Accounting prices are set and allocate costs to determine the price for each product, orders, or services. Information prices to help businesses build sales price, cost control and performance evaluation activities, especially important with large-scale enterprise.

The same Lac Viet find out details about accounting profession related to price from concept, method, account, accounting entries to the actual process, thereby supporting business organization, the business price calculator basically more efficient in administration.

1. Learn about the prices of products

1.1 the Price is what?

Product price is the entire actual cost to produce, complete a unit of product or service in the states. Reflect the “true cost” is not dependent work has been sold or not, if the business does not determine the right price will sell below the price of capital, not timely detection stitch wasting as well as make wrong decisions about expanding or cut production.

The item cost structure of the product price includes:

- The cost of raw materials directly: costs accounted for a large proportion in most of the manufacturing enterprises. The cost of raw material directly covering the entire value raw main material, filler material, semi-finished products purchased outside be directly used to create products.

- Costs directly: payments for direct labor in production, including the salaries, allowances and deductions from salary. This cost should be monitored tied to labor productivity since the same rate of pay, but yield different will create price different.

- Production costs, general: the cost to serve, support for production activities, but do not accounted directly for each product such as salary management workshop, electricity, water, and repair machinery, depreciation of assets and tools. This is a item easy to distort the price if allocation is not reasonable.

1.2 The method of calculating the price of today's popular

Don't have a method of calculating the price of which is suitable for any business. The choice of method should be based on production characteristics, processes, technology, and administrative requirements of each unit. On that basis, the method of calculating the price of popularity today can be classified as well as apply according to each particular business as follows:

- Pricing methods into simple: Apply for business are the production process simple, homogeneous products, short production cycle, and almost no products unfinished end of the period. This method is easy to deploy, easy to control costs consistent with small-scale entrepreneurs or new business standardized accounting prices.

- The method of calculating the cost of orders: Apply for manufacturing enterprises in each order, separate contract such as mechanical, printing, furniture, construction and installation. The biggest advantage is to help the business determine the exact interest – holes in each order, from which improves the ability of quotes as well as negotiating with customers.

- The method of calculating the cost of each coefficient, the rate of: Business suits have the same production process, but create many different types of products. This method helps to allocate a reasonable cost between the products, avoid product “burden” cost is not the right practice.

- The method of calculating the cost of the production process: Apply for business continuous production, multiple stages, such as chemical, food, building materials. This method allows for the collection, allocation of costs according to each stage. Help business control costs, detailed, timely detection point congestion and stitch cause waste in the production process.

Many businesses have difficulty when choosing accounting methods accordingly. In fact, the right choice right from the start help accounting system, stable operation, limit deviations, significantly reducing the cost adjustments later on.

2. Accounting price is what? Job description main

2.1 Concept

Accounting price is parts perform the collection, classification, allocation of cost of production and price according to each product, orders, works or projects. About the admin, not only to know “how much” but also to determine the cost incurred primarily where there are reasonable or not and businesses are profit or loss on each object. So even medium businesses small if it does not know the price of reality is also very easy to fall into a state as do as the hole.

2.2 description of the main work of the accounting price

The work of accounting costing fastened with the entire production process – providing services of the business. Below is the core mission to bring value directly to operations management.

- Set cost of production is the accounting gather, check, note, get the full costs incurred in the period, including the cost of direct material cost, direct labour and production overhead. Thereby not only the formation of accounting data, but also to help businesses identify cost accounts for a large proportion, the cost increase unusual, as well as the account arises not create value, respectively.

- Allocate a reasonable cost is job accounting selection criteria appropriate to allocate the costs of production such as water, electricity, salary management workshop, depreciation of machinery for each product. The allocation of the right help price reflects the fact, to avoid this product “burden” cost for other products as well as support leaders accurately assess the effectiveness of each product line.

- Calculate the price of products/services step is determining the price of reality for each product, orders, construction or project after it has set and cost allocation base rate effective for decisions about price, product portfolio, as well as continue or stop the operation. If only average business very easy to undetectable activity are holes.

- Analysis of variances cost – prices is the tasks management, but often overlooked, in which accounting compare the actual cost with the norm, plan, and price of the previous period to determine the causes of discrepancies. Through that help businesses detect waste, evaluate the effectiveness improvements, as well as timely adjustments norms as well as production planning.

