the process of synthesis, allocation of production costs incurred to determine the actual cost of each product, orders, works or services. This information is the basis for construction enterprises selling price, determine the profit margin to evaluate business performance according to each specific audience.

Can understand short:

- The cost of production reflects the process of incurred costs in the states

- Price reflects the results of allocation of costs to finished product

Distinguish accounting cost of production and price calculation:

| Criteria | Cost of production | Price |

| Time | Incurred during the accounting period | Determine when to products, orders, or complete works |

| Nature | Reflected lines costs incurred | Reflect the results of cost allocation |

| Purpose | Control your spending, use of resources | Determine the sales price, profit, business performance |

1.3. The relationship between accounting cost of production and price calculation

accounting production costs and price are two stitch related more closely in the system of financial management of the business.

If collection costs are not full, not the right audience or misclassified, then the price would not reflect the real costs. When that business can encounter the risks following:

- Determine the selling price is not accurate, resulting in lower selling costs or loss of competitive advantage due to the price too high

- Misjudged the effect of each product, orders or projects

- A decision to invest, expand or reduce production based on information not reliable

So the value of good, if not better control the cost right from the start, nor can business decisions accurately if the lack of a system of cost accounting and cost are organized and whether transparent.

2. The role of accounting, the cost of production and price calculation for business

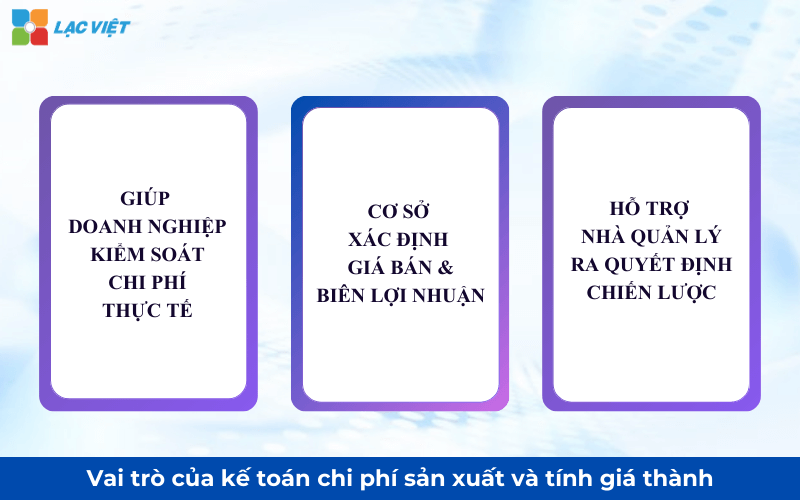

2.1. To help businesses control the actual cost

In production activities, the cost can arise in many items at the same time different. An accounting system production cost and price of products will effectively help businesses:

- Detect irregular expenses & waste: When expenses are recorded according to each element such as raw materials, workers, as well as the cost of production in common, accounting can compare the actual data with the level and plan. This comparison helps to identify the costs exceed the expected or does not create value, from which timely adjust production processes or purchasing.

- Compare the actual cost with the level of plan: establishing norms and cost before production allows you to “measure” to assess the level of resources used. Real comparison with the level of help leaders understand the how costs are to promote efficiency, somewhat are consuming resources in vain.

- Determine the cause cost overruns to timely adjust: detailed Data helps indignation area source drain cost, from which management may decide to adjust the supply chain, increase productivity labour or re-structure the production process towards saving more.

This information serves not only financial statements but also the tools to the management team take timely decisions, minimise financial risk.

2.2. The basis for determining the selling price & profit margin

Product price is base key to building strategic reasonable selling price, determine the profit margin of the business.

- If the price is lower estimate fact, the sale of goods at low prices can make great business idea is profitable but the fact is so cost is not burden the right level.

- If the price is too high due to the misallocation of costs, business set selling price higher than the market, reduce the competition.

Determining the price of the exact help businesses proactively adjusting selling prices according to your business goals, market fluctuations. This is the basis to set the profit margin justified, just ensure effective financial and maintain competitiveness.

2.3. Support the management decision-making strategy

One of the most important values of the accounting cost of production and the price of the products is to provide quantitative data serve strategic decisions. When the information cost is aggregated clearly for each product, orders, or process, managers are able to answer these key questions:

- Products are really profitable? Thanks to the analysis of the business know which product would have cost has been optimized as well as generate profits to expectations.

- Empty lines are “corrosive” to profit? Some product lines may bring revenue, but the cost of production is too large, which leads to actual profit is low or negative. Identify these products help leaders decided to re-structure the products list.

- There should continue or stop an order project? With respect to the business of production according to orders or project, getting to know the cost associated with each order to help leaders assess the effect before accepting new orders.

- There is need to optimize the production process, no? Data rates of detail in each stage of production to help businesses identify what process is hogging the cost unreasonable, from which optimized the operational capacity.

3. The method of accounting cost of production and price of common

3.1. The method of calculating the cost of simple (direct)

The method of calculating the price of simple (direct method) is the way in which the entire production costs in the states was common set, then divided by the number of finished product to determine the price of the unit. Businesses do not split the cost, according to each stage or each product line, which allocates the average cost for each unit product to quickly determine actual cost.

General formula:

(Price unit = Total cost of production in / Production of the finished product)

In which:

- The total cost of production includes the cost of direct material cost, direct labour and production overhead.

- Production of finished product is the number of standard products, eligible to enter the warehouse or delivered.

| Advantages | Restrictions |

|

|

This method applies to any business?

This method is consistent with the organizations and enterprises are to find out information about accounting cost of production and price calculation in the context of:

- Business only produce one type of product or a few categories.

- Production process continuous, self-contained, cost incurred relatively evenly between the products.

- Category management focuses on controlling the total cost, determine the rates of average to serve valuation as well as track the general effect.

For example:

- Factory pure water only produce a kind of water bottle with the same specification.

- Cement plant production of a type of cement standards follow the same process.

- Business production, brick building in continuous chain.

3.2. Method coefficient, the rate of

Method coefficient, the ratio is how to allocate the total cost of production for many kinds of products based on the coefficient reflects the level of consumption of resources of each product. The system is built according to the specification or actual data as the raw material, used, processing times, or complexity of production. Thanks to that, the cost is allocated more suitable help price reflects the true effect of each product line.

| Advantages | Restrictions |

|

|

Apply this method for any business?

In accordance with the organizations and enterprises are to find out information about accounting, production costs and prices in the case of:

- Business processed from an input source into many types of products, different output.

- Businesses can determine the relationship relative level of attrition costs between the products.

- Businesses need effective management of each product line for optimum profit, the category business.

For example:

- The refinery produces gasoline, liquefied petroleum gas, bitumen from the same source of crude oil.

- Woodworking business make out of plywood, wood chips, sawdust from the same wood.

- Business, agricultural products processing to create the finished rice bran, rice husk, from the same raw rice.

3.3. The method of calculating the cost of orders

The method of calculating the cost of each order is the whole set costs individually for each order, contract or project specific. Each order is tracked as an independent object, when completed, will determine the own price and profit of it. Thus, businesses can accurately assess the effectiveness of each contract instead of just look at the final result, all states.

| Advantages | Restrictions |

|

|

Business in accordance with this method?

In accordance with the organizations and enterprises are to find out information about accounting cost of production and price calculation in the following cases:

- Business production according to the orders separately, not mass-produced.

- Business, construction, consulting, project implementation according to the contract have a long implementation period as well as costs incurred in-progress.

- Businesses need effective governance by each customer, each contract in order to optimize the category business.

For example

- Construction company, construction, furniture in each work.

- Sewing business export, according to each order.

- Business manufacture of machinery and equipment according to individual requirements of the customer.

3.4. Method level

Methods the norm is the construction business before the cost standard for each element as raw materials, workers and general expenses on a unit of product or stage. In the process of production, actual costs are compared with norms to determine as well as analysis difference. Thanks to that, the business noted not only the cost but also proactive control, as well as improve the efficient use of resources.

| Advantages | Restrictions |

|

|

Apply this method for any business?

In accordance with the organizations and enterprises are to find out information about accounting cost of production as well as the price in the following cases:

- The business of mass production with stable processes, little has changed.

- Businesses have enough historical data, the capacity to build the reasonable rates.

- Business oriented management streamlined, cost control, tight, continuous improvement.

For example

- Business manufacturing, electronic components, plastics, food products, pharmaceutical products.