In summary, accounting is not only functional recorded data which is the bridge between accounting and finance management, production. The proper investment into this functionality to help businesses control costs, improve production efficiency, as well as decisions based on reliable data.

3. Principles & accounts accounting equation

3.1. Principles of accounting prices should master

Principles of fit & consistency

According to current regulations (Circular 99/2025/TT-BTC), production costs must be recorded in accordance with the revenue, right, subject to cost, and are applied consistently about the method of collection, allocation between the states accounting. About the admin, this principle helps businesses:

- Compare prices between the states in a reliable way

- Appreciating trend fluctuations in cost

- Avoid each work in a different way, losing the ability to compare

Principles full & accurate

Circular 99 emphasize the recorded cost to full and correct accounting period, the true economic nature and the right audience to bear the costs. Not be recorded, teen, recorded or recorded a wrong purpose.

This principle helps businesses:

- Prices reflect the actual cost was incurred

- Avoid the status of “interest-false – true hole” due to missing or wrong cost

- Reduce the risk of removal costs when tax settlement

In fact, many businesses overlook the expenses such as electricity, water workshop, small repairs, tools and supplies low value... that lower the price of the real, which leads to determine the selling price deviations.

Principles of rational allocation of

Under the new rules, the cost of joint production must be allocated according criteria match, there are clear grounds, reflecting the level of enjoyment the cost of each object and can exposition as needed.

This principle is particularly important because if the allocation is not reasonable:

- Simple products can “burden” cost for complex product

- Small order is, the price is not required

- Profit and loss statement according to the product order is wrong, doing wrong decision management

3.2. The accounts used in the accounting equation

According to mode of business accounting, current account system service accounting prices be designed relatively clear, which TK 154 plays a central rolealso TK 621, 622, 627 is the account set the initial cost. Specific as follows:

- Account 621 – the Cost of raw materials directly: Account 621 reflect the value of raw materials directly used for production in the period, recorded at the time of production use. The accounting TK 621 to help businesses control the consumption of materials and timely detection of abnormalities, loss, loss.

- Account 622 – Cost, direct labour: Account 622 reflect wages, deductions from wages of workers directly produced in the states. The accounting properly TK 622 helps enterprises assess the effective use of labor, the cost comparison between the parts to ensure correct enough price.

- Account 627 – production Costs, general: Account 627 set the service costs as well as production management at the workshop, such as personnel management, materials, shared, depreciation and outside service. Detailed tracking TK 627 in each workshop to help businesses analyze fluctuations in cost, control the production efficiency.

- Account 154 – the Cost of production, unfinished business: Account 154 whole set production costs after the transfer from TK 621, 622 and 627, used to track costs according to each product, orders, or works as a base to calculate the price of reality.

The organization details TK 154 according to the right audience costing is a prerequisite to the accounting system to operate effectively.

4. General journal entries accounting prices in the business

4.1. Pen math set cost of production

The table below sum up the pen basic math used to set the cost of production in the states according to each expense item, as a basis the transfer and price.

| Profession | Accounting implementation details | Notes |

| Export raw materials directly to production | Debt TK 621 / Có TK 152 | According to products, orders, |

| Buy NVL put straight into production | Debt TK 621

Debt TK 133 (if available) Have TK 111/112/331 |

Do not over stock |

| Recovery of scrap in production | Debt TK 152/111/112

Have TK 621 |

Reduced MATERIAL cost |

| Payroll workers directly | Debt TK 622

Have TK 334 |

According to the pay table |

| Deduct SOCIAL insurance, health INSURANCE, UNEMPLOYMENT insurance, KPCĐ for SUN direct | Debt TK 622

Have TK 338 |

According to the rate specified |

| Employee salary management workshop | Debt TK 627

Have TK 334 |

Cost SXC |

| Quotes BH salary NV workshop | Debt TK 627

Have TK 338 |

According to the rate specified |

| Material use general workshop | Debt TK 627

Have TK 152 |

Cost SXC |

| Production tools, tools used for PRODUCTION | Debt TK 627

Have TK 153 |

|

| Depreciation of fixed assets workshop | Debt TK 627

Have TK 214 |

|

| The cost of electricity, water, outside service | Debt TK 627

Debt TK 133 Have TK 111/112/331 |

Accounted for right of entry this helps to ensure costs are recorded in full, true essence and true object. Through which reflects the correct price, efficient production.