- Business application management models such as Lean, Kaizen, TPM to optimize operational efficiency.

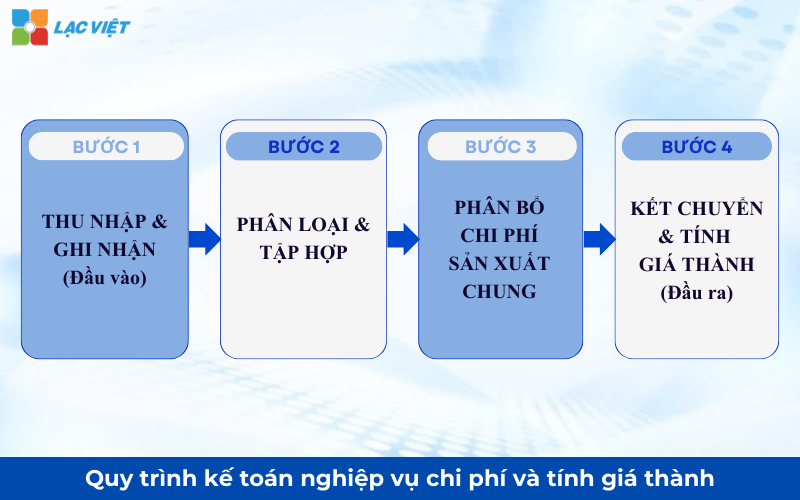

4. Accounting process, service cost and price calculation in the business

Process cost accounting and cost not only to the recorded data, which is information tool service administrator. When well-organized, businesses can control the cost, detect waste to timely decisions based on reliable data.

Step 1: collect & record expenses incurred

This is the most important step, because the whole result of the latter depends on the completeness and accuracy of input data.

Businesses need to collect the cost from the original documents arise every day, such as:

- Warehouse raw materials for production.

- Timesheets, payroll, workers directly involved in production.

- Bills electricity, water, rental of machinery and equipment repair.

- Spreadsheet, allocate depreciation of fixed assets used for production.

Recorded timely help administrators track costs in real time, early detection of expenditures unusual as well as have measures to regulate before passing the budget.

Step 2: sorting & collection charges

After recorded, the cost should be classified, set according to the criteria appropriate to serve for the calculation of the price.

Typically, costs are classified according to two angles:

- According to cost elements:

- The cost of raw materials directly

- Costs directly

- The cost of production in common

- According to the subject costs:

- Under each product

- According to each order

- According to each work item

Correct classification helps businesses know exactly, “the money is going to where” parts would cost the most and where is the need to optimize.

Step 3: allocation of production costs, general

Production overhead is the costs can not be attached directly to each product, but still need to allocate reasonable, as your workshop, depreciation of machinery and salary management workshop.

Businesses need to choose the allocation formula appropriate to the specific operation, for example:

- Hours of machine running

- Labor hours direct

- Production

- Direct costs

Allocate the right help price was not “team up” or “down low” in a way misleading, avoid bad decisions sale prices or cut costs based on incorrect data.

Step 4: The shipping cost & price calculator

When products, orders, or complete works, the entire cost was set will be transferred to the account price to determine the:

- The price of each product or order

- Profit and loss according to the contract-project

- The level difference between the price of the actual price plan

This result is used for:

- Financial reporting, management reports.

- Evaluate the effectiveness and production activities.

- As a base to adjust the level, price, strategy, business.

Businesses can know exactly what products are profitable, products are “corrosive” profit, from which adjust the product portfolio and market strategy.

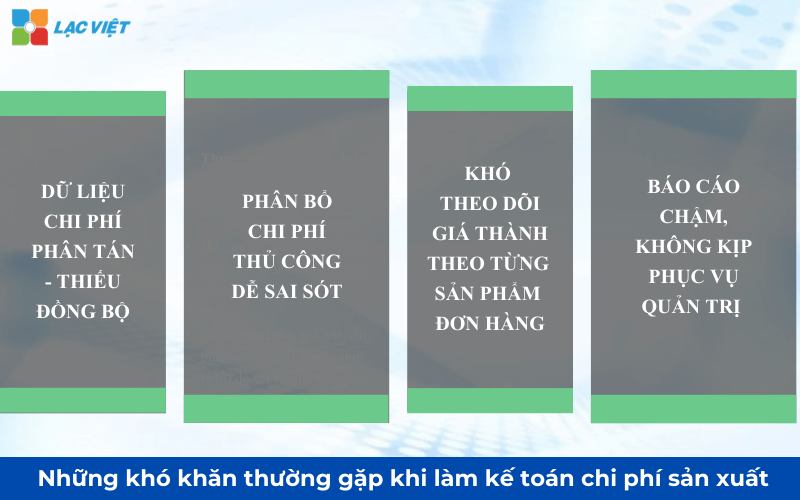

5. The difficulty enterprises often encounter when doing cost accounting production

In fact deployed, many enterprises still face difficulties due to data scatter, the process has not standardized, as well as tool support is still limited. This reduces the reliability of the data, limiting the effective cost management as well as the decisions of leadership.

5.1. Cost data dispersion, lack of synchronization

Costs incurred in many different parts such as purchase, inventory, production, human resources, accounting, but not be related more data in the same system.

The result is:

- Data is delayed compared to the actual, not reflecting fluctuations in the cost.

- Easy to miss or recorded to coincide costs, distort prices.

- Hard for projector, control cross between the parts.

Leadership doesn't have to be painting cost in real time to adjust in time when the cost exceeds the plan, leading to the risk of losses only to be discovered when the end of the accounting period.

5.2. Cost allocation craft, easy-to-flaws

Many businesses still cost allocation joint production by Excel or manually, based more on personal experience of accounting.

This leads to:

- Easy to confuse formulas and input data, especially when the volume of big data.

- Allocate lack of consistency between the states, loss of comparability of the data.

- Hard to explain when data is inspection or audit.

Price is false that business can mispriced products, ideas, interest rate but the actual holes, or miss the opportunity to compete due to price too high.

5.3. Difficult to track the cost of each product, orders,

Many businesses only understand the price in the overall end-states that don't know:

- Orders are really words, orders are holes.

- Products are consumable cost unusually high.

- Every stage in the production process are wasteful.

Business can't management product portfolio in a strategic way, there is no data to decide should focus on developing or remove the line products less effective.

5.4. Reports slow down, not up service administrator

Reported prices generally only be set after the end of the accounting period (month or quarter) when any costs have been incurred done.

This makes:

- Businesses slow to respond to fluctuations in input cost (the price of raw materials, wages, energy costs).

- All adjustments are “fire” instead of prevention.

Business miss an opportunity to optimize costs in the process of commissioning only see the problem when it was too late, reduces the effectiveness of long-term competitiveness.

6. Accnet ERP – solutions to improve management efficiency, production costs and prices

In fact, many businesses are struggling due to cost data scattered in many parts handle manually on Excel, so that the information is slow, easy to misleading and difficult to control in real time. AccNet ERP system is integrated management help connect data, as well as transfers from the way “recorded after” to “control in the process”.

AccNet ERP support for business:

- Automate collect costs from purchase – warehouse – manufacturing – human resources: All costs incurred (raw materials, production, warehouse, public money, depreciation of machinery, cost of electricity, water...) is recorded automatically from the analysis related and push on accounting system.

- The set costs according to each product, orders, works in real time: Businesses can track the cost incurred for each object right in the manufacturing process, instead of waiting until the final new synthesis.

- Cost allocation joint production automatically according to criteria set available: AccNet ERP allows to set the allocation consistent with reality (hours, hours, product quality, direct costs...) then the system automatically allocated, the move by states.

- Report price of multi-dimensional: by product, by order, according to the workshop, according to states: Business not only see the total cost, but also detailed analysis in multiple angles to evaluate the effectiveness of each product line, each workshop or each contract.

- Compare real – norm – plan to control – optimal cost: the System supports comparison between the actual cost with the level of plan. From that help businesses clearly identify the causes of discrepancies: due to wasted raw materials, low labor productivity, or due to fluctuations in input prices.