4.2. Pen calculate the shipping cost into the price of

After collection costs according to each item, the accountant made the shipping cost into TK 154 to serve calculate the cost of products and services.

| Profession | Accounting implementation details | Notes |

| The shipping cost NVL directly | Debt TK 154

Have TK 621 |

End of period |

| The shipping cost directly | Debt TK 154

Have TK 622 |

End of period |

| The shipping cost of production in common | Debt TK 154

Have TK 627 |

After allocation |

The pen payment, the transfer should be carried out in full, on time last states to ensure prices reflect actual costs incurred.

4.3. Accounting related production costs unfinished

The table below presents the accounting entries related to the track, adjust the production costs of uncompleted in the process of revaluation of the end states.

| Profession | Accounting implementation details | Notes |

| Track CP SX uncompleted states | Does not arise pen math | According to the details window TK 154 |

| Adjust the CP unfinished | Debt TK 154

Have TK 627/632 |

When re-evaluate |

| Adjustable reduced CP unfinished | Debt TK 627/632

Have TK 154 |

When re-evaluate |

Track, properly adjust the cost of uncompleted help ensure the price is not amiss between the states, reflecting the true state of production.

4.4. Pen calculates prices & warehousing

After set the shipping cost at TK 154, accounting performed costing and recorded value of the finished product according to the table below.

| Profession | Accounting implementation details | Notes |

| Finished product warehouse | Debt TK 155

Have TK 154 |

According to the price of reality |

| Finished product for sale now | Debt TK 632

Have TK 154 |

Do not over stock |

Pen math this step is to transfer the cost of the price of capital or inventory, serve for the determination business results.

4.5. Pen cost in special cases

In some models of production – trading as special production according to orders, according to public works or more stages, the accountant should perform the own private journal entries to reflect the correct price according to the subject to charges.

| Profession | Accounting implementation details | Notes |

| Completed orders | Debt TK 155 or 632

Have TK 154 |

Under each menu |

| Works completed items | Debt TK 632

Have TK 154 |

Construction business |

| The transfer between the phases SX | Debt TK 154 (phase after)

Have TK 154 (phase advance) |

SX multiple stages |

Properly accounted according to each case to help businesses determine the exact price of capital, effective control each order, works or each stage of production.

4.6. Pen payment processing costs special

In the production process may be incurred expenses as extraordinary as beyond the level or faulty products, accounting need to be processed separately in order to not distort the price of the product.

| Profession | Accounting implementation details | Notes |

| The cost exceeds the | Debt TK 632 or 811

Have TK 154/627 |

Not calculated in the price |

| Waste products recovered | Debt TK 152/111/112

Have TK 154 or 621 |

Recovered value |

| Product not recovered | Debt TK 632

Have TK 154 |

In the capital |

Separate and properly handle the special costs to help business faithfully reflect the price at the same time support administrator control cause waste, as well as improve production efficiency.

4.7. Pen cost of capital related to price

After finished product and is consumed, the accountant performs the accounting entries recorded as well as the transfer price of capital to determine the right business results in the states.

| Profession | Accounting implementation details | Notes |

| Production of semi-finished products | Debt TK 632

Have TK 155 |

Recorded the price of capital |

| The transfer pricing capital end of period | Debt TK 911

Have TK 632 |

Set FS |

Recorded, the transfer price of capital, timely regulations are the basis to determine the exact profit to ensure the integrity of financial reporting.

5. Process accounting cost in the actual business operation

In fact, many businesses do not calculate the price accurately by accounting process calculates the price of unorganized items, the missing link between accounting – production – management. Meanwhile, a efficient processes help control costs and evaluate the effectiveness of production and support decisions based on data. So, enterprises need to build a process according to the standard steps below:

Step 1: Set the cost of production

This step is the foundation of the entire process of accounting prices. If collection costs are not full or wrong right from the start, the results calculate the price of the rear are no longer meaningful. Accounting proceed to collect the entire stock from arise related to manufacturing operations in the usa, including:

- Warehouse materials

- Timesheets, payroll, workers directly

- Electricity bills, water, outside service

- Stock depreciation from asset allocation tools

Then the cost is sorting right from the start according to the true essence:

- The cost of raw materials directly

- Costs directly

- The cost of production in common

Sorting the right cost from the beginning to help businesses avoid confusion between the cost of production and cost management. Limit adjustment errors end of the period, create a background accurate data analysis service the cost of the latter.

Step 2: allocation of production costs, general

The cost of production is generally group the cost can not be attached directly to each product, but it greatly affects the price. This is also a controversial and deviations in accounting prices. Accounting options criteria to allocate suitable with production characteristics of the business, for example:

- Labor hours direct

- Production

- The cost of raw materials directly

- Time used machinery

Target allocation formula should be applied consistency between the states, there are reasonable grounds.

Errors frequently encountered & how to fix: Flaws popular is allocation of costs according to the sense, or out of habit, leading to

- Simple product is the price of

- Small orders burden costs are not commensurate

- Report profit and loss by product skewed

The fix is periodically review criteria allocated based on the actual production updates when scale or process change.

Step 3: Calculate the price of products/services

Formula for calculating price: Depending on the business with or without products of uncompleted states, the final formula is used as follows:

(Prices of production in the period = Cost of production uncompleted beginning of the period + Cost of production incurred during the period − Cost of production the unfinished end)

In which:

- Production costs of uncompleted states: the cost of the unfinished products from the states before moving on to the

- Production costs arising in any: includes the cost of direct material, direct labour costs, overall production was set in the states.

- Production costs unfinished end of the period: the cost of the unfinished products shipping to states below.

If there is not unfinished products

Production cost = Total manufacturing costs incurred in the period

Price unit

Price unit = Total production cost / Number of finished product

Illustrative examples: (Assuming the business of manufacturing wooden table in year 6 have data as below)

Product uncompleted states: 20,000,000; Costs incurred in the states:

- Raw materials-direct: 120.000.000 dong

- Direct labour: 50,000,000

- The cost of production in common: 30,000,000

→ The total cost incurred during the period = 200,000,000

Products unfinished end states: 30,000,000

Number of tables finished in the usa: 100 pcs

TH 1: Calculate the total production cost in the states

Production cost = 20.000.000 + 200.000.000 − 30.000.000 = 190.000.000 dong

TH 2: Calculating the cost of unit

Price unit = 190.000.000 / 100 = 1.900.000/unit

Step 4: analyze & report price

This is the bold administrator, but often overlooked in many businesses. Meanwhile, the greatest value of the accounting prices, located in ability to analyze and provide information to leadership. Accounting reports such as:

- Report price according to products, orders, works

- Price comparison of actual with planned or norms

- Analyze the causes of discrepancies costs

Through the report, the leadership can timely identification stitch wasting, performance evaluation, process improvement, production decisions adjusted sales price and norms, as well as production planning.

6. Any business required to organize accounting price?

Not every business needs accounting organization price at the same level of detail, but with the models that have incurred costs according to each object, this is a mandatory requirement to control costs and ensure business efficiency. Perspective financial management, business groups, then need to organize accounting lessons:

6.1. Business production

This is the typical business, the most obvious need accounting. Any business that directly create a physical product, from simple production to the production of multiple stages, each need to determine the exact price.

Accounting bring manufacturing enterprise, including:

- Properly determine the actual cost of each product

- Do construction base price, the profit margin

- Control wastage of raw materials, labor costs, general

- Assess the effectiveness each workshop, production line

In the context of input cost volatility, corporate production do not grasp the price of reality would be very difficult to maintain stable profitthough revenue can increase.

6.2. Business, construction, and installation

For the construction business, each works or main items is an “object calculate the price of” independence. If not, the organization of accounting the cost of each work, the business will not be able to:

- Determine the exact interest – hole of each project

- Control costs exceed estimates

- Evaluate the effectiveness of construction, capacity, project management

In fact, many business building only to see a profit at the aggregate level, but when analyzed in detail according to the works shall have the project are hole is offset cross by other projects. This is a big risk if the business continues to expand without control prices.