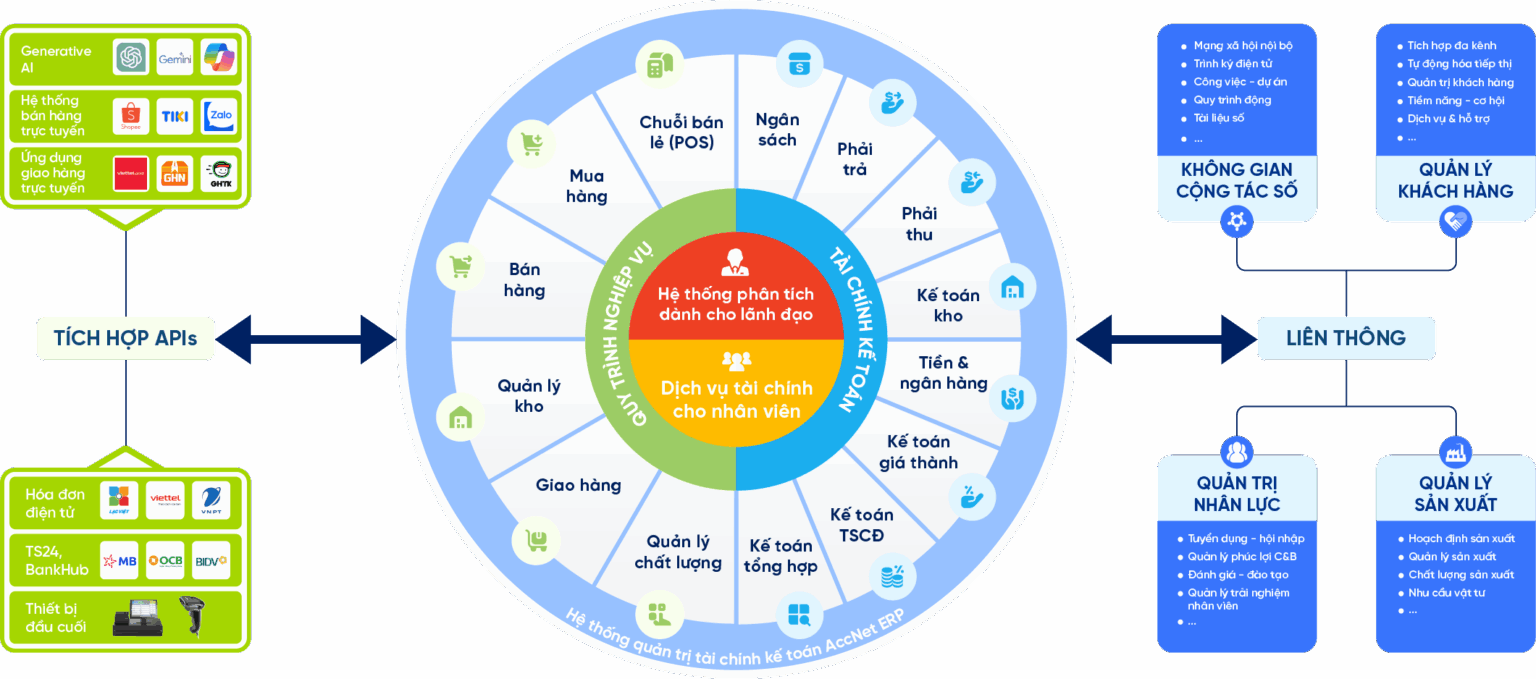

ACCOUNTING SOLUTIONS ACCNET ERP INTEGRATED AI AUTOMATE ALL BUSINESS

AccNet ERP is a software solution financial accounting integrated in the management system, comprehensive enterprise, which is developed by Lac Viet corporation. Difference highlights of AccNet ERP is the app artificial intelligence (AI) in many accounting process to help businesses:

- Automation of accounting and classified documents.

- Improving the accuracy in data control.

- Shorten processing time business accounting – financial.

Thanks to that, AccNet ERP not only is support tool but also a “smart assistant” with the business in financial management transparent effect.

Feature highlights:

✔️ Automatic accounting vouchers, collate public debt thanks to AI.

✔️ Manage your finance – accounting multi-branch, multi-subsidiary.

✔️ Financial statements consolidated standards of Vietnam & international (VAS, IFRS).

✔️ Cash flow management, budgeting, forecasting the exact cost.

✔️ Connect with the manure management system, hr, production, sales to sync data.

✔️ Integration of AI in data analysis, risk warning and proposed optimal scheme.