6.3. Business services have set costs, according to the project contract

Not only manufacturing enterprises or new construction should accounting prices. With the business services activities under the project, contract or package services (IT consulting, design, communications, maintenance,...), accounting role is increasingly important in the business services include:

- Calculate the correct cost for each project, each contract

- Assess the effectiveness each customer or group of services

- As a basis accurate quote for the the next contract

- Avoid the status of “revenue but lower profit”

In summary, For the business has incurred costs associated with the product, the process, order or project, the organization of accounting price is required to properly calculate the complete cost, support business decisions based on real data and help business owners control profits.

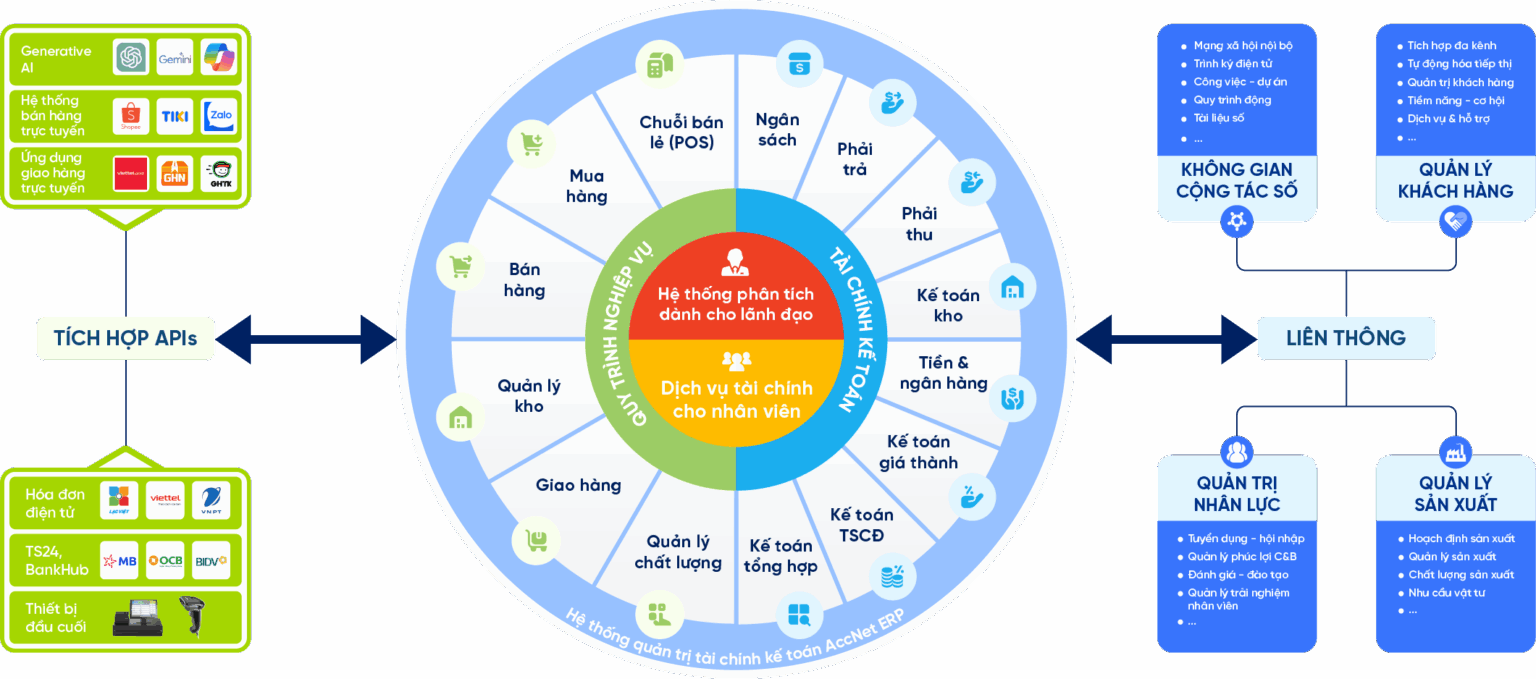

7. Application software Accnet ERP to management accounting and cost effective for business

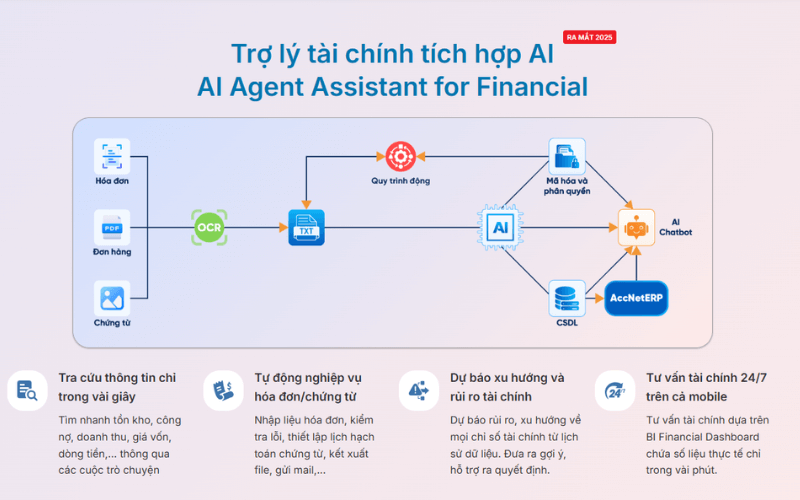

AccNet ERP is the system of management accounting and financial integration (ERP) is developed in accordance with the context of business, Vietnam. This solution handles the accounting price according to modern approach, focusing data, transparent process:

- Set cost automatic & accurate: AccNet ERP automatically aggregate cost of raw materials, labor, and production overhead from the career-related services on a unified platform, helping to ensure data consistency as well as to limit errors due to input manually.

- Cost allocation flexible according to the actual formula: AccNet ERP allows allocation of costs according to many criteria in accordance with the peculiarities of production, such as time machine, the level of use of raw materials or production volumes, instead of applying a rigid formula for any kind of costs.

- Calculate the price according to the various methods: AccNet ERP support price according to products, orders, projects or works, help enterprises to flexibly apply the method to suit each production model and cost structure different.