TYPICAL CUSTOMERS ARE DEPLOYING ACCNET ERP

- Nitto Denko – control production costs thanks to the application of accounting costing: Nitto Denko has chosen solution AccNet ERP to deploy the system accounting calculating cost ofhelp business control costs more effectively in the production process. After a period of use, company, highly effective, practical system that brings, as well as the degree of stability superior to other software in the market.

- ANTESCO – restructuring process works with management accounting operation: At ANTESCO, our team of consultants and deployment of AccNetERP has collaborated closely with the business in the first phase, reset the standard process and construction work-flow related departments throughout. The solution has helped ANTESCO significantly improve management capabilities, operating in a synchronized way and versatile

- Khatoco – expansion pack solution AccNetC after the successful implementation of original: Lac Viet has successfully deployed package solution AccNetC for trade co., LTD Khatoco in Nha Trang, according to the agreement signed on 29/07/2014. After the system is first put into operation efficiency, Khatoco intends to continue cooperation and expand the distribution finance – accounting and retail management with AccNetC, expressing the deep trust in implementation capacity and quality of service from Lac Viet.

SIGN UP TO RECEIVE DEMO NOW

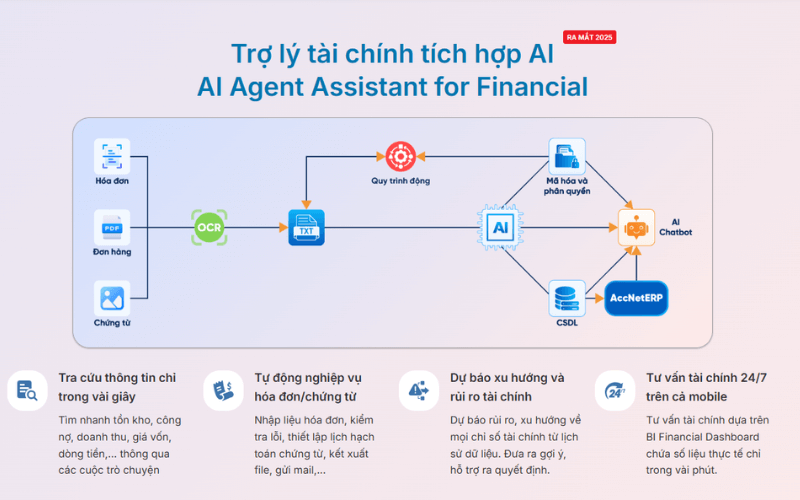

INTEGRATED AI ACCELERATION CONVERTER OF ACCOUNTING

AI in AccNet ERP't just stop at automate data entry, but also:

- Identification & classification certificate from smart: AI scan, read & sort invoice, voucher, receipt, limit errors due to input manually.

- Financial forecasting & budget: the system uses algorithms machine learning to forecast cost, revenue, business support decision fast.

- Warning risk accounting: AI to detect abnormalities in the book, from which timely warning of false or fraud risks.

- Reports assistant smart: AI suggested report template, automatic data aggregation support, leadership, financial analysis instant.

BUSINESS IS WHAT WHEN IMPLEMENTING ACCOUNTING SOFTWARE LAC VIET?

- Experience more than 30 years develop software solutions business management in Vietnam.

- Ecosystem of comprehensive: AccNet ERP easily connect with other solutions of Lac Viet (HRM, Workflow, Portal...).

- Advanced technology: Integrated AI support, cloud & on-premise flexible.

- Services dedicated support: A team of knowledgeable professionals with accounting – finance in Vietnam, companion throughout the deployment.

- Trust from thousands of customers in many areas: finance, banking, manufacturing, trade, services.

See details, feature & get FREE Demo

CONTACT INFORMATION:

- Hotline: 0901 555 063

- Email: accnet@lacviet.com.vn | Website: https://accnet.vn/

- Office address: 23 Nguyen Thi Huynh, Phu Nhuan, ho chi minh CITY.CITY

Accounting production cost and price calculation requires not only compliance with accounting, which is the administration tool in helping businesses understand the operational efficiency and quality of their profits. When the cost is controlled strictly, the price is determined accurate information is provided timely, managers can make decisions based on data instead of hunches. This is the foundation for enterprises to enhance competitiveness, optimize resources and sustainable development in the long term.