- Expense tracking production progress in real time: Instead of just holding costs after the end of the accounting period, AccNet ERP allows to track real-time business help early detection of irregular expenses, timely adjust the production plan and provide accurate information to the leader board when you need a fast decision.

- Report price details, decision support fast: The system provides analysis table price according to the product/unit as well as comparison with the norm planning, support leaders evaluate the effectiveness of production – business immediately. This is the difference compared with the general craft that the board always timely data.

ACCOUNTING SOLUTIONS ACCNET ERP INTEGRATED AI AUTOMATE ALL BUSINESS AccNet ERP is a software solution financial accounting integrated in the management system, comprehensive enterprise, which is developed by Lac Viet corporation. Difference highlights of AccNet ERP is the app artificial intelligence (AI) in many accounting process to help businesses: Thanks to that, AccNet ERP not only is support tool but also a “smart assistant” with the business in financial management transparent effect. Feature highlights: ✔️ Automatic accounting vouchers, collate public debt thanks to AI. TYPICAL CUSTOMERS ARE DEPLOYING ACCNET ERP SIGN UP TO RECEIVE DEMO NOW INTEGRATED AI ACCELERATION CONVERTER OF ACCOUNTING AI in AccNet ERP't just stop at automate data entry, but also: BUSINESS IS WHAT WHEN IMPLEMENTING ACCOUNTING SOFTWARE LAC VIET? See details, feature & get FREE Demo CONTACT INFORMATION:

✔️ Manage your finance – accounting multi-branch, multi-subsidiary.

✔️ Financial statements consolidated standards of Vietnam & international (VAS, IFRS).

✔️ Cash flow management, budgeting, forecasting the exact cost.

✔️ Connect with the manure management system, hr, production, sales to sync data.

✔️ Integration of AI in data analysis, risk warning and proposed optimal scheme.

Accounting prices not only is required to comply with the financial side but also the administration tools essential to help businesses control costs, protect profits, enhance competitiveness. When prices are determined properly and timely, managers have solid basis for decisions about price, product portfolio, growth strategy. In the context of input cost volatility, market pressures, increasingly, the organization of accounting, it is platform that helps business to operate effectively and sustainable development.